Ortec Group Bundle

Can Ortec Group Continue Its Impressive Growth Trajectory?

Ortec Group, a leader in engineering and services, has built a strong foundation since its inception in 1981, evolving from a consulting firm to a global software company. With a current annual revenue of $5 billion as of May 2025, understanding its Ortec Group SWOT Analysis is crucial to assess its future potential. This analysis will explore the company's strategic direction and future prospects, providing insights into its expansion plans, innovation, and financial outlook.

This deep dive into Ortec Group's growth strategy will examine its business development efforts and how it plans to navigate the evolving industry landscape. We'll also conduct a thorough market analysis to assess its competitive position and identify potential investment opportunities. Furthermore, we'll explore Ortec Group's strategic planning initiatives and long-term goals to understand its commitment to sustainable growth strategy.

How Is Ortec Group Expanding Its Reach?

The Ortec Group is actively pursuing a multi-faceted growth strategy, focusing on both geographical and product category diversification, alongside strategic mergers and acquisitions. This approach is designed to strengthen the company's market position and capitalize on emerging opportunities within the environmental services and energy sectors. The company's future prospects are closely tied to the successful execution of these expansion initiatives.

A key element of Ortec Group's strategy involves strategic acquisitions to broaden its service offerings and enter new markets. These acquisitions are carefully selected to complement existing capabilities and drive inorganic growth. By integrating complementary services and technologies, the company aims to diversify revenue streams, access new customer bases, and stay ahead of industry changes.

Beyond acquisitions, Ortec is expanding its product and service offerings. This includes the launch of new ventures and the development of innovative solutions to meet evolving market demands. The company is also focused on strengthening its leadership in key markets through strategic partnerships and investments.

In June 2024, Ortec Group acquired Englobe Corp.'s contaminated soil and organic waste treatment and management activities in North America, the United Kingdom, and France. This acquisition, now known as Biogénie, significantly strengthened Ortec’s position in soil remediation. The acquired business line contributes approximately 180 million Canadian dollars in revenue.

In December 2024, Ortec acquired Weetec Group, a leading player in electrical and HVAC engineering in the Paris region. This acquisition expanded Ortec's expertise in energy-efficient building renovation. Weetec Group had a revenue of 85 million euros in 2024, further bolstering Ortec's capabilities in the energy sector.

Ortec also acquired Alzéo Environnement in March 2024, specializing in wastewater treatment, and 3C Metal in September 2024, enhancing metallurgy expertise for the energy sector. These acquisitions demonstrate Ortec's commitment to diversifying revenue streams and expanding its service portfolio. These strategic moves help Ortec stay ahead of industry changes.

In September 2024, Ortec launched Oreve, an ultra-fast charging network for trucks and vans operating throughout France. This initiative demonstrates Ortec's commitment to electric mobility and its expansion into new markets. This move aligns with the growing demand for sustainable transportation solutions.

Ortec Group is focusing on strengthening its leadership in the US and Europe in supply chain, workforce management, and data science & consulting. A significant investment from Battery Ventures in January 2024 supports this strategic move. This partnership aims to accelerate product development and support Ortec's transition to a Software-as-a-Service (SaaS) model.

- Acquisitions are a core part of Ortec's growth strategy.

- The company is expanding into new markets and service offerings.

- Strategic partnerships support innovation and expansion.

- The company is focused on sustainable practices and the energy transition.

To better understand the Ortec Group's approach, you can also read about the Marketing Strategy of Ortec Group to get a better grasp of their overall approach.

Ortec Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ortec Group Invest in Innovation?

The growth strategy of the Ortec Group heavily relies on innovation and technology, particularly focusing on digitalization. This approach aims to boost employee efficiency and improve customer support. The company's innovation strategy emphasizes collaborative efforts, including customer input, to foster a dynamic environment.

Ortec Group's commitment to technology and innovation is evident in its dedicated department of engineers. They are focused on developing advanced solutions, tools, materials, and products. A digital committee, including senior management and external partners, drives the digital transformation, creating an agile 'digital offering' that aligns with local interests and meets customer and employee needs. This strategic focus is crucial for the company's future prospects.

The company actively embraces technologies like AI, IoT, and data science to enhance its solutions. Their decision support software and data science capabilities help customers improve business outcomes, showcasing the practical application of their technological investments.

Ortec Group's digital transformation involves leveraging technologies like AI, IoT, and data science. The company's 'digital offering' is designed to meet the needs of both customers and employees.

Ortec Group is committed to sustainability and has set ambitious emission reduction targets. The company's O'Climat plan focuses on carbon accounting, energy reduction, and sustainable practices.

Ortec Group supports its clients in their environmental transition by offering Sustainable Performance Solutions. In 2024, Ortec helped its customers prevent 586 kilotons of CO2-e emissions.

Ortec Group's short-term GHG emission reduction targets, validated by the Science Based Targets initiative (SBTi), include a 42% reduction in scopes 1 and 2 emissions by 2030 (compared to a 2021 baseline).

Ortec Group aims for a 51.6% reduction per million euros of added value for scope 3 emissions by 2030, aligning with a 1.5°C global warming trajectory.

In 2024, Ortec Group helped its customers improve their financial performance by €1.3 billion.

A core aspect of the Ortec Group's growth strategy is its dedication to sustainability. The company's O'Climat plan focuses on carbon accounting, energy consumption reduction, and promoting sustainable practices. These initiatives are crucial for the company's long-term goals and market position.

- The company's commitment to sustainability is demonstrated by its validated emission reduction targets.

- Ortec Group is supporting its clients in their environmental transition.

- The company's initiatives have contributed to significant environmental and financial benefits for its customers.

- Ortec Group's sustainable growth strategy is a key factor in its future prospects.

Ortec Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Ortec Group’s Growth Forecast?

The financial outlook for the Ortec Group is shaped by its strategic initiatives and market positioning. As of May 2025, the company reported an annual revenue of $5 billion. This financial performance reflects the company's ability to execute its growth strategy effectively.

While specific projections for 2025 are not publicly available, the company's recent activities suggest a positive trajectory. Acquisitions and partnerships are key drivers of business development. The company's focus on high-value solutions across various sectors indicates a strategy aimed at profitable expansion.

The Ortec Group's commitment to sustainability, through initiatives like the O'Climat plan, is also expected to contribute to long-term financial benefits. These efforts are designed to increase efficiency and meet the growing market demand for sustainable solutions, further supporting the company's long-term goals.

The acquisition of Weetec Group, with over €85 million in revenue in 2024, directly boosted Ortec's top line. This acquisition strengthens its presence in the electrical and HVAC engineering market. The Englobe Corp. soil and organic waste treatment activities acquisition brought in 180 million Canadian dollars in revenue.

The partnership with Battery Ventures, announced in January 2024, involved a significant investment. This investment is aimed at accelerating growth, expanding go-to-market efforts in North America, and supporting the transition to SaaS. These partnerships are crucial for achieving Ortec Group's expansion plans.

Ortec Group operates in key markets including energy, aerospace, and automotive. A thorough market analysis suggests these sectors offer significant growth potential. Understanding these markets is crucial for strategic planning and identifying investment opportunities.

The company faces competition in its various sectors. Analyzing the competitive landscape helps Ortec Group refine its strategies. Understanding the strengths and weaknesses of competitors is vital for maintaining and improving Ortec Group's market share.

The O'Climat plan demonstrates Ortec Group's commitment to sustainable growth strategy. This focus on sustainability can lead to long-term financial benefits. This approach also aligns with increasing investor and consumer demand for environmentally responsible practices.

Ortec Group's financial performance is a key indicator of its success. The company's revenue of $5 billion as of May 2025 showcases its strong position. Analyzing the financial results provides insights into the company's ability to execute its growth strategy.

Ortec Group's future challenges include navigating market dynamics and maintaining profitability. Adaptability and innovation are essential for overcoming these challenges. Effective risk management and strategic decision-making are crucial for long-term success.

The company's strategic initiatives, such as acquisitions and partnerships, are vital. These initiatives support Ortec Group's expansion and enhance its market presence. The company's focus on high-value solutions drives its growth strategy.

Ortec Group's key markets are diverse, including energy, aerospace, and automotive. These sectors offer significant opportunities for expansion. The company's strategic focus ensures it can capitalize on industry trends and maintain a competitive edge.

- Focus on high-value solutions.

- Acquisitions to expand market presence.

- Partnerships to accelerate growth.

- Commitment to sustainability.

To learn more about the company's core values and mission, read the article: Mission, Vision & Core Values of Ortec Group.

Ortec Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Ortec Group’s Growth?

The Ortec Group faces potential obstacles that could influence its growth strategy and company future. These challenges include market competition, evolving regulations, and the need to adapt to technological advancements. Understanding these risks is critical for stakeholders, from individual investors to business strategists, seeking to assess the company's long-term viability and potential for business development.

Market analysis reveals that the sectors in which Ortec Group operates, such as industry, environment, and energy, are dynamic and competitive. The company's ability to innovate and differentiate its services will be key to maintaining its market position. Furthermore, the company's strategic planning must account for external factors, such as regulatory changes and technological disruptions, to ensure sustainable growth and resilience.

Regulatory changes, particularly in the environmental and energy sectors, present significant risks. Staying compliant and adapting to new regulations can involve substantial investments and operational adjustments. The company's response to these challenges will impact its financial performance and ability to capitalize on investment opportunities. For more insights, consider reviewing the analysis of Owners & Shareholders of Ortec Group.

Intense competition within the industrial, environmental, and energy sectors requires continuous innovation and differentiation. Ortec Group must proactively respond to competitive pressures from both established and emerging companies. This includes adapting to market dynamics and customer demands to maintain a competitive edge in the market share.

Evolving regulations, especially in environmental and energy, pose a significant risk. Compliance can necessitate substantial investments in new technologies and operational adjustments. The focus on CO₂ emissions regulations in Europe, for example, could influence Ortec Group's growth in the energy sector.

The rapid pace of technological advancements, particularly in AI and automation, requires continuous adaptation. Ortec Group must integrate new solutions to avoid becoming obsolete. This includes strategic investments in research and development to maintain its competitive advantage and navigate industry trends.

Disruptions in material availability or logistics can affect project timelines and costs. This is a general concern for industrial and engineering services, particularly in a globalized economy. Ortec Group needs to develop resilient supply chain strategies to mitigate these risks and ensure operational continuity.

Attracting and retaining skilled talent in specialized engineering and technical fields can hinder growth. Ortec Group must foster a culture of innovation and continuous learning to mitigate this. This includes providing opportunities for professional development and creating an environment that attracts top talent.

Climate change can influence credit default rates and asset pricing, suggesting broader economic risks. Physical risks from extreme weather events could also impact operations and infrastructure. Ortec Group must integrate climate risk assessments into its strategic initiatives and long-term goals.

Ortec Group employs diversification through acquisitions to broaden its service portfolio and reduce reliance on any single market segment. The company emphasizes risk management frameworks and scenario planning. These strategies are crucial for navigating potential obstacles and ensuring sustainable growth strategy. The company's approach to risk management is vital for investors and stakeholders.

Analyzing key financial metrics provides insights into Ortec Group's ability to manage risks. Key indicators include revenue growth, profit margins, and return on investment. The company's investments in new technologies and acquisitions should be evaluated to determine their impact on financial performance. This helps in understanding Ortec Group's ability to overcome future challenges.

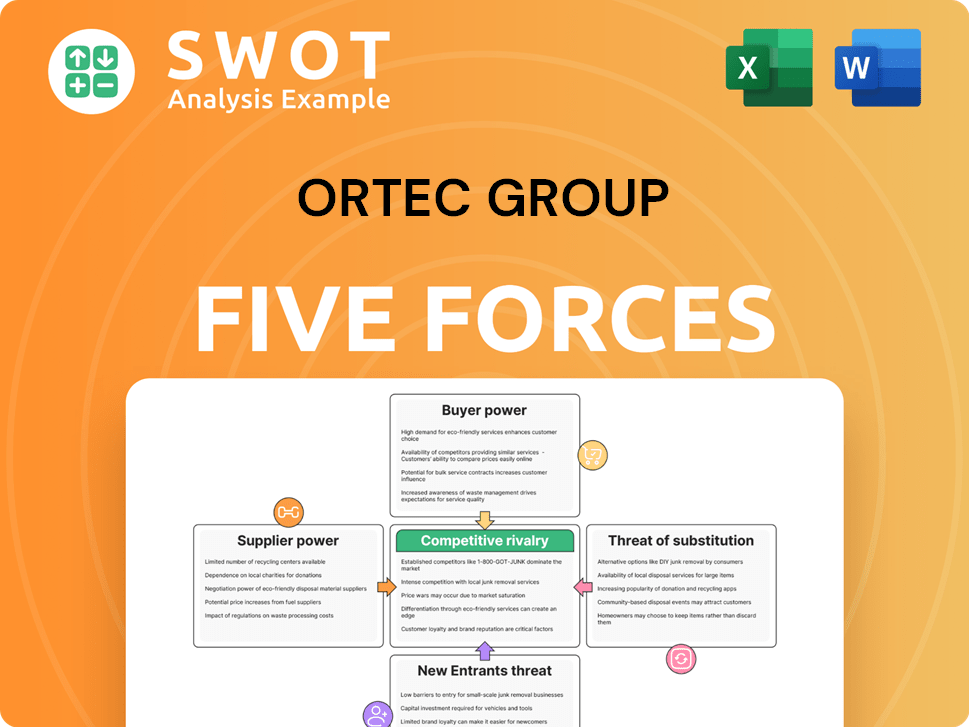

Ortec Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ortec Group Company?

- What is Competitive Landscape of Ortec Group Company?

- How Does Ortec Group Company Work?

- What is Sales and Marketing Strategy of Ortec Group Company?

- What is Brief History of Ortec Group Company?

- Who Owns Ortec Group Company?

- What is Customer Demographics and Target Market of Ortec Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.