Volvo Car Bundle

Can Volvo Car Company Drive the Future of Automotive?

Volvo Cars is charging ahead, boldly pivoting towards an all-electric future by 2030, a move that signals a significant transformation in the Volvo Car SWOT Analysis and its strategic direction. This commitment to electric vehicles (EVs) is a pivotal moment for the Swedish automaker, known for its legacy of safety and innovation. With record sales in 2023 and continued growth in 2024, what does the future hold for this automotive pioneer?

This deep dive into Volvo's Volvo growth strategy will explore its transition to an all-electric lineup and its implications for the Volvo future prospects. We'll examine the company's expansion plans, particularly in key markets like China, and analyze its Volvo market analysis within the dynamic Volvo automotive industry. The analysis will also cover Volvo's Electric vehicle strategy, its financial performance, and the potential impact on its global market share, providing a comprehensive overview of the Volvo car company and its ambitious vision for the future.

How Is Volvo Car Expanding Its Reach?

The Volvo growth strategy is heavily focused on expanding its market presence and diversifying its offerings, particularly in the electric vehicle (EV) segment. This expansion is crucial for the Volvo car company to maintain its competitive edge in the rapidly evolving Volvo automotive industry. The company is aiming to become a fully electric car company by 2030, which necessitates significant investments in new models, charging infrastructure, and digital services.

A key element of Volvo's future prospects involves strategic geographic expansion, with a strong emphasis on growth markets like Asia, especially China. Furthermore, the company is exploring innovative retail models, such as online sales and subscription services, to enhance customer accessibility and adapt to changing consumer preferences. These initiatives are designed to broaden the customer base and boost market penetration in both established and emerging markets, supporting Volvo's long-term vision for the future.

Strategic partnerships are also vital for supporting this expansion, including collaborations for battery production and charging networks, which are essential for a smooth transition to an all-electric future. This comprehensive approach aims to not only increase sales but also to strengthen Volvo's brand positioning strategy and ensure its sustainability in the competitive automotive landscape. This strategy is detailed in Mission, Vision & Core Values of Volvo Car.

Volvo's electric vehicle strategy is central to its growth plans, targeting a 50% share of fully electric car sales by 2025. This involves launching new EV models like the EX30 and EX90 to attract diverse customer segments. The EX30, a small premium SUV, is designed to appeal to a younger, urban demographic. These new models are critical for expanding the product portfolio and meeting the growing demand for EVs.

Volvo's expansion plans in China and other key markets are driving significant growth. Sales in China increased by 5% in the first quarter of 2024, indicating strong market penetration. The US market also saw a substantial increase, with sales up by 24% during the same period. These results highlight the effectiveness of Volvo's global market share trends.

Volvo's investment in new technologies includes exploring online sales and subscription models like 'Care by Volvo' to enhance accessibility. These initiatives aim to broaden the customer base and enhance market penetration in both established and emerging markets. By adapting to evolving consumer preferences, Volvo is ensuring its relevance and competitiveness.

Strategic collaborations are crucial for supporting Volvo's expansion, especially in battery production and charging infrastructure. These partnerships are vital for ensuring a seamless transition to an all-electric future. These collaborations are essential for Volvo's long-term vision for the future and its ability to compete in the automotive industry.

Volvo's competitive landscape analysis shows a strong focus on electric vehicles, geographic expansion, and innovative retail models. The company is strategically positioning itself to capitalize on the growing demand for EVs and enhance its global presence. Volvo's sustainable manufacturing practices are also a key focus.

- Aggressive EV push with new models like EX30 and EX90.

- Focus on key growth markets, especially in Asia and China.

- Exploring online sales and subscription models to enhance accessibility.

- Strategic partnerships for battery production and charging networks.

Volvo Car SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Volvo Car Invest in Innovation?

The Volvo growth strategy is heavily reliant on innovation and technological advancements, particularly in the areas of electrification, safety, and autonomous driving. The company is making substantial investments in research and development (R&D) to facilitate its transition to an all-electric future. This involves both in-house development and strategic collaborations to drive its Volvo future prospects.

Digital transformation is also a key focus, with the company leveraging data analytics, AI, and connected car technologies to enhance the customer experience and boost operational efficiency. The integration of advanced driver-assistance systems (ADAS) and the development of autonomous driving capabilities, often in partnership with technology providers, are central to its long-standing reputation for safety. This approach is a key differentiator in the premium automotive segment, shaping the Volvo car company's future.

The company's commitment to sustainability, including the use of recycled materials and circular economy principles in its manufacturing processes, further positions it as a leader in environmentally conscious automotive innovation. This focus aligns with evolving consumer preferences and regulatory demands, contributing to the company's long-term viability and competitive advantage.

Volvo's electric vehicle strategy is central to its growth plans. The company aims to become a fully electric car company by 2030. This transition involves significant investments in EV technologies, including battery chemistry and electric powertrains.

Securing a sustainable and efficient supply chain for batteries is a priority. Volvo is collaborating with partners to establish gigafactories for battery production. This ensures a reliable supply of batteries for its growing EV lineup.

Digital transformation is a crucial element of Volvo's strategy. The company leverages data analytics, AI, and connected car technologies to enhance the customer experience. This includes over-the-air updates and new digital services.

Volvo is investing heavily in autonomous driving capabilities. The company collaborates with technology partners like Luminar for LiDAR technology. Advanced driver-assistance systems (ADAS) are a key focus.

Safety remains a core value for Volvo. The company continues to innovate in safety features, maintaining its reputation for safety. This includes advanced driver-assistance systems (ADAS) and other safety technologies.

Sustainability is a key aspect of Volvo's strategy. The company uses recycled materials and follows circular economy principles. This commitment positions it as a leader in environmentally conscious automotive innovation.

Volvo's innovation strategy includes several key initiatives. These initiatives are designed to support the company's long-term goals. The company is focusing on several areas to ensure its future success in the Volvo automotive industry.

- Electric Vehicle Development: Significant investments in EV technologies, including battery chemistry and electric powertrains. Volvo aims to have EVs account for 100% of its sales by 2030.

- Strategic Partnerships: Collaborations with partners to establish gigafactories for battery production and develop autonomous driving technologies. For example, Volvo has partnered with Northvolt for battery production.

- Digital Services and Connectivity: Leveraging data analytics, AI, and connected car technologies to enhance the customer experience. This includes over-the-air updates and new digital services, contributing to recurring revenue streams.

- Advanced Safety Systems: Continued focus on safety innovation, including advanced driver-assistance systems (ADAS) and the development of autonomous driving capabilities. Volvo aims to reduce traffic fatalities to zero with its safety innovations.

- Sustainable Manufacturing: Commitment to sustainability, including the use of recycled materials and circular economy principles in its manufacturing processes. The company is working to reduce its carbon footprint across its operations.

Volvo Car PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Volvo Car’s Growth Forecast?

The financial outlook for Volvo Cars is promising, driven by its strong performance in the electric vehicle (EV) market and its strategic initiatives. The company's focus on electrification and premium vehicles positions it well for future growth. Volvo's target market is a key factor in its financial success.

In 2023, global sales reached a record of 708,716 cars, marking a 15% increase compared to 2022. This positive trend continued into the first quarter of 2024, with sales increasing by 11%. The growing share of Recharge models (fully electric and plug-in hybrid cars) in total sales, reaching 41% in 2023, highlights the successful shift towards electrified powertrains.

Volvo Cars is actively investing in new EV platforms, battery technology, and manufacturing capabilities to drive future revenue growth. While these investments may influence short-term profit margins, they are crucial for long-term success. The company aims to achieve an operating margin of 8-10% in the mid-term.

Volvo's Volvo growth strategy is evident in its impressive sales figures. The company's global sales reached a record 708,716 cars in 2023, a 15% increase from the previous year. This growth is fueled by strong demand for its premium vehicles and the rising popularity of its electric models.

The Electric vehicle strategy is central to Volvo's future. The share of Recharge models (fully electric and plug-in hybrid cars) in total sales reached 41% in 2023. This indicates a significant shift towards electrified powertrains and positions the company well in the Volvo automotive industry.

Volvo is investing heavily in EV platforms, battery technology, and manufacturing. These investments are expected to drive future revenue growth. The company aims for an operating margin of 8-10% in the mid-term, demonstrating a commitment to profitability alongside its growth ambitions.

Volvo's financial strategy includes exploring various funding avenues to support its capital expenditures. This approach aims to maintain a healthy financial position to fuel its strategic plans. The company is focused on ensuring sustainable growth and financial stability.

The Volvo future prospects are bright, with analysts anticipating continued sales growth driven by strong demand for EVs and the introduction of new models. The company's strategic investments and focus on electrification are key drivers. Volvo's long-term vision includes innovation in safety features and sustainable manufacturing practices.

- Continued sales growth driven by strong EV demand.

- Strategic investments in new EV platforms and technology.

- Focus on achieving an operating margin of 8-10% in the mid-term.

- Exploration of funding avenues to support capital expenditures.

Volvo Car Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Volvo Car’s Growth?

The Volvo car company, despite its promising Volvo growth strategy and ambitious Volvo future prospects, faces several potential risks and obstacles. These challenges could impact its ability to achieve its goals in the competitive automotive market. Understanding these hurdles is crucial for assessing the company's long-term viability and investment potential.

Market competition, regulatory changes, and supply chain vulnerabilities represent significant challenges. The rapid evolution of the electric vehicle (EV) market, in particular, demands constant adaptation and investment. The company must navigate these complexities to maintain its position and drive sustainable growth.

Technological disruption and internal resource constraints also pose risks to Volvo's plans. Keeping pace with advancements in battery technology, autonomous driving, and software development requires substantial investment and expertise. Efficiently allocating resources and managing internal capabilities are critical for success.

The automotive industry is intensely competitive, with both established automakers and new entrants vying for market share, especially in the EV segment. This competition can lead to pricing pressures, requiring significant investments in marketing and R&D. The competition will impact Volvo market analysis and its ability to maintain profitability.

Evolving emissions standards and EV mandates across different regions necessitate continuous adaptation of product development and manufacturing processes. Compliance with these regulations can be costly. Volvo's ability to adapt to changing regulations will influence its Volvo automotive industry performance.

Supply chain disruptions, particularly concerning critical raw materials for EV batteries and semiconductors, pose a significant risk. Geopolitical tensions and unforeseen global events can exacerbate these vulnerabilities, leading to production delays and increased costs. Securing reliable supply chains is essential for Volvo's Electric vehicle strategy.

Rapid advancements in battery technology, autonomous driving, and software development present both opportunities and risks. Failing to keep pace with these advancements could hinder competitiveness. Investments in new technologies are crucial for Volvo's Volvo's future prospects.

The availability of skilled labor in EV-related fields and the efficient allocation of capital for ambitious projects could limit growth. Effective resource management is essential for achieving strategic goals. This constraint could affect Volvo's Volvo's expansion plans in China and other markets.

Global events and political tensions can significantly impact Volvo's operations, particularly regarding supply chains and market access. Adapting global strategies to navigate these risks is crucial. The company must monitor geopolitical developments closely to protect its Volvo's global market share trends.

To address these risks, Volvo employs several strategies. It diversifies its supply chain to reduce dependency on single sources. The company establishes robust risk management frameworks to identify and mitigate potential disruptions. Strategic partnerships, such as those with battery component suppliers, are crucial. Volvo is also investing in in-house software development to reduce reliance on external providers, as part of its Volvo's investment in new technologies. The company actively monitors geopolitical developments to adapt its global strategies effectively.

Volvo's financial performance and outlook are subject to these risks. For example, in 2024, the company reported a slight decrease in sales volume, reflecting the challenges in the automotive market. Volvo's sales forecast for the next five years will depend on its ability to effectively manage these risks and capitalize on opportunities. The company's financial health is closely tied to its ability to innovate and adapt to changing market conditions. For more context, explore a Brief History of Volvo Car.

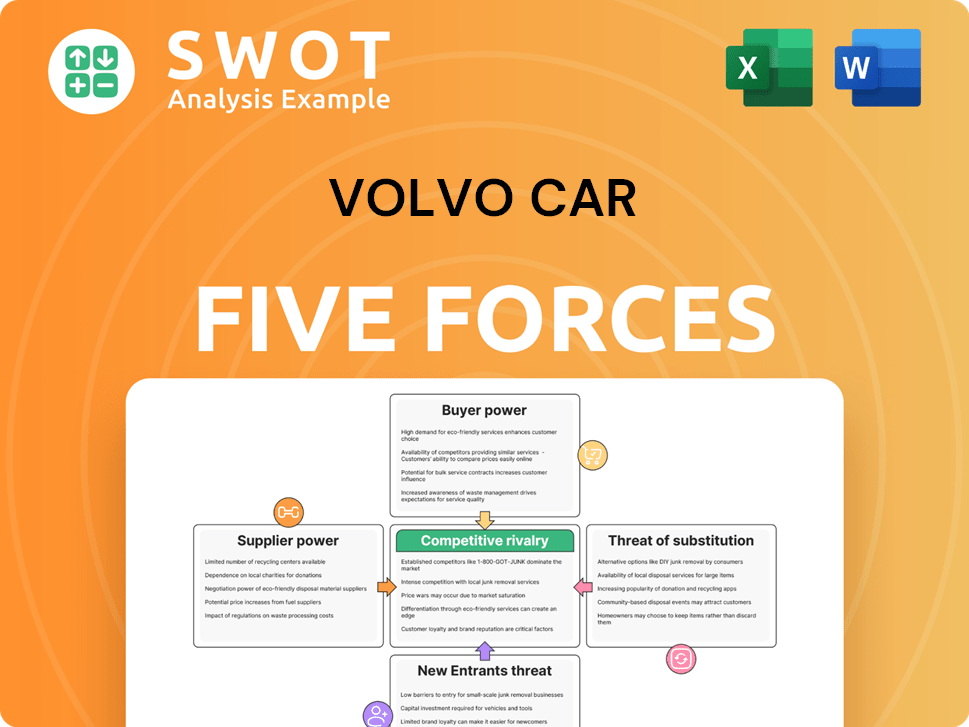

Volvo Car Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Volvo Car Company?

- What is Competitive Landscape of Volvo Car Company?

- How Does Volvo Car Company Work?

- What is Sales and Marketing Strategy of Volvo Car Company?

- What is Brief History of Volvo Car Company?

- Who Owns Volvo Car Company?

- What is Customer Demographics and Target Market of Volvo Car Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.