NTPC Bundle

How Does NTPC Power India?

NTPC Limited, the behemoth of India's power sector, is more than just a company; it's the engine driving a nation's growth. Its vast network of power plants, from thermal to renewables, is critical infrastructure, directly impacting India's economic trajectory. Understanding NTPC SWOT Analysis is key to grasping its strategic position.

This exploration of NTPC's operations delves into the core of its business model, revealing how it generates electricity and revenue. We'll examine its significant role in power generation India, including its thermal power plants and burgeoning renewable energy NTPC initiatives. From its impact on the environment to its future plans, we'll uncover the comprehensive story of this energy giant.

What Are the Key Operations Driving NTPC’s Success?

The core of NTPC's operations lies in the generation and sale of electricity. Primarily, it serves state electricity boards and distribution companies across India. Its value proposition is centered on providing reliable, affordable, and increasingly sustainable power to support India's economic growth and electrification efforts.

NTPC's diverse portfolio includes thermal power plants (coal and gas-based), hydroelectric power plants, and a growing number of renewable energy projects, such as solar and wind power. This diversification helps manage varying energy demands and reduces risks associated with relying on a single energy source. The company's business model is built on integrated operations, from fuel sourcing to power transmission.

NTPC is a major player in Power generation India. The company's effectiveness stems from its economies of scale, operational efficiencies in managing large power complexes, and a strong focus on technology adoption for improved performance and reduced emissions. For instance, NTPC's commitment to reducing carbon intensity and developing green hydrogen projects demonstrates its adaptability to global energy transitions and its dedication to providing cleaner energy solutions, thereby translating into long-term environmental and economic benefits for its customers and stakeholders.

NTPC sources fuel, primarily coal, through long-term agreements and captive mines. It then generates power using advanced plant technologies. The electricity is transmitted through the national grid. The company has a significant presence in Thermal power plants.

NTPC also offers consultancy, engineering, and project management services. It leverages its extensive experience in power plant development and operation. This expands its revenue streams and expertise in the power sector.

The supply chain involves numerous domestic and international suppliers for equipment, fuel, and services. NTPC focuses on technology adoption to improve performance and reduce emissions. This includes initiatives in Renewable energy NTPC.

NTPC is committed to reducing carbon intensity and developing green hydrogen projects. This aligns with global energy transitions and cleaner energy solutions. This commitment supports How NTPC contributes to sustainable development.

NTPC's operational processes are highly integrated, covering fuel sourcing, power generation, and transmission. The company's focus on efficiency and sustainability is evident in its operations. This includes a strategic push towards renewable energy and cleaner technologies.

- Fuel Sourcing: Primarily coal, through long-term agreements and captive mines.

- Power Generation: Utilizes advanced plant technologies.

- Transmission: Electricity is transmitted through the national grid.

- Renewable Energy: Expanding its portfolio with solar and wind projects.

For more insights into NTPC's strategic direction, consider reading about the Growth Strategy of NTPC.

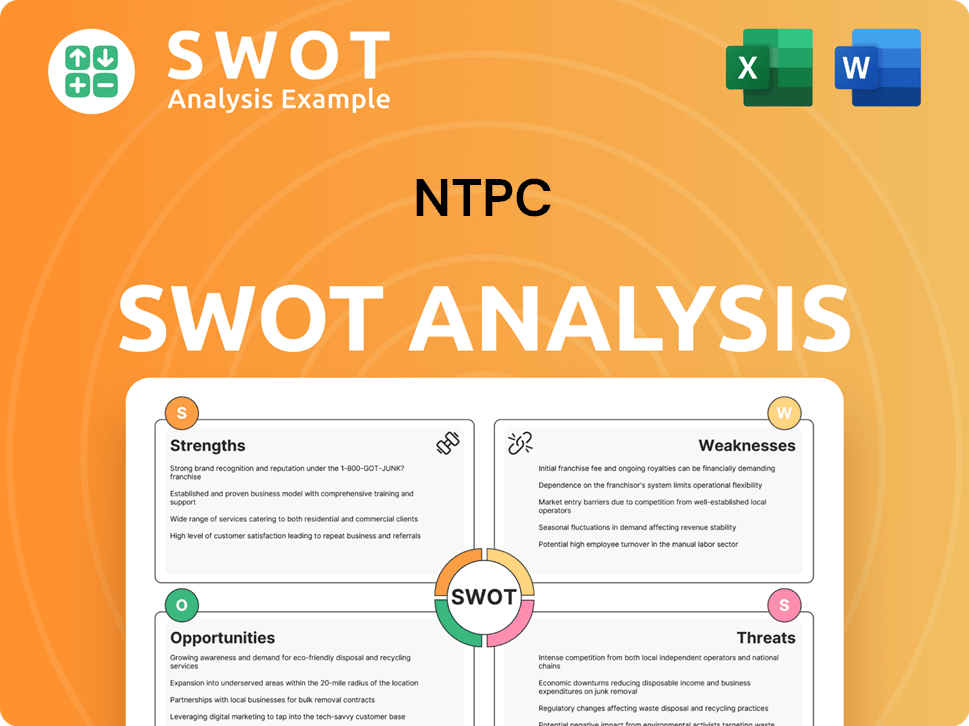

NTPC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does NTPC Make Money?

NTPC's primary revenue stream centers around the sale of electricity. This forms the backbone of its financial performance, with the majority of its income derived from this core activity. The company's business model is heavily reliant on its ability to generate and sell power efficiently.

The sale of electricity is primarily conducted through long-term Power Purchase Agreements (PPAs). These agreements with state electricity boards and distribution companies provide a stable and predictable revenue stream. Tariffs are determined by regulatory bodies, ensuring cost recovery and a reasonable return on investment for NTPC.

Beyond its core business, NTPC also generates revenue through consultancy and project management services. This diversification adds to the company's financial strength.

The principal revenue source for NTPC is the sale of electricity. This is facilitated through Power Purchase Agreements (PPAs) with various entities.

NTPC offers consultancy and project management services. This involves leveraging its expertise in power project development and operation.

NTPC is exploring new monetization strategies in the renewable energy sector. This includes potential avenues like carbon credits and green hydrogen sales.

Tariffs for electricity sales are determined by regulatory bodies. This ensures cost recovery and a reasonable return on investment.

NTPC's financial performance is robust, as evidenced by the increase in standalone net profit. The company's consolidated gross generation for the fiscal year 2023-24 was 399.40 Billion Units (BU), reflecting a growth of 5.86%.

The company is focusing on renewable energy to align with global sustainability trends. This creates new avenues for revenue generation.

NTPC's revenue model is multifaceted, with a strong emphasis on power generation and strategic diversification.

- Electricity Sales: The primary source, secured through PPAs.

- Consultancy Services: Leveraging expertise in power project management.

- Renewable Energy: Exploring carbon credits and green hydrogen sales.

- Regulatory Compliance: Adhering to tariff regulations for financial stability.

- Financial Growth: Demonstrated by increased generation and net profit.

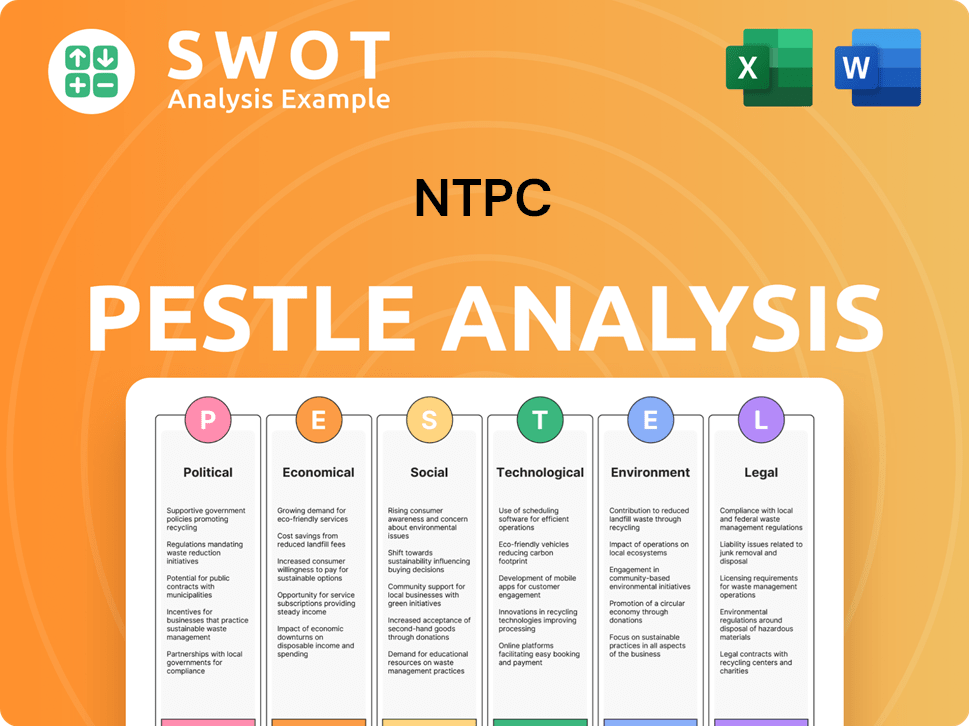

NTPC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped NTPC’s Business Model?

The journey of NTPC, a major player in India's power sector, is marked by significant milestones, strategic shifts, and a competitive edge that has solidified its position. From its inception, NTPC has consistently expanded its power generation capacity, playing a crucial role in meeting the growing energy demands of India. Its evolution showcases a commitment to adapting to the changing energy landscape, embracing both thermal and renewable energy sources.

A key strategic move for NTPC has been its aggressive push into renewable energy. This diversification is vital for long-term sustainability and alignment with global climate goals. The company's focus on integrating cleaner energy sources reflects its forward-thinking approach to the power generation business. This is further demonstrated by its commitment to expanding its green energy footprint.

NTPC's business model has evolved to address operational challenges and leverage its strengths. The company has navigated fluctuations in coal prices and environmental regulations through strategic fuel procurement and the adoption of cleaner technologies. Its robust project execution capabilities and strong relationships with government bodies have further strengthened its market position. The company is also investing in advanced technologies like carbon capture utilization and storage (CCUS) and green hydrogen.

NTPC has achieved several significant milestones, including expanding its power generation capacity and diversifying its energy sources. A notable recent achievement is securing a tender for a 1200 MW ISTS-connected wind power project through NTPC Renewable Energy Limited (NTPC REL). These milestones highlight NTPC's commitment to growth and sustainability.

NTPC's strategic moves include diversifying into renewable energy and adapting to evolving regulatory landscapes. The company is investing in advanced technologies and focusing on sustainable practices. For example, NTPC is actively involved in projects related to green hydrogen and CCUS, positioning itself for future energy transitions.

NTPC's competitive advantages include its massive installed capacity, operational expertise, and strong relationships with government bodies. Its robust project execution capabilities and consistent commissioning of new power plants give it a distinct edge. These factors collectively contribute to NTPC's leadership in the Indian power sector.

In recent financial reports, NTPC has demonstrated robust performance. The company's financial results reflect its operational efficiency and strategic investments. For detailed insights into NTPC's financial strategies and growth, consider reading Growth Strategy of NTPC.

NTPC's operations involve a mix of thermal and renewable energy sources, contributing significantly to India's power generation. The company is focused on expanding its renewable energy portfolio and adopting advanced technologies. This includes investments in green hydrogen and CCUS to reduce its carbon footprint and ensure sustainable development.

- NTPC's installed capacity includes both coal-fired power plants and renewable energy projects.

- The company is actively working on projects that contribute to sustainable development.

- NTPC’s future plans include further expansion into renewable energy and adoption of cleaner technologies.

- NTPC's financial performance is closely tied to its operational efficiency and strategic investments.

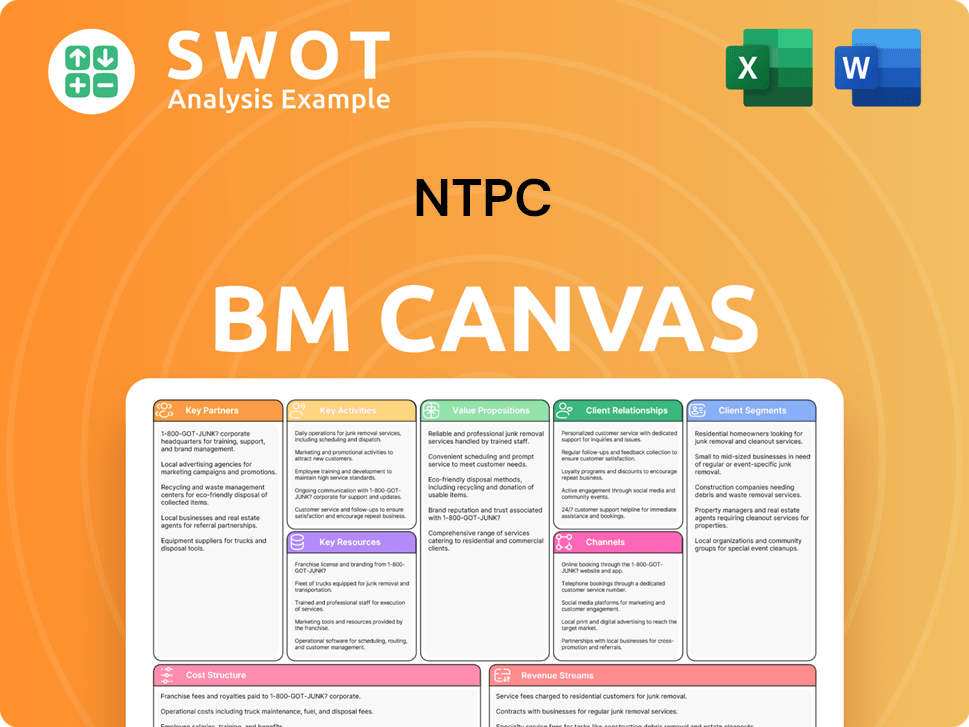

NTPC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is NTPC Positioning Itself for Continued Success?

NTPC holds a commanding position in India's power sector, standing as the largest power generating company with a substantial market share. NTPC operations are widespread, and its extensive portfolio and widespread presence across the country contribute to significant customer loyalty. Furthermore, it has a broad global reach, particularly within its operational scope in India and neighboring countries through consultancy services.

However, NTPC faces several key risks. Regulatory changes in the power sector, including tariff revisions and environmental norms, can impact its profitability. New competitors, particularly in the rapidly expanding renewable energy segment, pose a challenge. Technological disruptions, such as advancements in energy storage or decentralized power generation, could alter the industry landscape. Additionally, changing consumer preferences towards cleaner energy sources necessitate continuous adaptation.

NTPC is the largest power generator in India, holding a significant market share. The company's diverse portfolio includes thermal, hydro, and renewable energy sources. NTPC's widespread presence ensures strong customer loyalty across the country.

Regulatory changes, especially in tariffs and environmental norms, pose a risk to NTPC's profitability. Competition from renewable energy companies is increasing. Technological advancements and changing consumer preferences towards cleaner energy sources are also challenges.

NTPC aims for 60 GW of renewable energy capacity by 2032. The company is exploring opportunities in energy storage, electric vehicle charging, and green hydrogen. NTPC plans to leverage its existing infrastructure and invest in new technologies.

NTPC is focused on sustainable growth, with a strong emphasis on renewable energy. The company is committed to decarbonization and a diversified energy mix. NTPC is actively participating in India's energy transition.

NTPC's future outlook is shaped by its strategic initiatives focused on sustainable growth. The company aims to achieve 60 GW of renewable energy capacity by 2032, significantly increasing its green energy footprint. It is also exploring opportunities in energy storage solutions, electric vehicle charging infrastructure, and green hydrogen production. Leadership statements emphasize a commitment to decarbonization and a diversified energy mix. NTPC plans to sustain and expand its ability to make money by leveraging its existing infrastructure, investing in cutting-edge technologies, and actively participating in India's energy transition, ensuring its continued relevance and profitability in a dynamic energy market. To learn more about the company, you can read the Brief History of NTPC.

NTPC’s installed capacity is around 75 GW as of early 2024. The company has a significant presence in thermal power generation, with a growing focus on renewable energy. NTPC's revenue and profit figures fluctuate based on market conditions and regulatory changes.

- NTPC plans to invest significantly in renewable energy projects.

- The company is actively involved in the development of green hydrogen projects.

- NTPC is exploring opportunities in the electric vehicle charging infrastructure.

- NTPC's commitment to sustainable development is evident in its environmental initiatives.

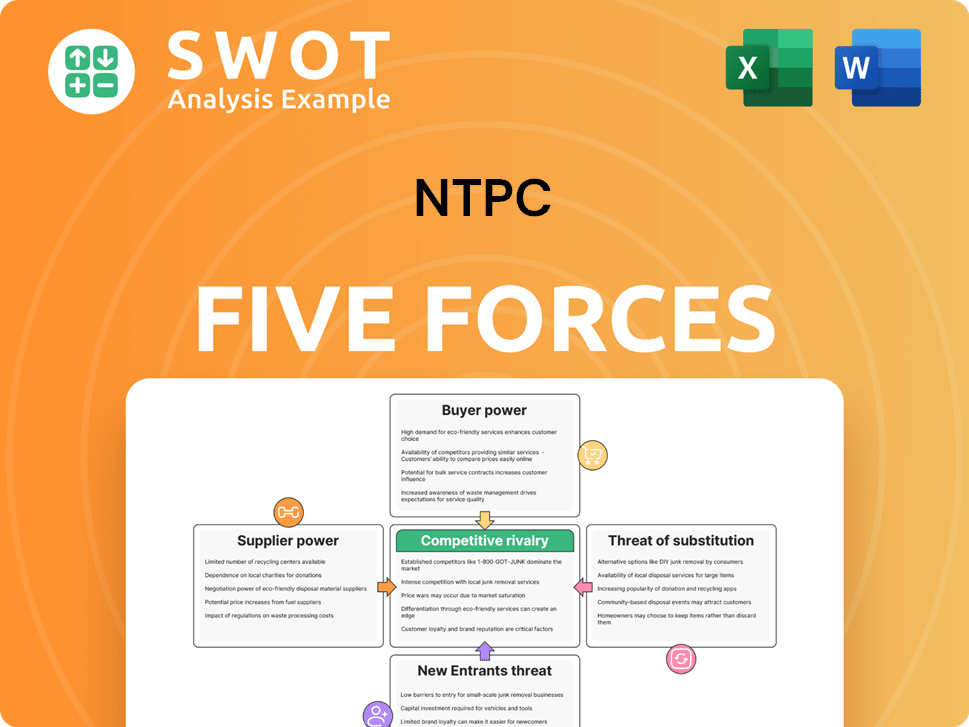

NTPC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NTPC Company?

- What is Competitive Landscape of NTPC Company?

- What is Growth Strategy and Future Prospects of NTPC Company?

- What is Sales and Marketing Strategy of NTPC Company?

- What is Brief History of NTPC Company?

- Who Owns NTPC Company?

- What is Customer Demographics and Target Market of NTPC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.