Nipro Bundle

Can Nipro Conquer the Future of Healthcare?

Nipro Corporation, a powerhouse in the global healthcare landscape since 1954, is charting an ambitious course for future growth. From its humble beginnings in Japan, Nipro has evolved into a comprehensive provider of medical devices, pharmaceuticals, and packaging, boasting a significant global footprint. This Nipro SWOT Analysis will unveil the strategies driving its expansion and the innovations fueling its journey.

This deep dive into Nipro's Nipro growth strategy will explore its latest ventures, especially its significant investment in the U.S. market, and analyze the Nipro future prospects within the competitive pharmaceutical industry. We'll examine the Nipro business model, dissect its expansion plans, and assess its ability to navigate challenges while maximizing its potential in the dynamic medical devices market. Understanding Nipro's trajectory is crucial for anyone seeking insights into the healthcare industry's future.

How Is Nipro Expanding Its Reach?

The expansion initiatives of the company are central to its Nipro growth strategy, aiming to capitalize on opportunities within the pharmaceutical industry and medical devices market. These initiatives encompass geographical expansion, product portfolio enhancements, and strategic partnerships, all geared towards achieving sustainable growth and strengthening its market position. These strategic moves are critical for the company's Nipro future prospects and overall Nipro company analysis.

A significant aspect of the company's growth strategy involves expanding its manufacturing footprint. This includes establishing new facilities and increasing production capacity to meet rising global demand. By focusing on both geographical and product-specific expansions, the company is positioning itself to meet the evolving needs of its customers and stakeholders. These initiatives are designed to improve operational efficiency, reduce costs, and enhance its competitive edge in the market.

The company's approach to growth is multifaceted, reflecting its commitment to innovation and market responsiveness. Strategic partnerships and acquisitions are key components of this strategy, allowing the company to enter new markets and broaden its product offerings. These efforts are supported by substantial investments in research and development, ensuring that the company remains at the forefront of technological advancements in the healthcare sector. For more insight, check out the Owners & Shareholders of Nipro.

The company is establishing its first North American medical device manufacturing facility in Greenville, North Carolina, USA. This facility, announced in July 2024, represents a significant investment of approximately $398 million over five years. The project is expected to create 232 new jobs.

The company is increasing its production capacity for premium quality glass tubing for injectable medicines. This involves an investment of over $60 million at its facilities in Aumale, France, and Millville, New Jersey (USA). The expansion at the Pune Plant in India was recently unveiled in May 2025.

A key partnership is with Haselmeier for its PiccoJect autoinjector in the Japanese market, starting Q1 2025. This collaboration expands the distribution channels for Haselmeier. The company is also expanding dialyzer production, with the 10th line at its Odate Plant in Akita prefecture starting operation in October 2024.

In December 2024, the company acquired a dialysis RO equipment manufacturing company in China. This move strengthens its presence in the Chinese market and enhances its dialysis-related product lineup. The 11th line and 7th line of FB dialyzers are planned for operation in April 2025.

The company's expansion initiatives are driven by several key factors, including increasing demand in the U.S. market, the need to improve supply chain stability, and the aim to reduce transportation costs and carbon emissions. These strategies are designed to enhance its Nipro business model and maintain its competitive advantage.

- Meeting growing demand in the U.S. and neighboring countries.

- Improving supply chain stability and reducing transportation costs.

- Expanding product offerings through strategic partnerships and acquisitions.

- Strengthening its presence in the dialysis market.

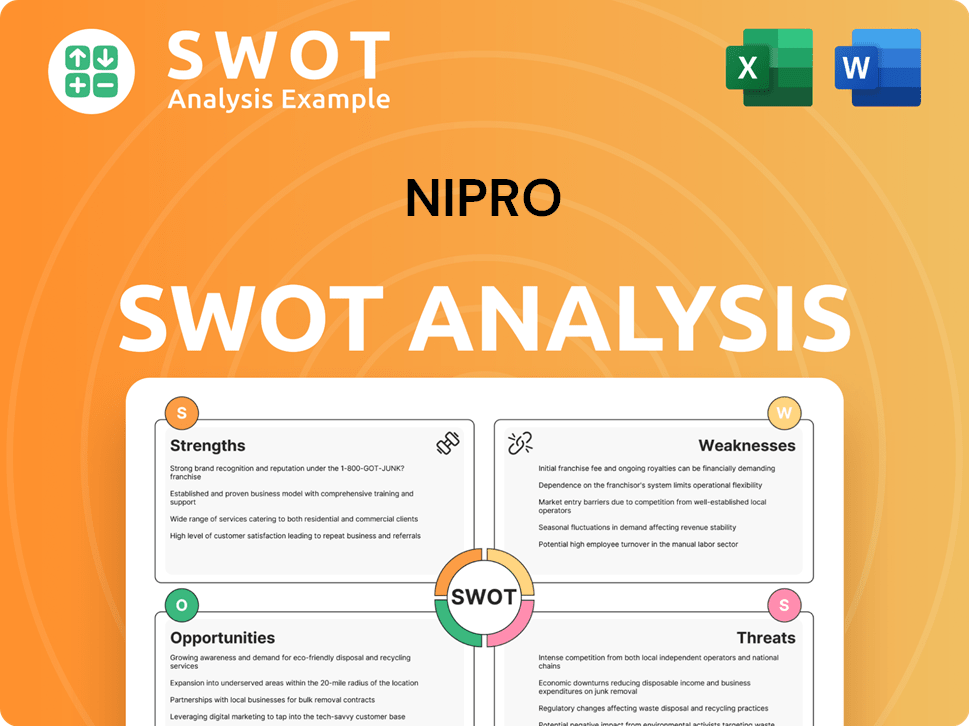

Nipro SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Nipro Invest in Innovation?

The growth strategy of the company is heavily reliant on innovation and technology, which includes significant investments in research and development, digital transformation, and sustainable practices. This approach is crucial for the company's future prospects within the pharmaceutical industry and medical devices market. The company's business model is designed to leverage these advancements across its diverse operations.

The company's commitment to innovation is evident in its extensive patent portfolio, which includes a substantial number of granted and pending patents. This focus on intellectual property underscores the company's dedication to technological advancement and maintaining a competitive edge in the market. This commitment is crucial for its long-term growth outlook and projections.

The company's in-house development efforts are central to its strategy, particularly in medical devices, pharmaceuticals, and pharmaceutical packaging. This strategy allows for the creation of cutting-edge medical devices and integrated solutions. This approach is key to understanding the company's competitive advantage in the industry.

The company's R&D efforts are supported by a substantial patent portfolio. The company holds a total of 7,103 documents for applications and grants. This includes 4,000 granted patents and 1,159 pending patents, demonstrating a strong commitment to intellectual property and technological progress.

The company focuses on producing state-of-the-art medical devices. This includes devices for diabetes, chronic kidney disease, and other renal health issues. A new U.S. manufacturing facility highlights its commitment to this segment.

The company is strengthening its position in pharmaceutical packaging. This includes investments in automated lines to meet market demands for high-quality products. The company's D2F™ Pre-Fillable Glass Syringes were proven compatible with SHL Medical's Molly® autoinjectors in March 2025.

The company focuses on developing integrated solutions. This includes the compatibility of its Unit-Dose™ Microvials with Nemera's UniSpray® in January 2025. The launch of D2F™ Glass Vials powered by Stevanato Group's EZ-fill® Technology in October 2024 is also a key development.

The company integrates digital transformation initiatives into its strategy. This helps improve efficiency and innovation. The company is adapting to market changes through these digital initiatives.

Sustainability is a key part of the company's strategy. The company aims to minimize its environmental impact and foster a sustainable future. These initiatives are crucial for Nipro's sustainability initiatives and growth.

The company is committed to reducing its environmental impact. Nipro PharmaPackaging Germany (NPG) aims for a 30% reduction in CO2 emissions by 2025 compared to 2015. NPG has reduced its water for injection (WFI) consumption by 32% since 2015. Nipro Medical Group Limited aims for Net Zero emissions by 2045.

- NPG uses state-of-the-art power and heating systems.

- Waste heat recovery and smart energy meters are implemented.

- Reverse osmosis technology is planned for further water conservation.

- Nipro Medical Group Limited has an interim target of a 42% reduction in Scope 1 and Scope 2 emissions and a 25% reduction in Scope 3 from 2025 levels by 2035.

- The company is introducing environmentally friendly equipment.

- Switching to total oxygen combustion for glass manufacturing is underway.

- Installation of photovoltaic panels and biomass boilers is in progress.

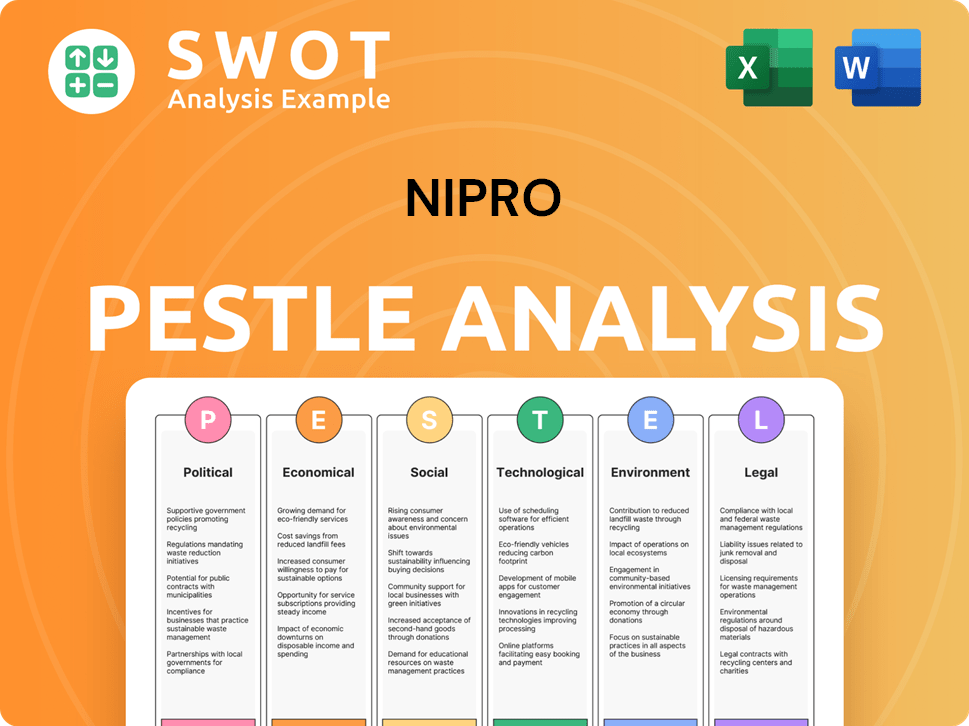

Nipro PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Nipro’s Growth Forecast?

The financial outlook for Nipro Corporation reflects a strategic focus on enhancing sales and profitability across its core business segments. As of March 31, 2025, the trailing 12-month revenue stood at $4.23 billion. The company's performance is geared towards achieving significant growth in the coming fiscal years, driven by strategic initiatives and market opportunities.

For the fiscal year ending March 31, 2025 (FY2025), Nipro projects consolidated sales of JPY 677.0 billion, indicating a 5.0% year-on-year increase. The company is also anticipating a substantial increase in operating profit, with a 39.1% rise to JPY 37.0 billion. These projections highlight the company's commitment to sustainable growth and financial stability.

Nipro's strategic financial goals include reaching consolidated net sales of 1 trillion yen by FY2030 (fiscal year ending March 2031). This ambitious target is supported by a focus on capital investments, streamlining working capital, and selling idle assets. Furthermore, the company is focused on reducing its net interest-bearing debt/EBITDA ratio to the 4x range, demonstrating a commitment to strengthening its financial position.

In FY2024, Nipro reported a net income of JPY 5.1 billion, a decrease of 54.0% year-on-year. Despite this, revenues increased by 9.9% to JPY 644.6 billion. The company's performance was impacted by increased inventories and reorganization efforts. The Mission, Vision & Core Values of Nipro are also important to understand the company's financial strategy.

For FY2025, Nipro anticipates a 5.0% increase in consolidated sales to JPY 677.0 billion. The company projects a significant rise in operating profit, up 39.1% to JPY 37.0 billion. Net income attributable to owners of the parent is expected to reach JPY 13.0 billion, a substantial 153.3% increase.

Nipro is focusing on improving its financial position by prioritizing capital investments and streamlining working capital. A key goal is to reduce the net interest-bearing debt/EBITDA ratio to the 4x range. The company also plans to distribute dividends, reflecting its commitment to shareholder value.

As of May 30, 2025, Nipro's stock price was $8.82, with a market cap of $1.44 billion. The company paid a final dividend of 20 JPY on March 27, 2025, and an interim payment of 12 JPY on September 26, 2024. These payouts demonstrate Nipro's commitment to returning value to its shareholders.

Nipro's financial strategy is centered on achieving sustainable growth through strategic investments and operational efficiencies. The company aims to strengthen its position in the pharmaceutical industry and medical devices market.

- Trailing 12-month revenue as of March 31, 2025: $4.23 billion

- FY2025 Projected Sales Growth: 5.0%

- FY2025 Projected Operating Profit Increase: 39.1%

- Target Net Sales by FY2030: 1 trillion yen

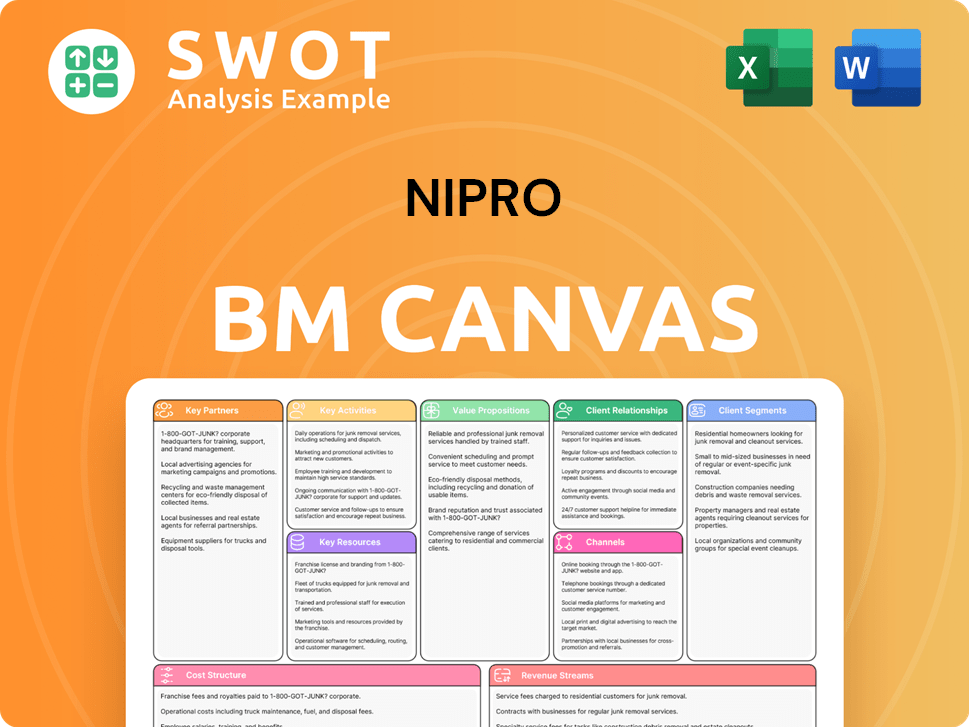

Nipro Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Nipro’s Growth?

Analyzing the potential risks and obstacles is crucial for understanding the Nipro company analysis. While the company has ambitious growth plans, several external and internal factors could impede its progress. These challenges span from intense market competition to the complexities of global supply chains and the need for continuous innovation.

The medical device and pharmaceutical industries are dynamic and competitive. Moreover, regulatory changes and internal resource constraints present significant hurdles. Understanding and proactively addressing these risks will be essential for Nipro to achieve its long-term goals and maintain a strong market position.

Nipro's growth strategy is subject to various risks that could impact its future prospects. These risks span from market competition to regulatory changes and supply chain vulnerabilities. The company's ability to navigate these challenges will be critical to its success.

The medical device market and the pharmaceutical industry are highly competitive. Nipro faces competition from companies such as Bausch + Lomb, Abbott, and Fresenius SE & Co KGaA. Maintaining market share requires constant innovation and efficient operations.

The pharmaceutical market faces increasing regulatory scrutiny, particularly in the parenteral segment. Compliance with evolving global standards, such as FDA certification, is vital. Non-compliance can lead to delays and market access restrictions.

Nipro's global operations expose it to geopolitical events, natural disasters, and logistical disruptions. The company's investment in a North American manufacturing facility aims to enhance supply chain stability. Large-scale expansions come with their own set of execution risks.

The rapidly advancing healthcare sector requires continuous investment in R&D. Failure to adapt or introduce competitive new products could impact market position. The focus on regenerative medicine involves significant upfront investments and uncertainties.

Nipro focuses on improving its financial position by prioritizing capital investments and streamlining working capital. The balance between interest-bearing debt and cash flow is a key area of focus. For the fiscal year ending March 31, 2025, profits were lower than expected due to increased inventories and reorganization efforts.

Nipro mitigates risks through diversification across its medical, pharmaceutical, and pharmaceutical packaging segments. The company's strategy of 'local production for local consumption' for medical devices, as seen in its new U.S. plant, ensures stable supply chains and addresses global transportation-related risks. The company aims to reduce its net interest-bearing debt/EBITDA ratio to the 4x range.

The medical devices market is highly competitive, with major players like Bausch + Lomb, Abbott, and Fresenius SE & Co KGaA. These companies continuously innovate and strive for operational efficiency to gain market share. Nipro must maintain a competitive edge through product development and strategic positioning to succeed in this environment. The continuous innovation is crucial for Nipro's long-term growth.

Regulatory changes pose a significant obstacle, especially in the pharmaceutical industry. The FDA certification received by Nipro's Pharma Odate Plant in April 2024 highlights the importance of compliance. Non-compliance can lead to product launch delays, increased costs, and market access restrictions, affecting Nipro's ability to expand and innovate in the market. Therefore, Nipro must invest in regulatory compliance to maintain its position.

Nipro's global operations are exposed to supply chain vulnerabilities due to geopolitical events, natural disasters, and logistical disruptions. The company's investment in a North American manufacturing facility aims to reduce transportation needs and improve supply chain stability in the U.S. market. These risks can impact the timely delivery of products and increase operational costs, affecting Nipro's financial performance and growth.

Technological disruption is an inherent risk in the rapidly advancing healthcare sector. Nipro must consistently invest in research and development and new technologies to stay ahead of emerging medical innovations. Failure to adapt or introduce competitive new products could impact its market position. The company's focus on regenerative medicine, while a growth area, also entails significant upfront investments and uncertainties regarding monetization.

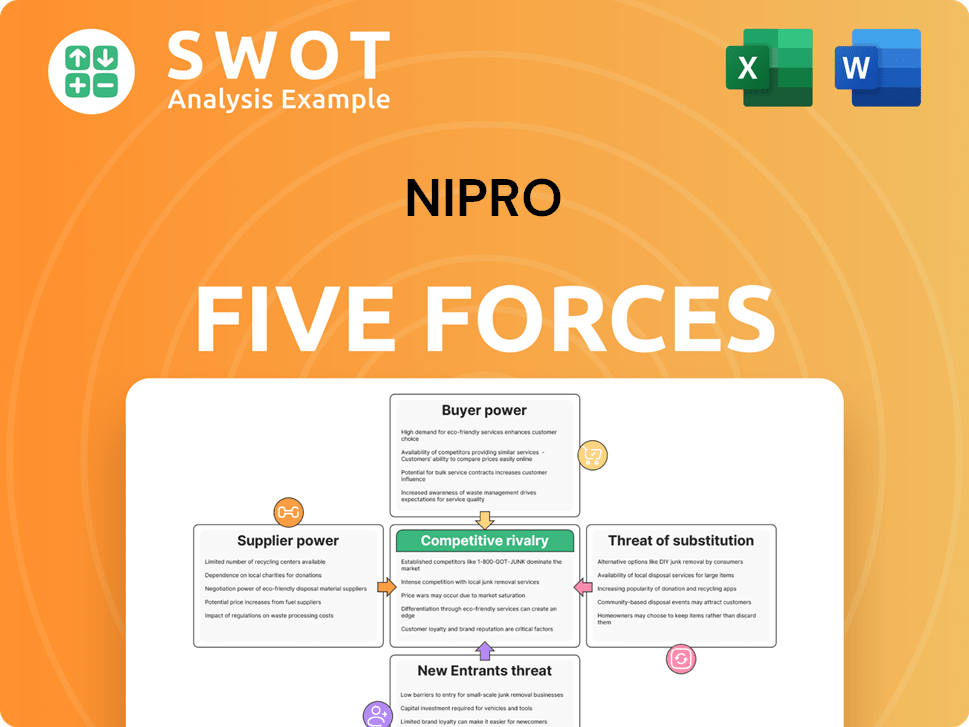

Nipro Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nipro Company?

- What is Competitive Landscape of Nipro Company?

- How Does Nipro Company Work?

- What is Sales and Marketing Strategy of Nipro Company?

- What is Brief History of Nipro Company?

- Who Owns Nipro Company?

- What is Customer Demographics and Target Market of Nipro Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.