Solvay Bundle

How Does Solvay Company Thrive in a Changing World?

Solvay, a titan in the specialty chemicals and advanced materials sector, is reshaping industries with its forward-thinking Solvay SWOT Analysis. Its influence spans crucial sectors, from automotive to healthcare, making its strategies essential for investors and industry watchers. Understanding the inner workings of Solvay, including its

In 2024, Solvay's strategic demerger into Solvay and Syensqo highlighted its commitment to focused growth. This article will explore the

What Are the Key Operations Driving Solvay’s Success?

The Solvay Company creates value by focusing on essential chemicals and serving various industrial applications. Their core offerings include soda ash, peroxides, and highly dispersible silica. These Solvay products are vital for industries such as automotive, construction, and consumer goods, demonstrating the company's broad market reach.

The Solvay business model centers around a global manufacturing footprint, strategically located to serve key markets. They emphasize efficient sourcing, continuous innovation, and robust logistics. Their commitment to sustainability, including reducing carbon emissions and developing bio-based solutions, sets them apart in the industry.

Solvay's operational processes involve advanced production facilities and a resilient supply chain. The company's focus on sustainable chemistry provides customer benefits like improved product performance and a reduced environmental footprint. This aligns with the growing global demand for greener solutions, making their value proposition increasingly relevant.

Solvay's main product lines include soda ash, peroxides, and highly dispersible silica. Soda ash is crucial for glass manufacturing and detergents. Peroxides are essential for pulp and paper bleaching and disinfection. Highly dispersible silica enhances the performance of tires.

Solvay serves diverse customer segments, including manufacturers in the automotive, construction, consumer goods, and environmental sectors. These customers rely on Solvay's chemicals for various applications. This wide range highlights the company's importance across multiple industries.

Solvay's operations emphasize efficient sourcing of raw materials, continuous innovation, and robust logistics. They have a global manufacturing footprint with strategically located facilities. Their supply chain is designed for resilience, ensuring timely delivery worldwide.

Solvay is committed to sustainability, reducing carbon emissions and developing bio-based solutions. This focus differentiates them and provides customer benefits like improved product performance and a reduced environmental footprint. This aligns with growing global demand for greener solutions.

Solvay's strategic advantages include a diverse product portfolio, a global manufacturing presence, and a strong focus on sustainability. This allows them to serve various industries while minimizing environmental impact. Their commitment to innovation ensures they stay ahead of market trends.

- Diverse product portfolio for various industries.

- Global manufacturing presence for efficient distribution.

- Strong focus on sustainability and innovation.

- Resilient supply chain and customer-centric approach.

For more details on the company's origins and development, you can read a Brief History of Solvay. In recent years, Solvay has emphasized its commitment to sustainability, with initiatives aimed at reducing its environmental footprint and developing eco-friendly products. For example, in 2024, the company announced further investments in sustainable chemistry projects to enhance its long-term value proposition.

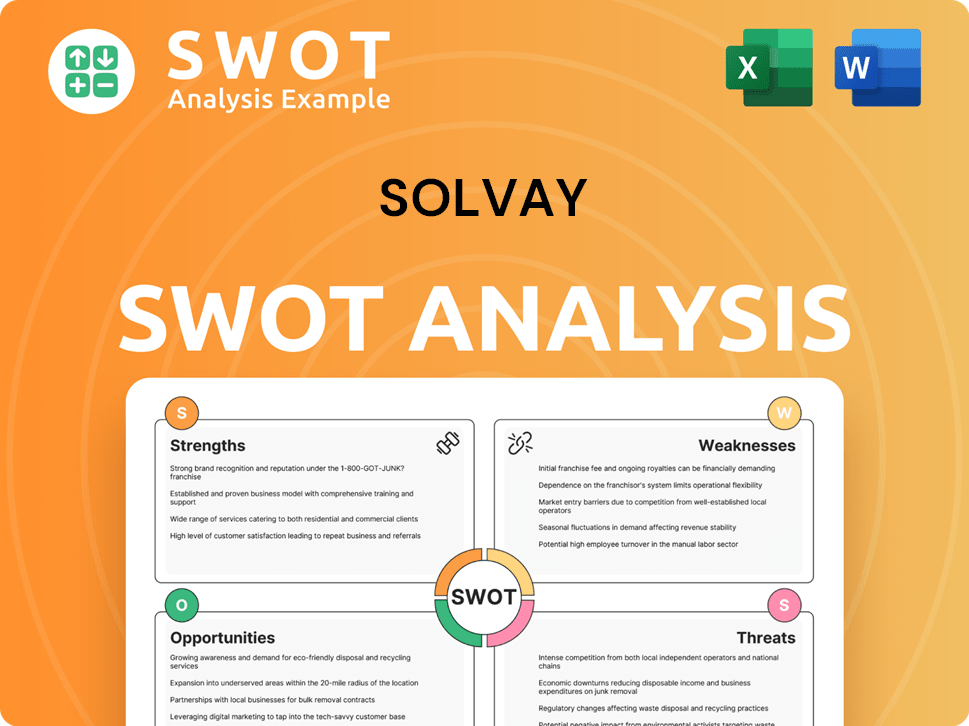

Solvay SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Solvay Make Money?

The Solvay Company generates revenue primarily through the sale of its essential chemicals. Following its 2024 restructuring, the company's financial focus is on its core businesses: soda ash, peroxides, and silica. This strategic shift underscores a commitment to streamlining operations and maximizing profitability within key market segments.

In the first quarter of 2024, Solvay reported net sales of €1,206 million, with an EBITDA of €261 million. This financial performance highlights the strength of its focused portfolio. The Solvay business model is centered on providing essential chemical products to various industries, driving significant revenue through strategic market positioning and operational efficiency.

Monetization strategies at Solvay are centered on product sales, with pricing influenced by global commodity markets, regional demand, and long-term contracts. The company also focuses on optimizing its product mix to prioritize higher-margin applications and leveraging its global scale to achieve cost efficiencies. The demerger in 2024 allowed both Solvay and Syensqo to pursue distinct growth strategies.

The primary revenue streams for Solvay come from the sale of its core Solvay products, including soda ash, peroxides, and silica. These products are essential in various industries, ensuring consistent demand. The company employs several strategies to monetize its products effectively.

- Pricing strategies are influenced by global commodity markets and regional demand, along with long-term contracts with industrial customers.

- The product mix is optimized to prioritize higher-margin applications, enhancing profitability.

- Solvay leverages its global scale to achieve cost efficiencies, improving overall financial performance.

- The strategic demerger in 2024 allowed Solvay to focus on its core businesses and tailor its strategies to specific market needs, aiming to unlock greater shareholder value.

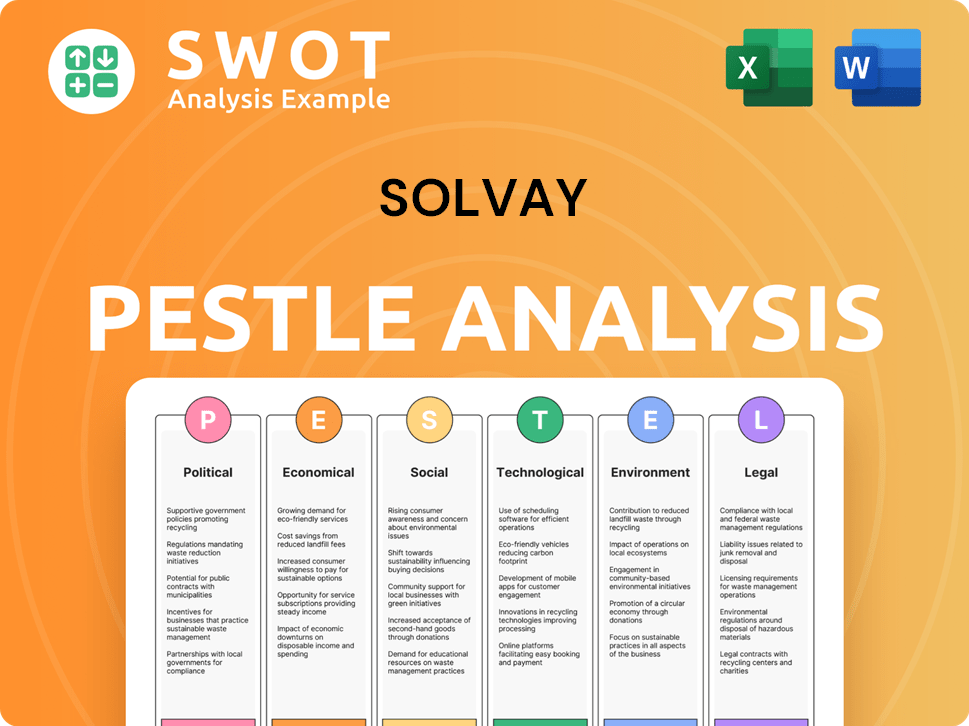

Solvay PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Solvay’s Business Model?

The Solvay Company has a rich Solvay history, marked by significant strategic shifts. A key event was the demerger in December 2023, finalized in December 2024, which split the company into Solvay and Syensqo. This restructuring allowed each entity to focus on its specific business model, with Solvay concentrating on essential chemicals. This move followed a period of strong financial results for Solvay.

The Solvay business model focuses on essential chemicals. The company has navigated operational challenges, including fluctuating raw material prices and energy costs, and evolving regulations. The company has responded by accelerating its energy transition, investing in renewable energy sources, and optimizing its industrial processes to reduce environmental impact and improve cost efficiency. For those interested in the company's ownership structure, more details can be found at Owners & Shareholders of Solvay.

The company's Solvay products are essential in various industries. Solvay's competitive advantages include a strong global market position in soda ash and peroxides, an extensive industrial footprint, and continuous investment in R&D for sustainable solutions. The company's commitment to innovation, particularly in green chemistry, helps it adapt to new trends and competitive threats, ensuring its long-term relevance and profitability in the chemical industry.

The demerger in late 2023, effective in December 2024, was a pivotal strategic move. This split created two independent entities: Solvay and Syensqo. This allowed Solvay to focus on its core essential chemicals business.

The company has focused on sustainability and operational efficiency. Solvay has invested in renewable energy and optimized processes to reduce environmental impact. This includes adapting to evolving regulatory landscapes concerning chemical production.

Solvay's strong market position and continuous innovation provide a competitive advantage. The company has a global presence and a commitment to R&D, particularly in green chemistry. This helps Solvay adapt to new trends and maintain profitability.

Solvay reported robust financial results in 2023. This included a significant increase in free cash flow and a record dividend payout. The company's financial health supports its strategic initiatives.

Solvay's strengths include its market position, innovation, and sustainability efforts. The company is focused on operational efficiency and adapting to market changes. These strategies are designed to ensure long-term growth and profitability.

- Strong market position in soda ash and peroxides.

- Continuous investment in R&D for sustainable solutions.

- Focus on green chemistry and innovation.

- Adaptation to evolving regulatory landscapes.

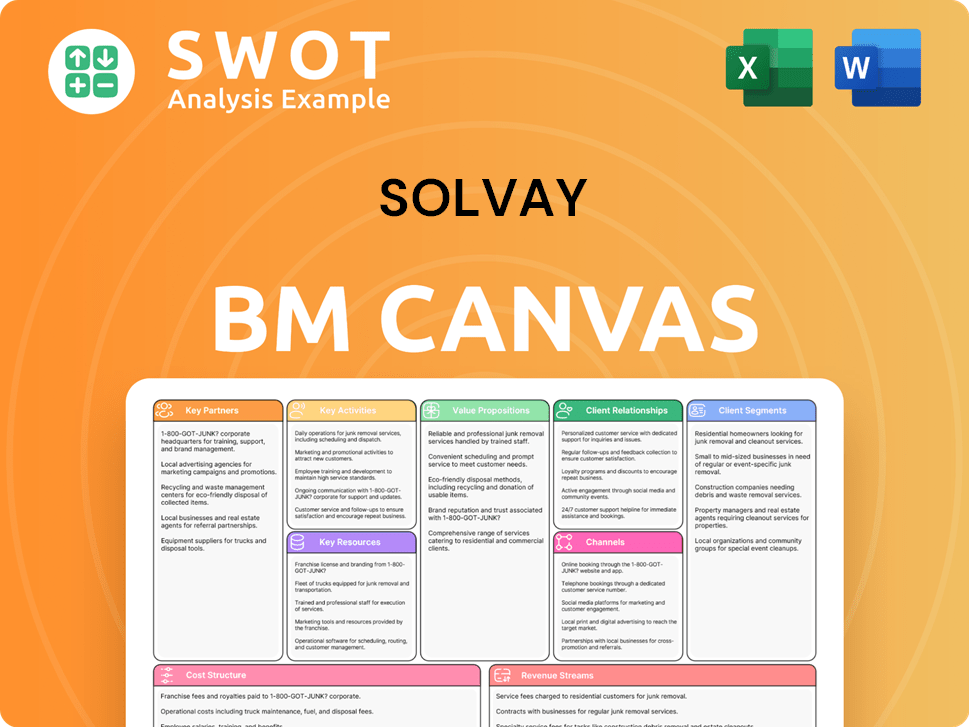

Solvay Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Solvay Positioning Itself for Continued Success?

The Solvay Company maintains a robust industry position, particularly in essential chemicals like soda ash and peroxides. Following the 2024 demerger, the company has sharpened its focus, aiming for greater agility and dedication to its core offerings. While specific market share data post-demerger is still emerging, the company's historical standing and global footprint indicate a strong competitive position. Understanding the Target Market of Solvay is key to grasping its market dynamics.

Key risks for Solvay include fluctuations in raw material and energy prices, which can significantly impact production costs and profitability. Regulatory changes concerning environmental standards and chemical safety also pose ongoing challenges, requiring continuous investment in compliance and sustainable practices. Furthermore, the emergence of new technologies or alternative materials could disrupt existing markets, necessitating ongoing innovation and adaptation.

Solvay holds a leading market position in several of its core product areas, particularly in soda ash and peroxides, serving a global customer base across diverse industries. The 2024 demerger has further solidified its position by creating a more focused and agile entity dedicated to essential chemicals.

Fluctuations in raw material and energy prices can significantly impact production costs and profitability. Regulatory changes concerning environmental standards and chemical safety also pose ongoing challenges. The emergence of new technologies or alternative materials could disrupt existing markets.

The future outlook is characterized by strategic initiatives focused on operational excellence, sustainable growth, and continued innovation in essential chemicals. The company aims to leverage its strong market positions and commitment to sustainability to capitalize on global demand for its products.

The company's leadership has emphasized its commitment to delivering long-term value to shareholders through disciplined capital allocation and a focus on core, high-performing assets. Specific financial data, such as revenue and profit margins, will be key indicators of performance in the coming years.

The company is focused on operational excellence, sustainable growth, and innovation. Solvay aims to leverage its market positions and commitment to sustainability to capitalize on global demand for its products.

- Focus on essential chemicals.

- Commitment to sustainable practices.

- Disciplined capital allocation.

- Innovation in materials science.

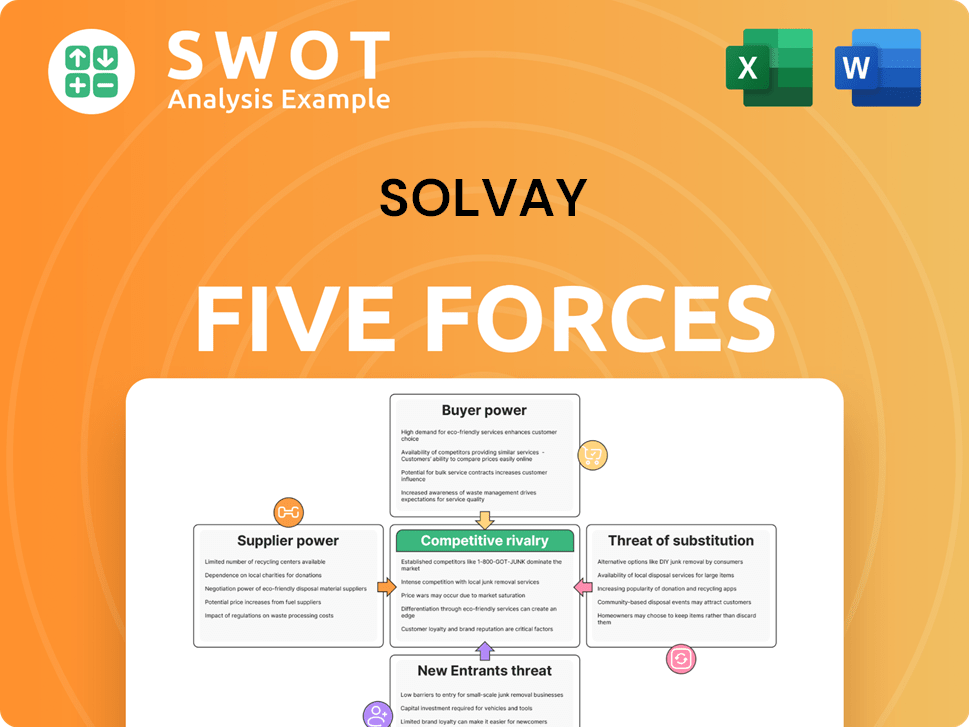

Solvay Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Solvay Company?

- What is Competitive Landscape of Solvay Company?

- What is Growth Strategy and Future Prospects of Solvay Company?

- What is Sales and Marketing Strategy of Solvay Company?

- What is Brief History of Solvay Company?

- Who Owns Solvay Company?

- What is Customer Demographics and Target Market of Solvay Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.