Société des Bains de Mer Bundle

How Does Société des Bains de Mer Thrive in Monte Carlo?

Société des Bains de Mer (SBM), a cornerstone of Monaco's allure since 1863, isn't just a company; it's an experience. This luxury powerhouse masterfully blends casinos, hotels, and entertainment, creating an integrated ecosystem that defines high-end hospitality. With a recent financial surge, including a record-breaking €768 million revenue in the fiscal year ending March 2025, SBM showcases its enduring appeal.

To truly understand SBM's success, we must explore its multifaceted operations and strategic vision. From its iconic Casino de Monte-Carlo to its Société des Bains de Mer SWOT Analysis, SBM's influence extends far beyond its luxurious properties. This deep dive will unravel the secrets behind SBM's impressive financial performance, its strategic investments, and its pivotal role in Monaco's economy, offering insights for investors and industry enthusiasts alike. Knowing how SBM manages its properties and its real estate portfolio is crucial for understanding its sustained success.

What Are the Key Operations Driving Société des Bains de Mer’s Success?

Société des Bains de Mer (SBM) is a cornerstone of Monaco's luxury ecosystem, offering a comprehensive array of high-end experiences. The company caters to an affluent international clientele through its integrated offerings. These include luxury hotels, casinos, restaurants, bars, and real estate holdings, all meticulously managed to provide an unparalleled experience.

The core operations of SBM are designed to deliver exceptional value through a combination of world-class service, exclusive access, and the prestigious Monte-Carlo brand. Its operational uniqueness stems from its exclusive gaming rights in Monaco and ownership of iconic assets. This integrated approach allows SBM to create a seamless and exclusive experience for its guests.

SBM's value proposition is rooted in its ability to offer an integrated luxury resort experience. This is achieved through rigorous standards in hotel management, culinary excellence, casino operations, and property maintenance. The company's operational processes are meticulously managed to ensure a seamless and exclusive experience for its guests.

SBM's primary offerings include luxury hotels, such as the Hôtel de Paris Monte-Carlo and the Monte-Carlo Beach. The company operates the iconic Casino de Monte-Carlo, and manages over 30 restaurants and bars. It also has extensive real estate holdings, including commercial and residential properties.

SBM maintains rigorous standards in hotel management, culinary excellence, and casino operations. The company focuses on providing seamless and exclusive experiences. These operations are supported by a robust supply chain and strategic partnerships.

SBM offers an unparalleled, integrated luxury resort experience. This includes world-class service, exclusive access to high-end entertainment, and the prestigious Monte-Carlo brand. The company's commitment to excellence differentiates it from competitors.

SBM collaborates with luxury dining groups for international restaurant expansions, enhancing its offerings. These partnerships extend its global reach and enhance its brand presence. These collaborations are a key part of SBM's strategy for growth.

SBM's operational success is underpinned by several key factors. The company's exclusive gaming rights in Monaco provide a significant competitive advantage. Its ownership of iconic assets, such as the Casino de Monte-Carlo, reinforces its glamorous image and brand prestige. To understand more about the company's marketing approach, you can read about the Marketing Strategy of Société des Bains de Mer.

- Exclusive Gaming Rights: SBM holds exclusive rights in Monaco, a significant revenue driver.

- Luxury Hotels: The company operates high-end hotels that attract affluent guests.

- Casino de Monte-Carlo: This iconic casino is a major attraction and revenue source.

- Real Estate: SBM's real estate portfolio includes valuable commercial and residential properties.

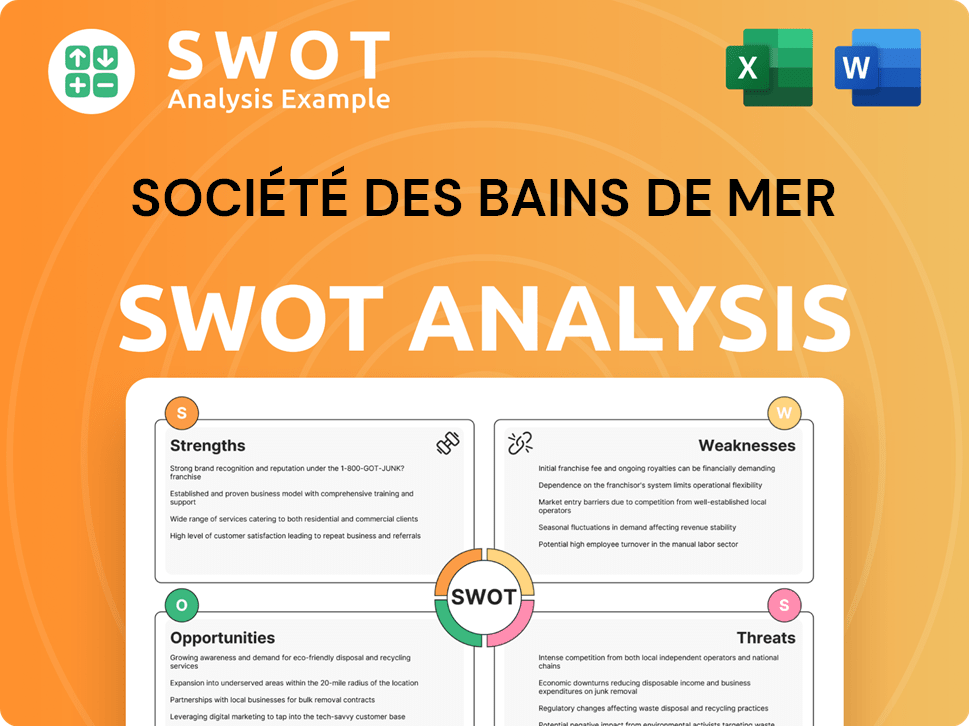

Société des Bains de Mer SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Société des Bains de Mer Make Money?

The revenue streams and monetization strategies of the Société des Bains de Mer (SBM) are intricately linked to its luxury hospitality and gaming operations, primarily centered in Monte Carlo, Monaco. SBM's financial performance reflects its ability to attract high-end clientele and manage its diverse portfolio of assets effectively. Understanding these strategies is key to grasping how SBM maintains its position in the luxury market.

For the fiscal year ending March 31, 2025, SBM reported a consolidated revenue of €768 million, marking a 9% increase year-on-year. This growth underscores the company's resilience and strategic focus on maximizing revenue across its core business segments. SBM's operations are a significant part of Monaco's economy.

SBM's primary revenue drivers are:

The hotel sector is the largest contributor to SBM's revenue. For the fiscal year 2024/2025, it climbed 16% to €399.9 million, representing 52% of total activity. This growth was driven by increased summer occupancy rates, higher average daily rates (ADR), and the popularity of new venues. The ADR across all hotels reached a record €800 per night.

- The opening of venues like Amazónico Monte-Carlo and the revamped Café de Paris contributed to the sector's growth.

- The hotel sector's strong performance highlights SBM's ability to attract high-spending tourists.

- The company focuses on maximizing occupancy and ADR in its luxury resorts.

Gaming generated €215.5 million in revenue for fiscal year 2024/2025, a 3% decrease from the previous year. This decline was due to unfavorable variance and stricter compliance regulations, despite an increase in gaming volume. In fiscal year 2023/2024, gaming revenue was €221.3 million, accounting for over 30% of total revenue. The Casino de Monte-Carlo is a key part of this revenue stream.

- Despite the slight decrease, gaming remains a significant revenue source.

- SBM continues to adapt to changing regulatory environments.

- The company leverages its exclusive gaming rights to maintain its competitive edge.

Revenue from rental activities reached €149.9 million for fiscal year 2024/2025, an 11% increase. This segment, which includes the rental of boutiques, offices, and luxury residences, showed resilience with a nearly 100% occupancy rate and positive lease indexations. In fiscal year 2023/2024, rental revenue was €135.4 million, contributing just under 20% of total revenue. SBM's real estate portfolio adds to its revenue streams.

- Rental activities provide a stable revenue stream.

- The high occupancy rate indicates strong demand for SBM's properties.

- The company optimizes rental income through new leases and indexed rent adjustments.

SBM employs several monetization strategies. These include tiered pricing for its hospitality offerings and cross-selling between its various luxury services. For example, guests staying at SBM's luxury hotels might utilize the casino and spa facilities. The company also focuses on maximizing occupancy and average daily rates in its hotel sector and optimizing rental income through new leases and indexed rent adjustments. To understand who SBM targets, read this article about Target Market of Société des Bains de Mer.

While the catering business remained unprofitable for fiscal year 2024/2025, it is considered an integral part of the company's identity and commitment to staff well-being. The company's focus on operational efficiency and strategic investments supports its financial performance and market position.

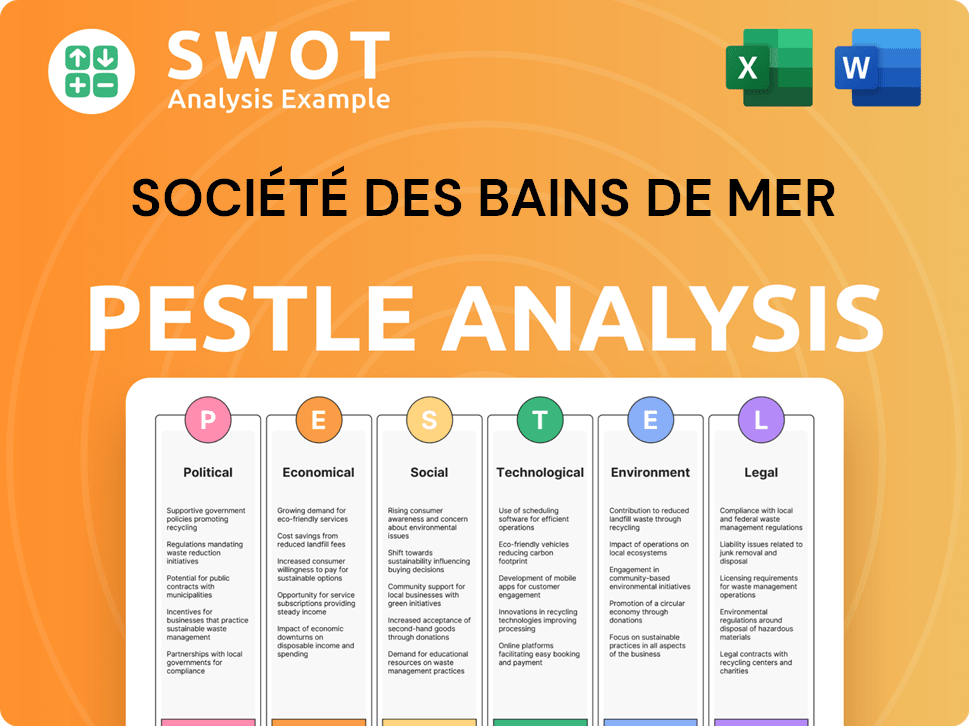

Société des Bains de Mer PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Société des Bains de Mer’s Business Model?

Société des Bains de Mer (SBM) has consistently demonstrated strategic prowess, marked by significant milestones and adaptive maneuvers. The company's trajectory is defined by its ability to evolve within the luxury tourism and entertainment sectors. Its recent financial performance and strategic expansions highlight its commitment to growth and maintaining its competitive edge in the market.

A key recent milestone for SBM was achieving a record revenue of €768 million for the fiscal year ending March 31, 2025. This financial achievement underscores the effectiveness of its diversified business model. Strategic moves, such as the launch of new venues and international expansions, are central to SBM's ongoing success.

SBM's operational highlights include the successful launch of Amazónico Monte-Carlo in April 2024 and the reopening of the Café de Paris Monte-Carlo brasserie in November 2023. These initiatives have significantly contributed to revenue growth. SBM's strategic vision also encompasses international expansion, as seen with the acquisition of the Palace des Neiges in Courchevel, slated to open in December 2027. The brand is also extending its restaurant presence with the Monte-Carlo Club 1863, with its first international location planned for Dubai in autumn 2025.

SBM's financial performance has been robust, with record revenue of €768 million for the fiscal year ending March 31, 2025. The company's strategic moves include the launch of Amazónico Monte-Carlo and the reopening of the Café de Paris Monte-Carlo brasserie. International expansion is also a key focus, with the acquisition of the Palace des Neiges in Courchevel.

SBM is actively expanding its global footprint, particularly with the opening of Monte-Carlo Club 1863 in Dubai. The company is also focused on enhancing its existing properties through renovations and new venue openings. These moves aim to maintain SBM's leadership in the luxury tourism sector and adapt to evolving market trends.

SBM's brand strength, embodied by 'Monte-Carlo,' offers a globally recognized luxury experience. The company benefits from exclusive gaming rights in Monaco and its unique 'Resort' offering. SBM also maintains a strong financial position, with a net cash position of €186.3 million as of March 31, 2025.

The company faces challenges, such as the unpredictable nature of gaming revenue. SBM has responded by focusing on its diversified strategy, with strong performances in its hotel and rental sectors offsetting the gaming dip. Continuous adaptation through renovations and new openings helps maintain its leadership.

SBM's competitive advantages are significant, stemming from its strong brand and unique offerings. The company's brand, 'Monte-Carlo,' is synonymous with luxury and excellence. SBM's integrated resort model, combining hotels, casinos, and entertainment, provides a comprehensive experience.

- Exclusive gaming rights within Monaco.

- A strong financial position, with a net cash position of €186.3 million as of March 31, 2025.

- Continuous adaptation through renovations and new venue openings.

- International expansion to maintain its leadership in luxury tourism.

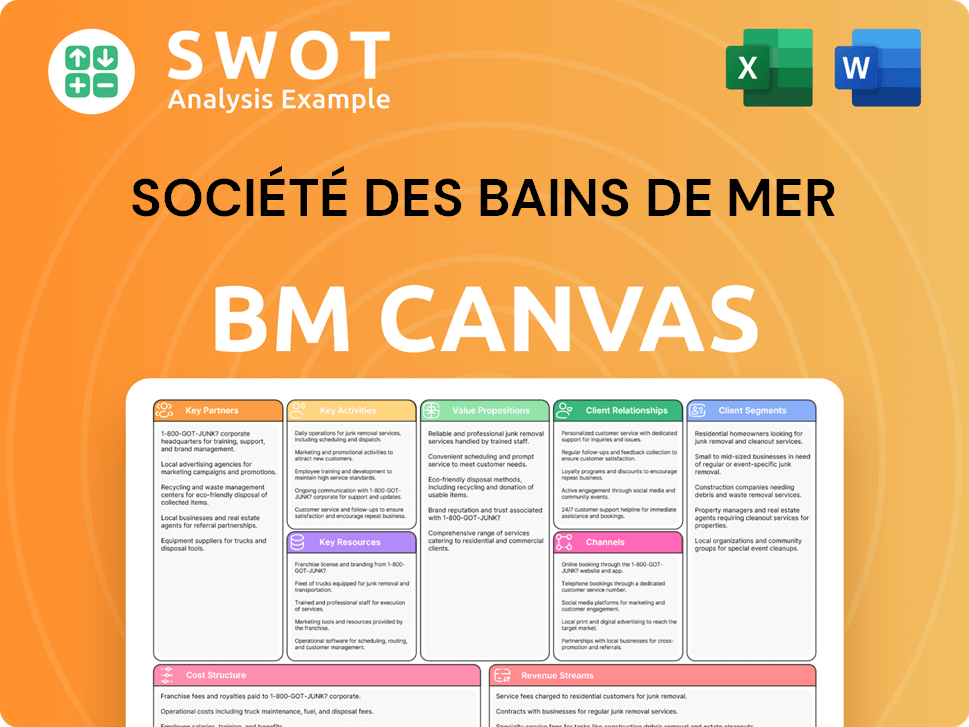

Société des Bains de Mer Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Société des Bains de Mer Positioning Itself for Continued Success?

Société des Bains de Mer (SBM) holds a prominent position in Monaco's luxury tourism and gaming sectors. The company benefits from exclusive gaming rights in the principality, which significantly contributes to its market share. Its brand recognition and integrated luxury resort experiences drive customer loyalty, solidifying its status in the industry.

SBM's operations are primarily based in Monaco, but the company is expanding internationally. This includes projects like Monte-Carlo One Courchevel and the Monte-Carlo Club 1863 restaurant in Dubai. SBM's strategic initiatives and investments aim to sustain and expand its revenue generation capabilities, ensuring its continued success in the luxury market.

SBM dominates the luxury tourism and gaming market in Monaco. Its exclusive gaming rights and iconic assets, such as the Casino de Monte-Carlo, contribute to its strong market position. The company's integrated luxury resort experience fosters customer loyalty and brand recognition.

Regulatory changes, especially in gaming, could affect SBM's revenue. Competition in luxury hospitality and gaming, and changing consumer preferences, pose challenges. The inherent unpredictability of gaming operations also creates short-term forecasting difficulties.

SBM is investing in existing properties and developing new offerings. The company is focused on optimizing its real estate portfolio. Leadership emphasizes a diversified strategy and continued investment across all business segments. SBM aims to expand its global luxury footprint.

Ongoing investments in casinos and hotels are planned. New offerings include the Monte-Carlo Cigar Club and Marlow restaurant. SBM is also focusing on a new ultra-luxury residential and commercial complex in Monaco. International expansion is a key focus.

SBM's financial strategy involves continued investment across all business segments. The company aims to leverage its strong financial standing. This strategy is designed to solidify its position as a leading luxury resort and expand its global footprint.

- The company is focused on sustained profitability.

- SBM is committed to a diversified approach across gaming, accommodations, catering, and real estate.

- International growth drivers are being actively developed.

- SBM's ability to generate revenue is a key focus.

The article, Growth Strategy of Société des Bains de Mer, provides additional insights into the company's expansion plans and strategic initiatives.

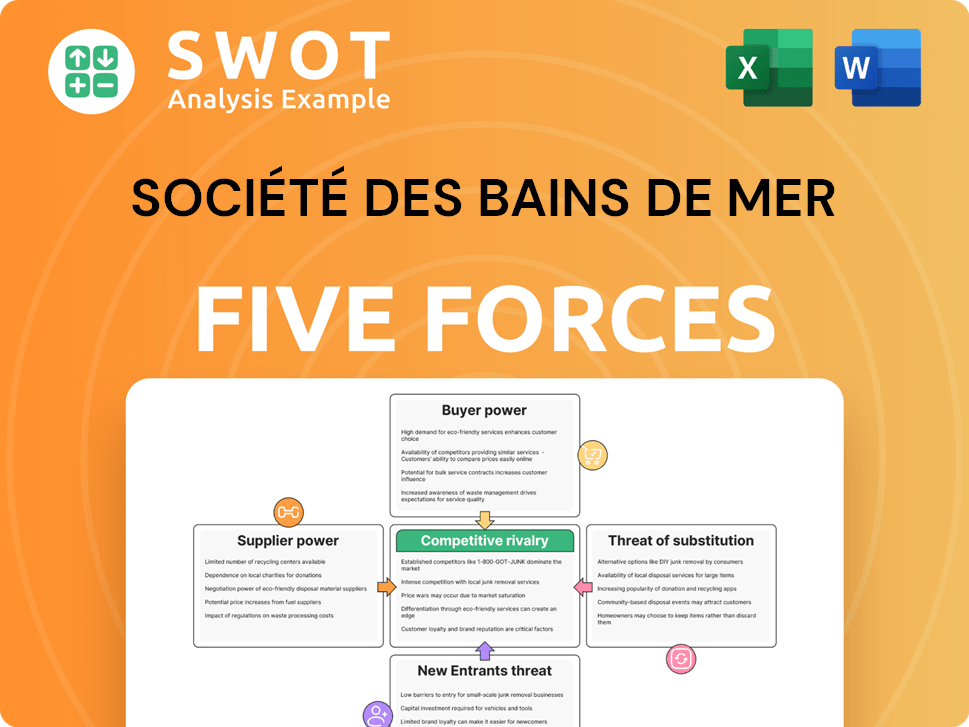

Société des Bains de Mer Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Société des Bains de Mer Company?

- What is Competitive Landscape of Société des Bains de Mer Company?

- What is Growth Strategy and Future Prospects of Société des Bains de Mer Company?

- What is Sales and Marketing Strategy of Société des Bains de Mer Company?

- What is Brief History of Société des Bains de Mer Company?

- Who Owns Société des Bains de Mer Company?

- What is Customer Demographics and Target Market of Société des Bains de Mer Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.