Turner Industries Bundle

Who Are Turner Industries' Key Clients?

In the dynamic industrial services sector, understanding customer demographics and target markets is crucial for sustained success. The evolving landscape, especially with the rise of renewable energy, demands strategic adaptation. This analysis dives into Turner Industries SWOT Analysis to explore the company's customer base and market positioning.

This exploration of Turner Industries Company provides a detailed market analysis, examining its customer profile and demographic data. We'll uncover the industries served, geographic locations, and customer acquisition strategies. Understanding the customer demographics for Turner Industries is essential for anyone seeking insights into this leading industrial services provider, its target market analysis, and how it maintains its position in a competitive environment.

Who Are Turner Industries’s Main Customers?

Understanding the customer demographics and target market is crucial for any business, and for Turner Industries Company, this means focusing on its primary customer segments within the heavy industrial sector. The company operates predominantly in a Business-to-Business (B2B) model, which shapes its approach to market analysis and customer profile development. This focus allows for a more targeted strategy, emphasizing industry-specific needs and operational requirements.

The core target market for Turner Industries comprises large corporations in key sectors. These include the chemical, petrochemical, energy (oil, gas, and power generation), and other heavy industrial markets. These clients typically have significant infrastructure and ongoing needs for construction, maintenance, and fabrication services. The demographic data for these clients is less about age or income and more about industry sector, operational scale, and geographic location. This allows for a more effective customer segmentation strategy.

Decision-makers within these client organizations are typically experienced professionals. This includes plant managers, project engineers, procurement specialists, and executive leadership. These individuals prioritize safety, project efficiency, reliability, and cost-effectiveness. Turner Industries tailors its services to meet these specific needs, ensuring customer satisfaction and long-term relationships. A detailed Growth Strategy of Turner Industries can provide further insights into their market approach.

The primary customer segments for Turner Industries are concentrated in the chemical, petrochemical, and energy sectors. These industries represent the largest share of the company's revenue. The company's market reach and segmentation efforts are heavily influenced by the needs of these sectors.

The customer profile includes plant managers, project engineers, and procurement specialists. These individuals are responsible for making decisions related to construction, maintenance, and fabrication projects. Their priorities include safety, efficiency, and cost-effectiveness.

The geographic location of Turner Industries' customers is a key factor. The company operates in regions with significant industrial activity. This includes areas with large chemical plants, refineries, and power generation facilities. This focus allows for efficient resource allocation and service delivery.

The company is adapting to external trends, such as the energy transition. Increased investments in renewable energy infrastructure and sustainable chemical processes have led to strategic expansion. This involves adapting service offerings to meet new demands for specialized fabrication and construction techniques.

Understanding the customer demographics and target market is essential for Turner Industries' strategic planning. The company's focus on the B2B model allows for a more targeted approach. This includes tailoring services to meet the specific needs of clients in the chemical, petrochemical, and energy sectors.

- Industry Sector: Chemical, petrochemical, energy (oil, gas, and power generation), and other heavy industrial markets.

- Key Decision-Makers: Plant managers, project engineers, procurement specialists, and executive leadership.

- Geographic Location: Regions with significant industrial activity, including areas with large chemical plants, refineries, and power generation facilities.

- Market Trends: Adapting to external trends such as the energy transition and increased investments in renewable energy infrastructure.

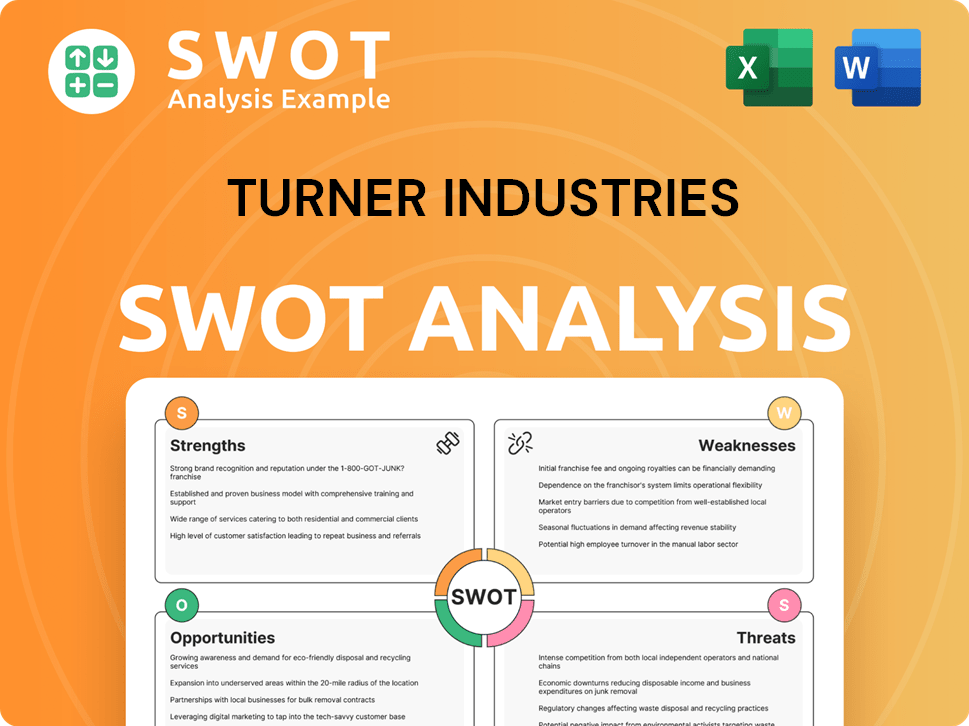

Turner Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Turner Industries’s Customers Want?

Understanding the customer needs and preferences is crucial for a company like Turner Industries Company. Their success hinges on meeting the specific demands of clients in heavy industrial sectors. The focus is on operational efficiency, safety, and project execution excellence.

The primary drivers for clients include minimizing downtime, adhering to safety standards, and delivering projects on time and within budget. These factors heavily influence purchasing decisions, making a vendor's track record, technical capabilities, and safety performance critical. A 'single vendor solution' is often preferred to streamline project management.

Product usage patterns show consistent demand for maintenance, turnarounds, and specialized fabrication. Loyalty is built on delivering high-quality, safe, and reliable services, along with strong communication and proactive problem-solving. Addressing the complexities of coordinating multiple contractors is a key pain point that Turner Industries alleviates through its integrated service model.

Clients need minimal downtime, adherence to safety standards, and on-time project delivery. Their focus is on operational efficiency and regulatory compliance. These needs drive their preferences and purchasing decisions.

Clients are motivated by the desire to reduce costs, improve safety records, and maintain compliance. They seek partners who can ensure the smooth operation of their facilities. The goal is to optimize performance and minimize risks.

Clients prefer vendors with a strong track record, technical expertise, and a commitment to safety. They often favor a single-source solution to simplify project management. This streamlines the process and reduces coordination issues.

Purchasing decisions are driven by a comprehensive evaluation of a vendor's capabilities and performance. Factors include safety records and the ability to provide integrated services. Clients conduct thorough due diligence.

The ability to provide a single vendor solution is a significant advantage. It streamlines project management and reduces coordination complexities. This approach enhances efficiency and accountability.

There is consistent demand for recurring maintenance, periodic turnarounds, and specialized fabrication. These services support the ongoing operations of industrial facilities. This ensures continued productivity.

In response to evolving industry preferences, Turner Industries has likely expanded its module fabrication capabilities. This expansion caters to the demand for expedited project delivery and enhanced safety. For more insights, consider reading about the Marketing Strategy of Turner Industries. Customer feedback, especially regarding project timelines and safety benchmarks, directly influences operational improvements. For instance, in 2024, the company may have focused on increasing efficiency to meet the growing demand for modular construction, which is projected to grow by approximately 8% annually through 2028, according to recent market analyses. This growth underscores the importance of adapting to changing customer needs and preferences.

Understanding the customer demographics and target market is crucial for success. Clients in heavy industrial sectors have specific needs. Meeting these needs drives purchasing decisions.

- Operational Efficiency: Clients require minimal downtime and efficient project execution.

- Safety Compliance: Adherence to stringent safety standards, such as OSHA, is a top priority. In 2024, the industry saw a 5% increase in safety-related investments.

- Project Delivery: Projects must be completed on time and within budget.

- Integrated Services: Clients prefer a single vendor solution to streamline project management.

- Recurring Maintenance: Demand for ongoing maintenance and turnarounds is consistent.

- Fabrication: Specialized fabrication services for new construction and upgrades are essential.

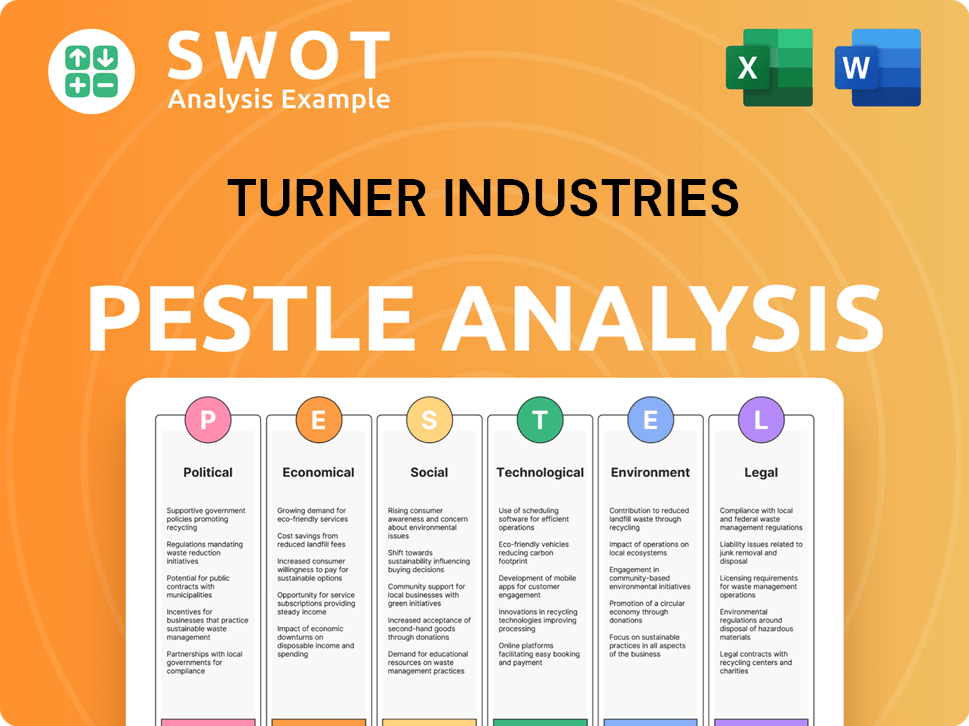

Turner Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Turner Industries operate?

The geographical market presence of Turner Industries Company is primarily focused on the United States, with a strong emphasis on heavy industrial markets. The Gulf Coast region, including Louisiana, Texas, and Mississippi, serves as a major hub for the company due to its high concentration of chemical, petrochemical, and energy production facilities. This area provides a significant market share and brand recognition for Turner Industries.

Beyond the Gulf Coast, Turner Industries operates in other industrial centers across the U.S., adapting its operational footprint to meet client needs in various locations. The company strategically positions itself to serve diverse geographical areas, ensuring it can offer its services where industrial demand is highest. This approach allows for flexibility and responsiveness to regional market dynamics.

The company's approach to its target market involves localizing its offerings through regional offices, local workforces, and adherence to specific state and local regulations. This localized strategy ensures that Turner Industries can effectively meet the unique needs of its clients in different regions. Recent expansions or strategic withdrawals are typically driven by shifts in industrial investment and client demand.

The Gulf Coast is a key area for Turner Industries, driven by the concentration of oil, gas, and petrochemical operations. This region's industrial activity provides a consistent demand for Turner Industries' services. The company has built a strong presence in this area over the years, establishing itself as a reliable provider.

Turner Industries tailors its offerings to different regions by establishing regional offices and deploying local workforces. This approach allows the company to meet specific state and local regulations and client requirements. By adapting to local needs, Turner Industries ensures it can provide effective services.

The company's strategic focus in 2024-2025 likely includes maintaining its strong presence in traditional markets while expanding into regions with increasing industrial capital expenditure. This expansion strategy is particularly focused on emerging energy sectors. This approach helps optimize the geographic distribution of sales and growth.

Differences in customer demographics across regions are primarily driven by specific industrial concentrations. For example, the Gulf Coast is dominated by oil, gas, and petrochemical operations, while other regions might focus on power generation or specialized manufacturing. This focus allows for better customer segmentation.

Turner Industries' strategic focus in 2024-2025 is to maintain its strong presence in traditional markets while expanding into regions with increasing industrial capital expenditure. This includes a focus on emerging energy sectors. The company aims to optimize the geographic distribution of its sales and growth.

- Maintain strong presence in traditional markets.

- Expand into regions with increasing industrial capital expenditure.

- Focus on emerging energy sectors.

- Optimize geographic distribution of sales and growth.

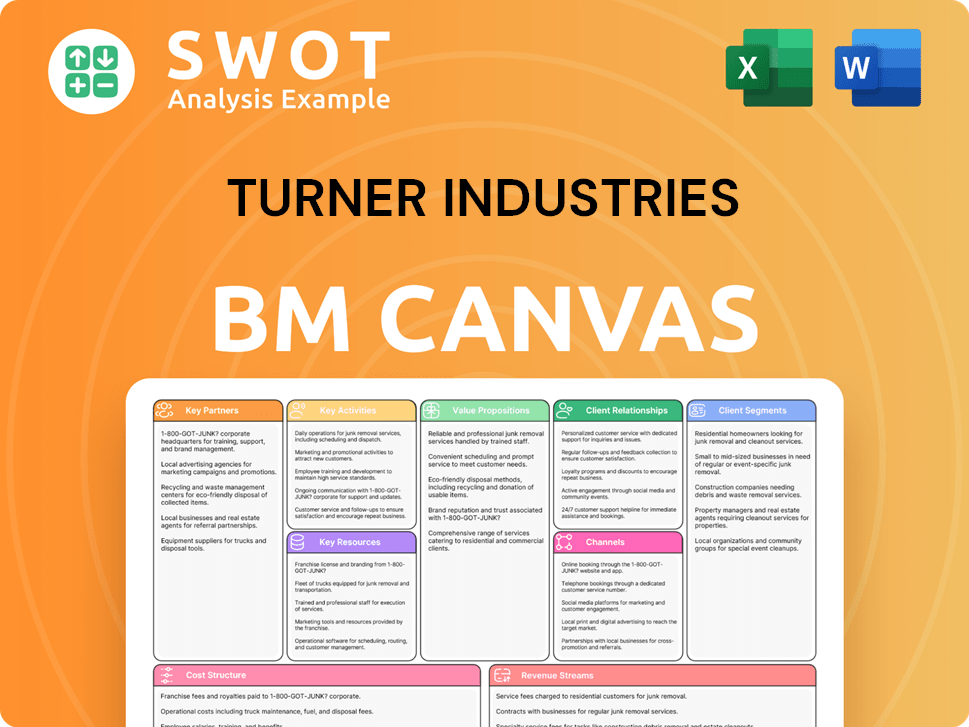

Turner Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Turner Industries Win & Keep Customers?

For the heavy industrial sector, customer acquisition and retention are critical for success. The strategies used by Turner Industries Company, a major player, are primarily centered around building strong relationships and providing top-notch service. This approach is well-suited to the business-to-business (B2B) nature of the industry, where long-term partnerships are highly valued.

The company's approach to finding and keeping customers is a mix of direct engagement, industry networking, and leveraging its reputation. Digital channels are also becoming increasingly important for showcasing their capabilities and thought leadership. This multifaceted approach helps them maintain a strong position in a competitive market.

Retention efforts are a key focus, emphasizing project excellence, safety, and long-term client relationships. This involves dedicated account management, feedback mechanisms, and a commitment to continuous improvement. As data-driven decision-making becomes more prevalent, the company may leverage customer data to personalize service and proactively address client needs.

Direct sales efforts are a primary channel for reaching potential clients. Industry networking and referrals from satisfied clients also play a significant role. Participation in industry conferences and trade shows provides opportunities for direct engagement.

A robust company website is essential for showcasing services, safety records, and project successes. A professional presence on platforms like LinkedIn is used to engage with industry professionals. Digital channels support the overall acquisition strategy.

Consistent project excellence and stringent safety standards are critical. Dedicated account management and regular client feedback are essential. The goal is to build long-term client relationships.

Internal CRM systems are used to manage client interactions and track project progress. Demonstrating measurable value through cost savings, efficiency, and reduced downtime is a key retention tactic. This is a critical element of their customer retention strategies.

The company's approach is designed to foster lasting relationships within the heavy industrial sector. As of 2024, the global industrial services market is valued at over $400 billion, with projections for continued growth. A focus on safety, efficiency, and building strong client relationships is crucial for success in this market. To understand the company's origins and evolution, you can read a Brief History of Turner Industries.

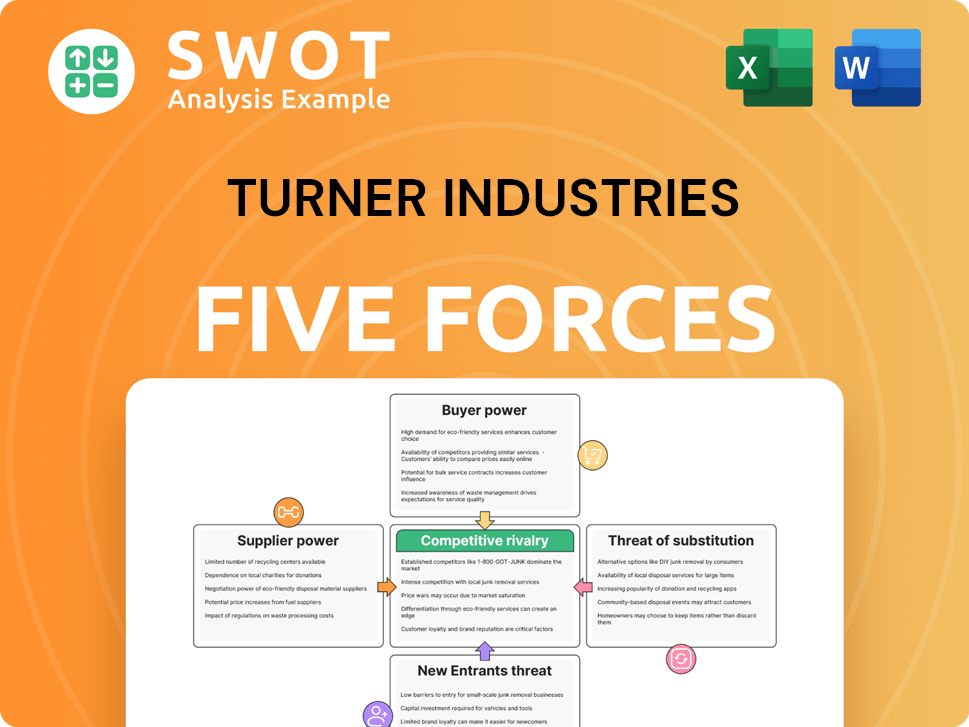

Turner Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Turner Industries Company?

- What is Competitive Landscape of Turner Industries Company?

- What is Growth Strategy and Future Prospects of Turner Industries Company?

- How Does Turner Industries Company Work?

- What is Sales and Marketing Strategy of Turner Industries Company?

- What is Brief History of Turner Industries Company?

- Who Owns Turner Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.