Vimeo Bundle

Can Vimeo's Growth Strategy Propel It to New Heights?

Vimeo, a leading video platform, has carved a unique space in the competitive digital media landscape by prioritizing quality and professional tools since its inception in 2004. Catering to businesses, filmmakers, and artists, it has become a trusted platform for high-quality video solutions. With a significant global presence and a diverse user base, Vimeo's future hinges on its ability to navigate evolving online video trends.

This in-depth Vimeo SWOT Analysis will explore the company's strategic initiatives and future prospects. We'll examine how Vimeo's commitment to innovation and its disciplined financial approach are shaping its trajectory in the video platform market. Understanding Vimeo's growth strategy is crucial for anyone looking to understand the evolving digital media landscape and the company's potential for innovation, including its long-term goals and how it makes money.

How Is Vimeo Expanding Its Reach?

The Vimeo company analysis reveals that the platform is actively pursuing several expansion initiatives to broaden its market reach and diversify its revenue streams. These initiatives are crucial for Vimeo's growth strategy and future prospects in the dynamic digital media landscape.

A key focus is on enhancing offerings for businesses and creators, particularly through Vimeo Enterprise and its over-the-top (OTT)/Streaming segments. This strategic direction aims to capitalize on the evolving online video trends and the growing demand for professional video solutions.

The company is also concentrating on international expansion, recognizing the global potential for its video platform. With over 45% of its revenue coming from outside the U.S. and serving video in over 190 countries, Vimeo is strategically positioning itself in the video platform market.

Vimeo Enterprise has shown significant growth, with revenue increasing by 37% in Q4 2024. This segment reached a $100 million-plus run rate in annualized bookings. In Q1 2025, the growth continued, with a 32% increase to $24.42 million.

In 2024, Vimeo secured new enterprise deals with prominent brands. These included Adidas, Clarins, and Datadog. The company also expanded relationships with existing clients such as Sanofi and Warby Parker, reflecting its ability to attract and retain large customers.

In April 2025, Vimeo launched Vimeo Streaming, an evolution of its OTT platform. This allows creators to establish their own streaming services and branded applications, boosting their monetization through direct-to-consumer video distribution.

The OTT/Streaming business saw a return to growth in bookings and customer numbers in 2024. In Q4 2024, Vimeo Enterprise and OTT/streaming combined accounted for 38% of bookings and 34% of revenue, demonstrating the importance of these segments.

Vimeo plans to focus incremental investment dollars on OTT in 2025 to draw streaming customers closer to its Vimeo Enterprise offerings. This strategic move aims to create synergies between the two segments and drive overall growth.

- Enhancing offerings for businesses and creators.

- Launching Vimeo Streaming to boost monetization.

- Focusing incremental investment on OTT in 2025.

- Prioritizing international expansion to broaden its reach.

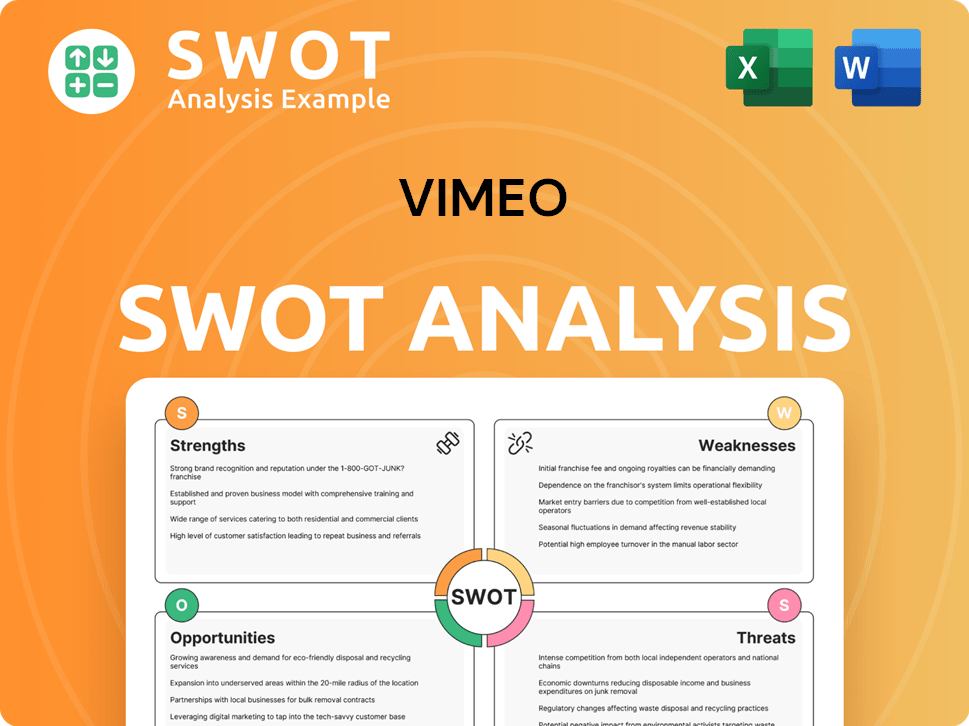

Vimeo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Vimeo Invest in Innovation?

The Owners & Shareholders of Vimeo are heavily invested in innovation and technology to drive sustained growth within the digital media landscape. This focus is particularly evident in the company's strategic investments in artificial intelligence (AI), which are designed to enhance its video platform market position and capitalize on online video trends. The company's commitment to technological advancement is a key component of its Vimeo growth strategy.

Vimeo's approach to innovation centers on leveraging AI to improve user experience and offer advanced features. These initiatives are expected to accelerate growth in the coming years. This strategic direction is crucial for maintaining a competitive advantage in the dynamic video platform market and achieving its long-term goals. This focus on innovation is a key element of Vimeo's future prospects.

The company plans to incrementally invest up to $30 million from 2024 levels in 2025, primarily in R&D growth initiatives. These initiatives will focus on AI, solutions, enterprise security, and innovative video formats. These investments highlight Vimeo's commitment to staying at the forefront of the digital media landscape.

AI investments are yielding significant returns. AI features drove 40% of new business acquisition in the enterprise segment in Q4 2024. This demonstrates the effectiveness of AI in attracting new customers and expanding Vimeo's user base demographics.

Vimeo is implementing several AI-powered tools. These include automated video transcription, captioning, and translation into over 28 languages with voice cloning. These features target creative professionals and enterprise clients, streamlining workflows. This approach enhances Vimeo's video hosting features.

Vimeo is collaborating with Apple on a new spatial video-sharing app for the Apple Vision Pro. This partnership highlights Vimeo's commitment to innovation and its ability to adapt to new technologies. This collaboration is part of Vimeo's expansion plans.

Vimeo plans to extend its enterprise-grade AI features to Self-Serve customers in the coming quarters. This expansion will make advanced tools more accessible to a wider range of users. This strategy supports Vimeo's target audience.

Vimeo's CEO, Philip Moyer, has stated that Vimeo will not allow generative AI models to be trained using videos hosted on its platform without the explicit consent of the video owner. This commitment ensures data privacy and protects creators' rights.

Vimeo's AI-powered tools are designed to support creators. These tools automate tasks like generating titles, metadata tags, chapters, and summaries. This focus enhances Vimeo's impact on creators.

Vimeo's innovation and technology strategy is centered on AI and strategic partnerships. The company is investing significantly in R&D to enhance its video platform and drive growth. This approach is designed to improve Vimeo's competitive advantage.

- AI-driven features are already contributing to new business acquisitions.

- Vimeo is rolling out AI tools for transcription, captioning, and translation.

- The company is collaborating with Apple on new video-sharing technologies.

- Vimeo is committed to data privacy and protecting creators' rights.

- These initiatives are integral to Vimeo's long-term goals and its potential for innovation.

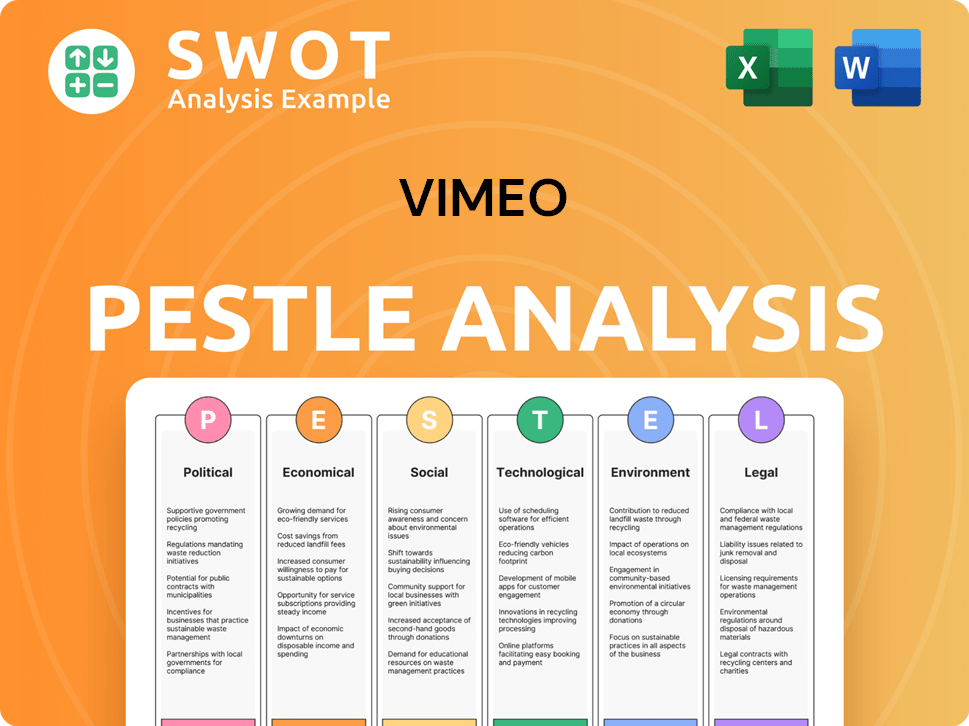

Vimeo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Vimeo’s Growth Forecast?

The financial outlook for Vimeo in 2025 indicates a strategic focus on growth, with the company aiming to accelerate its expansion throughout the year. Vimeo's Vimeo growth strategy involves significant investments designed to enhance its market position within the video platform market. This approach is intended to capitalize on current online video trends and the evolving digital media landscape.

For 2025, Vimeo anticipates low single-digit revenue growth overall, with the expectation of achieving double-digit growth in subsequent quarters. Analysts project a revenue increase of approximately 1.89% for the year, estimating total revenue to reach $424.87 million. This growth trajectory is supported by strategic initiatives and investments aimed at strengthening its market presence and expanding its user base.

In the first quarter of 2025, Vimeo reported a total revenue of $103.03 million, reflecting a 1.8% decrease year-over-year. However, the Self-Serve segment showed positive momentum, with bookings increasing by 6% year-over-year, marking the first growth in three years for this area. Self-Serve revenue contributed $56.11 million. Additionally, Vimeo Enterprise revenue grew significantly, increasing by 32% to $24.42 million during the same period. To understand the company's early days, read the Brief History of Vimeo.

In Q1 2025, total revenue was $103.03 million, a 1.8% decrease year-over-year. Self-Serve bookings grew by 6% year-over-year in Q1 2025. Vimeo Enterprise revenue grew 32% to $24.42 million in Q1 2025.

For the full year 2024, Vimeo achieved net earnings of $27 million and an all-time high Adjusted EBITDA of $55 million. Vimeo projects a full-year 2025 operating loss of approximately $3 million. The company plans to invest up to $30 million incrementally in its business.

Vimeo repurchased $24 million of stock in Q1 2025 to minimize dilution. The Board authorized a new $50 million share repurchase program on April 29, 2025. Vimeo's gross margin remained strong at 78% in Q4 2024.

Vimeo anticipates low single-digit revenue growth for 2025, with acceleration throughout the year. The company aims for double-digit growth in future quarters. Adjusted EBITDA for 2025 is projected to be between $25 million to $30 million.

Vimeo's financial performance in 2024 and the first quarter of 2025 showcases its strategic direction and priorities. The company's focus on profitability and investment in growth areas are key drivers.

- Vimeo's financial performance in Q1 2025 included a 1.8% year-over-year revenue decrease.

- Self-Serve bookings increased by 6% year-over-year in Q1 2025, showing positive momentum.

- Vimeo Enterprise revenue grew by 32% in Q1 2025, indicating strong demand.

- The company is investing up to $30 million incrementally in its business.

- A new $50 million share repurchase program was authorized to manage dilution.

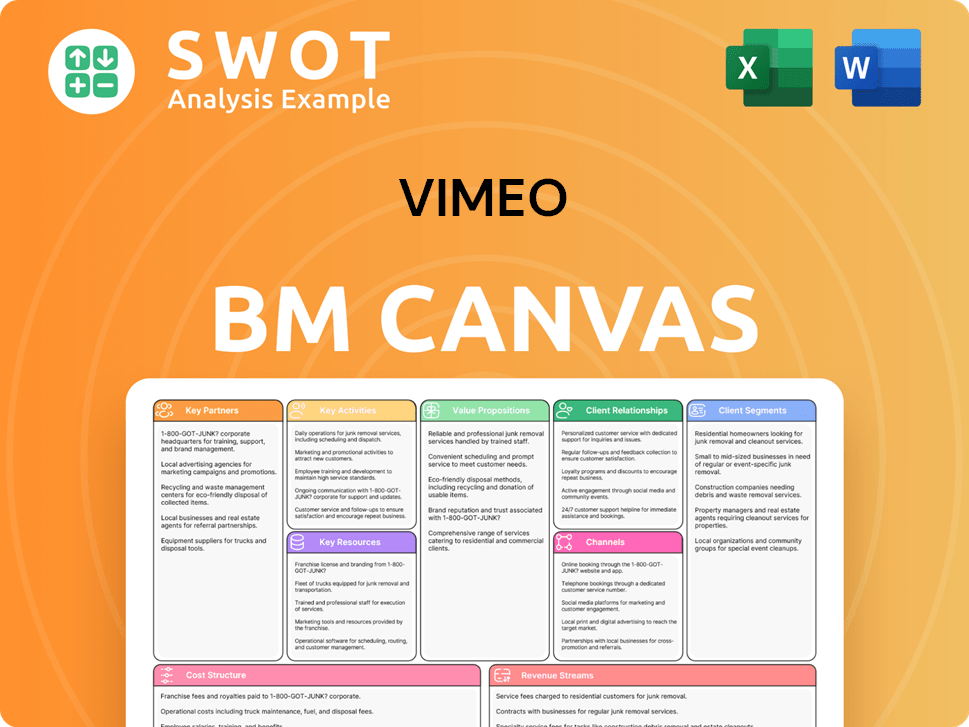

Vimeo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Vimeo’s Growth?

The online video platform market presents several challenges for Vimeo. Intense competition from larger players like YouTube and AWS could lead to pricing pressures, reduced market share, and decreased profitability. The company's subscale size, with $417 million in revenue in 2024, leaves little room for error against these rivals.

Regulatory changes and technological disruption also pose significant risks to Vimeo's growth. Changes in data privacy, content moderation, and intellectual property regulations could increase operational costs. The rapid evolution of technology requires continuous investment and adaptation to stay competitive.

Furthermore, macroeconomic uncertainty and potential market saturation in certain segments could affect Vimeo's performance. These factors can impact customer acquisition, revenue, and average revenue per user (ARPU). While Vimeo is making strategic moves, these risks require careful management.

The video platform market is highly competitive, with Vimeo facing rivals like YouTube and AWS. These competitors often have greater financial, technical, and marketing resources. This can lead to pricing pressure and challenges in gaining market share, impacting Vimeo's Vimeo growth strategy.

Changes in regulations concerning data privacy, content moderation, and intellectual property can significantly affect Vimeo. These regulatory shifts can increase operational costs and require significant adjustments to business practices. Staying compliant is crucial for Vimeo's future prospects.

The digital media landscape is constantly evolving, with new technologies emerging frequently. Vimeo must continuously invest in R&D to stay ahead. Technological advancements can disrupt existing business models and require ongoing innovation to maintain a competitive edge, impacting Vimeo company analysis.

Macroeconomic factors can influence customer acquisition, revenue, and ARPU. Economic downturns or fluctuations can lead to reduced spending on video platforms. Vimeo's ability to navigate economic cycles will be important for its long-term success, affecting online video trends.

Potential market saturation in certain segments could limit growth opportunities. As the market matures, it may become harder to acquire new users and increase revenue. Vimeo needs to identify new markets and strategies to overcome saturation challenges within the digital media landscape.

Vimeo's financial performance is crucial to its ability to mitigate risks. While its Q1 2025 revenue guidance of $100 million (midpoint) fell slightly below consensus estimates, the company's strong cash position supports its growth initiatives. Maintaining profitability while expanding its market presence is a key challenge.

Vimeo is making calculated investments to address these risks. The company is investing up to $30 million in R&D, focusing on AI and enterprise solutions. These investments aim to drive future growth and mitigate some of the challenges. These investments are detailed in this article about 0.

Vimeo is rearchitecting its pricing strategy and rolling out price increases to aid bookings growth through 2025. Despite a net income decline in Q1 2025, these adjustments are designed to improve financial performance. While Self-Serve revenue and bookings were down year-over-year in Q4 2024, the company is focused on growth.

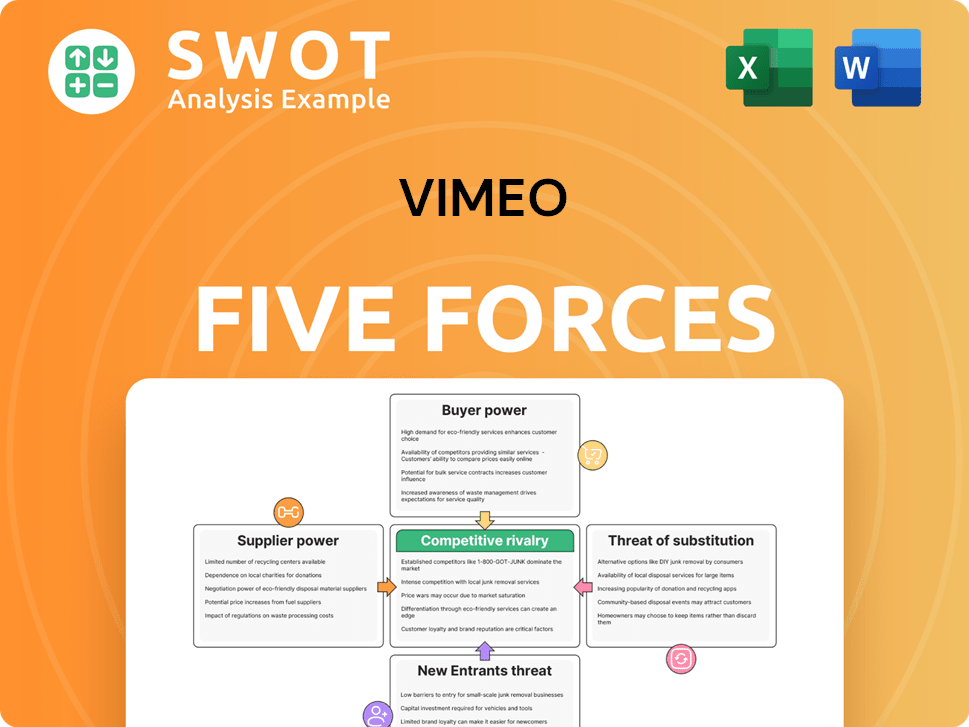

Vimeo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vimeo Company?

- What is Competitive Landscape of Vimeo Company?

- How Does Vimeo Company Work?

- What is Sales and Marketing Strategy of Vimeo Company?

- What is Brief History of Vimeo Company?

- Who Owns Vimeo Company?

- What is Customer Demographics and Target Market of Vimeo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.