TMS International Bundle

Can TMS International Navigate the Shifting Sands of Global Logistics?

The transportation and logistics sector is experiencing a seismic shift, and TMS International SWOT Analysis is crucial for understanding the competitive landscape. Driven by technological advancements and evolving supply chain dynamics, the market is poised for substantial growth. This analysis examines the growth strategy and future prospects of TMS International, exploring how it can capitalize on these transformative trends.

Understanding TMS International's strategic planning is essential to assess its long-term growth potential. Analyzing market trends and the competitive landscape provides insights into potential investment opportunities. This exploration will delve into TMS International's expansion plans and sustainable growth strategies within the dynamic industrial services and logistics sector, examining key performance indicators and future business models.

How Is TMS International Expanding Its Reach?

The industrial services and logistics sector is experiencing a wave of expansion initiatives, with companies like TMS International focusing on growth strategies to capture new markets and diversify their revenue streams. These efforts are crucial for staying competitive in a rapidly evolving industry. The global transportation management systems market, a key area for TMS International, is poised for significant growth, presenting numerous opportunities for strategic expansion.

A central element of these expansion plans involves entering new markets, both geographically and in terms of the services and products offered. TMS International and its competitors are actively working to fortify their positions as leading TMS providers across various shipment types, including rail and truck transport. This strategic approach is essential for capturing a larger share of the expanding market and enhancing overall business development.

The focus on international expansion is particularly noteworthy. The international TMS solutions market is projected to increase by 17.4% from 2024 to 2030. This growth is driven by technological advancements like AI and shifts in global trade patterns. This expansion includes developing more sophisticated international shipping capabilities to address challenges such as risk management, trade compliance, and multi-modal transportation across different currencies and languages.

Companies are prioritizing expansion into new geographic markets to increase their global footprint. This includes strengthening their presence in industrial, economic, and free zones to enhance connectivity and drive business volumes. The aim is to create integrated and scalable businesses that capitalize on the growth opportunities in these regions.

Expansion also involves broadening the product pipeline. This can be achieved through in-licensing novel therapeutic candidates or forming strategic partnerships to advance development programs. These initiatives are designed to diversify offerings and meet the evolving needs of customers within the TMS International framework.

Companies are actively developing new business models to offer comprehensive solutions. These include providing real-time tracking, automated freight auditing, and route optimization services. The aim is to enhance customer value and create a competitive edge in the market.

Strategic acquisitions and partnerships are key components of expansion strategies. These activities help scale up global footprints, enhance connectivity, and integrate operations. By expanding regional and global shipping networks, companies can connect more countries and ports, thereby increasing container capacities.

TMS International's expansion strategies focus on several key areas to drive growth and enhance its market position. These strategies are designed to capitalize on the increasing demand for advanced TMS solutions and to navigate the complexities of the global logistics landscape.

- Geographic Expansion: Expanding into new international markets to increase global presence and capture new customer segments.

- Product Diversification: Broadening the range of TMS solutions offered, including advanced features like AI-driven analytics and automation.

- Strategic Partnerships: Forming alliances with technology providers and logistics companies to enhance service offerings and market reach.

- Technological Innovation: Investing in research and development to stay at the forefront of technological advancements in the TMS industry.

TMS International SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does TMS International Invest in Innovation?

Innovation and technology are crucial for sustained growth in the industrial services and logistics sectors. Companies are significantly increasing their investments in research and development (R&D) and utilizing cutting-edge technologies to stay competitive. The global TMS market is expected to expand due to the growing adoption of emerging technologies such as artificial intelligence (AI), machine learning (ML), and blockchain.

The digital transformation is accelerating, with companies rapidly digitizing their operations. Advanced tools like fleet management software are enabling real-time monitoring, route optimization, predictive maintenance, and fuel usage tracking. These tools lead to reduced operational costs and enhanced service reliability. By 2025, the use of IoT-enabled services is predicted to reach nearly 60% of trucking companies, with smart sensors and connected technologies generating actionable insights for improved safety, compliance, and decision-making.

AI is driving major advancements in TMS platforms, allowing for predictive analytics to anticipate disruptions, optimize routes, and support faster data-driven decisions. TMS platforms are expected to take on more autonomous decision-making, including automated actions for shipment re-routing and capacity adjustments, which can reduce manual intervention and fuel costs. Dynamic route optimization is becoming more sophisticated, using continuous analysis of factors like weather, traffic, and road closures. Blockchain technology is being adopted to enhance transparency, security, and traceability in the supply chain, reducing fraud and errors.

Companies are rapidly digitalizing their operations to improve efficiency and reduce costs. Advanced fleet management software enables real-time monitoring and route optimization. Predictive maintenance and fuel usage tracking are also key components of this transformation.

AI is driving significant advancements in TMS platforms, enabling predictive analytics. These platforms can anticipate disruptions, optimize routes, and support faster data-driven decisions. AI-powered TMS systems are expected to handle more autonomous decision-making.

Blockchain technology is being adopted to enhance transparency, security, and traceability in the supply chain. This helps in reducing fraud and errors. Blockchain applications are improving overall supply chain efficiency.

TMS platforms are increasingly focused on sustainability. They automatically suggest eco-friendly routes to minimize carbon footprints. Companies are also adopting smarter contract management technology.

Companies are adopting smarter contract management technology. This includes automated compliance tracking and real-time tariff monitoring. These tools help navigate evolving trade regulations.

IoT-enabled services are predicted to be used by nearly 60% of trucking companies by 2025. Smart sensors and connected technologies generate actionable insights. These insights improve safety, compliance, and decision-making.

Sustainability initiatives are also a key focus, with TMS platforms automatically suggesting eco-friendly routes to minimize carbon footprints. Companies are also adopting smarter contract management technology with automated compliance tracking and real-time tariff monitoring to navigate evolving trade regulations. For more insights into the company’s structure, you can refer to the article Owners & Shareholders of TMS International.

The future of TMS involves integrating advanced technologies to improve efficiency and sustainability. This includes AI, blockchain, and IoT applications.

- AI-Driven Optimization: Predictive analytics and autonomous decision-making.

- Blockchain for Transparency: Enhanced supply chain security and traceability.

- IoT for Real-time Monitoring: Smart sensors for improved safety and compliance.

- Sustainable Practices: Eco-friendly routing and carbon footprint reduction.

TMS International PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is TMS International’s Growth Forecast?

The financial outlook for the transportation management system (TMS) sector, which includes companies like TMS International, is promising. The market is fueled by increasing demand for efficiency and technological advancements. This positive trend indicates potential for substantial growth and financial gains for companies operating in this space.

The global TMS market was valued at an estimated USD 15.88 billion in 2024. Projections suggest a robust growth rate, with a Compound Annual Growth Rate (CAGR) of 17.5% expected from 2025 to 2030. This growth trajectory is anticipated to propel the market to USD 41.57 billion by 2030. This expansion is supported by the growth of e-commerce and retail, ongoing technological innovation, and strengthening global trade relationships.

While specific financial details for TMS International are not available in the provided search results, the overall market trends suggest a positive financial outlook. For instance, companies in related sectors, such as those involved in Transcranial Magnetic Stimulation (TMS) therapy, are anticipating growth. This indicates a favorable environment for companies within the broader TMS industry, including TMS International.

The TMS market's growth is driven by the expansion of e-commerce and retail, which increases the need for efficient logistics. Technological innovations, such as AI-powered TMS solutions, are also key drivers. Strengthening global trade relations further supports the market's expansion by increasing the volume of goods transported.

Companies are investing in TMS solutions to reduce transportation costs and improve customer service. Data-driven decision-making is becoming crucial for optimizing logistics operations. These investments help in improving operational efficiency and gaining a competitive edge in the market.

Companies are focusing on strengthening their financial foundations, which includes issuing stock acquisition rights to support global clinical trials. This strategic move allows them to fund expansion and innovation. Acquisitions of new pipeline assets also contribute to long-term growth and market share.

The competitive landscape is dynamic, with companies striving to offer advanced TMS solutions. Innovation in areas like real-time tracking and predictive analytics is essential for staying competitive. Companies that can provide comprehensive and efficient solutions are well-positioned for growth.

The TMS market is expected to experience significant revenue growth from 2025 to 2030. This growth is driven by the increasing adoption of TMS solutions across various industries. Companies that can effectively meet the evolving needs of their customers will see increased revenue.

Analyzing market share is crucial for understanding the competitive landscape. Companies must monitor their market share to assess their position relative to competitors. Strategies to increase market share include innovation, strategic partnerships, and customer-focused solutions.

Effective strategic planning is essential for navigating the TMS market. This involves identifying growth opportunities, assessing risks, and developing strategies to achieve long-term goals. Companies must adapt their strategies to stay ahead of market trends.

Expansion plans are a key component of growth strategies for TMS companies. This includes entering new geographic markets and expanding product offerings. Strategic partnerships and acquisitions can accelerate expansion and increase market penetration.

Monitoring financial performance is crucial for assessing the success of TMS companies. Key metrics include revenue growth, profit margins, and return on investment. Strong financial performance enables companies to invest in innovation and expansion.

The TMS market presents various investment opportunities for those looking to capitalize on its growth. Investing in companies with innovative solutions and strong market positions can yield significant returns. Understanding market trends is essential for making informed investment decisions.

Several KPIs are crucial for evaluating the success of TMS companies. These include revenue growth, customer acquisition cost, and customer retention rate. Monitoring these metrics helps companies assess their performance and make data-driven decisions.

- Revenue Growth: Measures the increase in sales over a specific period.

- Customer Acquisition Cost (CAC): The cost of acquiring a new customer.

- Customer Retention Rate: The percentage of customers who continue to use the service.

- Profit Margins: Indicates the profitability of each sale.

For further insights into the Revenue Streams & Business Model of TMS International, it's helpful to understand the various revenue models and how they contribute to the company's financial performance.

TMS International Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow TMS International’s Growth?

Navigating the industrial services and logistics landscape, especially for companies like TMS International, requires a keen awareness of potential pitfalls. Several strategic and operational risks could impede TMS International's growth strategy and future prospects. These challenges span economic volatility, regulatory hurdles, supply chain disruptions, and technological advancements.

Market dynamics, including freight rate fluctuations and fuel price volatility, pose a significant threat. The industry is recovering from a freight recession, but the recovery is uneven. Regulatory changes, particularly regarding environmental compliance and carbon taxes, add further complexity. Supply chain vulnerabilities, exacerbated by geopolitical tensions, environmental issues, and piracy, can lead to delays and cost increases.

Technological disruption is another critical area to watch. Rapid advancements in areas such as AI and automation necessitate continuous investment and adaptation. Cybersecurity threats also loom large, with the transportation sector becoming a target for cyberattacks. Internal resource constraints, including expertise gaps and the complexities of TMS solution implementation, can also hinder progress.

Fluctuations in freight rates and fuel prices significantly impact profitability. The freight market is emerging from a 'brutal freight recession,' and the recovery is not uniform. For example, van spot rates and reefer rates showed considerable jumps in late Q2 2024, reflecting the unpredictable nature of the market.

Stricter environmental regulations and the implementation of carbon taxes increase operational costs. Companies must adapt to reduce emissions and meet growing demands for sustainable practices. The complexity of compliance adds to the administrative burden and potential financial risks.

Geopolitical tensions, environmental challenges, and piracy can disrupt supply chains. Disruptions in areas like the Red Sea and bottlenecks at the Panama Canal can lead to delays and cost surges. These vulnerabilities require proactive risk management and diversification strategies.

Rapid technological advancements, particularly in AI and automation, require continuous investment. Companies must adapt to new technologies to remain competitive. The speed of innovation necessitates ongoing investment in new tools and training.

The transportation industry is a target for cyberattacks, including schemes like ghost trucks and ransomware. Protecting sensitive data and implementing robust cybersecurity measures are critical. The financial and operational impacts of a cyberattack can be substantial.

Limited in-house expertise, skill gaps, and employee turnover can hinder progress. The time and cost involved in implementing and migrating TMS solutions present additional challenges. Addressing these internal constraints is crucial for smooth operations.

Companies can mitigate risks through various strategies. Diversifying supplier networks, adopting predictive analytics to anticipate disruptions, and leveraging real-time visibility tools are essential. Redesigning logistics networks for flexibility is also crucial. Implementing robust risk management frameworks and scenario planning is vital.

Continuous investment in technology is necessary to stay competitive. This includes adopting AI and automation to improve efficiency and reduce costs. Companies should also focus on enhancing cybersecurity measures to protect their data and operations. Investing in the Marketing Strategy of TMS International can help in adapting to the changing market dynamics.

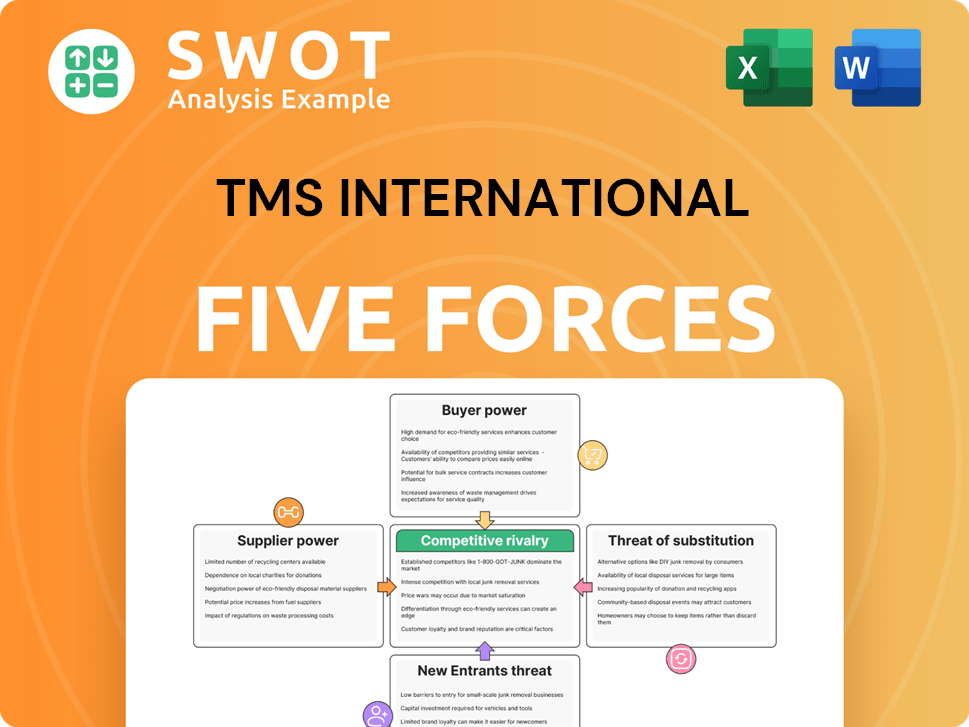

TMS International Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TMS International Company?

- What is Competitive Landscape of TMS International Company?

- How Does TMS International Company Work?

- What is Sales and Marketing Strategy of TMS International Company?

- What is Brief History of TMS International Company?

- Who Owns TMS International Company?

- What is Customer Demographics and Target Market of TMS International Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.