Nanogate Bundle

Can Techniplas Nano Tec SE reshape the future of advanced materials?

Following a strategic acquisition in 2021, Techniplas Nano Tec SE, formerly Nanogate SE, is charting a new course in the competitive landscape. This transformation, born from a period of restructuring, has positioned the company to leverage its expertise in nanotechnology and advanced materials. Explore the Nanogate SWOT Analysis to understand the core strengths and weaknesses driving this evolution.

This in-depth analysis explores the Nanogate growth strategy, focusing on its market position and future prospects within the automotive and industrial sectors. We'll delve into the company's business model, examining its potential for long-term growth and sustainability, alongside an assessment of its financial performance. Understanding the challenges and opportunities facing Techniplas Nano Tec SE is key to evaluating its investment opportunities and impact on the industry.

How Is Nanogate Expanding Its Reach?

The expansion initiatives of the combined entity, following the acquisition of the core business of the company by Techniplas, are primarily focused on leveraging the strengths of both companies. This strategic move aimed to broaden capabilities and market reach. The goal is to capitalize on the company's expertise in nanotechnology-based surface finishing and coating, alongside Techniplas' established global presence in plastic component manufacturing. This approach is central to the company's Nanogate growth strategy.

The merger has significantly increased the company's operational footprint. The combined entity now operates across 30 global sites and serves over 250 customers worldwide. This enhanced infrastructure supports the company's ability to access new markets and diversify revenue streams. With a workforce exceeding 3,500 employees, the focus is on integrating operations to maximize efficiency and innovation. This is a key aspect of the company analysis.

The company is concentrating on high-performance surfaces and components. These include those with advanced functionalities like radar-transparency, translucency, and anti-corrosion properties. The focus on innovation and advanced materials is a critical element of the company's future prospects.

The company is actively expanding its presence in key markets, particularly the automotive and industrial sectors. This expansion strategy involves leveraging existing customer relationships while pursuing new opportunities. The goal is to increase market share and diversify revenue streams.

A significant part of the expansion strategy involves continuous innovation in product offerings. The focus is on developing advanced materials and surface treatments that offer superior performance. These innovations are designed to meet the evolving needs of various industries.

The company is actively seeking strategic partnerships to enhance its capabilities and market reach. These partnerships are designed to leverage the strengths of other industry players. This collaborative approach supports the company's long-term growth potential.

The company is focused on improving operational efficiency through streamlined processes and optimized resource allocation. This includes integrating the operations of the merged entities to reduce costs and enhance productivity. These improvements are crucial for sustainable financial performance.

The company's expansion strategy includes several key areas of focus, including market expansion, product innovation, strategic partnerships, and operational efficiency. These initiatives are designed to drive revenue growth and increase market share. The company's business model is centered around these strategic areas.

- Expanding into new geographic markets.

- Developing new product lines with advanced functionalities.

- Forming strategic alliances to enhance technological capabilities.

- Improving operational efficiency to reduce costs.

Nanogate SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Nanogate Invest in Innovation?

Techniplas Nano Tec SE, a key part of the company's focus on nanotechnology, uses advanced materials and surface technologies to drive its growth. This division builds on the company's expertise in developing and producing high-performance surfaces and components through nanotechnology-based solutions. These solutions include surface finishing, coating, and innovative plastic components, offering unique properties like radar-transparency, anti-corrosion, and scratch resistance.

The company's approach to innovation is centered on nanotechnology. This allows it to offer specialized finishing solutions with unique properties. This focus on advanced materials and surface technologies is a core element of the company's growth strategy. The ability to provide these specialized solutions strengthens its market position.

While specific 2024-2025 R&D investments or new patents for Techniplas Nano Tec SE were not detailed, the broader nanotechnology and advanced manufacturing sectors are experiencing significant innovation. The company's business model is built on this technological foundation, enabling it to create and deliver high-value products.

The company leverages nanotechnology to develop high-performance surfaces and components. This includes surface finishing, coating, and innovative plastic components. This technological focus is central to its growth strategy.

The company utilizes advanced materials to create products with unique properties. These properties include radar-transparency, anti-corrosion, and scratch resistance. This approach enhances its competitive advantage.

The nanotechnology and advanced manufacturing sectors are seeing significant innovation. Companies are focusing on areas like AI, IoT, and sustainable manufacturing. This broader trend supports the company's growth.

The company likely engages in strategic partnerships to enhance its technological capabilities. These partnerships can help in expanding its product portfolio and market reach. This is a key element of the company's long-term growth potential.

The company's focus on nanotechnology and advanced materials gives it a competitive advantage. The unique properties of its products, such as radar-transparency, set it apart. This contributes to its market position.

The company's future prospects are tied to its ability to innovate and adapt to industry trends. The focus on sustainable manufacturing practices and AI will be critical. This will drive its long-term growth potential.

The company's innovation strategy is influenced by broader technological trends. These trends include advancements in AI, IoT, and sustainable manufacturing practices. These trends are crucial for the company's future prospects.

- AI and IoT: Integration of AI and IoT technologies in manufacturing processes.

- Sustainable Manufacturing: Focus on environmentally friendly practices and materials.

- Advanced Materials: Development and application of new materials with enhanced properties.

- Digital Manufacturing: Utilizing digital tools and processes to improve efficiency.

Nanogate PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Nanogate’s Growth Forecast?

The financial outlook for Techniplas Nano Tec SE, following its acquisition of Nanogate's assets, is focused on integration and stabilization. The acquisition, valued in the mid-double-digit million euro range, aimed to integrate Nanogate's core business into Techniplas. This strategic move is crucial for the Nanogate growth strategy and its future financial performance.

While specific financial targets for 2024-2025 are not available, the focus is likely on leveraging the acquired assets to drive profitability. The financial health of Techniplas Nano Tec SE will be closely tied to its ability to successfully integrate and optimize the acquired operations. Understanding the Nanogate business model and its adaptation within Techniplas is key to assessing its future prospects.

Analyzing the Nanogate company analysis requires considering the broader market context. The advanced materials and manufacturing sectors are showing signs of growth and resilience. Companies in related fields are actively pursuing expansion and demonstrating financial stability, which may indicate a favorable environment for Techniplas Nano Tec SE.

Nano Dimension reported a gross margin improvement of 235 bps to 46.2% in Q1 2024, up from 43.9% in Q1 2023. This indicates improved operational efficiency and profitability.

NANO Nuclear Energy reported over $120 million cash on hand by the end of December 2024 and $118.6 million in cash and cash equivalents as of March 31, 2025, demonstrating strong financial backing.

Technip Energies reported an adjusted backlog of €19.6 billion at December 31, 2024, equivalent to 2.9 times their 2024 revenue, providing multi-year visibility.

Companies in advanced materials and manufacturing are actively pursuing growth, suggesting a favorable environment for Techniplas Nano Tec SE. This supports the Nanogate market position.

The financial health of Techniplas Nano Tec SE will depend on several factors, including the successful integration of Nanogate's assets, operational efficiency, and market dynamics. For a deeper dive, explore the recent developments and strategic direction of Nanogate in this detailed article: Nanogate's Strategic Outlook and Financial Analysis. This analysis provides a comprehensive view of the company's trajectory and potential investment opportunities, crucial for understanding the Nanogate future prospects.

Nanogate Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Nanogate’s Growth?

The path for Techniplas Nano Tec SE, as with any company, isn't without potential pitfalls. Understanding these risks is crucial for assessing the Nanogate growth strategy and its future prospects. Several factors could impact the company's ability to achieve its goals, from competitive pressures to operational challenges.

One of the primary hurdles is the competitive landscape. The high-performance surfaces and components sector is dynamic, requiring continuous innovation. Furthermore, regulatory shifts and supply chain disruptions pose significant threats. These factors could affect the company's ability to maintain its Nanogate market position.

The company also faces technological disruption from emerging materials or processes. Additionally, the integration into Techniplas after prior financial difficulties presents ongoing operational challenges. Navigating these risks is essential for long-term success. For a deeper dive, consider reviewing the Marketing Strategy of Nanogate.

The high-performance surfaces and components market is highly competitive, with continuous innovation being a key driver. Competitors are constantly developing new materials and processes. This necessitates continuous investment in research and development to maintain a competitive edge and secure Nanogate's market position.

Changes in regulations, particularly those concerning nanotechnology and chemical formulations, could necessitate adjustments to production processes and product compositions. Compliance with evolving standards requires significant investment and adaptation. This can impact Nanogate's business model and financial performance.

Global supply chain issues can affect the availability and cost of essential raw materials. Disruptions can lead to production delays and increased expenses. Mitigating these risks requires robust supply chain management strategies to ensure operational continuity and protect Nanogate's financial performance.

Emerging materials or manufacturing processes could offer superior performance or cost efficiencies, posing a constant threat. Companies must invest in research and development to stay ahead of these advancements. Adapting to these changes is critical for sustained growth and maintaining a competitive advantage in the market, influencing the Nanogate future prospects.

Successful integration into Techniplas following the insolvency proceedings is crucial. Overcoming past financial and operational challenges requires careful planning and execution. The ability to realize synergies and streamline operations directly impacts the company's financial stability and Nanogate company analysis.

Economic downturns can reduce demand in key industries like automotive and aerospace. Reduced consumer spending and business investment can affect sales. Diversifying into various sectors and developing resilient business models can help mitigate the impact of economic fluctuations on Nanogate's revenue growth drivers.

Diversification of product portfolios can help spread risk across different market segments. Implementing a robust risk management framework can identify, assess, and mitigate potential threats. Scenario planning helps prepare for various contingencies, such as economic downturns or supply chain disruptions. These strategies are essential for securing Nanogate's long-term growth potential.

The ability to innovate and adapt quickly to market and technological shifts is vital. Investing in research and development to stay ahead of competitors is essential. Building strategic partnerships can provide access to new technologies and markets. These efforts directly influence Nanogate's impact on the industry.

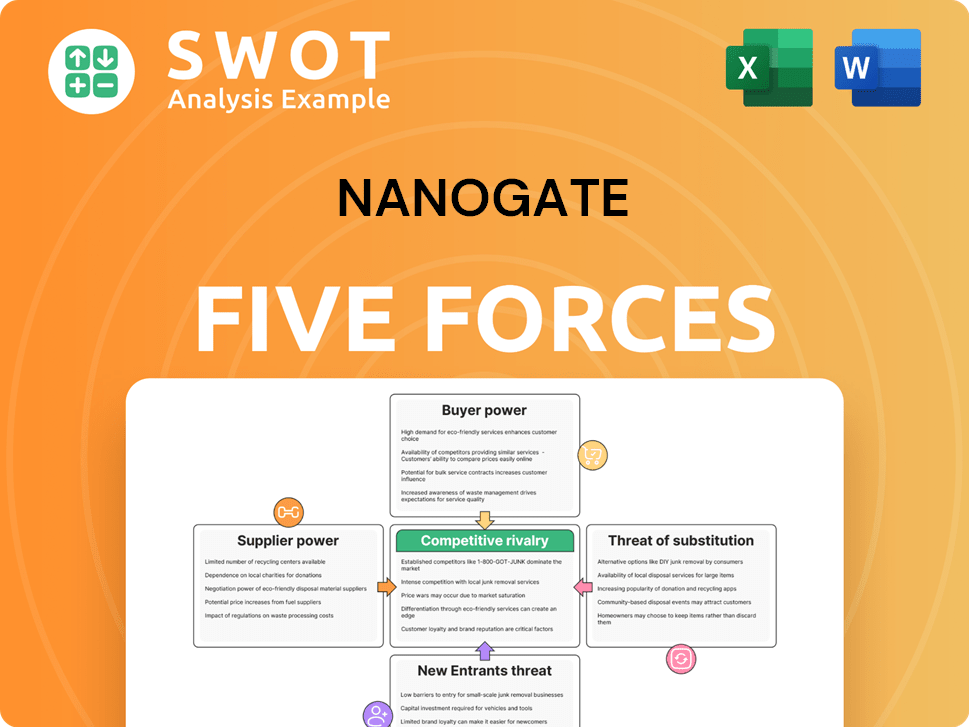

Nanogate Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nanogate Company?

- What is Competitive Landscape of Nanogate Company?

- How Does Nanogate Company Work?

- What is Sales and Marketing Strategy of Nanogate Company?

- What is Brief History of Nanogate Company?

- Who Owns Nanogate Company?

- What is Customer Demographics and Target Market of Nanogate Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.