Starbucks Bundle

Can Starbucks Maintain Its Global Coffee Dominance?

From its humble beginnings in Seattle to a global empire, Starbucks has redefined the coffee experience. Its remarkable journey showcases the power of a compelling Starbucks SWOT Analysis and a well-executed Starbucks growth strategy. But as the market evolves, can Starbucks continue its impressive trajectory? This analysis explores the company's future prospects.

This deep dive into Starbucks company analysis will reveal how the coffee giant plans to navigate the complexities of international expansion strategy and maintain its significant market share. We'll examine Starbucks's business model, including its new product development and customer loyalty programs, as well as the impact of inflation and supply chain challenges. Understanding Starbucks's long term growth plans, including its digital transformation strategy and sustainability initiatives, is crucial for investors and strategists alike.

How Is Starbucks Expanding Its Reach?

The Starbucks growth strategy involves aggressive expansion, both geographically and through product innovation. The company is focused on increasing its presence in existing markets and penetrating new ones. A key aspect of this strategy is international expansion, with a strong emphasis on the Chinese market. This approach is designed to diversify revenue streams and maintain a competitive edge in the global coffee market.

Starbucks future prospects are closely tied to its ability to execute its expansion plans and adapt to changing consumer preferences. The company aims to open approximately 2,000 new stores globally in fiscal year 2024, with a significant portion of these outside North America. This growth is supported by new store formats and product development, including ready-to-drink (RTD) beverages and innovative menu items. These initiatives are crucial for sustaining long-term growth and increasing market share.

In the first quarter of fiscal year 2024, the company opened 549 net new stores, bringing the total to 38,588 stores worldwide. This expansion reflects its commitment to reaching new customer bases and increasing its global footprint. The company's strategies include streamlining operations and improving customer accessibility through new store formats like drive-thru and pickup locations.

The company is heavily investing in international markets, particularly in China, which is projected to become its largest market. This expansion is a core component of the Starbucks expansion strategy. This focus allows the company to access new customer bases and diversify its revenue streams.

Product innovation is a key element of the company's strategy, including the expansion of its ready-to-drink (RTD) portfolio. Strategic partnerships, such as the one with PepsiCo for RTD products, play a significant role in this. These collaborations help maintain its competitive advantages.

The company is exploring new store formats, including smaller, more efficient drive-thru only locations and Starbucks Pickup stores. These formats are designed to enhance convenience and optimize operational costs. These initiatives support its long term growth plans.

The company's financial performance is crucial for sustaining its growth. To understand the company's financial health, you can explore the Revenue Streams & Business Model of Starbucks. The company's ability to maintain and increase its revenue is essential for funding expansion initiatives and new product development.

The company's expansion strategy is multifaceted, focusing on both geographical growth and innovation. This includes a focus on international markets, particularly China, and the development of new store formats. These strategies are designed to enhance customer accessibility and adapt to changing retail landscapes.

- Aggressive international expansion, with a focus on China.

- Product innovation, including RTD beverages and new menu items.

- Development of new store formats for enhanced convenience.

- Strategic partnerships to support product development and distribution.

Starbucks SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Starbucks Invest in Innovation?

The company's innovation and technology strategy is a key driver of its sustained growth and enhanced customer experience. This strategy focuses on digital transformation, customer loyalty programs, and operational efficiency through automation and sustainability initiatives. These efforts not only improve customer convenience but also align with evolving consumer values, supporting long-term growth objectives.

The company's approach to innovation is multifaceted, integrating technological advancements with sustainability practices. This dual focus allows the company to meet consumer demands for convenience and environmental responsibility. This strategy is crucial for maintaining its competitive edge in the global market.

The company’s digital transformation strategy is significantly centered on its rewards program and mobile ordering capabilities. This digital infrastructure allows for personalized marketing, streamlined ordering, and efficient payment. These features contribute to customer retention and sales growth.

The company has invested heavily in its digital transformation. This includes the development of its mobile app and online ordering system.

The company's rewards program is a cornerstone of its customer retention strategy. As of the first quarter of fiscal year 2024, the company Rewards active members in the U.S. reached 32.8 million, growing 13% year-over-year.

The company consistently invests in improving its operational efficiency through automation. This includes areas like inventory management and beverage preparation.

Sustainability is deeply integrated into the company's innovation strategy. Efforts include sustainable sourcing, waste reduction, and eco-friendly packaging.

The company is exploring the use of cutting-edge technologies to enhance customer experience and operational efficiency. This includes potential applications of AI and data analytics.

The company often forms strategic partnerships to enhance its technological capabilities and market reach. These collaborations can involve technology providers and other businesses.

The company's innovation strategy is multifaceted, focusing on digital enhancements, operational efficiency, and sustainability. These elements work together to improve customer experience and drive growth. The company's continuous investment in technology and its customer-centric approach are key to its success. For a deeper understanding of the competitive landscape, consider exploring the Competitors Landscape of Starbucks.

- Digital Customer Experience: Enhancing the mobile app, online ordering, and rewards program to provide a seamless and personalized customer experience.

- Operational Efficiency: Utilizing automation and data analytics to optimize processes, reduce costs, and improve speed of service.

- Sustainability Initiatives: Developing eco-friendly packaging, reducing waste, and sourcing ingredients sustainably to align with consumer values.

- Data-Driven Decision Making: Leveraging data analytics to understand customer preferences, predict trends, and make informed business decisions.

Starbucks PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Starbucks’s Growth Forecast?

The financial outlook for the company remains positive, supported by its strategic growth initiatives. The company is projecting strong performance in fiscal year 2024, reflecting confidence in its expansion plans, digital engagement, and product innovation. This positive outlook is a key element of its overall business strategy.

For fiscal year 2024, the company anticipates global comparable store sales growth of 7% to 10%. Revenue growth is projected to be in the range of 10% to 12%. These figures demonstrate the company's commitment to sustainable, long-term growth. The company’s financial health is further bolstered by ongoing investments in store development and technology infrastructure.

In the first quarter of fiscal year 2024, the company reported consolidated net revenues of $9.4 billion, an increase of 8% compared to the prior year. Non-GAAP earnings per share are projected to grow by 15% to 20% in fiscal year 2024. The company's strong financial performance is a testament to its effective business model and strategic initiatives.

The company expects revenue growth of 10% to 12% in fiscal year 2024. This growth is driven by a combination of factors, including new store openings and increased comparable store sales. The company's focus on innovation and customer experience contributes to its revenue growth.

Global comparable store sales growth is projected to be between 7% and 10% in fiscal year 2024. This growth indicates the company's ability to attract and retain customers. The company's digital initiatives and loyalty programs play a significant role in driving comparable store sales.

Non-GAAP earnings per share are projected to grow by 15% to 20% in fiscal year 2024. This growth reflects the company's operational efficiency and strong financial management. The company's focus on profitability is a key aspect of its financial strategy.

Ongoing investments in store development are a critical part of the company's growth strategy. The company plans to open new stores in key markets to expand its global presence. This expansion is supported by a strong balance sheet and consistent cash flow.

Investments in technology infrastructure are essential for enhancing the customer experience and operational efficiency. This includes digital platforms, mobile ordering, and loyalty programs. The company's digital transformation strategy supports its long-term growth plans.

The company is committed to investing in its partners (employees) through wages and benefits. This investment supports employee satisfaction and retention. These investments are crucial for maintaining high-quality service and operational excellence.

Starbucks Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Starbucks’s Growth?

The journey of the company, and its future prospects, is not without its hurdles. Several risks and obstacles could potentially impact its growth strategy. These challenges range from intense competition to the ever-changing consumer preferences.

The company must navigate a complex landscape of both internal and external pressures to maintain its market share and achieve its long-term growth plans. Understanding these potential pitfalls is crucial for investors, analysts, and anyone interested in a comprehensive Starbucks company analysis.

The company faces several strategic and operational risks that could impact its growth ambitions. Intense market competition from both established global chains and independent coffee shops poses a continuous challenge to market share and pricing power. Regulatory changes, particularly concerning labor laws, environmental regulations, and food safety standards across its diverse international markets, could lead to increased operational costs or restrictions.

The coffee market is highly competitive, with numerous players vying for market share. Competitors include other global chains like Costa Coffee and local independent coffee shops, which can impact pricing and customer loyalty. The company's ability to maintain its competitive advantages will be tested by these rivals.

Changes in labor laws, environmental regulations, and food safety standards across the company's diverse international markets can increase operational costs. The company must comply with various regulations, which can vary significantly by region. Non-compliance can lead to fines, legal battles, and reputational damage.

Supply chain disruptions, particularly related to coffee bean sourcing and global logistics, present ongoing risks. Events like climate change, political instability in coffee-producing regions, and transportation issues can affect the availability and cost of coffee beans. The company is working on diversification of its supply chain.

Geopolitical tensions and economic slowdowns in key markets can significantly impact the company's performance. Economic downturns can reduce consumer spending, while political instability can disrupt operations. The company’s international expansion strategy must consider these risks.

Managing a vast network of stores and ensuring a consistent brand experience across diverse cultures is a complex operational challenge. This includes maintaining quality, training staff, and adapting to local market preferences. The company must continuously refine its operational strategies.

Evolving consumer preferences towards healthier options or alternative beverages require continuous innovation and menu adaptation. The company must stay ahead of trends. The company's ability to adapt to changing consumer tastes is critical for its long-term success.

To mitigate these risks, the company employs several strategies. It diversifies its supply chain to reduce reliance on any single source, and implements robust risk management frameworks to anticipate and manage potential disruptions. For example, the company is investing in its digital transformation strategy to improve customer experience and operational efficiency. The company has demonstrated resilience in overcoming past obstacles, such as navigating the COVID-19 pandemic through rapid adaptation of its service model. For more details on the financial aspects, you can read more about Owners & Shareholders of Starbucks.

The company sources coffee beans from various regions, making it vulnerable to supply chain disruptions. Climate change, political instability, and transportation issues can affect the availability and cost of coffee beans. The company is working on diversifying its supply chain to mitigate these risks. For example, in fiscal year 2023, the company reported a slight increase in the cost of goods sold due to supply chain pressures, which impacted its profit margins.

The coffee market is intensely competitive, with both global chains and independent coffee shops vying for market share. Competitors often offer similar products or lower prices, putting pressure on the company's revenue. The company's ability to differentiate itself through brand loyalty and new product development is crucial. For example, in 2024, the company's market share in the U.S. coffee shop segment was around 40%, facing pressure from competitors like Dunkin'.

Economic slowdowns can reduce consumer spending and impact the company's sales. During economic downturns, consumers may cut back on discretionary spending, including coffee purchases. The company must adapt its pricing and promotional strategies to maintain sales. For example, during the 2008 financial crisis, the company experienced a decline in same-store sales, which led to restructuring efforts.

Geopolitical tensions and instability in key markets can disrupt operations and impact the company's growth. Political unrest, trade wars, and changes in government policies can affect the company's international expansion strategy. The company must carefully assess and manage these risks in its global operations. For example, the company has had to navigate complex geopolitical situations in markets like China and the Middle East.

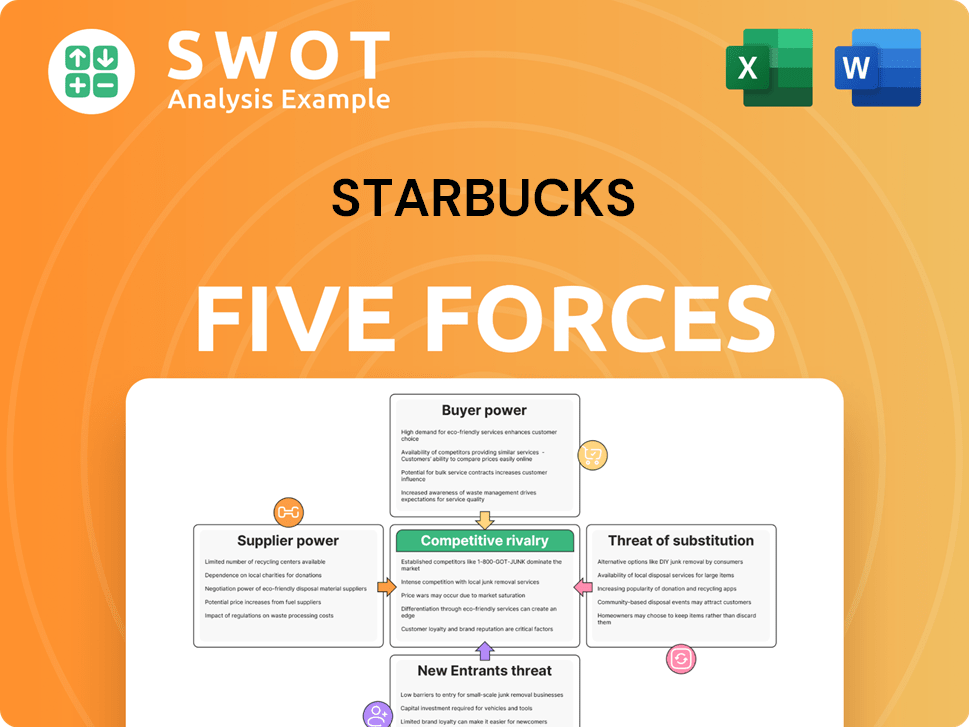

Starbucks Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Starbucks Company?

- What is Competitive Landscape of Starbucks Company?

- How Does Starbucks Company Work?

- What is Sales and Marketing Strategy of Starbucks Company?

- What is Brief History of Starbucks Company?

- Who Owns Starbucks Company?

- What is Customer Demographics and Target Market of Starbucks Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.