Stratasys Bundle

Who Really Controls Stratasys?

Unraveling the Stratasys SWOT Analysis is just the beginning; understanding who owns the company is key to grasping its future in the 3D printing world. The ownership structure of Stratasys, a leader in additive manufacturing, offers a fascinating look into its past, present, and potential future. Knowing the major players behind Stratasys is essential for anyone looking to understand its strategic moves and financial health.

The story of Stratasys company is a story of innovation and evolution, from its founding by Scott and Lisa Crump to its current status as a publicly traded entity. Examining the Stratasys ownership provides crucial insights into the company's strategic direction, governance, and long-term prospects. This exploration will delve into the Stratasys shareholders, its history, and the influences shaping its future in the dynamic additive manufacturing sector, including the impact of Stratasys stock performance on ownership.

Who Founded Stratasys?

The company, now known as Stratasys, was established in 1989 by S. Scott Crump and Lisa Crump. Scott Crump is credited with inventing Fused Deposition Modeling (FDM) technology, which became a cornerstone of the company's offerings. The early ownership of the company was primarily held by the founders, reflecting their pivotal role in the company's inception and technological innovation.

At its inception, Stratasys was a privately held entity. While specific details of the initial equity distribution are not publicly available, it's typical for founders to retain a significant ownership stake. This structure allowed the Crump family to have considerable influence over the company's strategic direction and technological advancements.

Early financial backing likely came from angel investors, friends, and family members, who would have received equity in exchange for seed capital. These initial investors played a crucial role in supporting the company during its early stages of development. The ownership structure was designed to ensure the founders' long-term commitment to the company.

The initial ownership of the Stratasys company was concentrated with the founders, S. Scott Crump and Lisa Crump, and a small group of early investors. The founders' vision for 3D printing technology was central to the company's initial direction, allowing them to guide technological advancements and market strategies. The early ownership structure facilitated the development of FDM technology, which was crucial to the company's initial success. For more insights, you can explore the Growth Strategy of Stratasys.

- The founders held a significant majority stake.

- Early investors included angel investors and family.

- Vesting schedules were likely used to ensure commitment.

- Buy-sell clauses would have been in place.

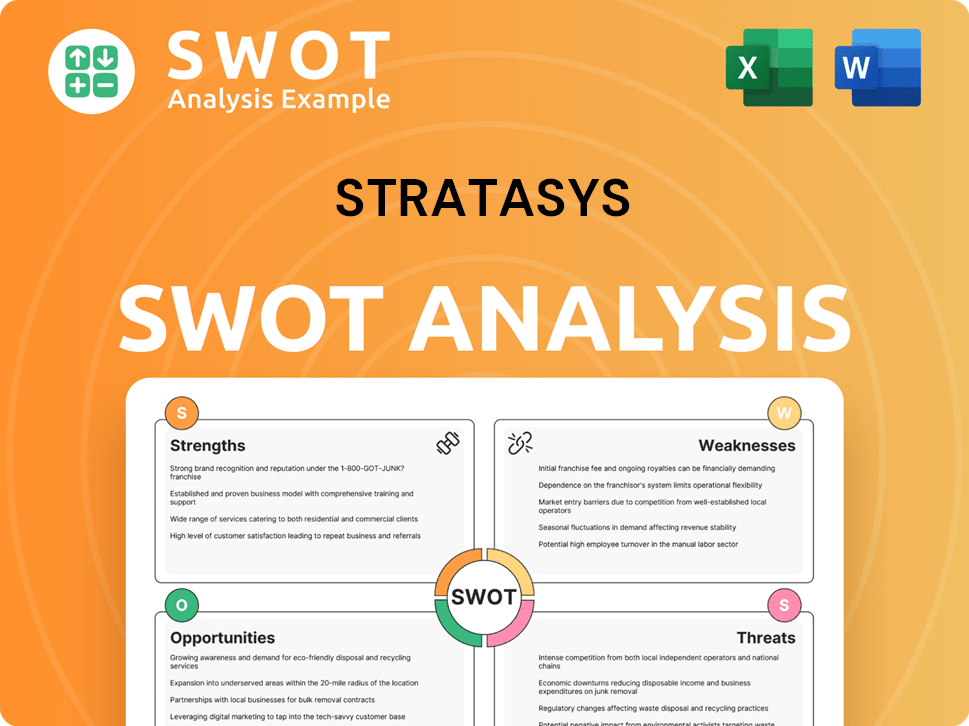

Stratasys SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Stratasys’s Ownership Changed Over Time?

The evolution of Stratasys ownership has been marked by key events that shaped its current structure. The initial public offering (IPO) in 1994 was a pivotal moment, transitioning the company to public ownership and fueling its growth through access to capital. Another significant event was the 2012 merger with Objet Ltd., a deal valued at approximately $3 billion at the time. This merger created Stratasys Ltd., broadening its shareholder base to include Objet's investors and management.

As a publicly traded entity on the NASDAQ (SSYS), Stratasys company ownership is now distributed among various institutional investors, mutual funds, and individual shareholders. The shift to public ownership and the merger with Objet fundamentally altered Stratasys's governance, increasing transparency and accountability to a diverse shareholder base.

| Event | Impact on Ownership | Year |

|---|---|---|

| Initial Public Offering (IPO) | Transitioned to public ownership, provided capital for growth. | 1994 |

| Merger with Objet Ltd. | Diversified shareholder base, integrated Objet's investors. | 2012 |

| Ongoing Market Activity | Fluctuations in institutional holdings, influenced by investment strategies. | Ongoing |

As of early 2025, major institutional investors, such as Vanguard Group Inc. and BlackRock Inc., hold a substantial portion of Stratasys stock. These firms, along with other asset management companies and hedge funds, collectively exert significant influence. Individual insiders, including current and former executives and board members, also hold shares, aligning their interests with the company's performance. Understanding the Stratasys shareholders and their influence is crucial for anyone interested in the company's strategic direction. To gain more insights into the competitive landscape, you can explore the Competitors Landscape of Stratasys.

Stratasys's ownership structure has evolved significantly since its IPO in 1994 and the 2012 merger with Objet Ltd.

- Publicly traded on NASDAQ (SSYS).

- Major shareholders include institutional investors.

- Ownership structure influences strategic decisions.

- Individual insiders also hold shares.

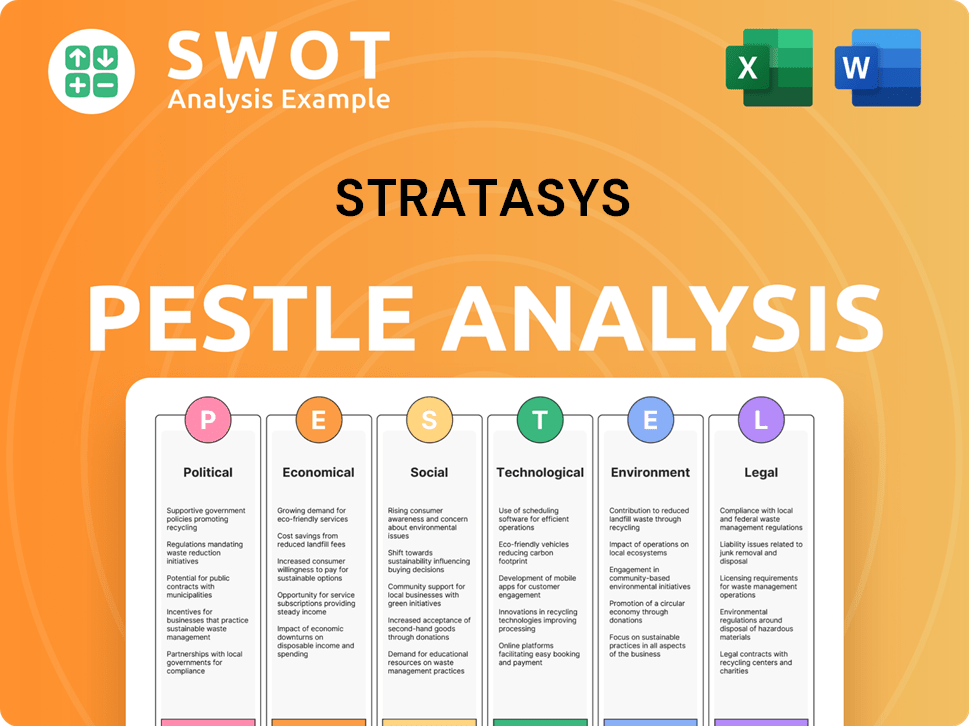

Stratasys PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Stratasys’s Board?

The current board of directors of the Stratasys company plays a vital role in its governance, representing the interests of its shareholders. As of early 2025, the board includes a mix of independent directors, representatives of major shareholders, and executive management. These individuals bring expertise in technology, finance, and manufacturing, reflecting the company's industry focus and strategic needs. The board's composition ensures diverse perspectives and oversight.

Board members often include representatives from significant institutional investors, ensuring their voices are heard in key decisions. Independent directors provide objective oversight. The board's responsibilities include evaluating strategic alternatives and defending shareholder interests, especially during corporate actions like acquisition bids or activist investor campaigns. The board's decisions significantly impact the company's direction and value for Stratasys shareholders.

| Board Member | Title | Background |

|---|---|---|

| Yoav Stern | Chairman of the Board | Extensive experience in technology and business leadership |

| Dr. Ken Traub | Director | Experience in finance and investment management |

| Erez Simha | Director | Expertise in technology and corporate strategy |

Stratasys operates under a one-share-one-vote structure, meaning that each ordinary share typically carries one vote. This structure ensures that voting power is directly proportional to the number of shares owned. There are no publicly reported instances of special voting rights or founder shares that would grant outsized control beyond equity stakes. The Growth Strategy of Stratasys highlights the importance of understanding the company's ownership structure for strategic planning.

The board of directors oversees Stratasys, representing shareholder interests and ensuring strategic direction. Stratasys follows a one-share-one-vote structure, providing proportional voting power. Understanding the board's composition and voting structure is crucial for investors.

- The board includes independent directors and representatives of major shareholders.

- Voting power is directly proportional to share ownership.

- The board plays a key role in strategic decisions and shareholder value.

- The board's decisions significantly impact the company's direction and value for Stratasys shareholders.

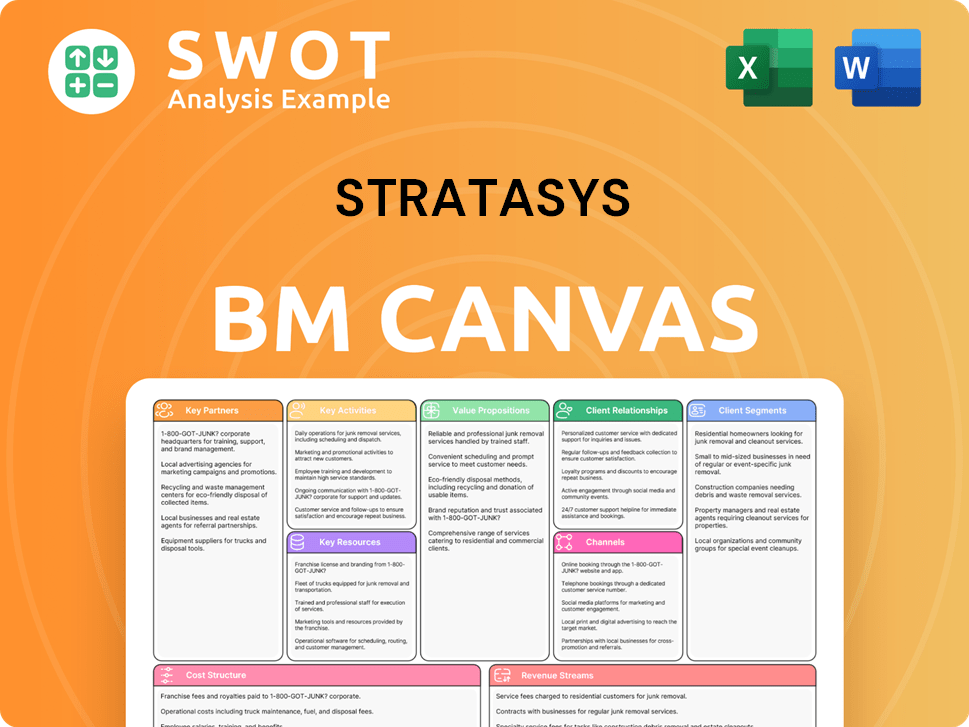

Stratasys Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Stratasys’s Ownership Landscape?

Over the past few years, the ownership of the Stratasys company has seen significant shifts. In 2023, the company faced multiple acquisition offers, including bids from 3D Systems and Desktop Metal. These events led to a period of strategic review, highlighting the active role of institutional investors in influencing major corporate decisions. Ultimately, Stratasys decided to remain independent, terminating its merger agreement with Desktop Metal in September 2023.

Industry trends indicate an increase in institutional ownership within additive manufacturing companies like Stratasys. This shift can lead to changes in the ownership structure over time, especially through capital raising, mergers, and acquisitions. The involvement of activist investors, as seen during the attempted takeovers, also influences ownership dynamics, potentially pushing for strategic changes to improve shareholder value. Strategic partnerships and acquisitions, like the 2020 acquisition of Origin, can also alter the ownership through share issuances or cash transactions.

Increased institutional ownership is a notable trend. Larger investment funds are seeking exposure to the growth potential of 3D printing. This can lead to founder dilution over time as companies raise capital or engage in mergers and acquisitions.

The rise of activist investors influences ownership dynamics. They push for strategic changes or improved shareholder value. This was evident during the attempted takeovers, highlighting the importance of shareholder influence.

While no specific public statements about immediate future ownership changes or planned privatization have been made, the company's focus on organic growth and strategic partnerships suggests a continued evolution of its shareholder base. This evolution aims to expand its market share and technological capabilities within the rapidly advancing additive manufacturing sector. The company's strategic decisions reflect a dynamic environment, with

key shareholders

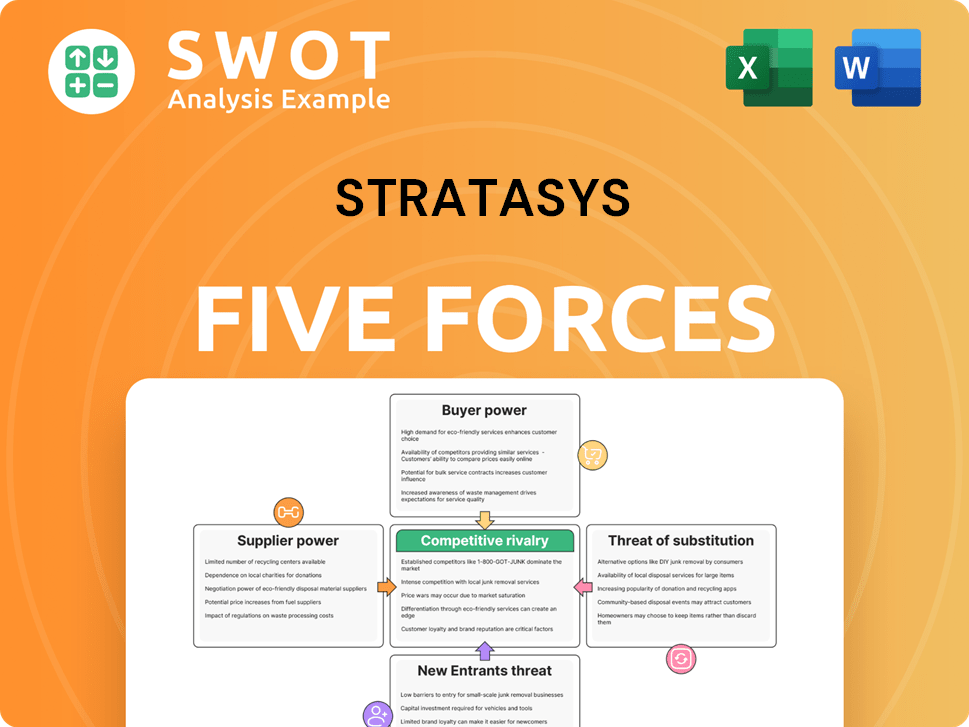

playing an active role in shaping its future.Stratasys Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Stratasys Company?

- What is Competitive Landscape of Stratasys Company?

- What is Growth Strategy and Future Prospects of Stratasys Company?

- How Does Stratasys Company Work?

- What is Sales and Marketing Strategy of Stratasys Company?

- What is Brief History of Stratasys Company?

- What is Customer Demographics and Target Market of Stratasys Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.