Société des Bains de Mer Bundle

Can Société des Bains de Mer Maintain Its Reign in Luxury Hospitality?

Société des Bains de Mer (SBM), a cornerstone of luxury, is experiencing a growth surge, highlighted by impressive revenue gains in the first half of 2024/2025. The company's strategic moves, like the successful launch of Amazónico Monte-Carlo and the revitalization of Café de Paris Monte-Carlo, showcase its commitment to innovation. But what does the future hold for this iconic brand?

From its inception in 1863, SBM has been synonymous with luxury, evolving from a vision of a grand casino to a multifaceted entertainment and hospitality empire. Today, SBM is a major player in the European gambling and casino business, and the number one luxury tourism market in Monaco. This article will explore the Société des Bains de Mer SWOT Analysis, its growth strategy, future prospects, and how it plans to maintain its competitive edge in the ever-changing landscape of luxury hospitality and entertainment, including its expansion plans in Monaco and its long-term outlook for SBM company.

How Is Société des Bains de Mer Expanding Its Reach?

The SBM Company is actively pursuing a multi-faceted growth strategy, focusing on expansion both within Monaco and internationally. This strategy includes entering new markets, launching new products, and forming strategic partnerships. These initiatives aim to diversify revenue streams and attract new clientele, leveraging the company's strong position in the luxury hospitality market.

A key element of this strategy is the development of Monte-Carlo One Courchevel, the group's first international hotel venture. This project is located in Courchevel 1850 and is set to open for the 2026/2027 winter season. The expansion efforts are designed to capitalize on regional potential, especially with the upcoming 2030 Winter Olympics.

Domestically, SBM is enhancing its existing properties and introducing new culinary and entertainment offerings. The success of recent launches, like Amazónico Monte-Carlo in April 2024 and the revamped Café de Paris brasserie in late 2023, demonstrates the effectiveness of these strategies. These efforts are part of a broader plan to strengthen Monaco's position as a premier global destination.

The development of Monte-Carlo One Courchevel represents a significant international initiative. This luxury hotel and chalet complex is designed to offer over 14,000 square meters of luxury space. Construction is scheduled to begin in May 2025, with the opening planned for the 2026/2027 winter season.

Several new venues are set to launch in 2025, including Marlow, Jondal at La Vigie Monte-Carlo, a Cédric Grolet boutique at the Hôtel de Paris Monte-Carlo, and the Monte-Carlo Cigar Club. The Monte-Carlo Beach is also undergoing renovations. These projects are designed to enhance the overall guest experience and drive revenue growth.

The agreement with D.ream International group to open a new restaurant brand in Dubai in 2025 is a key partnership. The plan is to export the brand to other luxury locations like Miami and London. This strategy leverages Monaco's culinary expertise and global brand recognition.

These expansions are driven by a strategy to enhance Monaco's status as a premier global destination. They aim to diversify revenue streams and stay ahead of industry trends by offering unique and high-end experiences, ensuring the company remains competitive in the luxury market. For further insights into the financial workings of the company, consider reading about the Revenue Streams & Business Model of Société des Bains de Mer.

The SBM Company is investing significantly in both domestic and international projects to boost its future prospects. These initiatives are designed to attract high-net-worth individuals and maintain a competitive edge in the luxury market.

- Monte-Carlo One Courchevel: A major international project set to open in the 2026/2027 winter season.

- New Venues in Monaco: Launching venues like Marlow, Jondal, and a Cédric Grolet boutique in 2025.

- Strategic Partnerships: Collaborations like the one with D.ream International to expand into Dubai, Miami, and London.

- Renovations and Enhancements: Upgrading existing properties, such as the wine cellars at the Hôtel de Paris.

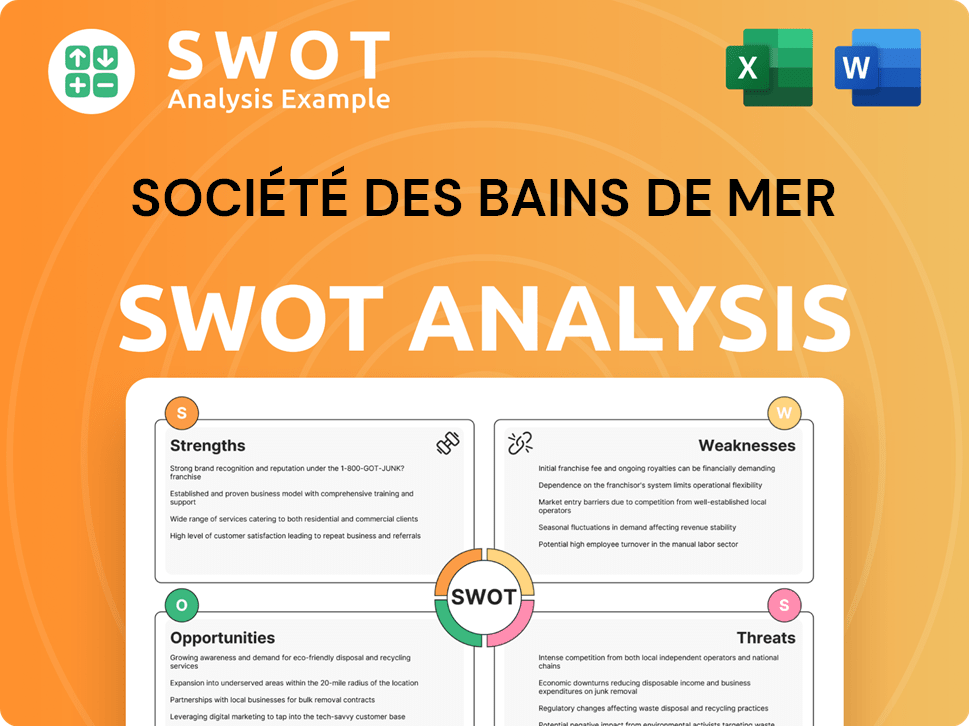

Société des Bains de Mer SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Société des Bains de Mer Invest in Innovation?

Société des Bains de Mer (SBM) actively integrates innovation and technology to enhance its luxury offerings and sustain growth. This strategy is crucial for maintaining its competitive edge in the luxury hospitality market, particularly in Monte Carlo. The company's commitment to digital transformation and sustainability showcases its forward-thinking approach.

SBM's focus on technological advancements and sustainable practices reflects its dedication to meeting evolving customer expectations. The company's initiatives are designed to improve operational efficiency and enhance the overall guest experience. These efforts align with the broader Marketing Strategy of Société des Bains de Mer, which aims to attract and retain high-net-worth individuals.

While specific details on R&D investments for 2024-2025 are not extensively publicized, SBM's continuous modernization efforts indicate a focus on technological integration. The company's strategy emphasizes continuous investment, modernization, and the creation of new establishments.

SBM is committed to digital transformation, with ongoing IT master plan projects. This includes integrating technology to improve customer experience and operational efficiency. Modern amenities are incorporated into renovated spaces like the Hôtel Hermitage and Monte-Carlo Bay.

SBM is focused on sustainability, which often involves technological solutions for environmental management. The company has transitioned to geothermal systems and introduced electric and hybrid vehicles. This aligns with their 'Go Sustainable' charter, signed in October 2022.

SBM's culinary excellence is highlighted by the award of three new Michelin stars in 2024/2025, bringing the total to ten. This reflects a commitment to innovation in service and product quality. The company is the most Michelin-starred resort in the world.

The commercialization of the Hôtel de Paris wine cellars, including an expanded museum and tours, demonstrates an innovative approach. This leverages existing assets for new revenue streams and enhanced customer experiences. This is part of SBM's growth strategy.

SBM's strategy emphasizes continuous investment, modernization, and the creation of new establishments. This forward-looking approach is key to maintaining its leadership in the luxury market. These efforts support the company's future revenue projections.

The company is focused on technological integration to improve customer experience and operational efficiency. The renovation of the Hôtel Hermitage and Monte-Carlo Bay includes modern technological amenities. This is part of SBM's expansion plans in Monaco.

SBM's approach includes digital transformation, sustainability initiatives, and culinary excellence. These strategies are crucial for adapting to changing market trends and attracting high-net-worth individuals. The company's competitive advantage in the luxury market is enhanced by these efforts.

- Digital Transformation: Ongoing IT master plan projects to improve customer experience.

- Sustainability: Transition to geothermal systems and electric vehicles, aligned with the 'Go Sustainable' charter.

- Culinary Excellence: Award of three new Michelin stars in 2024/2025, bringing the total to ten.

- Revenue Generation: Commercialization of the Hôtel de Paris wine cellars for new revenue streams.

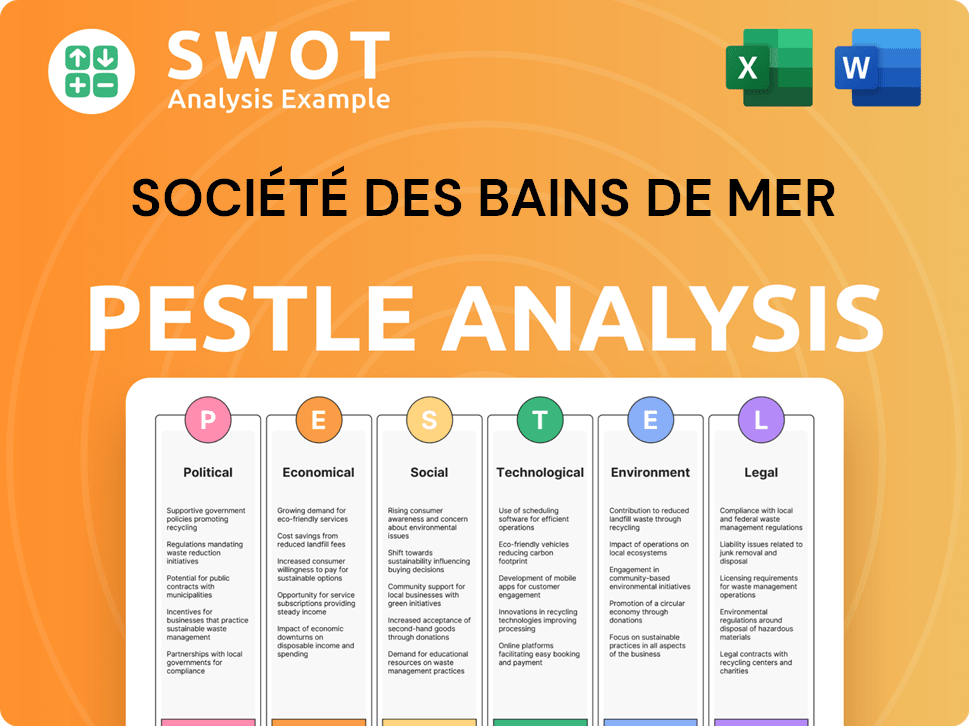

Société des Bains de Mer PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Société des Bains de Mer’s Growth Forecast?

The financial performance of Société des Bains de Mer (SBM) for the fiscal year 2024/2025, ending March 31, 2025, reflects a record year. The company's consolidated revenue reached €768 million, marking a 9% increase compared to the previous fiscal year. This growth underscores the effectiveness of SBM's Growth Strategy and its strong position in the Luxury Hospitality market.

The hospitality sector played a crucial role in this financial success. Hotel revenue increased by 16% to €399.9 million, accounting for 52% of total activity. The average room rate hit a record of €800 per night. Additionally, catering services saw a significant 24% increase, with over one million covers served. These figures highlight SBM's ability to attract and serve a high-end clientele in Monte Carlo.

The company's financial investments also contributed positively to its performance. The financial result reached €35.6 million, which boosted the overall profitability. The company's diversified business model, with equity at €1.64 billion and a positive net cash position of €186.3 million, provides a solid foundation for future growth. To learn more about the company's origins, you can read the Brief History of Société des Bains de Mer.

Consolidated revenue for 2024/2025 reached €768 million, a 9% increase from the previous year. This growth was driven by strong performance across various sectors, particularly hospitality and catering. This demonstrates the effectiveness of the SBM Company's strategic initiatives.

Hotel revenue increased by 16% to €399.9 million, accounting for 52% of total activity. The average room rate hit a record €800 per night. This highlights the success of SBM in the luxury market. These figures support the Future Prospects.

Catering revenue increased by 24%, with over one million covers served. Rental revenue reached a record €74 million. This diversification contributes to the overall financial health and demonstrates the SBM Company business model.

Consolidated operating income for 2024/2025 was €74.5 million, and net income rose to €110.1 million. This reflects the company's ability to manage costs and generate profits. This is a good sign for Société des Bains de Mer stock analysis.

Management anticipates continued positive trends for the first two months of the 2025/2026 fiscal year. SBM is continuing its investment strategy, including renovations and new openings within its Monaco resort and the significant hotel development project in Courchevel.

- SBM plans to consolidate its presence in luxury hospitality.

- The company is focused on continuous investment and development across all business segments.

- The company's strategy focuses on attracting high-net-worth individuals to Monaco.

- SBM is adapting to changing market trends.

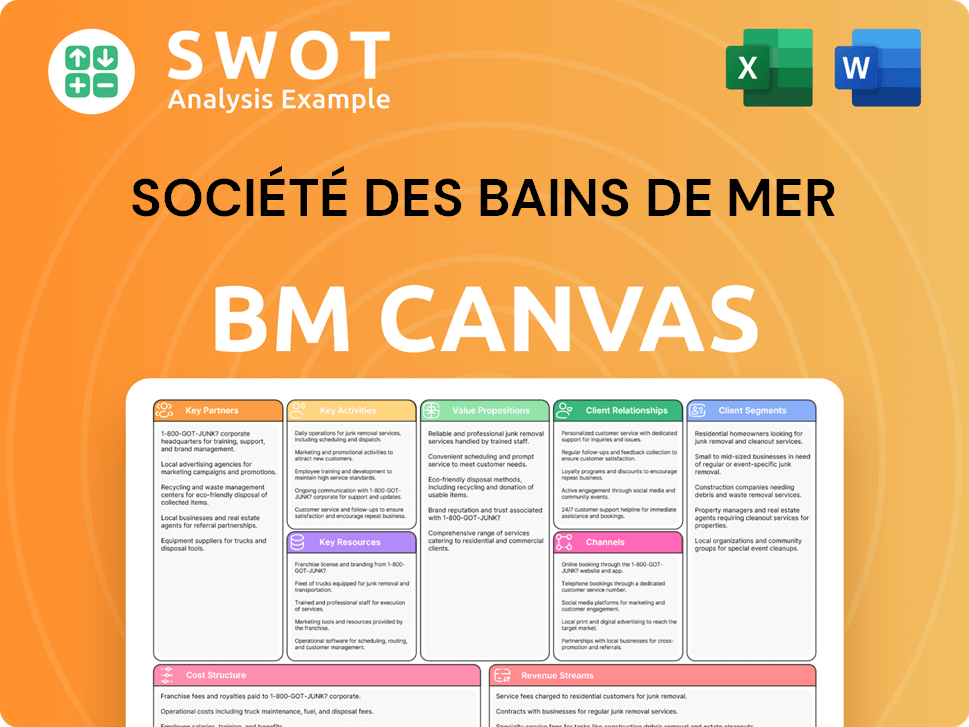

Société des Bains de Mer Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Société des Bains de Mer’s Growth?

The Société des Bains de Mer (SBM) faces several potential risks and obstacles that could influence its future growth and financial performance. These challenges span market competition, regulatory changes, technological disruptions, and internal operational constraints. Understanding these risks is crucial for assessing the long-term outlook of the company and its ability to maintain its position in the luxury hospitality and gaming sectors.

Despite its strong presence in Monte Carlo and its established brand, SBM must navigate a complex landscape to sustain its growth trajectory. The company's expansion plans, including international ventures, aim to mitigate some of these risks by diversifying its revenue streams and customer base. The ability to adapt to changing market dynamics and proactively address potential challenges will be key to SBM's success.

For a deeper dive into the company's ownership structure and financial health, consider exploring the analysis provided by Owners & Shareholders of Société des Bains de Mer.

The luxury hospitality market is highly competitive globally, posing a significant challenge to SBM's growth. While SBM has a strong position in Monaco, it must compete with other luxury resorts and casinos worldwide. Diversifying geographically and expanding into new markets, like the Courchevel project and the Dubai restaurant, is crucial.

The gaming sector is subject to regulatory changes and increased global compliance constraints, impacting SBM's revenue. The inherent unpredictability of the gaming sector makes forecasting challenging. A slight 3% dip in gaming revenue was observed in the 2024/2025 fiscal year due to these factors.

Rapid technological advancements in the hospitality and entertainment industries require continuous adaptation. SBM is investing in its IT master plan to maintain a competitive edge. Staying ahead of technological trends is essential to meet evolving customer expectations.

Supply chain vulnerabilities could affect high-end catering and hotel operations. Reliance on premium goods and services makes SBM vulnerable to supply chain disruptions. Although not explicitly detailed, this is a potential risk that could impact operations.

Managing a large workforce of over 5,000 employees and recruiting seasonal workers presents operational challenges. Although the company offers a €1,800 performance bonus to each staff member, managing costs while maintaining profitability is crucial. Staff wages account for a significant portion of restaurant revenue.

SBM’s financial position, while strong, is subject to economic fluctuations and market conditions. The company's ability to maintain its strong financial health, with €1.64 billion in equity and a positive net cash position of €186.3 million, provides a buffer against unforeseen obstacles. Maintaining profitability is crucial.

SBM addresses these risks through a diversified strategy across gaming, accommodations, catering, and real estate. Continuous modernization of hotels and renewal of culinary and entertainment offerings are key. The company's strong financial position, with a positive net cash position of €186.3 million, provides a buffer against unforeseen obstacles.

Stéphane Valeri, Chairman and CEO, emphasizes the importance of innovation and investment. The group will continue to invest, modernize, and create new establishments. International development is a key part of shaping SBM's future trajectory.

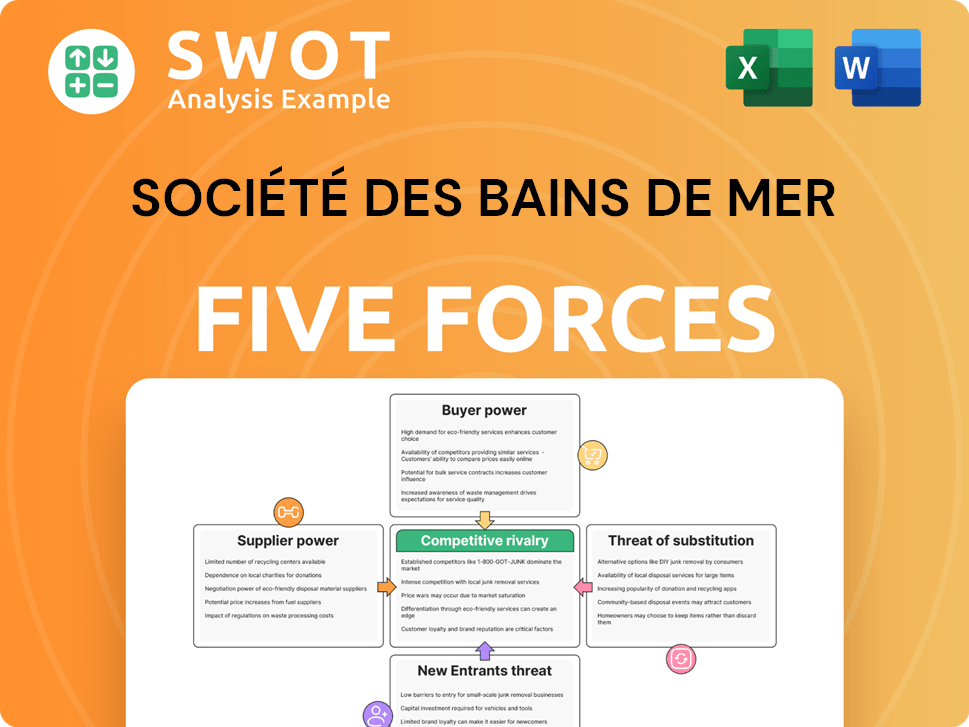

Société des Bains de Mer Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Société des Bains de Mer Company?

- What is Competitive Landscape of Société des Bains de Mer Company?

- How Does Société des Bains de Mer Company Work?

- What is Sales and Marketing Strategy of Société des Bains de Mer Company?

- What is Brief History of Société des Bains de Mer Company?

- Who Owns Société des Bains de Mer Company?

- What is Customer Demographics and Target Market of Société des Bains de Mer Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.