Proto Labs Bundle

Can Proto Labs Continue to Disrupt the Manufacturing World?

Proto Labs, a pioneer in digital manufacturing, revolutionized rapid prototyping and on-demand production since its inception in 1999. Its innovative approach, leveraging cutting-edge software and manufacturing technologies, has transformed how engineers and designers access custom parts. This Proto Labs SWOT Analysis will help us understand the company's position.

This Proto Labs company analysis will explore the company's growth strategy, evaluating its expansion plans and innovation strategy. We'll examine the company's future prospects, considering its market share and financial performance within the evolving manufacturing landscape. Understanding Proto Labs' business model is key to assessing its long-term growth potential and its impact on the manufacturing industry.

How Is Proto Labs Expanding Its Reach?

Proto Labs is actively pursuing several expansion initiatives to broaden its market reach and diversify its service offerings. These initiatives are crucial for its long-term growth potential and adapting to market changes. A key aspect of Proto Labs' growth strategy involves entering new geographical markets, particularly in regions with growing demand for rapid prototyping and on-demand manufacturing. The company's focus on expanding its presence in Europe and Asia aims to capture a larger share of these burgeoning markets.

In terms of product categories and services, Proto Labs continues to invest in expanding its capabilities. This includes enhancing its existing services like injection molding, CNC machining, 3D printing, and sheet metal fabrication, as well as exploring new manufacturing processes. The acquisition of Hubs (formerly 3D Hubs) in January 2021 was a strategic move to access new customers and diversify revenue streams by offering a more comprehensive digital manufacturing solution.

Proto Labs aims to leverage its expanded network to provide customers with an even wider array of manufacturing options, from rapid prototyping to low-volume production. The company's commitment to innovation and strategic partnerships is central to its competitive advantages. Understanding the Revenue Streams & Business Model of Proto Labs is essential to grasp the impact of these expansion plans.

Proto Labs is focusing on expanding its presence in Europe and Asia. These regions represent significant growth opportunities for rapid prototyping and on-demand manufacturing services. This expansion is part of the company's broader Proto Labs growth strategy.

Proto Labs is enhancing its existing services, including injection molding, CNC machining, 3D printing, and sheet metal fabrication. The company is also exploring new manufacturing processes to meet evolving customer needs. This diversification supports Proto Labs' future prospects.

The acquisition of Hubs in January 2021 significantly bolstered Proto Labs' manufacturing partner network. This move allowed for greater capacity and a broader range of services. It also provided more competitive pricing and lead times.

In Q1 2024, Proto Labs reported revenue of $115.1 million, with Hubs contributing $12.3 million. This demonstrates the continued integration and contribution of Hubs to the company's overall growth strategy. This data is crucial for Proto Labs financial performance analysis.

Proto Labs’ expansion initiatives are designed to increase its market share and improve its financial performance. The company is focused on both organic growth and strategic acquisitions to enhance its service offerings.

- Expanding into new geographical markets.

- Diversifying service offerings to meet evolving customer needs.

- Leveraging the Hubs acquisition to provide a wider range of manufacturing options.

- Focusing on innovation and strategic partnerships.

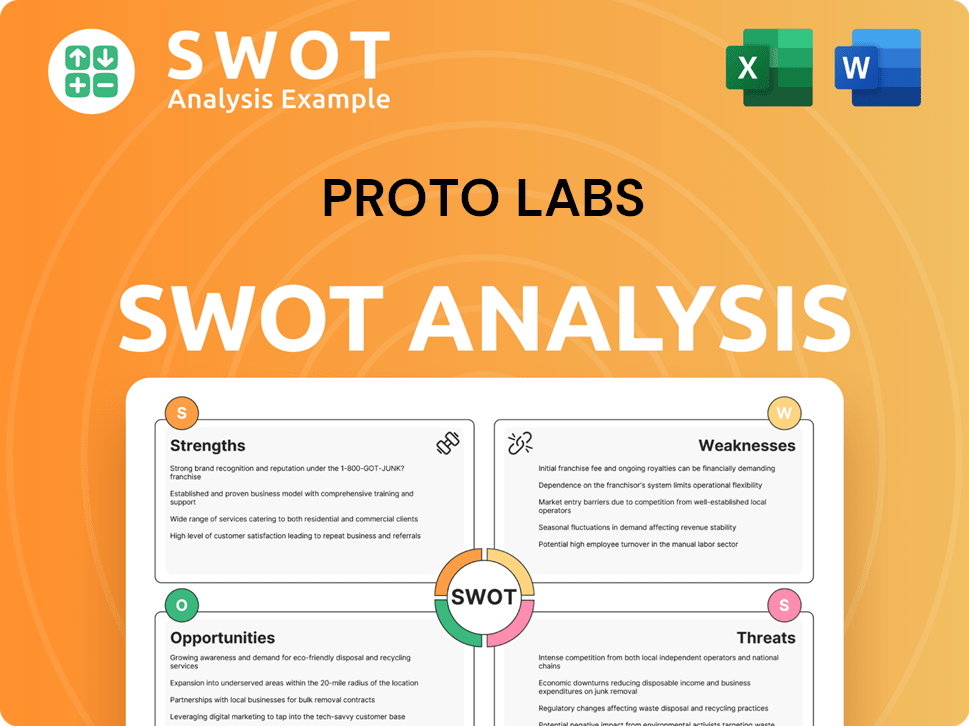

Proto Labs SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Proto Labs Invest in Innovation?

The sustained growth of Proto Labs is intrinsically linked to its robust innovation and technology strategy. This strategy emphasizes continuous R&D investments and the adoption of cutting-edge technologies to maintain a competitive edge. Proto Labs focuses on in-house development of proprietary software and automation tools to streamline manufacturing processes.

This digital transformation is central to its competitive advantage, enabling rapid quoting, automated design analysis, and lights-out manufacturing. The company's commitment to technological advancement is evident in its application of AI and ML to optimize production workflows. This includes improving part quality and enhancing customer experience, demonstrating a forward-thinking approach to manufacturing.

Proto Labs actively leverages advanced technologies such as artificial intelligence (AI) and machine learning (ML) to optimize its production workflows, improve part quality, and enhance customer experience. AI-driven algorithms are employed in design analysis to identify potential manufacturing issues early in the product development cycle, while ML helps in predicting optimal machining parameters for various materials. Proto Labs also explores the integration of IoT (Internet of Things) to monitor machine performance and predictive maintenance, further increasing operational uptime.

Proto Labs prioritizes in-house development of software and automation tools. This focus streamlines manufacturing processes and reduces lead times, enhancing efficiency.

The company uses AI and ML to optimize production workflows. This includes design analysis and predicting optimal machining parameters.

Proto Labs explores the use of IoT for machine performance monitoring and predictive maintenance. This aims to increase operational uptime.

Ongoing investment in these areas aims to expand its capabilities. This includes offering more complex geometries and working with a wider range of exotic materials.

Proto Labs focuses on enhancing customer experience through technology. This includes improving part quality and providing rapid quoting.

Digital transformation is central to Proto Labs' competitive advantage. This enables automated design analysis and lights-out manufacturing.

The company's focus on automation and digital manufacturing platforms demonstrates its leadership in applying technology to solve complex manufacturing challenges. Proto Labs' consistent investment in these areas aims to expand its capabilities, such as offering more complex geometries or working with a wider range of exotic materials, thereby contributing directly to its growth objectives by attracting new customers and retaining existing ones. To understand how Proto Labs' innovation strategy aligns with its overall business goals, consider reading about the Marketing Strategy of Proto Labs.

Proto Labs' innovation strategy is built on several key technological pillars.

- In-house Software Development: Continuous development of proprietary software and automation tools.

- AI and ML Applications: Utilizing AI and ML for design analysis and process optimization.

- IoT Integration: Exploring IoT for machine monitoring and predictive maintenance.

- Expanding Material Capabilities: Aiming to work with a wider range of materials.

- Enhanced Customer Experience: Improving part quality and providing rapid quoting.

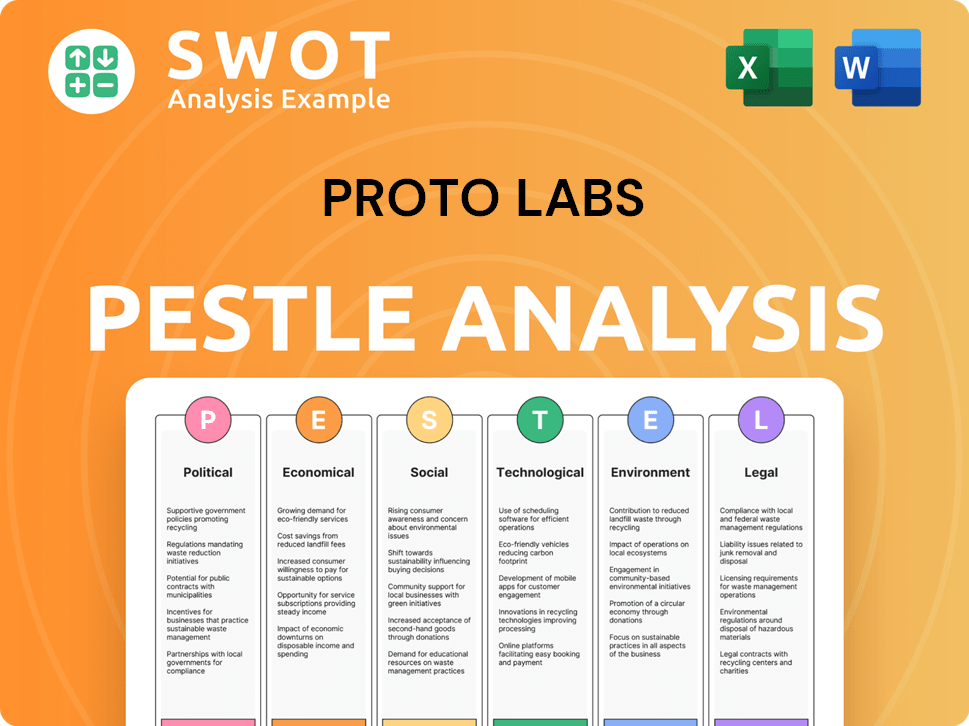

Proto Labs PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Proto Labs’s Growth Forecast?

The financial outlook for Proto Labs, a key player in the digital manufacturing space, reflects a strategic approach focused on sustainable growth and operational efficiency. The company's Proto Labs growth strategy is underpinned by targeted investments and a commitment to improving profitability. This strategy is crucial as the company navigates the dynamic landscape of the manufacturing industry.

For the first quarter of 2024, the company reported revenue of $115.1 million, which was a slight decrease of 0.4% compared to the same period in 2023. Despite this minor dip in revenue, the company maintained a strong gross profit margin of 44.9% in Q1 2024. Furthermore, the non-GAAP diluted net income per share was reported at $0.18, indicating a solid financial foundation.

Looking at the full-year 2023 results, revenue was $486.2 million, representing a decrease of 3.8% compared to 2022. This data provides a basis for understanding Proto Labs financial performance over recent periods. The company's ability to manage its costs and maintain profitability is a key factor in its long-term success.

For the second quarter of 2024, Proto Labs anticipates revenue to be in the range of $116 million to $124 million. This guidance reflects the company's expectations for the near term and its ability to adapt to market conditions.

Proto Labs aims to expand its Proto Labs market share in the digital manufacturing space. This growth will be driven by leveraging expanded service offerings and technological advancements. The integration of Hubs is a key component of this strategy.

The company is focused on optimizing operations through continued automation and efficiency gains. This aligns with its broader growth ambitions and is expected to positively impact future financial performance.

The ongoing integration of Hubs is a crucial element in Proto Labs' strategy. This integration is expected to contribute to improved financial results and support the company's long-term goals. Understanding the Target Market of Proto Labs is essential for assessing its financial outlook.

Analyzing key financial metrics provides insights into the company's performance and future prospects. These metrics are essential for understanding Proto Labs future prospects and its position in the market.

- Revenue: Q1 2024 revenue was $115.1 million.

- Gross Profit Margin: 44.9% in Q1 2024.

- Non-GAAP Diluted Net Income Per Share: $0.18 in Q1 2024.

- 2023 Revenue: $486.2 million.

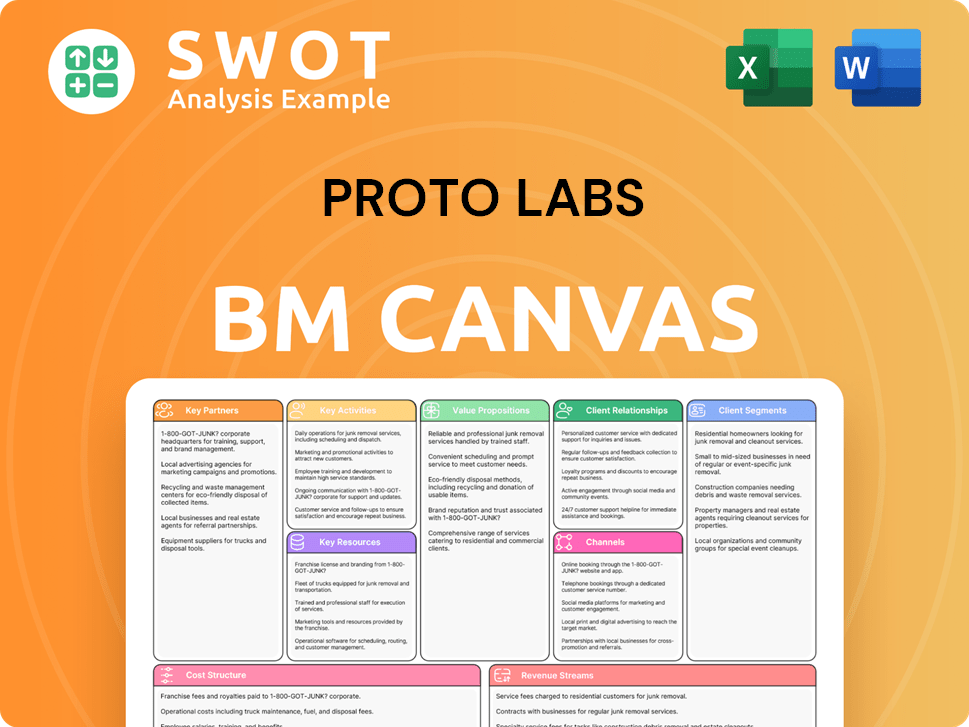

Proto Labs Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Proto Labs’s Growth?

The path forward for Proto Labs, like any growth-oriented company, is fraught with potential risks and obstacles. The company faces the constant pressure of intense competition within the rapid prototyping and on-demand manufacturing sectors. These challenges could affect the company's Proto Labs market share and overall profitability.

Regulatory changes, particularly in manufacturing standards and international trade, present further hurdles. Fluctuations in tariffs or import/export rules could disrupt Proto Labs' global supply chains and expansion strategies. Supply chain vulnerabilities, such as raw material shortages or logistical issues, also threaten production timelines and costs.

Technological disruption is a persistent risk. The fast pace of innovation in manufacturing could render current offerings obsolete. Internal resource constraints, such as the availability of skilled labor or capital for R&D and expansion, could also limit Proto Labs future prospects.

The on-demand manufacturing market is highly competitive. Numerous players, from small specialized firms to large diversified manufacturers, compete for market share. This competition can lead to pricing pressures and reduced profit margins, impacting Proto Labs financial performance.

Changes in manufacturing standards, material safety regulations, or international trade policies can create significant obstacles. Alterations in tariffs or import/export regulations could affect Proto Labs' global supply chain and expansion efforts. These factors could significantly impact the company's operations.

Disruptions in the supply chain, such as shortages of raw materials or logistical challenges, can impact production timelines and increase costs. The reliance on a global network makes Proto Labs vulnerable to external shocks. This could affect the company's ability to meet customer demands efficiently.

The rapid pace of technological advancement in manufacturing poses a constant threat. New processes or materials can emerge quickly, potentially challenging Proto Labs' existing offerings. The company must continually innovate to stay ahead of the curve.

Internal resource limitations, such as the availability of skilled labor or capital for R&D and expansion, could hinder growth. Securing and retaining a skilled workforce is crucial. Adequate capital is also essential for continued innovation and geographic expansion.

The company must continually adapt to changing market dynamics and customer demands. This includes responding to shifts in industry trends, technological advancements, and competitive pressures. Understanding how Mission, Vision & Core Values of Proto Labs can aid in this adaptation.

Proto Labs likely employs several strategies to mitigate these risks. These include diversifying service offerings and customer base, investing in robust risk management frameworks, and engaging in scenario planning to anticipate various market and operational challenges. Investments in automation and AI can also help address labor shortages and maintain a competitive edge.

Proto Labs' digital processes and network of manufacturing partners (including through Hubs) offer some resilience against supply chain shocks. The company's focus on rapid prototyping and on-demand manufacturing provides a degree of agility. Their ability to quickly adapt to customer needs is a key advantage.

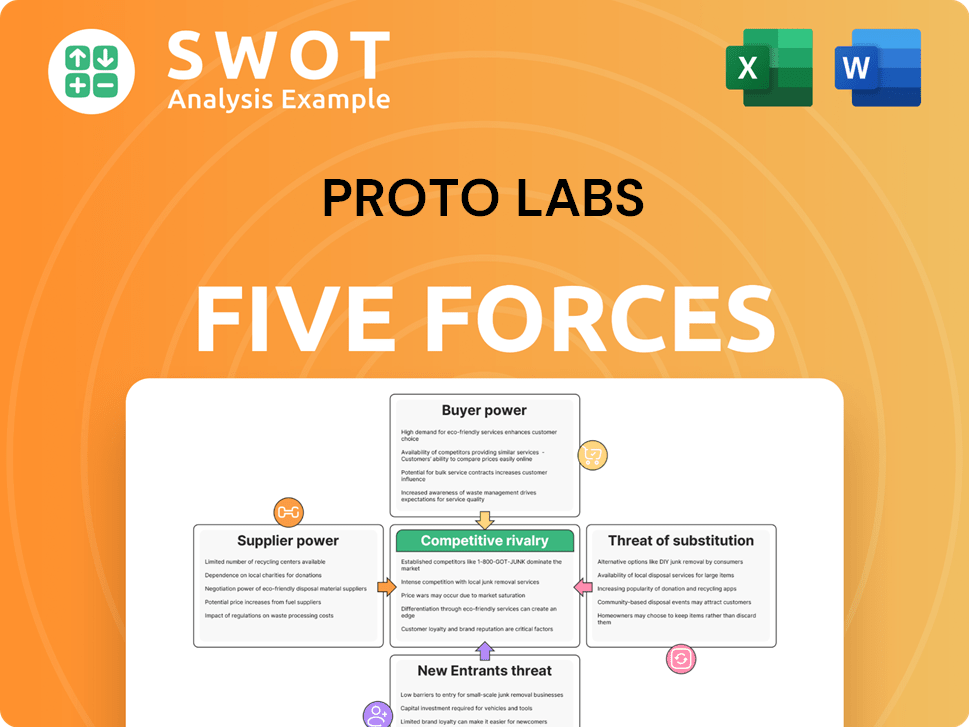

Proto Labs Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Proto Labs Company?

- What is Competitive Landscape of Proto Labs Company?

- How Does Proto Labs Company Work?

- What is Sales and Marketing Strategy of Proto Labs Company?

- What is Brief History of Proto Labs Company?

- Who Owns Proto Labs Company?

- What is Customer Demographics and Target Market of Proto Labs Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.