A2A Bundle

How is A2A Shaping Italy's Future?

A2A, an Italian multi-utility powerhouse, is not just another company; it's a key player driving Italy's ecological transition. With an impressive 18% EBITDA growth and record investments of nearly €3 billion in 2024, A2A is setting the pace. But how does the A2A SWOT Analysis truly reveal its inner workings and strategic vision?

This exploration of the A2A company delves into its core operations, examining how this 'Life Company' generates revenue through its diverse services in energy, water, and waste management. Understanding the A2A business model is essential for anyone looking to understand its role in Italy's sustainable development and its potential for future growth. We'll uncover how the A2A platform facilitates its ambitious goals and what makes this company a leader in the industry.

What Are the Key Operations Driving A2A’s Success?

The A2A company operates as an integrated multi-utility provider, delivering essential services throughout Italy. The core of its operations centers on sustainable development and the principles of the circular economy, making it a key player in Italy's infrastructure. This approach allows it to offer a range of services, from energy production to waste management and smart city solutions.

The A2A business model is built on three main pillars: energy, waste management, and smart city services. This integrated approach allows the company to create synergies across its business units, enhancing efficiency and reducing environmental impact. This strategy not only benefits the environment but also provides reliable services to customers, contributing to cleaner urban areas.

The A2A platform focuses on creating value through a combination of traditional utility services and a strong emphasis on ecological transition and circular economy principles. The company's commitment to these principles is evident in its investments in renewable energy sources and waste-to-energy plants, which contribute to a cleaner environment and more efficient urban areas. This integrated approach sets it apart in the market, driving both economic and environmental benefits.

In the energy sector, A2A manages a diverse portfolio of generating plants. It supplies electricity to approximately 2.1 million customers and gas to 1.5 million customers. The company's strategic plan includes investments in distribution infrastructures to grow its electricity network's Regulated Asset Base (RAB) to €3.4 billion by 2035.

A2A is a leading operator in Italy for waste management, handling collection, treatment, disposal, and recovery. The Brescia waste-to-energy plant processed over 700,000 tonnes of waste in 2024. The company aims to transform over 1 million tons of waste into products and secondary raw materials by 2035.

A2A offers smart city services, including public lighting, energy efficiency, and electric mobility solutions. These services contribute to urban decarbonization and the development of more sustainable cities. The company is constantly innovating to integrate these services effectively.

The value proposition of A2A includes reliable and sustainable energy and waste services, contributing to a cleaner environment. The company focuses on creating value through a combination of traditional utility services and a strong emphasis on ecological transition and circular economy principles. To understand more about the company's marketing strategies, you can read about the Marketing Strategy of A2A.

A2A's core operations are centered on energy production, distribution, waste management, and smart city services. The company's integrated approach allows for synergies across its business units, enhancing efficiency and reducing environmental impact. This integration allows for synergies across its business units, enhancing efficiency and reducing environmental impact.

- Energy: Manages a total capacity of 9.8 GW, including thermoelectric, hydroelectric, solar, and wind sources.

- Waste Management: Processes waste through various methods, including waste-to-energy plants.

- Smart City: Provides services like public lighting and energy efficiency solutions.

- Circular Economy: Aims to transform over 1 million tons of waste into products by 2035.

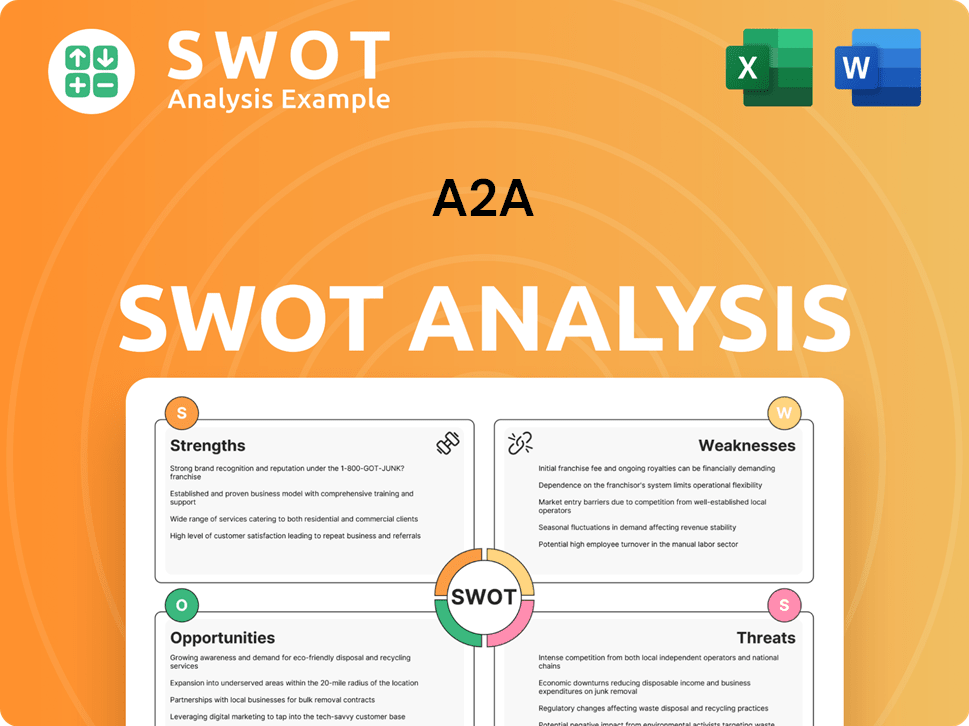

A2A SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does A2A Make Money?

The A2A company generates revenue through a diversified portfolio, focusing on energy production, distribution, waste management, and smart city services. In 2024, the company's revenues were 12,857 million euro, though this was a 13% decrease compared to 2023, primarily due to energy commodity price fluctuations. Despite this, the company saw an 18% increase in EBITDA, reaching 2,328 million euro, and a 29% rise in ordinary net profit, hitting 816 million euro.

For the first quarter of 2025, the A2A business model showed revenues of 3.97 billion euro, a 16% increase from the same period in 2024, driven by the consolidation of Duereti and higher energy commodity prices. The company's monetization strategies are built around several key areas, including energy sales, distribution, waste management, and smart city services, aiming for sustainable growth.

The A2A platform approach emphasizes sustainable development goals, as demonstrated by its inaugural European Green Bond of 500 million euro in January 2025, which will fund projects in renewable energy, energy efficiency, and network upgrades. This strategy supports multiple revenue streams while attracting environmentally conscious investors.

The company sells electricity and gas to residential, commercial, and industrial customers. A2A aims to expand its customer base to over 5 million by 2035, increasing electricity customers to align with the electrification of consumption. The growth in fixed-price retail contracts also contributes to revenue stability.

Revenues are generated from the regulated asset base (RAB) associated with electricity and gas distribution networks. The electricity RAB is projected to reach €3.4 billion by 2035, surpassing its gas RAB, driven by significant investments in network infrastructure and strategic acquisitions.

This segment generates revenue from waste collection, treatment, disposal, and the recovery of materials and energy. A2A's goal is to treat over 7 million tons of waste by 2035, producing electricity and heat, and transforming over 1 million tons of waste into secondary raw materials.

The company earns revenue from public lighting, energy efficiency solutions, and electric mobility services. A2A plans to invest around 0.5 billion euro in e-mobility, aiming to expand its recharging network from 2,000 points in 2023 to 34,000 by 2035, with an expected EBITDA of approximately 200 million euro from this sector by 2035.

A2A's commitment to sustainable finance is evident in its inaugural European Green Bond of 500 million euro placed in January 2025, the first on the market by a European corporate issuer, which will fund projects in renewable energy, energy efficiency, and network upgrades.

The company plans to significantly expand its e-mobility infrastructure. This includes increasing the number of recharging points from 2,000 in 2023 to 34,000 by 2035. This expansion is projected to generate approximately 200 million euro in EBITDA by 2035.

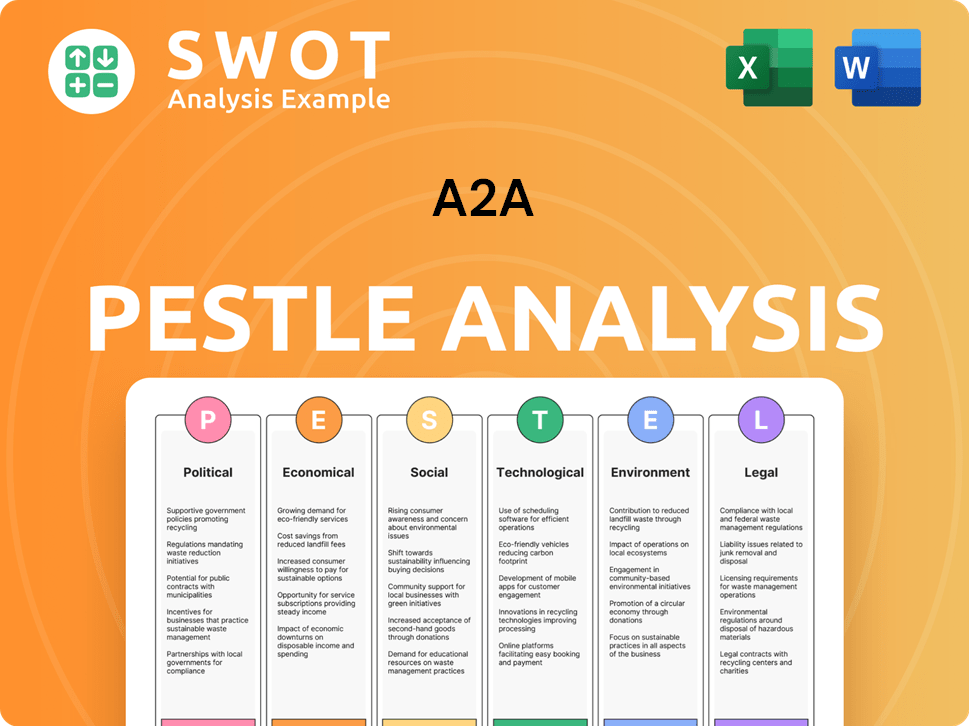

A2A PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped A2A’s Business Model?

The trajectory of the A2A company has been marked by significant milestones and strategic decisions, particularly in its pursuit of ecological transition and the circular economy. A key strategic move was the approval of its 2024-2035 Strategic Plan Update in November 2024, which confirms a substantial investment plan.

In 2024, A2A made record investments, with a significant portion dedicated to M&A transactions. A notable acquisition expanded its managed electricity network. Another key move in January 2025 was the placement of its inaugural European Green Bond, demonstrating its leadership in sustainable finance. A2A's commitment to innovation and expansion is evident through its strategic investments and initiatives.

A2A's strategic approach, as detailed in Growth Strategy of A2A, focuses on sustainable practices and infrastructure development. This is evident in its financial results and future plans.

The approval of the 2024-2035 Strategic Plan Update in November 2024, which includes a €22 billion investment plan, with €6 billion allocated to the circular economy and €16 billion to energy transition. This plan aims to achieve €3.3 billion in EBITDA and over €1 billion in net income by 2035.

Record investments in 2024 totaling €2,941 million, with €1,429 million dedicated to M&A transactions. The acquisition of 90% of Duereti S.r.l.'s share capital expanded the managed electricity network. Placement of the inaugural €500 million European Green Bond in January 2025.

Gross operating margin (EBITDA) increased by 18% in 2024, reaching €2,328 million. Ordinary net income grew by 29% to €816 million. A2A's commitment to sustainable finance is reflected in its high percentage of sustainable debt, which was 78% in 2024.

A2A aims for 5.7 GW of installed renewable capacity by 2035. The company is investing in new technologies, such as the €40 million allocated to the 360 LIFE II climate tech fund for circular economy and energy transition. It also focuses on expanding its customer base, aiming to reach over 5 million customers by 2035.

A2A's competitive advantages are rooted in its integrated multi-utility model, commitment to ecological transition, and strong infrastructure investments. The company is a leading operator in Italy for waste collection and treatment and is the second-largest electricity producer and distributor in the country.

- Integrated Multi-Utility Model: Diversified operations across energy, waste, and smart cities.

- Commitment to Ecological Transition: Focus on renewable energy and circular economy initiatives. 50% of total production in 2024 from renewable sources.

- Strong Investment in Infrastructure: €22 billion planned investments between 2024 and 2035.

- Market Leadership: Leading operator in Italy for waste collection and treatment.

- Sustainable Finance Leadership: High percentage of sustainable debt (78% in 2024).

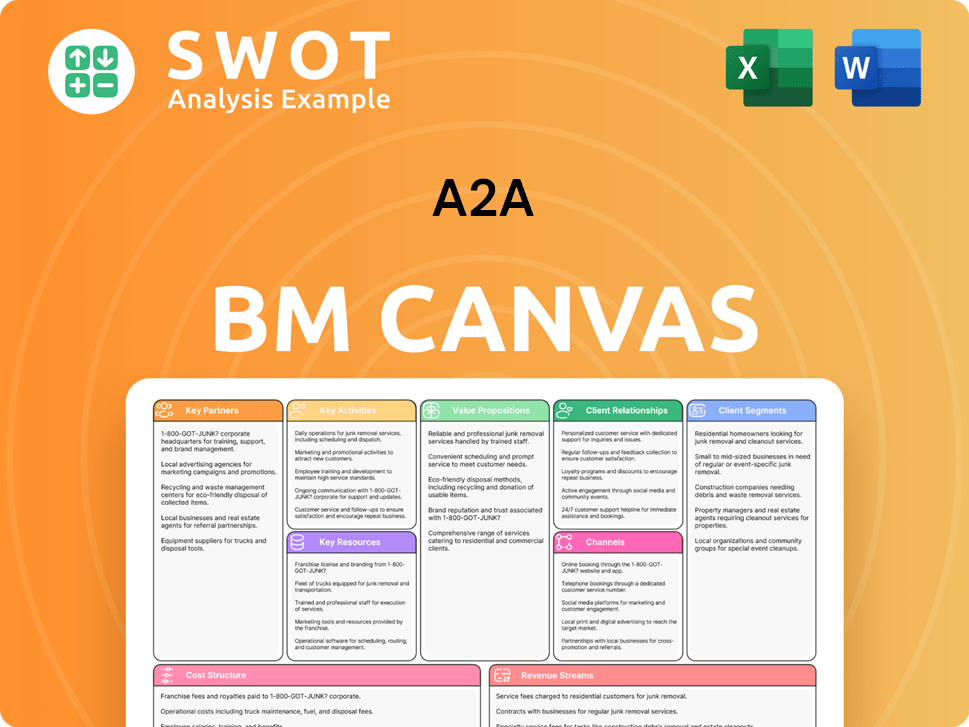

A2A Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is A2A Positioning Itself for Continued Success?

The A2A company holds a strong position in Italy's utility sector, particularly in energy and waste management. It is the leading operator in waste collection and treatment and the second-largest electricity producer and distributor. The company's business model, supported by a multi-channel strategy and brand awareness, is projected to increase its market share in electricity from 6% in 2023 to 9% by 2035. This growth is fueled by a focus on essential services and sustainable growth, fostering customer loyalty. You can find more information about the Owners & Shareholders of A2A.

Despite its strong market position, A2A faces several risks. These include energy commodity price volatility, regulatory changes, technological disruption, and competition. Environmental and sustainability targets also pose challenges, with potential financial implications if missed. The company's future outlook is closely tied to its strategic initiatives and innovation roadmap, as outlined in its 2024-2035 Strategic Plan.

A2A is a leading player in Italy's utility sector, particularly in waste management and energy. It is the top operator in waste collection and treatment. The company's market share in electricity is expected to grow. A2A's focus on essential services enhances customer loyalty, supporting its strong industry position.

Key risks include energy price volatility, regulatory changes, and technological disruption. Competition in the market requires continuous strategic efforts. Missing sustainability targets can lead to financial implications. The company's financial performance can be affected by these factors.

The future of A2A is linked to its 2024-2035 Strategic Plan, with a focus on energy transition and the circular economy. The company plans to invest significantly in renewable energy and grid modernization. Growth is also expected in waste management and e-mobility. The company plans to expand its customer base.

A2A plans to increase renewable generation capacity to 5.7 GW by 2035. Investments are planned for electricity grid upgrades, aiming to treat over 7 million tons of waste. The company aims to expand its customer base to over 5 million by 2035. A significant investment is allocated to e-mobility.

A2A plans to invest €22 billion between 2024 and 2035. The company aims for net-zero emissions by 2040. The company is focused on sustainable growth and a competitive ecological transition. The company maintains a solid financial position.

- €16 billion for energy transition.

- €6 billion for the circular economy.

- Increase renewable generation capacity to 5.7 GW by 2035.

- Expand the recharging network to 34,000 points by 2035.

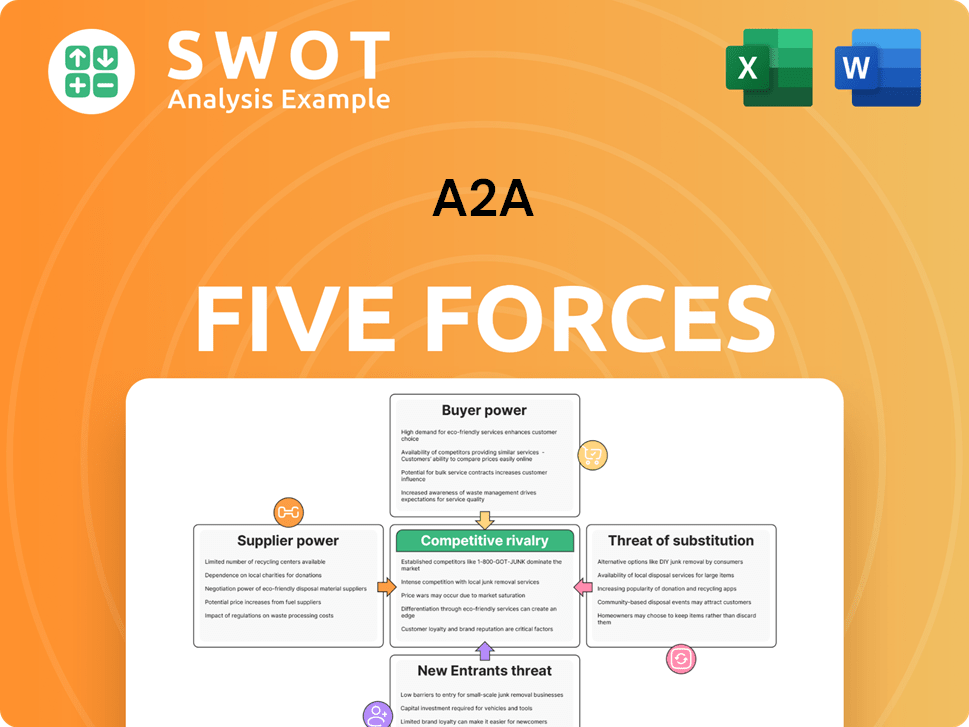

A2A Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of A2A Company?

- What is Competitive Landscape of A2A Company?

- What is Growth Strategy and Future Prospects of A2A Company?

- What is Sales and Marketing Strategy of A2A Company?

- What is Brief History of A2A Company?

- Who Owns A2A Company?

- What is Customer Demographics and Target Market of A2A Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.