Sharp Bundle

Can Sharp Corporation Thrive in Tomorrow's Tech Landscape?

Sharp Corporation, a titan of innovation since 1912, stands at a pivotal juncture. From pioneering the Ever-Ready Sharp mechanical pencil to shaping the modern electronics era, Sharp's journey reflects a relentless pursuit of ingenuity. This exploration delves into Sharp's Sharp SWOT Analysis, examining its path forward amidst fierce competition and rapid technological advancements.

Understanding Sharp's growth strategy is crucial for investors, analysts, and anyone tracking the future of consumer electronics. This analysis will dissect Sharp's market analysis, including its expansion plans and investments in research and development, to uncover its competitive advantages. We'll also explore how Sharp is adapting to market changes and its potential for sustainable growth, providing insights into the company's financial performance and outlook.

How Is Sharp Expanding Its Reach?

The expansion initiatives of Sharp Corporation are primarily focused on strategic restructuring, entering new business areas, and reinforcing its brand segments. A key aspect of this strategy involves 'Asset Light Initiatives,' which include divesting non-core assets and streamlining operations. This approach aims to improve efficiency and focus on high-growth sectors.

Sharp's strategic shifts are also driven by market dynamics and technological advancements. The company is repurposing its facilities, such as the Sakai plant, into AI data centers, demonstrating its adaptability. Simultaneously, Sharp is actively pursuing new opportunities in smart office solutions and consumer electronics, indicating a multifaceted growth strategy.

The company's restructuring efforts, including the closure of LCD panel production at the Sakai plant in 2024, reflect a strategic realignment. These changes are part of a broader plan to optimize resources and capitalize on emerging market trends. For a deeper understanding of the competitive landscape, you can read about Competitors Landscape of Sharp.

Sharp is undergoing significant restructuring, including divesting non-core assets. This involves streamlining operations to focus on more profitable areas. These actions aim to improve financial performance and adapt to market changes, as part of its overall Sharp growth strategy.

The company is entering new business areas, such as AI data centers. This move is a strategic shift towards high-growth technology sectors, aiming to diversify its revenue streams. The repurposing of existing facilities shows Sharp's innovation and adaptability.

Sharp is reinforcing its brand segments, particularly in smart office and consumer electronics. This includes introducing new products and services to meet evolving consumer demands. These efforts are crucial for sustaining long-term growth and market share.

In Q4 2025, Sharp reported extraordinary losses due to restructuring, including impairment losses of ¥30,193 million and business restructuring expenses of ¥18,518 million. Despite these challenges, the company is focused on long-term profitability. These financial adjustments are part of its strategic realignment.

Sharp is actively adapting to market changes, as seen in its expansion plans in the healthcare sector. The company's focus on smart office solutions and consumer electronics is driving sales growth. The Smart Office segment saw a 9% increase in sales to ¥163.8 billion in the third quarter of fiscal 2024.

- The cessation of large LCD panel production at the Sakai plant in 2024.

- Repurposing the Sakai facility into an AI data center.

- Introduction of new products like the AQUOS R10 and AQUOS wish5 smartphones in May 2025.

- Exiting the European solar market on March 31, 2025, while maintaining customer service.

Sharp SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Sharp Invest in Innovation?

The innovation and technology strategy of Sharp is deeply rooted in its 'Be Original' motto. This philosophy emphasizes sincerity and creativity, driving the company to continuously create new value. This approach is central to understanding the Sharp growth strategy.

Sharp focuses on leveraging cutting-edge technologies and investing in research and development (R&D) to drive sustained growth. This commitment is evident in their diverse product offerings and their proactive approach to market changes. Analyzing Sharp market analysis reveals a company consistently adapting to evolving consumer needs.

The company's approach to digital transformation includes developing AIoT (Artificial Intelligence of Things) cloud services. This is exemplified by products like refrigerators that suggest recipes and air conditioners that optimize energy efficiency based on weather data. These initiatives highlight Sharp's business prospects in the smart home market.

R&D expenditures, while experiencing a cumulative decline, remain a key focus. From 2020 to 2024, there was a 27.4% decrease in R&D spending. Despite this, Sharp continues to invest strategically in key areas to maintain its competitive edge.

Sharp is developing AIoT cloud services, integrating AI into everyday appliances. Products like smart refrigerators and air conditioners showcase the company's commitment to enhancing user experience and energy efficiency. This focus aligns with Sharp's growth strategy in the smart home market.

Sharp is known for its innovations in display technology, including LCDs and 8K professional displays. Recent product launches, such as the Advanced Color ePaper (ACeP) displays, demonstrate a commitment to advancing display capabilities. The future of Sharp's display technology looks promising.

Venturing into new fields, Sharp is exploring opportunities within the EV ecosystem. This expansion indicates a proactive approach to diversify its portfolio and tap into emerging market trends. This move is a part of Sharp's expansion plans in the healthcare sector.

Sharp continues to innovate in office solutions, with digital MFPs passing 'Device Penetration Testing' in February 2025. The focus on high-end PCs and lifecycle management services reflects a commitment to providing comprehensive business solutions. This illustrates Sharp's competitive advantages in the industry.

Sustainability initiatives are highlighted by the showcasing of new Sharp-branded products with reduced energy consumption. The award-winning Sharp ePaper Display at ISE 2025 underscores the company's commitment to environmental responsibility. This is one of Sharp's strategies for sustainable growth.

Sharp's innovation strategy encompasses various technologies and products. From AIoT cloud services to advanced display technologies and office solutions, the company is diversifying its offerings. These initiatives are integral to understanding what are Sharp's key products and services.

- AIoT Cloud Services: Development of smart appliances and services.

- Display Technology: Innovations in LCDs, 8K displays, and ePaper.

- Office Solutions: Digital MFPs, high-end PCs, and lifecycle management.

- EV Ecosystem: Expanding into the EV market.

- Sustainability: Focus on energy-efficient products.

Sharp PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Sharp’s Growth Forecast?

The financial outlook for Sharp Corporation reveals a significant shift, with a projected return to profitability for fiscal year 2024, ending March 31, 2025. This positive trajectory follows two years of operating and net losses, indicating a successful implementation of strategic reforms and initiatives. The company's consolidated operating profit is expected to reach approximately ¥5 billion in fiscal 2024, a substantial improvement from the ¥35 billion operating loss recorded in fiscal 2023. This recovery is a testament to the effectiveness of structural reforms and asset-light strategies.

Despite a decline in total net sales in 2024, with overseas sales dropping to ¥1,548,953 million, Sharp's financial position is showing signs of stabilization. The company's net assets and total assets experienced significant declines in 2023 and 2024, with net assets falling to USD 157,424 million in 2024 and total assets to USD 1,590,032 million. However, the financial health of the company is improving. The company's cash and cash equivalents increased to ¥219,128 million in 2024, up ¥12,515 million from the previous year, and operating cash flow surged to ¥124,495 million in 2024, up from ¥14,746 million in 2023. These figures highlight the company's ability to manage its finances effectively and generate positive cash flow.

For the fiscal year ended March 31, 2025, Sharp reported consolidated net sales of 2,160,146 million yen and a net income of 36,095 million yen. The company is actively pursuing measures to strengthen its financial structure. These include the strategic use of proceeds from asset sales, such as the camera module business to Foxconn and part of the Sakai plant to Sekisui Chemical Co. Ltd., to reduce debt. Furthermore, Sharp has unveiled its Medium-Term Management Plan for FY2025-2027, outlining its Sharp growth strategy and future plans for sustained expansion.

Sharp's financial performance in fiscal year 2024 shows a positive trend. The company's return to profitability is a key indicator of its successful restructuring efforts. The increase in operating profit, coupled with improvements in cash flow, demonstrates the company's ability to adapt to market changes and improve its financial stability. The company's Sharp market analysis indicates that the company is moving in the right direction.

The company's strategic initiatives, including structural reforms in the Device Business and Asset Light Initiatives, have played a crucial role in its financial recovery. The focus on streamlining operations and reducing costs has led to improved profitability. Sharp's strategies for sustainable growth are evident in its long-term planning and asset management.

The strategic sale of assets, such as the camera module business and part of the Sakai plant, is a key part of Sharp's financial strategy. These sales are aimed at reducing debt and improving the company's financial position. The proceeds from these sales are being strategically allocated to strengthen the company's financial health. This will help the company to achieve its Sharp business prospects.

Sharp's Medium-Term Management Plan for FY2025-2027 provides a roadmap for future growth. This plan outlines the company's strategies for continued expansion and its vision for the future. The plan will focus on Sharp innovation and adapting to the changing market landscape. For more insights into the company's core values, consider reading Mission, Vision & Core Values of Sharp.

The financial outlook for fiscal year 2025 is positive, with the company anticipating further improvements in its financial performance. The continued execution of the Medium-Term Management Plan is expected to drive revenue growth and enhance profitability. The company is focused on leveraging its strengths and adapting to the evolving market dynamics.

A key focus for Sharp is debt reduction, which will improve its financial stability. The strategic use of proceeds from asset sales and the generation of positive cash flow are central to this effort. Reducing debt will enhance the company's financial flexibility and enable it to invest in future growth opportunities. The company's Sharp Company future is looking bright.

Sharp Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Sharp’s Growth?

Sharp Corporation faces several potential risks and obstacles that could hinder its future growth and business prospects. These challenges range from intense market competition and fluctuating demand to regulatory changes and internal resource constraints. Understanding these risks is crucial for evaluating the company's Sharp growth strategy and long-term viability.

The volatile nature of the electronics industry, particularly in the display device sector, presents significant hurdles. Sharp's financial health is directly impacted by these factors, as evidenced by past losses. Moreover, the company must navigate a complex web of geopolitical and economic uncertainties that can affect its operations and profitability.

Sharp's ability to adapt and innovate will be critical in overcoming these obstacles and achieving its strategic goals. The company's response to these challenges will shape its future in a competitive global market.

Intense competition and rapid changes in demand for products and services pose a significant risk. Price competition can erode profit margins, especially in the display device business. Sharp's ability to maintain profitability depends on its ability to quickly adapt to market changes.

Supply chain disruptions, a common issue in the electronics industry, can impact production and sales. These disruptions can lead to delays, increased costs, and reduced availability of products. The company's reliance on various suppliers makes it vulnerable to these risks.

Changes in regulations and trade restrictions, along with geopolitical tensions like U.S.-China trade friction, can affect Sharp's business. These factors can lead to increased costs, reduced market access, and operational challenges. The company must navigate these complexities to maintain its global presence.

The fast-paced nature of the electronics industry means that technological advancements can quickly render products obsolete. The company needs to invest heavily in research and development to stay ahead of the curve. Failure to innovate can lead to a loss of market share.

Large-scale investments in the device business and other areas can strain internal resources. These constraints can limit the company's ability to develop new categories and attract new customers. Efficient allocation of resources is critical for Sharp's future.

Large bank loans and upcoming repayment deadlines pose a risk to Sharp's financial stability. A significant repayment is due in April 2026. The company's ability to manage its debt and maintain sufficient liquidity is crucial for its long-term viability.

Sharp is undertaking restructuring efforts, including asset sales, to streamline operations and improve financial stability. The sale of the camera module business and parts of the Sakai plant are examples of these efforts. However, the timing of other asset sales, such as land and buildings in the Sakai plant, remains uncertain.

Cybersecurity is an emerging risk, as demonstrated by a data breach in July 2024 that potentially compromised personal information of over 100,000 customers. Protecting customer data and maintaining data security are essential for maintaining customer trust and avoiding financial and reputational damage.

Sharp's financial performance, particularly in the display device business, has been volatile. Significant losses were recorded in fiscal 2022 and 2023. The company's ability to generate stable profits and manage its financial obligations is critical for its future. For more background, check out the Brief History of Sharp.

Sharp is committed to social responsibility and aims to conduct operations with concern for its impact on stakeholders and the environment. These commitments are increasingly important in today's business environment. The company's strategies for sustainable growth include environmental initiatives.

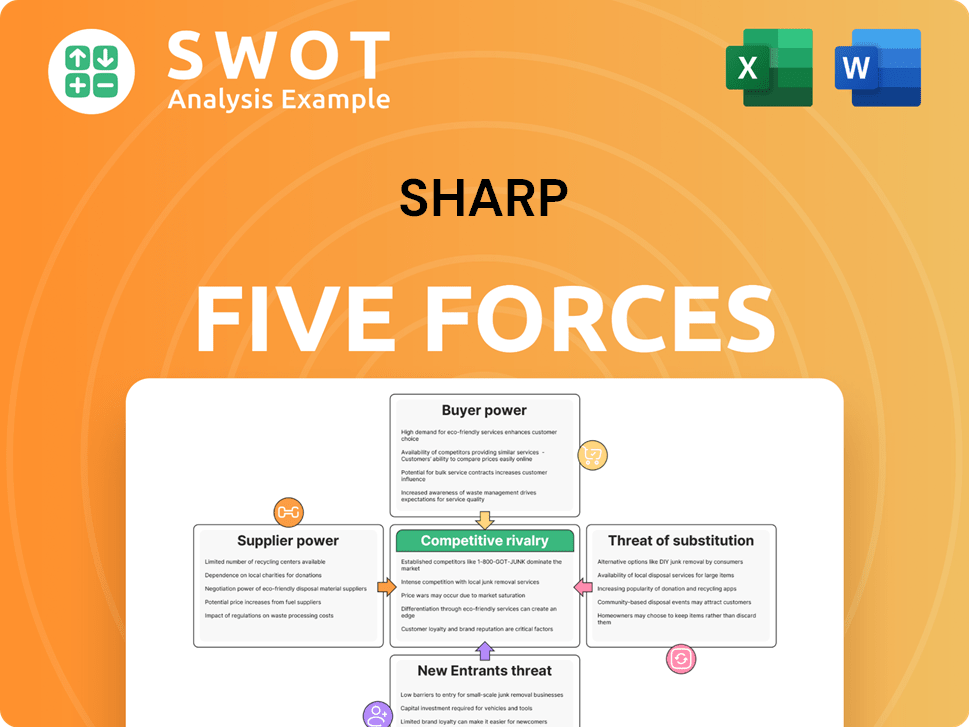

Sharp Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sharp Company?

- What is Competitive Landscape of Sharp Company?

- How Does Sharp Company Work?

- What is Sales and Marketing Strategy of Sharp Company?

- What is Brief History of Sharp Company?

- Who Owns Sharp Company?

- What is Customer Demographics and Target Market of Sharp Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.