Penske Corp. Bundle

How Does Penske Corporation Thrive in the Transportation Industry?

Penske Corporation, a global giant in transportation services, has strategically diversified its operations across the automotive and logistics sectors. From its roots in automotive retail and racing, Penske has evolved into a multifaceted enterprise, encompassing truck leasing, rental services, and a vast network of dealerships. This strategic expansion has solidified its position as a key player in the global supply chain and vehicle services industry.

To truly grasp Penske's success, we must explore its Penske Corp. SWOT Analysis, which reveals its strengths, weaknesses, opportunities, and threats. Understanding the Penske business model and its core operations, from Penske services to its financial performance, is essential for anyone looking to understand the intricacies of this industry leader. This analysis will also shed light on how Penske's leadership and history have shaped its current standing and future outlook, including its role in transportation and its impact on the trucking industry.

What Are the Key Operations Driving Penske Corp.’s Success?

Penske Corporation's core operations are centered around providing comprehensive transportation and automotive solutions. The company creates and delivers value through three main segments: truck leasing and rental, logistics, and automotive retail. This diversified approach allows Penske to serve a wide range of customers and adapt to changing market demands, solidifying its position in the industry.

Penske's value proposition is built on operational excellence, technological innovation, and a strong customer-centric approach. By offering a suite of services, from fleet management to supply chain optimization and automotive sales, Penske aims to enhance efficiency and reduce costs for its clients. This integrated strategy supports its long-term growth and competitive advantage.

The company's operational effectiveness is supported by its extensive geographical footprint, significant technology investments, and a strong focus on customer service and operational reliability. These core capabilities translate into tangible benefits for customers, such as reduced operational costs, improved fleet uptime, and enhanced supply chain visibility and efficiency.

Penske Truck Leasing provides full-service truck leasing, commercial truck rental, contract maintenance, and connected fleet solutions. These services cater to various businesses, helping them optimize their transportation fleets. The operational processes involve a vast network of service facilities and advanced telematics for fleet management.

Penske Logistics offers integrated supply chain solutions, including dedicated contract carriage and distribution center management. This segment focuses on optimizing clients' supply chains, reducing costs, and improving efficiency through technology. Their value proposition lies in delivering tailored, end-to-end logistics solutions.

Penske Automotive Group operates a large number of automotive dealerships selling new and used vehicles, parts, and services. This segment involves extensive sales, marketing, and customer service efforts, supported by robust inventory management and financing capabilities. It is a significant part of the broader Penske Corporation ecosystem.

Penske's operational effectiveness stems from its extensive geographical footprint, significant investment in technology for fleet management and logistics optimization, and a strong emphasis on customer service and operational reliability. These core capabilities translate into tangible customer benefits such as reduced operational costs, improved fleet uptime, and enhanced supply chain visibility and efficiency.

Penske's business model is built on providing integrated transportation and automotive solutions. The company's success is driven by its ability to offer a wide range of services, leveraging technology and operational expertise to meet diverse customer needs.

- Truck Leasing and Rental: Offers full-service leasing, rental, and maintenance services.

- Logistics: Provides integrated supply chain solutions, including dedicated contract carriage and distribution center management.

- Automotive Retail: Operates dealerships selling new and used vehicles, parts, and services.

- Technology and Innovation: Utilizes advanced telematics and fleet management systems to optimize operations.

- Customer Focus: Prioritizes customer service and operational reliability to build long-term relationships.

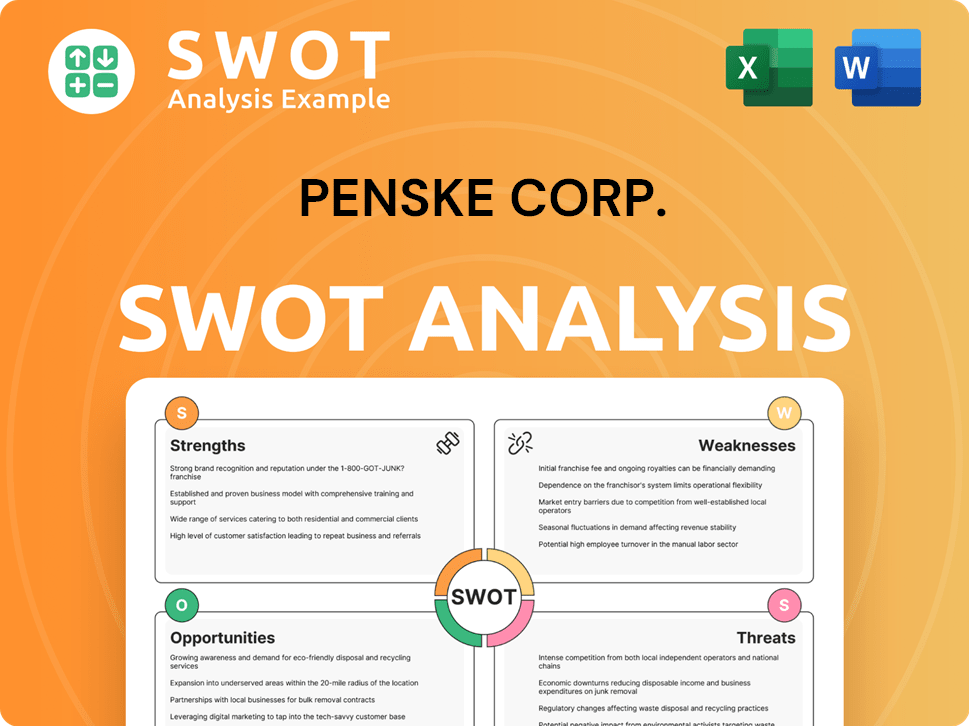

Penske Corp. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Penske Corp. Make Money?

The Penske Corporation generates revenue through a diverse set of services, including truck leasing and rental, logistics, and automotive retail. This diversified approach allows the company to cater to various market segments and economic conditions. The Penske business model is built on providing comprehensive transportation and logistics solutions, ensuring a steady income stream.

The company's revenue streams are primarily derived from its subsidiaries and joint ventures. These include Penske Truck Leasing, Penske Logistics, and Penske Automotive Group, each contributing significantly to the overall financial performance. Understanding these streams is crucial for assessing the Penske company operations and its market position.

Penske Truck Leasing, a joint venture, is a major revenue contributor, offering long-term full-service leases, short-term rentals, and contract maintenance. Full-service leases provide a stable, recurring revenue stream. Short-term rentals cater to fluctuating demands. The specific financial contributions of Penske Truck Leasing are not publicly disaggregated for the private Penske Corporation, but it is a significant part of the overall enterprise.

Penske Logistics generates revenue through fees for its supply chain management services. These services are typically contract-based. The monetization strategy focuses on delivering cost savings and efficiency gains to clients. For a deeper dive, consider reading about the Target Market of Penske Corp.

- Penske Automotive Group: In the first quarter of 2025, the group reported revenue of $7.3 billion, primarily from vehicle sales, parts, services, and finance products.

- Monetization Strategies: These include tiered pricing for vehicles, bundled services, and cross-selling finance and insurance products.

- Technology and Expansion: Penske continually invests in technology and expands its service offerings in logistics and connected fleet solutions.

- Market Adaptation: Penske adapts to evolving customer needs and market demands.

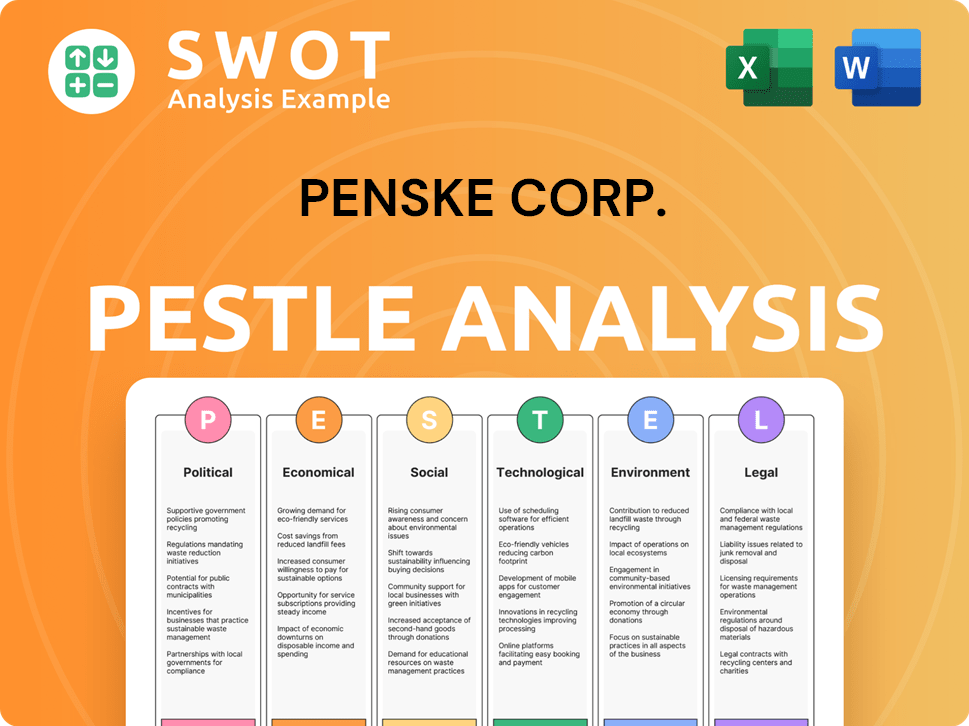

Penske Corp. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Penske Corp.’s Business Model?

Penske Corporation's journey has been marked by significant milestones and strategic decisions, solidifying its position in the transportation and logistics sector. A key move was the expansion of Penske Truck Leasing through a joint venture with Mitsui & Co., providing capital for growth and extending its global footprint. The company's consistent investment in technology, such as advanced telematics and logistics software, has enhanced its service offerings and operational efficiency. For example, integrating connected fleet solutions has allowed Penske to offer predictive maintenance and real-time tracking, creating a competitive advantage.

Operational challenges, including recent global supply chain disruptions, have been addressed through strategic responses like diversifying sourcing and optimizing logistics networks to maintain service levels. The company's competitive advantages are multifaceted, including strong brand recognition built over decades, significant economies of scale across its truck leasing and logistics operations, and a robust, integrated ecosystem that covers vehicle sales, leasing, maintenance, and supply chain management. Penske's ability to offer a comprehensive suite of services provides a 'one-stop shop' solution for many businesses, setting it apart from more specialized competitors.

The company continues to adapt to evolving trends, such as the increasing demand for electric vehicles in commercial fleets and the ongoing digitalization of logistics, by investing in relevant technologies and infrastructure. Understanding the Competitors Landscape of Penske Corp. provides additional insights into its market position.

Penske's growth includes key acquisitions and expansions. The Mitsui & Co. joint venture significantly boosted capital and global reach. Continuous investment in technology, like telematics, has improved services.

Penske has strategically responded to supply chain disruptions by diversifying sourcing and optimizing logistics. The company focuses on offering a comprehensive suite of services. Investments in electric vehicle technology and digitalization are ongoing.

Penske benefits from strong brand recognition and economies of scale. Its integrated ecosystem, covering sales, leasing, and maintenance, provides a competitive advantage. The company's ability to offer comprehensive services differentiates it from competitors.

Penske's strengths include a robust brand, economies of scale, and an integrated service ecosystem. The company's adaptability to industry trends, such as electric vehicles, is also key. A focus on customer service and technological innovation further enhances its position.

Penske's competitive edge is built on brand strength, economies of scale, and an integrated service model. They offer a one-stop-shop solution, differentiating them from specialized competitors. The company continues to adapt to new trends and technologies.

- Strong brand reputation built over decades.

- Significant economies of scale across operations.

- Integrated services: sales, leasing, maintenance, and supply chain.

- Adaptation to trends like electric vehicles and digitalization.

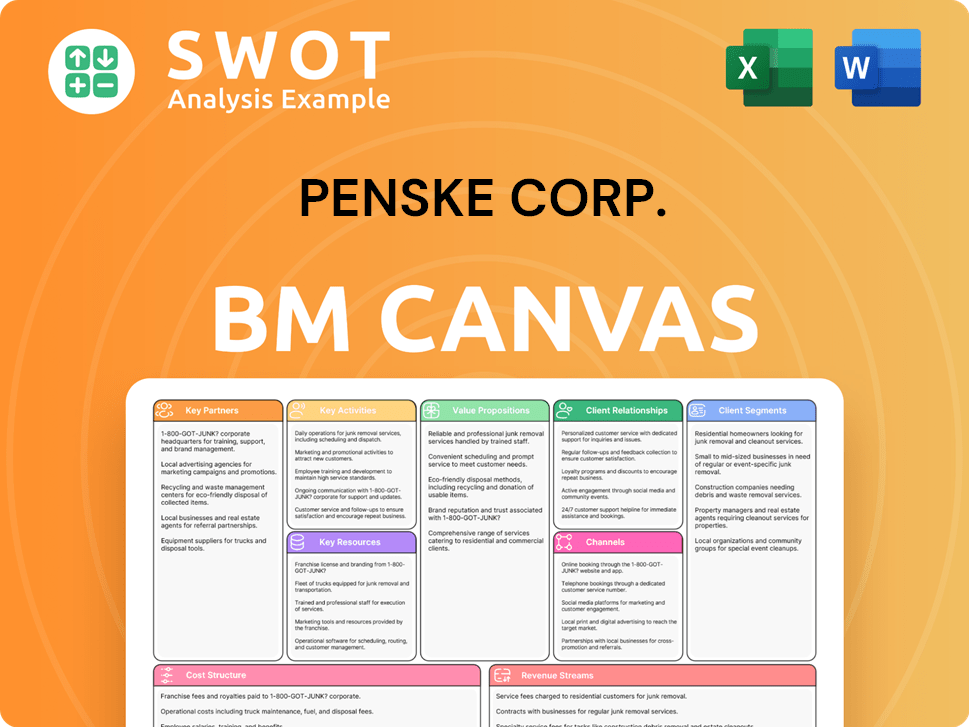

Penske Corp. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Penske Corp. Positioning Itself for Continued Success?

Penske Corporation holds a strong market position across its diverse segments, excelling in truck leasing, logistics, and automotive retail. The company is a significant player in the North American commercial truck leasing and rental market through its joint ventures. Penske Logistics is recognized for its comprehensive supply chain solutions, serving various industries, while Penske Automotive Group is consistently ranked among the top automotive retail groups globally.

The company's strategy focuses on innovation and customer-centric solutions to maintain market leadership and capitalize on future growth opportunities within the dynamic transportation and automotive sectors. To understand more about the company's origins, you can read the Brief History of Penske Corp.

Penske Truck Leasing is a key player in the North American commercial truck leasing and rental market. Penske Logistics offers extensive supply chain solutions. Penske Automotive Group is a leading automotive retail group globally, with a strong presence in the US and Europe.

Economic downturns can affect the demand for transportation services and vehicle sales. Regulatory changes, like emission standards, can impact operations. Rising fuel and labor costs, along with new competitors in logistics technology and electric vehicle fleets, also pose risks.

Penske is investing in advanced technologies for fleet management and logistics optimization. The company is expanding into new geographical markets. They are adapting to sustainable transportation solutions, such as electric and autonomous vehicles.

Penske focuses on innovation and customer-centric solutions to maintain market leadership. The company aims to capitalize on future growth in transportation and automotive sectors. This includes investments in technology and sustainable solutions.

Penske's future success depends on adapting to market changes and technological advancements. The company's approach involves strategic investments and customer-focused solutions to drive growth. This includes expanding into new markets and embracing sustainable practices.

- Investment in advanced fleet management technologies.

- Expansion into new geographical markets.

- Adaptation to sustainable transportation solutions.

- Focus on innovation and customer-centric solutions.

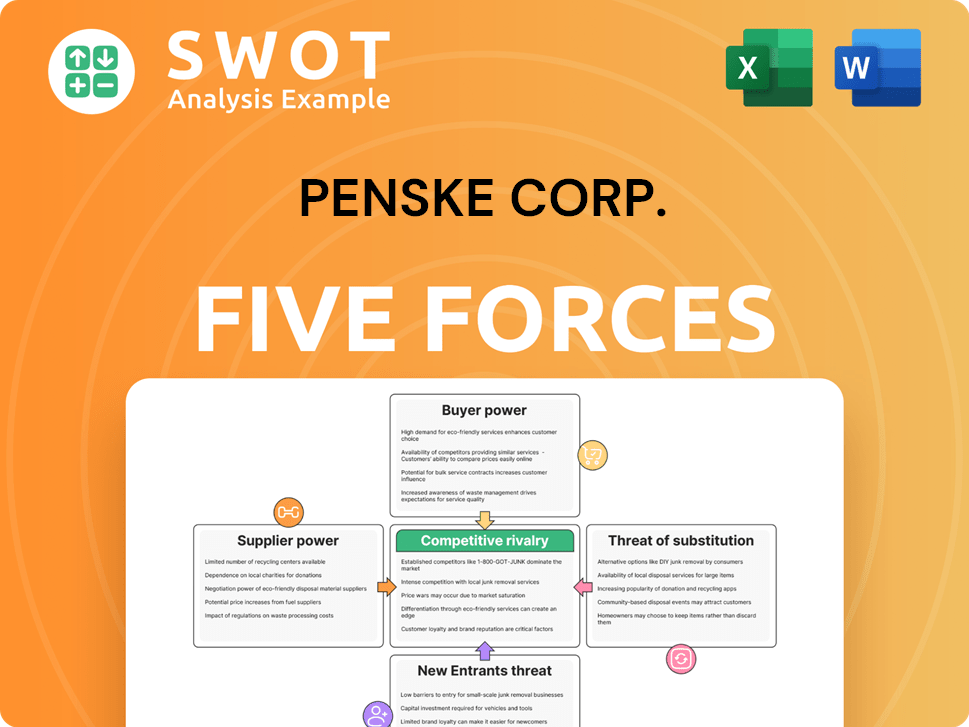

Penske Corp. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Penske Corp. Company?

- What is Competitive Landscape of Penske Corp. Company?

- What is Growth Strategy and Future Prospects of Penske Corp. Company?

- What is Sales and Marketing Strategy of Penske Corp. Company?

- What is Brief History of Penske Corp. Company?

- Who Owns Penske Corp. Company?

- What is Customer Demographics and Target Market of Penske Corp. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.