NTPC Bundle

Can NTPC Power the Future of India?

Born from India's energy needs in 1975, NTPC Company has become the nation's power generation giant. From its humble beginnings, NTPC has evolved into a powerhouse, significantly contributing to India's energy demands. Now, with a massive installed capacity and ambitious expansion plans, what does the future hold for this energy titan?

This analysis delves into NTPC's NTPC SWOT Analysis, its current NTPC Growth Strategy, and the promising NTPC Future Prospects. We'll explore its NTPC Business Model, including its NTPC Power Generation capabilities, and examine the challenges and opportunities shaping its trajectory. Understanding NTPC's strategic initiatives and NTPC Expansion Plans is crucial for anyone invested in India's energy landscape.

How Is NTPC Expanding Its Reach?

NTPC is actively pursuing ambitious expansion initiatives to enhance its power generation capacity and diversify its energy sources, which is a key element of its NTPC Growth Strategy. The company's strategic focus includes significant investments in renewable energy, green hydrogen, and other innovative technologies. These efforts are designed to position NTPC as a leader in India's energy transition and to capitalize on emerging opportunities in the power sector.

By the end of FY25, the NTPC Group added 3,972 MW of capacity, reaching a cumulative installed capacity of approximately 80 GW. This growth reflects NTPC's commitment to meeting India's increasing energy demands while reducing its carbon footprint. The company's expansion plans are aligned with the government's broader goals for sustainable development and energy security.

The NTPC Future Prospects are closely tied to its ability to execute these expansion plans effectively. NTPC aims to add 5 GW to its portfolio in FY25, with a focus on 3 GW from renewable energy (RE) sources and 2 GW from thermal energy. This approach balances the need for reliable power generation with the imperative of transitioning to cleaner energy sources. This approach also aligns with the Target Market of NTPC.

NTPC is committed to achieving 60 GW of renewable energy capacity by 2032. This ambitious target represents a significant increase from its current operational RE capacity of 3.5 GW and a pipeline exceeding 20 GW. The company is investing heavily in solar, wind, and other renewable projects to meet this goal.

A major focus area for NTPC is green hydrogen solutions, including the development of a Green Hydrogen Hub in Pudimadaka, Andhra Pradesh. This project, with an estimated cost of $21 billion (Rs 1.8 trillion), aims to produce 1,500 tons of green hydrogen daily along with 7,500 tons of derivatives for export markets. This initiative positions NTPC at the forefront of the emerging green hydrogen economy.

NTPC is also expanding its nuclear power capacity, with plans to develop 2.8 GW of nuclear capacity in Madhya Pradesh and Rajasthan. The company aims to commission 30 GW of nuclear capacity by 2047, contributing to a diversified energy mix. This expansion underscores NTPC's commitment to providing reliable and sustainable power.

NTPC is pursuing international expansion, including a 50 MW solar project in Sri Lanka and exploring projects in Africa and Saudi Arabia. These ventures are part of NTPC's strategy to diversify its portfolio and tap into new markets. International expansion is expected to contribute to the company's long-term growth.

To enhance fuel security and meet increasing energy demand, NTPC aims to increase its coal production from captive mines to 40 million tons for FY25, a 17% growth compared to the previous fiscal year. This strategic move ensures a stable supply of fuel for its thermal power plants, supporting its overall power generation capacity.

- Increased coal production enhances fuel security.

- This supports the operation of thermal power plants.

- The growth in coal production is a key part of NTPC's expansion plans.

- It helps meet the growing energy demand in India.

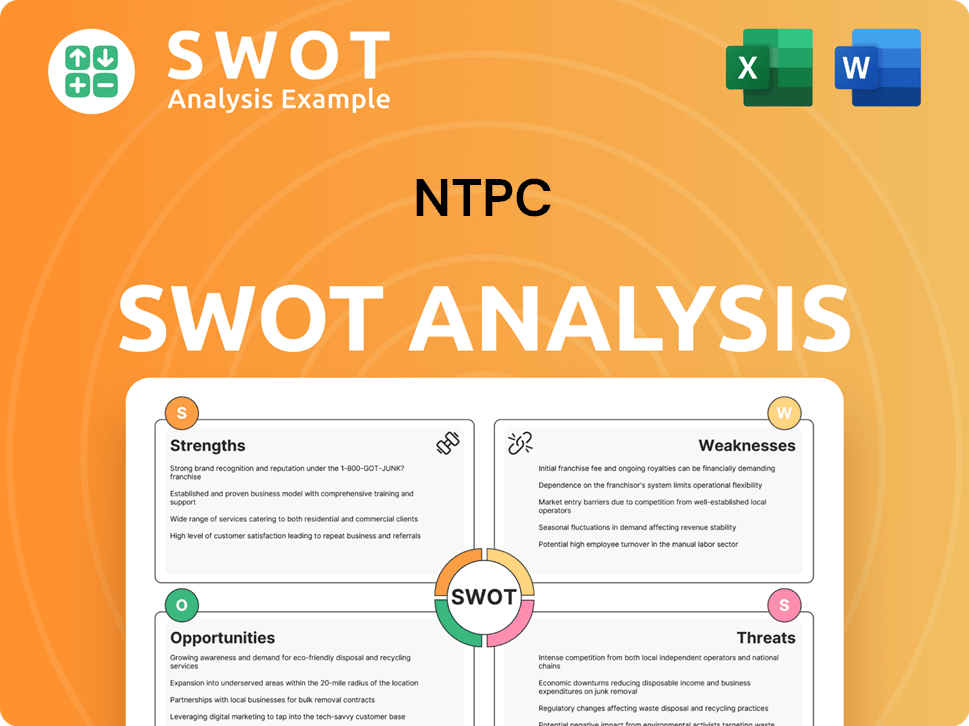

NTPC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does NTPC Invest in Innovation?

NTPC is aggressively embracing technology and innovation to fuel its sustainable growth and boost operational efficiency. The company is investing heavily in research and development (R&D) and innovation, with a focus on smart grids, artificial intelligence (AI), and the digitalization of operations. These efforts are expected to improve operational efficiency by up to 30% by 2025.

The company's strategic focus includes significant investments in clean energy technologies. This commitment is evident in its ventures into e-mobility, battery storage, pumped hydro storage, waste-to-energy projects, nuclear power, and green hydrogen solutions. These initiatives are designed to align with India's net-zero ambitions and position the country as a global leader in green energy.

NTPC's innovation strategy is a key component of its overall growth strategy, ensuring it remains competitive and contributes to India's energy security. The company's proactive approach to integrating new technologies is crucial for its future prospects in the evolving energy landscape. For more information about its marketing approach, consider exploring the Marketing Strategy of NTPC.

NTPC is heavily invested in green hydrogen production. It showcased a long-haul Hydrogen Fuel Cell Electric Bus (FCEB) at Mahakumbh 2025, supported by the National Green Hydrogen Mission.

The company is actively developing green hydrogen refueling stations to support the adoption of hydrogen-powered vehicles. This infrastructure is essential for the widespread use of green hydrogen.

NTPC is constructing India's largest green hydrogen production facility. This facility will have a capacity of 1200 tons per day (TPD), significantly boosting the country's green hydrogen production capabilities.

NTPC Green Energy Ltd. signed a Memorandum of Understanding (MoU) with Bharat Light and Power Pvt. Ltd. in February 2025. This collaboration focuses on green hydrogen and carbon capture initiatives.

The partnership aims to establish the necessary infrastructure for green hydrogen production under a build-own-operate model. This approach ensures efficient and sustainable operations.

NTPC's strategic roadmap was recognized at the World Energy Council Summit 2025 for 'Innovation in Public Sector Sustainability Initiatives.' This highlights its commitment to innovation.

NTPC is focusing on several key areas to drive its technological advancements and ensure its future prospects. These include smart grids, artificial intelligence, and digitalization, all aimed at enhancing operational efficiency and sustainability.

- Smart Grids: Implementing advanced grid technologies to improve efficiency and reliability.

- Artificial Intelligence (AI): Utilizing AI for predictive maintenance, optimizing operations, and enhancing decision-making.

- Digitalization: Digitizing operations to streamline processes, improve data management, and increase overall efficiency.

- Green Hydrogen: Investing in green hydrogen production and infrastructure to support the transition to clean energy.

- E-Mobility: Exploring e-mobility solutions, including electric buses and charging infrastructure.

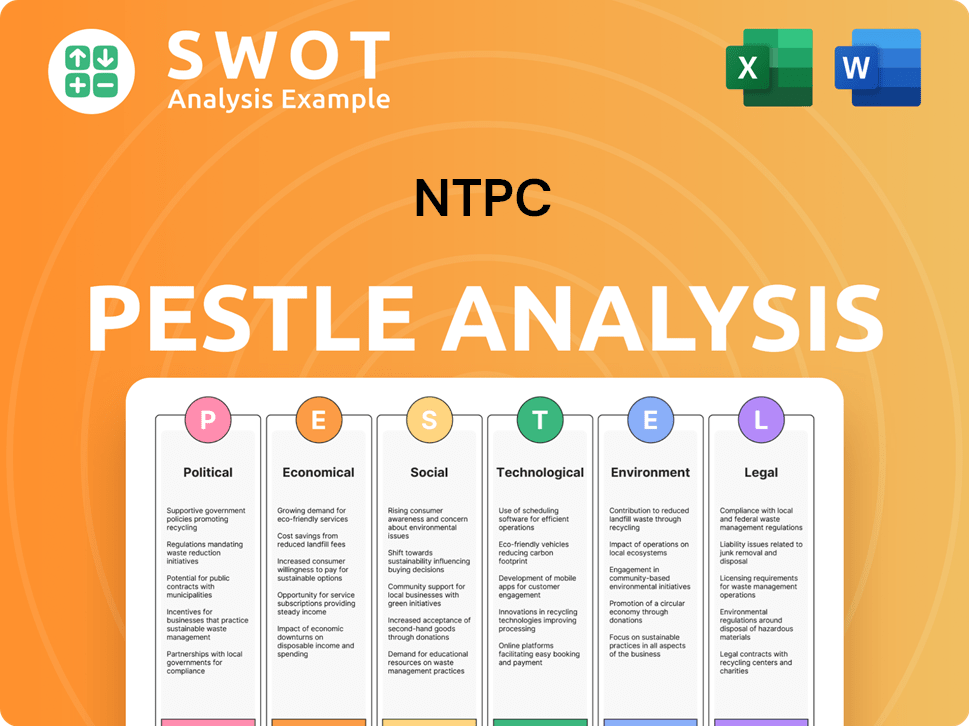

NTPC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is NTPC’s Growth Forecast?

The financial outlook for NTPC, a key player in India's power sector, remains robust, reflecting its strong operational performance and strategic initiatives. The company's ability to maintain profitability and expand its revenue streams is critical for its long-term sustainability and growth. NTPC's focus on both thermal and renewable energy projects positions it well to capitalize on the evolving energy landscape.

NTPC's financial results for FY25 demonstrate continued growth. The company's consolidated net profit for FY25 reached ₹23,953.15 crore, an increase from ₹21,332.45 crore in FY24. This growth is supported by a rise in total operational income, which climbed to ₹1,88,138.06 crore in FY25 from ₹1,78,524.80 crore the previous year. These figures highlight NTPC's strong financial health and its capacity to generate substantial earnings.

The company's performance in Q4 FY25 further underscores its financial strength. Consolidated net profit surged by nearly 22% to ₹7,897.14 crore, with revenue increasing by 10.17% to ₹54,013.54 crore. The net profit margin in Q4 FY25 was 14.09%, indicating efficient operations and effective cost management. These results reflect NTPC's resilience and its ability to adapt to market dynamics.

NTPC's projected income statement shows a positive trajectory. Net sales are estimated at ₹17,00,374 million for FY25, with anticipated growth to ₹18,92,236 million in FY26 and ₹20,04,514 million in FY27. Net income is projected to increase to ₹196,494 million in FY25, ₹215,956 million in FY26, and ₹234,018 million in FY27. These projections reflect the company's confidence in its future performance and its strategic growth plans.

NTPC's market capitalization as of May 2025 stood at ₹3,29,783.62 crore, demonstrating investor confidence. The board has recommended a final dividend of 33.50% (₹3.35 per share) for FY25, which is a reflection of its commitment to shareholder value. This dividend further enhances NTPC's appeal as a stable and rewarding investment.

Analysts anticipate that revenue will remain flat over the next three years, contrasting with the 15% growth forecast for the Renewable Energy industry in India. This divergence suggests that while NTPC is involved in the renewable energy sector, the growth rate may be different from the overall industry. This difference could be due to the company's diversified portfolio, which includes both thermal and renewable energy sources.

NTPC's strategic initiatives, including investments in renewable energy and plans for green hydrogen production, are crucial for its future. These initiatives are aligned with India's broader energy transition goals. Understanding the company's strategy is important for investors, which can be found in the Owners & Shareholders of NTPC.

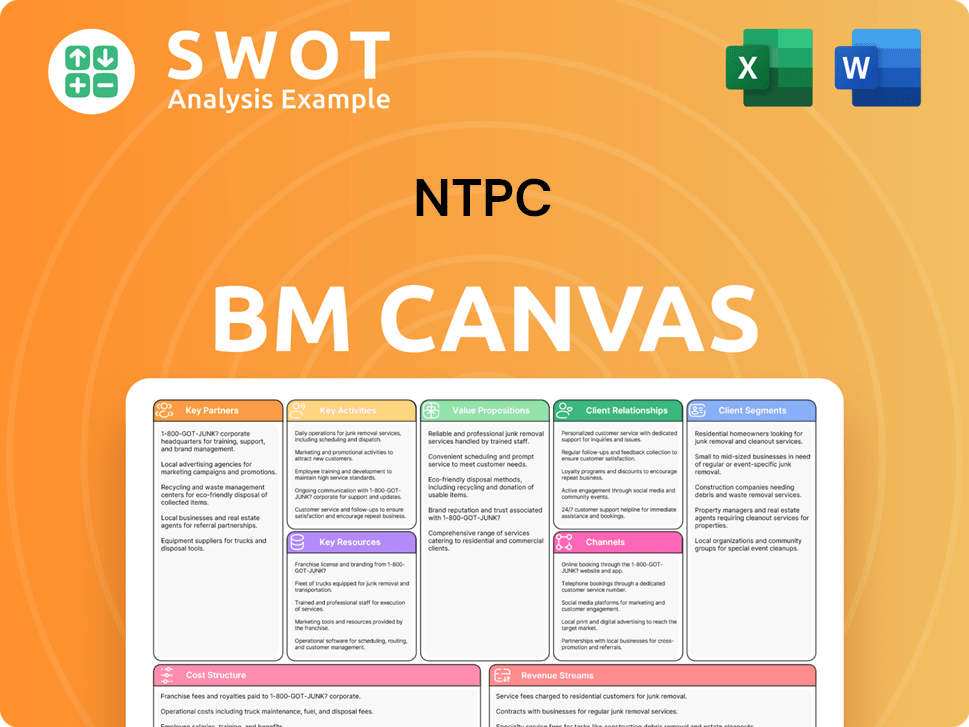

NTPC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow NTPC’s Growth?

The path to growth for the NTPC Company is not without its hurdles. While the company holds a strong position in the market, several risks could impact its ambitions. Understanding these challenges is crucial for assessing the company's future prospects.

One major concern is the increasing competition in the renewable energy sector. Furthermore, changes in government regulations, tariffs, and incentives could affect project profitability. Supply chain vulnerabilities, especially for critical components, also pose operational challenges.

Technological advancements and internal resource constraints add to the complexity. Adapting quickly to new technologies and managing finances for large-scale projects are vital for sustained growth.

The power sector is becoming increasingly competitive, with more players entering the renewable energy market. This increased competition could put pressure on NTPC's market share and profit margins. Companies like Adani Green Energy and ReNew Power are significant competitors in this space.

Changes in government policies, tariffs, or renewable energy incentives can significantly impact project viability. The power sector is heavily regulated, making it vulnerable to policy shifts. For example, changes to coal import duties or renewable purchase obligations could affect NTPC's operations.

Supply chain disruptions, particularly for components used in renewable energy projects or fuel for thermal plants, can pose operational challenges. The availability and cost of imported coal, for example, can fluctuate. The company aims to increase coal production from its captive mines to 40 million tons in FY25 to reduce import reliance, but this is still a factor.

Rapid technological advancements in power generation, such as the rise of more efficient renewable energy technologies, could render existing infrastructure less competitive. The company needs to invest in research and development and quickly adopt new technologies to stay ahead. The development of green hydrogen is one such area.

Internal resource constraints, including human capital and financial resources, could limit the company's ability to undertake large-scale projects. Securing funding for renewable energy projects and attracting skilled personnel are crucial. The company's consistent financial performance and strategic partnerships provide a robust framework for managing investments.

NTPC’s reliance on coal-fired power plants exposes it to environmental concerns and the risk of stranded assets. While the company is diversifying its energy portfolio, a significant portion of its capacity still comes from coal. The company is aiming for 60 GW of renewable energy capacity by 2032, but the transition will take time.

To address these risks, NTPC is diversifying its energy portfolio, including hydro, nuclear, and renewable energy sources. It is also focusing on in-house development and collaborations with external innovators to mitigate technological risks. The company's strategic partnerships and financial performance are also important for managing investments.

NTPC’s financial performance is crucial for its growth trajectory. The company's revenue from operations for FY24 was approximately ₹1.77 lakh crore. The company's focus on operational efficiency and cost management will be key to maintaining profitability and funding its expansion plans.

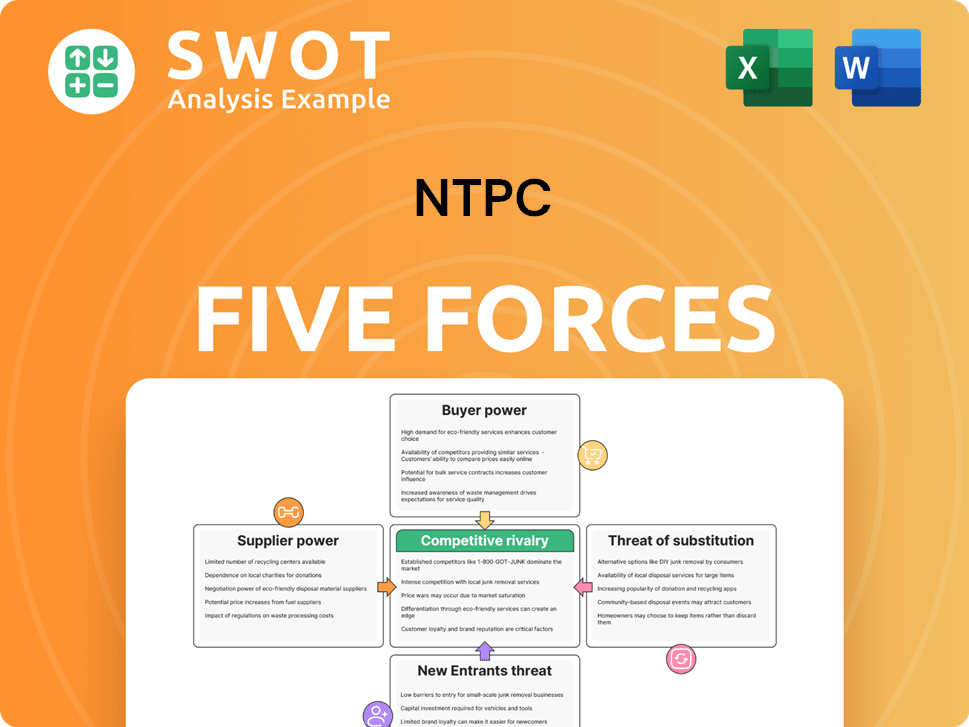

NTPC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NTPC Company?

- What is Competitive Landscape of NTPC Company?

- How Does NTPC Company Work?

- What is Sales and Marketing Strategy of NTPC Company?

- What is Brief History of NTPC Company?

- Who Owns NTPC Company?

- What is Customer Demographics and Target Market of NTPC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.