NTPC Bundle

Who Really Owns NTPC?

Understanding the NTPC SWOT Analysis is key, but have you ever wondered about the forces behind India's largest power generator? The question of 'Who Owns NTPC Company?' is fundamental to grasping its strategic direction and its impact on the Indian energy sector. Knowing the ownership structure of the National Thermal Power Corporation (NTPC) reveals who benefits from its success and who steers its course.

Delving into NTPC ownership unveils a fascinating interplay of government control and public shareholding, shaping its role in power generation India. As a public sector undertaking, NTPC's current ownership structure, primarily influenced by the Indian government, directly impacts its market position and strategic decisions. This exploration of NTPC India's ownership details is crucial for anyone seeking a comprehensive understanding of the company's operations and future trajectory.

Who Founded NTPC?

The National Thermal Power Corporation (NTPC) Limited, a key player in India's power generation sector, was established in 1975. As a public sector undertaking (PSU), its inception and early ownership were intrinsically linked to the Indian government's strategic objectives. This structure ensured that the entity was aligned with national development goals, particularly in the critical area of power infrastructure.

The initial ownership of the NTPC company was entirely vested in the Government of India. This arrangement was designed to facilitate the rapid expansion of power generation capacity across the country. The government's control was pivotal in directing investments, setting strategic priorities, and ensuring the widespread availability of electricity, which was essential for industrial growth and economic development.

There were no individual founders or private shareholders in the traditional sense. The establishment of NTPC was a deliberate policy decision by the government, reflecting its commitment to the energy sector. The early operational frameworks and strategic direction were governed by government policies and regulations applicable to PSUs, with the Ministry of Power exercising direct oversight.

The Government of India held 100% ownership of NTPC at its inception, reflecting its status as a PSU. The Ministry of Power, Government of India, had direct control and strategic guidance over NTPC. This structure ensured that the company's operations were aligned with national energy policies and development plans.

- NTPC was created to boost power generation India.

- The government's control ensured alignment with national energy policies.

- No individual founders or private shareholders were involved initially.

- The Ministry of Power provided direct oversight and strategic guidance.

The early years of NTPC were characterized by significant government investment and strategic direction. The company's growth was closely tied to the national five-year plans, which prioritized infrastructure development, including power generation. The focus was on expanding capacity and improving the efficiency of power plants to meet the growing energy demands of the country. For insights into how NTPC approached its market, consider reading about the Marketing Strategy of NTPC.

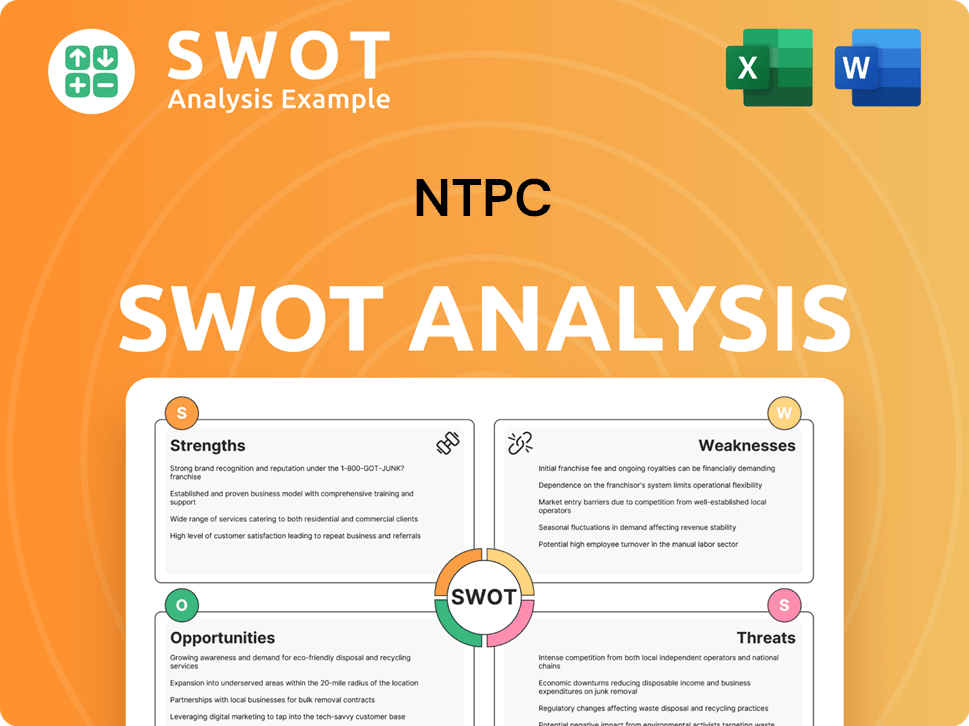

NTPC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has NTPC’s Ownership Changed Over Time?

The ownership structure of the National Thermal Power Corporation (NTPC) has primarily been shaped by the Government of India since its establishment. The company's journey towards public participation began with its Initial Public Offering (IPO) in 2004, leading to its listing on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). This crucial step allowed for public investment in the company, altering its ownership dynamics. The evolution of NTPC's ownership reflects the government's strategic approach to balance public sector control with market participation, aiming to enhance corporate governance and unlock value.

As of March 31, 2024, the President of India, acting through the Ministry of Power, Government of India, remains the largest shareholder of NTPC. The government holds approximately 51.10% of the total equity share capital, underscoring its continued influence. The remaining shares are distributed among various public shareholders. These include institutional investors, mutual funds, foreign portfolio investors (FPIs), and individual retail investors. The shifts in ownership also reflect the government's efforts to meet disinvestment targets and broaden the public float.

| Event | Impact | Date |

|---|---|---|

| Initial Public Offering (IPO) | Public participation in ownership | 2004 |

| Offer for Sale (OFS) | Divestment of government stake | Ongoing |

| Listing on NSE and BSE | Increased public accessibility | 2004 |

The shareholding pattern of NTPC includes major institutional investors like Life Insurance Corporation of India (LIC) and various mutual fund schemes. These entities frequently adjust their holdings based on market conditions and investment strategies. The ongoing presence of the Government of India as the majority shareholder ensures alignment with national energy policies. For further insights into the company's financial aspects, consider exploring the Revenue Streams & Business Model of NTPC.

The Government of India, through the Ministry of Power, holds the majority stake in NTPC. Public shareholders include institutional investors, mutual funds, and retail investors.

- Government ownership ensures alignment with national energy policies.

- Institutional investors frequently adjust their holdings.

- The IPO in 2004 marked the beginning of public participation.

- Offer for Sale (OFS) helps broaden the public float.

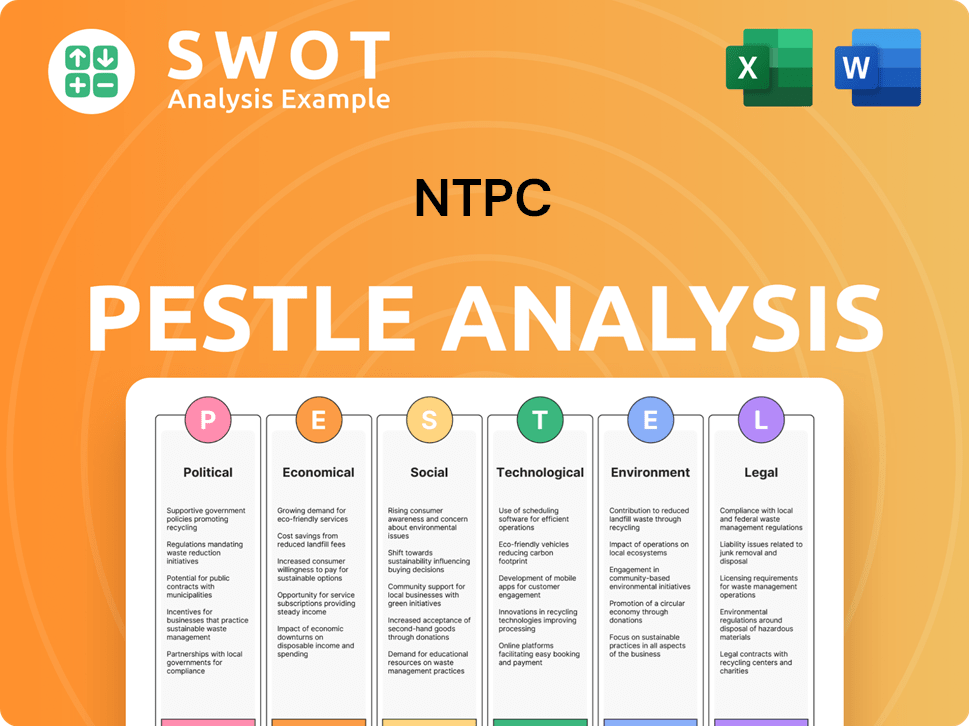

NTPC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on NTPC’s Board?

The Board of Directors of the National Thermal Power Corporation (NTPC) Limited, as of early 2025, includes both executive and non-executive directors. This structure typically involves a Chairman & Managing Director, functional directors overseeing areas like finance and operations, and independent directors. The composition reflects the company's status as a public sector undertaking, with the Government of India holding a significant ownership stake. The Chairman & Managing Director and functional directors are appointed by the Government of India.

The presence of government nominees on the board ensures that the interests of the largest shareholder are represented. Independent directors contribute external perspectives and expertise to the board's decision-making processes. The board's structure is designed to balance the strategic direction set by the majority shareholder with the need for independent oversight and adherence to corporate governance best practices. The board's composition is crucial for the company's strategic direction and operational efficiency within the Indian energy sector.

| Board Member Category | Role | Typical Representation |

|---|---|---|

| Chairman & Managing Director | Executive Leadership | Appointed by Government of India |

| Functional Directors | Oversee key operational areas (Finance, Operations, etc.) | Appointed by Government of India |

| Independent Directors | Provide external expertise and oversight | Appointed to ensure independent perspectives |

The voting structure at NTPC generally follows a one-share-one-vote principle. However, the Government of India's substantial shareholding, approximately 51.10% as of March 2024, grants it significant control over major decisions. This includes strategic direction, capital expenditure, and key appointments. While independent directors play a crucial role in governance, the ultimate decision-making power rests with the majority shareholder. Recent corporate governance initiatives in India aim to enhance the role of independent directors and increase transparency within the company.

The Government of India, as the majority shareholder, effectively controls NTPC. This control is exercised through board appointments and voting power. The company operates within the framework of a public sector undertaking, with the government's influence shaping its strategic direction.

- Government of India owns approximately 51.10% of the shares.

- The Chairman & Managing Director and functional directors are government appointees.

- Independent directors provide external oversight.

- The structure reflects NTPC's status as a public sector undertaking.

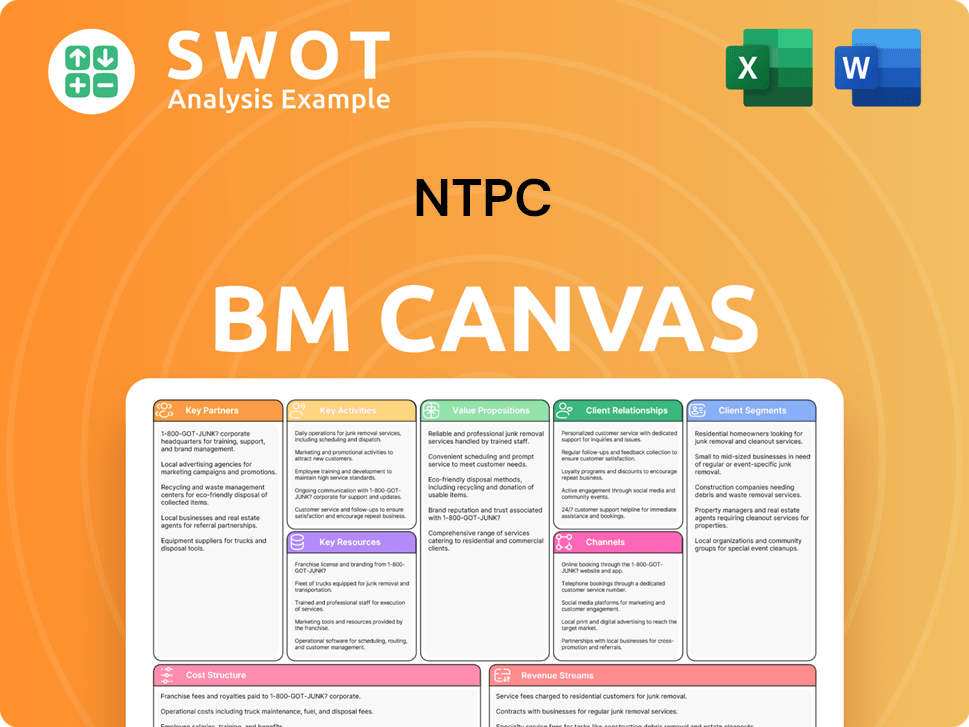

NTPC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped NTPC’s Ownership Landscape?

Over the past 3-5 years, the NTPC company, or National Thermal Power Corporation, has largely maintained a stable ownership structure. The Government of India remains the majority shareholder. While there have been minor adjustments in the public shareholding due to market activities and government disinvestment initiatives, the government's controlling stake has been consistently preserved. As of March 31, 2024, the government's holding in NTPC India was approximately 51.10%, demonstrating its continued control.

Industry trends in the Indian energy sector, especially for large public sector undertakings (PSUs), show a tendency towards increased institutional ownership and greater retail participation. NTPC ownership has been influenced by its strategic expansion into renewable energy, potentially attracting investors focused on green initiatives. The company's capital expenditure plans, funded through internal accruals, debt, and occasional equity infusions, have subtly impacted the ownership mix. Public statements confirm the government's commitment to NTPC's growth as a national asset, with no immediate plans for full privatization, thereby reinforcing the stability of its current ownership structure.

The evolution of NTPC ownership reflects a strategic approach to balance government control with market dynamics. For more insights, you might find the information on the Target Market of NTPC helpful.

The Government of India holds the majority stake, ensuring strategic control.

Public shareholding fluctuates due to market activities and government disinvestment efforts.

NTPC is expanding into renewable energy, potentially attracting new investors.

The government's commitment suggests stability in the current ownership structure.

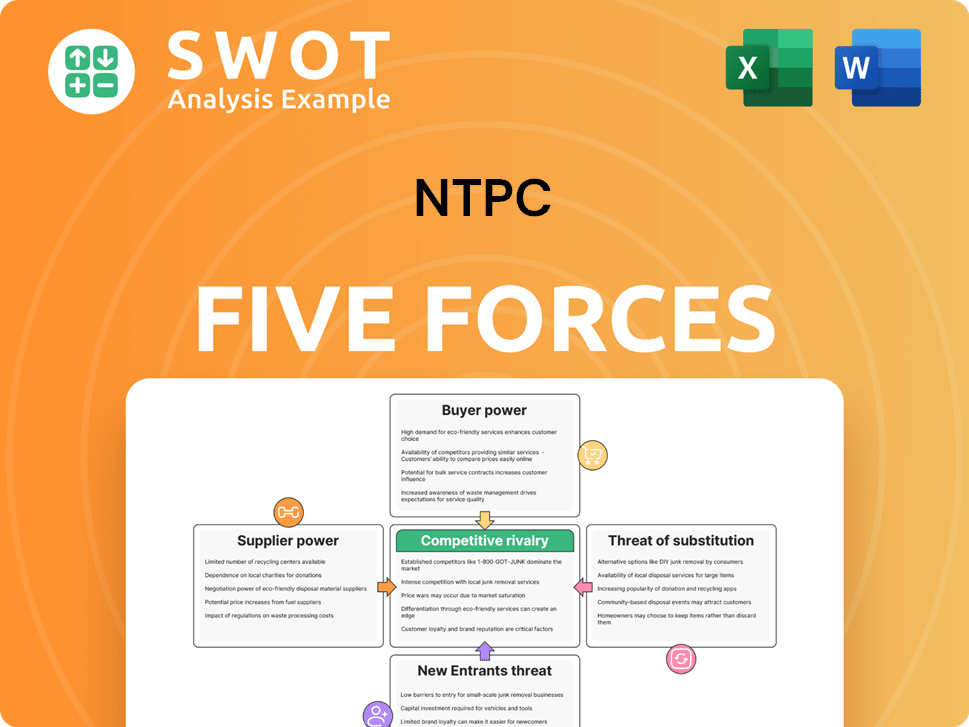

NTPC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NTPC Company?

- What is Competitive Landscape of NTPC Company?

- What is Growth Strategy and Future Prospects of NTPC Company?

- How Does NTPC Company Work?

- What is Sales and Marketing Strategy of NTPC Company?

- What is Brief History of NTPC Company?

- What is Customer Demographics and Target Market of NTPC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.