ZTE Bundle

Who Really Owns ZTE Corporation?

Unraveling the ownership of a global tech giant like ZTE is crucial for understanding its strategic direction and market influence. Founded in China, ZTE's journey from a small startup to a telecommunications powerhouse is a testament to its resilience. But who truly holds the reins of this influential company?

Understanding the ZTE SWOT Analysis is key, but first, let's explore the complex ownership structure of ZTE, a company that has significantly shaped the telecommunications landscape. From its origins in Shenzhen to its current global presence, the evolution of ZTE's ownership, including its ties to state-backed entities and public shareholders, offers critical insights. This analysis of ZTE ownership will reveal how these dynamics influence ZTE's operations, governance, and strategic decisions. The question of who owns ZTE is more than just a matter of shares; it's about understanding the forces driving this major player in the tech world.

Who Founded ZTE?

ZTE Corporation, originally known as Zhongxing Semiconductor Co., Ltd., commenced operations in 1985. The initial structure of the company was primarily shaped by its status as a state-owned enterprise, falling under the purview of the Ministry of Aerospace Industry. This setup significantly influenced ZTE's trajectory from its inception.

The founding of ZTE was a direct initiative of the Chinese government, reflecting a strategic move to develop indigenous telecommunications technology. This was aimed at supporting China's rapidly expanding infrastructure needs. Unlike private startups, ZTE's early development was fueled by government allocations and state-directed investments.

The early vision was to build domestic telecommunications technology. The ownership structure was intrinsically linked to national technological advancement goals, with state control over critical industries. The company's initial capital and resources were provided by state-affiliated entities.

ZTE was established in 1985 as Zhongxing Semiconductor Co., Ltd.

It was primarily a state-owned enterprise under the Ministry of Aerospace Industry.

The goal was to develop indigenous telecommunications technology.

Early funding came from government allocations and state-directed investments.

Control and strategic direction were tied to state objectives.

The founding team’s vision was linked to national technological advancement goals.

The early ownership of ZTE was heavily influenced by the Chinese government, making it a state-owned enterprise. This structure was crucial for the company's initial development and alignment with national strategic objectives. For further insights into the company's operations, consider exploring the Revenue Streams & Business Model of ZTE.

Understanding the initial ownership structure is crucial for grasping ZTE's history and its relationship with the Chinese government.

- ZTE was founded in 1985 as a state-owned enterprise.

- Initial funding came from government sources.

- The company's goals were aligned with national technological objectives.

- This early structure shaped ZTE's development and strategic direction.

ZTE SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has ZTE’s Ownership Changed Over Time?

The evolution of ZTE's ownership structure reflects its growth from a state-backed entity to a global telecommunications giant. A crucial step in this transformation was its initial public offering (IPO) on the Shenzhen Stock Exchange in 1997. This move allowed for the infusion of capital from public investors. Later, in 2004, ZTE expanded its reach by listing H-shares on the Hong Kong Stock Exchange, further broadening its investor base and increasing its visibility in international markets. These listings were pivotal in shaping the company's current ownership landscape.

The ownership structure of ZTE has been significantly influenced by its relationship with the Chinese government. The state's involvement has been a constant factor, shaping the company's strategic direction and aligning it with national objectives. This influence is primarily exerted through the major shareholder, Zhongxing Xin Telecommunication Equipment Co., Ltd. (Zhongxing Xin). Zhongxing Xin is largely owned by state-owned enterprises, ensuring the government's continued control and influence over ZTE's operations and strategic decisions. Understanding the Growth Strategy of ZTE requires a deep dive into this ownership dynamic.

| Event | Date | Impact on Ownership |

|---|---|---|

| Shenzhen Stock Exchange Listing | 1997 | Initial public offering, opening up to public investment. |

| Hong Kong Stock Exchange Listing (H-share) | 2004 | Expanded investor base, increased international exposure. |

| Ongoing State Influence | Present | Zhongxing Xin's continued control, aligning strategy with national goals. |

As of early 2024, Zhongxing Xin holds a substantial stake in ZTE Corporation, often exceeding 25-30% of the total shares. This significant ownership stake gives Zhongxing Xin considerable influence over ZTE's strategic direction. Other major stakeholders include institutional investors and mutual funds, both domestic and international, who hold shares through the public markets. However, their collective holdings typically do not challenge the controlling interest held by Zhongxing Xin. This ownership structure ensures that ZTE's strategy aligns with national industrial policies and long-term technological goals, particularly in critical infrastructure development and 5G deployment. The state-backed majority ownership directly impacts ZTE’s strategy.

ZTE's ownership is a blend of state and public shareholding, with significant influence from Zhongxing Xin, a state-backed entity.

- ZTE's IPOs in Shenzhen (1997) and Hong Kong (2004) brought in public investment.

- Zhongxing Xin's substantial ownership ensures alignment with national objectives.

- Institutional investors also hold shares, but do not challenge the state's control.

- The ownership structure shapes ZTE's strategic direction, especially in 5G and infrastructure.

ZTE PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on ZTE’s Board?

The composition of ZTE's Board of Directors is a reflection of its ownership structure. As of early 2025, the board typically includes between 10-14 directors. Many of these directors have backgrounds in state-owned enterprises or government-affiliated institutions, representing the interests of Zhongxing Xin and, by extension, the Chinese state. Independent non-executive directors are also appointed to the board to provide oversight and ensure compliance with listing rules. The board's structure is designed to balance state influence with independent oversight, though the former remains dominant.

The board's composition is crucial for understanding ZTE's strategic direction and its relationship with the Chinese government. The presence of directors with strong ties to state-backed entities underscores the company's alignment with national strategic objectives. This structure has remained consistent over time, reflecting the enduring influence of Zhongxing Xin. Understanding the board's makeup is essential for anyone analyzing ZTE's corporate governance and its position within the global telecommunications market. For more insights, consider reading about the Marketing Strategy of ZTE.

| Director Category | Approximate Number (2025) | Typical Background |

|---|---|---|

| Executive Directors | 3-5 | Senior Management, Industry Experience |

| Non-Executive Directors | 4-7 | Finance, Legal, Independent Advisors |

| Independent Non-Executive Directors | 2-4 | Corporate Governance, Regulatory Compliance |

The voting structure at ZTE is based on a one-share-one-vote principle for its publicly traded A-shares and H-shares. However, the significant ownership stake held by Zhongxing Xin grants state-backed entities substantial control. While there are no publicly reported dual-class shares or golden shares, Zhongxing Xin's share volume allows it to heavily influence shareholder votes on critical matters, including director elections and strategic decisions. This centralized control ensures that ZTE's decisions largely align with its primary stakeholders' strategic objectives. There have been no major proxy battles or activist investor campaigns that have successfully challenged the dominant control of the state-backed entities.

ZTE's ownership structure gives significant control to state-backed entities, primarily Zhongxing Xin.

- The board of directors includes members representing state-backed shareholders.

- Voting rights are primarily one-share-one-vote, but Zhongxing Xin's stake allows for substantial influence.

- Decisions are largely aligned with the strategic objectives of the primary stakeholders.

- No major proxy battles have challenged state-backed control.

ZTE Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped ZTE’s Ownership Landscape?

Over the past three to five years (2022-2025), the ownership structure of the ZTE corporation has remained relatively stable. The company continues to be largely controlled by state-backed entities, reflecting a strategic alignment with national objectives. While there have been shifts in public float and institutional holdings, the core ownership has not changed significantly. The company's focus on 5G development and expansion has attracted and retained institutional investors.

Navigating global geopolitical challenges, particularly those related to technology and trade, has indirectly impacted ZTE's market valuation. There haven't been any significant share buybacks or secondary offerings that have drastically altered the ownership structure. The emphasis remains on strengthening its technological capabilities and market position within the existing ownership framework. This includes substantial investments in research and development and global expansion initiatives, often supported by state initiatives. You can read more about the company's origins in the Brief History of ZTE.

| Aspect | Details | Data (as of early 2024) |

|---|---|---|

| Ownership Type | Publicly Traded, State-Backed | Significant state ownership; public float available |

| Market Capitalization | Fluctuating | Approximately $10-15 billion USD (subject to market conditions) |

| Institutional Ownership | Growing | Approximately 20-30% (varies) |

Industry trends show a continued strong presence of state-owned enterprises in major Chinese technology companies. This ensures strategic alignment with national goals. There are no public statements by the company or analysts suggesting privatization or a significant reduction in the state's controlling stake. The company's focus remains on technological advancement and market expansion under the current ownership framework.

ZTE's ownership structure has remained largely unchanged, with state-backed entities maintaining control. This stability provides a foundation for long-term strategic planning. The company continues to navigate global market challenges effectively.

Geopolitical tensions have indirectly influenced ZTE's market valuation and investor sentiment. The company's ability to adapt to global trade challenges is crucial. Ongoing focus on R&D and global expansion remains a priority.

ZTE has attracted and retained institutional investors due to its focus on 5G and market expansion. Institutional ownership percentages have been growing over the past few years. This indicates confidence in the company's future.

The company's future involves strengthening technological capabilities and global expansion. There is no indication of privatization or significant changes in state control. ZTE continues to focus on its core business strategies.

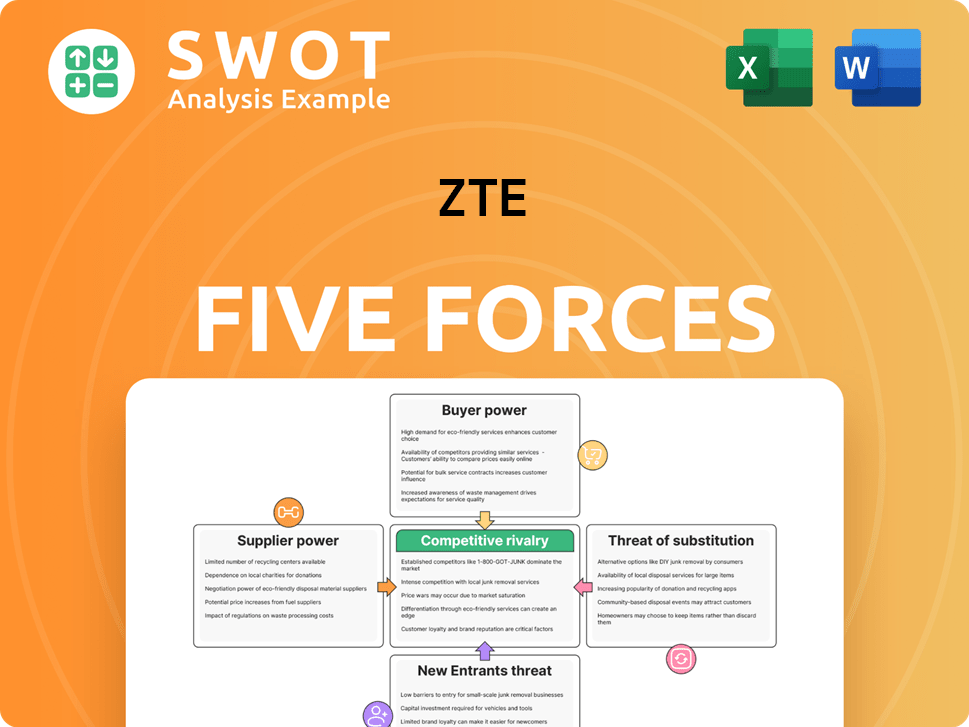

ZTE Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ZTE Company?

- What is Competitive Landscape of ZTE Company?

- What is Growth Strategy and Future Prospects of ZTE Company?

- How Does ZTE Company Work?

- What is Sales and Marketing Strategy of ZTE Company?

- What is Brief History of ZTE Company?

- What is Customer Demographics and Target Market of ZTE Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.