A2A Bundle

Who Really Owns A2A?

Unraveling the A2A SWOT Analysis is just the beginning; understanding its ownership is key. In the complex world of utilities and environmental services, knowing "Who owns A2A" is critical for investors and stakeholders alike. This knowledge directly impacts strategic direction and long-term value.

The A2A group, a major player in Italy's energy and waste management sectors, presents a fascinating case study in corporate ownership. Its history, rooted in the merger of municipal companies, has shaped its current structure. Exploring "A2A ownership" means understanding the interplay of public and private interests, and how "A2A shareholders" influence its trajectory. This exploration will provide insights into the "A2A company" and its position in the market.

Who Founded A2A?

The formation of A2A in 2008 marked a significant event in the Italian utilities sector. Unlike companies founded by individual entrepreneurs, A2A emerged from the merger of two established municipal entities: ASM Brescia and AEM Milano. This unique origin fundamentally shaped the early ownership structure of the A2A company.

Therefore, understanding A2A ownership requires looking at the shareholding of ASM Brescia and AEM Milano before the merger. These were primarily municipal companies, meaning their ownership was largely vested in the municipalities of Brescia and Milan. The merger agreement then dictated the share exchange and the resulting ownership proportions within the newly formed A2A.

The driving force behind the merger was to create a more competitive and efficient multi-utility. This entity would be better equipped to navigate the liberalized energy and environmental services markets in Italy. The initial backers were essentially the municipal entities themselves, representing the citizens of Milan and Brescia.

A2A was not founded by individuals but resulted from the merger of ASM Brescia and AEM Milano in 2008. This merger created a larger entity to compete in the energy and environmental services markets.

Early A2A ownership reflected the shareholdings of ASM Brescia and AEM Milano. These were primarily municipal companies, with ownership largely held by the municipalities of Brescia and Milan.

The merger aimed to create a more competitive multi-utility. This entity was designed to operate more effectively in the increasingly liberalized energy and environmental services markets in Italy.

The municipalities of Milan and Brescia held significant stakes in their respective companies before the merger. The merger agreement detailed the share exchange and the resulting ownership percentages.

The initial backers of A2A were the municipal entities themselves. They represented the citizens of Milan and Brescia, who were the primary stakeholders in the pre-merger companies.

For detailed information on current A2A shareholders, including major stakeholders and ownership structure, refer to the company's official reports and financial statements.

The A2A ownership structure is primarily influenced by the initial merger of ASM Brescia and AEM Milano. The municipalities of Milan and Brescia, therefore, held significant stakes. Understanding Growth Strategy of A2A also provides insights into the company's evolution.

- The initial ownership was largely municipal.

- The merger agreement defined the share exchange.

- The goal was to enhance competitiveness in the market.

- Current ownership details are available in company reports.

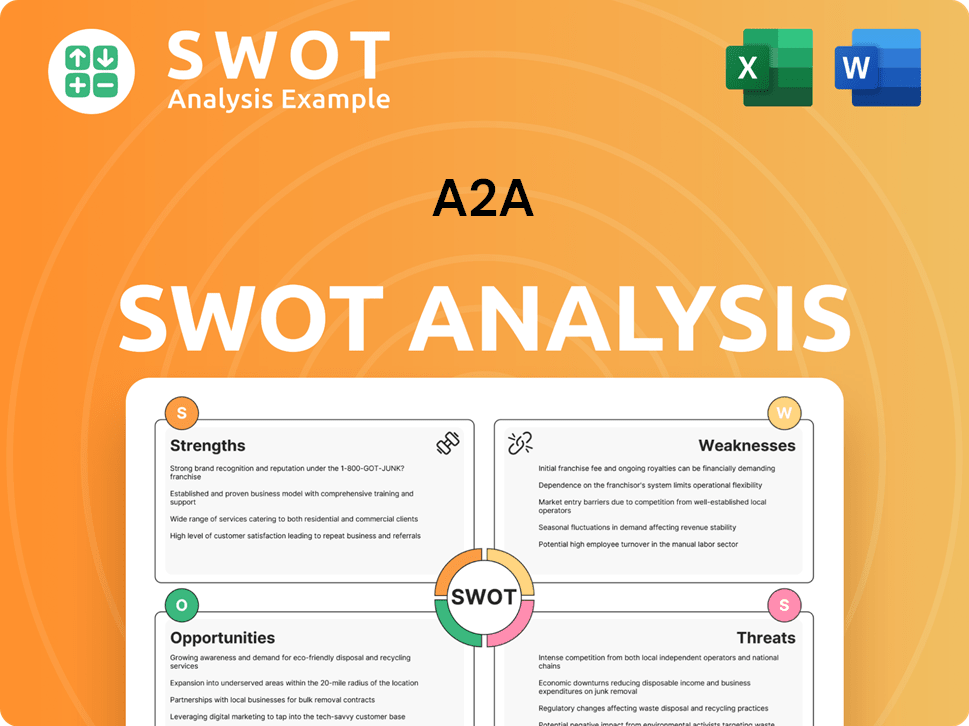

A2A SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has A2A’s Ownership Changed Over Time?

The ownership structure of the A2A company has evolved since its formation in 2008. As a publicly listed entity on the Milan Stock Exchange, its ownership has been shaped by the presence of its founding municipalities, which continue to hold significant stakes. This setup reflects a balance between public service responsibilities and the dynamics of a publicly traded company.

The evolution of A2A's ownership reflects its growth and adaptation within the energy and environmental services sectors. Key changes have been influenced by market conditions, strategic decisions, and the need to balance the interests of various stakeholders, including public entities, institutional investors, and individual shareholders. Understanding the A2A ownership structure is crucial for investors interested in the company's long-term strategy and operational focus. For additional insights into the company's strategic direction, consider exploring the Target Market of A2A.

| Year | Event | Impact on Ownership |

|---|---|---|

| 2008 | Formation of A2A | Initial ownership structure established, primarily involving the municipalities of Milan and Brescia. |

| Ongoing | Public Listing on the Milan Stock Exchange | Introduction of a free float, with shares available to institutional and individual investors. |

| Ongoing | Strategic Decisions and Market Fluctuations | Changes in the percentage held by institutional investors and the municipalities, reflecting market dynamics and strategic goals. |

As of early 2025, the primary shareholders of A2A are the Municipality of Milan and the Municipality of Brescia. They collectively hold approximately 50% of the company's share capital. The Municipality of Milan holds around 25%, and the Municipality of Brescia holds approximately 25%. The remaining shares are widely distributed among institutional investors, mutual funds, and individual shareholders. This ownership structure is typical of a large, publicly traded company, balancing public service obligations with profitability and sustainability goals. The significant stakes held by these municipalities highlight A2A's role in providing essential public services. Institutional ownership often includes major Italian and international asset managers. A2A's ability to balance these interests shapes its long-term strategic planning.

A2A's ownership structure is primarily defined by the significant stakes held by the Municipalities of Milan and Brescia, which together control about 50% of the company. The remaining shares are distributed among institutional and individual investors.

- The Municipality of Milan holds approximately 25%.

- The Municipality of Brescia holds approximately 25%.

- The remaining shares are held by a diverse group of investors.

- This structure balances public service obligations with market dynamics.

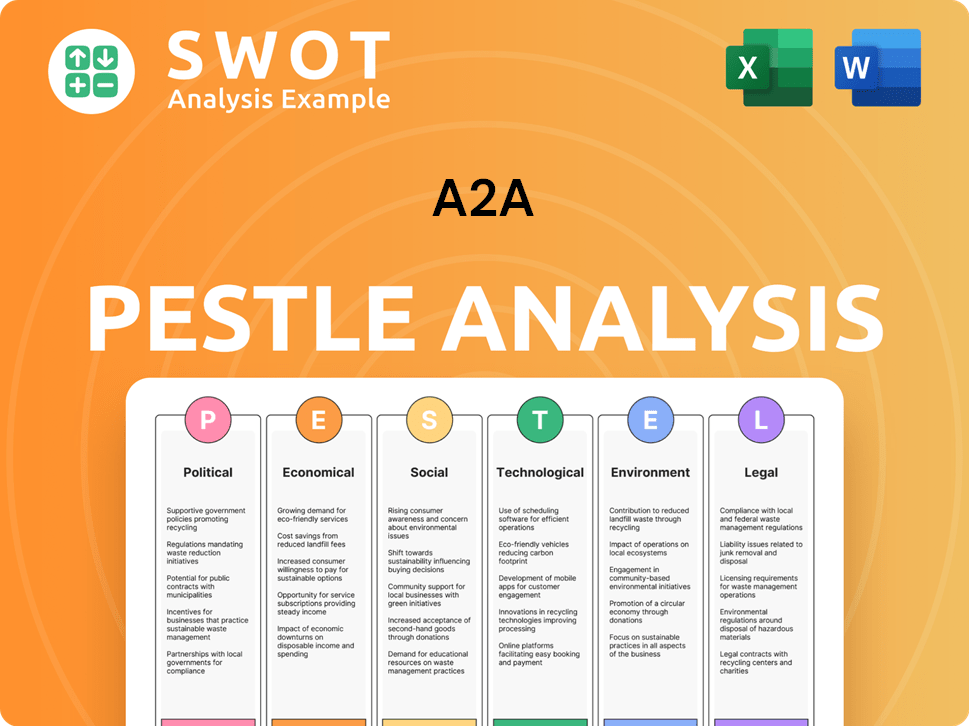

A2A PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on A2A’s Board?

The Board of Directors of A2A, reflecting its ownership structure, includes representatives from its major shareholders and independent members. As of early 2025, the board typically consists of members nominated by the Municipality of Milan and the Municipality of Brescia, alongside independent directors. For instance, Marco Patuano serves as the Chairman of the Board, and Renato Mazzoncini is the Chief Executive Officer and General Manager. Further details on the composition and roles of other board members, including those representing major shareholders, are available in the company's official reports and on its corporate website. Understanding the A2A ownership structure is key to grasping the company's governance.

The A2A company's board structure is designed to balance shareholder interests with independent oversight. The presence of independent directors ensures that decisions are made with a broader perspective, while the representation from major shareholders, such as the municipalities, ensures that strategic decisions align with their long-term objectives. This blend of perspectives is a critical aspect of the A2A group's operational framework, influencing everything from investment strategies to corporate social responsibility initiatives. Knowing who owns A2A is fundamental to understanding its strategic direction.

| Board Member | Role | Notes |

|---|---|---|

| Marco Patuano | Chairman | Oversees board activities and strategic direction. |

| Renato Mazzoncini | Chief Executive Officer and General Manager | Responsible for the company's day-to-day operations. |

| Board Members | Representatives from Municipalities | Nominated by the Municipality of Milan and Brescia. |

A2A operates under a 'one-share-one-vote' structure for its ordinary shares, meaning each share has equal voting rights. However, the significant combined stake of the Municipalities of Milan and Brescia, holding approximately 50% of the shares, grants them considerable influence over strategic decisions, board appointments, and key resolutions. This ownership structure generally promotes a long-term strategic outlook. The coordinated voting of the two main municipal shareholders is a dominant factor in the company's governance. The A2A shareholders thus play a crucial role in shaping the company's future.

The Municipalities of Milan and Brescia collectively hold around 50% of A2A's shares, significantly influencing decision-making. This concentrated ownership structure ensures stability and a long-term focus for the company. Understanding the A2A company ownership structure is essential for investors.

- The 'one-share-one-vote' system ensures equal voting rights per share.

- Municipalities' combined stake provides substantial control over strategic decisions.

- No publicly reported special voting rights or golden shares exist.

- This structure promotes stability and prioritizes public interest.

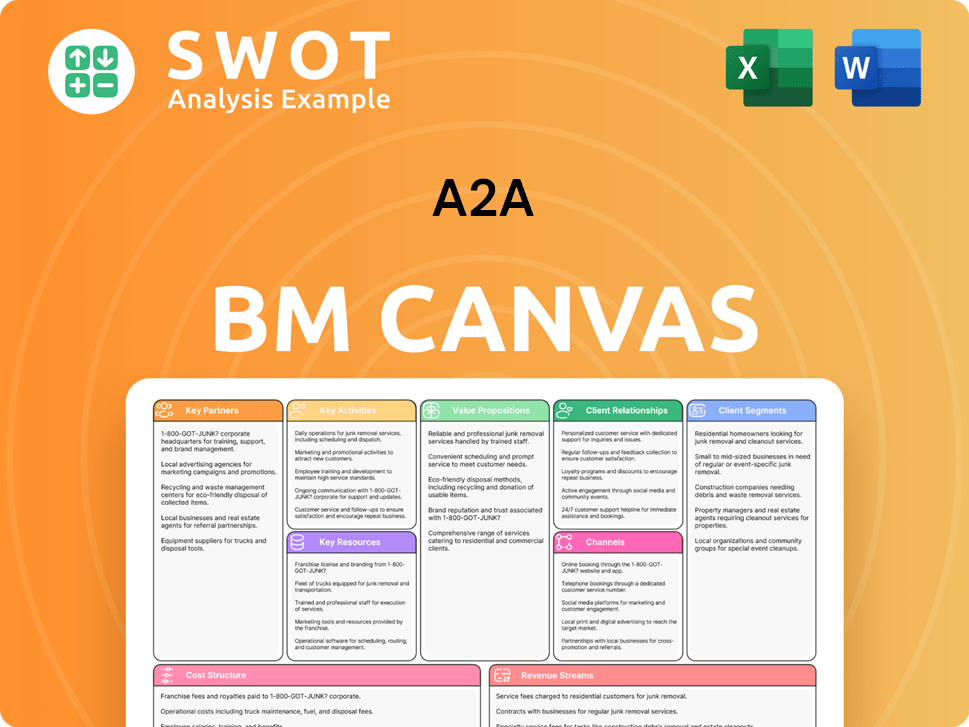

A2A Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped A2A’s Ownership Landscape?

In the past 3-5 years, the A2A ownership profile has remained relatively stable. The Municipalities of Milan and Brescia continue to hold significant stakes in the A2A company. While there haven't been major shifts in the core ownership structure, the company's strategic initiatives could indirectly influence its future ownership dynamics. The A2A group is actively pursuing a robust investment plan focused on energy transition, the circular economy, and digitalization.

A2A Italy has a substantial investment plan, with a total of 22 billion euros earmarked by 2035. This could lead to further equity issuances or strategic partnerships. Industry trends favor increased institutional ownership and a focus on ESG factors, which A2A shareholders, with their strong sustainability focus, are well-positioned to attract. The company's commitment to sustainability is highlighted in its 2024-2035 business plan, aiming for 100% decarbonized generation by 2040 and a 50% reduction in CO2 emissions by 2030 (Scope 1 and 2).

| Aspect | Details | Recent Data (2024-2025) |

|---|---|---|

| Ownership Stability | Core ownership structure | Municipalities of Milan and Brescia maintain significant stakes. |

| Investment Plan | Total Investment by 2035 | 22 billion euros |

| Sustainability Goals | Decarbonization Target | 100% decarbonized generation by 2040 |

| Sustainability Goals | CO2 Emissions Reduction | 50% reduction by 2030 (Scope 1 and 2) |

The current focus remains on sustainable growth and delivering on its multi-utility mandate. A deep dive into the A2A ownership structure explained can be found by exploring the Marketing Strategy of A2A.

The Municipalities of Milan and Brescia are the primary shareholders. They have maintained significant stakes over the past few years. The company's ownership structure is relatively stable.

A2A is heavily investing in energy transition, circular economy, and digitalization. The total investment plan is 22 billion euros by 2035. This focus may influence future ownership dynamics.

A2A aims for 100% decarbonized generation by 2040. It targets a 50% reduction in CO2 emissions by 2030. These initiatives position the company well for ESG-focused investors.

No immediate major ownership changes are expected. The emphasis is on sustainable growth. The company is committed to its current strategic plan.

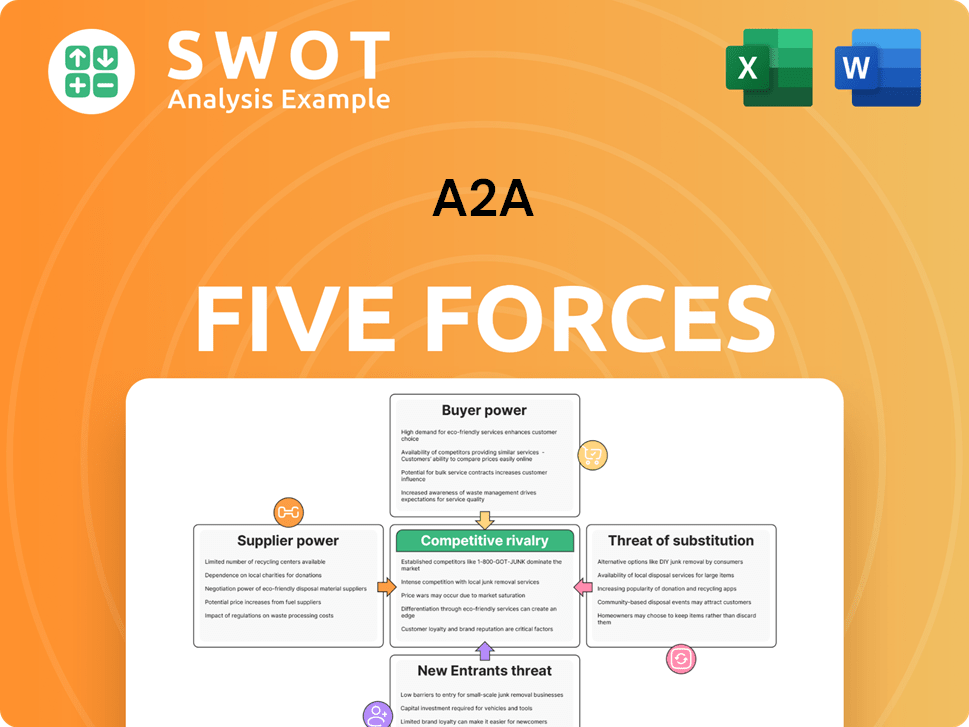

A2A Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of A2A Company?

- What is Competitive Landscape of A2A Company?

- What is Growth Strategy and Future Prospects of A2A Company?

- How Does A2A Company Work?

- What is Sales and Marketing Strategy of A2A Company?

- What is Brief History of A2A Company?

- What is Customer Demographics and Target Market of A2A Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.