Penske Corp. Bundle

Who Really Calls the Shots at Penske Corporation?

Understanding the ownership structure of a company is paramount for investors and business strategists alike. Penske Corporation, a titan in the transportation industry, presents a fascinating case study in how ownership shapes a company's destiny. From its humble beginnings to its current global presence, the story of Penske is inextricably linked to its ownership.

This exploration into Penske Corp. SWOT Analysis will uncover the key players behind Penske's success, from its founder, Roger Penske, to the current stakeholders. We'll examine how the Penske ownership structure has influenced its strategic decisions, its expansion into diverse business ventures, and its enduring impact on the transportation and automotive sectors. Delving into the details of who owns Penske is crucial for anyone seeking to understand the company's long-term vision and market position. The Penske Corp. SWOT Analysis will help you understand the company better.

Who Founded Penske Corp.?

The foundation of Penske Corporation was laid in 1969 by Roger Penske. His background in motorsports significantly influenced the company's ethos, emphasizing efficiency and strategic growth. This early period set the stage for Penske's expansion in the transportation sector and beyond.

Penske ownership in the initial stages was primarily held by Roger Penske himself. This structure is typical for entrepreneurial ventures, allowing for concentrated decision-making. Specific details about the equity splits are not publicly available due to the company's private status.

Roger Penske's approach to business, honed through his racing career, was instrumental in shaping the company's early trajectory. His focus on operational excellence and customer service became key elements of the company's identity.

Roger Penske, the founder, held the majority of the ownership and decision-making power. This structure was crucial for the company's swift strategic direction. Early financial backing came from Roger Penske's existing resources and reinvestment of profits.

- The initial focus was on building the truck leasing business.

- There were no publicly reported ownership disputes or significant buyouts early on.

- The concentrated control allowed for rapid decision-making as the company expanded.

- The company's commitment to operational excellence and customer service was evident from the start.

The early success of Penske Corporation can be attributed to a clear vision and a strong leadership team. For more details, you can read about the Growth Strategy of Penske Corp.

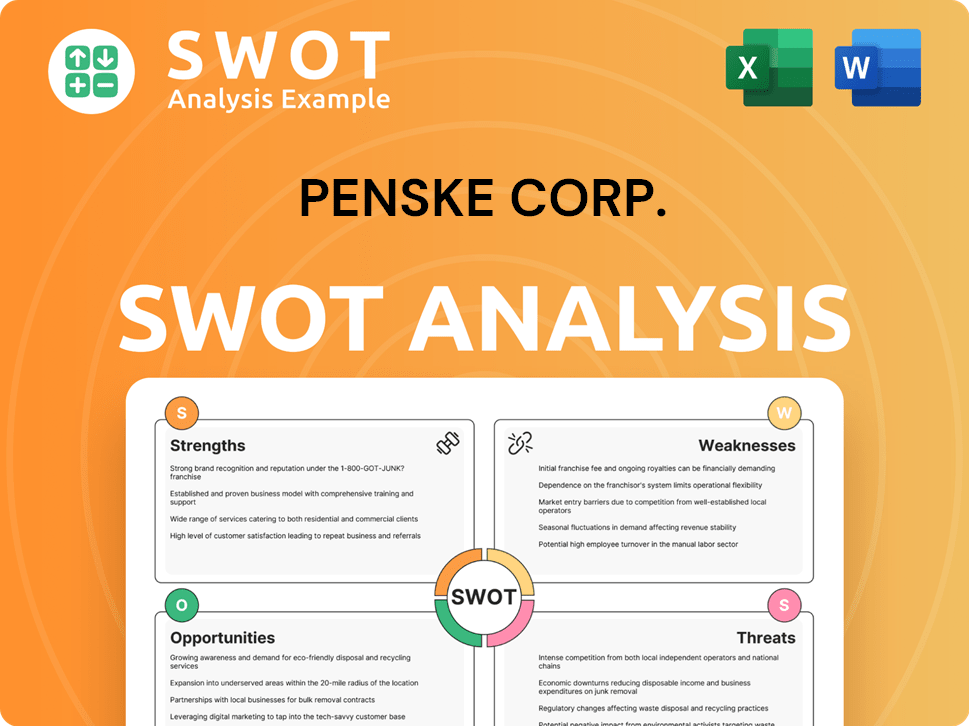

Penske Corp. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Penske Corp.’s Ownership Changed Over Time?

The ownership of Penske Corporation, a privately held entity, has largely been shaped by its founder, Roger Penske. The company's growth has been driven by reinvestment and strategic partnerships, rather than public market dynamics. A pivotal moment in its ownership structure was the 1988 joint venture with General Electric Capital, forming Penske Truck Leasing. This partnership provided significant capital and expanded the company's reach, which was a key factor in its growth trajectory.

In 2013, Penske Truck Leasing repurchased the remaining 15% interest from General Electric Capital, solidifying Penske Corporation's sole ownership. This move allowed for complete integration of the truck leasing operations into its broader strategic vision. The company's structure has enabled it to pursue aggressive growth strategies, including numerous acquisitions in the automotive retail and logistics sectors, while maintaining a unified vision.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| Formation of Penske Truck Leasing (Joint Venture) | 1988 | Partnership with General Electric Capital, expanding reach and capital. |

| Penske Truck Leasing Buyback | 2013 | Penske Corporation becomes sole owner, consolidating control. |

| PAG's Public Listing | Ongoing | Penske Corporation maintains significant ownership in a publicly traded subsidiary. |

Currently, the major stakeholder in Penske Corporation remains Roger Penske and his family. While specific percentages are not publicly disclosed, his control is substantial, allowing for long-term strategic planning. Penske Automotive Group (PAG), a publicly traded subsidiary, has shares listed on the New York Stock Exchange. Penske Corporation, the private parent company, holds a significant stake in PAG, estimated to be around 40% as of early 2024. For more insights into the company's operations, you can explore the Revenue Streams & Business Model of Penske Corp.

Roger Penske's influence remains central to the company's ownership and strategic direction. The structure allows for long-term planning and agility in the market. Penske Automotive Group's public listing provides a distinct ownership profile, with Penske Corporation maintaining a significant stake.

- Roger Penske is the primary owner of Penske Corporation.

- Penske Corporation holds approximately 40% ownership in Penske Automotive Group (PAG).

- Penske Truck Leasing is wholly owned by Penske Corporation since 2013.

- Penske Corporation's structure allows for strategic acquisitions and long-term planning.

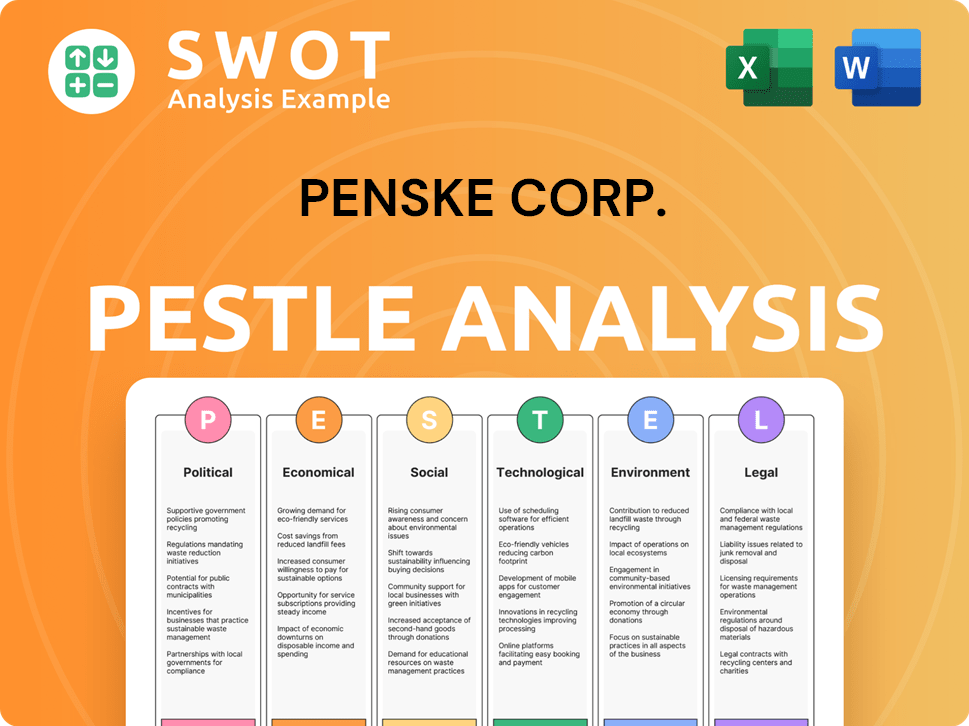

Penske Corp. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Penske Corp.’s Board?

Understanding the board of directors and voting power within Penske Corporation requires recognizing its private status. Unlike publicly traded companies, the details of the board are not publicly disclosed. However, it's widely understood that Roger Penske, the founder, holds significant influence, likely chairing the board. The board likely comprises key executives within the Penske organization and potentially includes a few independent directors or representatives from any major minority stakeholders. Given the private ownership structure, the voting structure doesn't face the same public scrutiny as a public company.

The voting power within Penske Corporation is heavily concentrated. It's highly probable that Roger Penske, through his substantial Penske ownership, controls the majority of the voting power. This structure ensures his vision and strategic direction are maintained. This contrasts with Penske Automotive Group (PAG), a publicly traded entity, which has a publicly disclosed board and follows a one-share-one-vote principle for common stock. For a deeper dive into the strategic direction of the company, consider reading about the Growth Strategy of Penske Corp.

| Board Member | Title | Affiliation |

|---|---|---|

| Roger Penske | Chairman | Penske Corporation |

| Other Executives | Various | Penske Corporation |

| Independent Directors | Various | Penske Corporation (potentially) |

The private nature of Penske Corporation means that governance discussions and decisions primarily occur internally among the leadership team and ownership. There have been no widely reported proxy battles or activist investor campaigns directly targeting Penske Corporation due to its private status. This structure allows for a more streamlined decision-making process, with Roger Penske at the helm, ensuring the company's long-term strategic goals are met.

Who owns Penske? Roger Penske has significant control.

- Private ownership structure concentrates voting power.

- Board composition is primarily internal.

- Governance decisions are made internally.

- No public proxy battles due to private status.

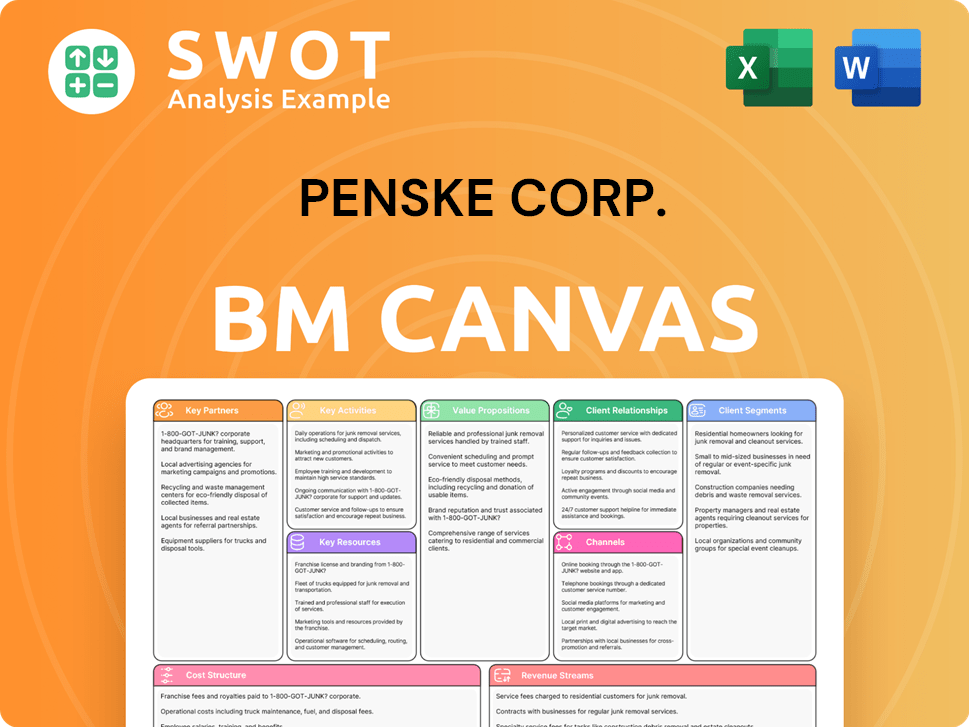

Penske Corp. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Penske Corp.’s Ownership Landscape?

In the past few years, Penske Corporation has maintained its strong position in the transportation and automotive sectors. The Penske ownership structure remains largely consistent under the leadership of Roger Penske. As a private entity, Penske Corporation doesn't publicly disclose ownership changes like share buybacks. However, the company has shown growth through strategic acquisitions. For example, Penske Logistics expanded through partnerships and technology investments in 2024 and 2025, focusing on supply chain capabilities.

Within the publicly traded Penske Automotive Group (PAG), there have been developments, including acquisitions of automotive dealerships. PAG expanded its global footprint with acquisitions in late 2023 and early 2024, diversifying its brand portfolio and geographic reach. These acquisitions don't fundamentally alter the controlling interest held by Penske Corporation. Industry trends, like increased institutional ownership, are more relevant to PAG. Roger Penske's substantial stake in PAG ensures his vision continues to guide the company. There have been no public statements about a potential privatization of PAG or significant ownership shifts within the private Penske Corporation, indicating a commitment to the current structure and leadership.

| Metric | Details | Year |

|---|---|---|

| Penske Logistics Revenue | Significant growth through client partnerships and technology investments. | 2024-2025 |

| PAG Acquisitions | Several dealership acquisitions, expanding global footprint | Late 2023-Early 2024 |

| Roger Penske's Stake | Maintains substantial control and influence | Ongoing |

For a deeper dive into the company's strategic approach, consider exploring the Marketing Strategy of Penske Corp.

Penske Corporation is a privately held transportation services company. It operates in automotive retail, truck leasing, logistics, and motorsports. Roger Penske is the chairman of the company. The company's structure emphasizes long-term strategic investments.

PAG is a publicly traded subsidiary of Penske Corporation. PAG focuses on automotive retail, representing various brands globally. It has been actively involved in expanding its dealership network. PAG's performance is a key indicator of Penske's business success.

Who owns Penske is primarily Roger Penske and his family. The private nature of Penske Corporation means detailed ownership isn't publicly available. Roger Penske's leadership ensures continuity in the company's direction. This structure supports long-term strategic planning.

Recent developments include strategic acquisitions by PAG. Penske Logistics continues to expand its supply chain capabilities. The company focuses on technology and client partnerships. These moves reinforce Penske's company profile and market position.

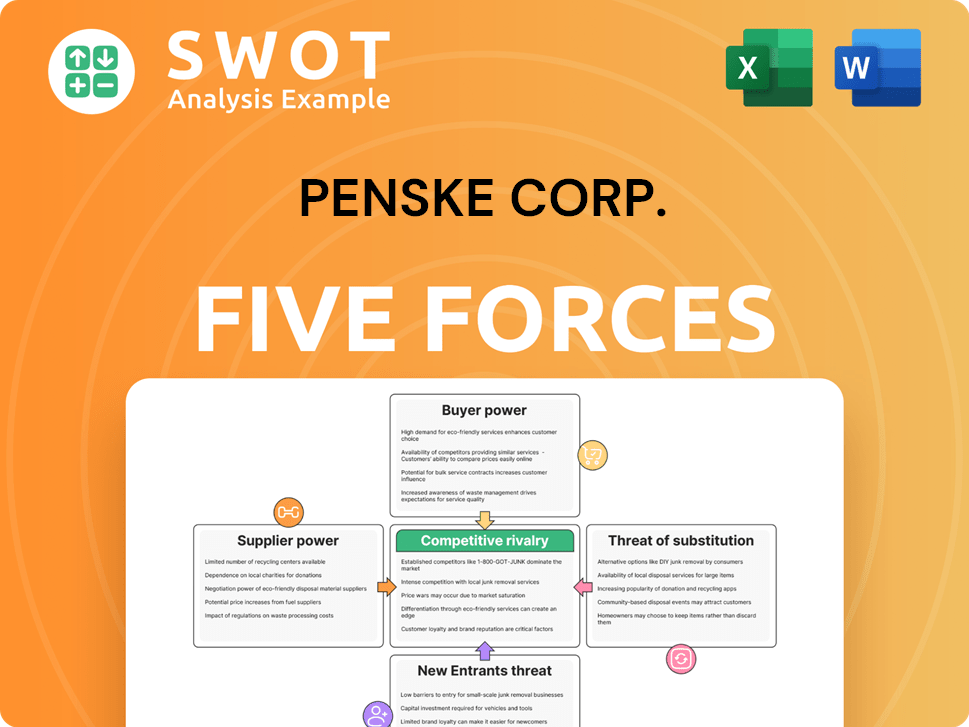

Penske Corp. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Penske Corp. Company?

- What is Competitive Landscape of Penske Corp. Company?

- What is Growth Strategy and Future Prospects of Penske Corp. Company?

- How Does Penske Corp. Company Work?

- What is Sales and Marketing Strategy of Penske Corp. Company?

- What is Brief History of Penske Corp. Company?

- What is Customer Demographics and Target Market of Penske Corp. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.