Nokia Bundle

How Does Nokia Stay Ahead in the Tech Race?

Nokia, a titan of the digital age, has dramatically reshaped its identity. From its iconic mobile phone legacy, the Nokia SWOT Analysis reveals a company now at the forefront of B2B technology innovation, driving the evolution of global networks. This transformation positions Nokia as a key player in the future of connectivity.

Understanding the Nokia company's inner workings is essential for anyone tracking the telecommunications sector. This exploration will delve into how Nokia works, examining its business model, the Nokia products and services it offers, and its strategic vision for the future, including its ambitious plans for 2025. We'll uncover how Nokia innovates, its current market position, and how it competes in a rapidly changing landscape, providing valuable insights into its financial performance and growth strategy.

What Are the Key Operations Driving Nokia’s Success?

The Nokia company creates value by pioneering networks that sense, think, and act. It leverages its expertise across mobile, fixed, and cloud networks. Its core focus includes mobile network products, network deployment, technical support services, and network management solutions. The company aims for leadership in key technologies such as 5G, O-RAN, and vRAN.

The company serves a diverse range of customers, primarily communications service providers and enterprises. This includes enterprise verticals and webscalers, in addition to licensing its intellectual property. Nokia's operational processes involve extensive technology development, driven by the award-winning Nokia Bell Labs, which is celebrating 100 years of innovation. Manufacturing capabilities, global supply chain, and distribution networks are integral to delivering its hardware and software solutions.

In 2024, Mobile Networks expanded its AirScale portfolio with new energy-efficient Massive MIMO radios to support mobile traffic growth and accelerate mass 5G rollouts. The company's focus on open architectures allows for seamless integration into various ecosystems, creating opportunities for monetization and scale. This approach highlights how Nokia works to stay competitive.

Nokia's operations stand out due to its leadership in B2B technology innovation. This focus drives secure, future-ready networking technology for digitalization, AI, and cloud solutions. This approach helps the company maintain a strong position in the market.

This translates into customer benefits by enabling them to invest in secure, future-proof technology. It also helps simplify operations to reduce costs, expand into new opportunity areas, and drive sustainable efficiency. This focus on customer needs is central to the Nokia business model.

The Network as Code platform and the acquisition of Rapid's technology and R&D unit in 2024 further exemplify this. This acquisition provides the world's largest API hub, strengthening its R&D capabilities. By the end of 2024, the company expanded its network API partners to 48, including Orange, Telefonica, and Google.

Nokia's commitment to innovation, as seen through its research and development efforts, is a key aspect of its strategy. This focus helps the company stay competitive and adapt to market changes. This is a core element of how Nokia innovates.

Nokia's operational effectiveness is rooted in its B2B technology leadership and commitment to future-ready networking. This is supported by continuous innovation and strategic acquisitions. The company's focus on open architectures and customer benefits drives its market position.

- Mobile Network Products and Solutions

- Network Deployment and Support Services

- Technology Development through Nokia Bell Labs

- Strategic Acquisitions and Partnerships

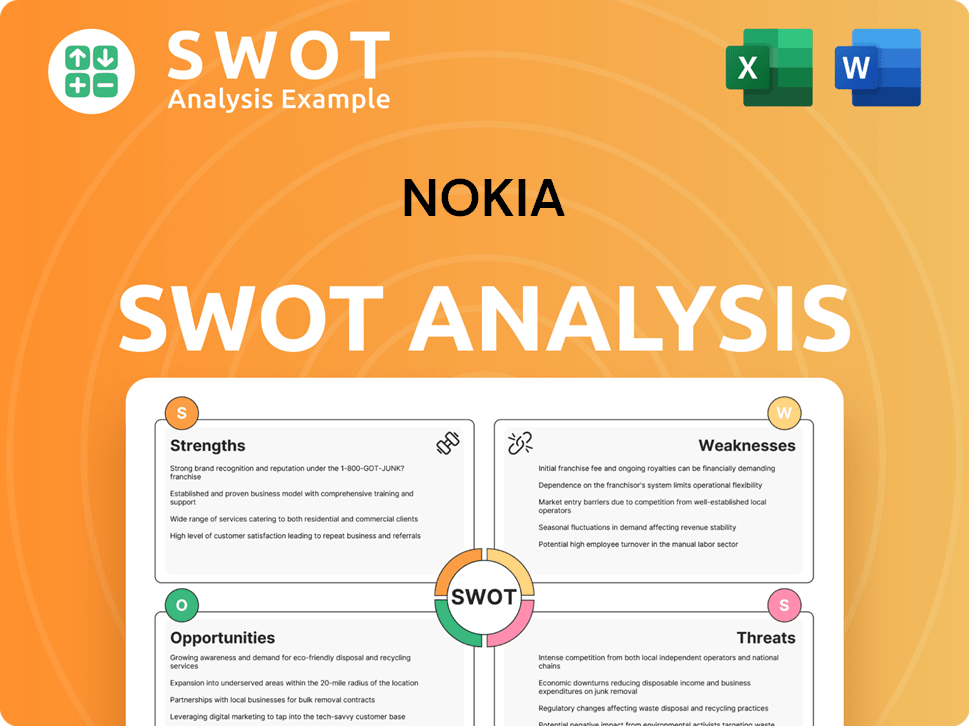

Nokia SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Nokia Make Money?

The Nokia company generates revenue through several key segments. These include Mobile Networks, Network Infrastructure, Cloud and Network Services, and Nokia Technologies. Understanding how Nokia works involves examining these diverse revenue streams and the strategies employed to maximize profitability.

In Q4 2024, Nokia saw its net sales increase by 10% to €5.98 billion (US$6.2 billion), surpassing analyst expectations. For the full year 2024, the company's annual revenue was $20.798 billion, a 13.66% decrease from 2023, largely influenced by a 7 percentage point decline linked to India.

The company is also focused on innovative monetization strategies. This includes enabling new revenue streams for its customers through 5G network slicing, private wireless, and service differentiation. Furthermore, Nokia is enhancing network efficiency using AI-driven automation and energy optimization. To learn more about the company's strategic direction, consider reading about the Growth Strategy of Nokia.

The primary revenue streams for Nokia are categorized into four main segments, each contributing differently to the overall financial performance. The Nokia business model relies on these diverse segments to maintain a strong market position.

- Mobile Networks: This segment focuses on mobile radio access, including 5G, 4G, and legacy technologies. In Q4 2024, Mobile Networks net sales saw a slight decline of 2% year-on-year in constant currency, mainly due to the APAC region.

- Network Infrastructure: This segment includes IP Networks, Fixed Networks, and Optical Networks. It experienced robust growth in Q4 2024, with net sales accelerating by 17%. In 2024, this business generated over 14 billion euros in revenue, with the Mobile Access division contributing 7.73 billion euros.

- Cloud and Network Services: This segment provides cloud-based solutions and network services. It returned to 7% net sales growth in Q4 2024, despite a prior business disposal.

- Nokia Technologies: This segment focuses on patent licensing. It saw a massive 85% increase in net sales in Q4 2024, driven by new deals. The annual net sales run-rate for Nokia Technologies increased to approximately between €1.3 billion and €1.4 billion in Q4 2024, progressing towards its mid-term target of €1.4 billion to €1.5 billion.

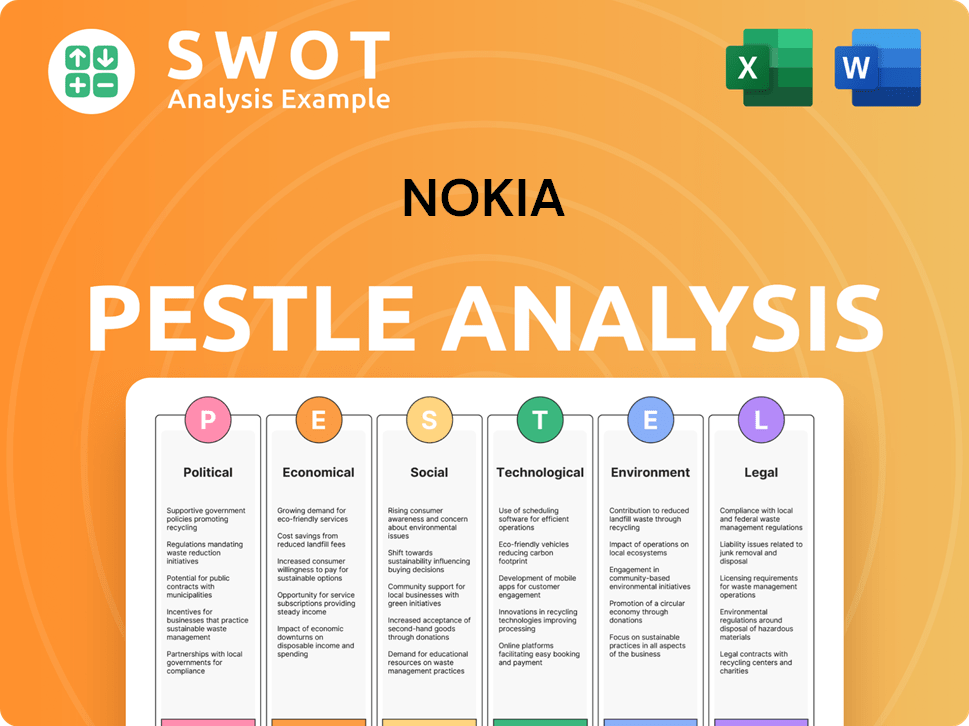

Nokia PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Nokia’s Business Model?

The evolution of the Nokia company has been marked by significant shifts in strategy and technological advancements. After a strategic restructuring, the company refocused its efforts on network infrastructure, particularly in the areas of 5G and the Internet of Things (IoT). This pivot followed a period where it lost its prominent position in the smartphone market. This transition has positioned Nokia to capitalize on the growing demand for advanced networking solutions.

A key strategic move in 2024 was the acquisition of Infinera, valued at US$1.7 billion, to strengthen its position in the growing optical networking market. This acquisition was completed in Q1 2025, and integration is underway, with positive momentum in customer orders driven by growth in hyperscalers. Nokia also filed a record-breaking 3,000 patents in 2024 and surpassed the milestone of 7,000 patent families essential to 5G, highlighting its commitment to innovation and technology leadership.

Nokia's journey has been shaped by both successes and challenges. The company has had to navigate a competitive landscape, especially from Chinese manufacturers, which has put pressure on margins. Despite these challenges, Nokia has demonstrated resilience and adaptability, securing important deals and maintaining a focus on innovation and customer satisfaction.

Nokia's history includes significant milestones, such as pioneering work in mobile technology and its early dominance in the mobile phone market. The company's strategic shift towards network infrastructure represents a major milestone. Nokia's acquisition of Infinera in 2024 and the filing of 3,000 patents in the same year are recent examples of its ongoing evolution.

The acquisition of Infinera is a strategic move to strengthen its position in the optical networking market. Focusing on 5G and IoT technologies is another key strategic decision. Nokia continues to invest heavily in R&D, with over 20% of sales invested in both 2022 and 2023, to maintain its technological edge.

Nokia's competitive advantages include its strong brand legacy and over 150 years of experience in the telecom industry. Its technological leadership is evident in its work in AI-RAN, Cloud RAN, and cloud-native core networks. The company is expanding its private wireless business, which reached 850 customers in 2024, and capitalizing on the rising demand for fixed broadband networks.

The global 5G upgrade cycle experienced a lull in 2024, impacting sales. Nokia's revenue halved in India to $1.49 billion. However, Nokia responded by maintaining commercial and pricing discipline to protect gross margins and secured many important deals, winning 18,000 additional base station sites since the start of 2024. Strong rebound in North American sales in H2 2024, fueled by growth in Network Infrastructure and Cloud & Network Services.

Nokia's operations are structured around several key business areas, including Network Infrastructure, Cloud and Network Services, and Nokia Technologies. The company invests heavily in research and development to stay at the forefront of technological advancements. Nokia's organizational structure supports its focus on innovation and its ability to adapt to changing market demands.

- Nokia's core values include customer focus, innovation, and collaboration.

- The company's supply chain is designed to support its global operations and ensure the delivery of high-quality products and services.

- Nokia's research and development efforts are focused on developing new technologies and solutions for the telecommunications industry.

- Nokia's current market position is influenced by its technological leadership, its strong brand, and its ability to adapt to new trends.

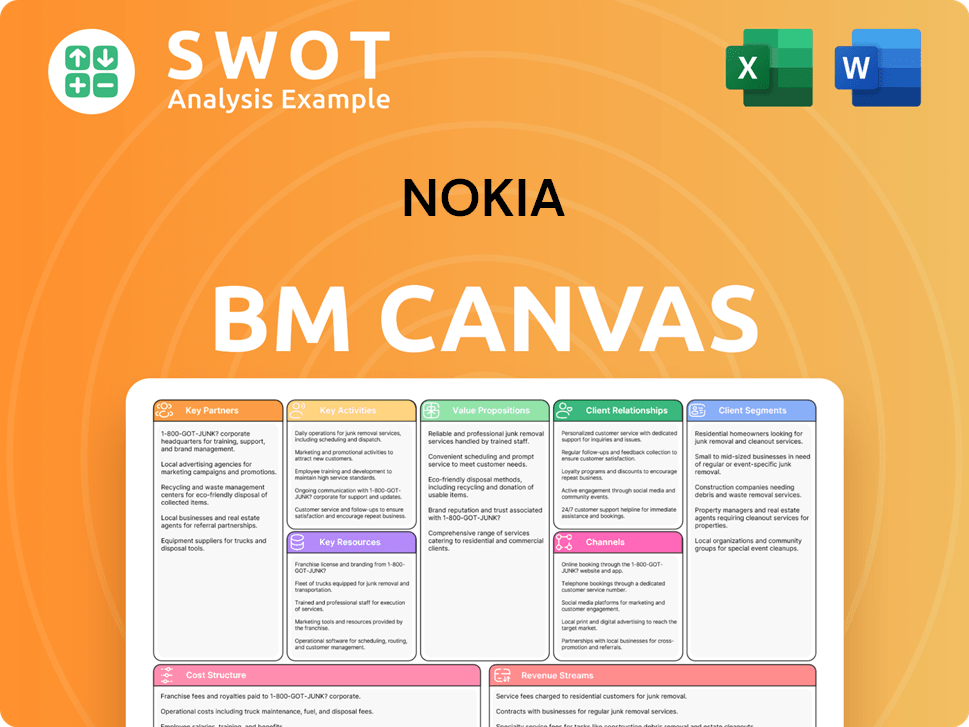

Nokia Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Nokia Positioning Itself for Continued Success?

Nokia holds a significant position within the telecommunications equipment sector, competing with major players like Ericsson, Huawei, and Samsung. The company is a leader in global Radio Access Network (RAN) equipment, operating in over 130 countries. Nokia's market share and customer loyalty hinge on its ability to provide secure, reliable, and sustainable networks, supporting future digital services for service providers, enterprises, and partners. This is how the Target Market of Nokia is defined.

The company faces several risks, including intense competition, changes in customer network investments, and rapid technological innovation. Cybersecurity threats and price wars, particularly from Chinese manufacturers, also pose challenges. Regulatory changes and tariff uncertainties, such as an estimated €20-€30 million impact on Q2 2025 operating profit, further complicate operations.

Nokia competes with major players like Ericsson and Huawei in the telecom equipment market. Its global presence is extensive, operating in over 130 countries. Nokia's market position is influenced by its ability to deliver secure and reliable networks.

Key risks include intense competition, changes in customer network investments, and rapid technological changes. Cybersecurity threats and price wars also pose challenges. Regulatory changes and tariff uncertainties present further operational difficulties.

Nokia anticipates strong net sales growth in Network Infrastructure for 2025. Cloud and Network Services are also expected to grow, driven by 5G Core momentum. Nokia Technologies is projected to deliver approximately €1.1 billion of operating profit.

Nokia is investing in private wireless and optical networking for future growth. The company aims for comparable operating profit between €1.9 billion and €2.4 billion in 2025. Free cash flow conversion from comparable operating profit is expected to be between 50% and 80%.

Nokia aims to achieve operating margins exceeding 13% and free cash flow representing 55% to 85% of operating profit for 2026. The company focuses on optimizing networks, cloudification, and developing new revenue streams. Nokia's strategy includes API-driven monetization and expansion in high-growth areas.

- Sustained growth in Network Infrastructure.

- Expansion in Cloud and Network Services.

- Focus on private wireless and optical networking.

- Commitment to achieving strong operating profit and free cash flow.

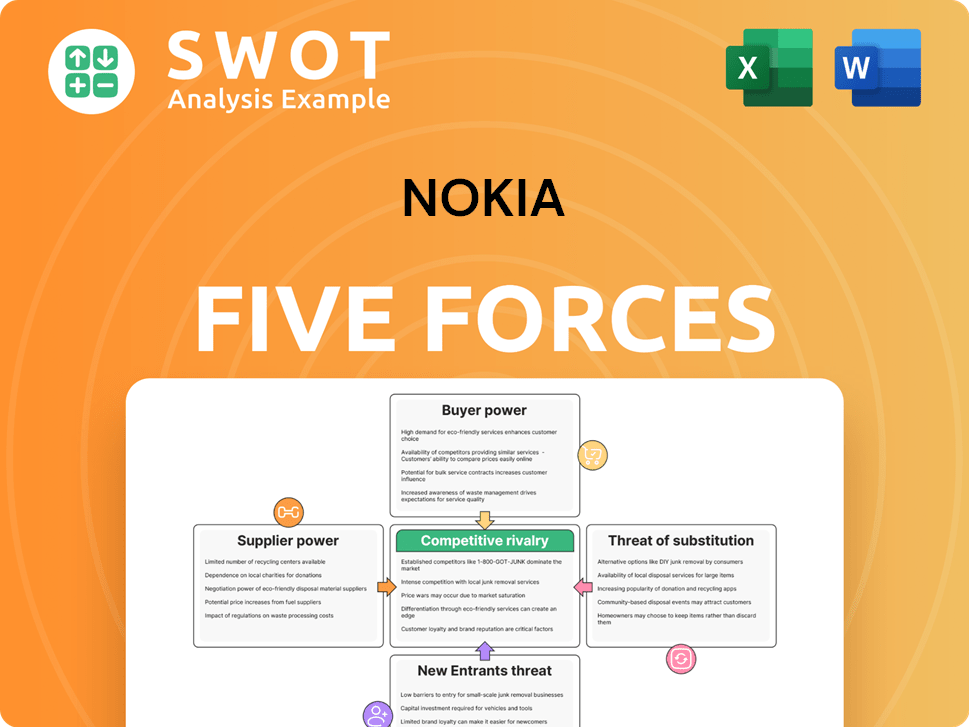

Nokia Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nokia Company?

- What is Competitive Landscape of Nokia Company?

- What is Growth Strategy and Future Prospects of Nokia Company?

- What is Sales and Marketing Strategy of Nokia Company?

- What is Brief History of Nokia Company?

- Who Owns Nokia Company?

- What is Customer Demographics and Target Market of Nokia Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.