Af Gruppen Bundle

Decoding AF Gruppen: How Does This Construction Giant Operate?

AF Gruppen, a major player in the Nordic construction landscape, presents a compelling case study for investors and industry watchers alike. With a market capitalization of $1.63 billion as of June 6, 2025, this Af Gruppen SWOT Analysis can provide valuable insights. Its diverse portfolio spans construction, property development, and more, making it a key entity to understand the dynamics of the Norwegian construction market.

The Af Gruppen company demonstrated resilience in Q1 2025, reporting solid revenues and improved earnings despite market challenges. This performance highlights the Af Gruppen business model's adaptability and strategic prowess. Exploring Af Gruppen's core operations, from project management to its impact on the Norwegian economy, offers a deep dive into a leading Construction company and its future prospects. Understanding its Norwegian construction and Real estate development strategies is key.

What Are the Key Operations Driving Af Gruppen’s Success?

The Af Gruppen company creates value through its diverse operations, spanning several key business areas. These areas include Civil Engineering, Construction, Betonmast, Property, Energy and Environment, Sweden, and Offshore. This structure allows the company to serve a broad customer base, including public entities, large industrial firms, and individual clients.

The company focuses on delivering high-quality projects and services across its segments. Their core operations are designed to ensure efficient project execution and sustainable practices. The company's approach includes continuous internal development and employee training to enhance project management, leadership, and technical skills.

AF Gruppen's value proposition lies in its ability to undertake complex projects and its innovative approach to problem-solving. This unique capability differentiates it in the market and provides significant benefits to its customers. The company's operational model emphasizes internal development, employee training, and targeted skills development.

Civil Engineering undertakes large-scale infrastructure projects. This segment reported revenues of NOK 2,366 million in Q1 2025, marking a 16% growth compared to the same period last year. Projects include roads, railways, bridges, and power plants.

The Construction segment provides contracting services for residential, public, and commercial buildings. This segment reported revenues of NOK 2,114 million in Q1 2025. Services include planning, new construction, and renovation projects.

Betonmast focuses on building and construction projects. This segment contributed NOK 1,044 million in revenues in Q1 2025. It is a key area within the company's construction portfolio.

The Property business area develops residential and commercial projects in Norway. These projects are often structured as associated companies and joint ventures. This area is crucial for real estate development.

AF Gruppen emphasizes internal development and employee training, particularly through the AF Academy. The company's supply chain and distribution networks are integral to project execution. Their focus on complex tasks and an entrepreneurial spirit drives innovation.

- Focus on internal development and employee training.

- Emphasis on project management, leadership, and technical expertise.

- Leveraging extensive experience in complex tasks.

- Innovative solutions to generate value.

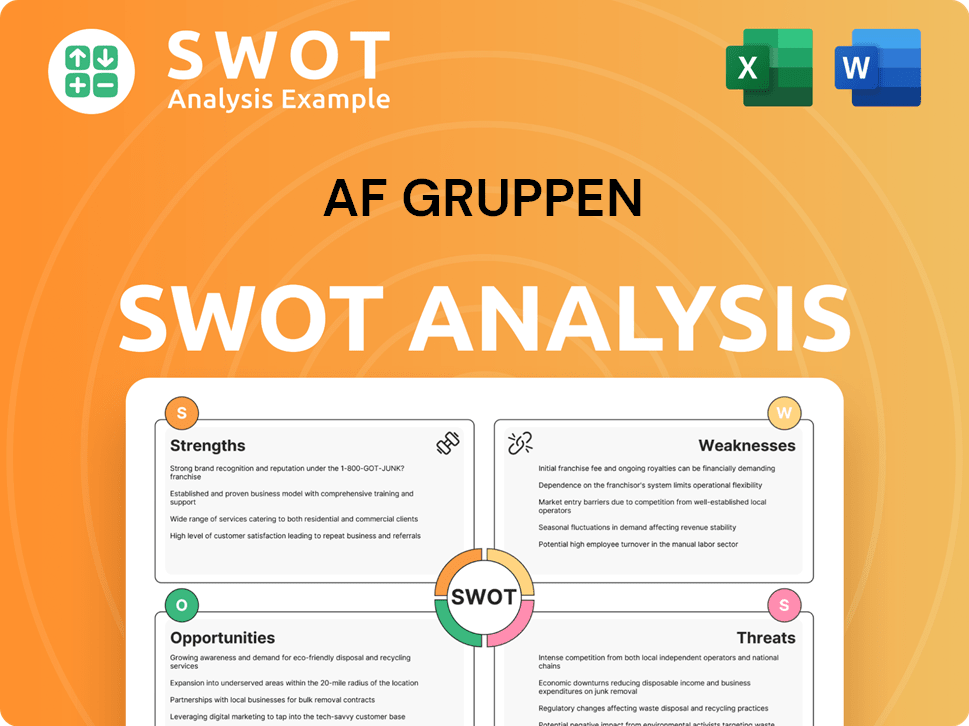

Af Gruppen SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Af Gruppen Make Money?

The Af Gruppen company generates revenue through diverse contracting and industrial operations across its seven business areas. This includes civil engineering, construction, and property development. The company's financial performance is closely tied to its project-based contracts and property sales.

In Q1 2025, Af Gruppen reported total revenues of NOK 7,129 million. For the full year 2024, revenues reached NOK 30,638 million. This demonstrates the company's significant scale and market presence within the Norwegian construction and real estate sectors.

As of March 31, 2025, Af Gruppen had a trailing 12-month revenue of approximately NOK 30.53 billion (equivalent to $2.8 billion).

Af Gruppen's revenue streams are primarily derived from its core segments. These segments include civil engineering, construction, and Betonmast. Each segment contributes significantly to the company's overall financial performance.

- Civil Engineering: Generated NOK 2,366 million in revenues in Q1 2025, reflecting a 16% growth compared to the previous year.

- Construction: Contributed NOK 2,114 million in revenues during Q1 2025.

- Betonmast: Reported NOK 1,044 million in revenues in Q1 2025, with an improved profit margin of 5.3%.

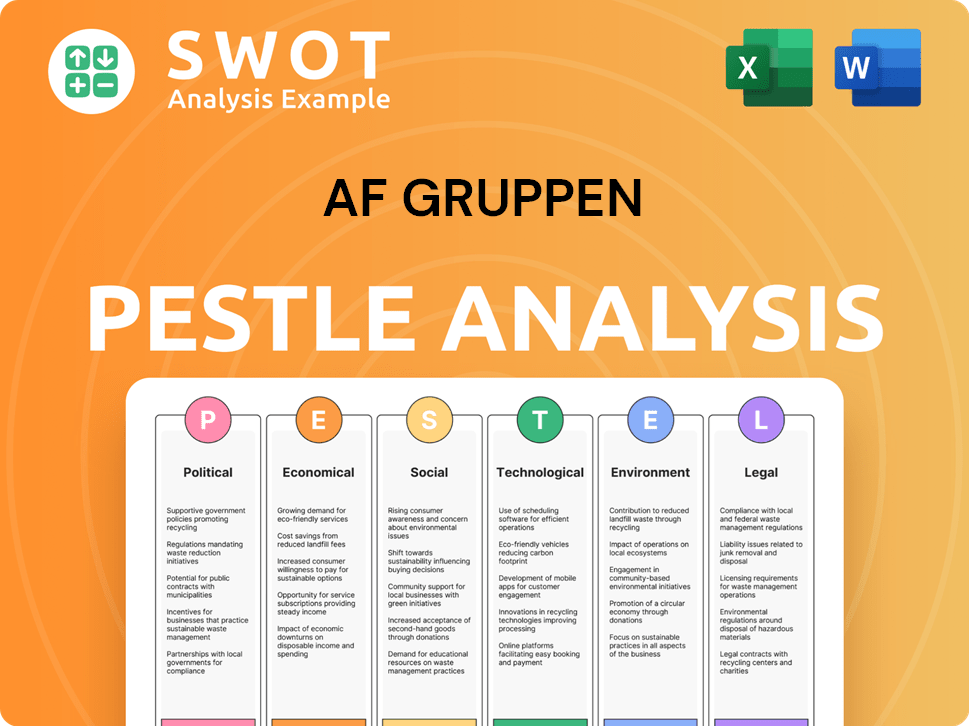

Af Gruppen PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Af Gruppen’s Business Model?

The journey of the Af Gruppen company has been marked by significant milestones and strategic responses to market dynamics. The company's entrepreneurial spirit, characterized by a willingness to innovate and find more future-oriented ways to generate value, has been a driving force. A crucial strategic move in 2024 was the development of a new group strategy, prioritizing safety, profitability, and halving its climate and environmental footprint by 2028.

Operational and market challenges are an inherent part of the construction industry. A notable challenge faced in early 2025 was the termination of a contract with AF Anläggning AB for the E4 Förbifart Stockholm project by the Swedish Transport Administration, which resulted in approximately NOK 100 million in shutdown and termination costs for the Civil Engineering business area. Despite this setback, the Af Gruppen business improved its profit compared to the previous year and maintained a strong order backlog.

Af Gruppen's competitive advantages stem from its strong brand, diversified portfolio, and expertise in complex projects. The company continuously adapts to new trends and technology shifts, as evidenced by its strategic goals for sustainability and energy efficiency, including a focus on energy efficiency improvements in buildings, which is supported by significant grants in the 2025 national budget.

The company's history is marked by a series of strategic moves and responses to market dynamics. The entrepreneurial spirit has been a key driver. A significant strategic move in 2024 was the development of a new group strategy.

The development of a new group strategy in 2024 prioritized safety, profitability, and sustainability. The company is focused on halving its climate and environmental footprint by 2028. This includes investments in energy efficiency.

Af Gruppen company's competitive advantages include its strong brand and diversified portfolio. Expertise in complex projects and a commitment to sustainability are also key. The company's focus on internal development and recruitment of leaders contributes to its sustained business model.

Despite challenges, the company improved its profit compared to the previous year. The order backlog stood at NOK 44,232 million as of March 31, 2025. The company is disputing the termination of a contract and will claim compensation for any losses.

Af Gruppen is committed to sustainability and energy efficiency. This includes a focus on energy efficiency improvements in buildings. The company continuously adapts to new trends and technology shifts to maintain its competitive edge in the Norwegian construction market.

- Focus on reducing environmental footprint.

- Emphasis on energy efficiency in projects.

- Adaptation to new technologies and trends.

- Supported by grants for sustainable initiatives.

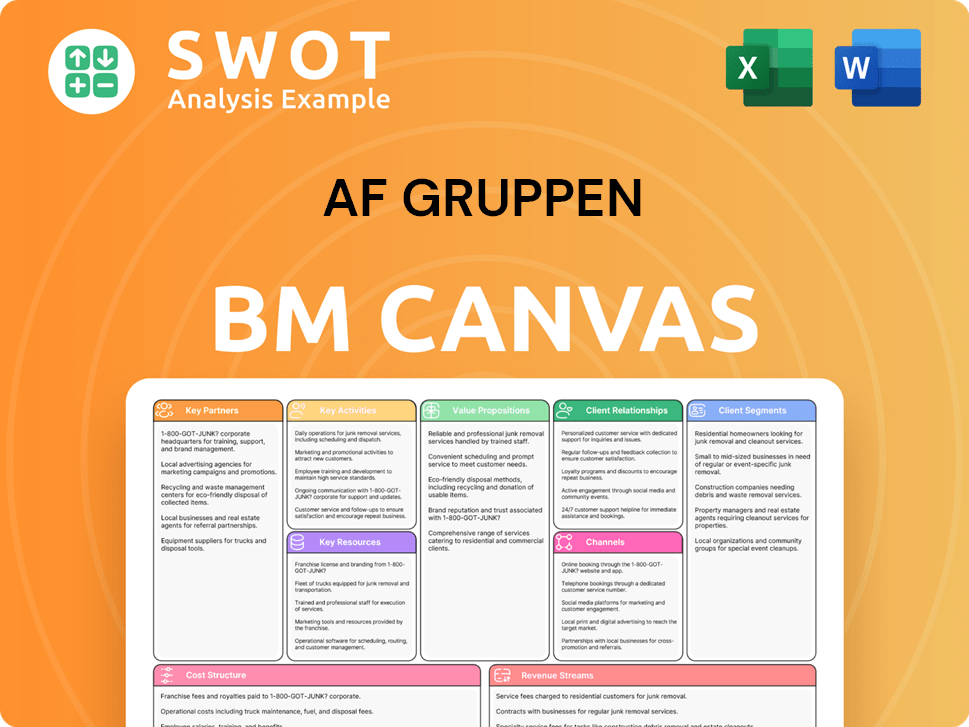

Af Gruppen Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Af Gruppen Positioning Itself for Continued Success?

As a leading contracting and industrial group in Norway and Sweden, the Af Gruppen company holds a strong market position. It's a major player in civil engineering, serving both public and private sectors. The company's diverse portfolio includes construction, property development, and environmental and offshore services, contributing to its robust market standing.

Despite its strong position, the Af Gruppen business faces various risks. These include operational challenges impacting project targets, as well as financial risks like foreign exchange rate and steel price fluctuations. The company also navigates competitive bidding, government contract compliance, and stringent regulations. A challenging property market has impacted sales figures.

The Af Gruppen company is a prominent construction company in Norway, with significant operations in Sweden. It is a key player in the civil engineering market, serving both public and private clients. Its diverse operations across various sectors strengthen its market position.

The company faces operational risks such as project delays and cost overruns. Financial risks include currency fluctuations and commodity price changes. Additionally, the company deals with competitive bidding and regulatory compliance. The real estate development sector faces challenges due to interest rate impacts.

Af Gruppen's future is shaped by its new group strategy for 2025-2028, focusing on safety, profitability, and reducing its environmental footprint. The company aims for NOK 40 billion in revenue and a 7% operating margin by 2028. There is optimism for growth, supported by a strong order backlog and strategic initiatives.

Analysts forecast Af Gruppen to grow earnings and revenue by 15.1% and 3.7% per annum, respectively, with EPS expected to grow by 14.3% per annum. The market for energy efficiency projects is expected to see excellent opportunities due to significant grants in the 2025 national budget and stricter environmental requirements for buildings.

Af Gruppen's strategic goals for 2025-2028 include achieving revenue targets and improving operational efficiency. The company is focused on sustainability, with a goal to halve its climate and environmental footprint. These initiatives aim to ensure long-term profitability and market leadership.

- Focus on safe and profitable operations.

- Reduce climate and environmental footprint.

- Achieve NOK 40 billion in revenue by 2028.

- Target an operating margin of 7% by 2028.

Af Gruppen Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Af Gruppen Company?

- What is Competitive Landscape of Af Gruppen Company?

- What is Growth Strategy and Future Prospects of Af Gruppen Company?

- What is Sales and Marketing Strategy of Af Gruppen Company?

- What is Brief History of Af Gruppen Company?

- Who Owns Af Gruppen Company?

- What is Customer Demographics and Target Market of Af Gruppen Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.