Alphabet Bundle

Decoding Alphabet: How Does the Tech Giant Really Work?

Ever wondered how the Google parent company, Alphabet Inc, orchestrates its vast empire? From AI breakthroughs to record-breaking revenues, Alphabet's influence is undeniable. Understanding the inner workings of this tech behemoth is key to navigating today's digital world. This exploration unveils the strategies and financial engines driving Alphabet's success.

Alphabet Inc, with Sundar Pichai at the helm, continues to shape the future, and understanding its structure is more critical than ever. This analysis will dissect the Google structure, examining its subsidiaries and diverse sectors. For investors and analysts, a deep dive into Alphabet SWOT Analysis is essential to forecast its future trajectory, including its innovation strategy and financial performance. We'll address questions like: How does Alphabet Inc make money, and what are the main products of Alphabet?

What Are the Key Operations Driving Alphabet’s Success?

The Alphabet company creates value through a diverse range of products and services, targeting a global audience. Its core operations revolve around offerings like Google Search, the Android operating system, Chrome, Gmail, Google Maps, and YouTube. For businesses, it provides Google Cloud Platform (GCP) and Google Workspace.

The Google parent company emphasizes advanced technology development, especially in AI. This includes foundational infrastructure, model development, research, and product integration. Investments in technical infrastructure, such as servers and data centers, support the growth of its various businesses, with Google Cloud leading in revenue growth due to demand for its core products, AI infrastructure, and generative AI solutions.

The operational processes are supported by extensive supply chains and distribution networks, enabling global reach. Competitive advantages stem from economies of scale, allowing for significant infrastructure investments. The integration of AI across products enhances user engagement and competitiveness. For example, AI Overviews in Search serves over 1.5 billion monthly users, demonstrating how core capabilities translate into customer benefits and market differentiation.

Key offerings include Google Search, Android, Chrome, Gmail, Google Maps, and YouTube. These services cater to a vast consumer base worldwide. For businesses, Google provides Google Cloud Platform (GCP) and Google Workspace, offering cloud computing and collaboration tools.

The company heavily invests in AI and technical infrastructure. This includes servers and data centers to support its diverse businesses. AI is integrated across products to enhance user engagement and competitiveness, driving innovation and efficiency.

Economies of scale and ecosystem synergies are key competitive advantages. The company's vast infrastructure supports fast search results and robust cloud services. The integration of Android, YouTube, and Chrome amplifies reach and effectiveness.

AI Overviews in Search serves over 1.5 billion users monthly, showcasing customer benefits and market differentiation. Continuous innovation and AI integration drive the company's impact on technology. The company's approach enhances user experience and strengthens its market position.

The operational structure of the Alphabet Inc is designed to foster innovation and efficiency across its various sectors. Its focus on AI and infrastructure allows it to drive significant market impact.

- Advanced AI Integration: Utilizing AI across products to enhance user experience.

- Infrastructure Investments: Focusing on data centers and servers to support growth.

- Global Reach: Leveraging extensive supply chains and distribution networks.

- Ecosystem Synergies: Benefiting from the integration of products like Android, YouTube, and Chrome.

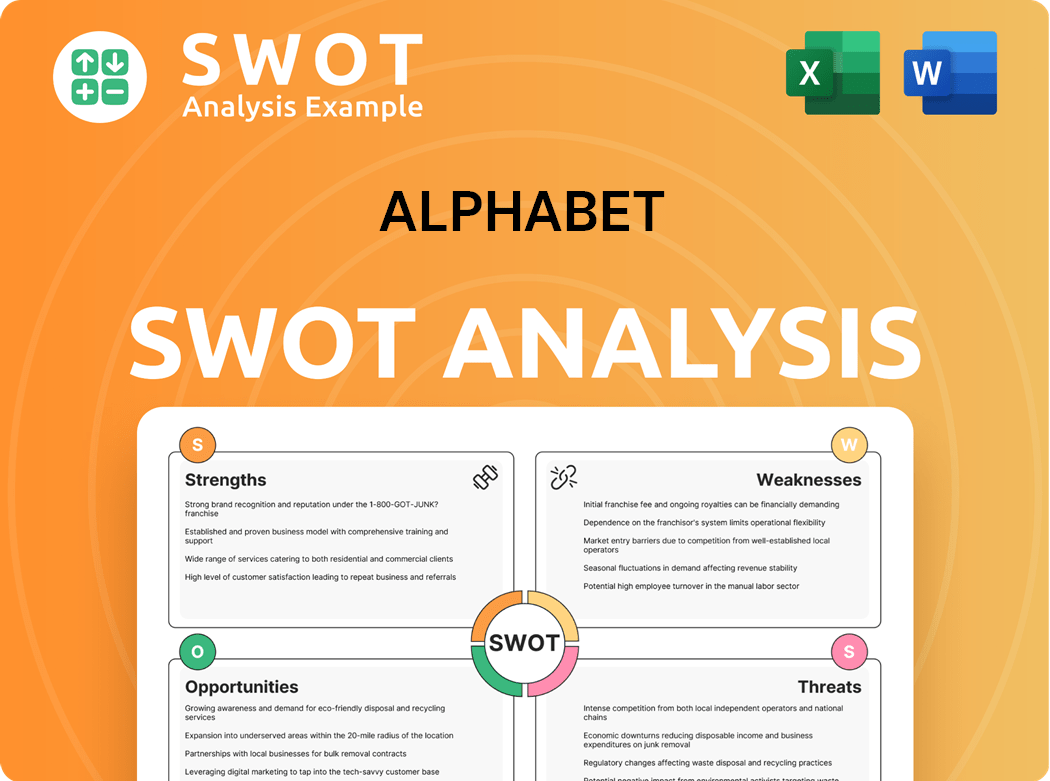

Alphabet SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Alphabet Make Money?

The Alphabet company, the parent company of Google, has a diversified revenue model. Its primary revenue streams include advertising, cloud services, and subscriptions. The Google parent company continues to evolve its monetization strategies, focusing on expanding its cloud services and subscription-based offerings.

In Q1 2025, Alphabet's consolidated revenue reached $90.2 billion, marking a 12% year-over-year increase. For the full year 2024, Alphabet reported $350 billion in revenue, a 14% increase compared to 2023, demonstrating strong financial performance across its various sectors. The company's financial success is a key aspect of understanding the Alphabet company's financial performance.

Alphabet's monetization strategies are multifaceted. They include advertising on its platforms, subscription models for services like YouTube and Google One, and consumption-based fees for Google Cloud Platform services. The company is also exploring AI-powered ad formats to enhance targeting and conversions. To learn more about their growth strategy, you can read this article: Growth Strategy of Alphabet.

The main revenue streams for Alphabet are Google Services, Google Cloud, and Other Bets. Each segment contributes differently to the overall revenue, reflecting the Alphabet company's different sectors and Alphabet company organizational structure.

- Google Services: This segment, including Google Search & other, YouTube ads, and Google subscriptions, platforms, and devices, generated $77.3 billion in Q1 2025, a 10% increase year-over-year. In 2024, Google Services revenue was $304.9 billion.

- Google Search & other: This is the largest component, contributing $50.7 billion in Q1 2025, up 10% year-over-year. In 2024, Google Search + Other generated $198.1 billion, accounting for 56.6% of total revenue.

- YouTube ads: Revenue from YouTube ads was $8.9 billion in Q1 2025, a 10% increase year-over-year. In 2024, YouTube Ads contributed $36.1 billion, or 10.3% of total revenue.

- Google Subscriptions, Platforms, and Devices: This segment contributed $10.4 billion in Q1 2025, a 19% increase year-over-year. In 2024, this segment generated $40.3 billion, representing 11.5% of total revenue.

- Google Cloud: This segment saw significant growth, with revenues increasing 28% year-over-year to $12.3 billion in Q1 2025. For the full year 2024, Google Cloud revenue was $43.2 billion, a 31% increase from 2023, making it the second-biggest revenue driver and accounting for 12.4% of total revenue.

- Other Bets: This segment, which includes experimental projects like Waymo (autonomous vehicles) and Wing (drone delivery), generated $450 million in Q1 2025, down 9% year-over-year. In 2024, Other Bets contributed $1.6 billion, or 0.5% of total revenue, and continued to operate at a loss.

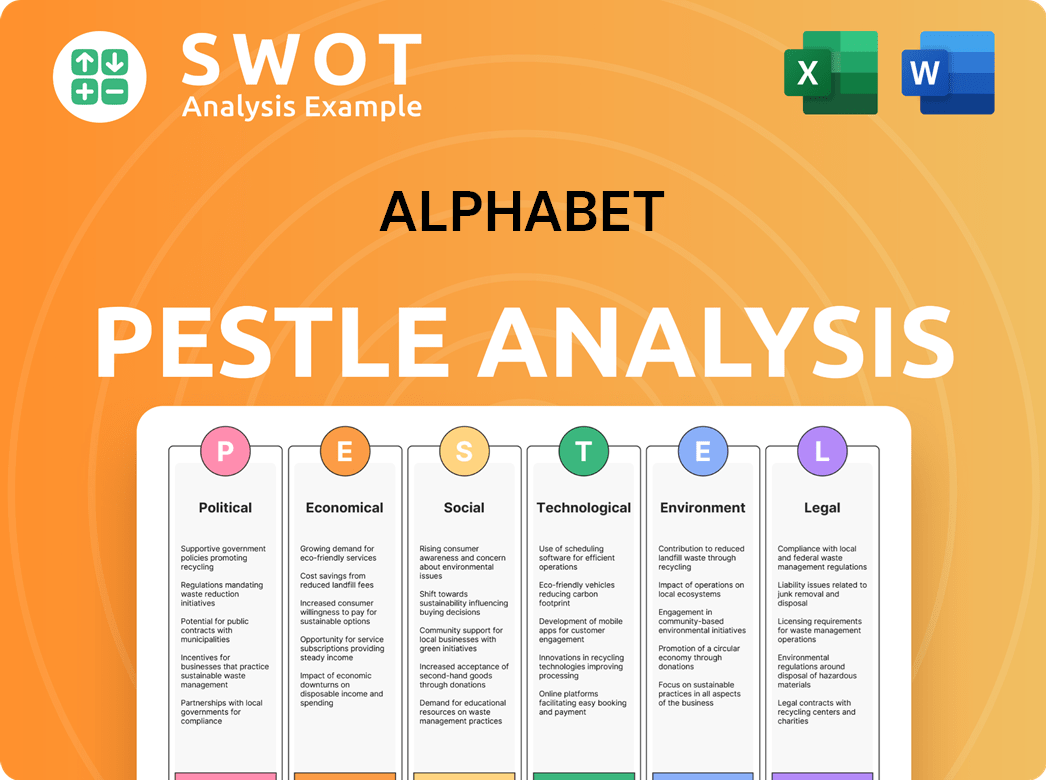

Alphabet PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Alphabet’s Business Model?

The evolution of the Alphabet company, formerly known as Google, has been marked by significant milestones and strategic shifts. A key focus has been on artificial intelligence (AI) and cloud computing, reflecting its commitment to innovation. In 2024, the company's performance showed growth across its core businesses, with a strong emphasis on integrating AI throughout its ecosystem.

One of the significant achievements is the integration of AI Overviews in Search, which now serves over 1.5 billion users monthly. This demonstrates how AI enhances core product engagement. The launch of Gemini 2.5, Alphabet's most advanced AI model, further strengthens its AI leadership. These efforts are critical for the Google parent company, which is continually adapting to the evolving tech landscape.

Operationally, Alphabet has faced challenges such as regulatory scrutiny and market competition. Despite these hurdles, the company has accelerated its AI investments and streamlined operations. The company plans to invest approximately $75 billion in capital expenditures in 2025, primarily directed towards technical infrastructure for AI and cloud expansion. This aggressive investment strategy aims to meet the soaring demand for AI and cloud services.

The rollout of AI Overviews in Search, serving over 1.5 billion users monthly, and the launch of Gemini 2.5, its most intelligent AI model, are key milestones. These developments highlight Alphabet's commitment to AI and its impact on user engagement. These advancements are crucial for the company's future growth.

Alphabet's strategic moves include increased investments in AI and cloud infrastructure, with approximately $75 billion in capital expenditures planned for 2025. The company is also streamlining operations to meet increasing demands. These strategic moves are designed to ensure the company's long-term competitiveness.

Alphabet's competitive advantages include brand strength, technology leadership in AI and search, and economies of scale. The company's vast ecosystem, including Android and YouTube, creates strong network effects. These advantages enable Alphabet to maintain its position in the market.

In 2024, Alphabet demonstrated robust financial performance. The company's investments in AI and cloud infrastructure, with a planned $75 billion in capital expenditures for 2025, reflect its commitment to future growth. These investments are aimed at meeting the increasing demand for AI and cloud services.

Alphabet leverages its brand strength, especially through Google's widespread presence, and technology leadership in AI and search algorithms. Its in-house Tensor Processing Units (TPUs) and full-stack AI approach provide a significant advantage. Economies of scale allow for lightning-fast search results and robust cloud services.

- Brand Strength: Google's ubiquitous presence.

- Technology Leadership: AI and search algorithms.

- Economies of Scale: Efficient cloud services.

- Ecosystem: Android, YouTube, and Chrome.

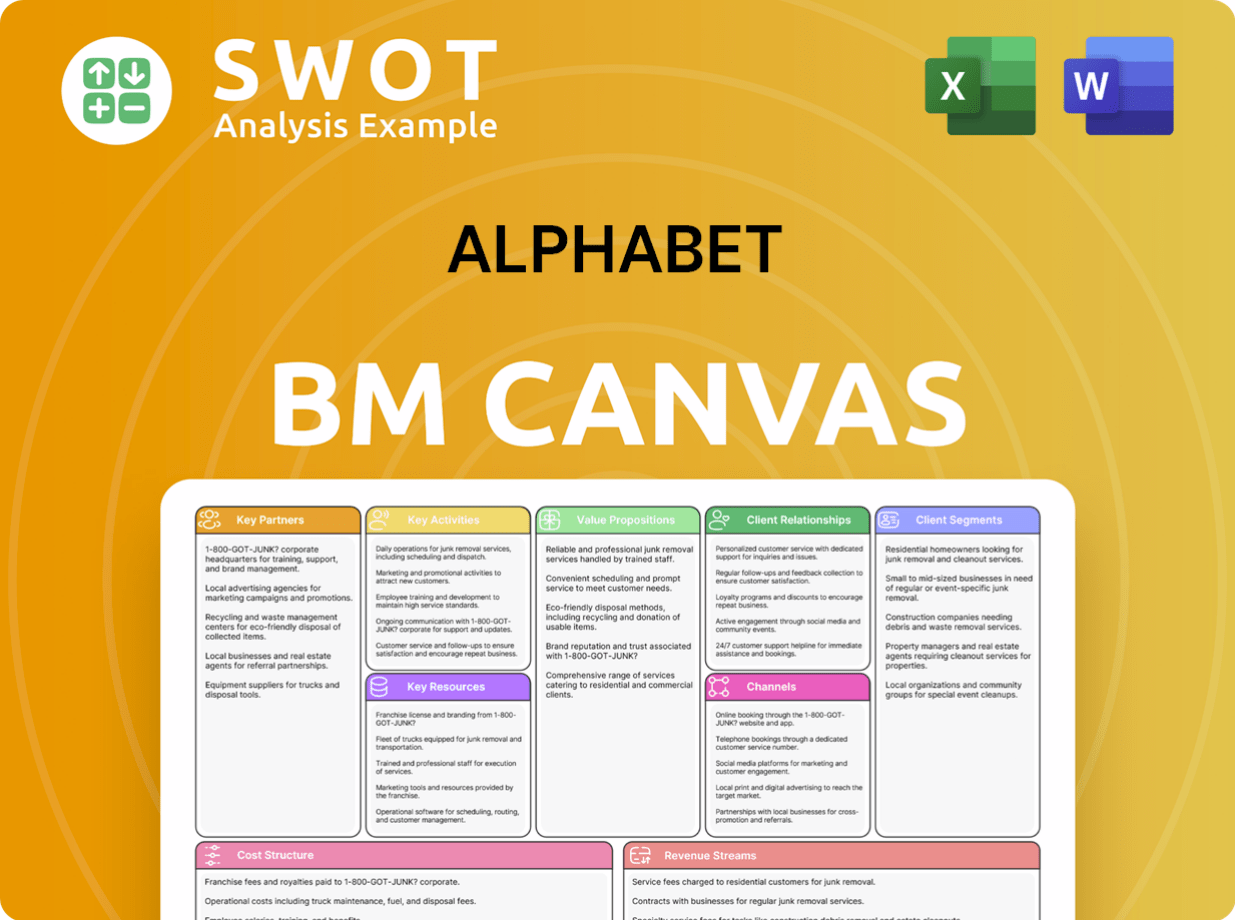

Alphabet Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Alphabet Positioning Itself for Continued Success?

The Marketing Strategy of Alphabet showcases a dominant position in the tech industry, particularly in online search and advertising. Despite increasing competition and regulatory pressures, Alphabet Inc continues to generate significant revenue. Customer loyalty remains strong across its various platforms due to their widespread utility and integration into daily life.

Key risks include regulatory challenges, such as antitrust cases, and heightened competition in AI, advertising, and cloud services. Technological disruption and changing consumer preferences also pose threats. However, Alphabet's strategic initiatives and innovation roadmap aim to sustain and expand its ability to generate revenue.

Alphabet, the Google parent company, maintains a strong market position, especially in online search and advertising. Google's advertising revenue continues to grow, with Google Search + Other generating $198.1 billion in 2024. Alphabet's cloud computing sector, Google Cloud, is the world's third-largest provider, with revenues of $43.2 billion in 2024.

Ongoing regulatory challenges, such as antitrust cases, pose significant risks to Alphabet's operations. Increased competition in AI, advertising, and cloud services also threatens its market share. Technological shifts, like the move towards AI-native platforms, could disrupt its core business. These factors could impact the Alphabet Inc stock price.

Alphabet plans to invest approximately $75 billion in capital expenditures in 2025, with a focus on AI development. CEO Sundar Pichai emphasizes the company's 'full-stack approach to AI'. Strategic initiatives include scaling Gemini, expanding Waymo, and re-entering the VR/AR space. The company aims for sustained growth despite a 'challenging' 2025.

Alphabet is focusing on scaling Gemini, expanding Waymo internationally, and re-entering the VR/AR space. These initiatives are part of the company's broader strategy to leverage AI and other technologies to drive innovation and growth. The company aims to enhance existing products and create new revenue streams. The company is working on Alphabet company's different sectors.

Alphabet's financial performance is driven by its diverse revenue streams, including advertising, cloud services, and other ventures. The company's innovation strategy centers on AI, with significant investments planned for 2025. This approach is designed to maintain Alphabet company's impact on technology.

- Google Search + Other generated $198.1 billion in 2024.

- Google Cloud's revenue reached $43.2 billion in 2024.

- Approximately $75 billion in capital expenditures planned for 2025, mainly for AI.

- Sundar Pichai highlights the 'full-stack approach to AI' for future innovation.

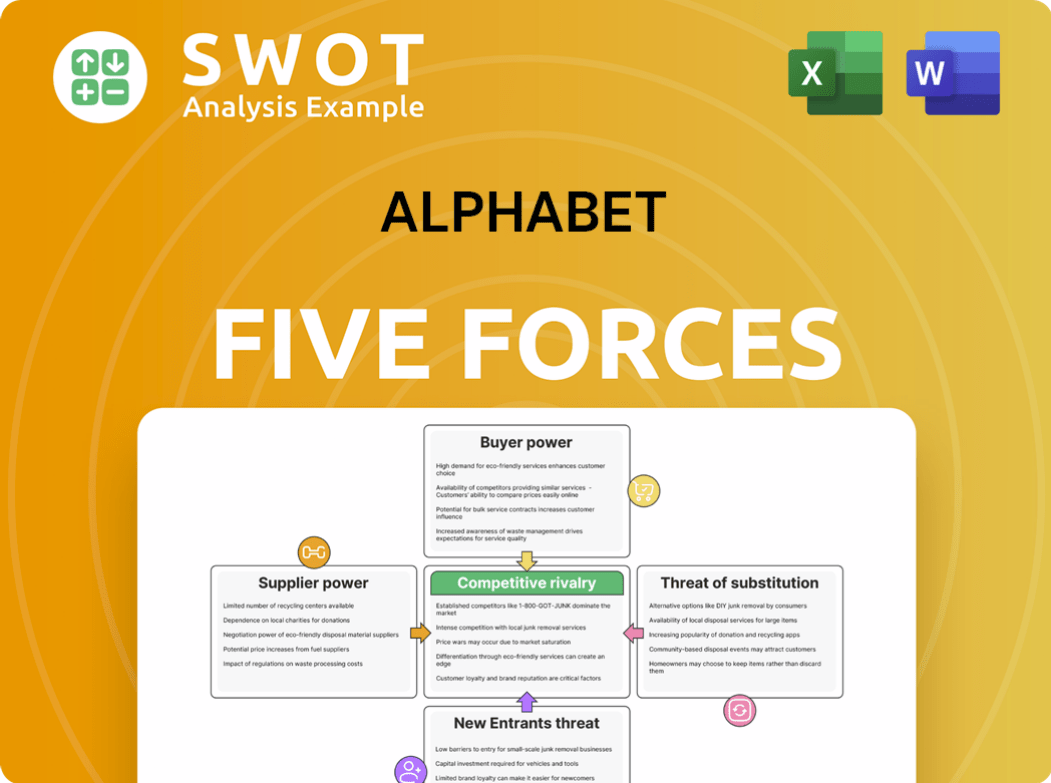

Alphabet Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Alphabet Company?

- What is Competitive Landscape of Alphabet Company?

- What is Growth Strategy and Future Prospects of Alphabet Company?

- What is Sales and Marketing Strategy of Alphabet Company?

- What is Brief History of Alphabet Company?

- Who Owns Alphabet Company?

- What is Customer Demographics and Target Market of Alphabet Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.