Metropolitan Bank & Trust Bundle

How Does Metropolitan Bank Thrive in the Philippine Financial Landscape?

Witnessing a staggering P48.1 billion net income in 2024, Metropolitan Bank & Trust Company (Metrobank) isn't just surviving; it's excelling. This Philippine bank, a financial institution powerhouse, achieved a remarkable 14% year-on-year increase, solidifying its position as a key player. But how does Metrobank, the second-largest private universal bank, consistently generate such impressive results and what strategies drive its success?

Metrobank's success story is built on a foundation of comprehensive banking services, catering to a diverse clientele with offerings ranging from deposit accounts to investment vehicles. Its extensive network ensures broad accessibility, while its robust financial health is reflected in a 13% return on equity. For investors and anyone interested in the Philippine financial market, understanding the inner workings of Metropolitan Bank & Trust SWOT Analysis is crucial to understanding its value and future potential, including its competitive standing against other Philippine bank competitors like BDO.

What Are the Key Operations Driving Metropolitan Bank & Trust’s Success?

Metrobank, also known as Metropolitan Bank & Trust Company, creates value by offering a wide range of banking services to diverse clients. It provides deposit accounts, loans (commercial and consumer), and investment services. This Philippine bank serves individuals, businesses, and institutions, aiming to meet varied financial needs.

Operationally, Metrobank Philippines uses a vast network of branches and ATMs, supplemented by digital platforms. This approach ensures widespread access to its services. The bank's operational processes include robust loan origination and risk management, particularly in commercial and specialist mortgage lending.

The bank's value proposition centers on a blend of physical and digital presence, with a strong emphasis on customer service. This strategy is highlighted by its high customer satisfaction rate and recognition as a 'Strongest Bank in the Philippines'. Metrobank adapts its services and targets underserved markets effectively, differentiating itself from competitors. If you want to learn more about its competitors, you can read the Competitors Landscape of Metropolitan Bank & Trust.

Metrobank offers a comprehensive suite of financial products. These include deposit accounts, various loan options such as commercial and consumer loans, and investment and trust services. The bank caters to both individual and corporate clients, providing solutions for diverse financial needs.

Metrobank operates through an extensive network of branches and ATMs across the Philippines. Digital platforms complement this physical presence, with 40% of customer transactions conducted digitally by the end of Q1 2024. This blend of physical and digital channels enhances accessibility and convenience for customers.

Metrobank prioritizes customer satisfaction, reflected in its reported 90% customer satisfaction rate in 2024. The bank focuses on delivering accessible and personalized financial solutions. This commitment to service is a key differentiator in the market.

The bank's competitive edge lies in its balanced approach to physical and digital banking, along with a strong emphasis on customer service. Metrobank also excels in adapting its offerings and targeting specific market segments. This strategy supports its consistent recognition and strong market position.

Metrobank distinguishes itself through several key factors. It combines a strong physical presence with digital innovation, ensuring broad accessibility. The bank's customer-centric approach, as seen in its high satisfaction rates, builds trust and loyalty.

- Extensive branch and ATM network.

- Ongoing investment in digital platforms.

- High customer satisfaction ratings.

- Recognition as a leading financial institution.

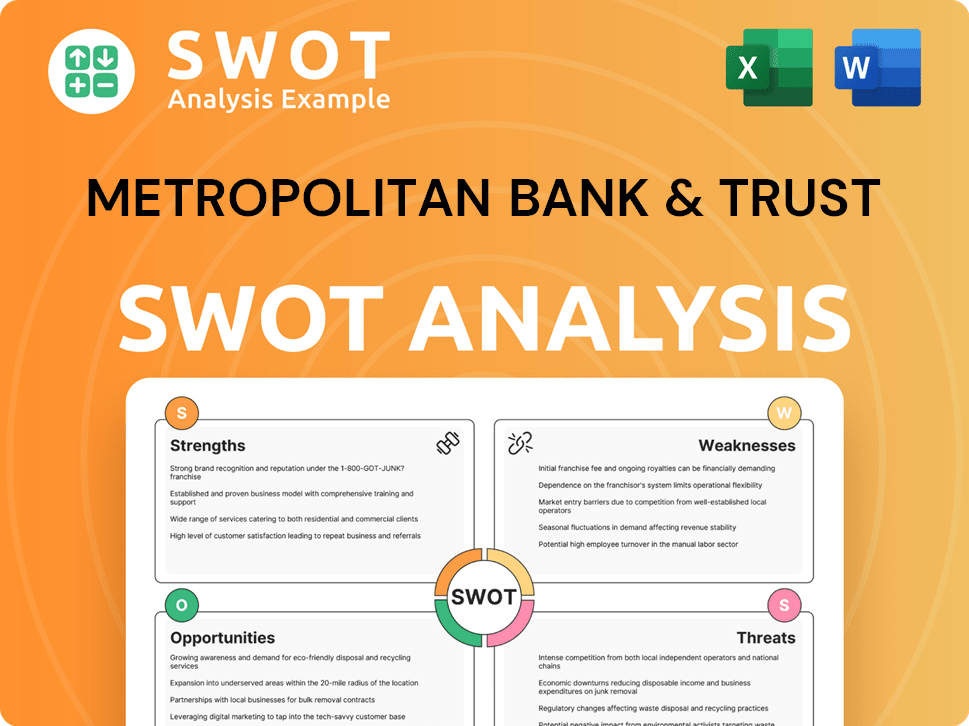

Metropolitan Bank & Trust SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Metropolitan Bank & Trust Make Money?

The primary revenue streams for Metropolitan Bank & Trust (Metrobank) are rooted in traditional banking activities. These streams are predominantly driven by net interest income and non-interest income. The bank's financial performance is heavily influenced by its ability to manage its loan portfolio and deposit base effectively.

Metrobank's monetization strategies focus on leveraging its extensive loan portfolio and deposit base to generate revenue. The bank aims to optimize its balance sheet and reduce its cost base to achieve its financial goals. This approach allows Metrobank to maintain a strong financial position within the competitive landscape of the Philippine banking sector.

Net interest income is a significant revenue source for Metrobank. In 2024, it increased by 8.71% to P114.12 billion, up from P104.97 billion in 2023. This growth was supported by a 17% increase in gross loans. Commercial loans saw a 17.7% increase, and consumer loans grew by 14.4%. In the first quarter of 2025, net interest income reached P29.4 billion, fueled by a 16.1% year-on-year increase in gross loans.

Non-interest income also contributes substantially to Metrobank's revenue. In 2024, it increased by 2.51% to P29.22 billion. Fee and trust income rose to P18.1 billion, and trading and foreign exchange gains improved by 39% year-on-year to P5.6 billion. The first quarter of 2025 showed even stronger growth, with non-interest income surging by 31.9% to P8.7 billion. Trading and foreign exchange gains nearly quadrupled to P2.6 billion, and fee income climbed 10.5% to P4.3 billion.

Metrobank's monetization strategies are centered on traditional banking models, using its loan portfolio and deposit base. The bank's total deposits rose by 8% year-on-year to P2.6 trillion in 2024, with low-cost current and savings accounts (CASA) making up 57.8% of the total.

- The loan-to-deposit ratio was 71.21% in 2024, up from 65.77% in 2023.

- The bank focuses on optimizing its balance sheet by pivoting lending towards higher-return commercial and specialist mortgage lending.

- Metrobank aims for a mid- to upper-teens return business model.

- To learn more about the bank's strategic direction, you can read about the Growth Strategy of Metropolitan Bank & Trust.

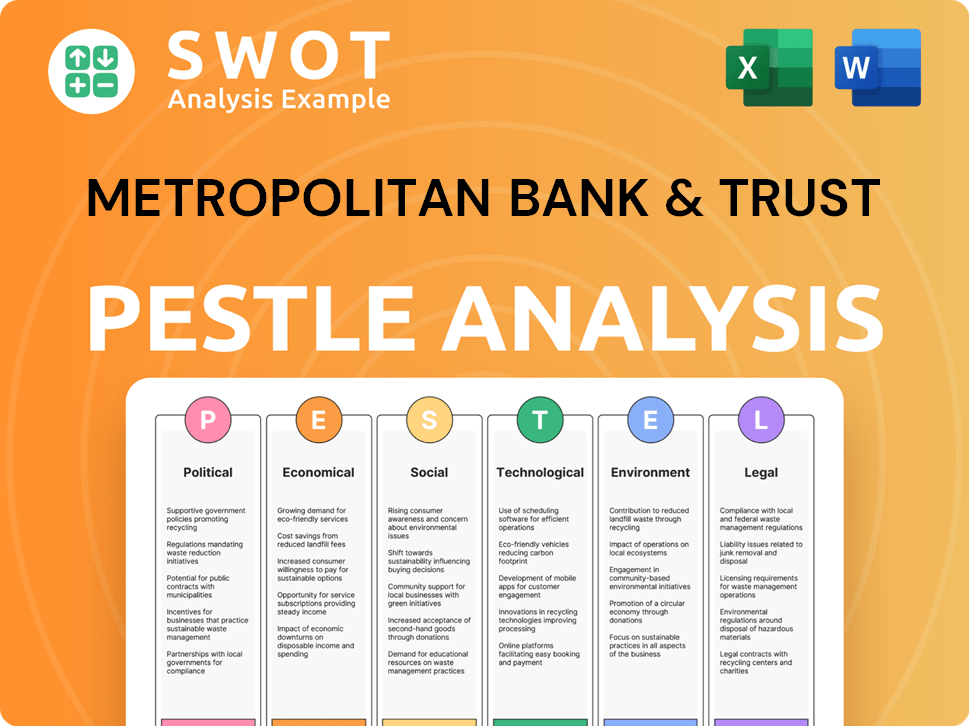

Metropolitan Bank & Trust PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Metropolitan Bank & Trust’s Business Model?

Examining the operational and financial trajectory of Metrobank reveals a series of pivotal moments, strategic maneuvers, and elements that define its competitive edge. These factors collectively illustrate how Metrobank has navigated the complexities of the financial landscape. The bank's approach to managing risks and adapting to market changes further underscores its resilience and strategic foresight.

Metrobank's journey is marked by consistent profitability and strategic initiatives aimed at enhancing its market position. The bank's ability to maintain a strong financial standing, even amidst economic uncertainties, highlights its robust operational framework. This focus on growth and efficiency is a key element in understanding its overall performance and future prospects. The bank's commitment to technological advancements and customer service further supports its competitive stance.

The strategic decisions and operational adjustments made by Metrobank Philippines have significantly influenced its performance and market position. These moves, combined with its competitive advantages, have enabled the bank to maintain a strong presence in the financial sector. Understanding these elements provides a comprehensive view of Metrobank's strategies and how they contribute to its success.

Metrobank has achieved significant milestones, including record net income and robust loan growth. In 2024, net income hit P48.1 billion, a 14% increase year-on-year. Gross loans expanded by 17%, exceeding industry averages. These achievements are a testament to its financial strength and strategic execution.

Strategic initiatives include focusing on growth in corporate, middle market, retail, and wealth segments. Investments in technology and human resources are also key. Metrobank is repositioning towards a mid- to upper-teens return business model, focusing on commercial and specialist mortgage lending.

Metrobank's competitive advantages include strong brand recognition and an extensive branch network. The bank's relationship-led banking model, particularly in commercial and SME lending, sets it apart. Digital transformation initiatives, with 40% of transactions through digital channels as of Q1 2024, boost its competitive position.

The bank's NPL ratio improved to 1.43% in 2024 from 1.69% in 2023, leading to a 29.2% reduction in loan loss provisioning. For Q1 2025, the NPL remained low at 1.6%, well below the industry average of 3.5%. These figures highlight the bank's strong asset quality and risk management.

Metrobank's success is underpinned by its strong brand, extensive network, and customer-focused approach. Its consistent recognition as the 'Strongest Bank in the Philippines' for four consecutive years by The Asian Banker Global 2024 Finance Awards highlights its reputation. The bank's focus on digital transformation and risk management further strengthens its competitive position.

- Strong Brand and Reputation: Recognized as the 'Strongest Bank in the Philippines'.

- Extensive Network: Wide distribution network and strong local presence.

- Relationship-Led Banking: Focus on commercial and SME lending.

- Digital Transformation: 40% of transactions through digital channels as of Q1 2024.

For a deeper understanding of the bank's origins and development, you can read more in the Brief History of Metropolitan Bank & Trust.

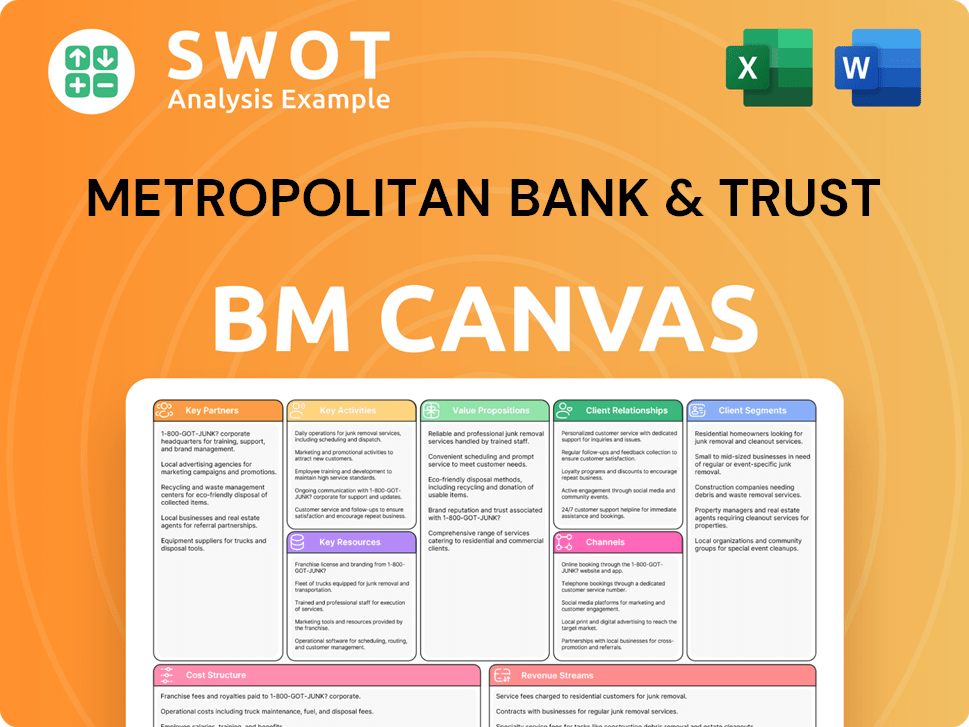

Metropolitan Bank & Trust Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Metropolitan Bank & Trust Positioning Itself for Continued Success?

Metrobank, or Metropolitan Bank & Trust Company, holds a prominent position in the Philippine banking sector. As of 2024, it stands as the second-largest private universal bank in the country by asset size, with total consolidated assets reaching P3.52 trillion. This strong foundation is reinforced by its consistent recognition as the 'Strongest Bank in the Philippines' for four consecutive years by The Asian Banker Global 2024 Finance Awards.

Despite its robust market standing, Metrobank Philippines faces various risks. These include potential impacts from global uncertainties and geopolitical tensions, and intense competition in both asset and liability markets. Furthermore, changes in regulatory policies, the emergence of new competitors, and evolving consumer preferences pose ongoing challenges. The bank's future outlook hinges on its strategic initiatives and ability to navigate these complex factors.

Metrobank is the second-largest private universal bank in the Philippines by asset size. It has a strong market share in personal banking. The bank's consistent recognition as the 'Strongest Bank in the Philippines' highlights its financial strength.

Global uncertainties and geopolitical tensions could impact inflation and economic growth. Intense competition in both asset and liability markets could affect margins. Changes in regulatory policies and evolving consumer preferences also pose challenges.

Metrobank anticipates continued monetary easing by the Bangko Sentral ng Pilipinas (BSP) and major central banks. The bank is focused on expanding its consumer lending and commercial loan portfolios. It plans to open new branches in strategic locations in 2025.

The bank is focused on medium-term growth strategies, particularly expanding its consumer lending and commercial loan portfolios. It is optimizing its balance sheet, pivoting lending towards higher-return commercial and specialist mortgage lending, and reducing costs. Metrobank's leadership emphasizes its strong capitalization and healthy portfolio.

Metrobank is aiming for robust economic growth of 6.2% and target-consistent inflation of 3.2% in the Philippines in 2025. It plans to open new branches in strategic locations such as Chester, Gateshead, and Salford in 2025. The bank's strong capitalization and healthy portfolio are key strengths.

- Expansion of consumer lending and commercial loan portfolios.

- Optimization of the balance sheet.

- Focus on higher-return lending and cost reduction.

- Strong capitalization to navigate economic changes.

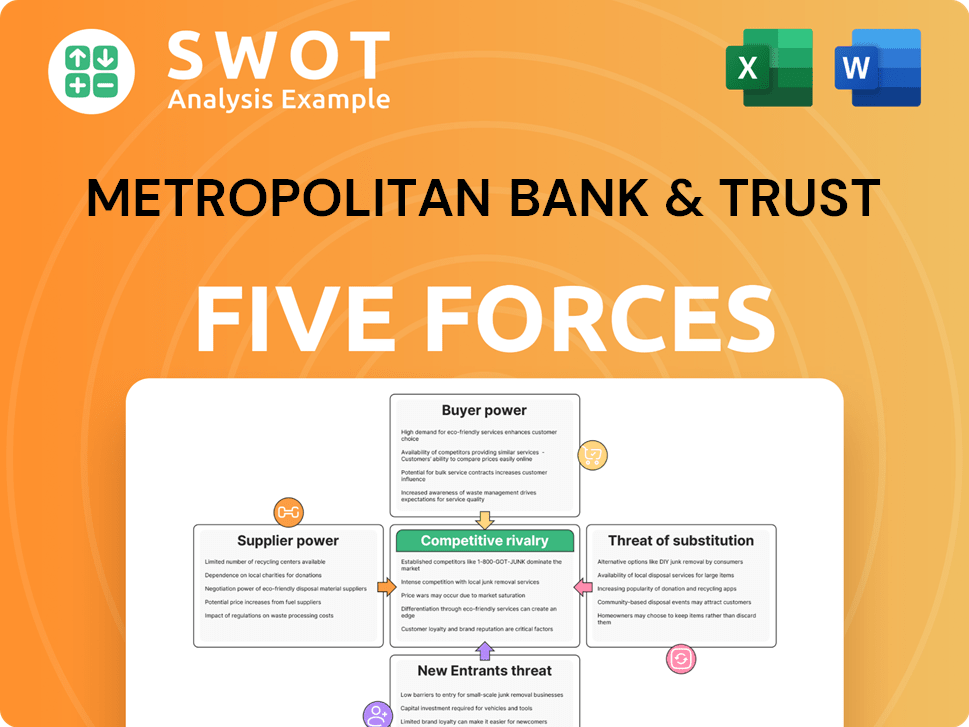

Metropolitan Bank & Trust Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Metropolitan Bank & Trust Company?

- What is Competitive Landscape of Metropolitan Bank & Trust Company?

- What is Growth Strategy and Future Prospects of Metropolitan Bank & Trust Company?

- What is Sales and Marketing Strategy of Metropolitan Bank & Trust Company?

- What is Brief History of Metropolitan Bank & Trust Company?

- Who Owns Metropolitan Bank & Trust Company?

- What is Customer Demographics and Target Market of Metropolitan Bank & Trust Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.