Solvay Bundle

Can Solvay Recapture Its Chemical Industry Dominance?

Following a transformative demerger, Solvay has redefined its strategic focus, setting the stage for a new era of growth. This pivotal shift, which saw the separation of its Specialty Businesses into Syensqo, is reshaping the company's trajectory within the chemical industry. Discover how the 'New Solvay' intends to leverage its core strengths to achieve sustainable expansion and solidify its market position.

This Solvay SWOT Analysis offers an in-depth look at the company's strategic repositioning and its implications for investors and industry analysts. The analysis explores Solvay's growth strategy, examining its renewed emphasis on essential chemicals and its plans for future prospects. Moreover, we'll dissect the Solvay business model, market position, and financial performance, providing a comprehensive Solvay company analysis to understand its long-term growth potential and how it adapts to market changes.

How Is Solvay Expanding Its Reach?

Following the demerger, the expansion initiatives of Solvay are strategically focused on bolstering its leadership within its core essential chemicals portfolio. This includes Soda Ash, Peroxides, Silica, and Coatis. The primary emphasis is on organic growth, achieved through the optimization of production capacities and the enhancement of existing product lines within these established markets. This approach is central to Solvay's growth strategy.

Solvay's strategy prioritizes consolidating its market position in regions where it already has a strong presence. The company is also actively identifying opportunities for incremental growth within its core segments. This measured approach allows Solvay to leverage its existing strengths and market share, ensuring steady and profitable expansion. The Solvay business model is designed to support these growth objectives.

A key element of Solvay's expansion strategy involves a strong commitment to sustainable solutions within its existing product categories. This includes the development and promotion of bio-based solutions and processes. These initiatives are designed to reduce environmental impact, aligning with the growing market demand for sustainable chemicals. This is a crucial aspect of Solvay's future prospects.

Solvay is concentrating on strengthening its position in essential chemicals such as Soda Ash and Peroxides. The company is investing in optimizing production and enhancing existing product lines. This strategy helps maintain and expand its market share in key segments.

The company is committed to developing bio-based solutions and processes to reduce environmental impact. This approach aligns with the growing market demand for sustainable chemicals. Solvay aims to offer more environmentally friendly alternatives within its established product lines.

Solvay is exploring targeted partnerships to enhance its supply chain and integrate complementary technologies. These collaborations support its core chemical processes. This strategy helps drive innovation and efficiency within the company.

The company is focused on operational excellence to achieve steady, profitable growth. Solvay leverages its strong market share to drive financial performance. This approach ensures the company can adapt to market changes effectively.

Solvay's strategic initiatives are designed to ensure steady, profitable growth by leveraging its strong market share in essential chemicals. The company's focus on operational excellence and sustainable solutions is key to its long-term growth potential. For a detailed analysis of Solvay's financial performance and strategic direction, you can refer to this article about Solvay's company analysis.

Solvay's expansion initiatives are centered on core chemical portfolios and sustainable solutions. The company is focusing on organic growth through production optimization and strategic partnerships to enhance its market position.

- Strengthening leadership in essential chemicals.

- Developing and promoting bio-based solutions.

- Exploring strategic partnerships.

- Focusing on operational excellence.

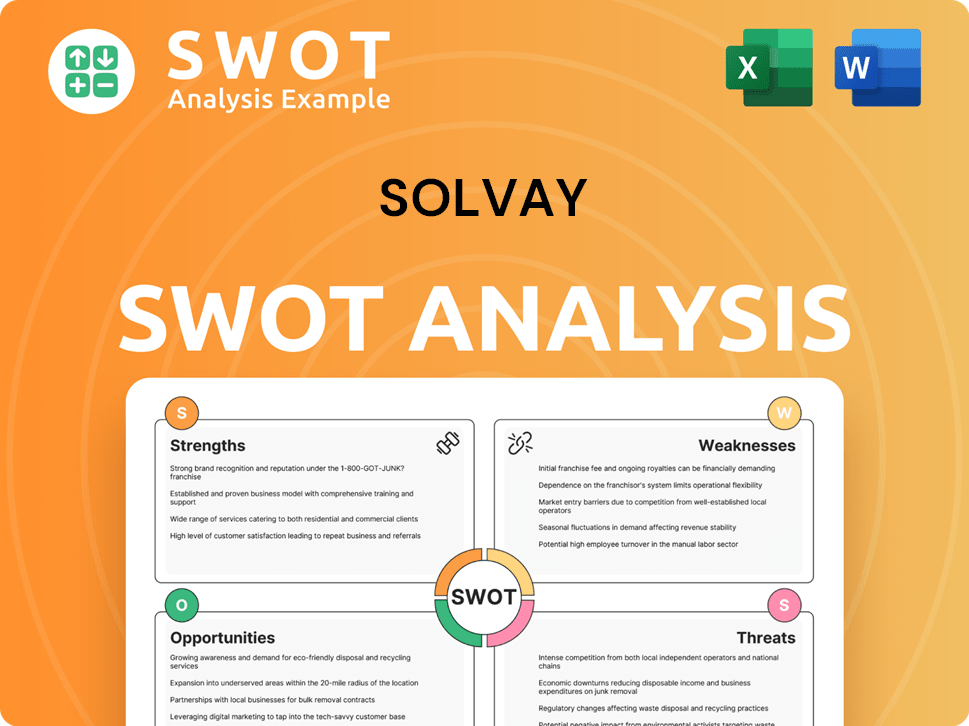

Solvay SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Solvay Invest in Innovation?

The post-demerger innovation and technology strategy of the company, focuses on enhancing its core chemical portfolio and driving sustainable solutions. This approach is critical for maintaining its market position and achieving its growth objectives. The company's commitment to innovation is evident in its investments in research and development.

The company is actively working on projects to decarbonize its industrial operations, which is a significant technological undertaking. This includes developing advanced processes for reducing energy consumption and CO2 emissions in production. This aligns with global sustainability goals and is crucial for long-term success. The company leverages in-house expertise and collaborates with external partners to accelerate innovation in areas such as green chemistry and circular economy solutions.

The company's digital transformation strategy involves integrating automation and data analytics into its manufacturing processes. This is done to optimize production, improve quality, and enhance operational efficiency. While the more advanced materials and specialized applications are now under Syensqo, the company continues to apply cutting-edge technologies to its essential chemicals for improved performance and sustainability.

The company invests significantly in research and development to improve the efficiency and environmental footprint of its core products. This investment is a key aspect of its strategy. This commitment is essential for its long-term growth.

The company is heavily focused on sustainability, with a strong emphasis on reducing its environmental impact. This includes projects to decarbonize industrial operations. This focus is driven by both regulatory demands and customer preferences.

The company is actively integrating automation and data analytics into its manufacturing processes. This is done to optimize production, improve quality, and enhance operational efficiency. This transformation is crucial for staying competitive.

The company collaborates with external partners to accelerate innovation, particularly in green chemistry and circular economy solutions. This collaborative approach helps to drive innovation. These partnerships are key to achieving its goals.

The company is concentrating on its essential chemicals portfolio, including soda ash, peroxides, silica, and Coatis. This focus allows it to leverage its existing strengths. This strategy is designed to ensure continued market leadership.

The company aims to secure its market leadership through continuous process innovation and the development of more sustainable product offerings. This strategy helps meet evolving customer and regulatory demands. The company is committed to innovation.

The company's strategic initiatives are centered around enhancing its essential chemicals portfolio and driving sustainable solutions. This includes significant investments in research and development. The company is focused on reducing its environmental footprint and improving operational efficiency.

- Decarbonization Projects: Actively working on projects to reduce carbon emissions from industrial operations.

- Green Chemistry and Circular Economy: Collaborating with partners to accelerate innovation in green chemistry and circular economy solutions.

- Digital Transformation: Integrating automation and data analytics into manufacturing processes for optimized production and improved efficiency.

- Sustainable Product Development: Developing more sustainable product offerings to meet evolving customer and regulatory demands.

- Process Innovation: Continuous improvement of manufacturing processes to enhance efficiency and reduce environmental impact.

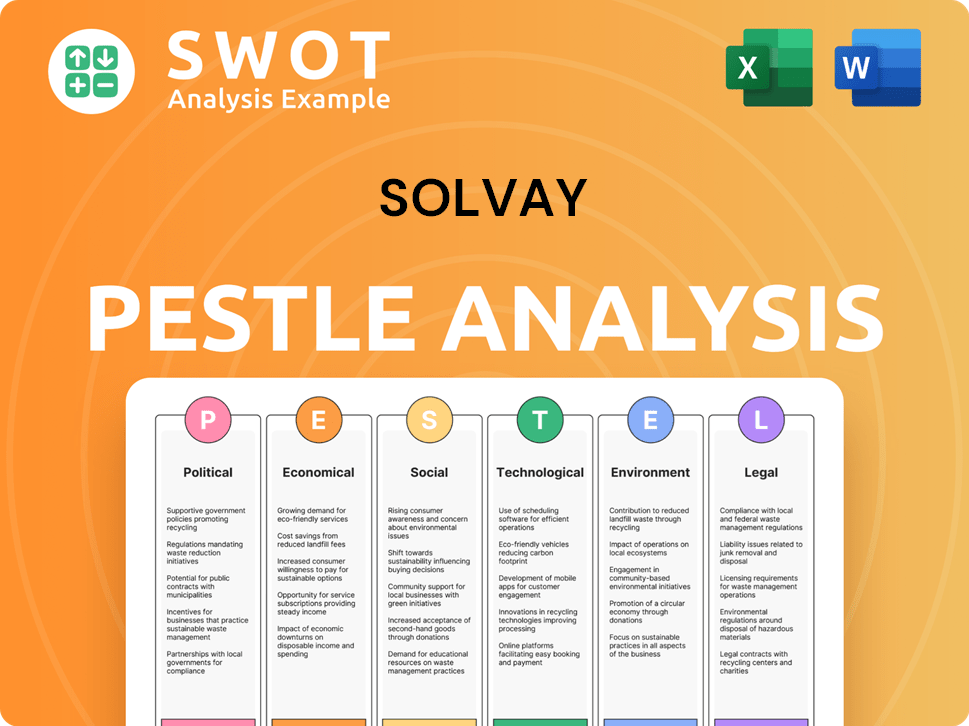

Solvay PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Solvay’s Growth Forecast?

Following the demerger of Syensqo, the financial outlook for the essential chemicals business of Solvay is designed for stability and predictability. The company's Solvay growth strategy focuses on its core businesses, aiming to generate strong cash flows and maintain a solid financial position. This strategic direction is supported by the company's strong market positions in key chemical segments.

For the full year 2024, Solvay projects an underlying EBITDA between €1.1 billion and €1.2 billion. Additionally, the company anticipates an underlying free cash flow of €400 million to €450 million for 2024. These financial targets reflect Solvay's commitment to operational efficiency and cash generation. Solvay's financial performance in the first quarter of 2024 showed net sales of €2.8 billion.

Solvay's financial ambitions are underpinned by its robust market positions in soda ash, peroxides, silica, and Coatis, which are considered essential to various industries. The company aims for sustainable growth through operational excellence and strategic investments. You can learn more about the company's structure and ownership by reading Owners & Shareholders of Solvay.

Solvay's financial targets for 2024 include an underlying EBITDA between €1.1 billion and €1.2 billion. The company also projects an underlying free cash flow of €400 million to €450 million. These figures highlight Solvay's focus on profitability and cash generation.

Solvay holds strong market positions in essential chemicals such as soda ash, peroxides, silica, and Coatis. These products are foundational to various industries, providing a stable base for the company's Solvay business model. This market presence supports the company's financial outlook.

Solvay's strategic initiatives include operational excellence and strategic investments in core businesses. The company is focused on optimizing its capital structure and allocating resources efficiently. These initiatives are designed to drive Solvay future prospects and value creation.

While specific long-term revenue targets beyond 2024 are not detailed, the company emphasizes maintaining healthy profit margins. Solvay's focus is on efficient capital allocation to ensure sustainable growth. The demerger has allowed Solvay to focus on its core strengths.

Solvay's strategy emphasizes operational excellence to enhance profitability and cash flow. The company is focused on improving efficiency across its operations. This approach supports the company's financial targets and long-term growth.

- Focus on core businesses.

- Efficient capital allocation.

- Strong market positions.

- Sustainable growth initiatives.

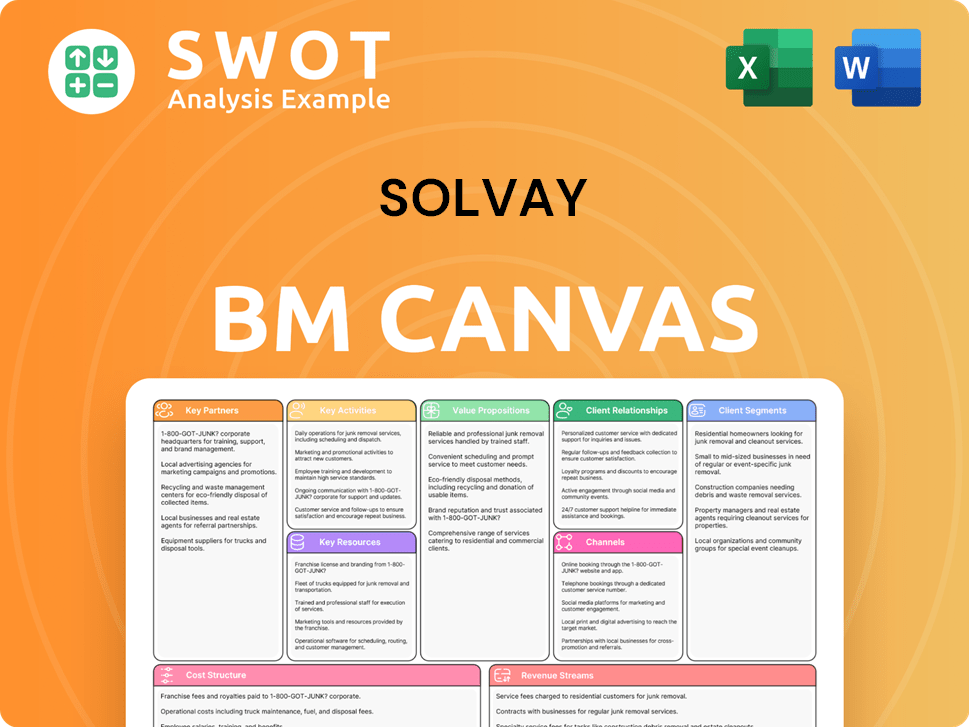

Solvay Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Solvay’s Growth?

The refocused Solvay faces several potential risks and obstacles that could impact its Solvay growth strategy and Solvay future prospects. Market competition, particularly in essential chemicals, remains a challenge, potentially affecting profitability. Fluctuations in raw material costs and energy prices also pose a continuous threat, impacting production expenses and profit margins.

Regulatory changes, especially those related to environmental protection and chemical safety, could necessitate significant investments, increasing operational costs. The company's reliance on a more concentrated portfolio after the demerger means that downturns in specific end markets could have a more pronounced impact on overall performance. These factors require careful management and strategic adaptation to ensure long-term success.

To mitigate these risks, Solvay emphasizes operational excellence, cost control, and supply chain optimization. The company also focuses on developing more sustainable and differentiated products within its core segments to reduce exposure to pure commodity cycles. While the demerger has streamlined its operations, it also means less diversification across different chemical segments, potentially increasing vulnerability to specific market shocks. Management assesses these risks through ongoing market analysis, robust risk management frameworks, and scenario planning to adapt its strategies proactively. For instance, Solvay’s commitment to decarbonizing its operations is a long-term strategy that also addresses future regulatory pressures and market demands for sustainable products, thereby mitigating environmental and reputational risks.

Intense competition within the chemical industry can squeeze profit margins. Overcapacity in certain segments can further exacerbate pricing pressures. Adapting to competitive dynamics is crucial for maintaining Solvay's market position and financial health.

Volatility in raw material and energy prices can significantly affect production costs. These fluctuations can directly impact Solvay's financial performance. Effective hedging strategies and cost management are essential.

Evolving environmental regulations and chemical safety standards require ongoing compliance investments. These changes can increase operational costs. Staying ahead of regulatory shifts is vital.

Economic downturns in key end markets can reduce demand for Solvay's products. The impact can be more pronounced due to the company's focused portfolio. Diversification and market analysis are key.

Geopolitical instability can disrupt supply chains and affect international trade. These disruptions can impact production and sales. Risk management and diversification are crucial.

Rapid technological advancements can render existing products obsolete. Continuous innovation and investment in R&D are crucial. Adapting to new technologies is essential for Solvay's business model.

Solvay employs several strategies to mitigate these risks, including operational excellence, cost control, and supply chain optimization. The company is focused on developing more sustainable and differentiated products within its core segments, reducing exposure to commodity cycles. These efforts are crucial for long-term growth.

Solvay's commitment to decarbonizing its operations is a key long-term strategy. This approach addresses future regulatory pressures and market demands for sustainable products. The focus on sustainability helps mitigate environmental and reputational risks. For a deeper understanding of the company's financial structure, consider Revenue Streams & Business Model of Solvay.

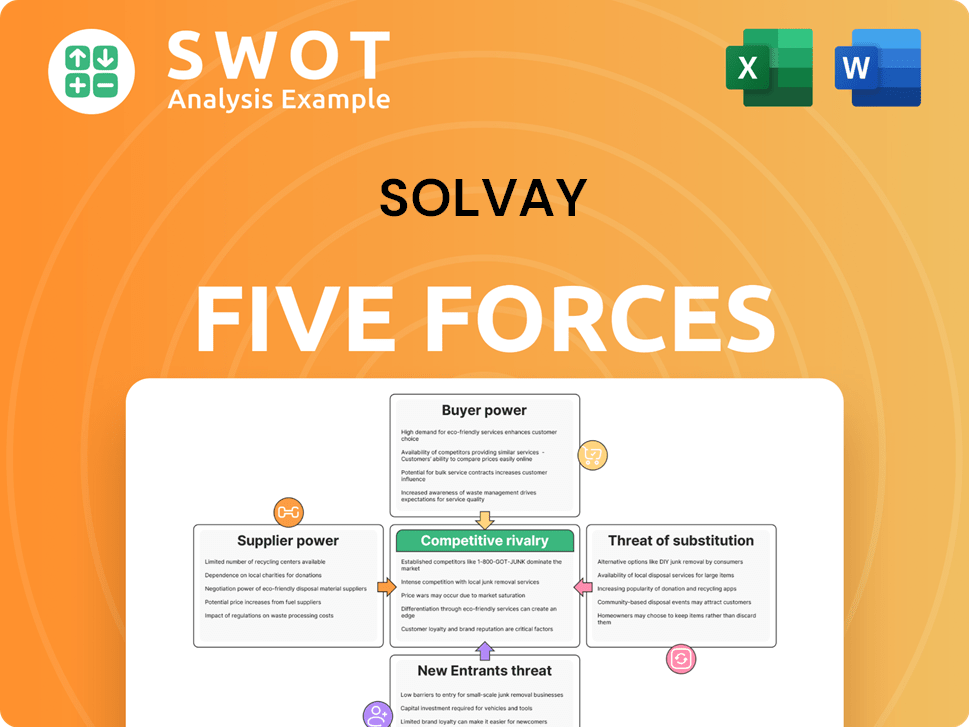

Solvay Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Solvay Company?

- What is Competitive Landscape of Solvay Company?

- How Does Solvay Company Work?

- What is Sales and Marketing Strategy of Solvay Company?

- What is Brief History of Solvay Company?

- Who Owns Solvay Company?

- What is Customer Demographics and Target Market of Solvay Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.