Stratasys Bundle

Can Stratasys' Growth Strategy Propel It to New Heights?

Founded in 1989, Stratasys has been at the forefront of the 3D printing revolution, transforming manufacturing across various sectors. With the Stratasys SWOT Analysis, we dissect the company's core strengths and weaknesses. This analysis is crucial for investors and strategists alike, given the rapid evolution of the 3D printing market and the need for robust additive manufacturing solutions.

Stratasys' recent strategic investment of $120 million from Fortissimo Capital highlights its commitment to innovation and expansion. This infusion of capital is a key component of its growth strategy, particularly as it navigates the competitive landscape. Understanding the Stratasys company analysis, including its financial performance and market share, is vital for assessing its long-term investment potential and future prospects within the additive manufacturing industry.

How Is Stratasys Expanding Its Reach?

The company is actively pursuing several expansion initiatives to fuel its growth. These initiatives focus on entering new markets, launching new products, and exploring strategic mergers and acquisitions. A key element of its strategy is to prioritize industrial manufacturing and recurring revenue streams, particularly from consumables and software.

The company's emphasis on end-part manufacturing applications is evident, with this segment accounting for 36% of revenues in 2024, an increase from 34% in 2023 and over 25% in 2020. This growth trajectory indicates a strategic shift towards higher-value applications and a more diversified revenue base. The company anticipates continued growth in this area, with the goal of making it the majority of its business.

The company's expansion strategy is multifaceted, involving both product and market development. It's also actively pursuing partnerships and acquisitions to strengthen its market position and technological capabilities. These efforts are designed to capitalize on the growing demand for 3D printing solutions across various industries. For a more detailed look at the company's origins, consider reading Brief History of Stratasys.

The company has introduced several new products to enhance its offerings. This includes the Fortus FDC filament dryer, designed to improve printing efficiency and prevent moisture-related issues. New polycarbonate electrostatic discharge (ESD) materials have also been launched for electronic manufacturing.

Expansion into new markets is a key focus. The company launched the H350 3D Printer in April 2024, targeting industrial clients with a high-speed, large-format system. It is also expanding into apparel customization with a direct-to-garment solution, broadening its application scope.

Through its subsidiaries, the company is expanding its material offerings. iSQUARED introduced 'iSQUARED Validated Materials' in November 2024, providing broader access to application-specific materials. iSQUARED is also launching a marketplace for pre-owned 3D printers.

Partnerships play a crucial role in the company's expansion strategy. The Select Additive Partnership, formed in April 2024, focuses on deploying 3D printing in automotive supply chains. This collaboration supports the company's growth initiatives and market penetration.

The company's strategy includes strategic investments to support future acquisitions. The $120 million investment from Fortissimo Capital, which closed in Q2 2025, is primarily intended to support future acquisitions. This positions the company to lead industry consolidation.

- The company is focused on expanding its market share in the 3D printing market.

- Acquisitions are a key part of the company's growth strategy.

- The company aims to strengthen its position through strategic partnerships and investments.

- The company is targeting growth in end-part manufacturing applications.

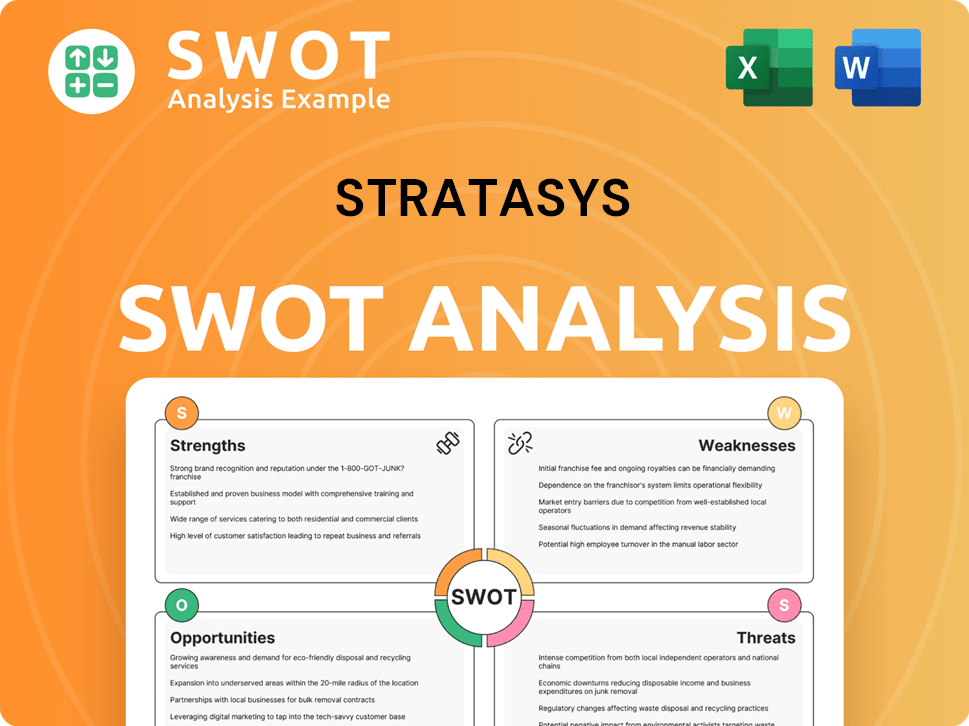

Stratasys SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Stratasys Invest in Innovation?

The innovation and technology strategy of the company is a central pillar in its growth strategy, focusing on continuous advancements in additive manufacturing. This approach is designed to maintain and enhance its leadership position within the 3D printing market. The company's commitment to research and development (R&D), in-house innovation, and strategic collaborations is key to its long-term success.

A core aspect of this strategy involves expanding its technology, materials, and software portfolio. This expansion supports the company's goal of providing comprehensive solutions to its customers. The company's focus on industrial applications and full-scale production, where manufacturing accounts for a growing percentage of its revenue, highlights its strategic direction.

The company anticipates that AI-centric production systems will strongly support additive manufacturing, indicating a future focus on integrating cutting-edge technologies. These technological advancements and new product offerings are crucial to the company's growth objectives, contributing to its leadership in the additive manufacturing space.

The company has introduced several key product innovations to enhance its offerings. These innovations are designed to meet the evolving needs of industrial clients and expand the capabilities of its 3D printing solutions. These advancements are crucial for maintaining a competitive edge in the market.

Launched in April 2024, the H350 3D printer offers high-speed, large-format capabilities. This printer is designed to meet the demands of industrial clients. This launch signifies a move towards more efficient and scalable production solutions.

The company introduced SAF ReLife, a software solution that enables the reuse of waste PA12 powder. This software is designed to be used in powder bed fusion 3D printing processes, including selective laser sintering (SLS) and high-speed sintering. This promotes sustainability and cost efficiency.

In June 2024, the company announced updates to its Industrial and Healthcare Business Unit products. These updates include an open platform for the F900™ 3D printer and a new high-performance material for its Fused Deposition Modeling line. These updates are aimed at accelerating product time-to-market.

The OpenAM™ software for the F900 printer allows for expanded functionality and new material possibilities. This software enhances the versatility of the F900 printer. This expansion enables users to explore new applications and improve production capabilities.

The company's commitment to innovation is reflected in its focus on industrial applications and full-scale production. Manufacturing accounts for a growing percentage of its revenue. This focus highlights the company's strategic direction towards industrial markets.

The company's approach to innovation and technology is critical for its future prospects within the 3D printing market. By continuously investing in R&D and expanding its product portfolio, the company aims to strengthen its market position and drive sustainable growth. The company's strategic initiatives are designed to capitalize on the growing demand for additive manufacturing solutions. For a deeper understanding of the competitive environment, consider examining the Competitors Landscape of Stratasys.

- R&D Investment: Continuous investment in R&D is crucial for developing new technologies and materials.

- Product Portfolio Expansion: Expanding the portfolio of technologies, materials, and software will help meet diverse customer needs.

- Industrial Applications Focus: Focusing on industrial applications and full-scale production will drive revenue growth.

- AI Integration: Integrating AI-centric production systems will enhance efficiency and capabilities.

- Sustainability Initiatives: Initiatives like SAF ReLife demonstrate a commitment to sustainability and resource efficiency.

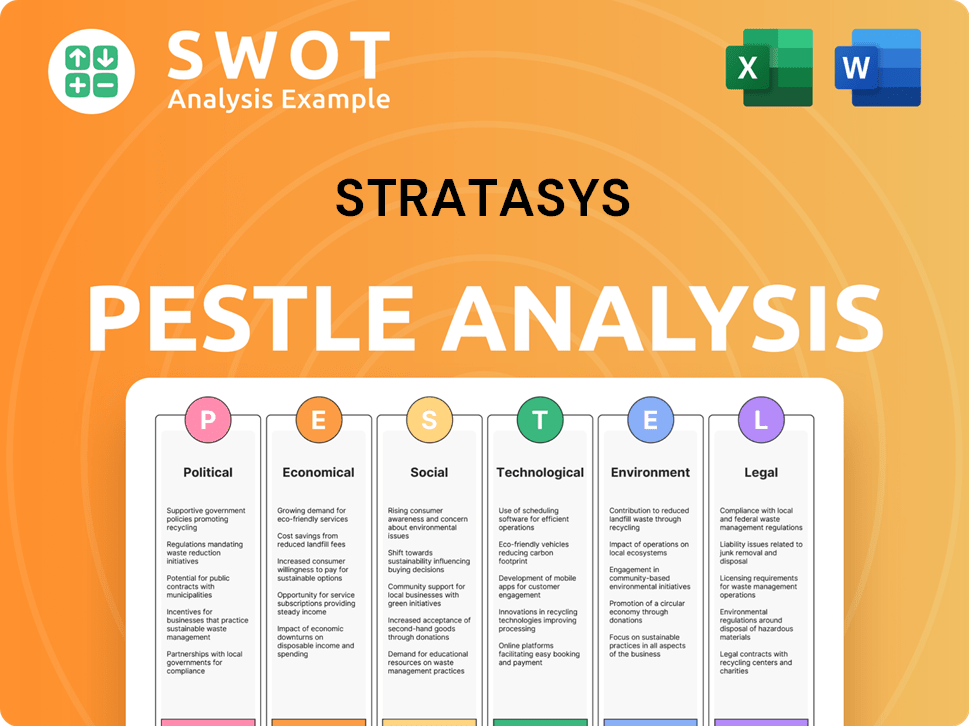

Stratasys PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Stratasys’s Growth Forecast?

The financial outlook for Stratasys in 2025 indicates a transition year with expectations of sequential revenue growth each quarter. The company projects annual revenue to be between $570 million and $585 million. This forecast reflects a measured recovery amid ongoing economic uncertainties, which is a key factor in the Stratasys growth strategy.

In 2024, the company reported revenue of $572.5 million, an 8.8% decrease from $627.6 million in 2023. Despite this revenue decline, Stratasys demonstrated improved profitability. Gross margins expanded, and adjusted EBITDA increased significantly, showing the effectiveness of the Stratasys business model in managing costs.

The company is set to receive a $120 million investment from Fortissimo Capital in Q2 2025. This investment will provide additional flexibility for growth initiatives and strengthen the company's balance sheet, supporting its Stratasys future prospects.

For 2025, Stratasys anticipates annual revenue between $570 million and $585 million. This projection suggests a recovery phase, with expected sequential quarterly revenue growth. This is crucial for understanding the Stratasys financial performance analysis.

Non-GAAP gross margins are forecasted between 48.8% and 49.2% for 2025. Adjusted EBITDA is expected to range from $44 million to $50 million, reflecting an Adjusted EBITDA margin of 7.8% to 8.5%. These figures are essential for a Stratasys company analysis.

Stratasys will close a $120 million investment from Fortissimo Capital in Q2 2025. Capital expenditures are projected to be between $25 million and $30 million for 2025. This investment is a key part of its Stratasys expansion strategies.

The company anticipates higher operating and free cash flow levels in 2025 compared to 2024. Non-GAAP net income is projected between $24 million and $30 million for 2025. These financial metrics are critical for assessing Stratasys long term investment potential.

The 3D printing market is dynamic, and understanding the 3D printing market is crucial for evaluating Stratasys. For more insights, you can refer to this article on Stratasys.

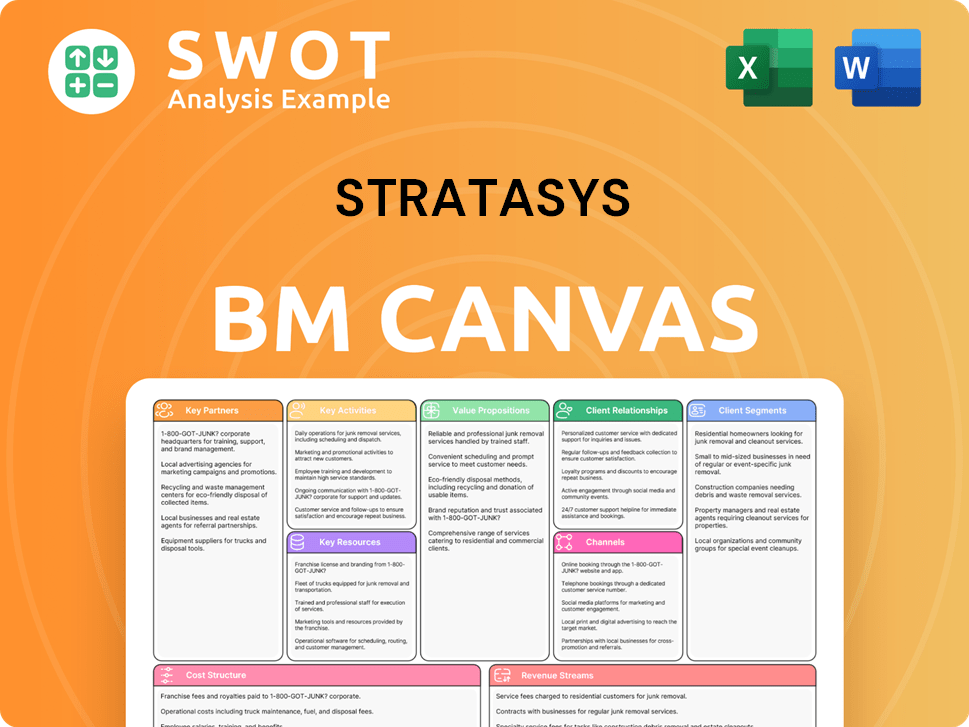

Stratasys Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Stratasys’s Growth?

The path forward for Stratasys, encompassing its growth strategy and future prospects, is not without its challenges. The 3D printing market is competitive, and Stratasys faces several risks that could impact its performance. Understanding these potential obstacles is crucial for a comprehensive Stratasys company analysis.

One of the primary concerns is the competitive landscape. The additive manufacturing sector is dynamic, with competition from lower-cost manufacturers posing a significant threat. Additionally, macroeconomic factors, such as inflation and interest rates, can impact the company. These economic pressures can lead to reduced customer spending and prolonged sales cycles, particularly affecting hardware sales and demand for recurring consumables.

Supply chain disruptions also present a risk to Stratasys. Moreover, integrating new technologies like AI and robotics introduces execution risks, despite the opportunities they offer. The company's financial performance in 2024, marked by a revenue decrease and a net loss, underscores these challenges. For a deeper dive into the business model, consider reading about the Revenue Streams & Business Model of Stratasys.

The 3D printing market is highly competitive, with numerous players vying for market share. Stratasys faces competition from both established companies and emerging startups, increasing pressure on pricing and innovation. This competitive intensity can affect Stratasys's ability to maintain or grow its market share, potentially impacting its financial performance. The company's ability to differentiate itself through technology and services is crucial.

Macroeconomic factors, including inflation, interest rates, and capital spending, can significantly influence Stratasys's performance. High interest rates can increase borrowing costs and reduce investment in capital equipment, which includes 3D printers. Inflation can raise production costs and potentially lower consumer demand. These economic conditions can lead to longer sales cycles and reduced demand, specifically impacting hardware purchases and recurring consumable demand. In 2024, the company experienced these headwinds, which contributed to a revenue decline.

Disruptions in the supply chain can affect the availability of components and materials needed for production. These disruptions can lead to delays in product delivery, increased costs, and reduced sales. The company must manage its supply chain effectively to mitigate these risks. Stratasys has taken steps to optimize its supply chain, but it remains a potential vulnerability.

Integrating new technologies, such as AI and robotics, presents both opportunities and risks. While these technologies can enhance product offerings and improve efficiency, they also require significant investment and expertise. There is a risk that the implementation of these technologies may face delays or not yield the expected results. The company’s ability to successfully integrate these technologies will be critical to its long-term growth.

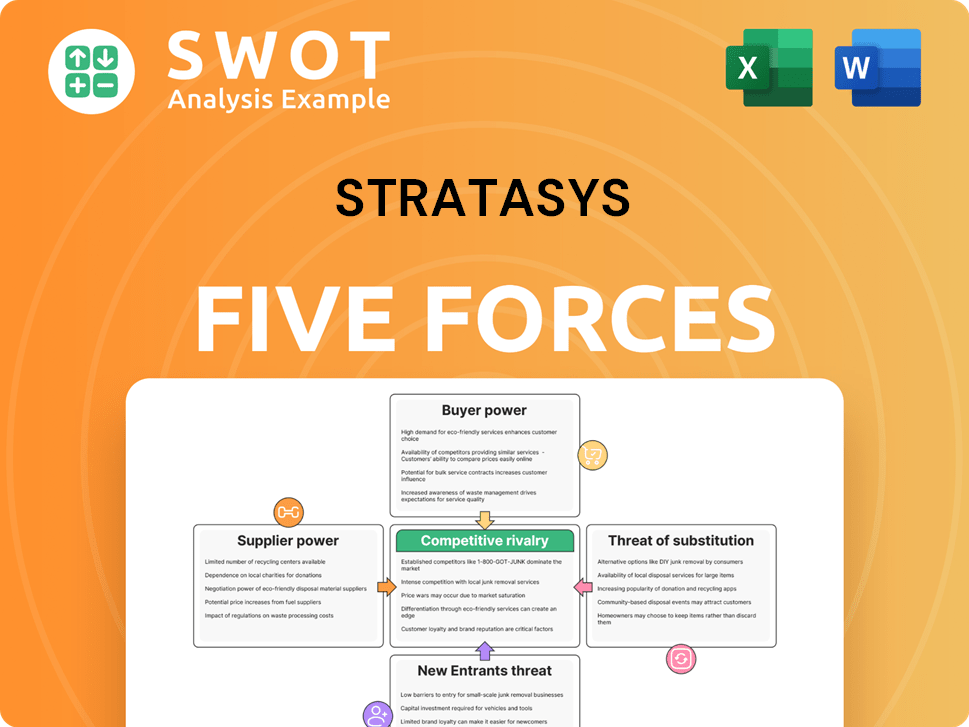

Stratasys Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Stratasys Company?

- What is Competitive Landscape of Stratasys Company?

- How Does Stratasys Company Work?

- What is Sales and Marketing Strategy of Stratasys Company?

- What is Brief History of Stratasys Company?

- Who Owns Stratasys Company?

- What is Customer Demographics and Target Market of Stratasys Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.