Nokia Bundle

Can Nokia Reclaim Its Technological Throne?

From pioneering mobile phones to leading the charge in 5G, Nokia's journey is a testament to its resilience and strategic adaptability. This Nokia SWOT Analysis delves into the core of this telecommunications giant, exploring its transformation from a consumer-focused brand to a B2B technology powerhouse. Discover how Nokia plans to navigate the ever-changing landscape of the telecommunications industry and secure its future.

This deep dive into the Nokia company analysis reveals its ambitious Nokia growth strategy, examining its strategic initiatives, technological innovations, and financial planning. We'll explore Nokia's future prospects, assessing its market share, business model, and the strategies it employs to overcome challenges and expand its market presence. With a focus on Nokia's investment in research and development and its role in the Internet of Things (IoT), we'll uncover the key factors driving its potential for long-term success in a competitive global market.

How Is Nokia Expanding Its Reach?

Nokia's expansion initiatives are primarily focused on strengthening its position in key network technologies and exploring new growth areas. The company is actively working to secure new deals and expand its footprint in various regions, particularly in the deployment of 5G infrastructure. This strategic approach aims to capitalize on the growing demand for advanced network solutions and maintain a competitive edge in the telecommunications industry.

A significant aspect of Nokia's strategy involves expanding its software and cloud services portfolio to diversify revenue streams beyond traditional hardware. This includes the development and offering of advanced software solutions for network management, automation, and cybersecurity. Furthermore, Nokia is exploring opportunities in emerging technologies, such as 6G research and quantum networking, positioning itself for future market leadership and innovation. This forward-thinking approach is crucial for long-term sustainability and growth.

Nokia is also focused on expanding its enterprise customer base, recognizing the increasing demand for private wireless networks and industrial automation solutions. This includes ongoing collaborations with various industries to deploy private 5G networks, aiming to capture a larger share of the enterprise market. The company's emphasis on sustainability also plays a role in its expansion, as it seeks to provide energy-efficient solutions that align with global environmental goals.

Nokia continues to secure new deals and expand its 5G infrastructure globally. In Q4 2023, the company reported strong orders in its Network Infrastructure business, highlighting the ongoing demand for its fiber and fixed wireless access solutions. This expansion is crucial for maintaining Nokia's market share and capitalizing on the growing 5G market.

Nokia is actively pursuing partnerships to expand its enterprise customer base. This includes deploying private 5G networks and industrial automation solutions. The enterprise market is projected to grow significantly, presenting a key opportunity for Nokia to increase its revenue streams and market presence. This strategy aligns with the company's focus on Nokia's target market.

Nokia is expanding its software and cloud services portfolio to diversify revenue streams. This includes developing advanced software solutions for network management, automation, and cybersecurity. This diversification strategy is vital for Nokia’s long-term growth and resilience in a rapidly evolving market.

Nokia is exploring opportunities in emerging technologies such as 6G research and quantum networking. This positions the company for future market leadership. Investing in these advanced technologies ensures that Nokia remains at the forefront of innovation and can capitalize on future market trends.

Nokia's expansion strategy involves a multi-faceted approach to secure its future prospects. This includes focusing on 5G infrastructure, expanding into the enterprise market, and investing in software and emerging technologies.

- Continued deployment of 5G infrastructure globally.

- Partnerships to expand the enterprise customer base.

- Development of software and cloud services.

- Exploration of emerging technologies like 6G and quantum networking.

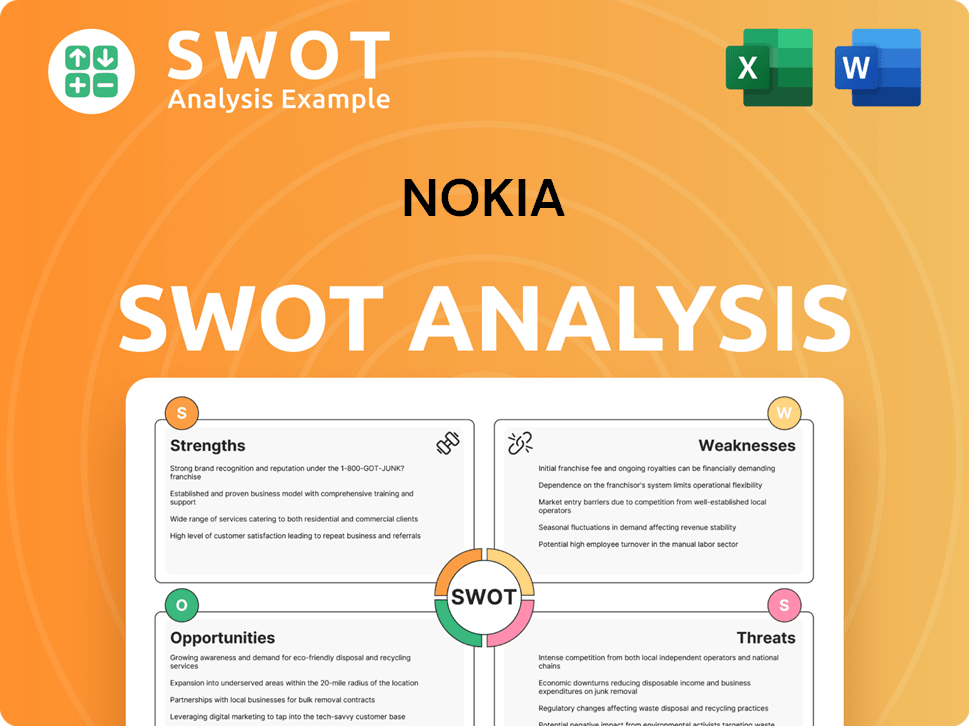

Nokia SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Nokia Invest in Innovation?

Nokia's growth strategy is deeply rooted in its commitment to technology innovation and significant investments in research and development (R&D). The company consistently allocates a substantial portion of its revenue to R&D, focusing on advancements in areas like 5G-Advanced, 6G, industrial automation, and cloud-native network solutions. This dedication underscores its ambition to maintain a leading position in the telecommunications industry.

Nokia's strategy involves leveraging emerging technologies such as AI, machine learning, and automation across its product portfolio and internal operations. This approach aims to enhance efficiency, reduce operational costs, and provide advanced solutions to its customers. Furthermore, Nokia is actively involved in the Internet of Things (IoT) space, offering connectivity solutions for various industrial and enterprise applications.

The company's innovation strategy is also closely tied to its sustainability initiatives, with a focus on developing energy-efficient products and solutions to minimize environmental impact. Nokia's extensive patent portfolio and industry recognition further validate its leadership in telecommunications technology. For a deeper understanding of how Nokia operates, you can explore the Revenue Streams & Business Model of Nokia.

Nokia's R&D spending is a crucial aspect of its growth strategy. In recent years, the company has invested billions in R&D to stay ahead in the competitive telecommunications market. For instance, in 2023, Nokia's R&D spending was approximately €4.6 billion.

Nokia is heavily invested in 5G-Advanced and 6G technologies. The company is actively involved in developing infrastructure and solutions for the next generation of wireless communication. This includes advancements in network slicing, edge computing, and massive MIMO.

Nokia Bell Labs plays a crucial role in driving innovation. This research arm is responsible for many groundbreaking technologies, including contributions to 5G and the development of future technologies. They focus on fundamental research and advanced technology development.

Nokia leverages AI, machine learning, and automation to transform its operations and product offerings. This includes AI-powered network optimization tools and automated network deployment and management processes. The goal is to enhance efficiency and reduce costs.

Nokia is actively involved in the IoT space, providing connectivity solutions and platforms for various industrial and enterprise applications. This includes solutions for smart cities, industrial automation, and connected vehicles. The IoT market presents significant growth opportunities.

Sustainability is integrated into Nokia's technology strategy. The company focuses on developing energy-efficient products and solutions to minimize environmental impact. This includes designing energy-efficient network equipment and promoting circular economy practices.

Nokia's technology innovation is central to its future prospects. The company's focus on 5G, 6G, and IoT positions it well for future growth. Nokia's competitive advantages include its strong R&D capabilities, extensive patent portfolio, and strategic partnerships.

- 5G Advancements: Nokia continues to enhance 5G capabilities, including network slicing, edge computing, and massive MIMO.

- 6G Research: Significant investment in 6G research to shape the future of wireless communication.

- AI and Automation: Implementation of AI and automation tools to optimize network performance and reduce operational costs.

- Industrial Automation: Providing solutions for industrial automation, including private wireless networks and IoT platforms.

- Cloud-Native Solutions: Developing cloud-native network solutions to improve flexibility and scalability.

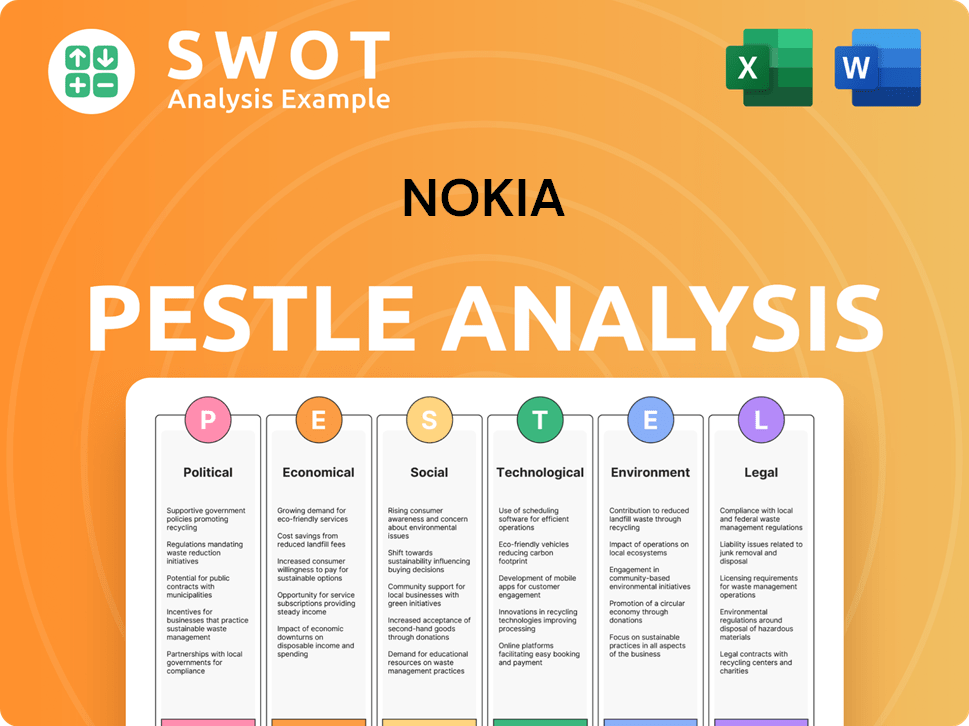

Nokia PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Nokia’s Growth Forecast?

Nokia's financial outlook is centered on achieving profitable growth and maintaining a disciplined approach to capital allocation. The company's strategy aims to capitalize on opportunities within the telecommunications sector and beyond. This includes a focus on innovation, operational efficiency, and strategic investments to drive long-term value for shareholders.

For the full year 2023, Nokia reported net sales of EUR 22.3 billion, with a comparable operating margin of 10.1%. This performance reflects the company's ability to navigate market dynamics and execute its strategic priorities. The financial outlook for 2024 and beyond is shaped by the company's strategic direction and market conditions.

Nokia's future prospects are closely tied to its ability to innovate and adapt in a rapidly evolving technological landscape. The company's commitment to research and development, particularly in areas like 5G-Advanced and 6G, is crucial for maintaining its competitive edge. This focus on technology innovation is a key element of its Nokia growth strategy.

Nokia anticipates a comparable operating profit in the range of EUR 2.3 billion to EUR 2.9 billion in 2024. The company is also expecting strong free cash flow generation. This financial guidance reflects the company's confidence in its ability to execute its strategy and deliver value.

The company has set long-term financial goals, including achieving a comparable operating margin of at least 13%. Nokia aims for continued growth in its addressable markets, driven by its leadership in network infrastructure, enterprise expansion, and software services. This demonstrates the company's commitment to sustainable growth.

Nokia's financial strategy includes ongoing investments in R&D, particularly in next-generation technologies. The company also emphasizes operational efficiency and cost management to improve profitability. These strategies are designed to support the company's growth and enhance its competitive position.

Nokia aims for sustainable growth driven by its leadership in network infrastructure, enterprise expansion, and software services. While specific revenue targets for future years are subject to market conditions, the company is focused on delivering long-term value. This approach underscores the company's commitment to responsible and sustainable business practices.

Nokia's solid balance sheet and cash generation provide flexibility for strategic investments and potential shareholder returns. The company's financial performance is a key indicator of its overall health and its ability to execute its strategy. For more insights, consider reading about Owners & Shareholders of Nokia.

- Net sales for 2023: EUR 22.3 billion

- Comparable operating margin for 2023: 10.1%

- 2024 comparable operating profit outlook: EUR 2.3 billion to EUR 2.9 billion

- Long-term comparable operating margin goal: At least 13%

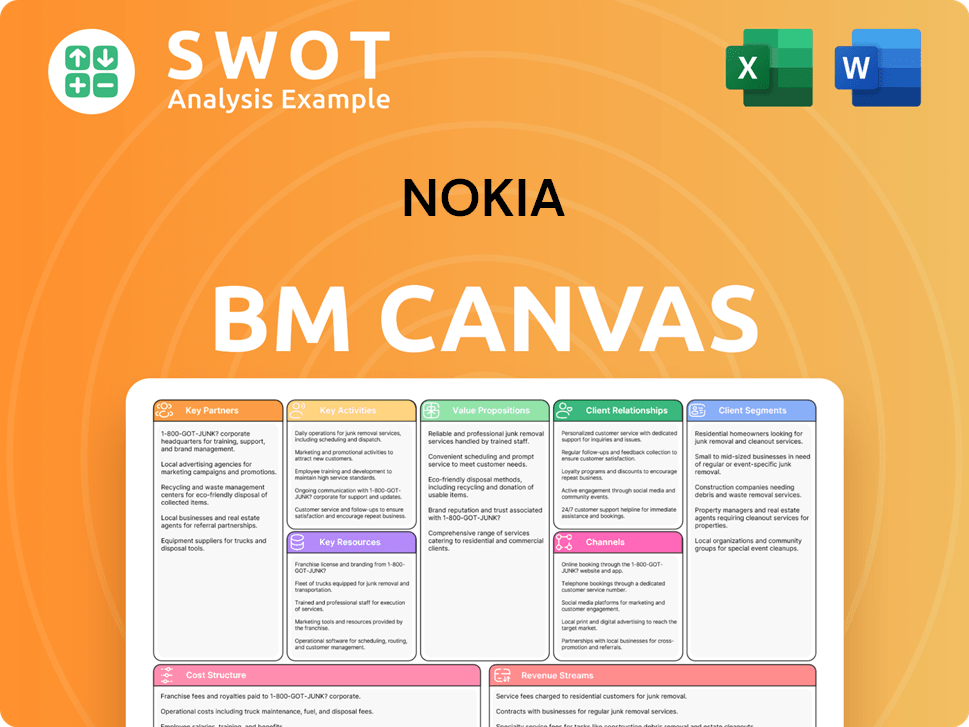

Nokia Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Nokia’s Growth?

The path forward for Nokia faces several potential risks and obstacles. Intense competition within the telecommunications equipment market, particularly from rivals like Ericsson and Huawei, poses a significant ongoing challenge. Navigating regulatory shifts, including cybersecurity mandates and geopolitical tensions, also presents complexities that could impact operations and market access.

Supply chain vulnerabilities remain a concern, as seen in recent global disruptions. Technological advancements, while offering opportunities, could also pose risks if Nokia fails to adapt quickly. Internal resource constraints, such as attracting and retaining top talent, could also hinder growth. These issues are crucial for understanding the Nokia company analysis.

To mitigate these risks, Nokia employs various strategies. These include diversifying its customer base and product portfolio, implementing robust risk management frameworks, and engaging in proactive scenario planning. The company's ability to adapt, as demonstrated by its transition from consumer handsets, highlights its resilience. Understanding the Nokia growth strategy is vital for investors.

The telecommunications equipment sector is fiercely competitive. Nokia competes with major players like Ericsson and Huawei, impacting its Nokia market share. This competition can lead to pricing pressures and reduced profitability.

Evolving regulations, including cybersecurity mandates and geopolitical tensions, can affect Nokia's operations. Restrictions in certain markets could limit sales opportunities. These changes require continuous adaptation and strategic planning.

Component shortages and supply chain disruptions pose a persistent risk. These issues can impact production timelines and delivery capabilities. Nokia actively manages these risks but remains vulnerable.

Rapid technological advancements present both opportunities and risks. Nokia must adapt to Nokia technology innovation in areas like 5G and the Internet of Things. Failure to do so could result in a loss of market share.

Attracting and retaining top talent in specialized fields is crucial. Competition for skilled professionals can be intense. Internal resource limitations can hinder growth and innovation.

Economic fluctuations can impact telecommunications spending. A downturn could lead to reduced investments in infrastructure. Nokia must prepare for potential impacts on its financial performance.

Nokia addresses these risks through diversification, robust risk management, and proactive planning. The company's ability to adapt, as seen in its transition from consumer handsets, highlights its resilience. Continuous investment in R&D and strategic partnerships are also crucial for maintaining a competitive edge. For more insights, consider reading this article about Nokia's business model.

Emerging risks include increasing cybersecurity threats and potential economic downturns. Nokia’s ongoing R&D investments and strategic collaborations are key to mitigating technological disruption and maintaining its competitive edge. The Nokia future prospects depend on its ability to navigate these challenges effectively.

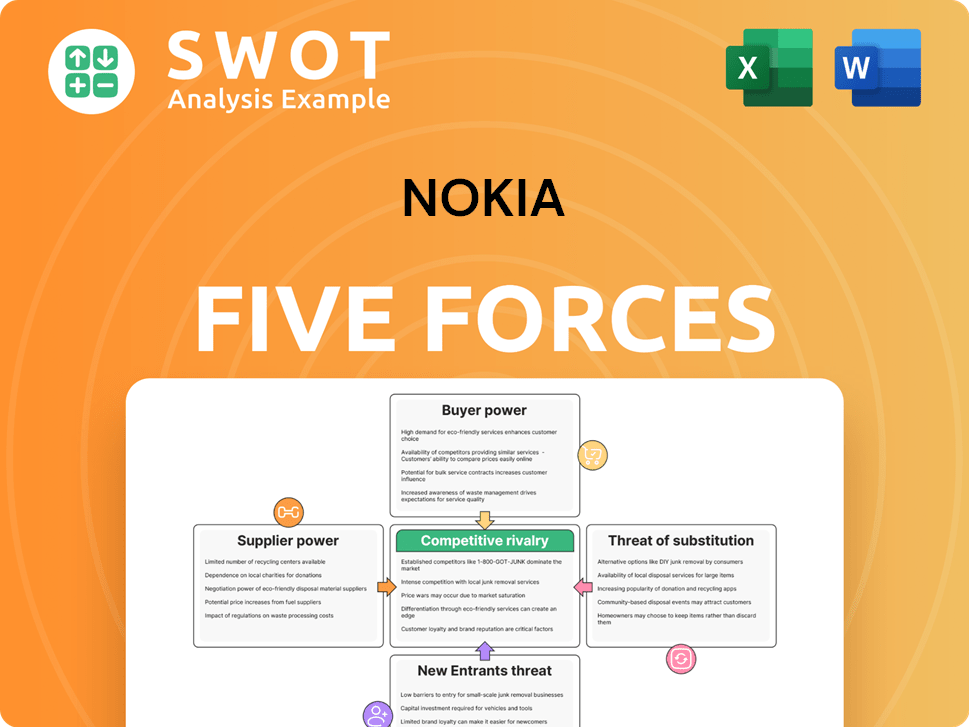

Nokia Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nokia Company?

- What is Competitive Landscape of Nokia Company?

- How Does Nokia Company Work?

- What is Sales and Marketing Strategy of Nokia Company?

- What is Brief History of Nokia Company?

- Who Owns Nokia Company?

- What is Customer Demographics and Target Market of Nokia Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.