Redwood Trust Bundle

Unlocking the Secrets of Redwood Trust Company: How Does It Thrive?

Redwood Trust, Inc. (NYSE: RWT) is a key player in the U.S. housing market, but how does this specialty finance company actually operate and generate returns? From expanding access to housing to navigating complex financial landscapes, Redwood Trust's influence is significant. Its recent financial performance, including a GAAP net income of $14.4 million for Q1 2025, showcases its strategic prowess.

Delving into Redwood Trust's operations is essential for anyone interested in Redwood Trust SWOT Analysis, mortgage finance, or real estate investment. As a Mortgage REIT, Redwood Trust plays a crucial role in providing liquidity to the housing market, making it a compelling subject for investors and industry professionals alike. Understanding the company's investment strategy, its portfolio, and its ability to adapt to market changes will provide valuable insights into its long-term potential and how to invest in Redwood Trust Company. The company's consistent dividend payments for 31 years further enhance its appeal to income-focused investors, making it an interesting case study in the financial world.

What Are the Key Operations Driving Redwood Trust’s Success?

Redwood Trust Company (RWT) generates and delivers value through its strategic focus on housing credit investments. The company primarily operates across three key segments: Sequoia Mortgage Banking, CoreVest Mortgage Banking, and Redwood Investments. This structure allows RWT to engage in various aspects of the mortgage finance market, from loan origination to investment and securitization, providing a diversified approach to real estate investment.

The company's operations are enhanced by its 'REIT over TRS' business structure, offering flexibility and tax efficiency. Furthermore, Redwood Trust has cultivated an extensive network of banking relationships, which stood at 118 partnerships by the end of 2024. This network is crucial for sourcing loans and potentially benefiting from future mortgage asset sales by banks, significantly contributing to the company's operational efficiency and market reach.

The company's approach to the market is multifaceted, with each segment playing a crucial role in its overall strategy. Understanding the intricacies of each segment is key to grasping how Redwood Trust creates value and navigates the complexities of the mortgage REIT landscape. To learn more about their approach, consider exploring the Growth Strategy of Redwood Trust.

The Sequoia Mortgage Banking segment acts as a mortgage loan conduit, acquiring residential consumer loans from third-party originators. This segment focuses on selling these loans to whole loan buyers and securitization. In Q1 2025, Sequoia locked $4.0 billion of loans, a 73% increase from the previous quarter. The gain on sale margin reached 123 basis points, surpassing its historical target.

CoreVest Mortgage Banking specializes in originating residential investor loans for securitization, sale, or transfer into Redwood Investments' portfolio. In Q1 2025, CoreVest funded $482 million of loans, a 48% increase year-over-year. This segment includes bridge and term loans, with term loan volume increasing by 43% to $227 million in Q4 2024.

The Redwood Investments segment encompasses organic investments sourced through mortgage banking operations. This includes securities retained from Sequoia and CoreVest securitizations. The net income for this segment significantly increased to $22.9 million in Q1 2025, up from $2.8 million in Q4 2024. This segment is crucial for generating returns from the company's portfolio.

Redwood Trust utilizes a 'REIT over TRS' business structure, which provides flexibility and tax efficiency. Its extensive network of banking relationships, which grew to 118 partnerships by the end of 2024, is vital for sourcing loans. The company's strategy also includes direct origination through Aspire, expanding its offerings to include alternative loan products.

Redwood Trust's value proposition is built on its ability to generate returns through diversified mortgage investments. The company's operational segments work together to create a robust cycle of loan origination, securitization, and investment. This integrated approach enables RWT to adapt to market changes and capitalize on opportunities in the mortgage finance sector.

- Diversified Investment Strategy: Spreads risk across different types of mortgage loans and investment strategies.

- Operational Efficiency: Streamlined processes through its mortgage banking segments.

- Strong Banking Relationships: Provides access to a consistent flow of loan opportunities.

- Strategic Business Structure: 'REIT over TRS' structure for flexibility and tax efficiency.

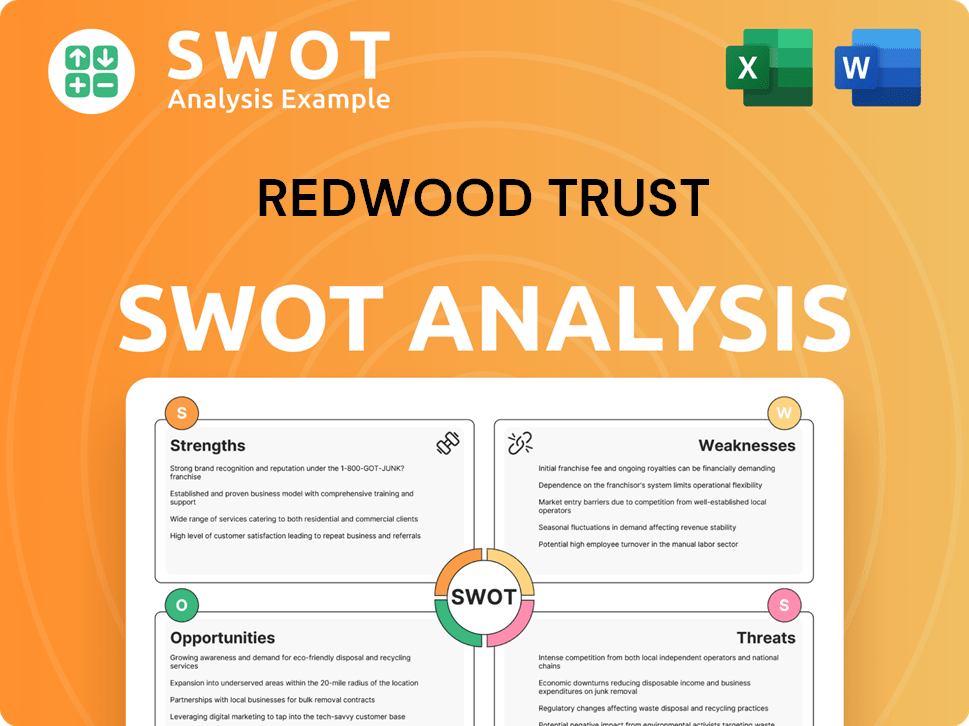

Redwood Trust SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Redwood Trust Make Money?

The revenue streams and monetization strategies of Redwood Trust Company (Redwood Trust) are multifaceted, primarily stemming from its activities in the mortgage finance sector. As a mortgage REIT, Redwood Trust generates income through various channels, including loan originations, securitizations, and investments. The company's financial performance reflects its strategic approach to navigating the real estate investment landscape.

Redwood Trust's financial health is significantly influenced by its ability to generate revenue across its key segments. Understanding these revenue streams and monetization strategies is crucial for investors and analysts assessing the company's overall financial performance and investment potential. The company's operational model, including its venture investing initiative, further diversifies its revenue sources.

For the first quarter of 2025, Redwood Trust reported total revenue of $71.6 million. This represents a 4.0% decrease from Q1 2024. Net income for Q1 2025 was $14.3 million, a decrease of 47% compared to the same period in 2024. The company's adjusted revenue for Q1 2025 was $27.9 million. The trailing 12-month revenue as of March 31, 2025, was $256 million.

Redwood Trust's revenue generation is primarily driven by its operations in the mortgage market. The company's strategy includes a combination of loan origination, securitization, and investment activities. The company's ability to adapt and innovate within the mortgage finance sector is crucial for its financial performance.

- Sequoia Mortgage Banking: This segment contributes significantly through loan originations and securitizations. In Q1 2025, it reported a net income of $25.8 million and a 28% annualized GAAP Return on Equity (ROE).

- CoreVest Mortgage Banking: This segment focuses on providing financing solutions. In Q1 2025, it generated a GAAP net income of $1.3 million and a 20% annualized non-GAAP EAD ROE.

- Redwood Investments: This segment focuses on investments and recorded a net income of $22.9 million in Q1 2025.

- Securitization and Whole-Loan Distribution: Redwood Trust distributes approximately $520 million of loans across its operating platforms through securitizations, whole loan sales, and sales to joint ventures.

- RWT Horizons: This venture investing initiative invests in early-stage companies aligned with its operating platforms.

- Dividend Policy: Redwood Trust has a regular quarterly dividend of $0.18 per common share for Q1 2025, marking its 103rd consecutive quarterly common dividend. This demonstrates the company's commitment to returning value to its shareholders. You can learn more about the Marketing Strategy of Redwood Trust to understand how the company positions itself in the market.

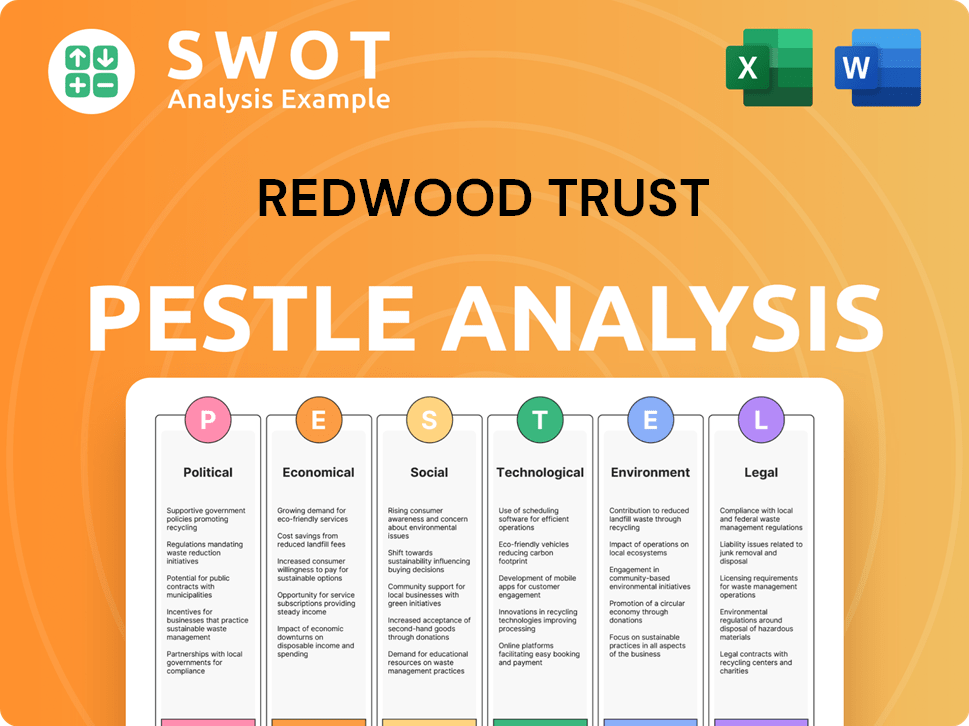

Redwood Trust PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Redwood Trust’s Business Model?

Redwood Trust Company (RWT) has strategically navigated the mortgage and real estate investment landscape, achieving significant milestones and adapting to market dynamics. The company's focus on innovation and strategic partnerships has been key to its performance. A significant move in early 2025 was the expansion of its home equity platform, Aspire, to include alternative loan products, demonstrating its responsiveness to evolving consumer needs.

The company's financial performance reflects its ability to adapt to market challenges. Despite facing volatility in the mortgage market, Redwood Trust has shown resilience, transitioning from a net loss in Q4 2024 to a GAAP net income of $14.4 million in Q1 2025. This showcases the effectiveness of its strategic initiatives and operational adjustments.

Redwood Trust has a strong position in the non-agency residential mortgage market. Its ability to adapt to new trends and technology shifts, with a strategic focus on growing market share and enhancing earnings power through strategic bank relationships and innovative new loan products. The company also invests in early-stage companies with a direct nexus to its operating platforms through RWT Horizons.

Redwood Trust expanded its home equity platform, Aspire, in early 2025 to include alternative loan products. The company updated the branding of its residential consumer operating platform to Sequoia. These moves reflect the company's focus on meeting evolving consumer needs and solidifying its market position as a leading non-bank distributor of jumbo loans.

The company has focused on building strong banking relationships, with 118 partnerships by the end of 2024. Redwood Trust has also demonstrated its adaptability by transitioning from a net loss to GAAP net income in Q1 2025. These strategic moves highlight its ability to navigate market challenges and capitalize on opportunities.

Redwood Trust has a strong position in the non-agency residential mortgage market. The company's flexible 'REIT over TRS' business structure provides a competitive advantage. Excellent lock volumes in its Sequoia mortgage banking platform, with $4.0 billion of loans locked in Q1 2025, demonstrate its operational strength. To understand the company's target market, you can read more here: Target Market of Redwood Trust.

Redwood Trust reported a GAAP net income of $14.4 million in Q1 2025, showcasing its resilience. The company's strong lock volumes in its Sequoia mortgage banking platform, with $4.0 billion of loans locked in Q1 2025, indicate robust operational performance. These figures reflect the company's ability to manage market volatility and maintain profitability.

Redwood Trust has demonstrated strategic agility and financial resilience in the mortgage and real estate investment sectors. The company's expansion of its home equity platform and its ability to transition to profitability highlight its adaptability.

- Strategic expansion of the home equity platform.

- Strong banking relationships with 118 partnerships by the end of 2024.

- Transition from net loss to GAAP net income in Q1 2025.

- Excellent lock volumes in its Sequoia mortgage banking platform, with $4.0 billion of loans locked in Q1 2025.

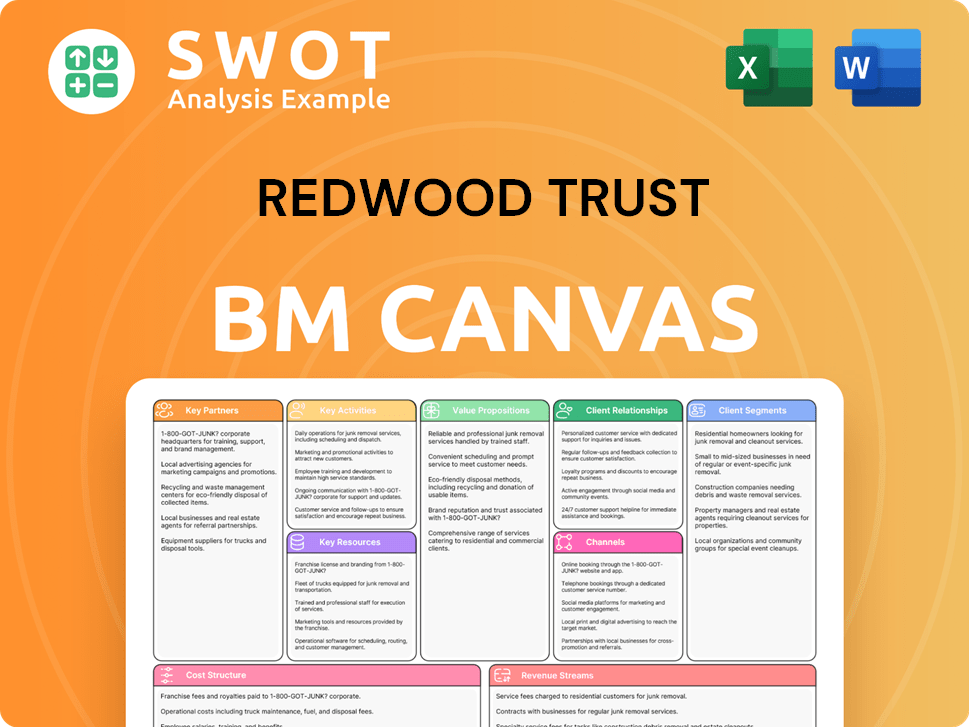

Redwood Trust Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Redwood Trust Positioning Itself for Continued Success?

Redwood Trust Company operates as a specialty finance company within the mortgage REIT sector, focusing on areas of housing credit not well-served by government programs. As of April 14, 2025, the company's market capitalization was approximately $0.85 billion. This positions Redwood Trust in the non-agency residential mortgage market, where it has established a notable presence.

The company has a history of consistent dividend payments, demonstrating a commitment to shareholder returns. However, it faces risks from market volatility and potential spread widening in the mortgage market. Analysts project a decline in revenue over the next three years, presenting a challenge compared to the broader industry's growth expectations.

Redwood Trust Company (RWT) holds a strong position in the non-agency residential mortgage market. Its focus on areas not covered by government programs differentiates it from other mortgage REITs. The company's market cap, as of April 2025, was around $0.85 billion.

Key risks include market volatility and potential widening spreads in the mortgage market. Challenges also arise from its legacy bridge loan portfolio. Revenue projections indicate a decline, contrasting with the broader industry's growth.

Redwood Trust aims to achieve an annualized Earnings Available for Distribution (EAD) return on equity (ROE) of 9% to 12% by the end of 2025. Strategic initiatives include partnerships and capital allocation towards operating platforms. The company plans to increase consumer loan volumes.

The company is focusing on expanding its Aspire platform and strengthening its Sequoia brand. The goal is to provide flexible financing solutions and solidify its position in the jumbo loan market. Redwood Trust plans to strategically rotate $200-$225 million from third-party investments into its operating businesses.

Redwood Trust is targeting an EAD ROE between 9% and 12% by the end of 2025, up from 7% in Q1 2025. The company plans to increase consumer loan volumes by 30%. Strategic partnerships and capital allocation are key to achieving its financial targets.

- The company is rotating capital into its operating businesses.

- Focus on the expansion of the Aspire platform.

- Emphasis on strengthening the Sequoia brand.

- Increase in consumer loan volumes.

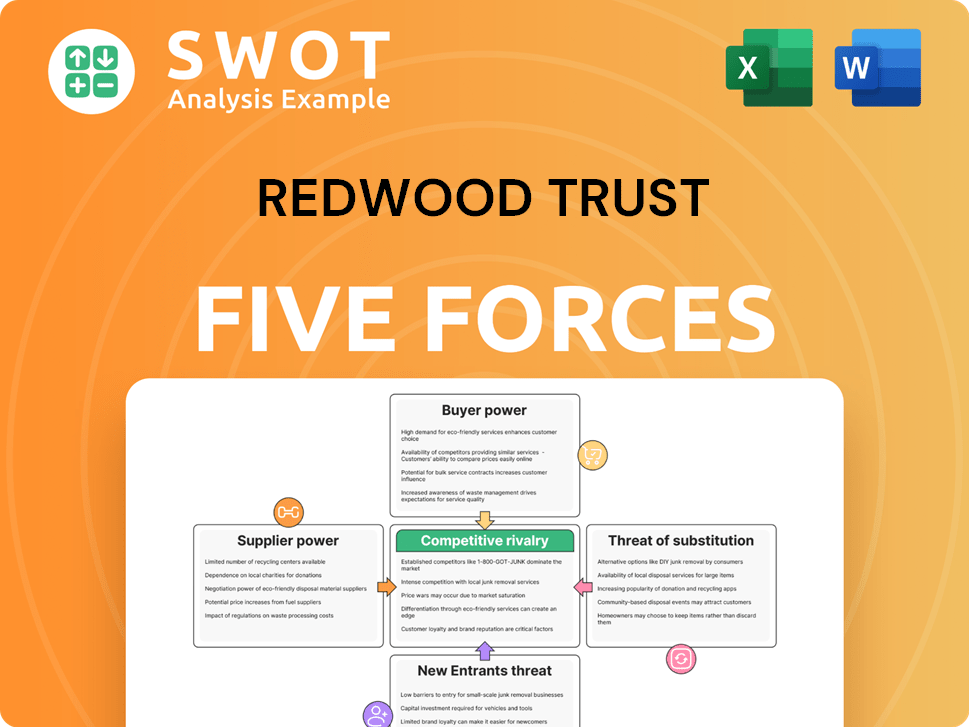

Redwood Trust Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Redwood Trust Company?

- What is Competitive Landscape of Redwood Trust Company?

- What is Growth Strategy and Future Prospects of Redwood Trust Company?

- What is Sales and Marketing Strategy of Redwood Trust Company?

- What is Brief History of Redwood Trust Company?

- Who Owns Redwood Trust Company?

- What is Customer Demographics and Target Market of Redwood Trust Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.