Société des Bains de Mer Bundle

Who Really Owns Société des Bains de Mer?

Unraveling the ownership of Société des Bains de Mer (SBM), the powerhouse behind Monaco's luxury scene, is key to understanding its strategic moves and future prospects. From its inception in 1863 under Prince Charles III, SBM has evolved into a global leader in luxury resorts and entertainment. With a record-breaking revenue of €768 million and a market cap of $2.872 billion as of June 2025, the question of who controls this Monegasque icon is more relevant than ever.

This deep dive into Société des Bains de Mer SWOT Analysis will explore the intricate web of SBM ownership, from its historical roots to its current shareholders. We'll examine the influence of major stakeholders, the role of the Monaco government, and the impact of private investment on this iconic company, including the Casino de Monte-Carlo. Understanding SBM ownership is crucial for anyone interested in its financial performance and strategic direction.

Who Founded Société des Bains de Mer?

The founding of Société des Bains de Mer (SBM) on April 2, 1863, marked a pivotal moment in the development of Monaco's luxury and gaming industries. The company's creation was driven by Prince Charles III of Monaco, who envisioned a premier destination for entertainment and leisure. This vision was brought to life through the strategic involvement of key figures like French businessman François Blanc.

François Blanc, who had previously achieved success in Homburg, was entrusted with the mission to develop the gaming and hotel industry in Monaco. He secured ownership of SBM and Cercle des Etrangers à Monaco for a period of 50 years. Blanc's expertise in creating luxurious environments was crucial to establishing Monte Carlo's reputation as a top destination.

While specific details on initial shareholding aren't readily available, François Blanc's significant role underscores his substantial control and investment in the company's early development. The Hôtel de Paris, Café de Paris, and Opéra de Monte-Carlo were among the early constructions, forming the core of the Place du Casino. These developments attracted notable personalities, solidifying Monte Carlo's status as a premier destination for the elite. The Growth Strategy of Société des Bains de Mer has been instrumental in maintaining its position.

Société des Bains de Mer (SBM) was officially founded on April 2, 1863.

French businessman François Blanc was a key figure in developing the gaming and hotel industry.

Early developments included the Hôtel de Paris (1864), Café de Paris (1868), and Opéra de Monte-Carlo (1879).

François Blanc owned SBM and Cercle des Etrangers à Monaco for 50 years.

After François Blanc's death, his wife, Marie Blanc, continued his work.

Monte Carlo became a premier destination for notable personalities and aristocracy.

The early ownership of SBM was primarily held by François Blanc, who significantly shaped the company's foundational phase. The initial focus was on developing luxury resorts and casinos to attract high-profile clientele to Monaco. The company's early ventures, such as the Casino de Monte-Carlo, played a crucial role in establishing Monte Carlo's reputation. These developments were instrumental in attracting wealthy individuals and aristocracy, solidifying Monte Carlo's image as a premier destination for luxury and entertainment.

- François Blanc's ownership was key to SBM's early success.

- Early developments included the construction of iconic landmarks.

- These ventures attracted a wealthy and influential clientele.

- SBM established Monte Carlo as a top luxury destination.

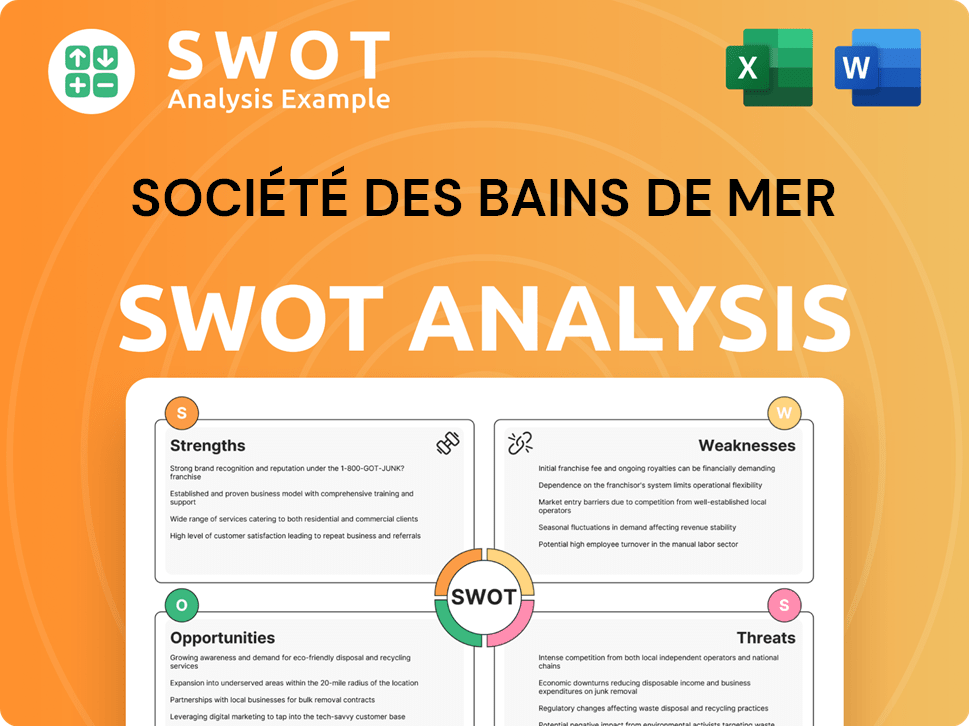

Société des Bains de Mer SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Société des Bains de Mer’s Ownership Changed Over Time?

The ownership structure of Société des Bains de Mer (SBM) has evolved significantly since its inception. Initially a privately-driven venture, the company is now predominantly controlled by the Monegasque State. The Government of Monaco currently holds a substantial stake in SBM, reflecting a strategic shift in ownership over time. Understanding the dynamics of SBM ownership is crucial for anyone interested in the company's financial performance and future prospects. The evolution of SBM's ownership is closely tied to the company's strategic direction and its role within the Principality of Monaco.

As of recent reports, the Government of Monaco holds a dominant stake of 59.47% in SBM. This significant ownership stake underscores the close relationship between SBM and the state. Beyond the state's controlling interest, several other major stakeholders hold notable percentages. Billionaire Aaron Frenkel, through Equity Finance & Investment Ltd., holds 7.8% of the company. The luxury conglomerate LVMH (UFIPAR SAS) holds a 5% stake, and GEG Investment Holdings holds 4.99%. SBM is a publicly traded company listed on Euronext Paris under the ticker BAIN. Its market capitalization was approximately €2.50 billion as of June 12, 2025, and $2.872 billion as of June 2, 2025.

| Stakeholder | Percentage | Details |

|---|---|---|

| Government of Monaco | 59.47% | Dominant shareholder, reflecting the close relationship between SBM and the state. |

| Aaron Frenkel (Equity Finance & Investment Ltd.) | 7.8% | Significant private investor in SBM. |

| LVMH (UFIPAR SAS) | 5% | Luxury conglomerate with a notable stake. |

| GEG Investment Holdings | 4.99% | Another key investor in SBM. |

Key events have significantly impacted SBM's ownership structure. A notable transaction occurred on June 30, 2022, where SBM transferred its full ownership of 47.30% in Betclic Everest Group (BEG) to FL Entertainment N.V. (renamed Banijay Group). This strategic move generated an exceptional profit of €813.5 million for SBM's consolidated financial statements for the fiscal year 2022/2023. As a result of this disposal and asset contribution, SBM International holds 4.95% of the voting rights and 10.39% of the economic rights in FL Entertainment, which is listed on Euronext Amsterdam. This strategic restructuring showcases SBM's commitment to optimizing its portfolio and generating capital for future developments. For more details about the company's revenue streams and business model, you can read Revenue Streams & Business Model of Société des Bains de Mer.

The Government of Monaco is the primary owner of Société des Bains de Mer, holding a majority stake.

- Other significant shareholders include Aaron Frenkel, LVMH, and GEG Investment Holdings.

- SBM's strategic decisions, such as the sale of its stake in Betclic Everest Group, have reshaped its financial landscape and ownership structure.

- SBM is a publicly traded company, offering investment opportunities on the Euronext Paris exchange.

- These changes highlight SBM's strategic approach to portfolio optimization and value creation.

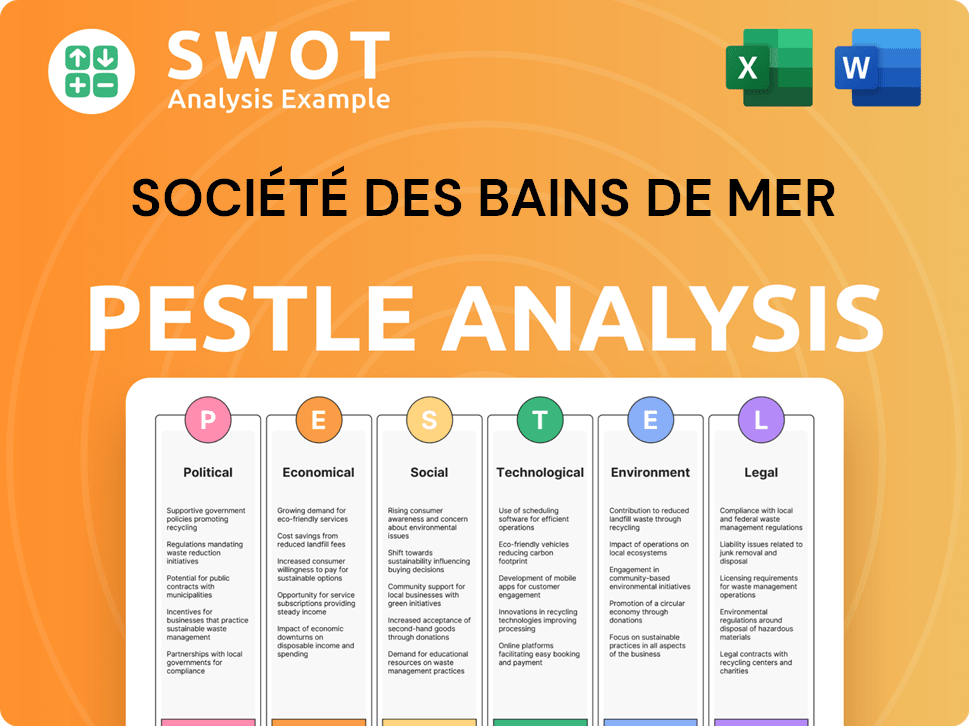

Société des Bains de Mer PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Société des Bains de Mer’s Board?

The current Board of Directors of Société des Bains de Mer (SBM) is pivotal in guiding the company, reflecting its ownership structure. Stéphane Valeri leads as Chairman and Chief Executive Officer. The management team includes Albert Manzone as Deputy Chief Executive Officer, Virginie Cotta as Corporate Secretary, Sophie Vincent as Chief Human Resources Officer, Vincent Bouvet as Chief Financial Officer, Julien Chenaf as Chief Information Officer, Julien Munoz as Chief Marketing and Digital Officer, Pascal Camia as Chief International Development Officer, Cedric Plantavin as Chief Legal Officer, and Olivier Bernard as Chief Construction and Real Estate Development Officer.

This team oversees the operations of SBM, which includes the iconic Casino de Monte-Carlo and various luxury resorts in Monaco. The leadership structure is designed to manage the diverse business interests of SBM, ensuring strategic alignment and operational efficiency. The composition of the board highlights the company's commitment to maintaining its premier status in the luxury hospitality and entertainment sectors. Understanding the board's composition is key to grasping the dynamics of SBM's governance and its strategic direction, especially in relation to SBM ownership.

| Position | Name | Title |

|---|---|---|

| Chairman & CEO | Stéphane Valeri | Chairman and Chief Executive Officer |

| Deputy CEO | Albert Manzone | Deputy Chief Executive Officer |

| Corporate Secretary | Virginie Cotta | Corporate Secretary |

| Chief Financial Officer | Vincent Bouvet | Chief Financial Officer |

The voting structure at SBM is largely based on a one-share-one-vote system, typical for publicly traded companies. However, the significant stake held by the Monegasque Government, at 59.47%, grants it substantial control and influence in decision-making. An Ordinary General Meeting held on September 20, 2024, saw shareholders voting on several resolutions, including the approval of financial statements for the fiscal year ending March 31, 2024. At this meeting, the total number of shares with voting rights was 24,516,661, with an impressive participation rate of 89.25% of votes. The agenda for board meetings is set by the Board of Directors, with proposals also potentially coming from statutory auditors or a group of shareholders holding at least one-tenth of the share capital. This structure ensures a balance between shareholder input and governmental influence, shaping the strategic direction of SBM. For further insights into the company's background, you can explore the Brief History of Société des Bains de Mer.

SBM's Board of Directors includes key figures like Stéphane Valeri, driving the company's strategic direction.

- The Monegasque Government's majority ownership significantly influences decision-making.

- Shareholders actively participate in key votes, as seen in the high participation rate at the September 2024 meeting.

- SBM's governance structure balances shareholder rights with governmental oversight.

- The company's leadership team manages a portfolio that includes luxury resorts and the Casino de Monte-Carlo.

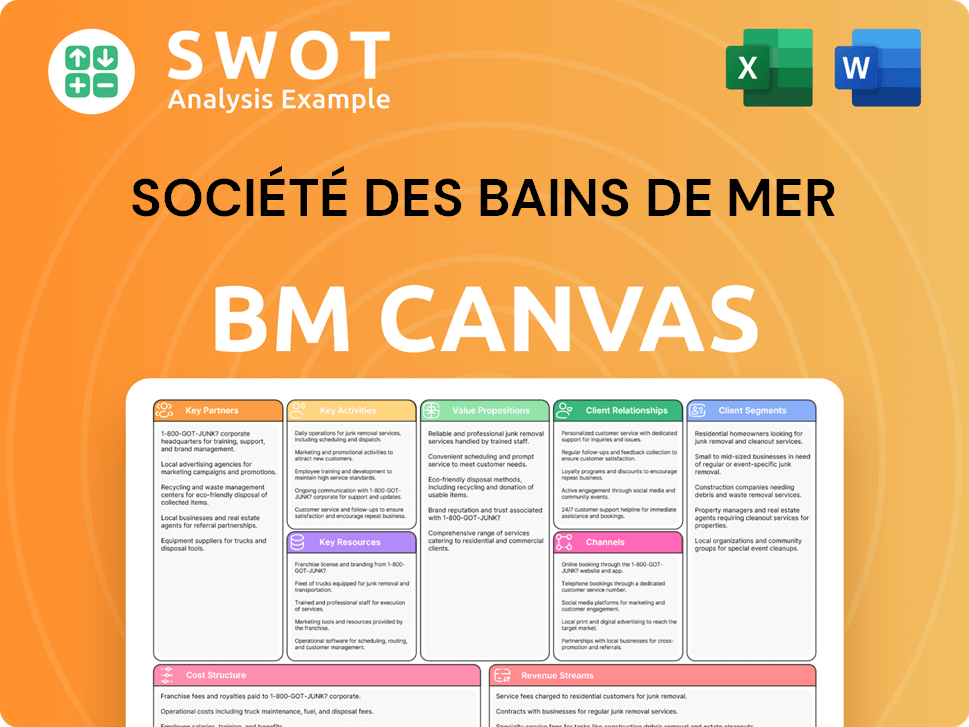

Société des Bains de Mer Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Société des Bains de Mer’s Ownership Landscape?

Over the past few years, the ownership and strategic direction of Société des Bains de Mer (SBM) have evolved, reflecting a focus on international expansion and diversification. For the fiscal year 2024-2025, SBM reported a record revenue of €768 million, a 9% increase, with a net profit of €110.1 million. This positive financial performance, including a 16% increase in hotel revenue to €399.9 million, underscores the success of its diversified business model. SBM's shareholder's equity (Group share) reached €1,643 million as of March 31, 2025, up from €1,567 million at the end of the previous fiscal year, and a positive net cash position of €186.3 million as of March 31, 2025, significantly up from €68.9 million on March 31, 2024, provides a strong foundation for future development.

A key development in SBM's strategy has been its expansion into luxury resorts and international markets. The acquisition of Le Palace des Neiges in Courchevel 1850 in October 2023 marked its first international hotel venture, with construction scheduled to begin in April 2024. Furthermore, SBM is venturing into new areas like cruise casinos, with its first Monte-Carlo casino launched aboard the Crystal Symphony in November 2024. The launch of Monte-Carlo Club 1863 internationally, with the first opening in Dubai in autumn 2025, highlights SBM's commitment to enhancing its global luxury hospitality and entertainment presence. These initiatives, along with SBM's strong financial position, signal a clear trend towards enhancing its global luxury hospitality and entertainment presence. To understand the competitive environment, see Competitors Landscape of Société des Bains de Mer.

| Financial Metric | Fiscal Year 2024-2025 | Fiscal Year 2023-2024 |

|---|---|---|

| Revenue (€ million) | 768 | 704 |

| Net Profit (€ million) | 110.1 | 98.7 |

| Shareholder's Equity (€ million) | 1,643 | 1,567 |

| Net Cash Position (€ million) | 186.3 | 68.9 |

The strategic moves and financial results of SBM indicate a proactive approach to maintain and grow its market position. SBM's ownership structure is deeply intertwined with the Principality of Monaco. The government of Monaco, along with the Grimaldi family, holds a significant stake in the company, ensuring its alignment with the principality's interests and its commitment to luxury and entertainment. This relationship is crucial to understanding SBM's strategic decisions and its long-term vision.

Acquisition of Le Palace des Neiges in Courchevel 1850 in October 2023, expanding into international luxury resorts.

Record revenue of €768 million in fiscal year 2024-2025, a 9% increase, with a net profit of €110.1 million.

Venturing into cruise casinos with the first Monte-Carlo casino aboard the Crystal Symphony in November 2024.

Strong ties with the government of Monaco and the Grimaldi family, ensuring alignment with the principality's interests.

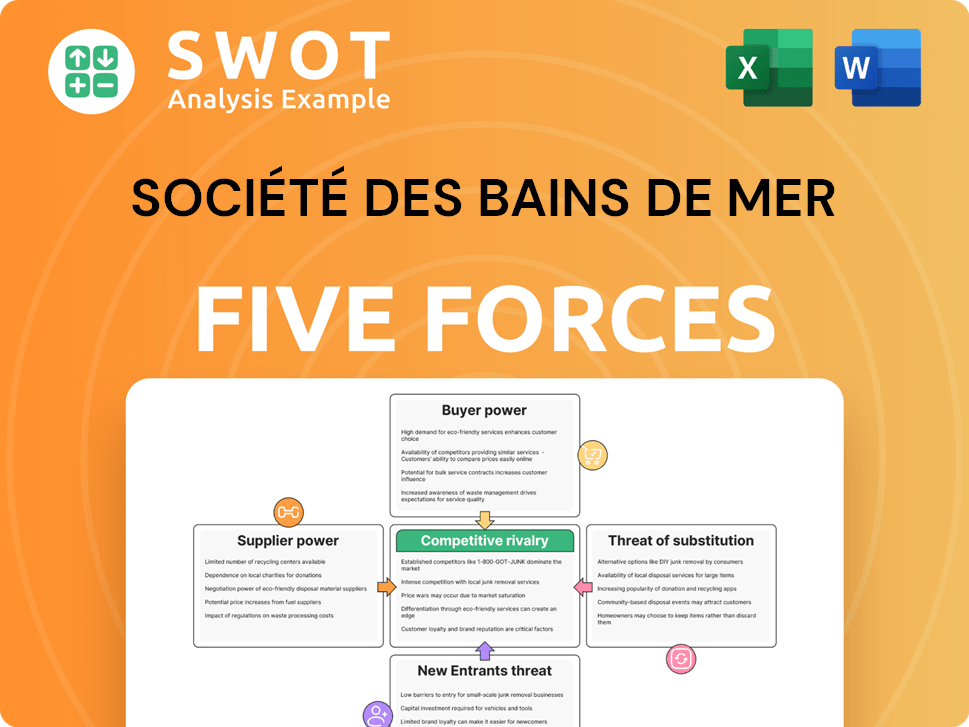

Société des Bains de Mer Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Société des Bains de Mer Company?

- What is Competitive Landscape of Société des Bains de Mer Company?

- What is Growth Strategy and Future Prospects of Société des Bains de Mer Company?

- How Does Société des Bains de Mer Company Work?

- What is Sales and Marketing Strategy of Société des Bains de Mer Company?

- What is Brief History of Société des Bains de Mer Company?

- What is Customer Demographics and Target Market of Société des Bains de Mer Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.