TMS International Bundle

How Does TMS International Thrive in the Steel Industry?

Formerly known as Tube City IMS Corporation, TMS International SWOT Analysis is a titan in the global industrial services sector. With roots tracing back to 1926, this TMS company has built a massive presence, operating across five continents. In 2024, TMS International showcased its financial prowess with $2.5 billion in revenue, marking its significant influence in the manufacturing landscape.

TMS International's operations revolve around providing essential services like on-site material processing and logistics solutions to steel mills, making it a vital logistics provider. Understanding the intricacies of TMS International's business model is critical for anyone interested in the shipping company, maritime services, and the broader global trade landscape. This examination will explore how this crucial player in the steel industry manages cargo, its global presence, and its impact on supply chain solutions.

What Are the Key Operations Driving TMS International’s Success?

The core of TMS International's operations revolves around providing outsourced industrial services to steel mills and metal producers. They offer a comprehensive suite of services designed to integrate seamlessly with their clients' operations. This approach allows them to act as a value-added extension of their partners' capabilities, focusing on efficiency and cost reduction.

Their value proposition lies in offering a single point of contact for a wide array of services. This includes everything from raw materials procurement and scrap management to metal recovery and logistics. By managing the entire lifecycle of materials within a steel mill, they enable steelmakers to concentrate on their core business: producing steel. This integrated model sets them apart in the industry.

The company serves a diverse customer base, including integrated steel mills, mini-mills, and foundries across North America, Europe, South America, and Asia. Their operational processes are designed to handle materials efficiently, from raw materials to by-products, emphasizing sustainability and resource optimization.

The TMS company provides a range of services tailored to the steel industry. These include raw materials procurement, scrap management, and raw materials optimization. They also offer slag processing, metal recovery, surface conditioning, and logistics support.

Clients benefit from increased efficiency and cost savings. Steel mills have reported efficiency boosts of between 5% and 10% through these services. This allows steelmakers to focus on their core operations.

The TMS operations are supported by extensive industry expertise and a strong global presence. They operate at over 80 customer sites worldwide. Safety and quality are key priorities.

- Integrated services accounted for 65% of revenue in 2024.

- Focus on efficiency and cost reduction for clients.

- Comprehensive service offerings from raw materials to metal recovery.

- A single point of contact for various pre- and post-production services.

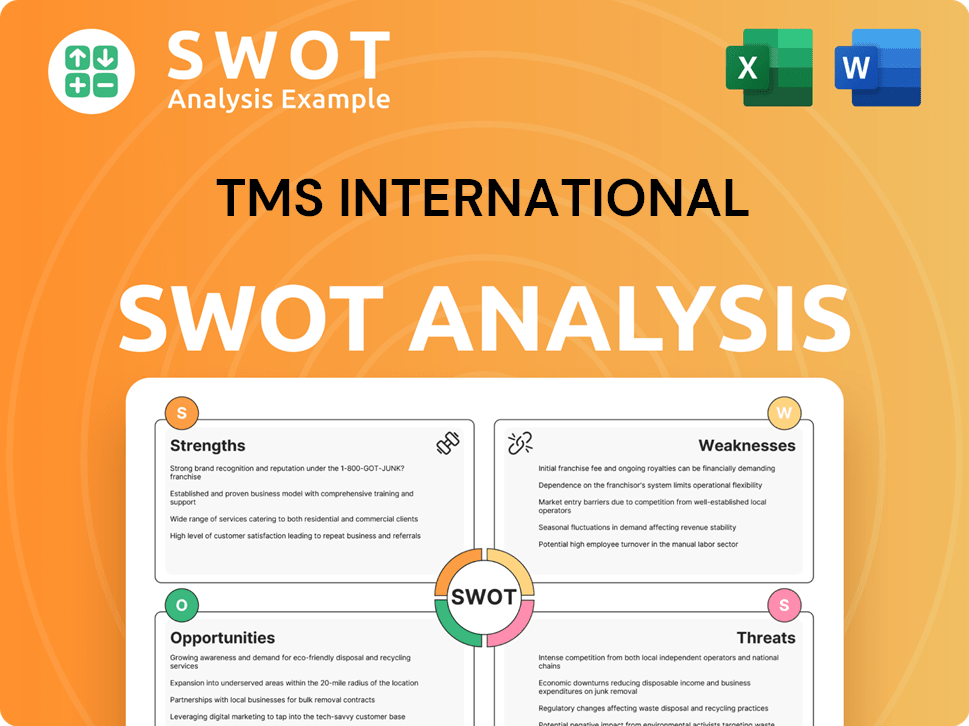

TMS International SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does TMS International Make Money?

The core of TMS International's revenue generation lies in its comprehensive industrial services, specifically tailored for steel mills and metal producers. These services encompass on-site material processing, handling, recovery, and transportation solutions. Growth Strategy of TMS International highlights how the company has strategically positioned itself within the industry.

In 2024, Tube City IMS, a key subsidiary, reported revenues of approximately $1.2 billion from on-site industrial services. Projections for 2025 estimate a 3% revenue increase in this area, demonstrating consistent growth. Integrated services, which combine multiple offerings, accounted for 65% of the company's revenue in 2024, showcasing the effectiveness of its bundled service approach.

The company's monetization strategies are built on long-term contracts with global steel producers, creating a stable revenue foundation. These partnerships, some lasting over three decades, contribute significantly to repeat business. In 2024, TMS International saw a 7% increase in repeat business, illustrating strong customer retention and satisfaction. The company also capitalizes on the outsourcing trend in manufacturing, which grew by 8% in 2024, by securing new contracts and expanding its business. Furthermore, in Q1 2025, revenue from outsourced services increased by 12%.

TMS International's financial success is driven by a multifaceted approach to revenue generation and strategic partnerships. The company leverages its global presence and innovative services to maintain and expand its market position.

- On-Site Industrial Services: This is the primary revenue source, including material processing, handling, and recovery.

- Integrated Services: Bundled service offerings that accounted for 65% of revenue in 2024, enhancing customer value.

- Long-Term Contracts: Stable revenue streams from enduring partnerships with global steel producers.

- Global Presence: International sales contributed 65% of total revenue in 2024, diversifying the customer base and market exposure.

- Outsourcing Trends: Capitalizing on the growth in manufacturing outsourcing, which grew by 8% in 2024.

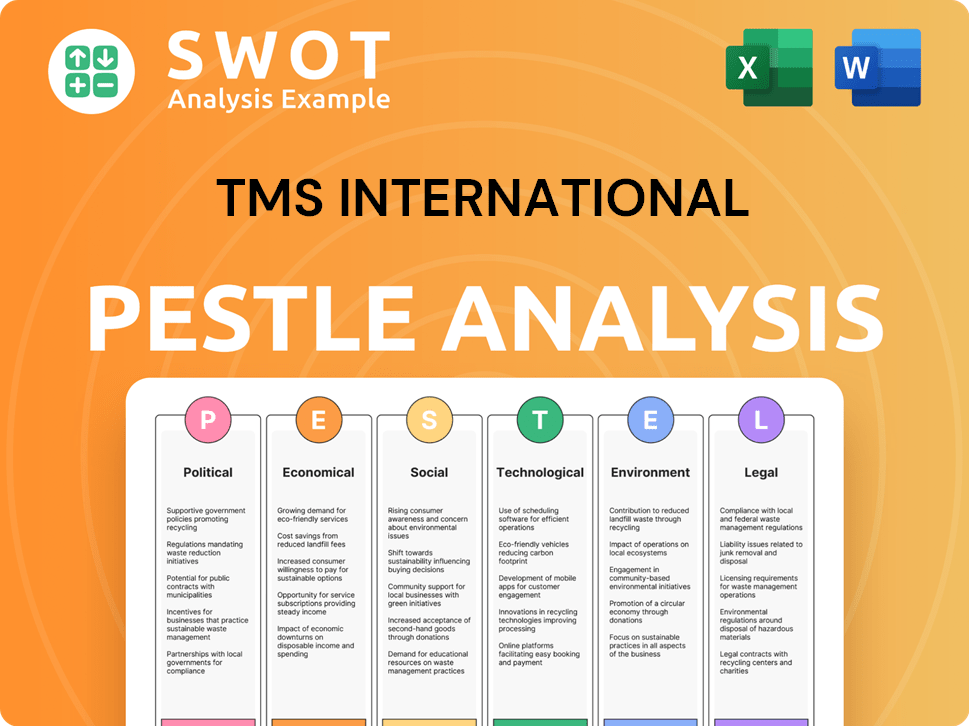

TMS International PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped TMS International’s Business Model?

The journey of TMS International, a leading player in outsourced steel services, is marked by strategic milestones and significant operational shifts. The evolution of the company, from its roots in 1926 as Tube City Iron & Metal to the 2004 merger of Tube City and International Mill Service (IMS), showcases a commitment to growth and adaptation. This merger was a pivotal moment, establishing a global presence and providing the foundation for its current operations.

A key strategic move was the 2016 name change to TMS International Corporation, reflecting its integrated operations and global reach. This rebranding aligned with the company's expanded service portfolio and geographic expansion. In 2024, the company secured new contracts, projected to generate $600 million in revenue, necessitating a $150 million capital investment, demonstrating its continued growth trajectory.

Despite facing challenges like economic downturns, which impacted global steel demand, decreasing by 1.9% in 2023, and commodity price fluctuations, the company has maintained its focus on efficiency and cost reduction. TMS International's ability to navigate these market dynamics, coupled with its strategic initiatives, underscores its resilience and forward-thinking approach in the competitive steel services sector. Read more about the Owners & Shareholders of TMS International.

TMS International, formerly Tube City IMS, has a rich history, starting in 1926. The merger of Tube City and IMS in 2004 was a significant step, creating a major player in outsourced steel services. The company rebranded to TMS International Corporation in 2016, reflecting its global operations.

The company consistently expands its service offerings and geographic reach. New contracts in 2024 are expected to generate $600 million in revenue over their lifespan. These strategic moves include add-on services and new customer acquisitions, requiring substantial capital investments.

TMS International's competitive advantage includes extensive industry expertise and a strong reputation. Its comprehensive service portfolio strengthens customer relationships. The company's global presence and long-standing customer relationships provide a stable revenue foundation.

Economic downturns and commodity price fluctuations pose challenges. Steel demand decreased by 1.9% in 2023, and prices fluctuated up to 10% in Q1 2024. TMS International focuses on efficiency, cost reduction, and introducing new steel mill services to mitigate these challenges.

TMS International's success is rooted in its deep industry knowledge and reputation, built over nearly a century. The company's comprehensive service portfolio and global presence, along with long-term customer relationships, are key differentiators. Their focus on safety, quality, and technological advancements further strengthens their market position.

- Extensive industry expertise and reputation.

- Comprehensive service portfolio.

- Global presence and long-standing customer relationships.

- Strong focus on safety and quality.

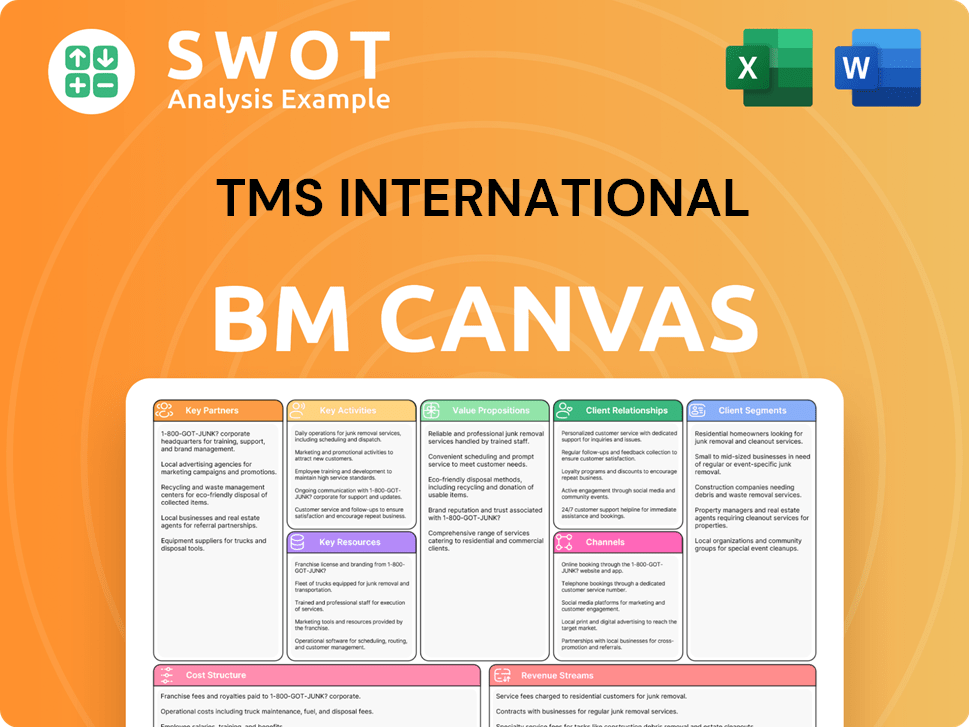

TMS International Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is TMS International Positioning Itself for Continued Success?

The [Company Name] holds a leading position in the outsourced industrial services sector, particularly within the steel industry. With a presence at over 80 customer sites across numerous countries and a global raw material procurement network, the company leverages a robust infrastructure to serve its clients. Its financial strength is underscored by its 2024 revenue of $2.5 billion, positioning it well against competitors.

However, the company faces risks stemming from its reliance on the cyclical steel industry and commodity price fluctuations. Operational challenges at client sites and evolving environmental regulations also pose significant concerns. Despite these challenges, the company is focused on strategic initiatives to sustain and expand its profitability.

The [Company Name] is a major player in outsourced industrial services for steel mills. It operates in over 80 locations worldwide, supported by a global raw material network. The company’s strong financial standing, with $2.5 billion in revenue in 2024, is a key advantage.

The company's performance is heavily tied to the steel industry, making it vulnerable to economic downturns. Fluctuations in raw material prices and potential operational issues at client sites also pose risks. Stricter environmental regulations and rising energy costs could increase operational expenses.

The company is focused on expanding its profitability through strategic initiatives. It aims to capitalize on increasing demand for outsourced services and the steel industry's shift towards sustainability. The adoption of new technologies is also a key focus.

The company is targeting new contracts and integrating waste reduction services to meet sustainability goals. It plans to use automation and data analytics to improve efficiency and reduce costs. Leadership is committed to safety, environmental responsibility, and providing cost-effective solutions.

The company's success is closely linked to the health of the steel industry, which saw a 1.9% decrease in global steel demand in 2023. The company is using strategies to mitigate risks, such as improving operational efficiency and expanding its service offerings. For more insights, consider reading the Growth Strategy of TMS International.

- The company's strong customer relationships, some lasting over three decades, contribute to high customer loyalty.

- The steel industry's shift towards sustainability offers opportunities in waste reduction and material recovery services.

- Adopting automation and data analytics aims to enhance operational efficiency and reduce costs.

- Leadership emphasizes safety, environmental responsibility, and cost-effective solutions.

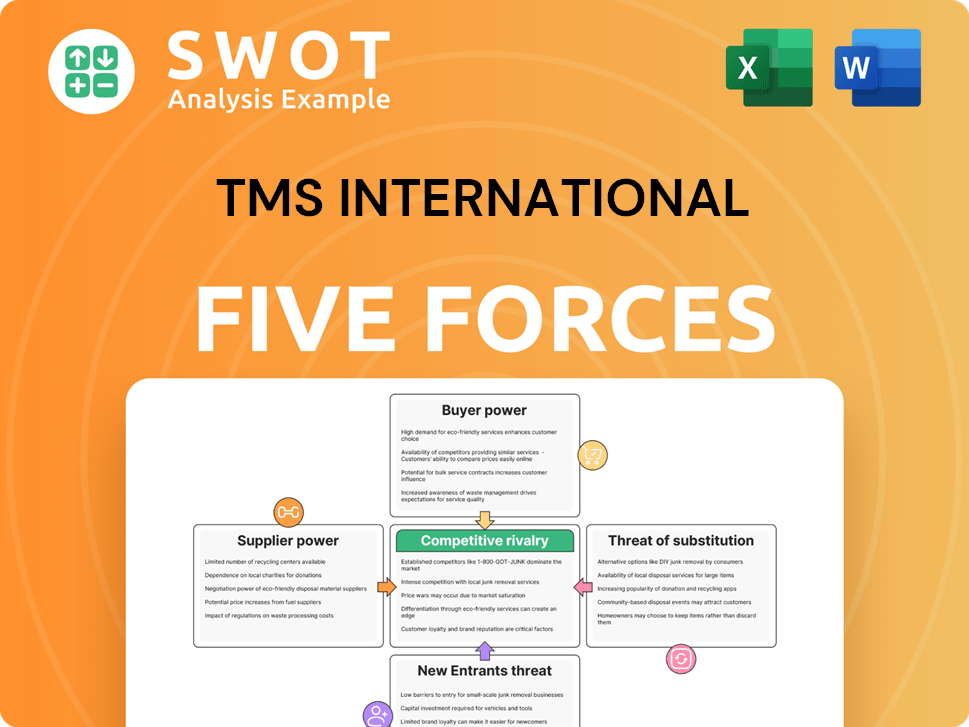

TMS International Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TMS International Company?

- What is Competitive Landscape of TMS International Company?

- What is Growth Strategy and Future Prospects of TMS International Company?

- What is Sales and Marketing Strategy of TMS International Company?

- What is Brief History of TMS International Company?

- Who Owns TMS International Company?

- What is Customer Demographics and Target Market of TMS International Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.