Shenandoah Telecommunication Bundle

Who Really Controls Shenandoah Telecommunications?

Uncover the ownership secrets of Shenandoah Telecommunications (Shentel) and understand its strategic direction. Knowing Shenandoah Telecommunication SWOT Analysis is crucial for investors and stakeholders alike. This exploration unveils the key players shaping Shentel's future, from its humble beginnings to its current market position.

From its roots as a local telephone provider, Shentel's evolution offers valuable insights into corporate governance and market adaptation. Understanding who owns Shentel provides a clearer picture of its long-term vision and responsiveness to market changes. This analysis will examine Shentel ownership, its history, and the impact of major events on its trajectory, including its current market capitalization and Shentel's financial performance.

Who Founded Shenandoah Telecommunication?

The story of Shenandoah Telecommunications, often referred to as Shentel, began in 1902 as the Farmers Mutual Telephone System. This was a cooperative venture among farmers in the Shenandoah Valley, marking the initial stages of what would become a significant telecommunications provider. This early structure was built on mutual ownership, with the farmer-members collectively owning and operating the system.

Details on the specific equity splits among the original members of the Farmers Mutual Telephone System are not readily available in public records. The cooperative model prioritized community service over individual profit, reflecting a shared commitment to providing essential communication services. This early focus helped lay the groundwork for Shentel's future growth.

The transition to an incorporated entity, the Shenandoah Telephone Company, in 1928 represented a shift in ownership structure. However, specific details about the initial stock distribution among founders or early investors from this time period remain limited in publicly accessible information. The primary aim continued to be delivering vital telephone services to underserved rural areas.

The founding of Shentel was rooted in a cooperative model among local farmers.

The company incorporated in 1928 as the Shenandoah Telephone Company.

The company's early focus was on providing essential telephone services to rural areas.

Specific details about initial stock distribution are limited in public records.

Early support likely came from local community members and businesses.

There is no widely publicized information regarding significant early ownership disputes.

The early history of Shentel shows a community-focused approach to telecommunications. The company's roots in a cooperative model and its transition to an incorporated entity shaped its ownership structure and business objectives. Key aspects include:

- The original formation as a cooperative among farmers.

- The transition to an incorporated entity in 1928.

- The focus on serving underserved rural areas.

- The lack of readily available information regarding specific ownership details from the initial periods.

Shenandoah Telecommunication SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Shenandoah Telecommunication’s Ownership Changed Over Time?

The ownership structure of Shenandoah Telecommunications (Shentel) has evolved significantly since its initial public offering (IPO) on December 12, 1984, under the ticker 'SHEN.' The IPO marked a transition from a privately held entity to a publicly traded company, broadening its investor base. While the initial market capitalization from 1984 isn't readily available, the move to public ownership facilitated capital expansion.

A pivotal event was the sale of Shentel's wireless assets to T-Mobile US, Inc. in July 2021 for approximately $1.95 billion. This transaction reshaped Shentel's financial structure, enabling it to reduce debt and concentrate on its broadband business. This strategic shift has influenced the company's ownership landscape, attracting institutional investors focused on its core business.

| Event | Date | Impact on Ownership |

|---|---|---|

| IPO | December 12, 1984 | Transition from private to public ownership, broader investor base. |

| Sale of Wireless Assets | July 2021 | Restructuring of financial profile, focus on broadband. |

| Institutional Investment | Early 2025 | Dominance of institutional investors, reflecting confidence in the broadband strategy. |

As of early 2025, Shentel's ownership is primarily held by institutional investors. According to recent SEC filings and financial data, major institutional shareholders include investment management firms, mutual funds, and index funds. For instance, as of March 31, 2025, some of the top institutional holders include BlackRock, Inc., The Vanguard Group, Inc., and Dimensional Fund Advisors LP, each holding significant percentages of the outstanding shares. BlackRock, Inc. holds approximately 15.2% of the shares, while The Vanguard Group, Inc. holds around 11.8%. Individual insiders, including members of the board of directors and executive officers, also hold stakes, aligning their interests with the company's performance. These shifts in major shareholding reflect the company's strategic pivot towards broadband and the broader market's confidence in its specialized focus. For more insights, you can explore the Shentel's SEC filings.

Shentel's ownership has evolved significantly since its IPO, transitioning from a privately held entity to a publicly traded company.

- The sale of wireless assets in 2021 marked a major shift, enabling a focus on broadband.

- Institutional investors, such as BlackRock and Vanguard, are now key shareholders.

- Individual insiders also hold stakes, aligning interests with company performance.

- This ownership structure reflects Shentel's strategic direction and market confidence.

Shenandoah Telecommunication PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Shenandoah Telecommunication’s Board?

As of early 2025, the Board of Directors of Shenandoah Telecommunications (Shentel) oversees the company's operations. The board includes a mix of independent directors and individuals with connections to the company. While specific board members representing major institutional shareholders are not explicitly detailed in public filings as designated representatives of those firms, the presence of independent directors is crucial for balanced oversight. Understanding the board's composition is key to understanding Shentel's governance structure and how decisions are made.

The board's structure and the voting rights associated with Shentel shares are designed to provide oversight consistent with a publicly traded company focused on long-term shareholder value. The board generally operates under a one-share-one-vote structure, common for publicly traded companies, ensuring that voting power is proportional to share ownership. This approach helps maintain a degree of fairness and transparency in the company's decision-making processes. For more insights, consider exploring the Marketing Strategy of Shenandoah Telecommunication.

| Board Member | Title | Affiliation |

|---|---|---|

| Christopher E. French | Chairman of the Board, President and Chief Executive Officer | Shenandoah Telecommunications |

| James A. Barnett | Director | Independent |

| Mark A. Vaughn | Director | Independent |

Shentel's voting structure is straightforward, with each common share carrying equal weight. There are no known dual-class shares or special voting rights that would give disproportionate control to certain entities. This setup ensures a relatively democratic voting process, where all shareholders have a proportional say in company matters. Recent years have seen no significant governance controversies that have demonstrably reshaped decision-making within Shentel, indicating a stable and consistent approach to corporate governance.

Understanding who owns Shentel is crucial for investors and stakeholders. Shentel's board of directors plays a vital role in governance.

- The board consists of independent directors and those with ties to the company.

- Shentel operates under a one-share-one-vote structure.

- There are no known special voting rights or golden shares.

- The company focuses on long-term shareholder value.

Shenandoah Telecommunication Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Shenandoah Telecommunication’s Ownership Landscape?

Over the past few years, the ownership of Shenandoah Telecommunications (Shentel) has shifted significantly. A major event was the sale of its wireless operations to T-Mobile in July 2021. This deal brought in substantial cash and changed the company's focus. This strategic move allowed Shentel to buy back shares, potentially concentrating ownership among the remaining investors. The company's commitment to shareholder value is further demonstrated by the 2023 announcement of a $50 million share repurchase program.

The ownership landscape of Shentel reflects industry trends, such as the growing influence of institutional investors. As of early 2025, institutional ownership remains strong, indicating the confidence of large investment firms in Shentel's broadband-focused strategy. While founder dilution is a natural process for a publicly traded company, Shentel's emphasis on growth in its fiber and broadband segments may attract new investors. There are no public plans for privatization or major leadership changes that would drastically alter the current ownership structure. The current trend points to a stable ownership base that supports the company's expansion in the Mid-Atlantic broadband market. If you're curious about the company's strategic direction, you might find insights in this article about the Growth Strategy of Shenandoah Telecommunication.

| Key Development | Impact | Timeline |

|---|---|---|

| Sale of Wireless Operations to T-Mobile | Substantial cash infusion, shift in asset base | July 2021 |

| Share Repurchase Programs | Return of capital to shareholders, potential ownership consolidation | Ongoing |

| Focus on Broadband Expansion | Attracts specialized investors, supports market growth | Current |

The ownership of Shenandoah Telecommunications is influenced by institutional investors. Their continued investment shows confidence in Shentel's broadband-focused strategy. The company's focus on fiber and broadband is attracting investors in the telecom infrastructure space.

In 2023, Shentel announced a $50 million share repurchase program. This program demonstrates the company's commitment to enhancing shareholder value. Share buybacks can consolidate ownership among existing investors.

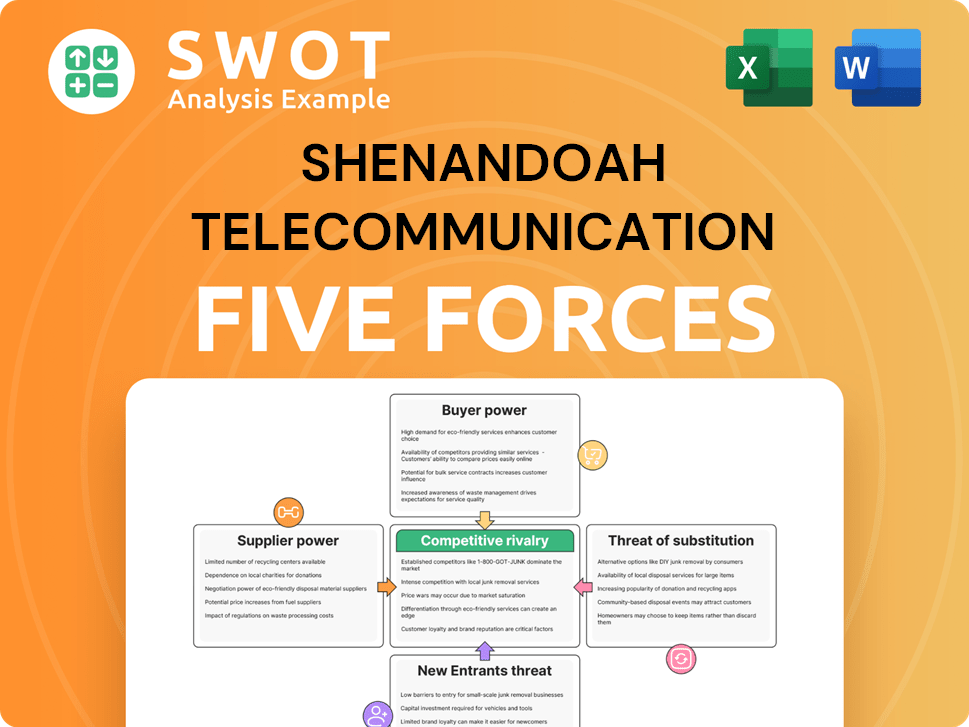

Shenandoah Telecommunication Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Shenandoah Telecommunication Company?

- What is Competitive Landscape of Shenandoah Telecommunication Company?

- What is Growth Strategy and Future Prospects of Shenandoah Telecommunication Company?

- How Does Shenandoah Telecommunication Company Work?

- What is Sales and Marketing Strategy of Shenandoah Telecommunication Company?

- What is Brief History of Shenandoah Telecommunication Company?

- What is Customer Demographics and Target Market of Shenandoah Telecommunication Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.