Metropolitan Bank & Trust Bundle

How is Metropolitan Bank & Trust Company Redefining Banking in 2025?

Founded in 1962, Metrobank has evolved into a financial powerhouse in the Philippines, but how does its sales and marketing strategy fuel its success? With a strategic pivot towards 'Relationship Banking' in early 2025, Metrobank is focusing on human-centered service in a digital world. This shift, developed with M&C Saatchi, aims to personalize customer experiences, particularly for SMEs and corporate clients.

This analysis explores Metrobank's journey, examining its Metropolitan Bank & Trust SWOT Analysis and how it navigates the competitive Philippine banking industry. We'll dissect its effective sales techniques, marketing plan, and customer acquisition strategies. Discover how Metrobank leverages digital marketing, social media, and data analytics to drive growth and maintain its position in the financial services sales landscape.

How Does Metropolitan Bank & Trust Reach Its Customers?

The sales and marketing strategy of Metropolitan Bank & Trust Company, often referred to as Metrobank, is a blend of traditional and digital approaches. This strategy ensures broad customer reach and accessibility within the Philippine banking industry. Metrobank's approach is designed to cater to various customer segments, from individual retail clients to large corporate entities, leveraging both physical and digital channels.

Metrobank's extensive network and digital initiatives are key components of its sales strategy. The bank's focus on customer experience and technological advancements, as seen in its collaborations and digital banking platforms, reflects its commitment to adapting to the evolving needs of its customer base. This strategy is crucial for maintaining a competitive edge in the financial services sales landscape.

Metrobank's approach to sales and marketing is multifaceted, combining a strong physical presence with robust digital capabilities. This strategy is crucial for maintaining a competitive edge in the financial services sales landscape and attracting new customers.

Metrobank maintains a vast network of over 960 branches across the Philippines. This extensive brick-and-mortar presence allows for a relationship-based approach, especially for corporate, commercial, and SME banking segments. This physical infrastructure remains a key element of their sales strategy.

Metrobank operates more than 2,200 automated teller machines (ATMs) nationwide. This widespread ATM network enhances customer convenience and accessibility, supporting the bank's overall sales and service strategy. The ATMs provide essential banking services.

Metrobank's award-winning mobile app and internet banking platforms offer customers convenience and choice. These digital channels are central to the bank's marketing strategy, providing accessible banking services. This strategy helps in customer acquisition and retention.

Metrobank has actively expanded its digital capabilities through strategic collaborations. For example, its partnership with Infosys, announced in September 2024, aims to improve IT functions, digital transformation, and customer experience. These partnerships are key to Metrobank's digital marketing initiatives.

Metrobank's collaborations are designed to enhance financial services accessibility and operational efficiency. These partnerships are crucial for expanding reach and improving customer experiences, particularly for high-net-worth clients.

- Palawan Group of Companies: In July 2024, Metrobank partnered with Palawan Group of Companies, leveraging Palawan's extensive network of over 3,000 branches for bills payment and collections services via the 'CollectAnywhere' platform. This collaboration benefits Metrobank's corporate clients and promotes financial inclusion.

- Temenos and CBTW: In March 2024, Metrobank partnered with Temenos and CBTW to advance its WealthTech capabilities. The aim is to boost operational efficiency and enhance customer experiences through digital channels, especially for High Net Worth and Ultra High Net Worth clients.

- Infosys: Announced in September 2024, the partnership with Infosys focuses on improving IT functions, digital transformation, and customer experience through automation and AI capabilities. This is a key part of Metrobank's sales and marketing strategy.

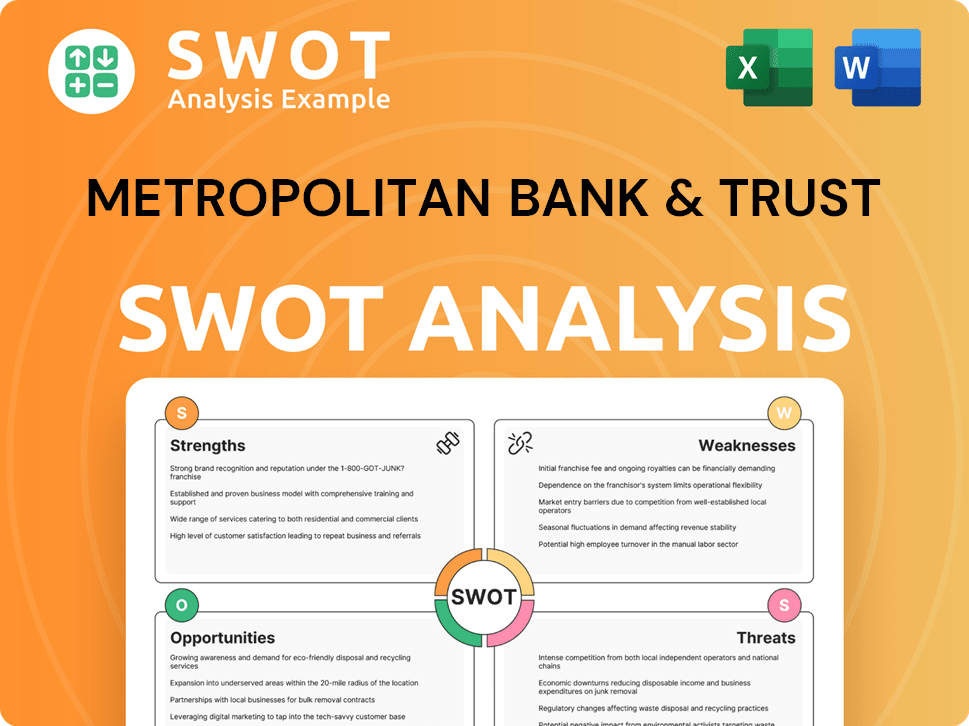

Metropolitan Bank & Trust SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Metropolitan Bank & Trust Use?

The Brief History of Metropolitan Bank & Trust reveals a robust sales and marketing strategy, blending digital and traditional methods to enhance brand presence and boost customer engagement. Metrobank's approach is designed to resonate with its wide customer base, focusing on both online and offline channels for maximum impact. This integrated strategy aims to drive sales and strengthen its position within the Philippine banking industry.

Metrobank's marketing tactics leverage a variety of platforms and techniques to reach its target audience effectively. The bank's digital transformation efforts, including partnerships with technology providers, suggest a strong emphasis on improving online visibility and targeted outreach. These initiatives are crucial for staying competitive in the rapidly evolving financial services sector. The bank's focus on customer-centric strategies and data-driven insights is key to its marketing success.

Metrobank's sales and marketing strategy is a dynamic combination of digital and traditional approaches, designed to build brand awareness and drive sales. The bank's initiatives are geared toward customer acquisition and retention. The bank's use of data analytics and AI further enhances its ability to understand and serve its customers better.

Metrobank uses content marketing, personalized messaging, and omnichannel engagement. They use platforms like Viber for personalized marketing messages and broadcasts. The bank integrates with Salesforce Marketing Cloud for real-time information.

Metrobank incorporates AI technology to better understand customer needs. This helps provide a more human and personalized experience. The data-driven approach aims to optimize the use of customer information.

The bank is enhancing digital capabilities and refining data through partnerships. This includes a focus on improving online visibility and targeted outreach. These efforts are critical for staying competitive.

Metrobank continues to utilize channels that resonate with its broad customer base. The 'Grow With Metrobank' campaign highlights customer and Metrobanker growth stories. This indicates an investment in video content and broader traditional media placements.

The bank focuses on community engagement and events. This aims to foster human connections. This approach helps build strong customer relationships.

The 'Grow With Metrobank' campaign won a Gold Stevie at the 2024 International Business Awards. This highlights the bank's successful marketing strategies. This demonstrates the effectiveness of their marketing efforts.

Metrobank's sales and marketing strategy includes a focus on digital marketing, AI integration, and traditional media. The bank is also committed to relationship banking and community engagement. These strategies are designed to enhance brand awareness and customer loyalty.

- Data-Driven Approach: Using customer data to personalize experiences.

- Omnichannel Engagement: Utilizing multiple channels for consistent messaging.

- Community Engagement: Building relationships through events and local initiatives.

- Content Marketing: Creating valuable content to attract and engage customers.

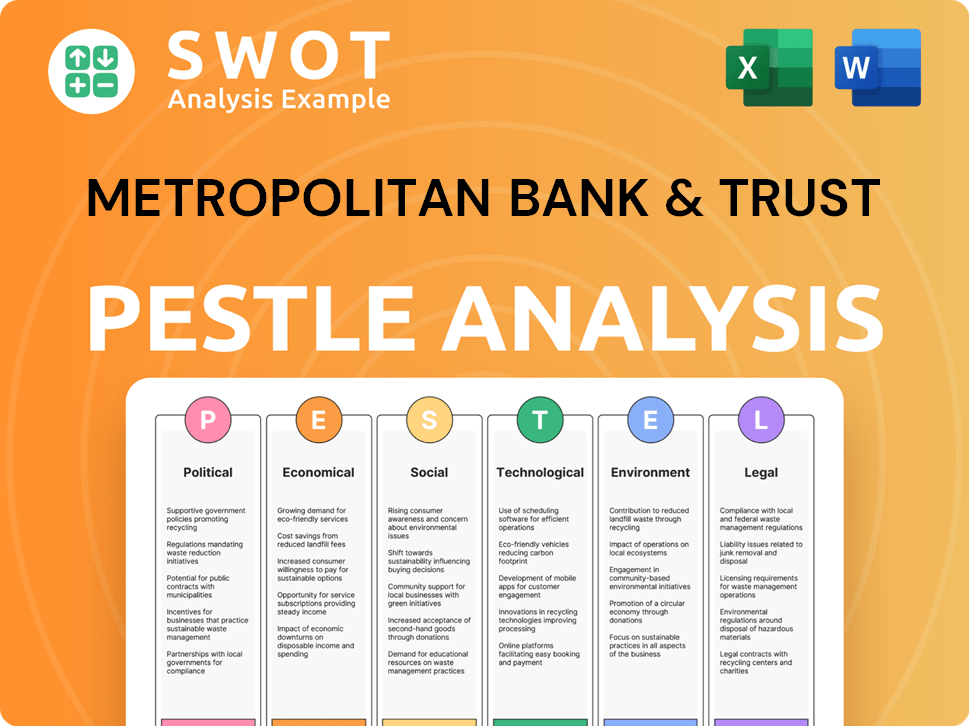

Metropolitan Bank & Trust PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Metropolitan Bank & Trust Positioned in the Market?

In early 2025, Metropolitan Bank & Trust Company (Metrobank) launched a brand positioning centered around 'Relationship Banking.' This strategic shift emphasizes a customer-centric approach, aiming to distinguish the bank within the competitive Philippine banking industry. The core message focuses on accessible, relationship-based banking services, highlighting 'People, Relationships, and Service' to resonate with its target audience.

Metrobank's brand identity retains its iconic logo while incorporating a modernized color palette and typography. The bank aims for a more conversational and welcoming tone of voice to foster personal connections with its customers. This approach is designed to strengthen customer relationships and drive loyalty in the financial services sales landscape.

This brand positioning is supported by Metrobank's consistent recognition as a leading financial institution. For instance, Metrobank was named the 'Strongest Bank in the Philippines' for the fourth consecutive year at The Asian Banker Global 2024 Finance Awards. Additionally, a January 2024 consumer survey recognized Metrobank as the 'Most Recommended Retail Bank in the Philippines.' These accolades underscore the effectiveness of Metrobank's sales and marketing strategies.

The core message revolves around providing accessible, relationship-based banking services. This emphasizes 'People, Relationships, and Service' to connect with customers on a personal level. This approach is designed to drive customer loyalty.

Metrobank targets SMEs, corporates, commercial sectors, and specialist mortgages. This segmentation allows for tailored marketing efforts. The bank highlights its expertise to build lasting relationships.

Metrobank strives for brand consistency across its website, social media channels, and physical stores. This ensures a unified brand experience for customers. Consistent branding enhances brand awareness.

The bank actively responds to shifts in consumer sentiment by evolving its brand message. This ensures the brand remains relevant. This adaptability is crucial in the dynamic Philippine banking industry.

Metrobank's brand positioning is reinforced by its consistent recognition in the industry. The bank's achievements include being named the 'Strongest Bank in the Philippines' and 'Most Recommended Retail Bank in the Philippines'. These awards validate the effectiveness of Metrobank's marketing efforts.

- Named 'Strongest Bank in the Philippines' at The Asian Banker Global 2024 Finance Awards.

- Recognized as the 'Most Recommended Retail Bank in the Philippines' in January 2024.

- Awarded 'Best Bank for Ultra-High-Net-Worth' by Euromoney Global Private Banking Awards in 2024.

- These accolades highlight Metrobank's commitment to excellence.

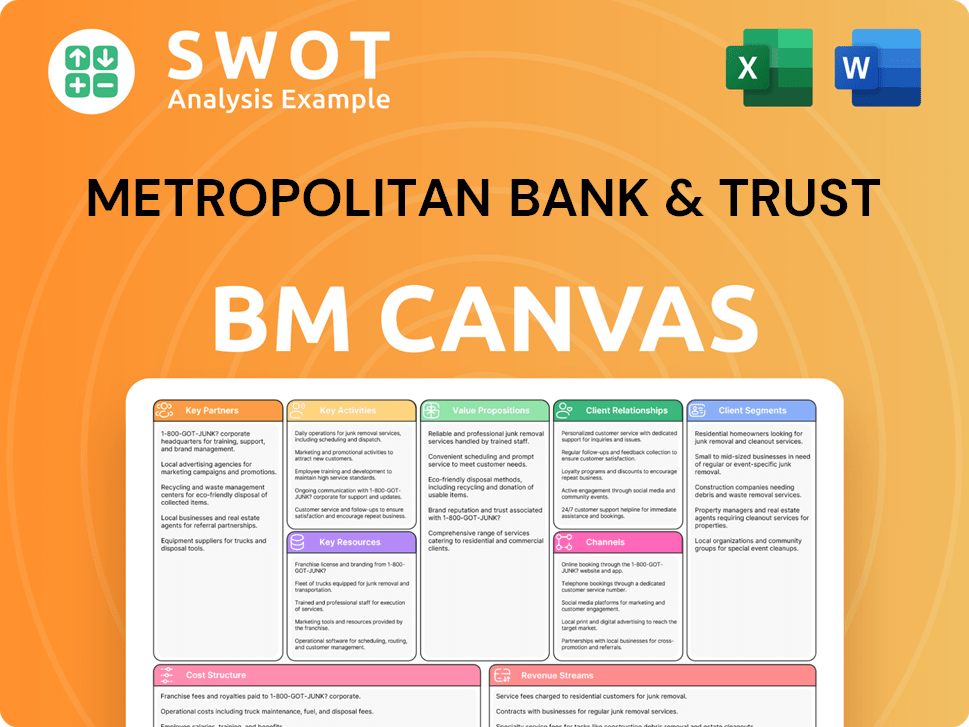

Metropolitan Bank & Trust Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Metropolitan Bank & Trust’s Most Notable Campaigns?

The sales and marketing strategies of Metropolitan Bank & Trust Company, or Metrobank, are centered around building strong customer relationships and enhancing brand perception within the Revenue Streams & Business Model of Metropolitan Bank & Trust. The bank focuses on campaigns that resonate emotionally with its target audiences, aiming to foster trust and loyalty. These strategies are crucial in a competitive Philippine banking industry, where differentiation and customer engagement are key.

Metrobank's approach involves leveraging various channels, including video content, social media, and physical branches, to communicate its brand message effectively. By telling compelling stories and highlighting its commitment to customer service, Metrobank seeks to attract new customers and retain existing ones. The bank's campaigns are designed to be inclusive, targeting a wide range of demographics from Gen Alpha to Baby Boomers.

The following are the key campaigns that Metrobank has launched recently.

The 'Grow With Metrobank' campaign, recognized with a Gold Stevie Award in 2024, showcased customer and employee growth stories. Its primary objective was to communicate the bank's long-standing promise of 'You're in good hands' authentically. Video content was the main channel, making Metrobank the only Philippine company to win in the financial services-banking category.

Launched in early 2025, this campaign, developed with M&C Saatchi, highlighted Metrobank's human-centered approach. It featured real customers and employees in striking photography and a modernized design. The campaign aims to accelerate growth by attracting new customers in key areas such as SMEs, corporates, commercial, and specialist mortgages.

The primary objectives of these campaigns include enhancing brand trust, attracting new customers, and reinforcing the bank's commitment to customer service. Metrobank aims to differentiate itself in the Banking sector marketing landscape by focusing on emotional connections and authentic storytelling.

Metrobank's campaigns target a broad audience, from Gen Alpha to Baby Boomers, with a particular focus on attracting customers in key business segments such as SMEs and corporates. The bank's Metrobank target market segmentation strategy ensures that its marketing efforts are inclusive and relevant to diverse customer needs.

The bank utilizes a multi-channel approach, including video content, social media, and physical branches, to disseminate its marketing messages. This integrated strategy helps to maximize reach and engagement, supporting the bank's Metrobank digital marketing initiatives.

The key messaging revolves around the bank's brand promise of 'You're in good hands' and its human-centered approach to Financial services sales. Metrobank emphasizes trust, reliability, and its commitment to building lasting customer relationships.

While specific performance metrics vary, the success of these campaigns is measured by increased brand awareness, customer acquisition, and customer loyalty. Metrobank’s Metrobank sales and marketing efforts are designed to drive sustainable growth.

Metrobank will likely continue to invest in campaigns that emphasize customer relationships and digital innovation. The bank is expected to expand its use of data analytics to refine its Metrobank customer acquisition strategies and personalize customer experiences.

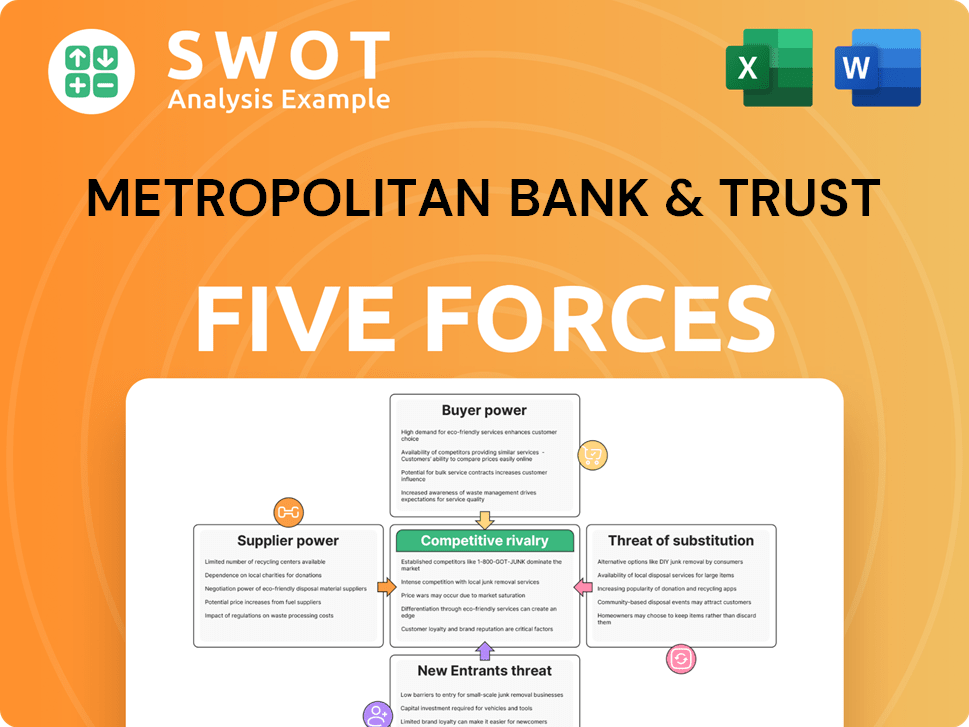

Metropolitan Bank & Trust Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Metropolitan Bank & Trust Company?

- What is Competitive Landscape of Metropolitan Bank & Trust Company?

- What is Growth Strategy and Future Prospects of Metropolitan Bank & Trust Company?

- How Does Metropolitan Bank & Trust Company Work?

- What is Brief History of Metropolitan Bank & Trust Company?

- Who Owns Metropolitan Bank & Trust Company?

- What is Customer Demographics and Target Market of Metropolitan Bank & Trust Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.