Ortec Group Bundle

Unveiling the Inner Workings of Ortec Group: How Does It Thrive?

Ortec Group stands as a global powerhouse, making waves in engineering and services across crucial sectors. With a massive international footprint and a workforce of approximately 10,000 employees as of May 2025, the Ortec Group SWOT Analysis is a must-read for understanding the company's strategic positioning. Its impressive $5 billion in annual revenue highlights its significant influence in the market.

This in-depth analysis explores the Ortec Group's core Ortec operations, from its strategic acquisitions in soil remediation to its diverse Ortec services. We'll examine how the Ortec company leverages its industry expertise and global presence to deliver impactful Ortec solutions, ensuring sustainable growth and financial performance. Understanding the Ortec business model is key for investors and those interested in how the company manages projects.

What Are the Key Operations Driving Ortec Group’s Success?

The Ortec Group creates value by offering a wide range of engineering and services tailored for the industry, environment, and energy sectors. Their core offerings include industrial cleaning, waste management, environmental remediation, and project management. The Ortec company serves a diverse client base across various industries.

Operational processes at Ortec business are designed to ensure high-quality, customized solutions while adhering to stringent safety and environmental standards. These processes cover manufacturing, sourcing, technology development, logistics, sales channels, and customer service. Strategic partnerships boost market share and facilitate access to new markets, technologies, and expertise.

The company's diversified service portfolio spans multiple high-growth sectors, mitigating risks and supporting multiple revenue streams. Their commitment to safety and environmental standards provides a significant competitive advantage. Furthermore, Ortec Group leverages technology and digitalization to enhance efficiency and create new services.

The Ortec Group provides industrial cleaning, waste management, environmental remediation, and project management services. These services cater to a wide array of industries, ensuring customized solutions. Their focus is on delivering high-quality, safe, and environmentally responsible services.

The company serves diverse sectors, including oil and gas, manufacturing, and the public sector. Other industries include aerospace, defense, automotive, chemicals, pharmaceuticals, railway, and nuclear. This broad reach helps mitigate risk and supports multiple revenue streams.

Operations are designed to ensure high-quality, customized solutions while adhering to stringent safety and environmental standards. These processes encompass manufacturing, sourcing, technology development, logistics, sales channels, and customer service. The company's supply chain is supported by its extensive international presence.

Strategic partnerships are crucial for Ortec Group, boosting market share. For instance, they partnered with Optimum Automotive to optimize equipment management in Africa. Partnerships facilitate access to new markets, technologies, and expertise.

The Ortec Group stands out due to its diversified service portfolio, spanning multiple high-growth sectors. Their decades of experience and deep industry knowledge enable the delivery of customized solutions, fostering strong client relationships. The company's commitment to safety and environmental standards provides a significant competitive advantage.

- Diversified service portfolio across multiple sectors.

- Decades of experience and deep industry knowledge.

- Commitment to safety and environmental standards.

- Leveraging technology and digitalization.

Ortec Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ortec Group Make Money?

The Ortec Group generates revenue through a diverse array of services spanning engineering, environmental, and energy sectors. As of May 2025, the Ortec company reported an annual revenue of $5 billion. This financial success is supported by a robust international presence, with over €300 million in revenue generated in 2024.

The Ortec business model focuses on providing comprehensive solutions, often through long-term contracts, which ensures a steady income stream. Strategic acquisitions and expansions into high-growth sectors further enhance their financial performance. Understanding the revenue streams and monetization strategies of the Ortec Group is key to appreciating its operational effectiveness.

The company's monetization strategies involve offering tailored solutions to meet specific client needs, frequently using long-term contracts for services like maintenance. The Ortec Group also uses strategic acquisitions to expand its service offerings and market reach. Furthermore, the integration of 3C Metal in September 2024, which generated an annual revenue of €110 million, increased the revenue from the Ortec Group's subsidiaries outside of France to 35% of the total turnover. To learn more about the competitive environment, you can check out the Competitors Landscape of Ortec Group.

The Ortec Group has several key revenue streams contributing to its financial success. These streams include industrial services, environmental services, energy sector services, digital and data science solutions, and electric mobility. Each segment plays a crucial role in the company's overall revenue generation and market positioning.

- Industrial Services: This segment, including maintenance and project management, is a significant 'cash cow' for the Ortec Group. These services are provided in mature markets like oil & gas, nuclear, and defense, offering consistent revenue and high market share. In 2024, the industrial maintenance market was valued at $4.7 billion, with Ortec's revenue in this area growing by 8%. Recurring revenue accounts for approximately 60% of the total revenue.

- Environmental Services: This includes industrial cleaning, waste management, and environmental remediation. The environmental services market was valued at $1.1 trillion globally in 2024 and is expected to reach $1.2 trillion by 2025. Ortec Group's waste management and environmental remediation services are considered 'Stars' in the BCG Matrix, indicating high growth potential, with the environmental remediation market valued at $100 billion in 2024.

- Energy Sector Services: The Ortec Group provides solutions for the energy sector, including traditional and renewable energies. The global renewable energy market is projected to reach $1.977 trillion by 2030.

- Digital and Data Science Solutions: The company's strategic move into digital and data science solutions, leveraging AI and IoT, targets these high-growth industrial and environmental sectors. The AI market is projected to reach $300 billion in 2024, indicating significant potential for this segment.

- Electric Mobility: The launch of Oreve, an ultra-fast charging network for trucks and vans in France, positions the Ortec Group in the growing electric mobility sector. The Oreve network, inaugurated in September 2024, plans to install 260 ultra-high-power charging stations throughout France by 2030.

Ortec Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Ortec Group’s Business Model?

The Ortec Group has consistently demonstrated strategic foresight through key milestones and strategic moves, significantly impacting its operations and financial performance. These actions have solidified its position within the engineering, environmental, and energy sectors. The company's agility in adapting to market dynamics and its commitment to innovation are central to its sustained success.

A notable strategic move in 2024 was the acquisition of Englobe Corp.'s soil and organic waste treatment activities, completed on June 17, 2024. This acquisition strengthened the Ortec Group's global standing in site and soil remediation. Further expansion occurred with the integration of 3C Metal on September 30, 2024, boosting the company's steel fabrication expertise and increasing international revenue. The acquisition of Weetec Group in December 2024 expanded its capabilities in electrical and HVAC engineering, particularly in the Paris region.

The Ortec Group has faced market challenges, including intense competition and economic fluctuations. Responding to these challenges, the company has diversified its service portfolio and focused on technological advancements to maintain a competitive edge. To learn more about the company's origins, you can read a Brief History of Ortec Group.

The Ortec Group offers a wide array of services across engineering, environment, and energy sectors. This diversification helps mitigate risks and supports multiple revenue streams. This approach allows the company to serve a broad client base and adapt to changing market demands.

With decades of experience, especially in specialized sectors like aerospace and defense, the Ortec business can provide customized solutions. This expertise enhances client relationships and enables the company to deliver high-quality services. This deep understanding allows for tailored solutions.

Operating in 28 countries with a network of local agencies, the Ortec company can tap into diverse markets. This structure allows the company to offer tailored solutions that meet local requirements. This global presence is a key advantage.

The Ortec Group's commitment to safety and environmental sustainability provides a competitive edge. This focus is particularly critical in industries where these factors are paramount. This commitment enhances its reputation.

The Ortec Group actively invests in technology and digitalization, including AI and IoT, to increase efficiency and create new services. Companies investing in technology saw an average revenue increase of 15% in 2024. This focus on innovation allows Ortec services to stay ahead.

- Investment in technology and digitalization.

- Focus on AI and IoT applications.

- Enhancement of efficiency and new service creation.

- Revenue increase due to technological advancements.

Ortec Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Ortec Group Positioning Itself for Continued Success?

The Ortec Group holds a strong position as a leading international integrator of high-value construction and engineering solutions. Its diversified service portfolio and global reach across 28 countries and four continents contribute to its competitive standing. Strategic alliances boosted its market share in 2024, aligning with projections for increased market penetration in 2025. The company's 'Cash Cows' provide consistent revenue, with recurring revenue accounting for approximately 60% of total revenue in 2024.

However, the Ortec Group faces risks, including economic downturns, increased competition, and regulatory changes. Market volatility and talent acquisition challenges also pose threats. The company must navigate supplier bargaining power and customer concentration to maintain its strong performance. The Ortec business is also impacted by global events.

The Ortec Group is a key player in construction and engineering, offering diverse Ortec services globally. It has a strong market share, enhanced by strategic alliances. The company's 'Cash Cows' and 'Stars' in the BCG Matrix highlight its diverse revenue streams and growth potential.

The company faces risks such as economic downturns, intensifying competition, and regulatory changes. Market volatility and talent acquisition are also significant challenges. Dependence on suppliers and customer concentration further complicate operations for the Ortec company.

The future of the Ortec Group is shaped by its strategic initiatives and commitment to innovation. Investments in technology and digitalization, acquisitions, and expansion into new markets like electric mobility are key. The company's sustainability efforts also contribute to its long-term prospects.

The company is actively investing in technology and digitalization, with a global digital transformation spending of $2.7 trillion in 2024, to enhance efficiency and create new services. Strategic acquisitions and expansion into new markets, like electric mobility, are also key. Sustainability practices are a core part of the Ortec operations.

The Ortec Group faces challenges related to economic conditions, competition, and regulations. However, its strategic initiatives and focus on innovation create opportunities for growth. Understanding the Marketing Strategy of Ortec Group is essential.

- Economic downturns can reduce service demand.

- Intensified competition can squeeze profit margins.

- Regulatory changes may increase compliance costs.

- Investing in technology and digitalization can enhance efficiency.

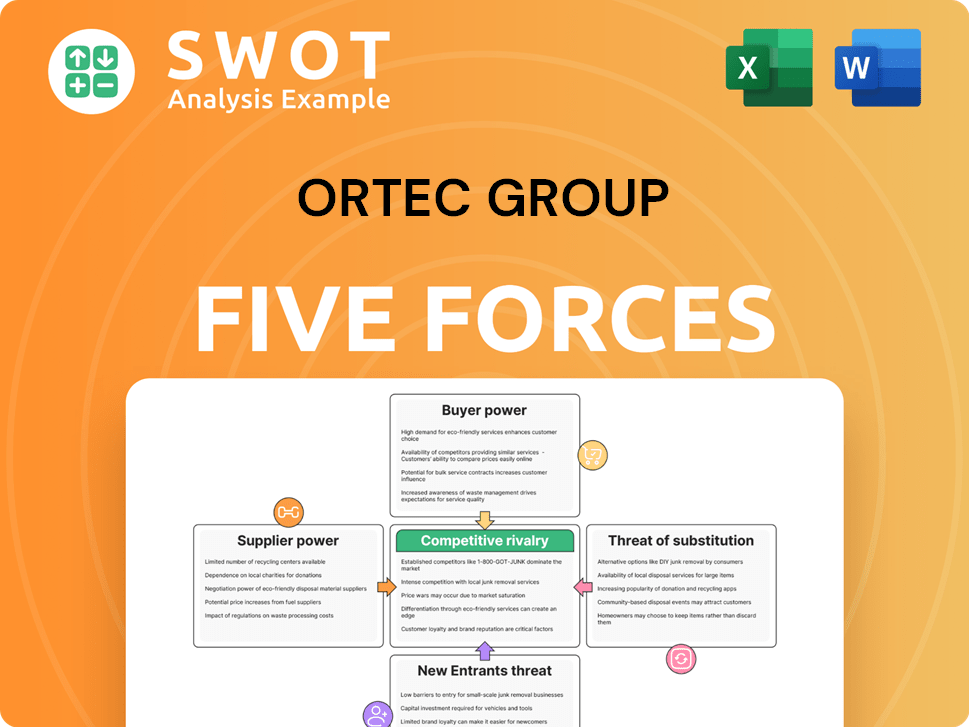

Ortec Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ortec Group Company?

- What is Competitive Landscape of Ortec Group Company?

- What is Growth Strategy and Future Prospects of Ortec Group Company?

- What is Sales and Marketing Strategy of Ortec Group Company?

- What is Brief History of Ortec Group Company?

- Who Owns Ortec Group Company?

- What is Customer Demographics and Target Market of Ortec Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.