Solvay Bundle

Who Really Owns Solvay Company?

Understanding a company's ownership structure is crucial for investors and strategists alike. The Solvay SWOT Analysis can provide deeper insights. But, who exactly controls the strategic direction and financial performance of this major player in the chemical industry? This exploration dives into the evolution of Solvay's ownership, revealing key stakeholders and recent transformations.

From its origins with Ernest and Alfred Solvay to its current status, the Solvay company has undergone significant changes. This includes a pivotal demerger in December 2023, which created Syensqo. This article will explore Solvay ownership details, including Solvay shareholders, key executives, and the impact of its strategic moves on its financial performance. Discover the Solvay history and its current market capitalization.

Who Founded Solvay?

The story of Solvay began in 1863, thanks to the vision of Ernest Solvay and his brother Alfred. Ernest, born in 1838, made a significant impact by developing the ammonia-soda process. This process revolutionized the manufacturing of soda ash, a crucial chemical compound.

Initially, the company operated as a limited partnership. It was primarily funded by family members and local business owners. This structure set the stage for a unique ownership model that would last for many years. The early ownership structure was tightly held, reflecting a long-term industrial approach.

The shares were held by the Solvay siblings and financial partners from the Pirmez, Lambert, Nélis, and Sabatier families. This close-knit ownership model was a defining characteristic of the company's early years. The founders' vision emphasized discretion and cooperation, which influenced the company's operations and strategic decisions.

The initial ownership of the company was primarily within the Solvay family and a few key partners.

For over a century, shares were rarely sold to outsiders, keeping the ownership structure closely held.

The founders' ambition was evident in the early expansion into international markets, such as the Solvay Process Company in America.

Management control largely remained within the Solvay family for many years.

Aloïs Michielsen became the first non-family chief executive in 1998.

The Solvay Process Company was a joint venture with American partners, showcasing early international collaboration.

The early ownership structure of the Solvay company was characterized by family control and a long-term vision. The Solvay shareholders included the founding family and a small group of financial partners. This closely held model allowed for a focus on industrial development and strategic growth. The Solvay history reflects a commitment to innovation and a gradual shift in Solvay ownership over time. The first non-family Solvay CEO was appointed in 1998, marking a significant change in the company's leadership structure. The company's headquarters are currently located in Brussels, Belgium. The company has a diverse range of subsidiaries and affiliates. In 2024, the company's revenue was approximately €12.3 billion. As of 2024, the company employed around 12,500 people worldwide.

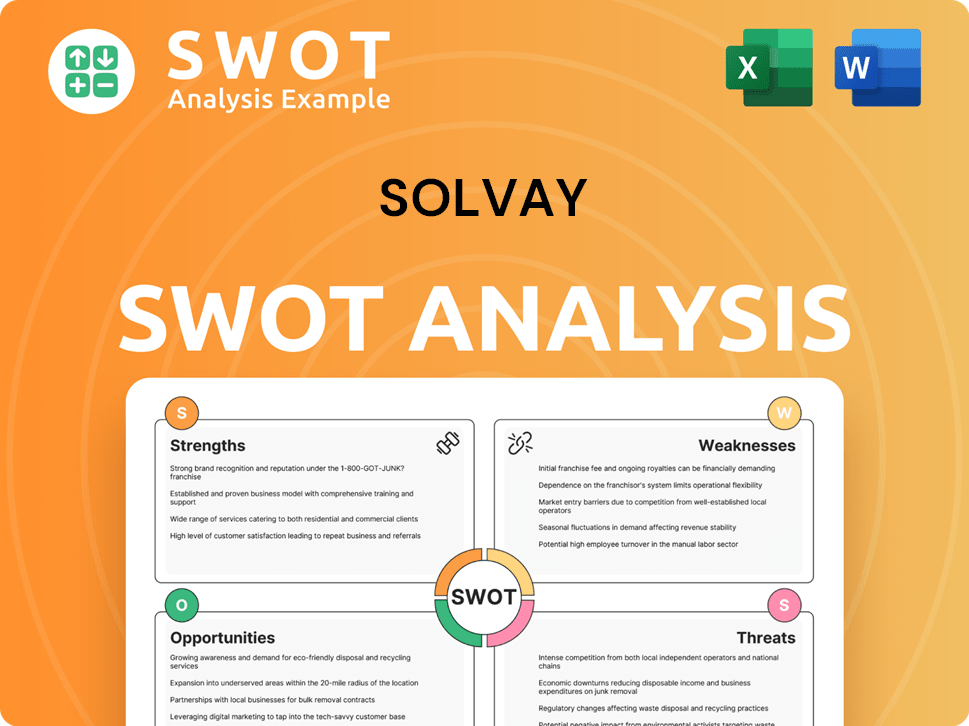

Solvay SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Solvay’s Ownership Changed Over Time?

The ownership structure of the Solvay company has evolved significantly since its beginnings. Originally, the company was publicly listed in 1969. Historically, Solvay financed itself through profits, distributing only a portion as dividends. The emergence of Solvac SA in 1983 was a pivotal moment. This public limited liability company, holding shares of Solvay and Syensqo, has played a crucial role in shaping the company's ownership landscape. This evolution reflects a transition from a family-controlled entity to a more diversified structure, while still maintaining family influence.

A key aspect of understanding who owns Solvay is the role of Solvac SA. As of August 9, 2024, Solvac SA holds the largest share, with 30.81% of Solvay's share capital and voting rights. The Solvay founding families own approximately 80% of Solvac SA's capital, demonstrating their continued substantial ownership interest. Beyond Solvac SA, institutional investors and hedge funds also hold significant stakes, contributing to the diverse ownership structure of the Solvay company.

| Shareholder Type | Stake | As of Date |

|---|---|---|

| Solvac SA | 30.81% | August 9, 2024 |

| Individual Investors | 44% | December 11, 2024 |

| Greenlight Capital, Inc. | 5.21% | March 15, 2024 |

| BlackRock, Inc. | About 4.2% | December 11, 2024 |

The Solvay company's ownership structure includes a variety of stakeholders, including individual investors, institutional investors, and hedge funds. As of May 9, 2025, 142 institutional owners held a total of 8,032,281 shares. Individual investors collectively held the largest share, with 44% as of December 11, 2024. Hedge funds like Greenlight Capital, Inc. (DME Advisors/DME Capital Management) also hold a notable stake, with 5.21% as of March 15, 2024. BlackRock, Inc. held about 4.2% of the company stock as of December 11, 2024. For more details on the company's financial aspects, you can explore the Revenue Streams & Business Model of Solvay.

The ownership of Solvay is a mix of family influence, institutional investors, and individual shareholders, reflecting a diversified structure.

- Solvac SA, primarily owned by the Solvay family, remains the largest shareholder.

- Institutional investors and hedge funds hold significant portions of the company's stock.

- Individual investors collectively hold a substantial share of the company.

- The ownership structure has evolved over time, shifting from family control to a more diversified model.

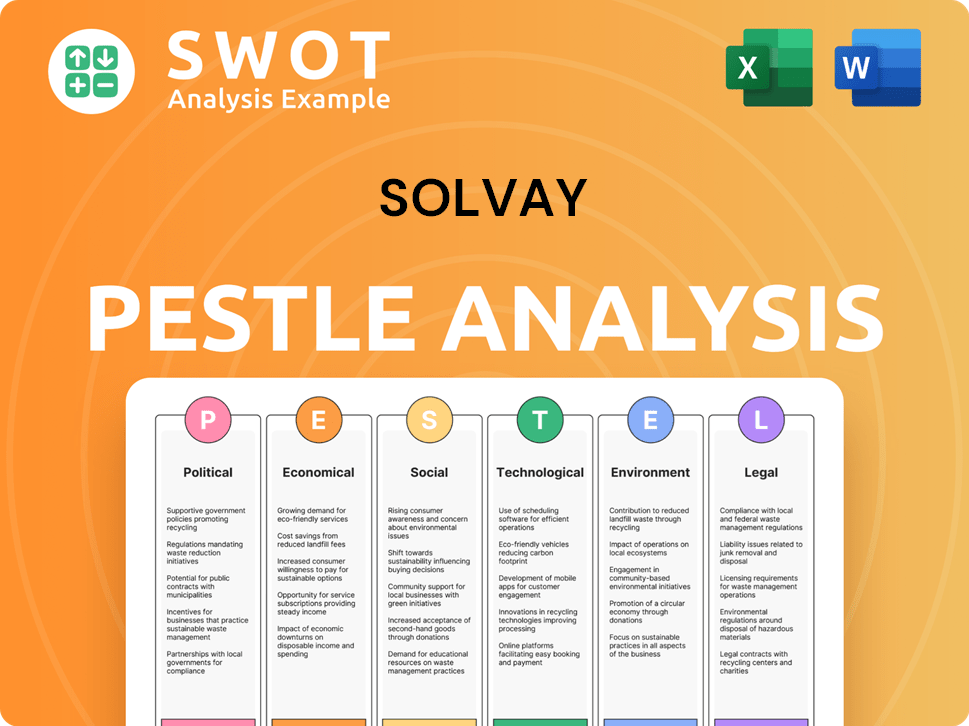

Solvay PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Solvay’s Board?

The Board of Directors is the top management body at Solvay, holding all legal powers not reserved for the Shareholders' Meeting by law or the by-laws. The board is primarily composed of independent members to ensure effective oversight. Board members are elected by the General Shareholders' Meeting based on proposals from the Board of Directors, which seeks preliminary advice from the Nominations Committee. The board strives for a composition that reflects the shareholders' makeup, boasts diverse competencies and experiences, and has an international composition. This structure is crucial for understanding Solvay company's governance and Solvay ownership.

The board's composition and the election process are designed to ensure accountability and represent the interests of all Solvay shareholders. The board's decisions significantly influence the company's strategic direction and financial performance. Understanding the board's structure and how it operates is key to grasping the dynamics of Solvay company.

| Board Member | Position | Additional Information |

|---|---|---|

| Ilham Kadri | Chairwoman of the Board | Appointed in 2023, also serves as a director. |

| Thomas Leysen | Vice-Chairman | Long-standing member, brings extensive experience. |

| Feike Sijbesma | Independent Director | Known for his expertise in sustainability and innovation. |

Solvay's voting structure generally operates on a one-share-one-vote basis, except for shares held by Solvay SA or its subsidiaries, where voting rights are suspended. Any shareholder holding voting rights equal to or greater than 3% must declare this shareholding to the company and the Financial Services and Markets Authority (FSMA). This requirement applies to crossings of the 3%, 5%, 7.5%, and any multiple of 5% thresholds. As of August 9, 2024, Solvac SA held 30.81% of the voting rights, significantly influencing the company. Recent shareholder meetings, like the Extraordinary Shareholders' Meeting on December 8, 2023, which approved the demerger into Solvay and Syensqo, highlight the importance of shareholder votes in shaping the company's future. Shareholders typically vote in person, by proxy, or virtually. For more insights, check out the Competitors Landscape of Solvay.

The Board of Directors governs Solvay, ensuring independent oversight and diverse expertise.

- Solvac SA is the largest shareholder, holding a significant percentage of voting rights.

- Shareholders have significant influence through their voting rights, shaping the company's future.

- The voting structure is primarily one-share-one-vote, with specific disclosure requirements for major shareholders.

- Understanding the board's composition and shareholder voting dynamics is crucial for grasping Solvay ownership.

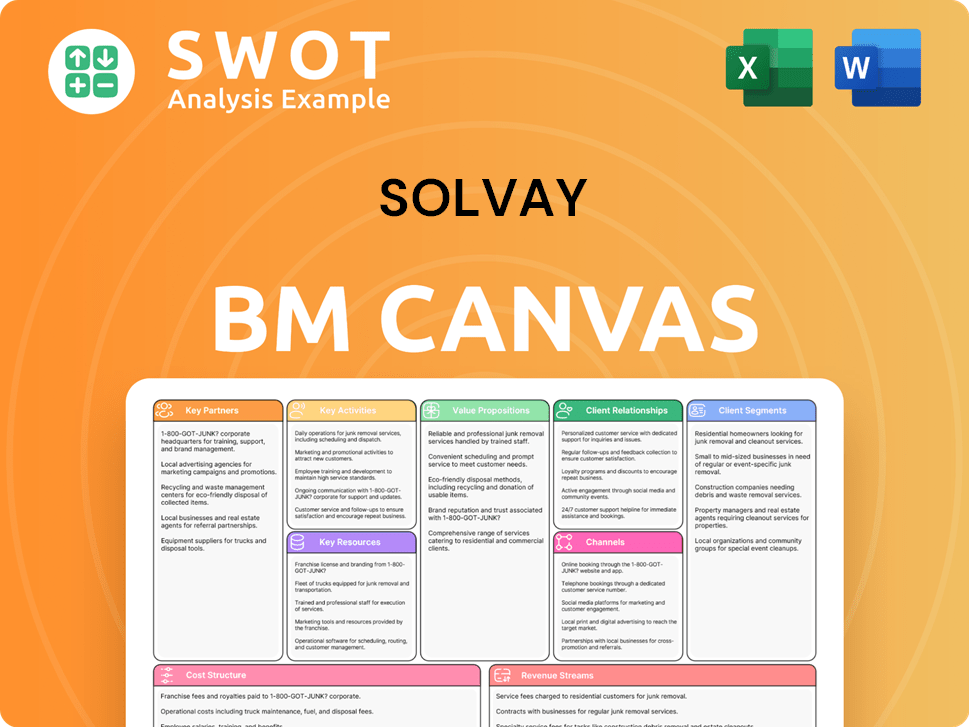

Solvay Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Solvay’s Ownership Landscape?

Recent developments in the Solvay company's ownership have been significant, largely due to a demerger approved by Solvay shareholders on December 8, 2023. This led to the spin-off of its specialty businesses into a new, independent, publicly listed company called Syensqo, effective December 9, 2023. Solvay retained its core chemistry activities, employing approximately 9,000 people and generating an annual turnover of €4.88 billion in 2023. This strategic move aimed to provide both entities with the autonomy needed to pursue their respective strategies.

In terms of ownership trends, Solvay has been involved in share buyback programs. A share buyback program, announced on August 1, 2024, was completed by October 1, 2024, with Solvay repurchasing 161,273 shares. As of March 10, 2025, Solvay held a total of 1,416,886 own shares, with 1,220,974 held directly by Solvay SA and 195,912 by its indirect subsidiary, Solvay Stock Option Management SRL (SSOM). These buybacks often fulfill obligations related to long-term incentive plans. The company’s 2024 Annual General Meeting, held on May 28, 2024, saw shareholders unanimously support all proposed resolutions, including a gross dividend payment of €2.43 per share for 2023. The financial statements for 2024 are subject to approval at the upcoming Ordinary General Shareholders' Meeting on May 13, 2025, where a total gross dividend of €2.43 per share is proposed.

Understanding the Solvay ownership structure is essential for investors. The company's recent actions, such as the share buybacks and the spin-off of Syensqo, reflect its strategic focus. For those seeking to understand Solvay's history and current status, further details can be found in various financial reports and company announcements. It's important to note that the Solvay CEO and other key executives play a crucial role in shaping the company's direction.

The demerger of specialty businesses into Syensqo, effective December 9, 2023, significantly altered Solvay's structure. This strategic move provided both entities with greater operational independence. Share buyback programs, such as the one completed in October 2024, also impact the ownership distribution.

Shareholders supported all resolutions at the May 28, 2024, Annual General Meeting. The proposed gross dividend of €2.43 per share for 2023 was unanimously approved. Financial statements for 2024 are awaiting approval at the upcoming meeting on May 13, 2025.

As of March 10, 2025, Solvay held a total of 1,416,886 own shares. This includes shares held directly by Solvay SA and its subsidiary, SSOM. The company continues to manage its share structure through buyback initiatives and other corporate actions.

Ongoing developments in Solvay's ownership structure will continue to shape its strategic direction. Investors and stakeholders should monitor the company's financial reports and shareholder communications. Further analysis on the company's performance can be found through various financial resources.

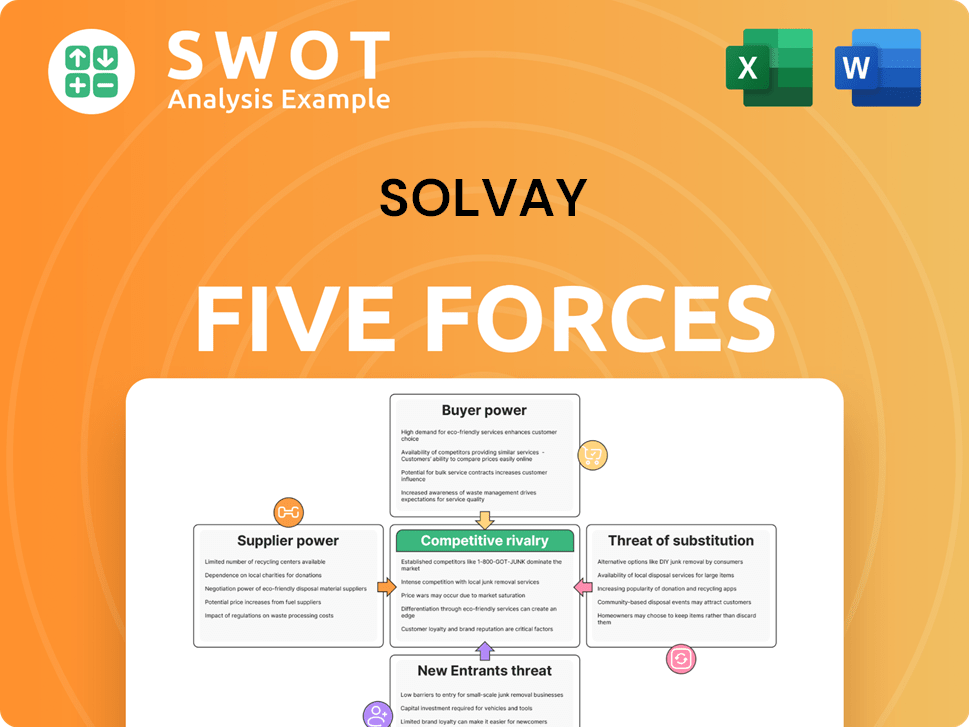

Solvay Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Solvay Company?

- What is Competitive Landscape of Solvay Company?

- What is Growth Strategy and Future Prospects of Solvay Company?

- How Does Solvay Company Work?

- What is Sales and Marketing Strategy of Solvay Company?

- What is Brief History of Solvay Company?

- What is Customer Demographics and Target Market of Solvay Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.