Nanogate Bundle

How Does Nanogate Thrive in the World of Advanced Materials?

Explore the cutting-edge world of Techniplas Nano Tec SE, formerly known as Nanogate, a leader in innovative Nanogate SWOT Analysis and surface technology. This company is revolutionizing industries with its nanotechnology-based solutions. From automotive to aerospace, discover how Nanogate's

Techniplas Nano Tec SE, with its focus on

What Are the Key Operations Driving Nanogate’s Success?

The Nanogate company, now part of Techniplas Nano Tec SE, focuses on providing nanotechnology-based solutions. Their core business revolves around advanced surface finishing and the production of innovative plastic components. This includes offerings like eco-friendly ePD coating, all designed to serve diverse customer segments across key industries.

The core operations of the

The value proposition of

Nanogate offers advanced surface finishing, including eco-friendly ePD coating. They also produce innovative plastic components. These products are designed to improve product durability and enhance aesthetic appeal across various industries.

The company primarily serves the automotive, aerospace, and industrial sectors. These industries benefit from Nanogate's ability to provide high-performance surfaces and components. The focus on these sectors allows for specialized solutions.

Their operational processes involve integrated material development and component manufacturing. This integrated approach enables them to offer complete solutions, from material creation to mass production. This streamlines the process.

Nanogate has a global footprint with facilities in Europe and North America. This global network supports a worldwide customer base, enhancing market access. The network is crucial for the company's growth, operating in over 19 countries.

Customers benefit from enhanced product durability, improved functionality, and aesthetic appeal. These improvements are achieved through advanced surface properties, such as scratch and chemical resistance. This leads to increased product lifespan and customer satisfaction.

- Enhanced Product Durability: Products last longer.

- Improved Functionality: Better performance.

- Aesthetic Appeal: Enhanced visual appearance.

- Advanced Surface Properties: Scratch and chemical resistance.

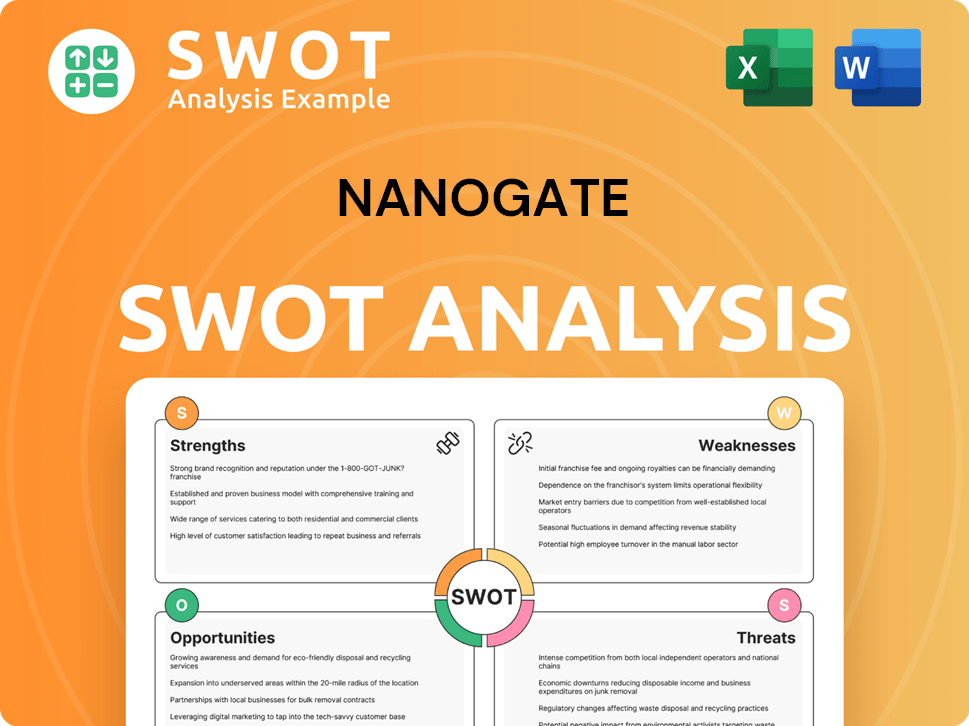

Nanogate SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Nanogate Make Money?

Techniplas Nano Tec SE, formerly known as Nanogate, generates revenue through the sale of its advanced nanotechnology-based surfaces and innovative plastic components. The company focuses on providing specialized solutions to various industries. This approach allows for tailored products and strong customer relationships, driving revenue growth.

The company's revenue streams are diversified across several key sectors, including automotive, aerospace, and consumer electronics. The monetization strategies emphasize direct sales and strategic partnerships to maximize market reach and foster innovation. The acquisition by Techniplas further broadened market access and enhanced competitive advantage.

In 2023, Nanogate's revenue was approximately €45.3 million. The automotive sector accounted for 40% of the revenue in 2024. Other significant sectors included aerospace (15%) and consumer electronics (20%) in 2024. Direct sales accounted for approximately 60% of Nanogate's revenue in 2024, demonstrating the importance of tailored solutions and customer relationships.

The company's monetization strategies rely heavily on direct sales and strategic partnerships. These strategies are designed to maximize market reach and foster innovation. For example, collaborations contributed to a 15% increase in market penetration for specific product lines in 2024. Strategic partnerships are expected to drive a 10% revenue increase by early 2025.

- Direct Sales: Approximately 60% of revenue in 2024.

- Strategic Partnerships: Increased market penetration by 15% in 2024.

- Techniplas Acquisition: Broadened market reach and enhanced competitive advantage.

- Revenue Growth: Expected 10% increase by early 2025 due to partnerships.

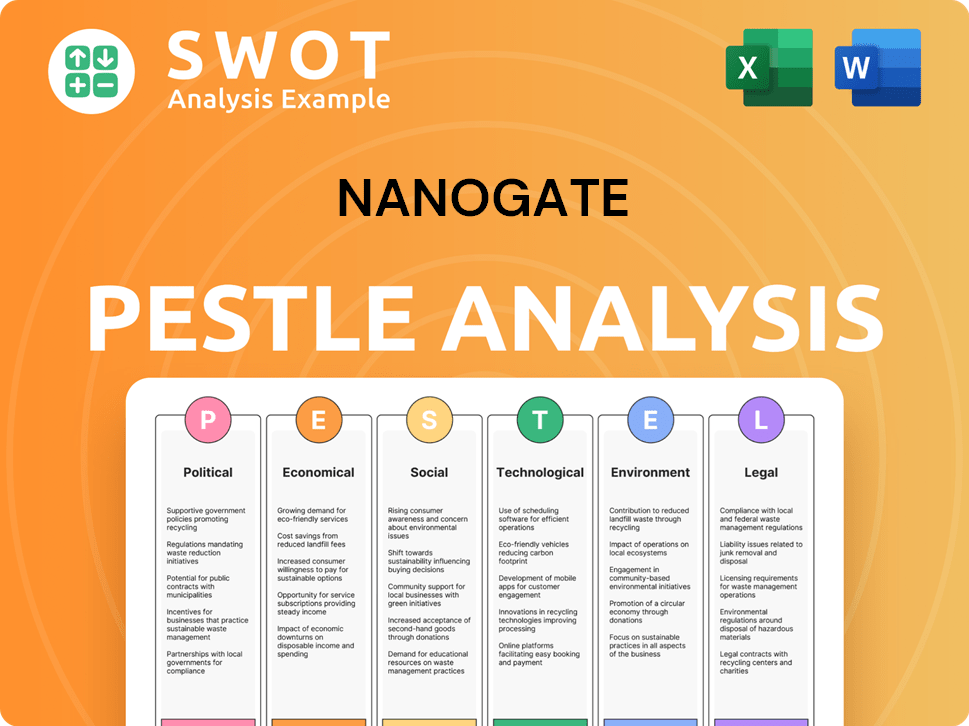

Nanogate PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Nanogate’s Business Model?

The acquisition of Nanogate SE by Techniplas LLC in June 2021 marked a significant turning point for the company. This strategic move followed Nanogate's insolvency proceedings in mid-2020, providing a pathway to stability. The integration of Nanogate's unique finishing capabilities with Techniplas' core expertise in injection molding created a stronger entity.

This acquisition allowed Techniplas to expand its global footprint across 19 countries, offering a comprehensive suite of molding and finishing solutions. The purchase price, in the mid-double-digit million euro range, facilitated the settlement of creditor claims. This strategic move underscored the importance of Nanogate's technology in the market.

The operational challenges, including insolvency, were addressed through the acquisition, securing jobs and fostering a stable future. The company's competitive advantages, rooted in its nanotechnology expertise, continue to drive innovation. Nanogate's integrated approach, combining material development and component manufacturing, further differentiates it in the market.

The acquisition by Techniplas LLC in June 2021 was a pivotal milestone, resolving insolvency and integrating Nanogate's technology. This strategic move allowed the company to leverage its unique finishing capabilities. The acquisition provided a solid foundation for future growth and market expansion.

Techniplas' acquisition of Nanogate was a strategic move to combine injection molding with advanced finishing technologies. This integration expanded the company's global presence and service offerings. The focus on high-growth sectors like advanced electronics and medical devices demonstrates adaptability.

Nanogate's competitive edge stems from its nanotechnology expertise, crucial for advanced surfaces and components. This expertise creates a significant barrier to entry for new competitors. The company's integrated approach and unique finishing solutions, such as radar transparency, further differentiate it.

Techniplas Nano Tec SE is adapting to new trends by expanding into high-growth sectors, including advanced electronics and medical devices. Strategic partnerships are also key, potentially boosting revenues. The global nanotechnology market is projected to reach $125 billion by 2025.

Nanogate's core strength lies in its innovative surface technology, particularly in nanocoatings and smart materials. The company's ability to offer unique finishing solutions, such as scratch-proof and non-stick properties, gives it a competitive advantage. For a deeper understanding of the company's growth strategy, see Growth Strategy of Nanogate.

- Nanogate's nanotechnology expertise provides a significant barrier to entry.

- The integrated approach, combining material development and component manufacturing, is a key differentiator.

- Strategic partnerships are crucial for driving innovation and revenue growth.

- The company's expansion into high-growth sectors aligns with market trends.

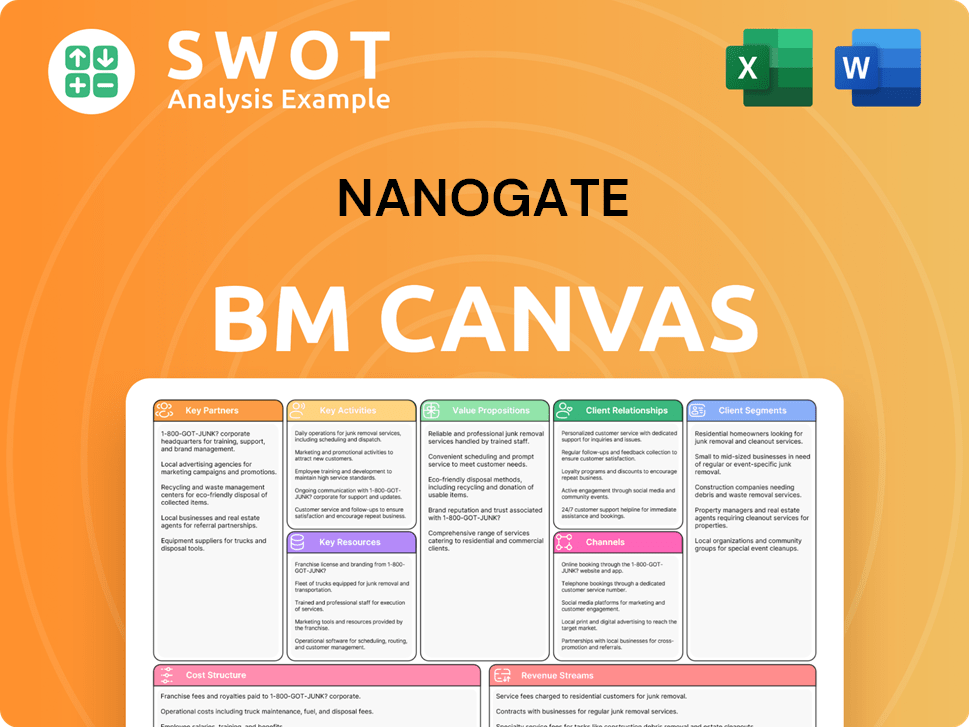

Nanogate Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Nanogate Positioning Itself for Continued Success?

Techniplas Nano Tec SE, operating under the name, holds a significant position in the advanced materials sector, particularly in the automotive, aerospace, and industrial markets. This prominence is largely due to its expertise in nanotechnology. The company's global presence, supported by Techniplas, extends across over 19 countries, serving a diverse customer base.

However, the company faces several challenges. The advanced materials market, where operates, was valued at approximately $80 billion in 2024 and is projected to reach $105 billion by 2025. The company's dependence on specific sectors, such as automotive and industrial, which contributed over 60% of its sales in 2024, presents a risk due to potential economic downturns in these areas.

The company is well-positioned in the advanced materials market, especially in the automotive, aerospace, and industrial sectors. Its strength lies in its nanotechnology expertise, supporting a broad customer base across multiple countries. The company's global footprint is a key asset.

Key risks include dependence on the automotive and industrial sectors, which account for a significant portion of sales. The nanotechnology market is highly competitive, with a projected CAGR of 17.4% from 2024 to 2030, and rapid technological changes require continuous investment in research and development.

The company aims to expand into high-growth markets such as advanced electronics, medical devices, and renewable energy. Strategic initiatives and partnerships are crucial for leveraging the growing nanotechnology market and mitigating competitive threats. Nano-enabled medical devices alone are expected to reach $8.5 billion in 2024.

The company specializes in Nanocoatings and Surface technology, providing Smart materials solutions. These solutions are applied across various industries, including automotive, where Nanogate applications in automotive industry enhances product durability and performance. The company's innovative surface solutions are a key differentiator.

Techniplas Nano Tec SE is focusing on sustaining revenue generation through strategic initiatives. This includes expansion into new high-growth markets such as advanced electronics, medical devices, and renewable energy. The company's commitment to innovation and strategic partnerships will be crucial in leveraging the growing nanotechnology market and mitigating competitive threats.

- Expansion into new high-growth markets.

- Commitment to innovation and strategic partnerships.

- Leveraging the growing nanotechnology market.

- Mitigating competitive threats.

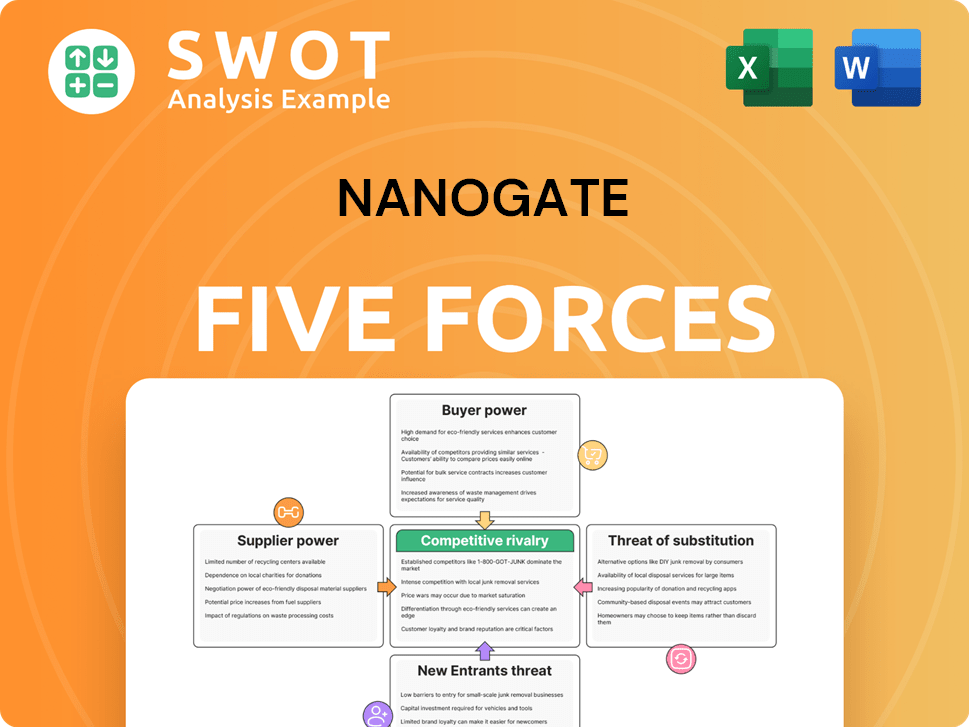

Nanogate Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nanogate Company?

- What is Competitive Landscape of Nanogate Company?

- What is Growth Strategy and Future Prospects of Nanogate Company?

- What is Sales and Marketing Strategy of Nanogate Company?

- What is Brief History of Nanogate Company?

- Who Owns Nanogate Company?

- What is Customer Demographics and Target Market of Nanogate Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.