TTEC Bundle

Can TTEC Rebound and Thrive?

Founded in 1982, TTEC has transformed from a call center into a global CX leader, serving major brands worldwide. Facing recent financial headwinds, including a revenue decline in 2024, the company is now at a critical juncture. This analysis delves into TTEC's TTEC SWOT Analysis and examines its strategies for future growth and market positioning.

This exploration of TTEC's TTEC growth strategy will uncover its plans for 2025 and beyond, focusing on TTEC future prospects and how it aims to leverage its TTEC business model to regain momentum. We'll dissect its TTEC market position, assess its TTEC financial performance, and investigate its revenue growth strategies, including its adaptation to AI in customer service and its customer experience initiatives. Understanding TTEC's digital transformation strategy and outsourcing services outlook is key to evaluating its long-term growth potential and its impact on the BPO industry.

How Is TTEC Expanding Its Reach?

The Competitors Landscape of TTEC reveals that its growth strategy is heavily focused on expansion initiatives. These initiatives are designed to broaden geographic reach, diversify its client base, and enhance digital customer experience (CX) offerings. These efforts are crucial for maintaining a strong market position and driving future prospects in the competitive business process outsourcing (BPO) industry.

TTEC's business model is evolving to meet the changing demands of the market. The company's strategic moves are aimed at accessing new customer bases and leveraging diverse talent pools. This approach is essential for sustaining revenue growth and adapting to industry changes, particularly in the rapidly evolving customer experience landscape.

The company's financial performance is directly linked to the success of these expansion initiatives. By strategically investing in new markets and technologies, TTEC aims to improve its financial outlook and provide value to its stakeholders. This proactive approach is vital for ensuring long-term growth potential.

TTEC is expanding its geographic delivery footprint to tap into new markets and customer bases. A significant portion of new business is being delivered offshore. This strategy leverages diverse talent pools and reduces operational costs. The company's global market presence is increasing with investments in new locations.

The company is continuously broadening its end-to-end digital CX value proposition. This includes introducing AI-enabled solutions for back office, revenue generation, and fraud prevention. TTEC Digital is aiming for double-digit growth, indicating strong demand for its tech-enabled CX solutions.

TTEC is building strategic partnerships to broaden its market reach and enhance its solution offerings. These partnerships with new CX technology partners are crucial for diversifying revenue streams. New enterprise clients signed in Q1 2025 further support this strategy.

TTEC is actively integrating AI-enabled solutions to improve customer service and operational efficiency. The focus is on innovation in customer service and digital transformation. These initiatives are designed to enhance customer experience and drive revenue growth.

TTEC's expansion initiatives are multifaceted, focusing on geographic growth, service diversification, and strategic partnerships. These efforts are designed to capitalize on market opportunities and drive long-term growth. The company's strategic moves are essential for sustaining its market position and achieving its financial goals.

- Offshore Delivery: Two-thirds of new business won from new clients is delivered offshore as of Q1 2024.

- India Expansion: A new customer experience center in Mohali, India, is adding 400 new jobs as of May 2025.

- TTEC Digital Growth: Aiming for double-digit growth, indicating strong demand for tech-enabled CX solutions.

- TTEC Engage: Targeting positive growth and double-digit EBITDA margins by 2025.

TTEC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does TTEC Invest in Innovation?

The company actively uses technology and innovation to drive sustained growth, with a strong focus on AI-enabled digital CX solutions. This approach includes both in-house development and collaborations with external innovators, including hyperscalers. TTEC Digital, one of the company's two primary segments, is dedicated to designing, building, and operating omnichannel contact center technology, CRM, AI, and analytics solutions.

A key aspect of this company's innovation strategy is its commitment to digital transformation and the integration of cutting-edge technologies. The company is heavily investing in AI and automation, recognizing their transformative impact on customer interactions. The company anticipates that 2025 will be a pivotal year for customer experience, as AI, data, and technology converge to unlock new opportunities for brands to connect with customers. This involves moving from the 'hype phase' of AI to practical, scalable solutions that deliver real results.

The company's focus on AI also extends to self-service, with autonomous AI agents enhancing customer independence while collaborating with human associates for real-time assistance. Furthermore, the company is recognized for its AI-driven innovations, having won Stevie Awards in 2025 for its contributions to customer experience and sales. The company's technology strategy also encompasses advanced data insights, aiming to break down silos and use AI-powered analytics to revolutionize omnichannel strategies, enabling more precise problem-solving and insight generation.

The company is significantly investing in AI and automation to transform customer interactions. This investment is crucial for the company's TTEC growth strategy and achieving its TTEC future prospects. These technologies are expected to deliver scalable solutions.

The company is committed to digital transformation, integrating cutting-edge technologies to enhance customer experiences. This commitment is a core element of the company's TTEC business model. The company is focused on moving from the 'hype phase' of AI to practical, scalable solutions.

The company develops proprietary AI-enabled capabilities to optimize new innovations and CX technology platforms. For instance, the 'Let Me Know' solution has improved handle time by 12%. This is a key factor in the company's TTEC market position.

The company leverages autonomous AI agents to enhance customer independence while collaborating with human associates for real-time assistance. This approach is part of the company's TTEC customer experience initiatives. This enhances customer service efficiency.

The company utilizes advanced data insights and AI-powered analytics to revolutionize omnichannel strategies. This helps in more precise problem-solving and insight generation. This strategy contributes to the company's TTEC digital transformation strategy.

The company collaborates with external innovators, including hyperscalers, to drive growth. These strategic partnerships are crucial for TTEC's strategic partnerships analysis. This approach enhances the company's innovation capabilities.

The company's innovation in customer service is evident through its AI-driven solutions and strategic partnerships. For more in-depth insights, you can explore how the company is adapting to AI in customer service by reading this article: TTEC's AI Integration.

The company's technological advancements include proprietary AI-enabled capabilities and optimization of new CX technology platforms. The company's focus on AI extends to self-service, with autonomous AI agents enhancing customer independence. The company has won Stevie Awards in 2025 for its contributions to customer experience and sales.

- Let Me Know Solution: Improved handle time by 12%.

- AI-Driven Innovations: Recognized with Stevie Awards in 2025.

- Data Insights: AI-powered analytics for omnichannel strategy.

- Strategic Partnerships: Collaborations with external innovators.

TTEC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is TTEC’s Growth Forecast?

The financial outlook for TTEC in 2025 reflects a strategic pivot towards recovery and improved financial performance, following a challenging 2024. The company's focus on cost optimization and operational efficiency is evident in its projections and recent financial results. The company is also working on its Owners & Shareholders of TTEC.

In 2024, TTEC reported a total revenue of $2.208 billion, a decrease of 10.4% year-over-year, alongside a net loss of $310.6 million. This included a significant non-cash impairment charge. Despite these setbacks, the company is setting its sights on a more positive trajectory for the upcoming year.

For 2025, TTEC anticipates revenues between $2.014 billion and $2.064 billion. The company projects a non-GAAP adjusted EBITDA in the range of $215 million to $235 million. The company's financial strategy includes profit optimization initiatives and an expanded suite of CX technology offerings to drive improved financial performance.

TTEC forecasts revenues between $2.014 billion and $2.064 billion for 2025. The company projects non-GAAP adjusted EBITDA to be between $215 million and $235 million, demonstrating a focus on profitability.

In Q1 2025, TTEC reported revenue of $534.2 million, a 7.4% decrease from the prior year. However, adjusted EBITDA improved to $56.4 million, or 10.6% of revenue, indicating improved efficiency.

As of March 31, 2025, TTEC had $85.1 million in cash and cash equivalents and debt of $966.6 million, resulting in a net debt of $881.4 million. The company is focused on debt reduction.

Capital expenditures in Q1 2025 were $5.4 million, a decrease from $13.5 million in Q1 2024, reflecting a strategic approach to capital allocation.

TTEC's TTEC growth strategy includes profit optimization and expanding its CX technology offerings. The company's TTEC market position is being reinforced by its focus on operational efficiency and strategic financial management. The TTEC future prospects are tied to its ability to execute its strategic initiatives and adapt to market dynamics.

TTEC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow TTEC’s Growth?

The path of TTEC's growth strategy is not without its challenges. Several risks and obstacles could potentially impact the company's future prospects. These issues range from economic uncertainties affecting client behavior to operational difficulties within specific business segments and financial burdens.

Understanding these potential pitfalls is crucial for a thorough TTEC company analysis. Addressing these challenges requires strategic foresight and proactive measures to ensure sustainable growth and maintain a strong market position. This article will delve into the specific risks and obstacles facing TTEC.

The primary challenge for TTEC stems from the cautious approach adopted by many clients, affected by current economic conditions and uncertainties in trade policy. This has led to a 'wait-and-see mindset,' making it difficult to accurately predict future business. The customer experience industry is also highly competitive, demanding continuous innovation and differentiation to maintain a competitive edge. Operational complexities, particularly within the Engage segment, further complicate the landscape.

Clients' cautious approach due to economic conditions and trade policy uncertainties impacts contract sizes and scopes. This 'wait-and-see mindset' makes it challenging to forecast future business accurately, affecting TTEC's revenue growth strategies.

The customer experience industry is highly competitive. Continuous innovation and differentiation are essential to maintain a strong market position and compete effectively. This impacts TTEC's competitive advantages.

Operational challenges, especially within the Engage segment, impact profitability. Larger enterprise deals can take longer to launch and achieve expected production and profitability levels. This can create less predictability for TTEC's financial performance.

TTEC operates with a significant debt burden, which stood at $1.06 billion as of Q1 2025. A higher normalized tax rate of 37.9% in Q1 2025 compared to 32.7% in the prior year also poses a financial risk.

A ransomware incident in 2023 impacted TTEC's financial results, causing disruptions and financial strain. This highlights the importance of cybersecurity in the context of TTEC's digital transformation strategy.

The company faced a significant non-cash pre-tax $196 million impairment charge related to the fair value of the TTEC Engage reporting unit in Q2 2024. This affects the company's financial outlook and long-term growth potential.

To address these challenges, TTEC is implementing several strategies. These include enhancing its diversification strategy with an expanded geographic delivery footprint and client portfolio. The company focuses on improving operational agility and strengthening financial performance through profit optimization initiatives and managing cost alignment throughout 2025.

TTEC emphasizes building adaptability and resilience within its workforce to navigate unexpected trials and overcome setbacks. This approach supports the company’s ability to adapt to AI in customer service and other technological advancements.

TTEC's commitment to debt reduction, including the suspension of its semi-annual dividend, is a testament to its strategic financial discipline to support future growth. This is a key aspect of TTEC's outsourcing services outlook.

For more insights into the company's history and development, consider reading a brief history of TTEC. This will help you further understand TTEC's strategic partnerships analysis and its impact on the BPO industry.

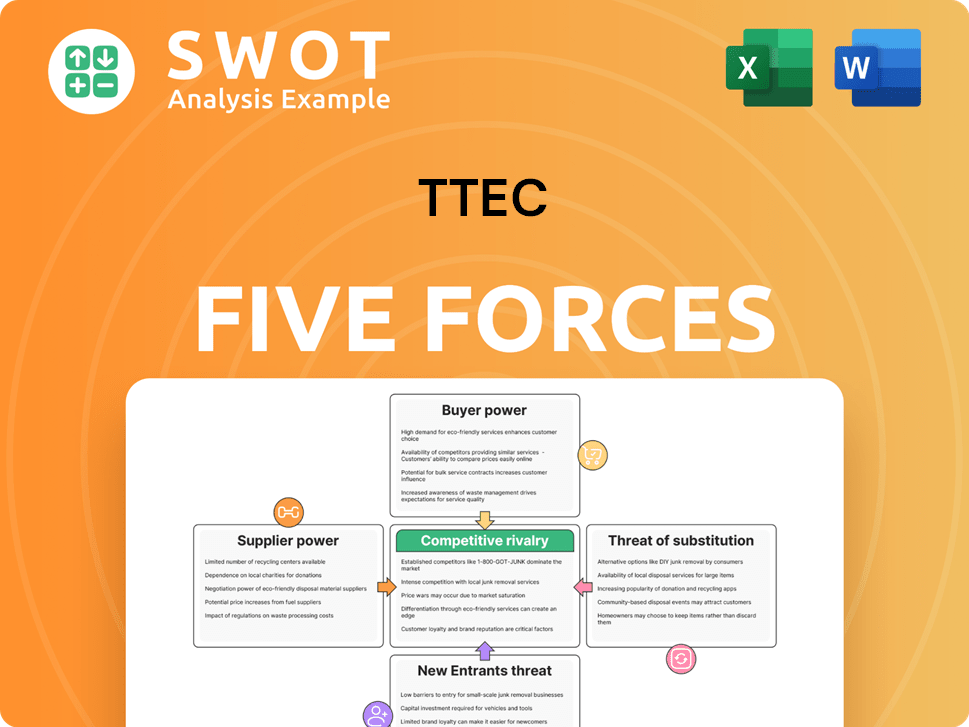

TTEC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TTEC Company?

- What is Competitive Landscape of TTEC Company?

- How Does TTEC Company Work?

- What is Sales and Marketing Strategy of TTEC Company?

- What is Brief History of TTEC Company?

- Who Owns TTEC Company?

- What is Customer Demographics and Target Market of TTEC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.