Proto Labs Bundle

Who Really Controls Proto Labs?

Uncover the intricate web of ownership behind Proto Labs, a leader in the rapid prototyping and on-demand manufacturing space. Understanding who owns Proto Labs is essential for investors and strategists alike, offering critical insights into the company's strategic direction and future prospects. From its humble beginnings to its current status as a publicly traded entity, the evolution of Proto Labs' ownership tells a compelling story.

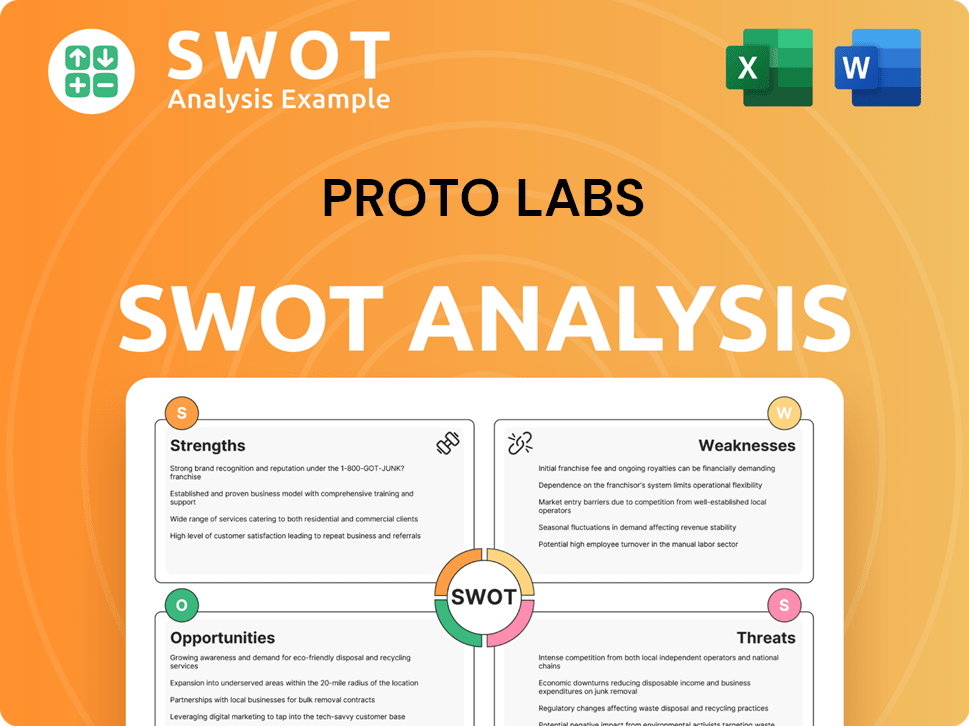

This deep dive into Proto Labs ownership will explore the influence of its major shareholders and how they impact decisions. We'll examine the company's history, including its IPO and subsequent growth, to understand how the ownership structure has evolved. To further understand the company's position, consider a detailed Proto Labs SWOT Analysis, which offers valuable insights into its strengths, weaknesses, opportunities, and threats. This analysis is crucial for anyone looking to understand the Proto Labs company profile.

Who Founded Proto Labs?

The origins of Proto Labs, now a prominent player in digital manufacturing, trace back to 1999. The company was founded by Larry Lukis, who previously led ColorSpan, an original equipment manufacturer (OEM) focused on printers and desktop publishing systems. Lukis initiated the venture with his personal funds and a $500,000 loan secured against his home.

Lukis's vision centered on revolutionizing the production of custom plastic injection molded parts. He aimed to automate the manufacturing process using sophisticated software, drastically reducing production times. Originally named The ProtoMold Company, Inc., the company's early structure reflected Lukis's significant investment and control.

In 2001, Brad Cleveland joined as CEO and president. This strategic move was crucial for the company's growth. While specific equity details from the beginning aren't public, Lukis's initial self-funding and a substantial loan suggest concentrated early ownership. The addition of a CEO like Cleveland often involves equity incentives to attract top management.

Larry Lukis, the founder, served as the chief technology officer before Cleveland's arrival. His technical expertise was fundamental in developing the automated manufacturing processes.

The initial funding came from Lukis's personal savings and a $500,000 loan. This indicates a significant personal commitment to the venture.

By 2001, Proto Labs had achieved $1 million in revenue. This early success demonstrated the viability of its business model.

The appointment of Brad Cleveland as CEO signaled a shift towards scaling the business. This is a common strategy to bring in experienced leadership.

Early ownership was likely concentrated with Lukis, given his initial investment. Details of early investors are not publicly available.

The company's focus on automated manufacturing processes set it apart. This approach aimed to reduce production times and improve efficiency.

Understanding the early ownership of Proto Labs provides insights into its foundational strategies. While the exact ownership breakdown at the start remains undisclosed, the founder's significant investment and subsequent leadership changes highlight critical phases in the company's evolution. For a deeper understanding of how the company has grown, consider reading about the Growth Strategy of Proto Labs.

Proto Labs' early success was driven by its founder's vision and initial investment. The transition to professional management was a key step in its growth trajectory. The company's focus on automated manufacturing set it apart in the industry.

- Larry Lukis founded Proto Labs in 1999.

- Brad Cleveland became CEO in 2001.

- The company achieved $1 million in revenue by 2001.

- Initial funding came from the founder's savings and a loan.

Proto Labs SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Proto Labs’s Ownership Changed Over Time?

The evolution of Proto Labs' ownership is marked by its transition to a publicly traded entity. This occurred in 2012 when it was listed on the New York Stock Exchange. This move provided the company with capital for expansion and increased its market visibility. At the time of its initial public offering, Proto Labs reported over $115 million in annual revenue and $35 million in profit, setting a strong financial foundation for future growth.

Proto Labs' ownership structure is diverse, with a significant presence of institutional investors. As of June 10, 2025, there were 433 institutional owners and shareholders, collectively holding 26,544,671 shares. Key institutional holders include BlackRock, Inc., The Vanguard Group Inc., Disciplined Growth Investors Inc., and State Street Corp. These major shareholders play a crucial role in the company's governance and strategic decisions. The activity of institutional investors in Q4 2024 showed varied movements, with some increasing and others decreasing their positions. For example, PACER ADVISORS, INC. reduced its holdings by 572,247 shares, while FIRST TRUST ADVISORS LP added 308,970 shares, and STATE STREET CORP increased its stake by 183,594 shares.

| Ownership Category | Approximate Share Percentage | Key Players |

|---|---|---|

| Institutional Investors | Significant | BlackRock, The Vanguard Group, State Street Corp |

| Insiders (Executives & Board) | Approximately 2% | Company Leadership |

| Retail Investors | Remainder | Various |

Insiders, including executives and board members, hold about 2% of the shares, which aligns their interests with those of the shareholders. The remaining shares are held by retail investors. Proto Labs' financial health is reflected in its total assets of $743.512 million as of fiscal year 2024 and a strong cash and investments balance of $120.9 million as of December 31, 2024. The company maintains zero debt. Furthermore, Proto Labs has been actively managing its capital, including share repurchase programs, with $60.3 million of common stock repurchased in 2024. These strategic moves in ownership and capital management are crucial for the company's strategy and governance, focusing on returning value to shareholders while investing in technology and manufacturing capabilities. For more insights, read about the Growth Strategy of Proto Labs.

Proto Labs' ownership structure is primarily influenced by institutional investors, with significant holdings by major financial firms.

- The company's IPO in 2012 was a pivotal moment, providing capital for expansion.

- Insiders hold a small percentage, aligning their interests with shareholders.

- Proto Labs demonstrates strong financial health with zero debt and active capital management.

- Ownership changes and financial strategies impact the company's direction.

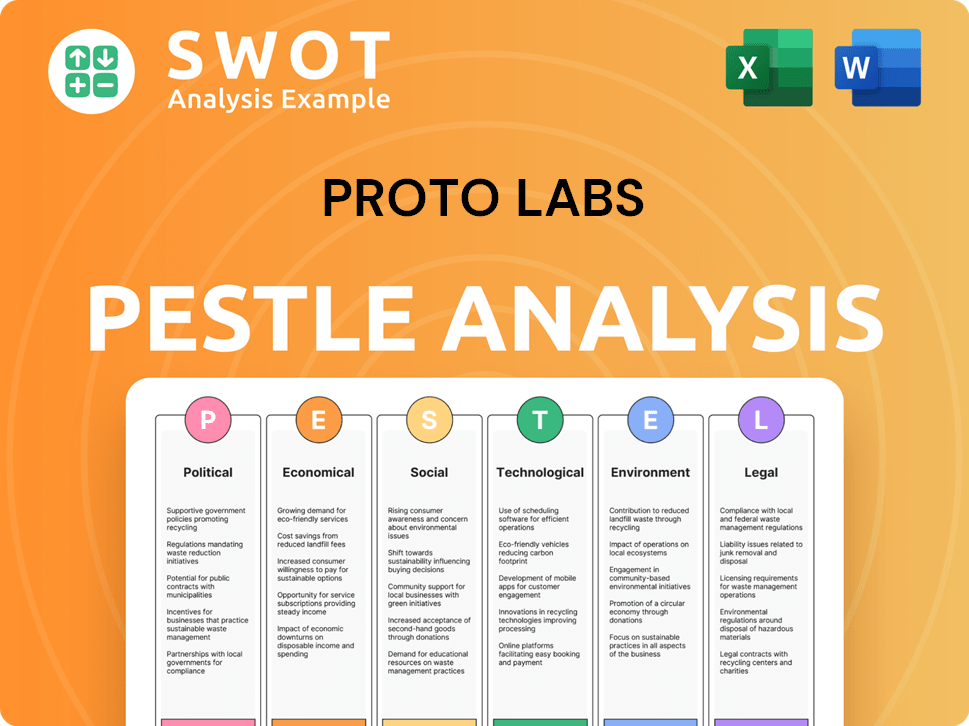

Proto Labs PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Proto Labs’s Board?

The Board of Directors at Proto Labs plays a critical role in the company's governance. While specific details on all current board members and their affiliations aren't fully available in the provided search results, the recent appointment of Suresh Krishna as President and CEO also included his joining the board. This indicates a direct link between executive leadership and board representation. Rainer Gawlick serves as the chairman of Proto Labs' board.

The board's composition reflects a blend of major shareholders, management, and independent voices, ensuring diverse perspectives in strategic decision-making. The leadership transition, with Rob Bodor passing the CEO role to Suresh Krishna on May 20, 2025, highlights the board's influence in shaping the company's direction, focusing on profitable growth and operational efficiency. For more insights into the company's background, consider reading the Brief History of Proto Labs.

| Board Member | Role | Affiliation |

|---|---|---|

| Suresh Krishna | President & CEO | Executive Leadership |

| Rainer Gawlick | Chairman | Not specified |

| Rob Bodor | Former CEO | Not specified |

Proto Labs operates under a one-share-one-vote structure for its common stock. Each share of common stock grants the holder one vote on shareholder matters, as stated in the company's Third Amended and Restated Articles of Incorporation. The company is authorized to issue up to 160,000,000 shares, divided into 10,000,000 shares of preferred stock and 150,000,000 shares of common stock, each with a par value of $0.001. The board can also establish series of preferred stock and set their rights.

Proto Labs uses a one-share-one-vote system, meaning each share of common stock has one vote. This structure is outlined in the company's Third Amended and Restated Articles of Incorporation.

- Each share equals one vote.

- No cumulative voting is allowed.

- Shareholders lack preemptive rights.

- The company can issue up to 160 million shares.

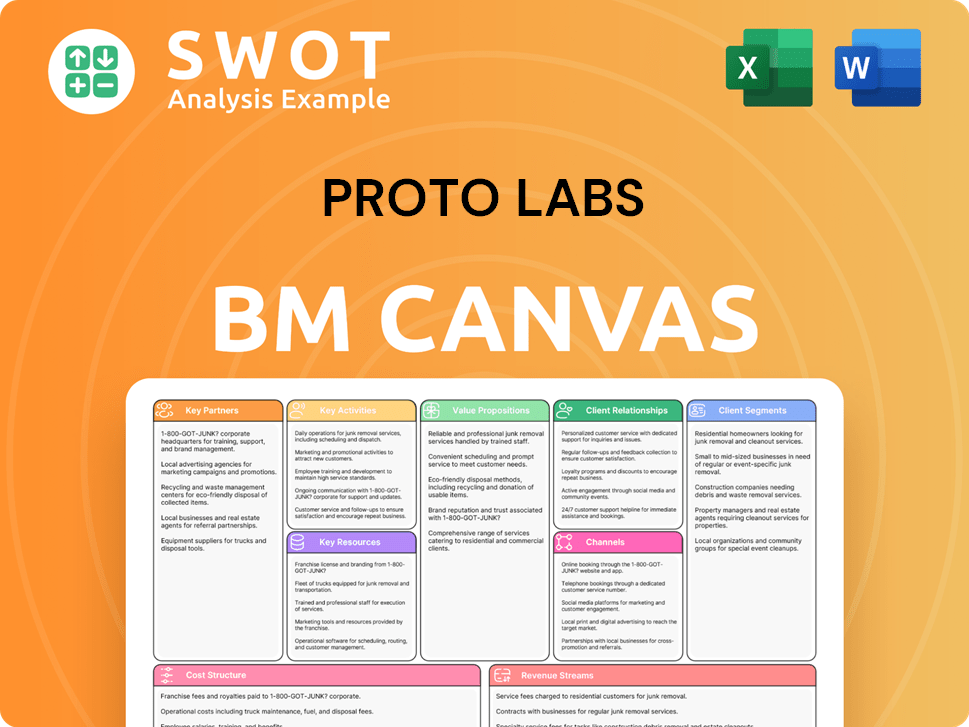

Proto Labs Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Proto Labs’s Ownership Landscape?

Over the past few years, the ownership structure of Proto Labs has been shaped by strategic decisions and market dynamics. A key development was the appointment of Suresh Krishna as President and CEO in May 2025, taking over from Rob Bodor. Bodor transitioned to a consulting role to ensure a smooth leadership change. This shift signals a focus on driving profitable growth and operational improvements, which influences the long-term strategy and, consequently, the interests of the company's owners and investors.

Proto Labs has also actively managed its capital through share repurchase programs. The board approved a new $100 million stock repurchase program on February 4, 2025. In 2024, the company repurchased $60.3 million of its common stock, returning 88% of its free cash flow to shareholders. As of March 31, 2025, $20.87 million in repurchases were made, demonstrating a commitment to returning value to shareholders. These actions reflect how the company's leadership views its stock valuation and the financial benefits for its owners.

| Metric | Value | Date |

|---|---|---|

| Stock Repurchase Program Approved | $100 million | February 4, 2025 |

| 2024 Stock Repurchases | $60.3 million | 2024 |

| Free Cash Flow Returned to Shareholders (2024) | 88% | 2024 |

| Cash and Investments (March 31, 2025) | $116.3 million | March 31, 2025 |

The company's strategic moves, including the acquisition of Hubs in 2021, rebranded as Protolabs Network by Hubs in January 2024, have expanded its service offerings. The closure of some European facilities by fiscal year 2025 is another sign of the company adapting to market needs. These developments, coupled with the company's strong financial position—with $116.3 million in cash and investments as of March 31, 2025—and its reaffirmed revenue guidance for Q2 2025, suggest a focus on sustainable growth and profitability, which is of great interest to those who own Proto Labs.

The primary ownership of Proto Labs is a mix of institutional investors and individual shareholders. This structure is typical for publicly traded companies. Understanding the ownership helps in assessing the company's strategic direction.

Proto Labs has demonstrated financial stability, with a strong cash position. The company's focus on profitability and strategic investments is key to its financial health. For more details, you can check Competitors Landscape of Proto Labs.

The recent CEO transition and the ongoing share repurchase programs highlight the company's proactive approach. These moves are aimed at enhancing shareholder value and operational efficiency.

With a focus on digital manufacturing and strategic capital allocation, Proto Labs is positioned for growth. The company's ability to adapt to market changes will be crucial for its future success.

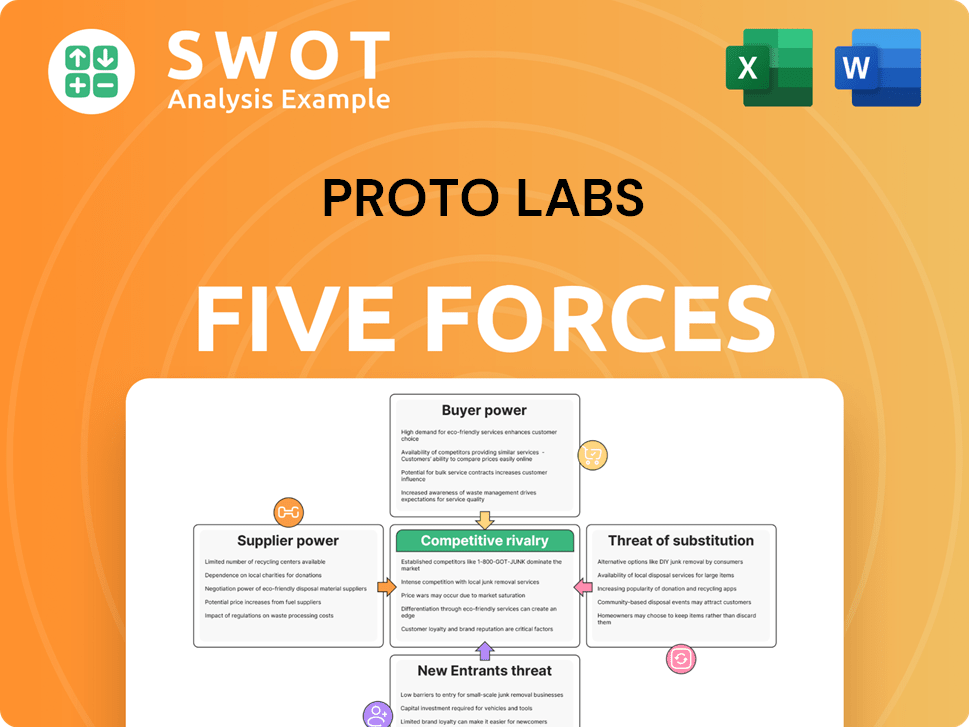

Proto Labs Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Proto Labs Company?

- What is Competitive Landscape of Proto Labs Company?

- What is Growth Strategy and Future Prospects of Proto Labs Company?

- How Does Proto Labs Company Work?

- What is Sales and Marketing Strategy of Proto Labs Company?

- What is Brief History of Proto Labs Company?

- What is Customer Demographics and Target Market of Proto Labs Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.