Redwood Trust Bundle

How Does Redwood Trust Thrive in Today's Mortgage Market?

Founded in 1994, Redwood Trust (NYSE: RWT) has consistently adapted to the ever-changing financial landscape. From its early focus on mortgage asset management, the company has evolved into a leader in expanding housing access. This evolution is a testament to its dynamic sales and marketing strategies, which have been crucial to its success.

This analysis delves into the specifics of the Redwood Trust SWOT Analysis, exploring how this specialty finance company currently reaches its customers and the marketing tactics it employs. Understanding Redwood Trust's sales strategy and how it positions itself in the competitive mortgage finance market is key. We'll examine its diverse sales channels and dissect its key marketing strategies, offering insights into its brand identity and recent campaigns within the financial services marketing sector.

How Does Redwood Trust Reach Its Customers?

The sales channels of Redwood Trust are multifaceted, focusing on its mortgage banking segments and strategic partnerships. These channels facilitate the acquisition, securitization, and management of mortgage loans and related investments. This approach is critical for the company’s mortgage finance operations and overall real estate investment strategy.

The company operates through three main segments: Sequoia Mortgage Banking, CoreVest Mortgage Banking, and Redwood Investments. These segments are key to how Redwood Trust markets its services and manages its financial services marketing efforts. The mortgage loan conduit within the Sequoia Mortgage Banking segment is a core channel, acquiring residential loans from third-party originators.

Redwood Trust's sales strategy involves a mix of securitizations, whole loan sales, and sales to joint ventures. The company has actively expanded its distribution channels to reach a broader customer base. This expansion is part of the Growth Strategy of Redwood Trust, focusing on improved financial performance.

The Sequoia Mortgage Banking segment acquires residential loans from third-party originators. These loans are then sold to whole loan buyers, securitized through the SEMT program, or transferred into its investment portfolio. This channel is crucial for the company’s mortgage-backed securities offerings.

The CoreVest Mortgage Banking segment originates business-purpose lending loans. These loans are subsequently securitized, sold, or transferred. This segment contributes significantly to Redwood Trust's overall financial performance analysis.

Redwood Trust distributed approximately $547 million of loans through securitizations, whole loan sales, and sales to joint ventures in Q4 2024. In Q1 2025, approximately $520 million in loans were sold through similar channels. These figures highlight the company’s sales and marketing plan.

By the end of 2024, Redwood Trust had expanded its banking relationships to 118 partners. The company locked $3.8 billion of loans with banks in 2024. This expansion is a key element of Redwood Trust's customer acquisition strategies.

Redwood Trust has launched new expanded loan programs through Aspire, which directly originates home equity investment options and purchases expanded home loan products. The company focuses on migrating capital towards its operating platforms to execute business plans and grow its earnings profile.

- Focus on expanding banking partnerships to increase mortgage asset sales.

- Direct origination of home equity investment options through Aspire.

- Strategic allocation of capital to support operational growth.

- Emphasis on growing the earnings profile through strategic initiatives.

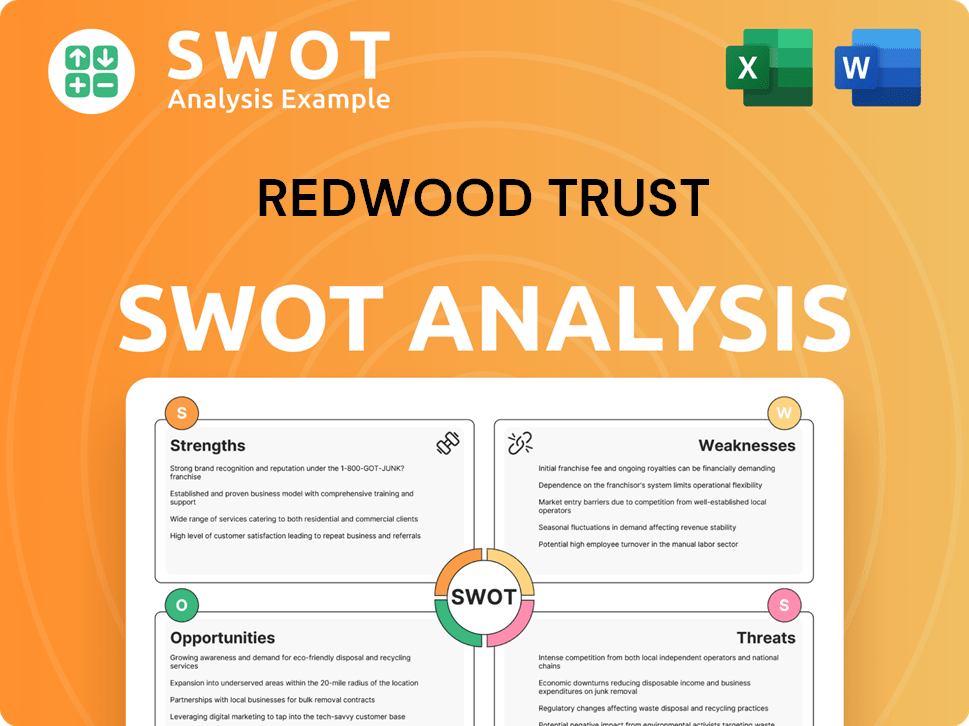

Redwood Trust SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Redwood Trust Use?

The marketing tactics of Redwood Trust are primarily designed to build awareness and generate leads within the specialized finance and housing credit sectors. Their approach is heavily focused on sophisticated investors and institutional partners. The company's strategy is deeply integrated with its investor relations activities, emphasizing transparency and detailed financial reporting.

Given its business-to-business and institutional focus, Redwood Trust de-emphasizes traditional consumer advertising. Instead, they prioritize digital tactics to reach their target audience. The company leverages its corporate website as a central hub for investor relations, providing access to essential information such as SEC filings and press releases. This online presence is critical for reaching financially-literate decision-makers.

Redwood Trust's marketing mix has evolved to reflect its strategic partnerships and innovative loan products. Their marketing efforts focus on 'strategic bank relationships and innovative new loan products,' which is a core part of their market penetration strategy. They actively communicate their commitment to 'providing critical liquidity to the housing finance market and supporting our partners and shareholders.'

Redwood Trust's investor relations strategy is central to its marketing efforts. They regularly release financial results, shareholder letters, and investor presentations. These communications serve as key tools to inform and attract investors, showcasing the company's financial performance.

Digital tactics are crucial for Redwood Trust, with the corporate website serving as a central hub for investor relations. They utilize platforms like LinkedIn for professional networking and disseminating news. Email alerts are also provided for interested parties, ensuring consistent communication.

The company focuses on 'strategic bank relationships and innovative new loan products' as part of its market penetration strategy. This approach is designed to provide critical liquidity to the housing finance market. This commitment supports partners and shareholders.

While specific details on technology platforms are not publicly detailed, their consistent financial reporting and investor presentations suggest a data-driven approach in their outreach to current and prospective investors. This approach likely informs their Redwood Trust sales strategy.

Key communication tools include regular financial result releases, shareholder letters, and investor presentations. These tools provide comprehensive data to the market. For example, Q1 2025 financial results were reported on April 30, 2025, and Q4 2024 results on February 13, 2025.

The target audience includes financially-literate decision-makers such as individual investors, financial professionals, business strategists, and academic stakeholders. The company's marketing efforts are designed to reach this specific group.

Redwood Trust's marketing strategy centers on investor relations, digital platforms, and strategic partnerships. Their approach is tailored to a sophisticated audience within the mortgage finance and real estate investment sectors. The company's focus on transparency and detailed financial reporting supports its overall marketing and sales efforts.

- Investor Relations: Regular financial reports, shareholder letters, and presentations.

- Digital Presence: Corporate website, LinkedIn, and email alerts.

- Strategic Partnerships: Focus on bank relationships and innovative loan products.

- Data-Driven Approach: Consistent financial reporting suggests a data-driven approach.

- Target Audience: Financially-literate decision-makers and institutional partners.

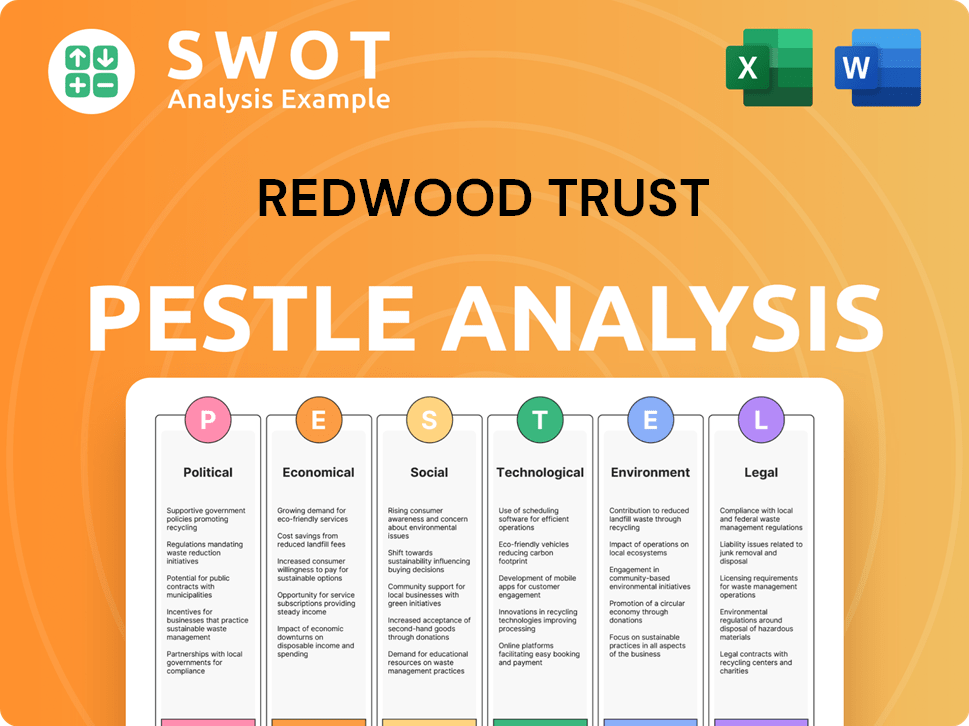

Redwood Trust PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Redwood Trust Positioned in the Market?

Redwood Trust positions itself as a leading specialty finance company, primarily focusing on expanding access to housing within the U.S. market. Its brand identity is rooted in innovation, expertise, and a commitment to quality within the housing finance sector. The company's long-standing presence, dating back to 1995, and its ability to navigate various market cycles, have built a strong reputation.

The company differentiates itself through its specific focus on credit-sensitive investments and its unique position within the housing finance value chain. The core message revolves around providing customized housing credit investments to a diverse investor base through various platforms. This approach is reflected in its professional, reliable, and transparent communication, essential in the highly regulated financial industry.

The company's appeal to its target audience, which includes financially-literate decision-makers, is driven by its focus on providing attractive returns through a stable stream of earnings and dividends. For example, in Q1 2025, Redwood Trust reported a GAAP net income of $14.4 million, or $0.10 per share, and declared a regular quarterly dividend of $0.18 per common share. This focus on consistent financial performance is a key element of its brand positioning.

The Redwood Trust sales strategy focuses on delivering customized housing credit investments to a diverse investor base. This involves leveraging securitization platforms and whole-loan distribution activities. The company also utilizes publicly traded shares to reach its target audience. This approach allows it to connect with a wide range of investors.

The Redwood Trust marketing strategy emphasizes transparency and reliability, reflecting its role in the financial industry. The company communicates its value through investor materials and official communications. The focus is on highlighting consistent financial performance and shareholder value. The Growth Strategy of Redwood Trust provides more detailed insights.

Redwood Trust differentiates itself through its unique position in the housing finance value chain. It focuses on credit-sensitive investments, setting it apart from competitors. The 'REIT over TRS' business structure provides tax efficiency and operational flexibility. These elements contribute to its distinct market position.

In Q1 2025, Redwood Trust reported a GAAP net income of $14.4 million. Analysts project a stable outlook for earnings per share (EPS) in 2025, with estimates of $0.80. A projected year-over-year increase of 45% in Earnings Available for Distribution (EAD) for 2025 is expected. These figures highlight the company's financial stability.

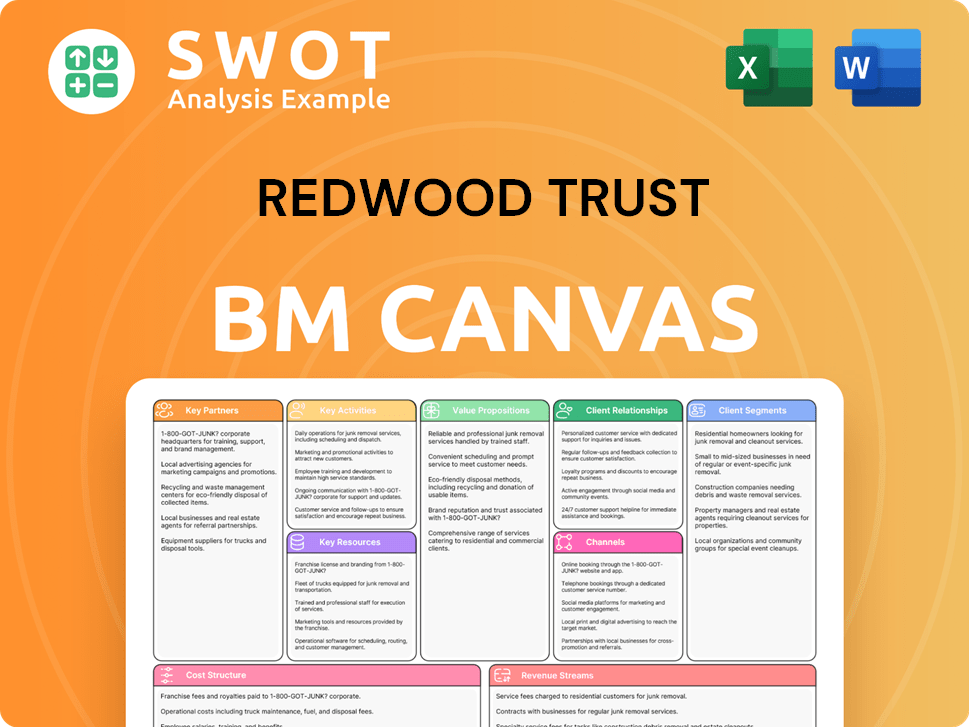

Redwood Trust Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Redwood Trust’s Most Notable Campaigns?

The sales and marketing strategy of the [Company Name] focuses on strategic initiatives and partnerships rather than traditional advertising. These 'key campaigns' aim to strengthen market presence, drive growth, and communicate value to investors and partners. The core of the strategy involves deploying capital, expanding distribution channels, and innovating in mortgage products.

A primary element of the [Company Name] sales strategy is securing and leveraging strategic partnerships to enhance financing capacity and expand its operational platforms. The company's marketing efforts are primarily directed toward investors, highlighting financial performance and strategic achievements through press releases, investor presentations, and earnings reports. These communications are crucial for maintaining investor confidence and attracting further investment.

The company's approach to marketing and sales is tailored to the specialty finance sector, emphasizing relationship-building and financial innovation to achieve its strategic goals. The success of these campaigns is measured by increased earnings, expanded market share, and the ability to meet the evolving needs of the mortgage finance market. This includes a focus on mortgage-backed securities and real estate investment.

In March 2024, [Company Name] announced a US$750 million strategic capital partnership with Canada Pension Plan Investment Board (CPP Investments). The goal was to boost financing capacity and support the growth of its operating platforms. This initiative aimed to facilitate over US$4 billion in total asset acquisitions, signaling an evolving investment approach.

The company consistently works to deepen its distribution channels and expand banking relationships. This effort has resulted in establishing connections with 118 banking partners and locking $3.8 billion of loans with banks in 2024. This initiative aims to capitalize on potential future mortgage asset sales from banks and enhance market share. This is vital for driving operational scale.

The formal launch of new expanded loan programs through Aspire represents a key product-focused 'campaign.' This initiative aims to directly originate home equity investment options and purchase expanded home loan products from mortgage originators. This reflects the company's ongoing innovation in loan products to meet evolving market needs.

The company communicates its progress through quarterly earnings reports and investor calls. For instance, in Q4 2024, $547 million of loans were sold through securitizations, whole loan sales, and JVs. In Q1 2025, approximately $520 million in loans were sold. These efforts are critical for driving operational scale and enhancing earnings power.

The partnership with CPP Investments is a key example of how [Company Name] uses strategic alliances to fuel growth. These partnerships provide the financial backing needed for expansion and are a core element of the company's investment strategies. This approach is crucial for long-term success.

Regular communication with investors, including quarterly reports and calls, is essential for maintaining trust and transparency. These communications highlight financial performance and strategic achievements, which is a key aspect of the company's investor relations overview. These efforts are crucial for attracting and retaining investors.

The launch of new loan programs through Aspire demonstrates the company's commitment to product innovation. This initiative allows [Company Name] to meet evolving market needs and expand its product offerings, which is a key component of its business model. This focus on innovation is central to its competitive strategy.

While specific details about the sales team structure are not extensively publicized, the focus on partnerships and banking relationships suggests a relationship-driven sales approach. The sales team likely focuses on building and maintaining strong relationships with financial institutions and investors. This approach is crucial for success.

The company's financial performance is a key indicator of the effectiveness of its sales and marketing strategies. The successful deployment of capital and the generation of earnings streams for shareholders are primary measures of success. For more details, take a look at the Owners & Shareholders of Redwood Trust.

The company's efforts to expand its distribution channels and banking relationships are aimed at increasing market share. The competitive landscape in the mortgage finance industry is dynamic, and the company's strategy is designed to position it favorably within this environment. The company's success depends on its ability to adapt.

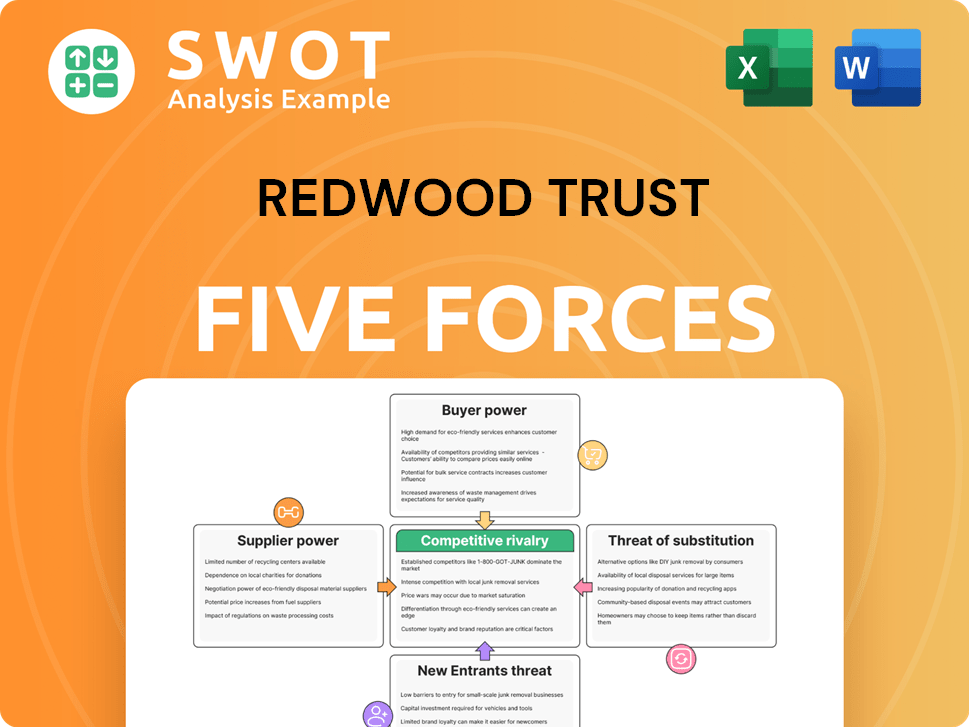

Redwood Trust Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Redwood Trust Company?

- What is Competitive Landscape of Redwood Trust Company?

- What is Growth Strategy and Future Prospects of Redwood Trust Company?

- How Does Redwood Trust Company Work?

- What is Brief History of Redwood Trust Company?

- Who Owns Redwood Trust Company?

- What is Customer Demographics and Target Market of Redwood Trust Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.