Penske Corp. Bundle

Can Penske Corporation Maintain Its Momentum?

From a single truck leasing venture in 1969, Penske Corporation has evolved into a global leader in transportation and automotive retail. With a diverse portfolio spanning truck leasing, logistics, and automotive sales, Penske has consistently demonstrated impressive financial performance. But what are the Penske Corp. SWOT Analysis and strategic initiatives driving its future?

This deep dive explores Penske's growth strategy, examining its market position and future prospects within the dynamic automotive industry and logistics services sectors. We'll analyze Penske's financial performance, including revenue growth drivers and its strategic responses to evolving market trends like electric vehicles and autonomous technologies. Furthermore, we'll investigate Penske's expansion plans, competitive advantages, and long-term financial outlook, providing actionable insights for investors and business strategists alike.

How Is Penske Corp. Expanding Its Reach?

Penske Corporation's growth strategy is significantly driven by strategic acquisitions and market diversification. This approach allows the company to access new customer bases and diversify revenue streams. The company aims to maintain a competitive edge in the evolving industry landscape through these initiatives, focusing on both automotive and transportation solutions.

In 2024, the company demonstrated its commitment to expansion through several key acquisitions and strategic divestitures. These moves are part of a broader strategy to strengthen its market position and capitalize on emerging opportunities within the automotive and transportation sectors. The company's expansion is designed to support long-term financial performance.

The company's growth strategy and future prospects involve a multi-faceted approach, with a strong emphasis on strategic investments and operational enhancements. A Penske Corp. business analysis reveals a focus on adapting to industry trends and enhancing customer service.

A notable acquisition in late 2024 was the Porsche Centre Melbourne in Australia. This addition added an estimated $130 million in annualized revenue. This acquisition marked Penske's 25th Porsche dealership worldwide, showcasing its global expansion strategy within the automotive sector.

Penske Automotive Group expanded its retail automotive franchises significantly in 2024. The company acquired 16 retail automotive franchises and opened one in the U.K., further broadening its market presence. This expansion included acquisitions in the U.S., Italy, and Australia, with a focus on diverse automotive brands.

Penske Transportation Solutions, with Penske Automotive Group holding a 28.9% ownership interest, continues to expand its managed fleet. As of December 31, 2024, the fleet consisted of over 435,000 trucks, tractors, and trailers under lease, rental, and/or maintenance contracts. This growth reflects the company's strength in logistics services.

The company anticipates sustained strong demand for service and parts operations. This demand is driven by increasing vehicle sales and the growing complexity of modern vehicles. This highlights a key area of revenue growth for Penske.

In 2024, Penske Automotive Group completed acquisitions representing approximately $2.1 billion in estimated annualized revenue. Simultaneously, the company strategically divested operations totaling around $650 million in estimated annualized revenue. These strategic moves are designed to optimize the company's portfolio and focus on core growth areas.

- Acquisitions aimed at accessing new customer bases.

- Diversification of revenue streams through various automotive franchises.

- Expansion of managed fleet through Penske Transportation Solutions.

- Focus on service and parts operations due to vehicle sales and complexity.

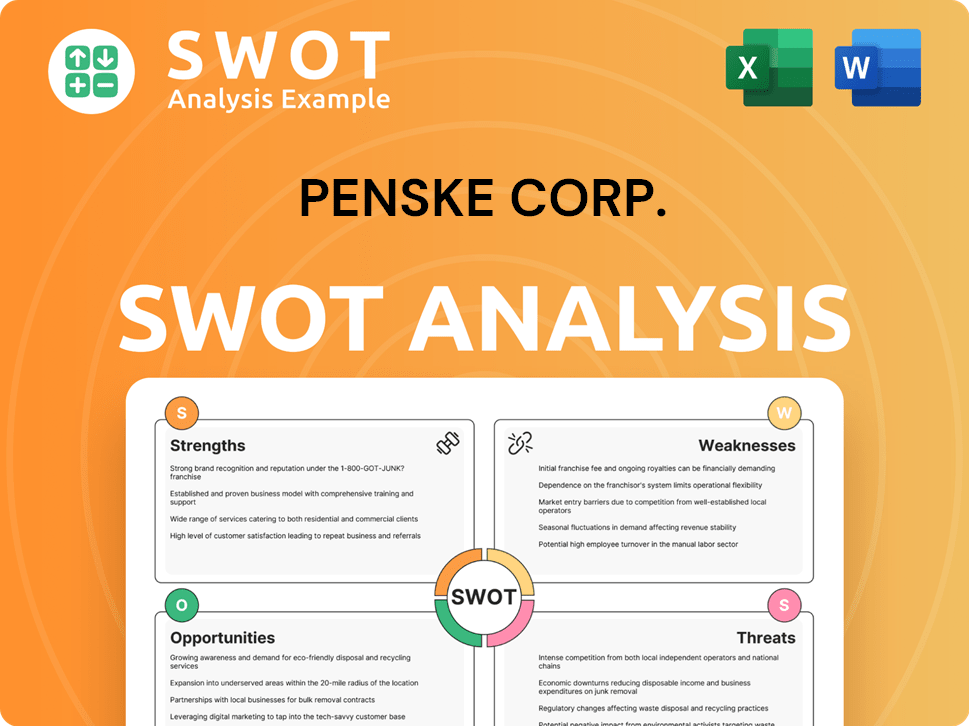

Penske Corp. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Penske Corp. Invest in Innovation?

Penske Corporation is actively leveraging technology and innovation to fuel its growth, particularly within its logistics and transportation segments. This strategic focus is essential for maintaining a competitive edge in the dynamic automotive and logistics industries. The company's approach to innovation is multifaceted, encompassing digital transformation, sustainability initiatives, and the adoption of advanced technologies.

The company's commitment to innovation is evident in its investments in digital freight-matching and route optimization software, which enhance supply chain agility and efficiency. Penske's strategic initiatives also include exploring and implementing eco-friendly practices and technologies, reflecting a broader commitment to sustainability. These advancements contribute to Penske's growth objectives by optimizing operations, reducing costs, and improving customer service.

To understand the company's market position, it's beneficial to look at its target market. You can find more details in this analysis: Target Market of Penske Corp.

Penske Logistics is at the forefront of adopting advanced technologies like digital freight-matching and route optimization software. This helps to enhance agility and efficiency in supply chains, a critical aspect of the Penske Corp growth strategy. The company is focusing on data-driven approaches to navigate supply chain challenges.

In February 2024, Penske Logistics implemented Blue Yonder's Yard Management solution at one warehouse site. The company plans further expansion in 2024. This will help gain greater visibility and control in warehouse yards through computer vision and machine learning.

Penske is committed to sustainability, exploring and implementing eco-friendly practices and technologies. An example is the new solar-powered facility initiative launched in November 2024. This reflects the company's focus on environmental responsibility.

Penske's 2024 3PL Study, in collaboration with Penn State University and NTT DATA, highlights the increasing adoption of data-driven approaches. These are used to navigate supply chain challenges. This data-driven approach is key to Penske's future prospects.

Penske's technology adoption in logistics is a significant driver of its strategic initiatives. The company's investment in digital tools enhances operational efficiency. This supports Penske's financial performance.

The company's technological advancements contribute to optimizing operations and reducing costs. This focus on efficiency is crucial in a competitive market. This is a key element of Penske's business analysis.

Penske's innovation strategy includes several key initiatives aimed at improving efficiency, reducing costs, and enhancing customer service. These strategies are essential for Penske's competitive advantages in trucking and the broader automotive industry.

- Digital Freight Matching and Route Optimization: Implementing software to enhance supply chain agility.

- Yard Management Solutions: Using computer vision and machine learning for better warehouse yard control.

- Sustainability Initiatives: Focusing on eco-friendly practices, such as solar-powered facilities.

- Data-Driven Approaches: Utilizing data analytics to address supply chain challenges.

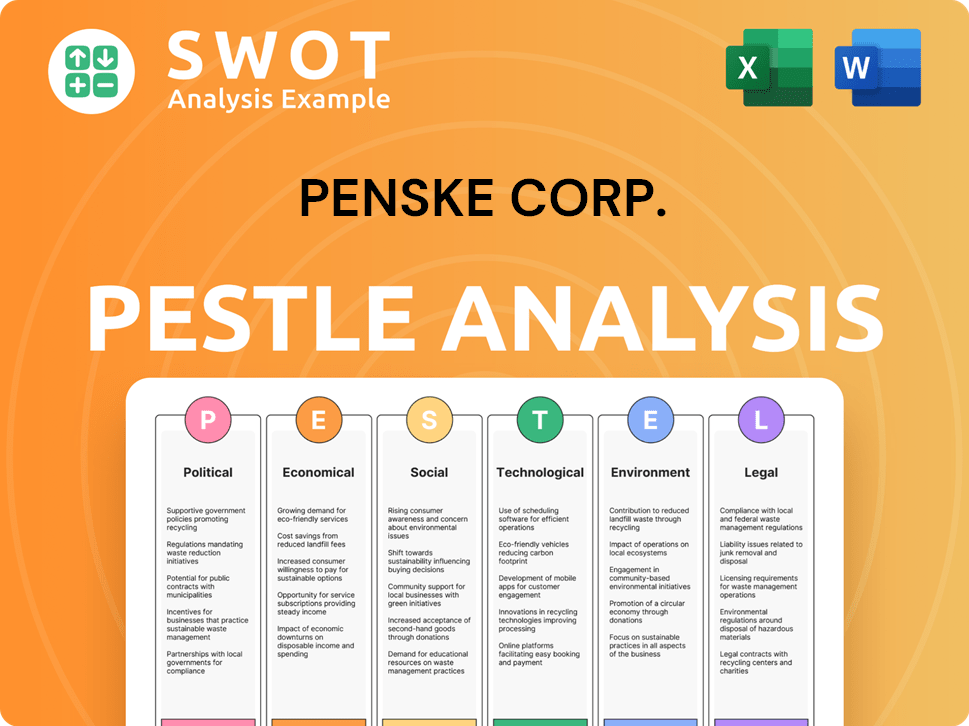

Penske Corp. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Penske Corp.’s Growth Forecast?

The financial outlook for Penske Corporation, is robust, characterized by solid revenue growth and a strategic approach to market dynamics. Penske's performance in the automotive industry and related sectors demonstrates a strong ability to generate profits and maintain financial stability. This is further supported by strategic investments and a focus on shareholder value.

Penske's diversified business model contributes significantly to its financial resilience. The company's operations span automotive retail and non-automotive segments, which helps to mitigate risks associated with market fluctuations in any single area. This diversification, coupled with effective cost management, positions Penske for sustained profitability.

The company's financial strategy includes a commitment to returning value to shareholders, which is evident in its consistent dividend increases. This, along with a strong liquidity position, underscores Penske's financial health and its capacity to invest in future growth opportunities. The consistent financial performance suggests a positive trajectory for the company's future prospects.

For the twelve months ended December 31, 2024, Penske Automotive Group reported a total revenue of $30.5 billion, a 3.1% increase from the previous year. This growth reflects strong performance across its automotive retail and non-automotive operations. This is a key indicator of the company's Penske Corp growth strategy.

Net income attributable to common stockholders for the year ended December 31, 2024, was $918.9 million. In the first quarter of 2025, net income attributable to common stockholders increased by 14% to $244.3 million, with earnings per share rising by 14% to $3.66. This demonstrates the company's ability to enhance profitability.

In Q1 2025, Penske Automotive Group achieved record revenue of $7.6 billion, a 2% increase from the same period in 2024. This growth was driven by strong performance across its automotive retail and non-automotive operations. This reflects positively on Penske Corporation future prospects.

The company's diversified business model, with 64% of its 2024 earnings from automotive retail and 36% from non-automotive operations, contributes to its resilience. This diversification helps mitigate risks and supports consistent financial performance. This is a key aspect of Penske business analysis.

Penske's profitability is supported by strong gross profit margins. Retail automotive service and parts gross margin improved by 60 basis points in Q1 2025. This improvement in margins highlights the company's operational efficiency.

As of December 31, 2024, the company maintained approximately $1.9 billion in liquidity, including $72 million in cash and $1.8 billion of availability under its credit agreements, with a leverage ratio of 1.2x. This strong financial position provides flexibility for investments and strategic initiatives.

Penske has consistently returned value to shareholders, increasing its quarterly dividend for the 17th consecutive quarter to $1.22 per share as of February 2025. This consistent dividend growth reflects the company's financial stability and commitment to shareholders.

Analysts project steady growth, with Q2 2025 EPS expectations at $3.63 and $13.75 for the full year. These projections indicate continued financial health and potential for future growth. This is important for the Penske automotive industry.

Penske's financial performance is marked by several key strengths that support its growth strategy and future prospects. These highlights underscore the company's ability to navigate market challenges and create shareholder value.

- Strong Revenue Growth: Total revenue of $30.5 billion in 2024, a 3.1% increase.

- Increased Net Income: Net income of $918.9 million in 2024, with significant growth in Q1 2025.

- Record Q1 2025 Revenue: $7.6 billion, a 2% increase year-over-year.

- Diversified Business Model: 64% of earnings from automotive retail, 36% from non-automotive operations.

- Improved Profitability: Retail automotive service and parts gross margin up 60 basis points in Q1 2025.

- Strong Liquidity: Approximately $1.9 billion in liquidity as of December 31, 2024.

- Consistent Dividend Increases: Quarterly dividend increased for the 17th consecutive quarter.

- Positive Analyst Outlook: Projected EPS of $3.63 for Q2 2025 and $13.75 for the full year.

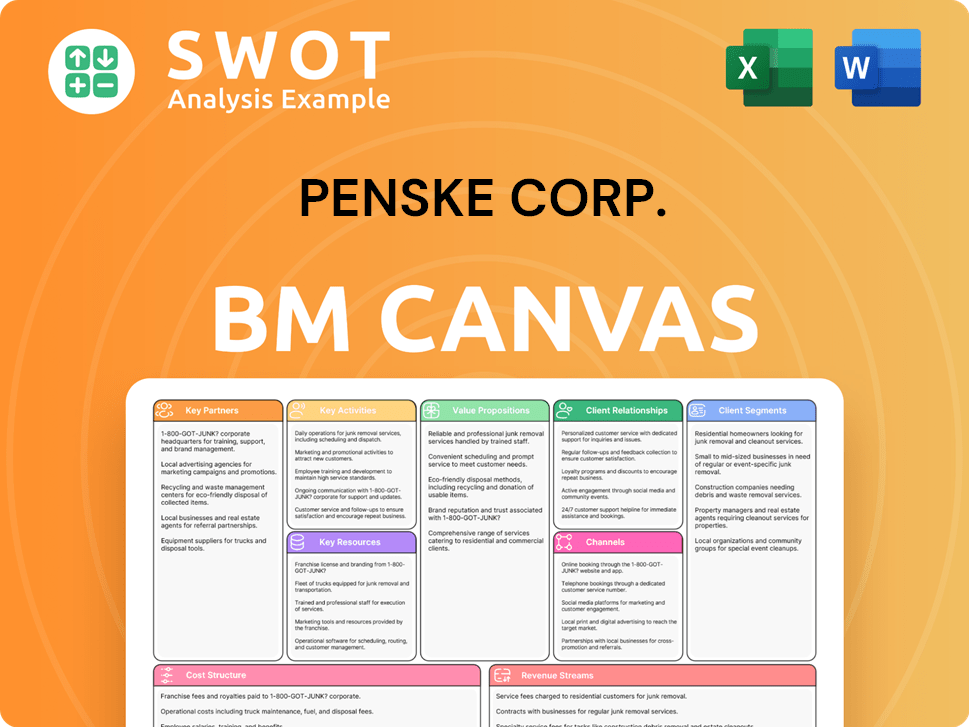

Penske Corp. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Penske Corp.’s Growth?

The growth strategy of Penske Corp. faces several potential risks and obstacles. These challenges stem from market competition, regulatory changes, and supply chain vulnerabilities. Understanding these risks is crucial for a comprehensive Penske business analysis and evaluating its future prospects.

The automotive and logistics industries are dynamic, requiring Penske Corporation to adapt constantly. Key areas of concern include the impact of franchise law changes and the adoption of electric vehicles. Moreover, the company's financial health and operational resilience are tested by economic conditions and cybersecurity threats.

Penske's ability to maintain a strong financial performance is significantly impacted by several factors. The company's substantial debt, with approximately $4.1 billion in long-term debt as of Q4 2024, makes it vulnerable to interest rate fluctuations. Furthermore, the ongoing freight recession has affected truck rental revenue and the gain on sale of used trucks, as highlighted in recent financial reports.

Intense competition from online retailers and new entrants in the electric vehicle market poses a significant challenge. This competitive landscape requires continuous strategic adjustments to maintain and grow market share.

Changes in regulations, particularly regarding emissions standards and the shift towards electrification, could impact Penske's ability to acquire, operate, and sell trucks. Adapting to these changes is vital for long-term sustainability.

Supply chain disruptions, influenced by macroeconomic and geopolitical conditions, can negatively impact vehicle and parts availability. These vulnerabilities require proactive management and diversification strategies.

Penske's substantial debt, standing at $4.1 billion as of Q4 2024, makes the company susceptible to interest rate changes. This financial burden can affect profitability and investment capacity.

Reliance on third-party information systems makes Penske vulnerable to cyberattacks. Protecting sensitive data and ensuring operational continuity requires robust cybersecurity measures.

The potential repeal or amendment of U.S. franchise laws could allow manufacturers to sell directly to consumers, bypassing the dealership model. This could significantly alter the automotive industry landscape and impact Penske's business model.

Penske proactively addresses these challenges through diversification, with a presence in 19 U.S. states and key international markets. The company also focuses on adapting processes to meet evolving trends, and invests in innovation and technology to maintain resilience. For more insights, consider reading about Mission, Vision & Core Values of Penske Corp.

Penske's response to economic downturns and market fluctuations is crucial. The company's ability to adapt to the changing automotive industry, including the rise of electric vehicles, will be a key factor in its long-term financial outlook. Penske's strategic initiatives in 2024 will be critical.

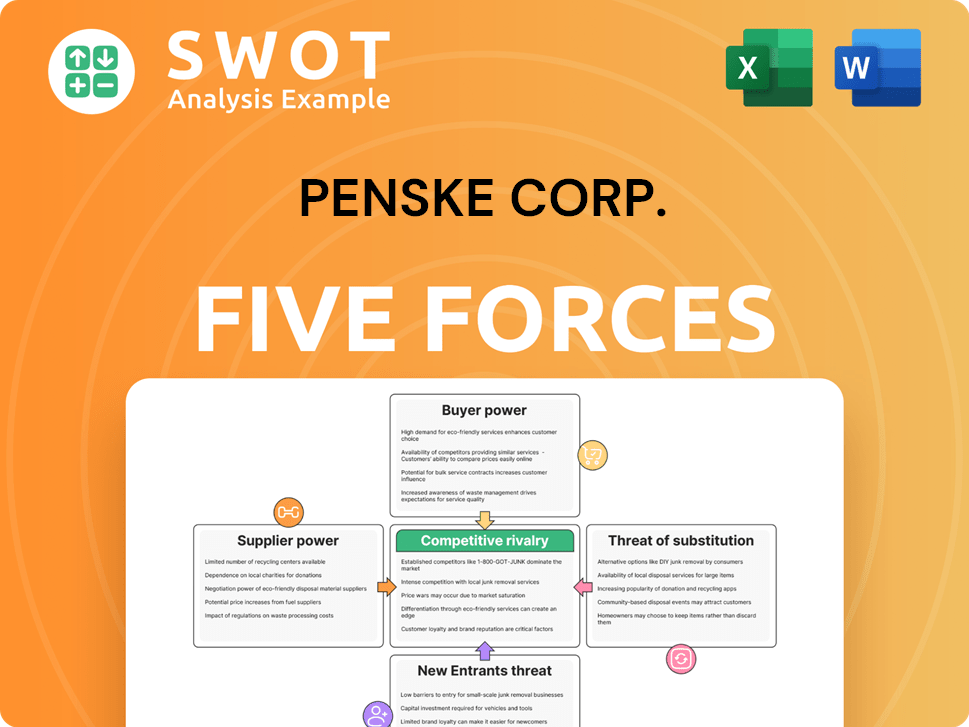

Penske Corp. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Penske Corp. Company?

- What is Competitive Landscape of Penske Corp. Company?

- How Does Penske Corp. Company Work?

- What is Sales and Marketing Strategy of Penske Corp. Company?

- What is Brief History of Penske Corp. Company?

- Who Owns Penske Corp. Company?

- What is Customer Demographics and Target Market of Penske Corp. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.