Proto Labs Bundle

How Does Proto Labs Revolutionize Manufacturing?

Proto Labs, a leader in digital manufacturing, has transformed how businesses bring products to market. Specializing in rapid prototyping and on-demand manufacturing, the Proto Labs company provides quick-turnaround custom parts using advanced technologies. This approach has positioned Proto Labs as a pivotal partner for companies across various sectors.

This in-depth analysis will explore Proto Labs' operational model, revenue streams, and competitive advantages. Understanding the Proto Labs SWOT Analysis is crucial for investors and businesses seeking to leverage the power of digital manufacturing. We will examine how Proto Labs utilizes digital manufacturing to streamline supply chains and accelerate product development, making it an indispensable player in the modern manufacturing ecosystem. Learn about Proto Labs services explained, Proto Labs pricing structure, and Proto Labs lead times for projects.

What Are the Key Operations Driving Proto Labs’s Success?

The Proto Labs company provides on-demand manufacturing services, specializing in rapid prototyping and low-volume production of custom parts. This approach leverages a digital workflow that streamlines the manufacturing process, offering quick turnaround times for product designers, engineers, and companies across various industries. Proto Labs manufacturing services include injection molding, CNC machining, 3D printing, and sheet metal fabrication, catering to diverse project needs.

The core of Proto Labs' operations lies in its digital-first approach. Customers upload 3D CAD models to a proprietary software platform, which analyzes designs for manufacturability and provides instant quotes. This automated system significantly reduces lead times and provides immediate feedback, allowing for faster product development cycles. The company's facilities are equipped with advanced machinery to support its quick-turn manufacturing model.

Proto Labs distinguishes itself through its commitment to automation and digital integration. This enables unparalleled speed and efficiency in producing custom parts, often delivering orders within days. This capability directly addresses critical customer pain points in traditional manufacturing, offering a highly differentiated value proposition and a competitive edge in the market. For a broader view, exploring the Competitors Landscape of Proto Labs can provide additional insights.

Customers upload 3D CAD models to the platform. The software analyzes designs, provides quotes, and identifies potential issues. This automated process reduces lead times and provides quick feedback, essential for rapid prototyping.

Proto Labs offers injection molding, CNC machining, 3D printing, and sheet metal fabrication. These services cater to various industries, including medical, aerospace, and automotive. This diverse range supports both prototypes and low-volume production.

Faster product development cycles and reduced time-to-market are key advantages. The ability to iterate designs more rapidly is a significant benefit. This approach addresses critical customer needs in the manufacturing sector.

The company focuses on automation and a digital-first approach. This leads to efficiency in producing custom parts. Proto Labs operates multiple manufacturing facilities equipped with state-of-the-art machinery.

Proto Labs provides significant advantages through its on-demand manufacturing services. These services are especially valuable for rapid prototyping and quick-turn manufacturing needs. The company's digital platform and automated processes offer distinct benefits.

- Rapid prototyping and production capabilities.

- Reduced lead times compared to traditional methods.

- Digital design analysis and instant quoting.

- Diverse manufacturing processes to meet various needs.

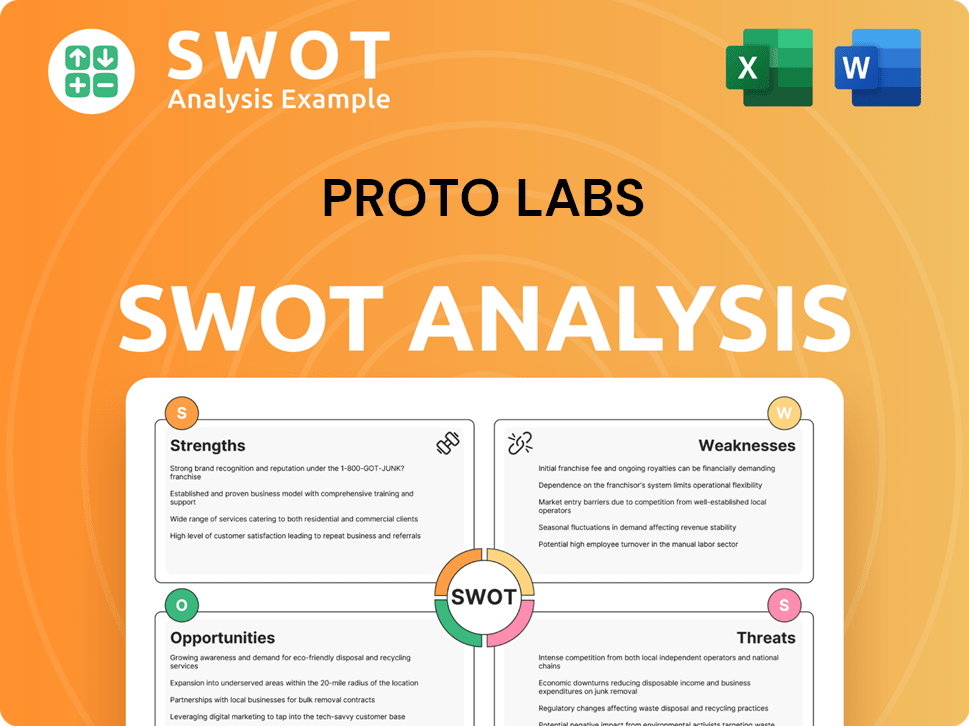

Proto Labs SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Proto Labs Make Money?

The core of the Proto Labs company's revenue model lies in its ability to provide custom manufacturing services. They generate income by selling custom parts made through injection molding, CNC machining, 3D printing, and sheet metal fabrication. The amount of revenue is directly linked to the volume and complexity of the parts that customers order.

Proto Labs' financial performance is significantly influenced by the services it offers. In Q1 2024, the company reported revenue of $115.0 million. For the full year 2023, total revenue was $485.8 million. The Americas segment contributed $372.4 million, Europe $98.1 million, and Japan $15.3 million.

The company's monetization strategy centers on a transparent pricing model. This model considers factors like part complexity, material selection, and order quantity. A digital quoting system gives immediate cost estimates, which is a key differentiator in the custom manufacturing space.

Proto Labs uses a tiered pricing structure based on turnaround time. Customers can pay extra for faster delivery, which increases revenue. The company may also earn from design analysis services and expedited shipping fees. The acquisition of Hubs in 2021 expanded manufacturing capabilities and potentially introduced new revenue streams.

- Injection Molding: A significant revenue contributor due to its widespread use in manufacturing.

- CNC Machining: Another major revenue source, often used for producing complex parts.

- 3D Printing: Important for prototyping and specialized parts, contributing to revenue growth.

- Sheet Metal Fabrication: Caters to specific manufacturing needs, adding to the overall revenue.

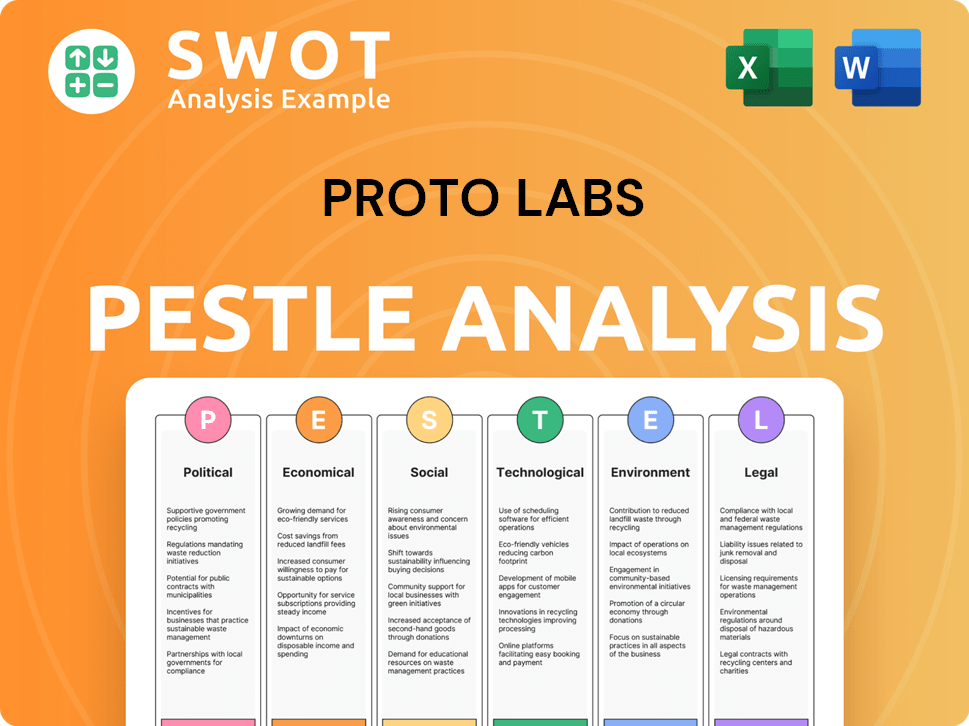

Proto Labs PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Proto Labs’s Business Model?

The journey of the Proto Labs company has been marked by significant milestones that have shaped its operational and financial trajectory. A pivotal moment was its initial public offering (IPO) in 2012, which provided capital for expansion and solidified its position as a publicly traded leader in digital manufacturing. Subsequent key milestones include the continuous expansion of its service offerings, notably the introduction of 3D printing in 2014 and sheet metal fabrication in 2016, broadening its appeal to a wider customer base.

A major strategic move was the acquisition of Hubs (formerly 3D Hubs) in 2021 for $280 million, a move that significantly expanded its manufacturing network and capabilities, allowing it to offer a more comprehensive suite of services and address a broader range of customer needs beyond its in-house capacity. The company has navigated operational challenges, including global supply chain disruptions and fluctuating demand, particularly during economic downturns. Proto Labs has responded by continuously optimizing its automated processes, investing in advanced manufacturing technologies, and diversifying its supply chain to enhance resilience.

Proto Labs' competitive advantages are deeply rooted in its brand strength, technological leadership, and operational efficiency. Its proprietary software platform, which automates design analysis and quoting, provides a significant technological edge, enabling faster turnaround times and greater cost predictability compared to traditional manufacturing. The company benefits from economies of scale through its highly automated facilities and established global presence. Its 'digital thread' approach, which seamlessly integrates design to manufacturing, creates an ecosystem effect where customers repeatedly return due to the speed, reliability, and ease of use. Read more about the Growth Strategy of Proto Labs.

Proto Labs' IPO in 2012 was a crucial step, providing capital for expansion. The introduction of 3D printing in 2014 and sheet metal fabrication in 2016 broadened its service offerings. The acquisition of Hubs in 2021 significantly expanded its manufacturing capabilities.

The acquisition of Hubs for $280 million in 2021 was a major strategic move. Proto Labs has focused on optimizing automated processes. They have also invested in advanced manufacturing technologies and diversified their supply chain.

Proto Labs leverages brand strength, technological leadership, and operational efficiency. Their proprietary software provides a technological edge, ensuring faster turnaround times. They benefit from economies of scale and a digital thread approach.

In 2023, Proto Labs reported a revenue of approximately $448 million. The company continues to invest in R&D, AI, and machine learning. They are exploring new materials and processes to sustain their business model.

Proto Labs' success is built on its ability to quickly produce parts. They use advanced software and automation to streamline the manufacturing process. This allows them to offer rapid prototyping and on-demand manufacturing services.

- Rapid Prototyping: Quick turnaround for prototypes.

- On-Demand Manufacturing: Flexible manufacturing solutions.

- Digital Manufacturing: Integration of design to manufacturing.

- Advanced Technologies: Use of AI and machine learning.

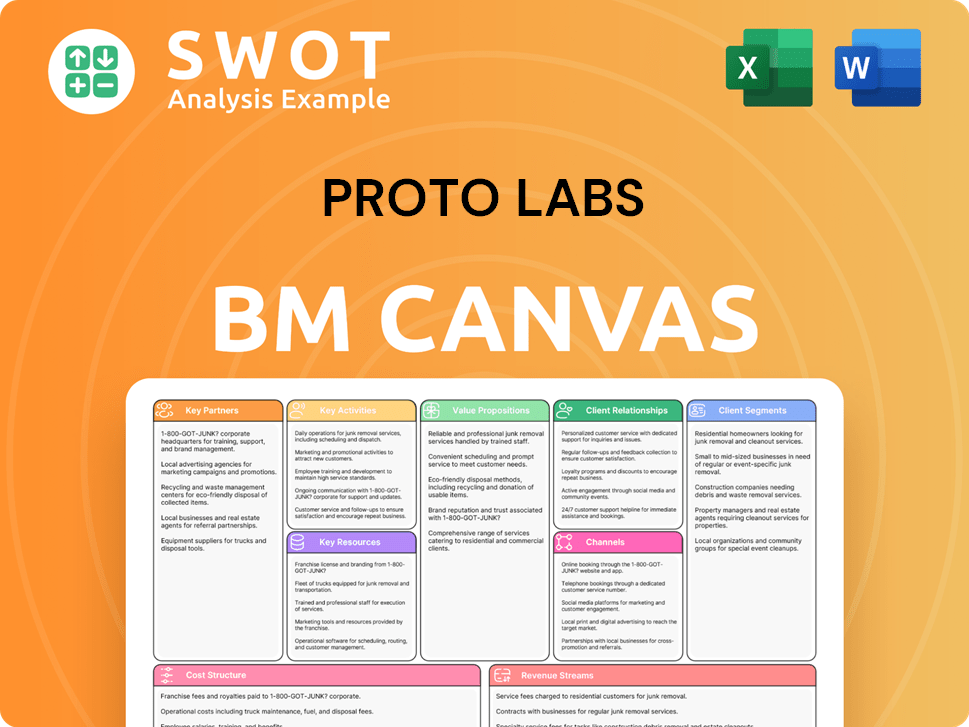

Proto Labs Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Proto Labs Positioning Itself for Continued Success?

Proto Labs is a key player in the on-demand digital manufacturing sector. It is known for its quick turnaround times and automated processes. While precise market share numbers vary, the company competes with others like Xometry and Fictiv. Proto Labs distinguishes itself through its highly automated, in-house production capabilities. Its market share is supported by strong customer loyalty, which is due to its consistent delivery of high-quality parts with speed. Proto Labs serves customers worldwide, with significant operations in the Americas, Europe, and Japan.

However, Proto Labs faces several risks. These include strong competition from other digital manufacturing platforms and traditional contract manufacturers, who may offer lower prices or specialized services. Economic downturns or shifts in industrial spending could impact demand for its custom parts. Technological advancements, such as in additive manufacturing or new materials, could also require significant investment to maintain its edge. Regulatory changes related to manufacturing standards, environmental compliance, or international trade could also pose challenges.

Proto Labs holds a leading position in the on-demand digital manufacturing industry. The company is recognized for its ability to deliver parts quickly, which is a key differentiator. It has a global presence, serving customers across the Americas, Europe, and Japan, solidifying its international reach.

Proto Labs faces risks from competitors offering lower prices and specialized services. Economic downturns could reduce demand for its custom parts. The company must also adapt to technological advancements and regulatory changes to stay competitive.

Proto Labs is focused on expanding its e-commerce platform and digital capabilities. The company is exploring new manufacturing technologies and materials. It is committed to expanding its market reach geographically and across new industry verticals.

Proto Labs is investing in its e-commerce platform to enhance the customer experience. It is exploring new manufacturing technologies and materials. The company is also focused on expanding its market reach, both geographically and across new industry verticals.

Proto Labs is focused on sustaining and expanding its revenue generation capabilities. The company continues to invest in its e-commerce platform and digital capabilities. It aims to enhance the customer experience and streamline the ordering process. For more details, you can read the Growth Strategy of Proto Labs.

- Investing in new manufacturing technologies.

- Expanding material offerings.

- Integrating AI for design optimization.

- Expanding market reach both geographically and across new industry verticals.

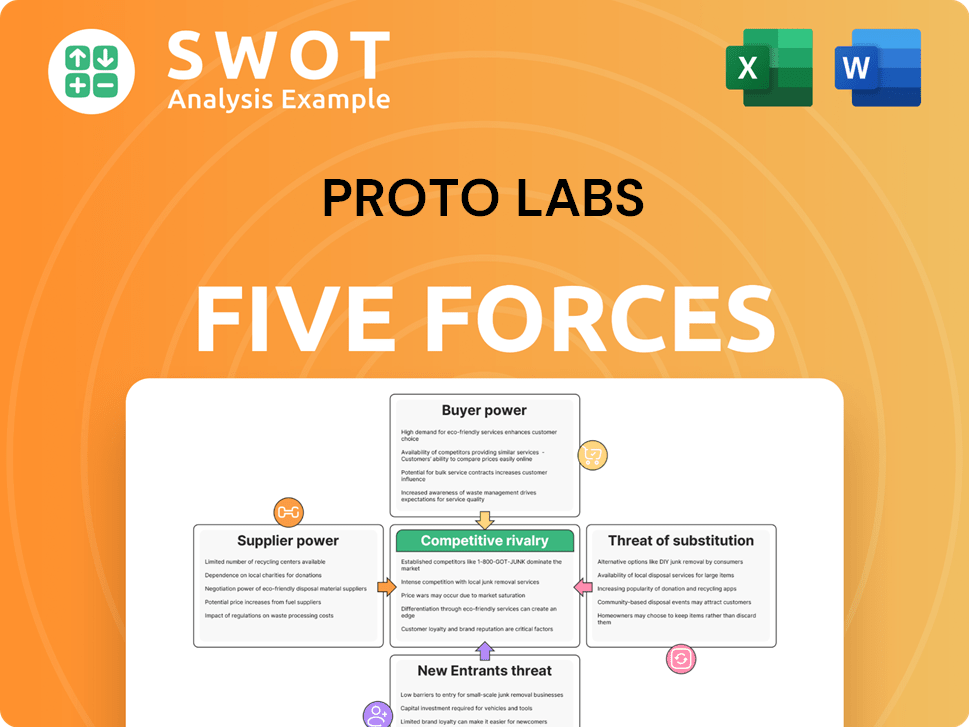

Proto Labs Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Proto Labs Company?

- What is Competitive Landscape of Proto Labs Company?

- What is Growth Strategy and Future Prospects of Proto Labs Company?

- What is Sales and Marketing Strategy of Proto Labs Company?

- What is Brief History of Proto Labs Company?

- Who Owns Proto Labs Company?

- What is Customer Demographics and Target Market of Proto Labs Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.