Stratasys Bundle

How Does Stratasys Thrive in the 3D Printing World?

Stratasys, a titan in the realm of additive manufacturing, is reshaping industries with its cutting-edge 3D printing solutions. Despite facing economic headwinds, the Stratasys SWOT Analysis reveals a resilient company that continues to innovate and adapt. In 2024, Stratasys demonstrated its ability to maintain profitability and secure substantial investments, signaling strong potential for future growth.

This in-depth analysis explores how Stratasys, a leader in 3D printing, operates, examining its core technologies like FDM technology, revenue streams, and strategic initiatives. We'll dissect the Stratasys company business model, explore its diverse product offerings, and analyze how Stratasys 3D printers explained contribute to its success. Understanding the intricacies of How Stratasys works is key to appreciating its impact on sectors like aerospace and healthcare, and its competitive standing within the 3D printing landscape.

What Are the Key Operations Driving Stratasys’s Success?

The Stratasys company creates value by providing comprehensive 3D printing solutions, encompassing hardware, materials, and software. This approach serves diverse customer segments, from rapid prototyping to full-scale production. The company's core offerings are centered around its FDM (Fused Deposition Modeling) and PolyJet 3D printers, known for their versatility and precision.

Operationally, How Stratasys works involves integrating technology development, manufacturing, and a robust supply chain. The company invests heavily in research and development to enhance printer capabilities and expand its materials portfolio. This includes the ongoing development of advanced materials and software solutions designed to improve efficiency and customer outcomes.

Stratasys's commitment to industrial applications and delivering measurable value through best-in-class solutions sets it apart. This focus enables customers to scale their additive manufacturing operations efficiently, leading to benefits like low-volume, high-mix production, complex geometries, and improved supply chain resilience.

Stratasys offers FDM and PolyJet 3D printers, known for their versatility. These printers are complemented by a wide selection of polymer materials. This allows for diverse applications across industries like aerospace, automotive, and healthcare.

The company integrates technology development, manufacturing, and a robust supply chain. Continuous investment in R&D enhances printer capabilities and expands materials. Software solutions like GrabCAD Print Pro and Streamline Pro improve machine uptime.

Stratasys provides solutions for low-volume, high-mix production and complex geometries. It also offers parts consolidation, supply chain resilience, personalization, and improved sustainability. This approach enhances customer efficiency and innovation.

Customers benefit from reduced time-to-market and lower production costs. They also gain the ability to create complex designs and customize products. Improved supply chain efficiency and sustainability are also key advantages.

Stratasys leverages FDM technology for its printers, offering a wide range of materials. The company also provides PolyJet technology for detailed and multi-material printing. Software like GrabCAD Print Pro enhances machine uptime and streamlines workflows.

- FDM (Fused Deposition Modeling) technology for robust parts.

- PolyJet technology for detailed and multi-material prints.

- GrabCAD software suite for improved machine uptime and efficiency.

- Materials like new polycarbonate electrostatic discharge (ESD) materials.

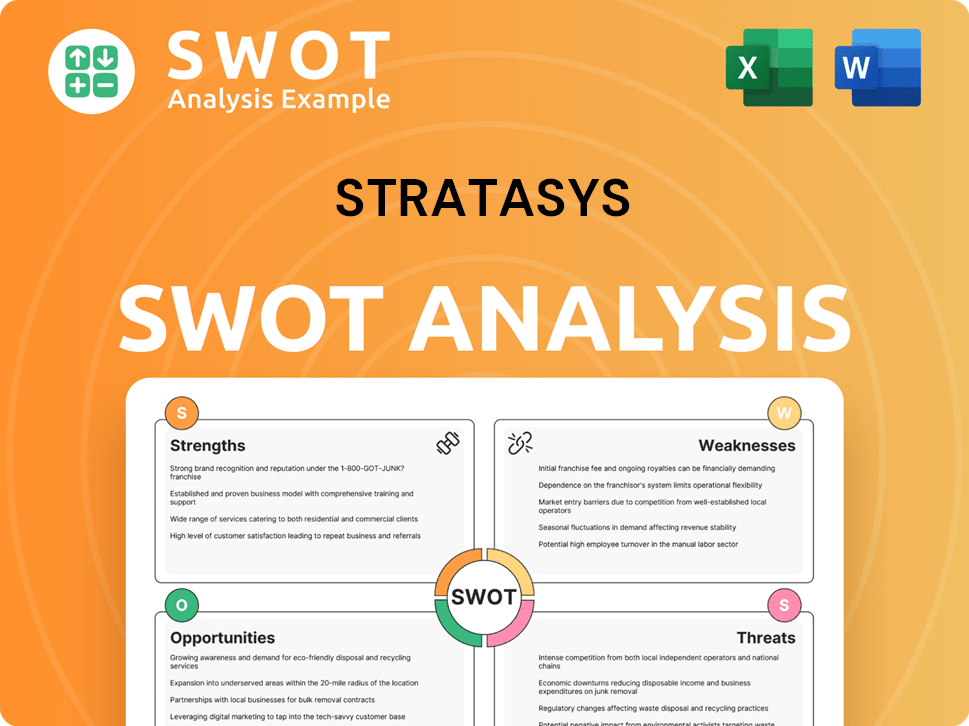

Stratasys SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Stratasys Make Money?

The Stratasys company generates revenue mainly through the sale of its 3D printing products and related services. This includes sales of 3D printing systems (printers) and consumables (materials), along with customer support, maintenance, and software solutions. This diversified approach allows the company to capture value from various aspects of the 3D printing ecosystem.

For the full year 2024, Stratasys reported total revenue of $572.5 million, demonstrating its significant presence in the 3D printing market. The company strategically leverages a combination of product sales and service offerings to ensure sustained financial performance. This model supports continuous revenue streams and enhances customer relationships.

In the first quarter of 2025, total revenue was $136.0 million, with a notable 7% sequential growth in recurring consumables revenue, indicating strong utilization of existing systems by customers. This growth highlights the importance of consumables in the company's revenue model.

Product sales include 3D printing systems (printers) and consumables (materials). In the fourth quarter of 2024, systems revenue was $46.7 million, and consumables revenue was $58.4 million. This segment is critical for initial revenue generation and ongoing material sales.

Service revenue includes customer support, maintenance, and software solutions. For the fourth quarter of 2024, service revenue was $45.3 million. These services provide recurring revenue and enhance customer relationships.

Beyond initial printer sales, Stratasys relies on recurring sales of proprietary materials (consumables). The company also offers tiered pricing for services, including customer support and software subscriptions. These strategies ensure continuous revenue generation.

The company is actively expanding its focus on industrial manufacturing applications. In 2024, this segment accounted for 36% of its revenue. The goal is for this to become the majority of its business, indicating a strategic shift towards higher-value applications.

Strategic partnerships and acquisitions, such as the recent acquisition of Forward AM's assets in May 2025, bolster its materials portfolio. These moves expand its market reach and enhance its offerings. Brief History of Stratasys provides additional context.

The razor-and-blade model, where printers are sold and consumables are continually purchased, ensures a steady revenue stream. This model is a key component of Stratasys' financial strategy. This ensures consistent revenue generation from its installed printer base.

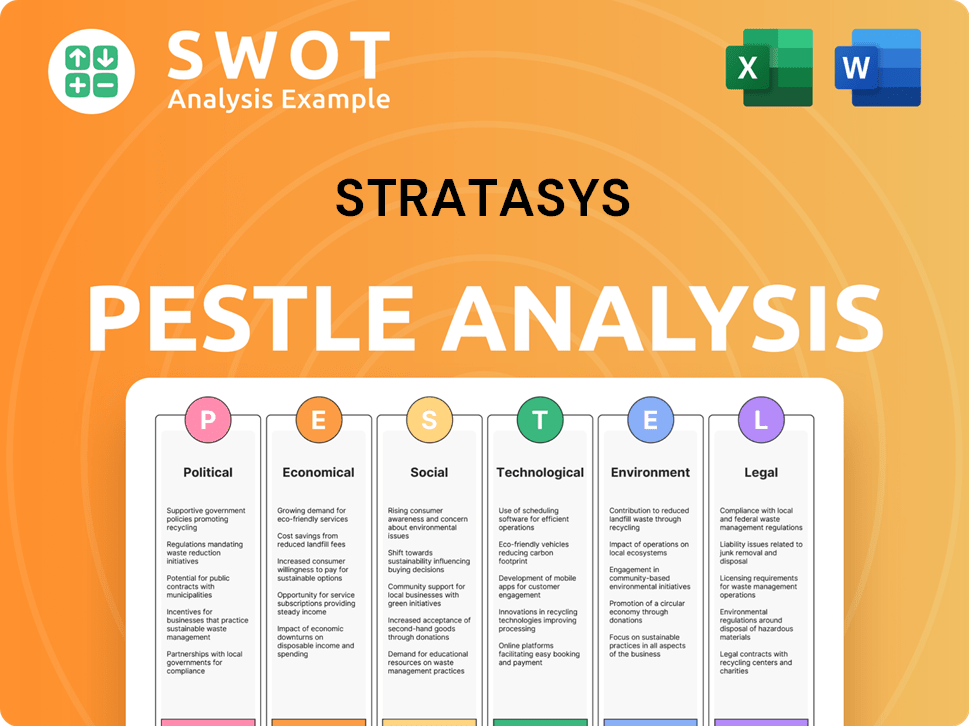

Stratasys PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Stratasys’s Business Model?

The evolution of the Stratasys company has been marked by significant milestones and strategic shifts, particularly in response to the dynamic 3D printing market. The company has consistently adapted its strategies to navigate economic challenges and capitalize on emerging opportunities. This has involved both internal restructuring and external partnerships, all aimed at strengthening its position in the additive manufacturing sector.

In 2024, Stratasys implemented strategic actions to improve operational efficiency and financial performance. These included cost-saving measures and product innovations designed to meet the evolving needs of its customer base. The company's focus on technological advancements and market expansion is evident in its recent moves, which are geared towards sustaining growth and enhancing its competitive edge within the 3D printing industry.

Stratasys has demonstrated resilience by adapting to market dynamics and focusing on innovation and strategic partnerships. The company's ability to secure investments and improve financial metrics reflects its commitment to long-term value creation and its strategic vision for the future of 3D printing. For more information about the company's ownership and structure, check out this article about Owners & Shareholders of Stratasys.

A major milestone in 2024 was the restructuring plan, which involved a 15% reduction in headcount. This initiative is projected to generate $40 million in annual cost savings. Furthermore, the company improved its gross margins, reaching 44.9% for FY 2024, up from 42.5% the previous year.

Strategic product launches in 2024 included the H350 3D Printer and new polycarbonate ESD materials. The company expanded into apparel customization and formed a partnership with Select Additive. In April 2025, Stratasys secured a $120 million investment from Fortissimo Capital to support future growth.

Stratasys benefits from its brand strength and technological leadership in polymer 3D printing. Its patented FDM and PolyJet technologies, extensive materials portfolio, and GrabCAD software platform offer comprehensive solutions. The focus on high-value industrial applications and recurring revenue from consumables further differentiates it.

The company's financial strategies aim to improve profitability and maintain a strong balance sheet. The restructuring plan aims to contribute to an 8% EBITDA margin by Q1 2025. As of April 2025, Stratasys had $270 million in cash and equivalents, with no debt, following the investment from Fortissimo Capital.

Stratasys is focused on adapting to market changes through strategic restructuring and product innovation. The company is leveraging its technological strengths and partnerships to maintain a competitive edge in the 3D printing market. The recent financial moves have strengthened its position for future growth and expansion.

- Restructuring efforts are expected to yield significant cost savings and improve profitability.

- Product launches and partnerships are expanding its market reach and application capabilities.

- The company's strong financial position supports its ability to invest in growth and innovation.

- Stratasys continues to emphasize industrial applications and full-scale production to drive growth.

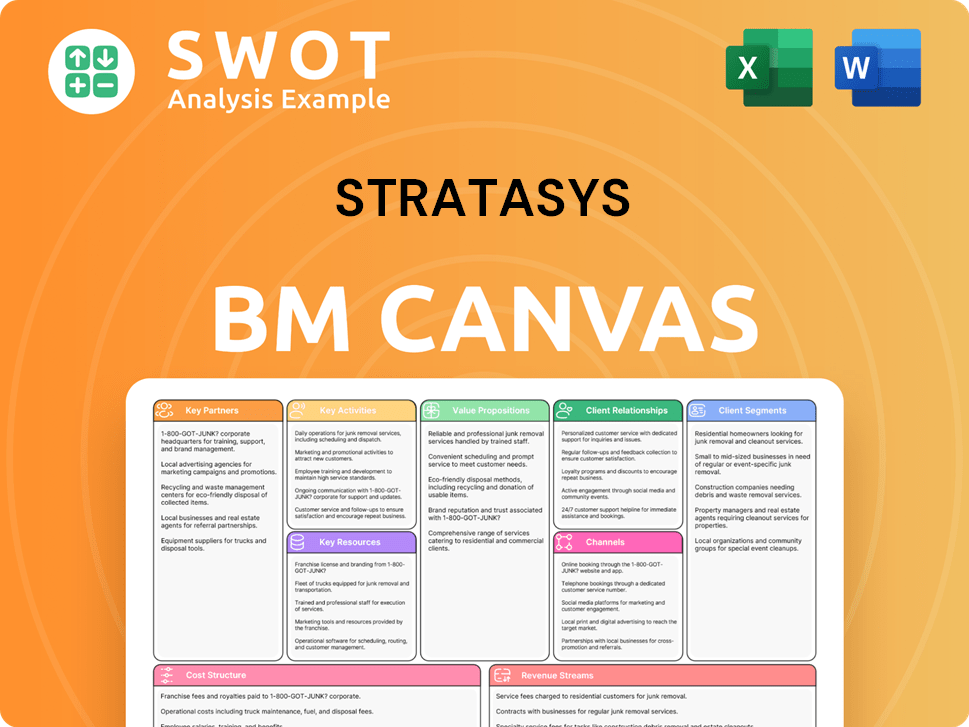

Stratasys Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Stratasys Positioning Itself for Continued Success?

The Stratasys company holds a prominent position in the polymer 3D printing solutions market. It serves a global customer base across various industries, specializing in industrial applications. In 2024, industrial applications accounted for 36% of its revenue, showcasing its focus on high-value segments and differentiating it from competitors. The company's customer loyalty is evident through the consistent use of its installed systems, as reflected in the recurring consumables revenue.

Despite its strong market position, Stratasys faces several risks. These include macroeconomic challenges like global inflation and high-interest rates, which affect capital expenditures and sales cycles, particularly impacting hardware sales. The company also contends with competition from low-cost providers and the ongoing evolution within the additive manufacturing sector. Regulatory changes and supply chain disruptions further pose potential operational and revenue impacts.

Stratasys is a leader in the 3D printing industry, particularly in polymer solutions. Its focus on industrial applications sets it apart from competitors. The company's global presence and diverse customer base highlight its market strength.

Macroeconomic factors, such as inflation and interest rates, impact sales cycles. Competition from lower-cost providers and technological shifts are ongoing challenges. Regulatory changes and supply chain issues also pose potential risks.

The company anticipates revenue between $570 million and $585 million for 2025. Strategic initiatives include a focus on large-scale 3D printing and strengthening partnerships. The acquisition of Forward AM's assets in May 2025 is a key move.

Non-GAAP gross margins are projected between 48.8% and 49.2%. Adjusted EBITDA is expected to grow to a range of $44 million to $50 million. Improved operating and free cash flow are expected in 2025.

Stratasys is focusing on large-scale 3D printing and strengthening key partnerships to drive growth. The company aims to sustain and expand profitability through continued investment in innovation and strategic acquisitions. The recent acquisition of Forward AM's assets is a move to consolidate its market position.

- Investment in innovation is a key strategy.

- Focus on profitable growth and industry consolidation.

- Emphasis on high-value applications to drive revenue.

- Streamlining cost structure to improve financial performance.

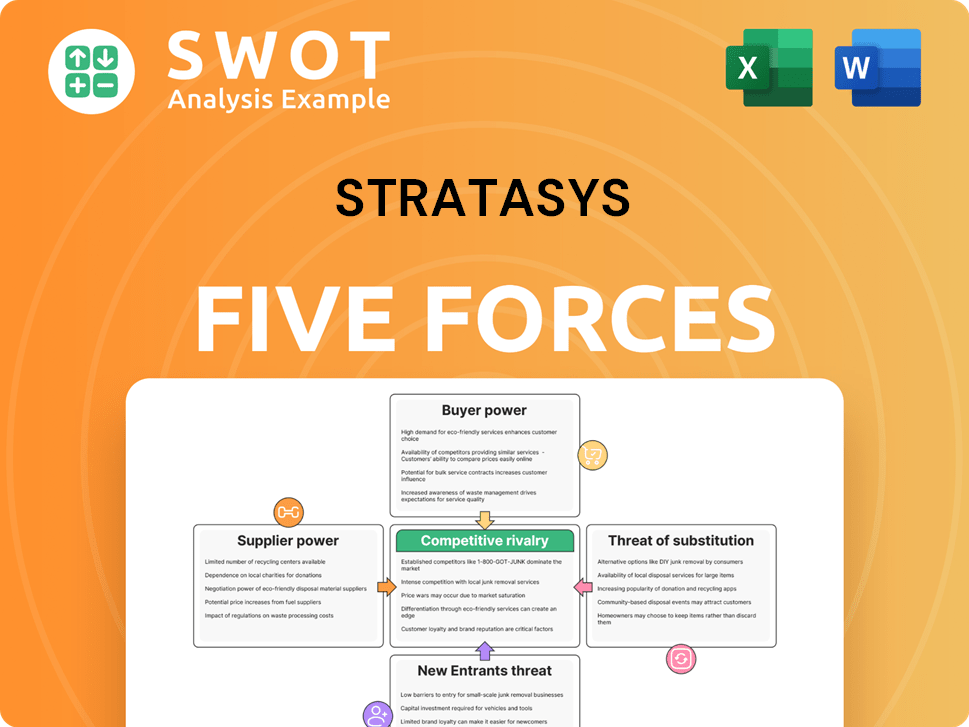

Stratasys Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Stratasys Company?

- What is Competitive Landscape of Stratasys Company?

- What is Growth Strategy and Future Prospects of Stratasys Company?

- What is Sales and Marketing Strategy of Stratasys Company?

- What is Brief History of Stratasys Company?

- Who Owns Stratasys Company?

- What is Customer Demographics and Target Market of Stratasys Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.