Redwood Trust Bundle

Can Redwood Trust Company Sustain Its Growth Trajectory?

In the ever-evolving world of specialty finance, understanding a company's growth strategy is crucial for investors and analysts alike. Redwood Trust Company, a prominent player in the mortgage-backed securities market since 1994, has consistently adapted to market dynamics. This article dives deep into Redwood Trust's strategic initiatives, exploring how they plan to maintain and expand their market presence.

From its inception, Redwood Trust has demonstrated a commitment to innovation and strategic foresight, evolving from a niche player to a key provider of credit in the housing market. This article provides a comprehensive analysis of Redwood Trust's future outlook, including its expansion plans and financial performance analysis. For a deeper dive into their strengths and weaknesses, consider exploring the Redwood Trust SWOT Analysis.

How Is Redwood Trust Expanding Its Reach?

The expansion initiatives of Redwood Trust are designed to strengthen its market position and diversify revenue streams. A key aspect of this strategy involves extending its presence in various segments of the housing market. The company is focusing on its residential and commercial mortgage platforms to broaden its credit offerings and reach new customer segments.

Redwood Trust aims to strategically invest in different types of mortgage-related assets. This includes exploring opportunities in both traditional and emerging mortgage products. This approach allows the company to cater to a wider array of borrowers and investors, enhancing its overall market reach and financial performance.

Furthermore, Redwood Trust continually assesses potential mergers and acquisitions (M&A) opportunities. These inorganic growth strategies are aimed at enhancing product capabilities, increasing market share, and acquiring specialized expertise. Such actions are designed to expand its operational footprint and maintain a competitive edge in the financial services sector.

Redwood Trust is actively expanding its residential and commercial mortgage platforms. This expansion includes a focus on broadening credit offerings. The goal is to reach new customer segments and increase overall market share within the real estate investment trust (REIT) sector.

Strategic investments in diverse mortgage-related assets are a core part of Redwood Trust's growth strategy. This involves exploring both traditional and emerging mortgage products. The objective is to cater to a wider range of borrowers and investors, thereby enhancing revenue streams.

Redwood Trust is continually evaluating potential M&A opportunities that align with its core business. These inorganic growth strategies are designed to enhance product capabilities. The company aims to gain market share and acquire specialized expertise through strategic acquisitions.

Strengthening the Redwood Residential platform is crucial for securitization activities. This involves refining securitization processes and exploring new avenues for distributing mortgage-backed securities. The aim is to enhance liquidity and capital efficiency.

Redwood Trust's expansion strategy focuses on several key areas to drive growth and enhance its market position. These include expanding mortgage platforms, strategic investments, and potential mergers and acquisitions. The company also emphasizes strengthening its Redwood Residential platform.

- Mortgage Platform Expansion: Broadening residential and commercial mortgage offerings.

- Asset Diversification: Investing in various mortgage-related assets.

- Strategic M&A: Evaluating potential acquisitions to boost capabilities.

- Platform Enhancement: Improving securitization processes.

For a deeper understanding of the company's core values and mission, consider reading about the Mission, Vision & Core Values of Redwood Trust. This provides context for the strategic initiatives aimed at long-term growth and value creation within the financial services industry.

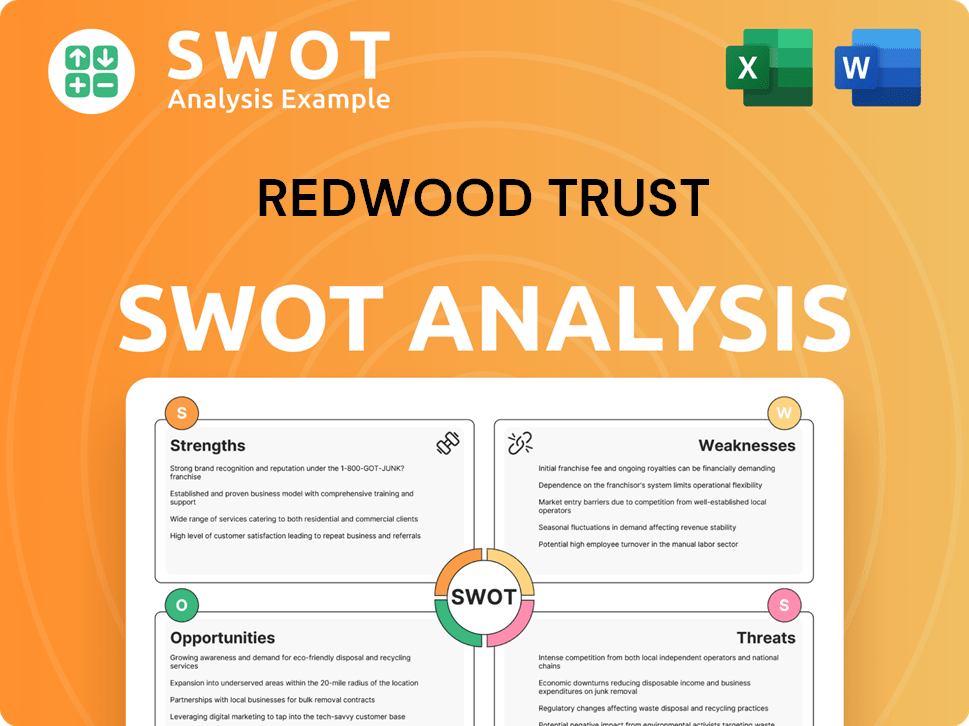

Redwood Trust SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Redwood Trust Invest in Innovation?

The innovation and technology strategy of Redwood Trust Company is designed to foster sustained growth and improve operational efficiency within the specialty finance sector. The company actively integrates digital transformation initiatives across its platforms, aiming to streamline processes, enhance data analytics, and improve the overall client experience. This approach highlights a commitment to leveraging technology to maintain a competitive edge in the market.

Redwood Trust's strategy often involves a combination of in-house development and strategic collaborations, though specific external partnerships are not always publicly detailed. The company focuses on using data-driven insights to optimize investment strategies and risk management frameworks. This includes using advanced analytics to assess credit quality, identify market trends, and make informed investment decisions in residential and commercial mortgage assets. Adoption of new platforms and technical capabilities directly supports growth objectives by enabling more efficient capital deployment and better asset performance.

While specific patents or industry awards are not frequently highlighted, Redwood Trust's consistent performance and adaptability in a complex market demonstrate its effective use of technology to maintain a competitive edge. The company's focus on technological advancement is a key component of its broader growth strategy, ensuring it can respond effectively to market changes and maintain its position as a leader in the mortgage REIT space. For more information about how the company operates, see Revenue Streams & Business Model of Redwood Trust.

Redwood Trust leverages data analytics to optimize investment strategies. This involves using data to assess credit quality, identify market trends, and make informed decisions in residential and commercial mortgage assets.

The company is committed to integrating digital transformation initiatives across its platforms. This includes streamlining processes and enhancing the overall client experience through technological advancements.

Redwood Trust's approach to innovation often involves in-house development. The company may also engage in strategic collaborations to enhance its technological capabilities.

Technology is used to enhance operational efficiency. This includes streamlining processes and improving data analytics to support better decision-making.

The effective use of technology helps Redwood Trust maintain a competitive edge. This is crucial for navigating the complexities of the market and ensuring long-term success.

Adoption of new platforms and technical capabilities directly contributes to growth objectives. This enables more efficient capital deployment and improved asset performance.

Redwood Trust's focus on innovation includes several key initiatives aimed at improving efficiency and performance. These initiatives are integral to the company's overall growth strategy.

- Data Analytics: Utilizing advanced analytics to assess credit quality and identify market trends.

- Platform Development: Investing in new platforms to improve capital deployment and asset performance.

- Process Automation: Streamlining processes to enhance operational efficiency.

- Client Experience: Improving the overall client experience through technological enhancements.

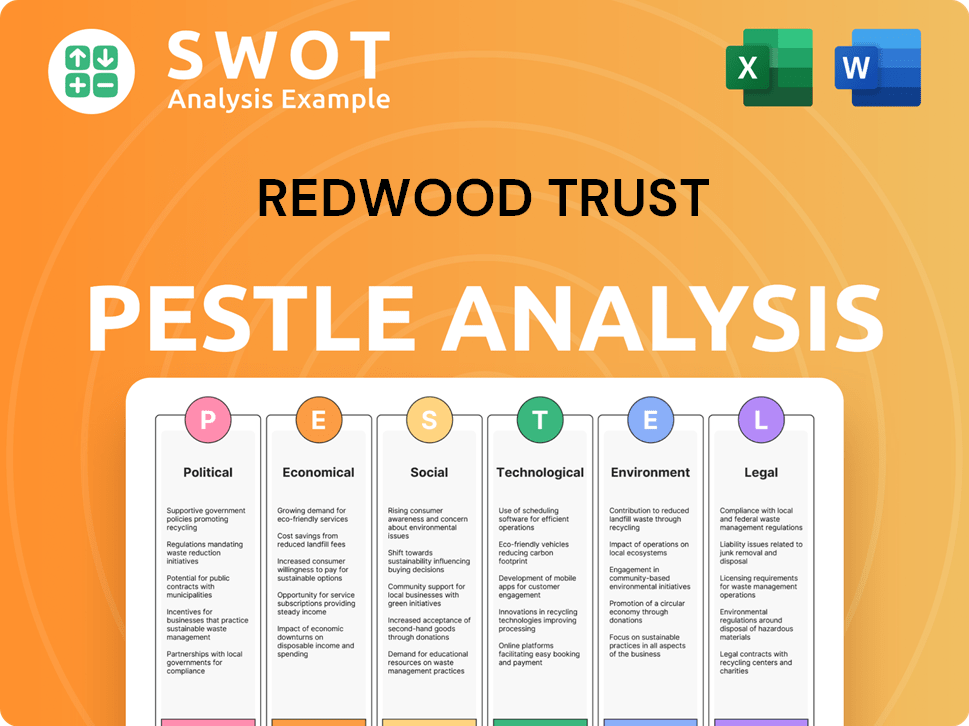

Redwood Trust PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Redwood Trust’s Growth Forecast?

The financial outlook for Redwood Trust Company is significantly influenced by its strategic focus on mortgage-related assets and its ability to adapt to market conditions. The company's performance is closely linked to the health of the housing market, fluctuations in interest rates, and broader economic trends. Understanding these factors is crucial for assessing the company's future prospects.

Recent reports indicate that Redwood Trust has shown resilience, although specific revenue targets and profit margin projections for 2024 and 2025 are typically detailed in their investor presentations and earnings calls. For example, in Q4 2023, Redwood Trust reported a GAAP net loss of $(0.09) per diluted common share, but a distributable earnings of $0.23 per diluted common share. This demonstrates the importance of looking at various performance metrics.

Analysts often track Redwood Trust's distributable earnings and dividend payouts as key indicators of its financial health and shareholder returns. The company's investments are primarily directed towards its residential and commercial mortgage portfolios, aiming to generate stable interest income and capital appreciation. For more details, consider reading Brief History of Redwood Trust.

Key financial metrics to watch include distributable earnings, which provide a clearer picture of the company's operational profitability. Dividend payouts are also crucial, as they reflect the company's commitment to returning value to shareholders. The company's ability to manage its portfolio and generate consistent income is a primary focus.

Redwood Trust's investment strategy centers on residential and commercial mortgage portfolios. The company aims to generate stable interest income and capital appreciation through these investments. This strategy is designed to capitalize on opportunities within the real estate market while managing risk effectively.

Managing interest rate risk and credit risk is a priority for Redwood Trust. The company employs various strategies to protect its financial performance against market volatility. Prudent risk management is essential for maintaining financial stability and delivering consistent returns.

Long-term financial goals include maintaining a strong capital position, optimizing the investment portfolio, and delivering shareholder value. The company aims to achieve these goals through consistent dividend payouts and prudent capital management. These objectives guide Redwood Trust's strategic decisions.

Analyzing Redwood Trust's financial performance involves evaluating several key areas. These include revenue generation from mortgage-related assets, the efficiency of capital allocation, and the effectiveness of risk management strategies. Key performance indicators (KPIs) such as distributable earnings and dividend yields are closely monitored by investors and analysts.

- Distributable Earnings: A critical metric for assessing operational profitability.

- Dividend Payouts: Reflects the company's commitment to shareholder returns.

- Portfolio Performance: The performance of residential and commercial mortgage portfolios.

- Interest Rate Risk Management: Strategies to mitigate the impact of interest rate fluctuations.

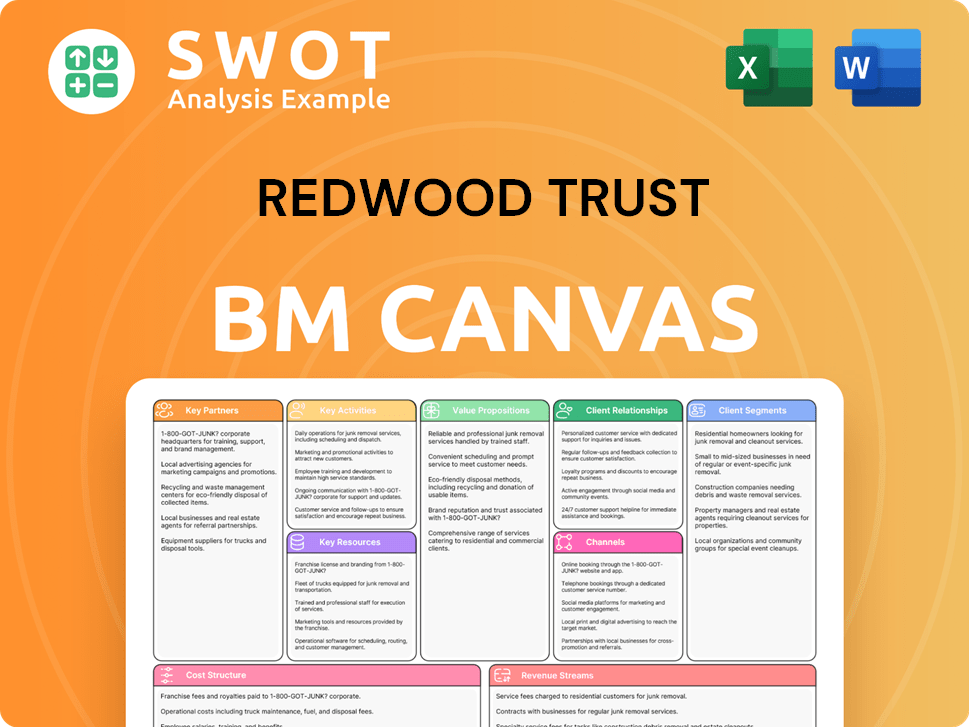

Redwood Trust Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Redwood Trust’s Growth?

The growth strategy of Redwood Trust Company faces several risks and obstacles that could influence its future trajectory. These challenges range from market competition and regulatory changes to technological disruptions and internal resource constraints. Understanding and proactively managing these risks is crucial for Redwood Trust to sustain its growth and maintain its market position.

Market competition presents a constant challenge, as numerous players compete in the specialty finance and mortgage investment sectors. Regulatory changes, particularly those affecting the mortgage market, securitization rules, or financial reporting standards, also pose a continuous risk. Moreover, shifts in interest rates can significantly impact the value of mortgage-related assets and the profitability of Redwood Trust's investments.

Emerging risks, such as sustained inflation, potential economic downturns, and shifts in consumer behavior towards housing, further complicate the landscape. The company's ability to navigate these challenges will be key to its long-term success and its ability to provide returns for its investors. For more information about the company, you can check out Owners & Shareholders of Redwood Trust.

The financial services industry, including the mortgage REIT sector, is highly competitive. Numerous established and emerging players compete for investment opportunities, which can squeeze profit margins. This competitive pressure necessitates continuous innovation and strategic adaptation to maintain a competitive edge.

Changes in regulations, particularly those affecting the mortgage market and securitization, present a significant risk. The company must comply with evolving rules and standards, which can increase operational costs and require strategic adjustments. Regulatory compliance is essential for maintaining operational integrity and investor confidence.

Fluctuations in interest rates can significantly impact the value of mortgage-related assets and the profitability of investments. Rising interest rates can decrease the value of existing mortgage portfolios. The company must manage interest rate risk through hedging strategies and careful asset selection.

While not directly involved in physical supply chains, disruptions in the housing market can indirectly affect mortgage origination volumes and property valuations. Economic downturns or shifts in construction activities can influence the demand for mortgages. The company must monitor broader economic trends.

The financial services sector is subject to technological disruption from fintech innovations and cybersecurity threats. Failure to adapt to new technologies or to adequately protect against cyber threats could negatively impact operations. Investing in robust technology and cybersecurity measures is crucial.

Attracting and retaining skilled talent in the competitive financial industry can be challenging. Resource constraints, including human capital, can hinder growth and operational efficiency. The company must invest in employee development and create an attractive work environment.

To mitigate these risks, Redwood Trust employs various strategies, including diversifying its investment portfolio across different asset classes and segments of the mortgage market. The company uses robust risk management frameworks, such as credit risk assessment, interest rate hedging, and liquidity management. These measures are designed to protect against potential negative impacts from market volatility and economic downturns.

Emerging risks include sustained inflation, potential economic downturns, and shifts in consumer behavior towards housing. These factors could shape the future trajectory of Redwood Trust and require ongoing strategic adjustments. The company must monitor these trends and adapt its strategies to maintain its financial performance. As of early 2024, the Federal Reserve's actions regarding interest rates and inflation continue to be a key focus for financial institutions.

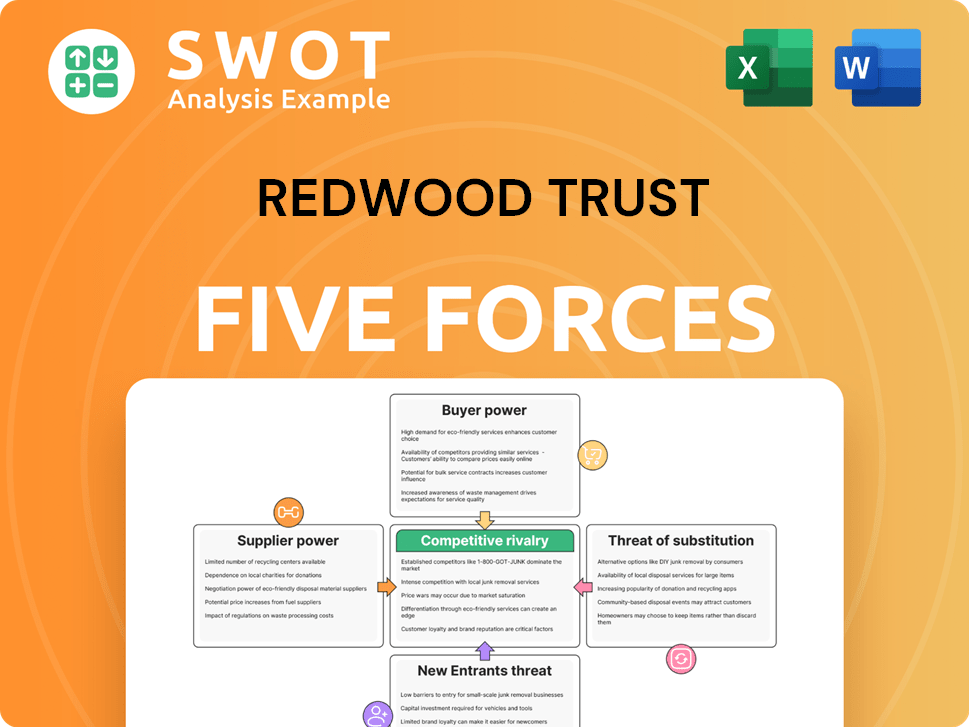

Redwood Trust Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Redwood Trust Company?

- What is Competitive Landscape of Redwood Trust Company?

- How Does Redwood Trust Company Work?

- What is Sales and Marketing Strategy of Redwood Trust Company?

- What is Brief History of Redwood Trust Company?

- Who Owns Redwood Trust Company?

- What is Customer Demographics and Target Market of Redwood Trust Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.