TMS International Bundle

Who Really Owns TMS International?

Understanding the ownership structure of a company is paramount for investors and strategists alike. A significant shift in ownership can dramatically impact a company's direction and performance. For TMS International, a global leader in industrial services, the story of its ownership is a dynamic one, shaped by acquisitions and strategic decisions.

TMS International, formerly Tube City IMS, has a rich history dating back to 1926, evolving from scrap metal dealing to a global service provider. This evolution is marked by key ownership changes, most notably the 2013 acquisition by The Pritzker Organization. To fully grasp TMS International's current position, one must understand its ownership journey, including its TMS International SWOT Analysis, major stakeholders, and the influence of its board of directors. Exploring the TMS ownership structure reveals critical insights for anyone interested in the TMS company's financial information and future prospects.

Who Founded TMS International?

The story of TMS International begins with two companies: Tube City Iron & Metal and International Mill Service (IMS). These companies, established in the early to mid-20th century, laid the foundation for what would eventually become the global entity known today. Understanding the origins of these companies is key to grasping the evolution of TMS International and its ownership structure.

Tube City Iron & Metal, founded in 1926, initially focused on scrap iron and metal dealing. IMS, established in 1936, began as a sand and gravel pit operation. The merger of these two companies in December 2004 marked a significant turning point, creating Tube City IMS, which later evolved into TMS International. The early ownership of these companies was likely private, involving founders and local investors, common for businesses in the industrial sector during that era.

While the specific founders and their initial equity stakes are not publicly available, the establishment of both Tube City and IMS was driven by the need to provide essential services to the metals industry. The consolidation of these businesses into a single entity reflects a strategic move to enhance operational capabilities and market reach. This merger was a crucial step in shaping the future of the company and its ownership dynamics.

The early ownership of Tube City Iron & Metal and International Mill Service was primarily private, with details of the founders and initial equity splits not publicly disclosed. The merger of Tube City and IMS in 2004 created Tube City IMS, setting the stage for the future TMS International. For further insights into the company's strategic growth, you can explore the Growth Strategy of TMS International.

- The founders of Tube City and IMS played a crucial role in establishing the companies.

- The merger in 2004 streamlined operations and expanded market presence.

- Early ownership structures were typical of industrial service providers of the time.

- The evolution of ownership reflects strategic business decisions.

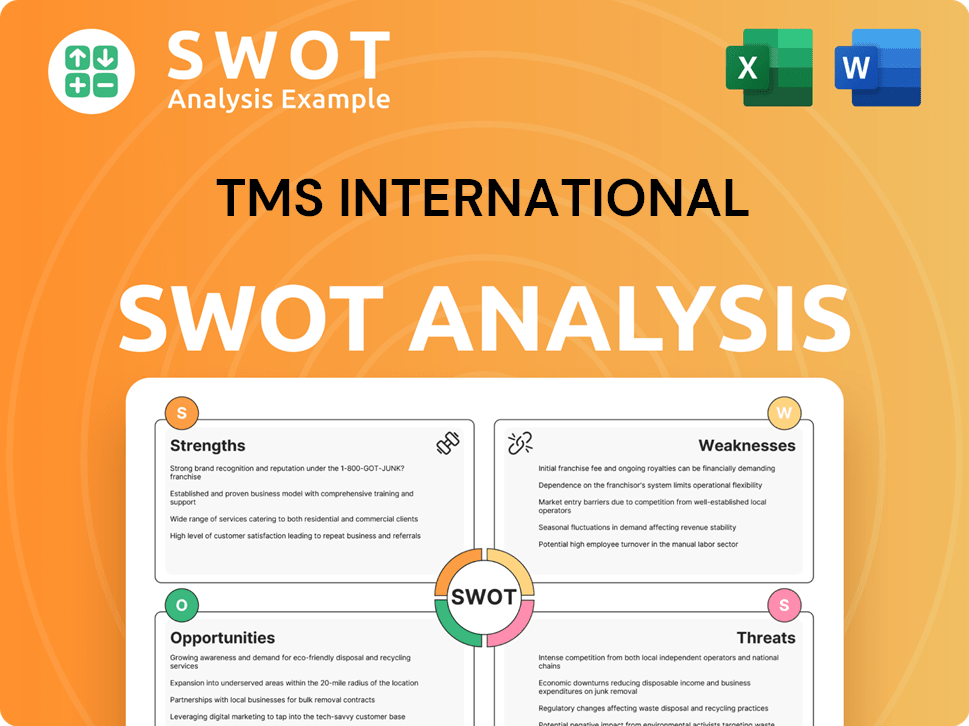

TMS International SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has TMS International’s Ownership Changed Over Time?

The ownership of TMS International has seen significant changes over time. Initially a private entity, the company transitioned to public ownership through an Initial Public Offering (IPO) in April 2011. During the IPO, the company, then known as Tube City IMS Corporation, offered shares at $13 each, raising approximately $109.3 million. This marked the beginning of its presence on the New York Stock Exchange under the ticker symbol TMS.

The ownership structure shifted again in August 2013, when The Pritzker Organization, LLC (TPO) acquired TMS International in an all-cash deal valued around $1 billion. This transaction, where shareholders received $17.50 per share, took TMS International private once more. At the time of the acquisition, Onex Corporation and its affiliates held roughly 60% of the outstanding shares, highlighting their significant stake in the company.

| Event | Date | Details |

|---|---|---|

| IPO | April 2011 | TMS International (Tube City IMS Corporation) went public on the NYSE, raising approximately $109.3 million. |

| Acquisition by TPO | August 2013 | The Pritzker Organization, LLC (TPO) acquired TMS International for approximately $1 billion, taking the company private. |

| Current Ownership | May 2025 | Primarily owned by The Pritzker Organization. Institutional ownership of debt instruments is held by entities like Huntington National Bank and BondBloxx ETFs. |

As a privately held company, detailed ownership information is not publicly available. However, The Pritzker Organization is the primary owner. Recent data from May 2025 shows that institutional investors hold shares, mainly through debt instruments. For example, Huntington National Bank holds 1 share, and BondBloxx ETFs hold a total of 112,000 shares. This structure allows TMS International to make strategic decisions without the pressure of quarterly earnings reports, common in public markets. If you want to learn more about the company, you can explore the Competitors Landscape of TMS International.

TMS International has transitioned from private to public and back to private ownership.

- The IPO in 2011 brought the company to the public market.

- The Pritzker Organization acquired TMS International in 2013.

- Current ownership is primarily held by The Pritzker Organization.

- Institutional investors hold shares through debt instruments.

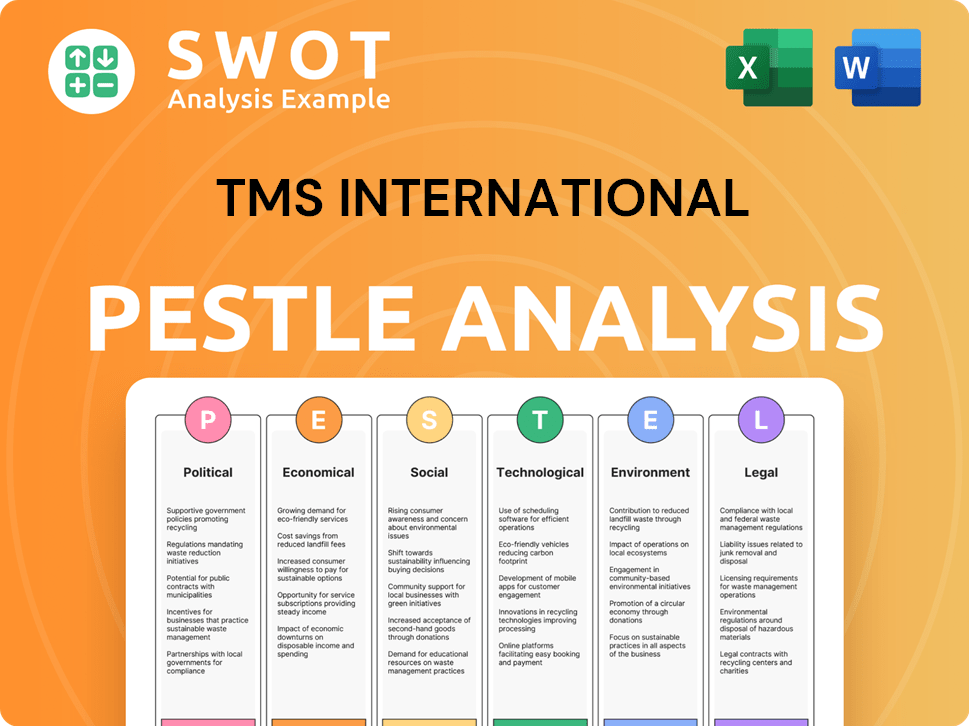

TMS International PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on TMS International’s Board?

As a privately held entity, the board of directors for TMS International is primarily influenced by its private equity owner, The Pritzker Organization. Public financial filings for private companies don't always offer a detailed list of board members and their specific roles. However, it's typical for the acquiring private equity firm to have significant representation on the board to oversee their investment and strategic direction. This structure allows the owner to directly influence decision-making and strategic planning.

As of February 20, 2025, Raymond Kalouche, after serving as President and CEO for 36 years, became Chairman of the Board. Joel Hawthorne was appointed as the new President and Chief Executive Officer, effective March 3, 2025. This transition highlights a leadership structure focused on a smooth handover while leveraging long-standing company knowledge and incorporating new executive experience. The board's composition reflects the interests of The Pritzker Organization, which focuses on maximizing value for its investment.

| Board Member | Title | Role |

|---|---|---|

| Raymond Kalouche | Chairman of the Board | Overseeing the strategic direction |

| Joel Hawthorne | President and CEO | Leading the company's operations |

| The Pritzker Organization Representatives | Board Members | Overseeing investment and strategic direction |

In a private company setting, voting structures are usually straightforward, often based on direct equity ownership. The Pritzker Organization, as the main owner, inherently possesses substantial control and voting power. This structure simplifies decision-making processes compared to publicly traded companies, where proxy battles and complex share structures are common. The focus remains on driving value creation and achieving the strategic objectives set by the primary shareholder, The Pritzker Organization.

The board of directors at TMS International is primarily influenced by its private equity owner, The Pritzker Organization. Raymond Kalouche transitioned to Chairman of the Board, and Joel Hawthorne became the new President and CEO in early 2025.

- The Pritzker Organization has significant representation.

- Voting power is based on direct equity ownership.

- The focus is on maximizing value for the investment.

- The leadership transition aims for continuity and new experience.

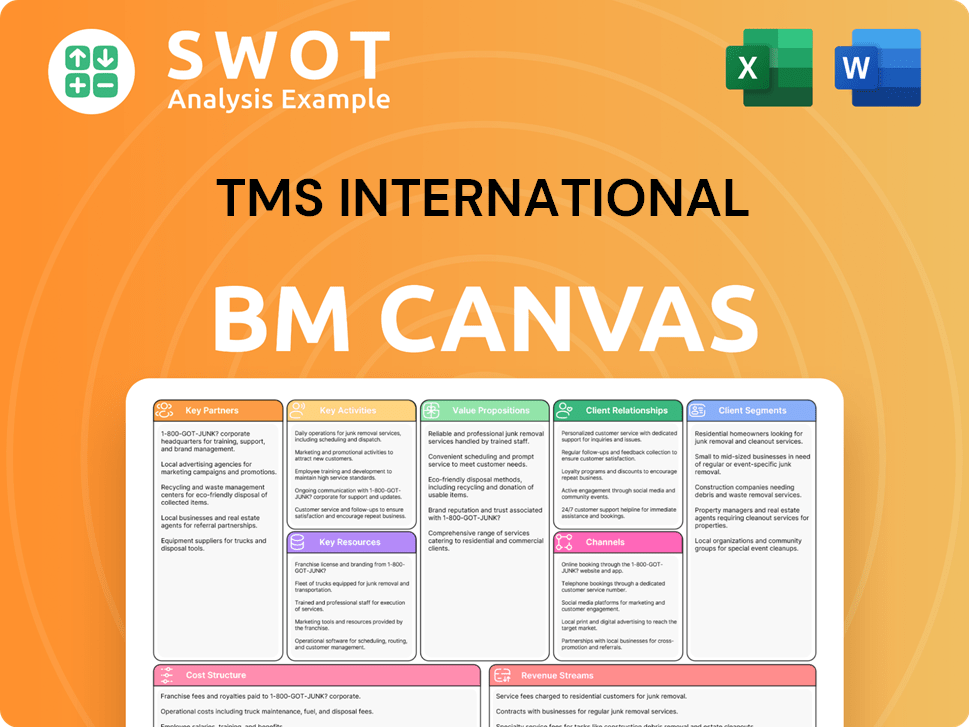

TMS International Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped TMS International’s Ownership Landscape?

Over the past few years, Revenue Streams & Business Model of TMS International has strategically evolved its operations. In December 2020, TMS International acquired Stein, LLC and Stein Steel Mill Services, LLC, expanding its services within the steel industry across several U.S. states. This acquisition strengthened TMS International's market presence and resource capabilities.

Recent leadership transitions also highlight the company's focus on future growth. As of March 3, 2025, Joel Hawthorne became President and CEO, succeeding Raymond Kalouche, who transitioned to Chairman of the Board. These changes signal a commitment to leveraging new expertise and continuing expansion within the metals industry. The company's strategic direction indicates a focus on enhancing its market position through operational improvements and strategic acquisitions, supported by its current ownership structure.

| Aspect | Details | Impact |

|---|---|---|

| Acquisition | Stein, LLC and Stein Steel Mill Services, LLC | Expanded U.S. footprint and service offerings |

| Leadership Change | Joel Hawthorne as President and CEO (March 2025) | Focus on growth and leveraging new expertise |

| Ownership | Private ownership under The Pritzker Organization | Emphasis on long-term strategic growth and operational efficiency |

The ownership structure of TMS International reflects broader trends in the industrial services sector, with private equity firms showing interest in companies with consistent revenue streams. Under The Pritzker Organization, the focus is on long-term value creation through strategic initiatives. This approach contrasts with the pressures often seen in publicly traded companies, allowing for a more focused strategy on operational improvements and acquisitions. This strategic direction is designed to reinforce TMS ownership and market position.

The private ownership structure of TMS International provides stability, allowing for long-term strategic planning. This structure enables the company to focus on operational improvements and strategic acquisitions without the short-term pressures associated with public markets. This stability supports consistent growth and market positioning.

The acquisition of Stein, LLC and Stein Steel Mill Services, LLC, in December 2020, is a key example of TMS company's strategic growth initiatives. These acquisitions expand the company's service offerings and enhance its presence in key markets, strengthening its overall market position. Further acquisitions are likely in the future.

The recent leadership changes, with Joel Hawthorne assuming the role of President and CEO, reflect a strategic succession plan. This transition brings new leadership expertise to the company, positioning it for continued growth and innovation. This change supports the company's long-term vision.

The industrial services sector shows continued interest from private equity firms in companies like TMS International. This trend highlights the value of stable revenue streams and essential services. The focus is on long-term value creation through strategic improvements and acquisitions within the TMS International owner framework.

TMS International Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TMS International Company?

- What is Competitive Landscape of TMS International Company?

- What is Growth Strategy and Future Prospects of TMS International Company?

- How Does TMS International Company Work?

- What is Sales and Marketing Strategy of TMS International Company?

- What is Brief History of TMS International Company?

- What is Customer Demographics and Target Market of TMS International Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.