Shenandoah Telecommunication Bundle

Can Shenandoah Telecommunications Conquer the Broadband Frontier?

Explore the dynamic transformation of Shenandoah Telecommunication SWOT Analysis, a company that has strategically navigated the ever-evolving telecommunications industry. From its roots connecting rural communities, Shentel has dramatically reshaped its focus, making a pivotal move by divesting wireless assets to T-Mobile. This strategic pivot has fueled its fiber-first broadband strategy, setting the stage for an in-depth look at its growth trajectory.

This analysis dives into the Shenandoah Telecommunications company growth strategy, examining its ambitious expansion plans and the future of fiber optic internet by Shentel. We'll dissect its competitive landscape, including how Shentel plans to grow within the telecommunications market, and assess its investment opportunities. Understanding Shentel's long-term business strategy and the impact of 5G is crucial for evaluating its future prospects and financial performance.

How Is Shenandoah Telecommunication Expanding Its Reach?

The growth strategy of Shenandoah Telecommunications (Shentel) is strongly focused on expanding its fiber-to-the-home (FTTH) network. This expansion targets both new geographic markets and increasing penetration within existing service areas. This approach is designed to capitalize on the rising demand for high-speed internet and diversify revenue streams beyond traditional cable services. The company aims to establish a strong position in underserved rural markets where competition may be less intense.

A key driver of Shentel's expansion is its participation in the RDOF program, which provides federal funding for broadband deployment in unserved rural areas. The company secured over $90 million in RDOF Phase I funding. Shentel plans to deploy gigabit-speed broadband to more than 38,000 unserved locations across its operating territory. This initiative supports the company's long-term goal of passing over 400,000 locations by 2030 through a combination of RDOF and commercial builds.

Shentel is also actively pursuing commercial fiber expansion, deploying fiber in towns adjacent to its existing cable plant and in new greenfield areas. This dual approach of government-subsidized and self-funded expansion allows Shentel to strategically grow its customer base and reinforce its network infrastructure. The company's focus on fiber also positions it to offer symmetrical speeds and more reliable service, attracting new customers and enhancing customer loyalty.

Shentel's expansion strategy involves aggressive FTTH network deployment. This strategy includes both government-funded projects and commercial builds. The company aims to increase its customer base and reinforce its network infrastructure through these initiatives. The company is focusing on underserved rural markets.

Shentel secured over $90 million in RDOF Phase I funding. This funding supports the deployment of gigabit-speed broadband to unserved locations. The company is leveraging government funding to expand its fiber network in rural areas.

Shentel is also expanding its fiber network commercially. This includes deploying fiber in areas adjacent to its existing plant. The company is strategically growing its customer base through commercial fiber expansion.

In Q1 2024, Shentel reported an increase of 9,800 fiber passings. This demonstrates tangible progress toward its expansion goals. The company's focus on fiber positions it to offer competitive services.

Shentel's primary goal is to pass approximately 70,000 new homes and businesses with fiber by the end of 2024, with a long-term goal of passing over 400,000 locations by 2030. This involves a dual approach of government-subsidized and self-funded expansion. These initiatives are part of a broader strategy to enhance Shentel's position in the Telecommunications Industry.

- Aggressive FTTH network deployment.

- Participation in the RDOF program.

- Commercial fiber expansion in new and adjacent areas.

- Focus on attracting new customers and enhancing customer loyalty.

Shenandoah Telecommunication SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Shenandoah Telecommunication Invest in Innovation?

The innovation and technology strategy of Shenandoah Telecommunications (Shentel) is centered on a 'fiber-first' approach. This strategy is designed to provide superior broadband services and drive sustained growth within the competitive Telecommunications Industry. The company's focus on advanced fiber optic infrastructure is a key differentiator in the market.

Shentel's commitment to technological advancement is evident in its investments in network upgrades to XGS-PON technology. This technology enables symmetrical multi-gigabit speeds, which is crucial for meeting the increasing bandwidth demands of both residential and business customers. This investment is a core part of its research and development efforts.

Beyond network infrastructure, Shentel is actively pursuing digital transformation initiatives. These initiatives aim to enhance operational efficiency and improve customer experience. The company leverages data analytics to optimize network performance and personalize customer interactions. This approach helps Shentel maintain a competitive edge in the market.

Shentel's investment in fiber optic technology is a cornerstone of its growth strategy. Fiber optic infrastructure is crucial for delivering high-speed internet, which is increasingly in demand. This technology allows Shentel to offer services that are competitive with larger providers.

The adoption of XGS-PON technology is a significant step in Shentel's technological advancement. This technology provides symmetrical multi-gigabit speeds, which is essential for meeting the growing bandwidth needs of customers. It positions Shentel to offer advanced services.

Shentel is focused on digital transformation to improve operational efficiency and customer experience. This includes using data analytics to optimize network performance and personalize customer interactions. These efforts enhance the company's competitiveness.

Data analytics plays a crucial role in Shentel's strategy. The company uses data to predict potential service issues and personalize customer interactions. This proactive approach helps improve customer satisfaction.

Shentel's investment in fiber optic technology provides a competitive advantage. The company is able to offer high-speed internet, attracting and retaining customers. This focus on technology supports its growth objectives.

The fiber network provides a foundation for future integration of technologies like AI and IoT. As these technologies become more prevalent, Shentel is well-positioned to incorporate them. This forward-thinking approach supports long-term growth.

Shentel's innovation strategy includes significant investments in fiber optic infrastructure and digital transformation initiatives. These investments are designed to enhance network performance and improve customer experience. These efforts support the company's long-term business strategy.

- Fiber Network Expansion: Shentel continues to expand its fiber network to reach more customers, particularly in rural areas. This expansion is a key part of its Growth Strategy.

- XGS-PON Deployment: The deployment of XGS-PON technology is critical for providing high-speed internet services. This technology enables Shentel to offer competitive services.

- Data Analytics: Utilizing data analytics to optimize network performance and predict service issues. This proactive approach enhances customer satisfaction.

- Customer Experience: Improving customer experience through personalized interactions and efficient service delivery. This focus helps retain customers.

Shenandoah Telecommunication PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Shenandoah Telecommunication’s Growth Forecast?

The financial outlook for Shenandoah Telecommunications (Shentel) is centered on its strategic shift towards profitable growth, primarily driven by the expansion of its fiber broadband network. This strategic pivot follows the divestiture of its wireless assets, allowing Shentel to channel capital investments into its high-speed fiber infrastructure. This focus is expected to significantly boost subscriber growth within its Glo Fiber segment, contributing to the company's overall financial performance.

For the full year of 2024, Shentel anticipates capital expenditures to be in the range of $180 million to $200 million. These investments are predominantly aimed at expanding and upgrading its fiber network, which is crucial for supporting its growth strategy. The company's financial projections reflect a commitment to enhancing its fiber optic internet services and expanding its reach, particularly in underserved areas.

Shentel's financial performance in the first quarter of 2024 showed consolidated revenue of $65.4 million, with an adjusted EBITDA of $23.2 million. While the revenue showed a slight decrease compared to the prior year, the primary focus remains on the expansion and monetization of its broadband segments. This strategic approach is designed to increase average revenue per user (ARPU) and improve profit margins as the subscriber base grows.

Shentel plans to invest between $180 million and $200 million in 2024. These funds are earmarked for the expansion and enhancement of its fiber network.

The company projects to add between 48,000 and 52,000 new Glo Fiber subscribers in 2024. This growth is a key indicator of Shentel's success in the broadband market.

Shentel reported consolidated revenue of $65.4 million for Q1 2024. The adjusted EBITDA for the same period was $23.2 million, reflecting the company's operational efficiency.

The company is concentrating on monetizing its expanding fiber network, aiming for increased ARPU and improved profit margins. This strategic focus is crucial for long-term growth.

The company's financial health is supported by a strong balance sheet, which benefits from the proceeds of the wireless asset sale. This financial strength provides Shentel with the flexibility needed to fund its ambitious fiber deployment plans without needing to rely heavily on external capital raises in the immediate future. The Owners & Shareholders of Shenandoah Telecommunication can expect a focus on sustainable growth through fiber expansion.

Analyst forecasts suggest a positive trajectory for broadband revenue. This growth is expected to come from both organic expansion in existing markets and the significant expansion into new RDOF-funded areas.

Shentel's robust financial position, bolstered by the sale of its wireless assets, provides ample liquidity. This allows the company to execute its fiber deployment plans without immediate external funding needs.

The primary driver of Shentel's growth strategy is the expansion of its fiber broadband network. This expansion is crucial for attracting new subscribers and increasing revenue.

The telecommunications market is competitive, but Shentel's focus on fiber provides a differentiated service. The company's strategic investments are aimed at capturing a larger share of the market.

Shentel's competitive landscape includes other telecommunications providers. Its focus on fiber optic internet allows it to compete effectively in the market.

Shentel's long-term business strategy centers on sustainable growth through fiber expansion. The company aims to increase its customer base and improve profitability over time.

Shenandoah Telecommunication Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Shenandoah Telecommunication’s Growth?

The path to growth for Shenandoah Telecommunications (Shentel) is not without its challenges. The company faces several potential risks and obstacles that could impact its Growth Strategy and Future Prospects. Understanding these challenges is crucial for investors and stakeholders assessing the company's long-term viability in the dynamic Telecommunications Industry.

Market competition, regulatory changes, supply chain vulnerabilities, and technological disruptions are among the key areas of concern. These factors could influence Shentel's financial performance and its ability to execute its expansion plans effectively. Internal operational challenges also present potential hurdles as the company strives to scale its operations.

Competition within the telecommunications sector is fierce, with established players and emerging fixed wireless access (FWA) providers vying for market share. This competitive landscape could affect Shentel's subscriber acquisition costs and pricing strategies, potentially impacting revenue and profitability. Regulatory shifts, especially concerning broadband deployment subsidies and net neutrality, could also alter Shentel's strategic approach. For additional context, you can check out a Brief History of Shenandoah Telecommunication.

The telecommunications market is highly competitive, with established companies and new entrants like FWA providers. This competition could lead to increased subscriber acquisition costs and pressure on pricing, affecting Shentel's financial results. Understanding the competitive landscape is essential for assessing Shentel's ability to maintain and grow its customer base.

Changes in regulations, particularly those related to broadband deployment funding and net neutrality, could significantly impact Shentel's expansion plans. Adjustments to RDOF funding or the introduction of new mandates might require the company to adapt its investment strategies. Staying abreast of regulatory developments is vital for strategic planning.

Supply chain disruptions, especially concerning fiber optic cables and network equipment, pose a risk to Shentel's network build-out plans. Delays in obtaining necessary materials or increased costs due to global events could hinder the company's ability to meet its expansion targets. Effective supply chain management is crucial.

The rapid advancement of telecommunications technology presents both opportunities and risks. Emerging technologies could render existing infrastructure less competitive, necessitating further investment. Shentel must continually innovate and adapt to stay ahead of technological changes to ensure sustained growth.

Managing the rapid pace of fiber deployment and subscriber growth can strain internal resources. This includes the need for skilled labor for network construction and customer service. Efficient operational management is critical for supporting Shentel's expansion and maintaining service quality.

The telecommunications industry is capital-intensive. Shentel needs to manage its debt levels and capital expenditures effectively to avoid financial strain. Economic downturns or rising interest rates could increase financial risks, impacting investment opportunities and profitability.

To mitigate these risks, Shentel employs a diversified expansion strategy, including both RDOF and commercial builds, and utilizes robust risk management frameworks. The company focuses on effective supply chain management to meet its aggressive fiber build targets. Continuous assessment of market dynamics and adaptability are crucial for overcoming future obstacles and sustaining growth.

As of the latest reports, Shentel continues to prioritize fiber optic network expansion, especially in rural areas. Fiber deployment is crucial for offering high-speed internet and is a key component of Shentel's long-term business strategy. Fiber-to-the-home (FTTH) is expected to continue driving growth in the coming years.

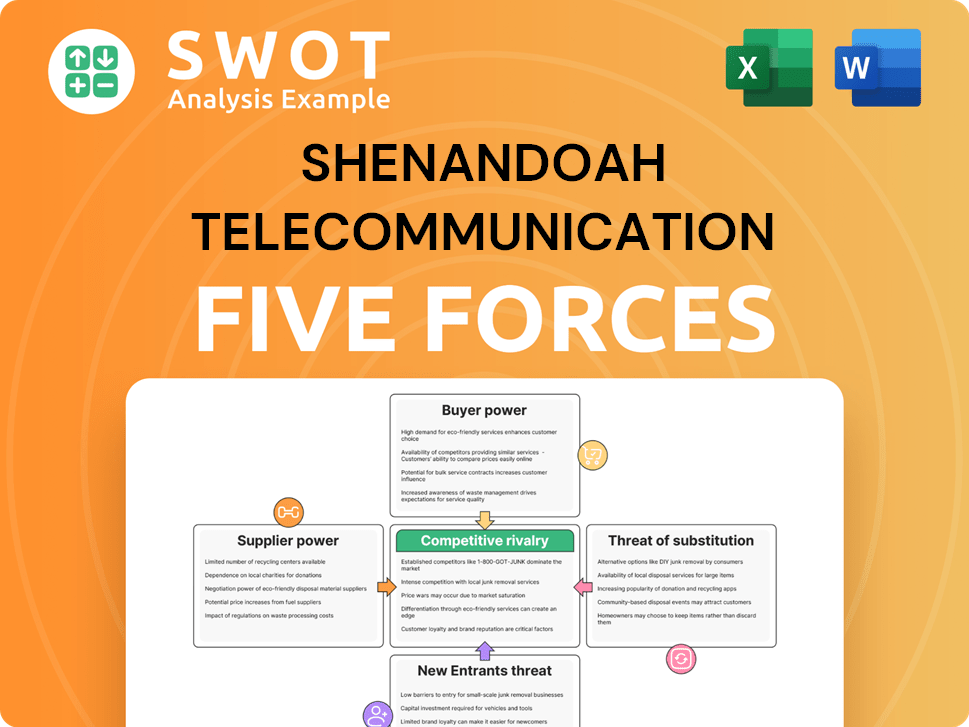

Shenandoah Telecommunication Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Shenandoah Telecommunication Company?

- What is Competitive Landscape of Shenandoah Telecommunication Company?

- How Does Shenandoah Telecommunication Company Work?

- What is Sales and Marketing Strategy of Shenandoah Telecommunication Company?

- What is Brief History of Shenandoah Telecommunication Company?

- Who Owns Shenandoah Telecommunication Company?

- What is Customer Demographics and Target Market of Shenandoah Telecommunication Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.