Turner Industries Bundle

How is Turner Industries Positioning Itself for Future Growth?

Founded in 1961, Turner Industries has evolved into a leading industrial services provider. From its roots in Baton Rouge, Louisiana, the company has become a major player in heavy industrial construction and maintenance. This analysis explores the Turner Industries SWOT Analysis, growth strategy, and future prospects of this industry giant.

Understanding the Turner Industries Growth Strategy is crucial for investors and industry watchers alike. The company's success hinges on its ability to adapt to Construction Industry Trends and capitalize on opportunities within the Industrial Services Market. We'll examine Turner Industries' Future Prospects, considering its expansion plans, technological innovations, and financial performance to provide a comprehensive outlook on the Turner Industries Company.

How Is Turner Industries Expanding Its Reach?

The Turner Industries Growth Strategy centers on aggressive expansion and diversification. The company is actively pursuing opportunities to broaden its market reach and service offerings, focusing on high-growth sectors. This strategic approach is designed to capitalize on favorable industry trends and secure long-term value.

Turner Industries' Future Prospects are closely tied to its ability to execute these expansion initiatives effectively. The company's focus on emerging markets and key industries positions it well for sustained growth. This strategic direction is supported by ongoing investments in key projects and partnerships, ensuring a robust project pipeline and solid financial performance.

The company's strategic pivot allows it to capitalize on powerful secular trends, including the increasing investment in advanced manufacturing, critical infrastructure rebuilding, and the global transition to clean energy. This strategic focus is expected to drive significant growth in the coming years, as the company continues to adapt and innovate within the Industrial Services Market.

Turner Industries Company is targeting high-demand sectors such as data centers, semiconductors, energy transition, industrial, and biopharma. These industries are projected to constitute 40% of Turner's portfolio in the near future. This strategic focus allows the company to capitalize on significant growth opportunities within these sectors.

Turner Industries is increasing its presence in Europe, exemplified by the recent acquisition of Dornan, an engineering and construction firm. The company continues to grow alongside its long-time corporate and multifamily clients. This expansion strategy supports the company's long-term growth objectives and enhances its global footprint.

Specific examples of ongoing projects include delivering a new stadium for the Tennessee Titans, a terminal building at San Diego International Airport, and an artificial intelligence (AI) data center for Meta in Louisiana. The company has renewed its Integrated Field Management (IFM) agreement with Ascend Performance Materials for an additional five years.

Turner Industries has expanded services at the Shell Houston Lubricants Plant. These initiatives demonstrate the company's commitment to providing comprehensive services and maintaining strong relationships with key clients. This expansion enhances the company's ability to meet the evolving needs of its customers and drive revenue growth.

Turner Industries' expansion initiatives are designed to drive long-term growth and enhance its competitive position within the Construction Industry Trends. The company's focus on emerging markets and key projects positions it well for sustained success. This strategic approach is supported by ongoing investments in its workforce and technology, ensuring it can meet the evolving needs of its clients.

- Targeting high-growth sectors like data centers and energy transition.

- Expanding its geographical presence, particularly in Europe.

- Securing long-term contracts and renewing key partnerships.

- Investing in workforce development and technological advancements.

For more insights into the company's origins and development, you can read a Brief History of Turner Industries. The company's ability to adapt and innovate will be crucial in navigating the challenges and opportunities within the Industrial Services Market and achieving its long-term growth objectives. The company's strategic initiatives and focus on key sectors are expected to drive sustained revenue growth and enhance its overall Turner Industries Financial Performance.

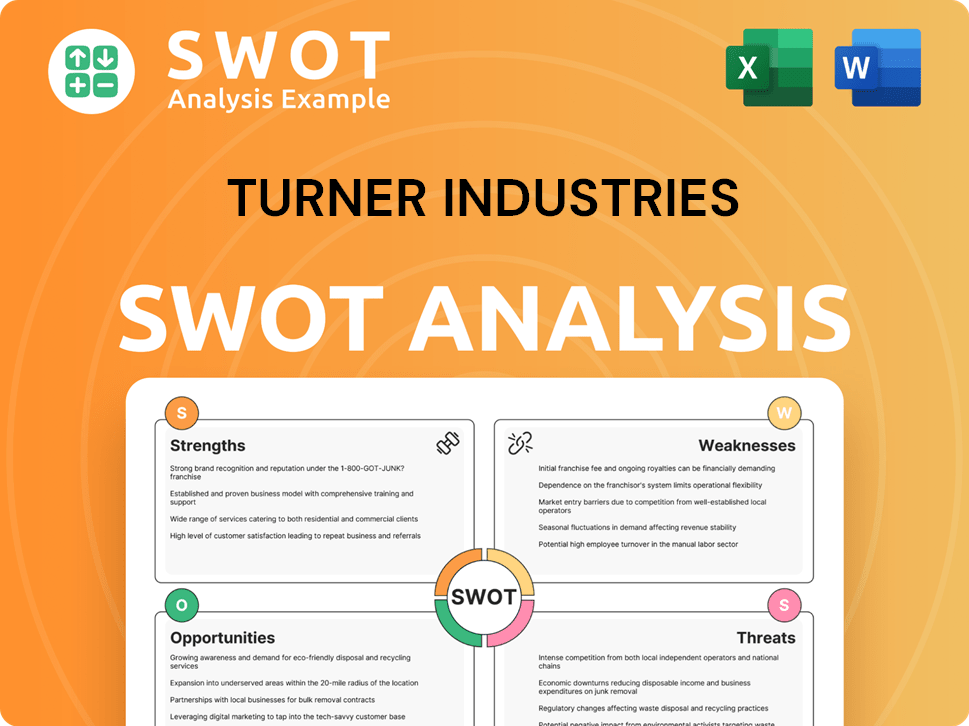

Turner Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Turner Industries Invest in Innovation?

The focus of the company on innovation and technology is a key element of its long-term growth strategy. This commitment enables the company to enhance service delivery and maintain a competitive edge within the industrial services market. By embracing digital transformation and investing in cutting-edge technologies, the company positions itself to meet evolving client needs and industry trends.

The company's proactive approach to technological advancements and sustainability initiatives shows its dedication to adapting to industry changes and securing future prospects. This strategy includes integrating innovative solutions and fostering a culture of continuous improvement, which is essential for sustained success. The company's investments in new technologies reflect a forward-thinking approach to meet the demands of the construction industry.

The company's commitment to sustainability and its focus on reducing emissions and waste are also crucial aspects of its growth strategy. These initiatives not only align with environmental goals but also enhance the company's reputation and appeal to clients prioritizing sustainability. This approach supports the company's long-term growth potential by addressing environmental concerns and promoting responsible business practices.

The company has adopted Google systems to reimagine business processes. This move empowers employees and delivers greater value to customers. This digital transformation is a core component of the company's innovation strategy.

Turner Specialty Services (TSS) uses the Elios 3 drone inspection system. This technology is used for elevated pipe rack inspections. This helps overcome challenges related to cost, labor, and safety.

The company launched new training programs and initiatives in 2024. These include the Top-Job Job Safety Analysis (JSA) Recognition Program and the Hard Hat Sticker Safety Recognition Program. These programs recognize and reward employees for promoting a safer work environment.

The Sustainability & Innovation Solutions Group focuses on reducing emissions and waste. This includes supporting clients' lower carbon goals. The company aims to achieve Net Zero Emissions in its own operations (Scope 1 and 2) by 2030 and across its supply chain (Scopes 1, 2 and 3) by 2040.

The company implements energy-efficient solutions like LED lighting upgrades. These upgrades reduced the carbon footprint by 1,066 tons annually across two campuses. This demonstrates a commitment to environmental responsibility.

The company aims to divert 80% of construction and demolition waste by 2025 and 95% by 2035. This ambitious goal reflects a strong commitment to sustainability and waste management within the construction industry.

The company's approach to innovation and technology is multifaceted, incorporating digital transformation, advanced inspection methods, and robust safety programs. These efforts are supported by a strong emphasis on sustainability. For a deeper understanding of the company's financial strategy, consider exploring the Revenue Streams & Business Model of Turner Industries.

- Digital Transformation: Adoption of Google systems to improve business processes and enhance customer value.

- Advanced Inspection: Deployment of the Elios 3 drone inspection system for efficient and safe inspections.

- Safety Programs: Launch of programs like the Top-Job JSA Recognition Program and Hard Hat Sticker Safety Recognition Program.

- Sustainability: Focus on reducing emissions, waste, and supporting clients' lower carbon goals.

- Energy Efficiency: Implementation of LED lighting upgrades to reduce carbon footprint.

- Waste Reduction: Goals to divert 80% of construction and demolition waste by 2025 and 95% by 2035.

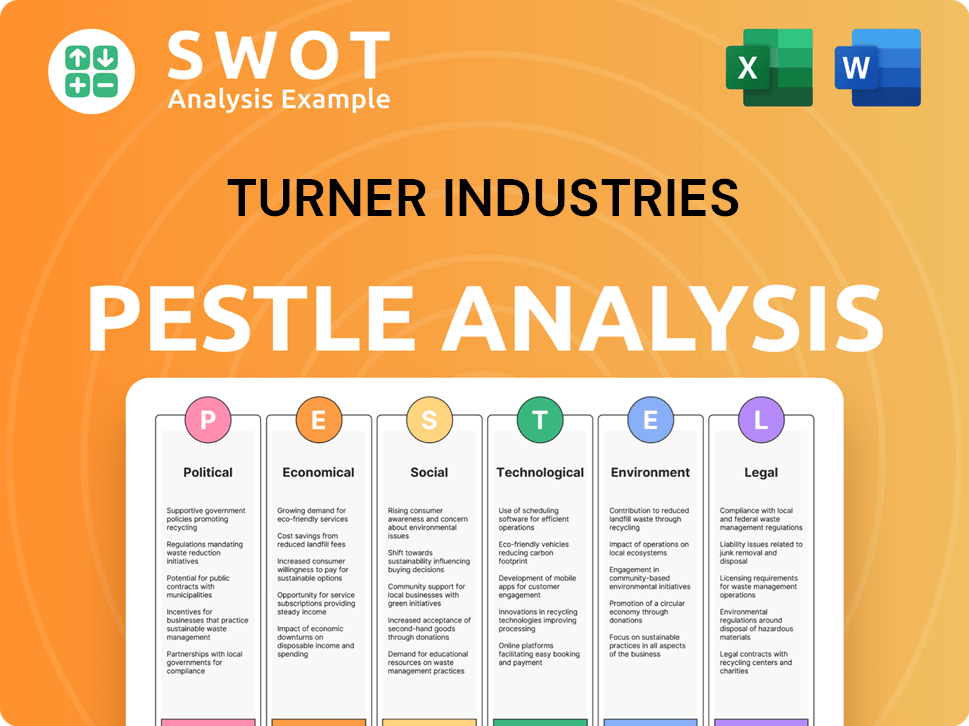

Turner Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Turner Industries’s Growth Forecast?

The financial outlook for 'Turner Industries Company' is promising, supported by strong performance within related entities and positive industry trends. While specific consolidated financial data for 'Turner Industries Company' is not readily available, the performance of related companies offers valuable insights. For example, in 2024, a related entity secured $26.14 billion in new contracts, demonstrating robust demand and operational capabilities within the broader construction and industrial services market.

The revenue growth in related entities also indicates a strong financial standing. Revenue reached $20.24 billion in 2024, a significant increase from the previous year. This positive trend continued into the first quarter of 2025, with substantial revenue and new orders, highlighting the company's ability to secure and execute projects effectively. These figures reflect a healthy financial environment for 'Turner Industries Company' and its associated operations.

The industrial services market is experiencing significant growth, which provides a favorable backdrop for 'Turner Industries Company's' future prospects. Despite the lack of specific consolidated financial statements, the performance of related entities and the broader market trends suggest a positive outlook. The company's ability to secure large contracts and generate substantial revenue positions it well for continued expansion and success. Understanding the Marketing Strategy of Turner Industries can provide additional context on how the company is positioned for growth.

While specific financial data for 'Turner Industries Company' is limited, the performance of related entities offers a glimpse into its financial health. The securing of $26.14 billion in new contracts and revenue of $20.24 billion in 2024 highlights strong financial performance.

The construction industry is experiencing growth, driven by sectors like data centers, healthcare, and education. This positive trend supports the 'Turner Industries Company's' future prospects. The company is well-positioned to capitalize on these industry trends.

The future prospects for 'Turner Industries Company' appear positive, supported by strong financial performance in related entities and favorable market conditions. Forecasts for 'Turner Industries Ltd' anticipate robust growth. The company's ability to adapt to industry changes will be critical.

Revenue growth in related entities demonstrates the company's ability to secure and execute projects. The financial health of related entities suggests a healthy financial environment for 'Turner Industries Company'. The company's focus on efficiency and project management is key.

Market analysis reveals strong demand in sectors like data centers, healthcare, and education. The company's strategic positioning in these sectors supports its growth strategy. Understanding the market dynamics is crucial for sustained success.

Strategic partnerships and collaborations can boost the company's market presence. These partnerships can enhance the company's capabilities and expand its reach. Collaborations will be important for future growth.

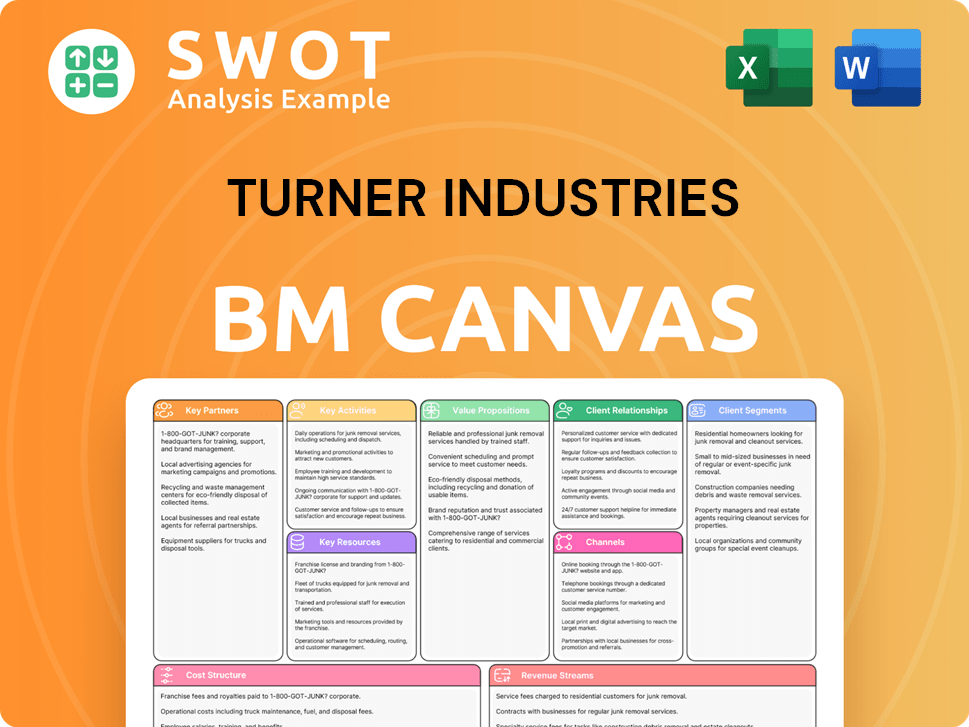

Turner Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Turner Industries’s Growth?

The Turner Industries Company faces several risks and obstacles that could influence its Turner Industries Growth Strategy and future. These challenges include intense competition within the Industrial Services Market and the broader construction industry, along with potential changes in regulations. Economic volatility, supply chain disruptions, and technological advancements also present significant hurdles.

Operational risks such as ensuring worker safety and managing internal resources are critical concerns. The company must navigate these challenges effectively to maintain its Turner Industries Future Prospects and achieve its strategic goals. Adapting to the dynamic Construction Industry Trends is essential for long-term success.

The company's ability to mitigate these risks will be crucial for its Turner Industries Company. Proactive measures, including safety programs, technological adaptation, and diversification strategies, will be key to navigating these challenges and fostering sustainable growth.

The industrial services sector is highly competitive. Turner Industries competes with both large national firms and smaller regional players, impacting Turner Industries Financial Performance. Maintaining a competitive edge requires continuous innovation and efficiency improvements.

The construction industry is susceptible to economic cycles, including inflation. Economic downturns can lead to project delays or cancellations, affecting revenue and profitability. Monitoring economic indicators and adjusting strategies accordingly is vital.

Disruptions in the supply chain can cause project delays and cost overruns. Business leaders expressed worry about these disruptions, with 62% citing them as a major concern in 2025. Managing supplier relationships and diversifying sourcing are crucial.

Rapid technological advancements, like AI and IoT, require continuous investment and adaptation. The company must stay current with new technologies to remain competitive and avoid being outpaced. This impacts Turner Industries' expansion plans and market analysis.

Finding and retaining skilled labor is a significant challenge. With 69% of business leaders expressing concern in 2025, workforce development programs and competitive compensation are essential for attracting and keeping talent. This influences Turner Industries' workforce development programs.

Maintaining worker safety is a critical operational risk. Potential worker injuries were cited as a major concern by 62% of business leaders. Comprehensive safety programs and rigorous training are paramount.

Turner Industries addresses these risks through a variety of strategic initiatives. Safety is a top priority, with comprehensive programs to eliminate worksite incidents. They are implementing ISO 45001 and working towards ISO 14001 certification by 2024 to improve risk management.

Diversifying into sectors like data centers and energy transition helps reduce reliance on any single market. They incorporate physical protection from severe weather events into project planning, and continuously evaluate sustainability criteria. The company continues its risk assessment for top five risks related to cyber security, developing and implementing mitigation measures by 2024.

Turner Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Turner Industries Company?

- What is Competitive Landscape of Turner Industries Company?

- How Does Turner Industries Company Work?

- What is Sales and Marketing Strategy of Turner Industries Company?

- What is Brief History of Turner Industries Company?

- Who Owns Turner Industries Company?

- What is Customer Demographics and Target Market of Turner Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.