Turner Industries Bundle

Who Really Owns Turner Industries?

Unveiling the ownership of Turner Industries is key to understanding its strategic moves and long-term vision within the industrial landscape. In 2005, a pivotal shift occurred when founder Bert Turner consolidated ownership, solidifying its family-owned status under Turner Industries Group LLC. This decision has profoundly shaped the company's trajectory, influencing its operations and strategic decisions to this day.

Founded in 1961 by Bert S. Turner and his wife Sue Turner, Turner Industries SWOT Analysis reveals the company's evolution from industrial construction to a leading single-vendor solution provider. This privately held entity, with its current focus on heavy industrial construction and maintenance, continues to be a major player, employing over 18,330 people and generating significant annual revenue. Understanding the Turner Industries ownership structure provides critical insights into its market position and operational strategies, including its Turner Industries owner and Who owns Turner Industries structure.

Who Founded Turner Industries?

The foundation of Turner Industries was laid in 1961 by Bert S. Turner. His vision was to create a company that could withstand the cyclical nature of industrial construction. He achieved this by incorporating industrial contract maintenance into the business model, ensuring a more stable revenue stream.

Bert Turner's initial ownership stemmed from his acquisition of Nichols Construction Company. This acquisition was pivotal, occurring after the death of Bob Nichols, the former owner, and the subsequent bankruptcy of Yuba Industries, which had previously acquired Nichols Construction. While specific equity details from the start are not publicly available, the company's ownership was firmly rooted in Bert Turner's control.

Early growth was significantly influenced by Roland Toups, a young engineer who rose to the position of executive vice president. The company's expansion throughout the 1970s and into the Gulf South during the 1980s and 2000s was crucial to its early success. The company's focus on both construction and maintenance has been a constant in its strategic direction since its inception.

Founded in 1961 by Bert S. Turner. Turner acquired Nichols Construction Company to start the business.

Roland Toups, a young engineer, played a crucial role in the company's early growth. He eventually became executive vice president.

In 2005, Bert Turner bought out minority stockholders. This move consolidated ownership within the Turner family.

The company's strategy has always been to provide diversified industrial services. This includes both construction and maintenance.

The company is structured as Turner Industries Group LLC. This structure reflects the family-oriented ownership.

Expansion across the Gulf South in the 1980s and 2000s was key to the company's development. This growth was supported by its diversified service offerings.

The Turner Industries ownership structure, which is privately held, has remained largely within the Turner family since the 2005 consolidation. The company's focus on both construction and maintenance services has allowed it to achieve significant annual revenues. For more details on the company's business model, you can read about the Revenue Streams & Business Model of Turner Industries. The company's commitment to a diversified approach has been a key factor in its long-term success and stability within the industrial services sector. The Turner Industries owner has consistently maintained this strategic direction, ensuring the company's continued growth and market presence. The Turner Industries company profile reveals a privately held company with a strong focus on family ownership and a diversified service model.

Understanding the origins and evolution of Turner Industries' ownership offers insights into its strategic focus and stability.

- Founded by Bert S. Turner in 1961.

- Early growth influenced by Roland Toups.

- Ownership consolidated within the Turner family in 2005.

- Focus on both construction and maintenance services.

- Privately held company with a diversified business model.

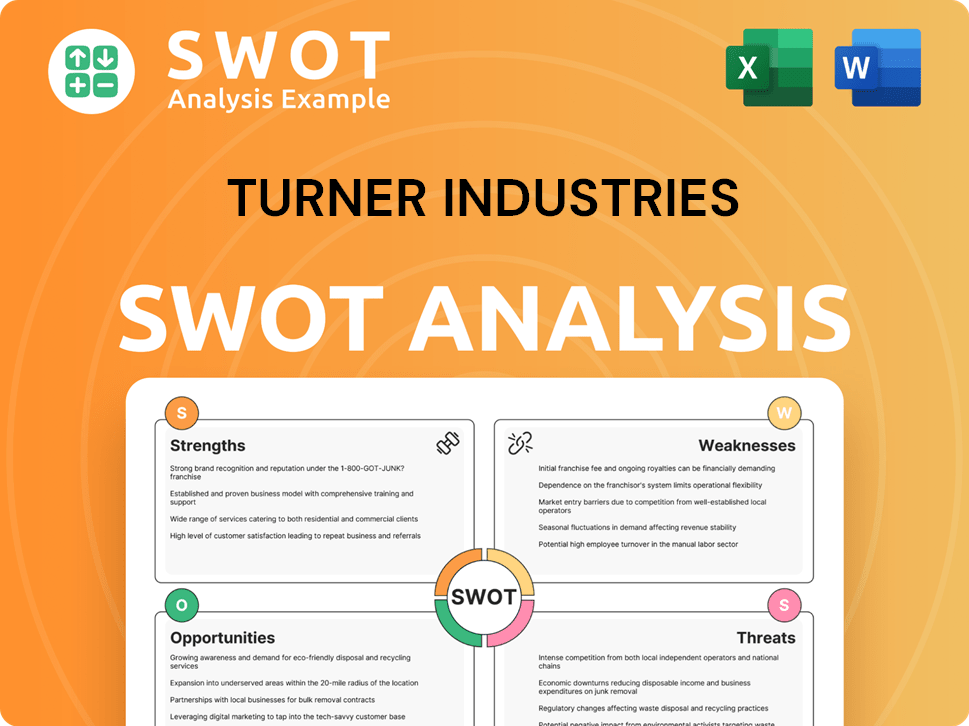

Turner Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Turner Industries’s Ownership Changed Over Time?

The ownership of Turner Industries, a privately held entity, has been significantly shaped by key events. A major consolidation occurred in 2005 when founder Bert Turner bought out all minority stockholders. This move solidified the Turner family's complete control over the company, establishing Turner Industries Group LLC. This pivotal decision reinforced the family's vision and long-term strategic focus for the company.

The company’s structure has remained consistent over the years, with the Turner family maintaining a firm grip on its operations. This is a key aspect of understanding who owns Turner Industries. The private status of the company means that detailed information on individual shareholdings is not publicly available. The leadership has been passed down through generations, ensuring continuity in upholding the family's values and dedication to the company's success. This approach has allowed the company to concentrate on long-term strategies and maintain a consistent corporate culture.

| Key Event | Impact on Ownership | Year |

|---|---|---|

| Acquisition of Minority Stockholders | Full ownership by the Turner family, establishing Turner Industries Group LLC | 2005 |

| Leadership Succession | Continued family involvement in shareholders and board member roles | Ongoing |

| Private Ownership | No public shareholders, institutional investors, or private equity firms | Present |

Currently, Turner Industries' ownership is primarily held by the Turner family. Bert and Sue Turner's five children are the principal shareholders. This structure allows the company to operate without the pressures of public reporting, focusing instead on long-term growth and maintaining its core values. The company's estimated annual revenue was around $2.7 billion as of February 2025. The company employs over 18,330 individuals, highlighting its significant market position within its privately held framework. For more information on the company's background, you can read the Brief History of Turner Industries.

Turner Industries is a privately held company, primarily owned by the Turner family. The company's structure allows it to focus on long-term strategies and maintain a consistent corporate culture.

- Family-owned and operated.

- No public shareholders or institutional investors.

- Focus on long-term growth and core values.

- Estimated annual revenue of $2.7 billion as of February 2025.

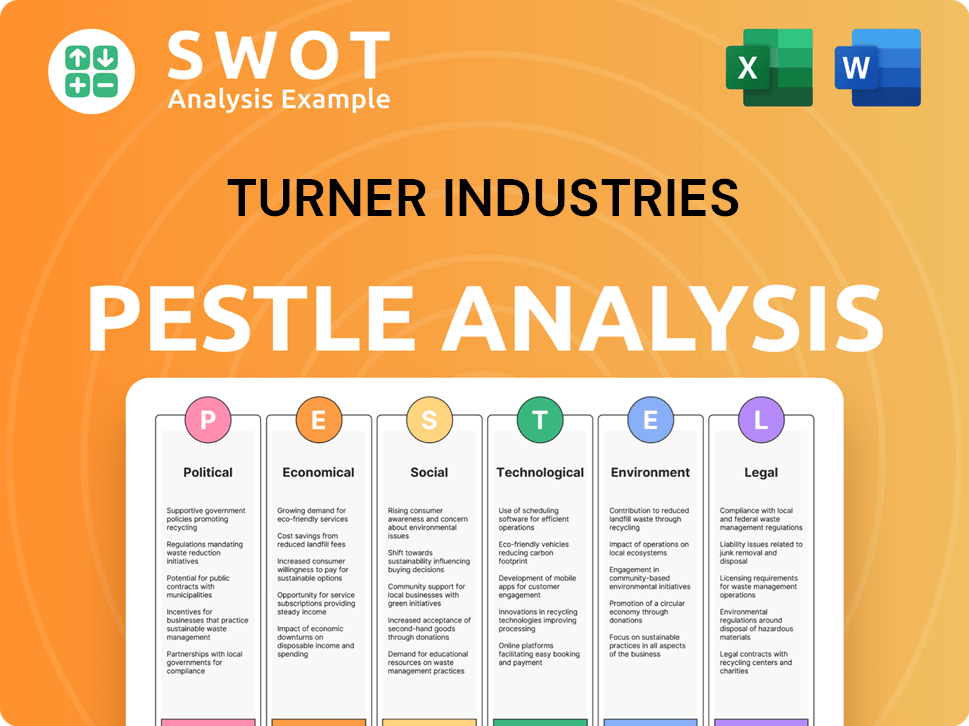

Turner Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Turner Industries’s Board?

Regarding Turner Industries ownership, the company operates differently from publicly traded entities. As a privately held company, it doesn't have a traditional board of directors in the public sense. Instead, governance is managed internally through an executive committee and the Turner family, who are the primary shareholders. This structure concentrates decision-making power within the family and the executive team, ensuring a focus on long-term strategic goals.

The core leadership team at Turner Industries includes key figures such as Stephen M. Toups as Chief Executive Officer, David J. Franks as Chief Operating Officer, and James P. Sylvester as Chief Financial Officer. Other essential members are Mark Brittain, President of Construction; John Richard, President of Pipe Fabrication; Mike Morain, President of Equipment, Rigging & Specialized Transportation; and Eddie Villeret, President of Specialty Services Division. This team, along with division presidents, is responsible for the company's strategic direction and operational execution.

| Leadership Position | Name | Title |

|---|---|---|

| Chief Executive Officer | Stephen M. Toups | CEO |

| Chief Operating Officer | David J. Franks | COO |

| Chief Financial Officer | James P. Sylvester | CFO |

The voting power and control within Turner Industries are primarily held by the Turner family, particularly the five children of Bert and Sue Turner, who are the principal shareholders. This family-centric ownership structure ensures that the company's direction is shaped by their vision and long-term strategic goals. The absence of an external board means no public proxy battles or independent seats, solidifying the family's influence on the company's trajectory.

The company's governance is managed by an executive committee and the Turner family. This structure emphasizes internal alignment and long-term vision. Key leadership roles are held by individuals like Stephen M. Toups, the CEO, and David J. Franks, the COO.

- The Turner family holds significant control.

- Decision-making is centralized within the executive team.

- There is no external board of directors.

- The company is privately held.

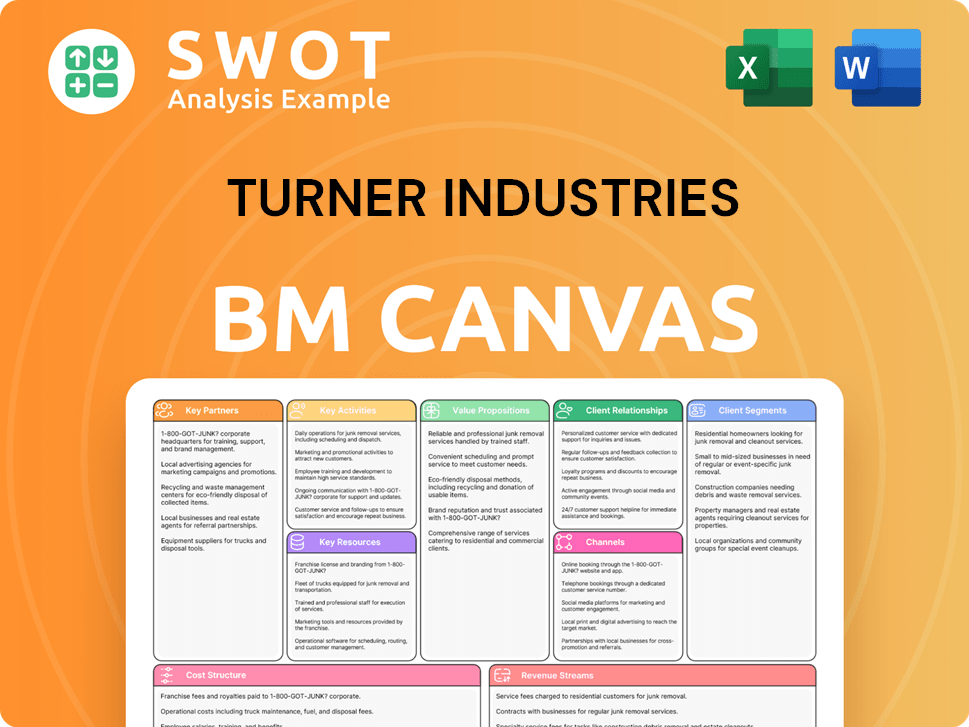

Turner Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Turner Industries’s Ownership Landscape?

Over the past few years, the ownership of Turner Industries has remained firmly within the Turner family, maintaining its status as a privately-held industrial contractor. As of February 2025, the company, which is a key player in the industrial sector, employs over 18,330 individuals. The company reported an estimated annual revenue of approximately $2.7 billion in 2024, highlighting its significant market presence. The company's consistent recognition, including topping Associated Builders and Contractors' 2025 Top Performers list for the fourth consecutive year, underscores its ongoing success and stability under its current ownership structure.

A notable leadership transition occurred with the retirement of Thomas H. Turner, son of the founder, as CEO effective December 31, 2020. Stephen Toups assumed the role of Chief Executive Officer, reflecting a planned succession within the company's leadership. There have been no public announcements regarding significant changes in ownership, such as share buybacks or the acquisition of substantial stakes by external investors. This reinforces the continued private and family-controlled nature of the company, which is a critical aspect of the Turner Industries ownership profile.

| Aspect | Details | Status |

|---|---|---|

| Ownership | Family-owned | Private |

| Employee Count (Feb 2025) | Over 18,330 | Stable |

| 2024 Revenue (Estimated) | $2.7 billion | Consistent |

The company's focus remains on delivering comprehensive industrial services, including heavy industrial construction, maintenance, and fabrication. This strategic direction aligns with the trend of successful private companies prioritizing long-term strategies. For additional insights into the company's strategic initiatives, consider exploring the Marketing Strategy of Turner Industries.

The company is primarily owned and controlled by the Turner family. This structure allows for long-term strategic planning without the pressures of public market demands. The private status provides flexibility in decision-making and operational strategies, focusing on sustained growth and stability.

Thomas H. Turner's retirement as CEO in late 2020 marked a significant transition. Stephen Toups, the current CEO, has continued to lead the company, reflecting a planned succession. This smooth transition has helped maintain operational continuity and strategic focus.

The company’s estimated annual revenue in 2024 was $2.7 billion, demonstrating strong financial health. This performance, coupled with consistent recognition in the industry, underscores its stability. The private ownership model supports long-term investment in growth.

With the current ownership structure and leadership in place, the company is well-positioned for continued growth. The focus on core industrial services and maintaining its private status suggests a commitment to sustainable, long-term value creation. No immediate plans for a public offering have been announced.

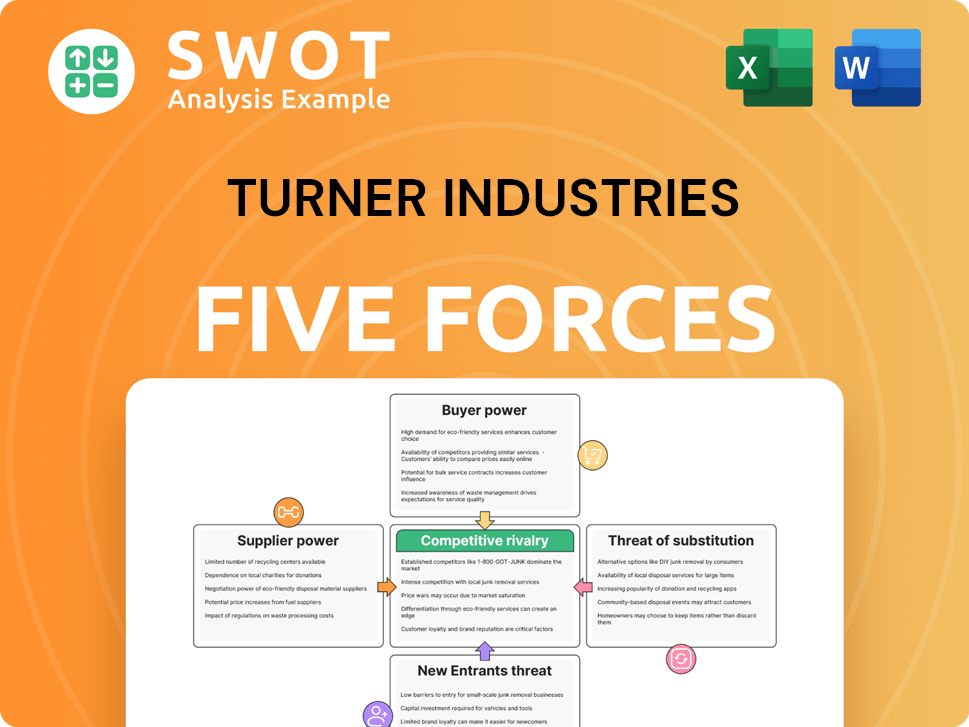

Turner Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Turner Industries Company?

- What is Competitive Landscape of Turner Industries Company?

- What is Growth Strategy and Future Prospects of Turner Industries Company?

- How Does Turner Industries Company Work?

- What is Sales and Marketing Strategy of Turner Industries Company?

- What is Brief History of Turner Industries Company?

- What is Customer Demographics and Target Market of Turner Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.