ZTE Bundle

Can ZTE Conquer the Future of Telecom?

In the fast-paced telecommunications industry, ZTE's journey from a Chinese startup to a global player is a compelling story of strategic adaptation. This analysis dives deep into ZTE's ZTE SWOT Analysis, exploring its growth strategy and future prospects amidst fierce competition and rapid technological advancements. We'll uncover how ZTE plans to navigate the evolving landscape, focusing on its innovation, expansion, and the challenges it faces.

Understanding ZTE's ZTE growth strategy is crucial for investors and industry watchers alike, given its significant ZTE market share and influence in the Telecommunications industry. This comprehensive ZTE company analysis will dissect the company's ZTE business model, examining its ZTE 5G technology strategy and potential for ZTE revenue growth forecast. Furthermore, we'll explore the ZTE competitive landscape analysis, providing insights into its ZTE expansion plans in Africa and other key markets, while also addressing the ZTE challenges and opportunities that lie ahead, including the impact of trade sanctions and the importance of ZTE partnerships and collaborations.

How Is ZTE Expanding Its Reach?

The company is actively pursuing a multi-faceted expansion strategy to solidify its global presence and diversify its revenue streams. A key pillar of this strategy involves deepening its engagement in the global 5G market, particularly in enterprise and industrial applications. This shift is designed to access new customer bases beyond traditional carrier networks and mitigate risks associated with reliance on a single market segment.

In terms of geographical expansion, the company continues to target emerging markets in Asia, Africa, and Latin America, where demand for telecommunications infrastructure remains robust. Product innovation is another critical component of its expansion initiatives, with continuous investment in research and development to launch new products and services that cater to evolving market demands. Strategic partnerships are also being pursued to co-develop solutions and expand market reach.

The company's focus extends to developing customized solutions for various industries, such as smart manufacturing, smart mining, and smart ports, leveraging 5G's capabilities for enhanced connectivity and automation. For instance, the company has been involved in several 5G network deployments across Europe and Asia in 2024, demonstrating its commitment to global infrastructure development.

The company aims to expand its market share in key regions by offering end-to-end 5G solutions, including core networks, transport networks, and wireless access. This strategy is crucial for the company’s Mission, Vision & Core Values of ZTE. The telecommunications industry is experiencing significant growth, with 5G playing a pivotal role.

Emerging markets in Asia, Africa, and Latin America are key targets for expansion, driven by robust demand for telecommunications infrastructure. The company is also strengthening its position in existing markets through enhanced service offerings and partnerships. This approach supports the company's global market strategy.

Continuous investment in research and development is essential to launch new products and services, catering to evolving market demands. This includes advancements in 5G-Advanced (5.5G) technologies, optical networks, and intelligent computing. The company aims to diversify its product portfolio with new terminal devices.

Collaborations with other technology providers and industry players are pursued to co-develop solutions and expand market reach. These partnerships are crucial for staying ahead of industry changes and fostering a more integrated ecosystem. This approach supports the company's business model.

The company's expansion strategy focuses on several key areas to drive growth and maintain a competitive edge in the telecommunications industry. These initiatives are designed to capitalize on emerging opportunities and mitigate potential risks.

- Focus on 5G Enterprise Solutions: Developing customized solutions for industries like smart manufacturing and smart ports.

- Geographical Expansion: Targeting emerging markets in Asia, Africa, and Latin America.

- Product Innovation: Investing in R&D for 5G-Advanced, optical networks, and new terminal devices.

- Strategic Partnerships: Collaborating with other companies to expand market reach and co-develop solutions.

ZTE SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ZTE Invest in Innovation?

The growth trajectory of ZTE is deeply intertwined with its robust innovation and technology strategy. This approach emphasizes substantial investments in research and development (R&D) and a commitment to pioneering technologies. This focus is critical for understanding the ZTE growth strategy and its future prospects within the telecommunications industry.

ZTE consistently allocates a significant portion of its revenue to R&D, which fuels in-house development across key areas. These areas include 5G-Advanced (5.5G), optical networks, and intelligent computing. This commitment to innovation is a cornerstone of the ZTE company analysis, highlighting its proactive stance in a rapidly evolving market. The company's strategic investments are designed to maintain a competitive edge and drive long-term growth.

ZTE's digital transformation strategy integrates automation and AI across its operations and product offerings. This includes leveraging AI and big data analytics to optimize network performance and develop intelligent applications. The company's focus on sustainability, with efforts to develop energy-efficient solutions, is also noteworthy. These initiatives are key to understanding the ZTE future prospects and its adaptability in the face of industry challenges.

In 2023, ZTE's R&D expenditure reached approximately 23.9 billion RMB.

R&D spending represented 19.8% of ZTE's operating revenue in 2023.

ZTE is actively involved in advancing 5.5G technology, showcasing its commitment to the next generation of mobile communication.

By the end of 2023, ZTE had over 85,000 global patent applications.

ZTE had over 43,000 granted patents by the end of 2023.

ZTE ranked second globally for PCT patent applications in 2023.

ZTE's technological capabilities are instrumental in creating new products and services. These advancements support its growth objectives within the telecommunications industry.

- Advancements in optical networks support the increasing demand for high-bandwidth connectivity.

- Intelligent computing solutions cater to the growing need for data processing and AI applications.

- The company's strong patent portfolio underscores its commitment to technological leadership.

- ZTE's innovation is further evidenced by its consistent ranking among the top global patent holders.

- For more details on ZTE's business model and revenue streams, see Revenue Streams & Business Model of ZTE.

ZTE PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is ZTE’s Growth Forecast?

The financial outlook for ZTE is centered on achieving stable growth and increasing profitability. This strategy is supported by investments in advanced technologies and market expansion efforts. For the first quarter of 2024, ZTE reported operating revenue of approximately 30.6 billion RMB. While there was a slight year-on-year decrease, the company's net profit attributable to ordinary shareholders of the listed company was about 2.7 billion RMB, showing a 4.5% year-on-year increase. This improvement in profitability reflects effective cost management and a focus on higher-margin businesses.

In 2023, ZTE's operating revenue reached 124.25 billion RMB, with a net profit attributable to shareholders of 9.33 billion RMB, which is a 15.4% year-on-year increase. The company's cash flow from operating activities in 2023 was 17.41 billion RMB, a significant increase of 10.19 billion RMB year-on-year, indicating strong operational efficiency. These figures demonstrate a positive trend in profitability and cash generation. For a deeper understanding of the company's origins, you can read more in the Brief History of ZTE.

ZTE's financial goals are closely aligned with its strategic investments in 5G, optical networks, and enterprise solutions. The company plans to maintain its R&D spending to maintain its technological leadership, which is expected to boost future revenue growth. Analyst forecasts and company guidance suggest a continued focus on optimizing business structures and improving operational efficiency to meet long-term financial targets. The company's financial strategy is one of resilient growth, leveraging its technological strengths and expanding market reach to deliver consistent returns. ZTE's capital allocation strategies prioritize investments that support its growth initiatives, ensuring a strong financial foundation for its future prospects.

ZTE's revenue growth is driven by its 5G technology strategy and expansion plans. The company is focusing on the telecommunications industry. The company's focus on innovation and development is expected to contribute to future revenue growth.

ZTE's market share is significant, especially in China. The company's global market strategy includes expansion in regions like Africa. The company's competitive landscape analysis shows a strong position in the telecommunications industry.

ZTE's financial performance review shows strong revenue and profit growth. The company's cash flow from operating activities in 2023 was 17.41 billion RMB. The company's net profit attributable to ordinary shareholders of the listed company was approximately 2.7 billion RMB in Q1 2024.

ZTE's business model focuses on innovation and sustainable growth initiatives. The company is investing in R&D to maintain its technological leadership. ZTE's product portfolio overview shows a wide range of telecommunications solutions.

ZTE faces challenges such as the impact of trade sanctions, but also has many opportunities for growth. The company's partnerships and collaborations are key to its expansion. ZTE's future prospects depend on its ability to navigate these challenges and seize opportunities.

- ZTE's sustainable growth initiatives are crucial for long-term success.

- The company's expansion plans in Africa and other regions are important.

- ZTE's focus on 5G technology and innovation will drive future growth.

- ZTE's financial performance review shows resilient growth and strong cash flow.

ZTE Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow ZTE’s Growth?

The ZTE company analysis reveals several potential risks and obstacles that could impact its ZTE growth strategy and ZTE future prospects. These challenges span competitive pressures, regulatory hurdles, and supply chain vulnerabilities, requiring proactive management and strategic adaptation. Understanding these risks is crucial for assessing the company's long-term sustainability and growth potential within the dynamic telecommunications industry.

Intense competition and rapid technological advancements are constant threats. The company must continuously innovate and adapt to maintain its market position. Moreover, geopolitical tensions and trade restrictions can severely impact its global operations, necessitating robust risk management strategies to navigate these complexities effectively.

ZTE's market share and overall success are intricately linked to its ability to navigate a complex landscape. Addressing these potential risks is critical for ensuring the company's continued growth and competitiveness in the global market. The following sections will delve into specific areas of concern and outline the strategies ZTE employs to mitigate these challenges.

The telecommunications industry is fiercely competitive, with established global players and emerging regional competitors. This intense competition can lead to pricing pressures and reduced profit margins. Continuous innovation and differentiation are essential to maintain a competitive edge in the market. The company must invest heavily in research and development to stay ahead of rivals.

Regulatory changes and geopolitical tensions pose significant risks, especially given the global nature of the business. Trade restrictions, export controls, and national security concerns can limit access to key markets. The company must navigate complex regulatory environments and adapt to evolving geopolitical dynamics. They must also ensure compliance with international laws and regulations.

The telecommunications industry relies on a complex global supply chain for components and manufacturing. Disruptions due to natural disasters, geopolitical events, or trade disputes can impact production schedules and increase costs. Diversifying its supply chain and maintaining strategic inventory levels are critical. The company must also establish strong relationships with multiple suppliers.

Rapid advancements can render existing technologies obsolete, requiring continuous innovation and substantial R&D investments. The company must anticipate future technological trends, such as the evolution towards 6G. This necessitates significant capital expenditure and a focus on staying at the forefront of technological developments. Investing in ZTE 5G technology strategy is crucial.

The availability of skilled talent in specialized areas like AI and advanced network architecture could impede growth. Talent acquisition programs and internal training initiatives are essential to address these constraints. The company must foster a culture of innovation and continuous learning. They need to attract and retain top talent to drive future growth.

Increasing cybersecurity threats pose a significant risk, especially with the deployment of highly integrated solutions. The company must invest in robust cybersecurity measures to protect its networks and data. They must also comply with data privacy regulations. The company needs to ensure the security and integrity of its products and services.

The company employs scenario planning and robust risk management frameworks to assess and prepare for these challenges. This includes diversifying its supply chain, investing heavily in R&D, and fostering strategic partnerships. ZTE's business model also emphasizes agility and adaptability. In 2024, ZTE's revenue growth forecast indicated a focus on expanding its presence in emerging markets like Africa, with ZTE expansion plans in Africa being a key strategic initiative. For more detailed insights, you can refer to this article about ZTE's strategies.

ZTE financial performance review reveals a commitment to sustainable growth initiatives. The company's financial results in recent years demonstrate resilience and strategic focus. ZTE's market position in China remains strong, and the company continues to expand its global footprint. While specific ZTE stock price prediction is speculative, the company's performance is closely tied to its ability to navigate these challenges effectively.

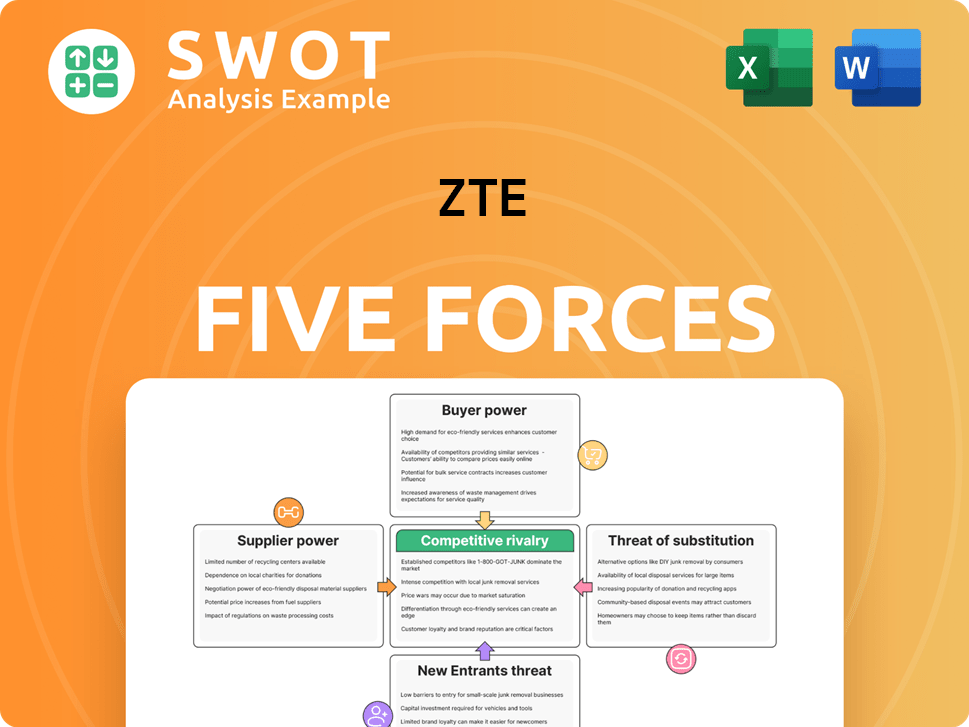

ZTE Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.