ASE Technology Holding Bundle

How Does ASE Technology Holding Thrive in the Semiconductor World?

ASE Technology Holding (ASEH), a titan in the semiconductor industry, is a key player in the assembly and testing of chips that power our modern world. In Q1 2025, ASEH demonstrated its strength with impressive revenue figures, signaling its robust market presence. Understanding the intricacies of ASE Technology Holding SWOT Analysis is crucial for anyone looking to navigate this dynamic sector.

This deep dive into ASE operations will unpack its core services, including semiconductor packaging and integrated circuit testing, and explore its strategic moves within the competitive landscape. We'll examine how ASE Group leverages its global presence and advanced packaging technologies to meet the escalating demands of AI and 5G. This exploration will provide valuable insights into ASE Technology Holding's financial performance and its critical role in the chip manufacturing supply chain, offering a comprehensive view of its sustained profitability.

What Are the Key Operations Driving ASE Technology Holding’s Success?

The core operations of ASE Technology Holding (ASEH), also known as ASE Group, center on providing comprehensive services within the semiconductor industry. The company's value proposition lies in its ability to offer end-to-end solutions, from chip manufacturing to testing, catering to a diverse range of customers. This integrated approach enables ASEH to meet the evolving demands of the tech industry effectively.

ASEH's business model is primarily divided into two key segments: semiconductor assembly and testing services (ATM) and electronic manufacturing services (EMS). These segments work in tandem to provide a broad spectrum of services, enhancing the company's market position. The company's operational excellence is further supported by its strong manufacturing capabilities and strategic partnerships.

The company's value is derived from its ability to innovate and adapt, particularly in the face of changing market demands. This is achieved through continuous technological advancements and strategic partnerships, which translate into benefits such as miniaturization, high performance, and superior quality for its customers.

The ATM segment includes front-end engineering test, wafer probing, IC packaging, and final testing. It accounted for 53% of total revenues in full-year 2024 and increased to 58% in Q1 2025. This segment is crucial for ensuring the quality and functionality of semiconductors.

The EMS segment focuses on the design, manufacture, and sale of electronic components and telecommunication equipment motherboards. It contributed 46% of revenues in full-year 2024 and 42% in Q1 2025. This segment supports the production of various electronic devices.

ASEH serves a diverse customer base, including major players in communications, computer, consumer, industrial, and automotive markets. This diversification helps mitigate risks and ensures a broad revenue stream.

ASEH's operational processes are vertically integrated, combining advanced packaging, testing, and manufacturing services to offer end-to-end solutions. This integrated approach reduces time-to-market and ensures high-quality standards for its customers.

ASE operations involve extensive manufacturing capabilities, strategic sourcing of materials, and continuous technology development. These elements are critical for maintaining a competitive edge in the chip manufacturing industry. For more insights into the company's strategic direction, see Growth Strategy of ASE Technology Holding.

- Extensive manufacturing capabilities.

- Strategic sourcing of materials such as organic substrates, lead frames, and encapsulation materials.

- Continuous technology development in areas like System-in-Package (SiP) and Fan-Out Wafer-Level Packaging (FOWLP).

- High dependency on key suppliers, with TSMC supplying 65% of advanced semiconductor packaging substrates.

- Long-term contracts with primary equipment manufacturers and strategic partnerships for critical component supply.

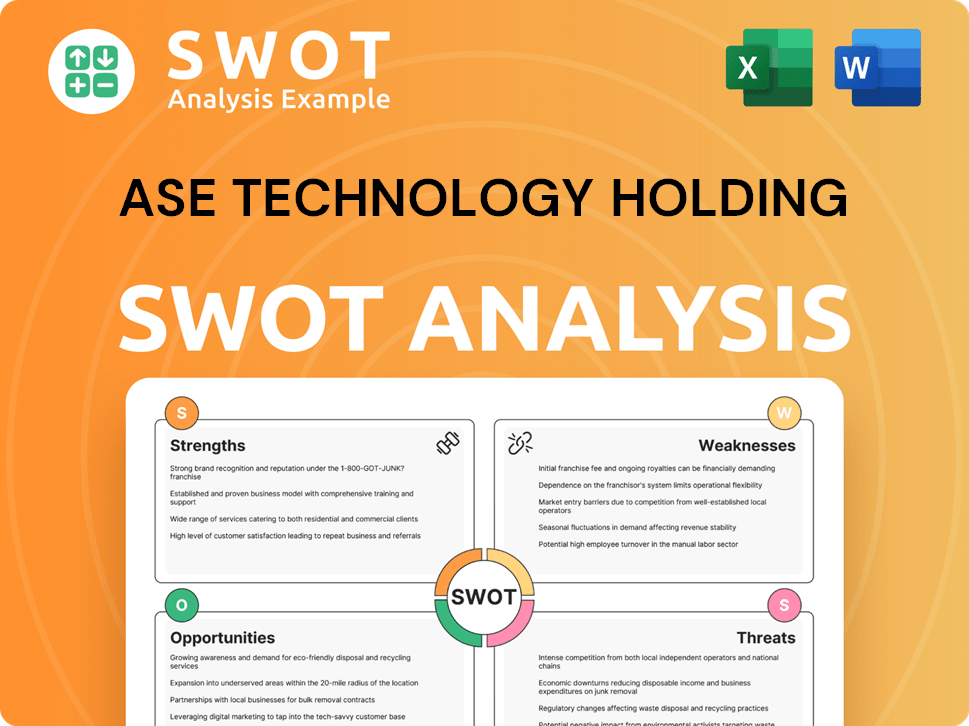

ASE Technology Holding SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ASE Technology Holding Make Money?

ASE Technology Holding (ASEH) generates revenue primarily through its Assembly, Testing, and Materials (ATM) and Electronic Manufacturing Services (EMS) segments. The company's financial performance reflects its strong position in the semiconductor industry, with consistent revenue growth driven by demand for advanced packaging and testing services. The company leverages its capabilities to serve a diverse customer base, contributing to its financial stability and market leadership.

The company's monetization strategies are centered around long-term contracts with key semiconductor firms and partnerships with emerging technology companies. This approach ensures a steady revenue stream and allows ASEH to invest in advanced technologies. The company's focus on advanced packaging, especially in AI-related areas, is a key driver of future revenue growth.

ASEH's ability to adapt to market trends, such as the increasing demand for high-performance chips, is crucial for its financial success. The company's vertically integrated business model and comprehensive solutions inherently provide value, supporting its revenue generation and market competitiveness. For more insights, you can review the Marketing Strategy of ASE Technology Holding.

In Q1 2025, ASE Technology Holding's net revenues reached NT$148,153 million, marking an 11.6% year-over-year increase. The ATM business segment saw revenues of NT$86,668 million, a 17.3% year-over-year increase, while the EMS segment generated NT$62,295 million, with a 4.9% year-over-year increase. For the full year 2024, net revenues were NT$595,410 million, a 2.3% increase from the previous year, with net income attributable to shareholders of NT$32,483 million. The company's strategic focus on advanced packaging is evident in the projected revenue growth in this area.

- In 2024, the ATM business contributed approximately 53% of total revenues.

- The EMS business accounted for approximately 46% of total revenues in 2024.

- Revenue from leading-edge packaging and testing services is expected to more than double to US$1.6 billion in 2025, up from US$600 million in 2024 and US$250 million in 2023.

- The growth in advanced packaging is fueled by the adoption of artificial intelligence (AI) technology.

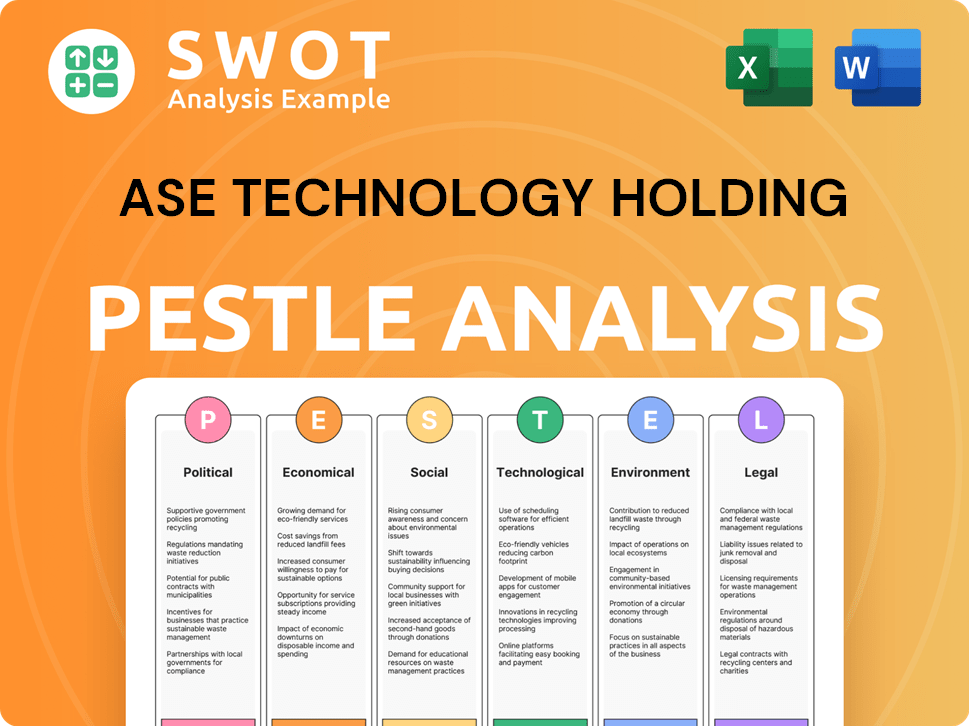

ASE Technology Holding PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped ASE Technology Holding’s Business Model?

The evolution of ASE Technology Holding has been marked by significant milestones, strategic shifts, and a focus on maintaining a competitive edge in the semiconductor industry. A pivotal moment was the formation of ASE Technology Holding itself in 2018, which was a result of a joint share exchange agreement between ASE and Siliconware Precision Industries (SPIL) in 2016. This consolidation solidified its position as the world's largest Outsourced Semiconductor Assembly and Test (OSAT) company.

The company consistently invests heavily in research and development and facility upgrades, with machinery and equipment capital expenditures reaching approximately $1.9 billion in 2024. These investments are primarily directed towards advanced packaging and testing technologies. This strategic allocation of resources is crucial for supporting the growing demand for cutting-edge technology and preparing for the anticipated AI-led super cycle within the semiconductor market.

ASE Technology Holding faces operational challenges typical of the semiconductor industry, including cyclical market conditions and the need to continuously innovate to stay competitive. Despite these hurdles, the company has demonstrated resilience, with its stock price outperforming its peers in 2024. For a deeper understanding of the company's journey, consider reading Brief History of ASE Technology Holding.

The formation of ASE Technology Holding in 2018, through the merger of ASE and SPIL, was a major milestone. This consolidation created the largest OSAT company globally. The company continues to invest heavily in R&D and facilities.

Strategic moves include heavy investment in advanced packaging and testing. ASE has also focused on strategic alliances, particularly with TSMC. The company is expanding its global footprint.

ASE's market leadership as the largest OSAT company is a key advantage. Its strategic partnership with TSMC is also crucial. The company's focus on advanced packaging technologies gives it a technological edge.

ASE faces cyclicality in the semiconductor market and the need for constant innovation. Despite these challenges, the company has shown resilience. The company's stock price has outperformed peers.

ASE Technology Holding's competitive advantages stem from its market leadership, strategic partnerships, and technological prowess. The company's strong focus on advanced packaging technologies is a major differentiator. Its diverse customer base also helps mitigate risks.

- Market Leadership: As the largest OSAT company, ASE benefits from economies of scale and a broad customer base.

- Strategic Partnership: The alliance with TSMC is vital, especially for advanced packaging, with ASE potentially handling a significant portion of TSMC's outsourced CoWoS-S packaging by 2025.

- Technological Edge: ASE's investment in advanced packaging technologies like SiP and FOWLP positions it well in the market.

- Diversified Customer Base: Serving various industries reduces dependence on any single sector, enhancing stability.

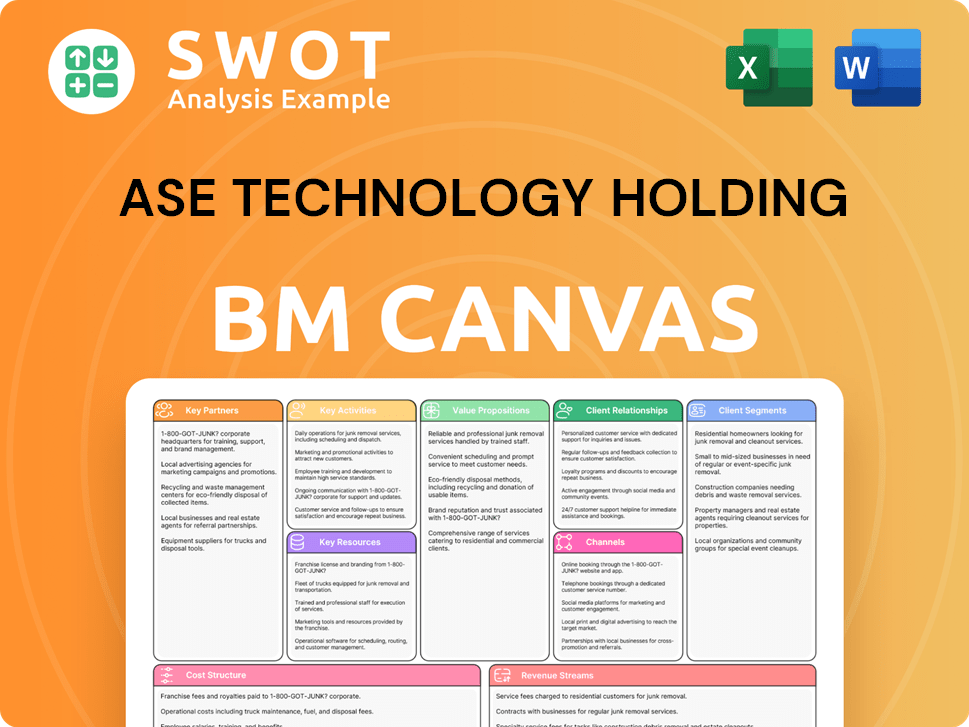

ASE Technology Holding Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is ASE Technology Holding Positioning Itself for Continued Success?

The following outlines the industry position, risks, and future outlook for ASE Technology Holding (ASEH). As the world's largest Outsourced Semiconductor Assembly and Test (OSAT) company, ASEH plays a crucial role in the semiconductor supply chain. Its strategic partnerships, particularly with TSMC, and diversified customer base, position it well within a competitive landscape.

However, ASEH faces several risks, including market cyclicality, supply chain disruptions, and the need for significant capital expenditure. Additionally, regulatory changes and geopolitical tensions introduce further uncertainties. Despite these challenges, the company anticipates substantial growth driven by the increasing demand for advanced packaging solutions, particularly in the AI sector.

ASE Technology Holding (ASEH) is the world's leading OSAT, competing with major players like Amkor Technology and JCET Group. Its close partnership with TSMC provides a competitive advantage, especially in advanced packaging. ASEH serves a diverse customer base across various sectors, mitigating reliance on any single market segment, as detailed in Target Market of ASE Technology Holding.

ASEH faces risks such as the cyclical nature of the semiconductor market and ongoing supply chain disruptions. High capital expenditures are necessary to maintain competitiveness in research and development. Regulatory changes and geopolitical shifts, including cross-strait relations, pose additional risks. Fluctuations in foreign currency exchange rates can also impact financial results.

The future outlook for ASEH appears positive, driven by the demand for AI chips and advanced packaging. The company anticipates significant revenue growth from leading-edge packaging and testing services, with projections to more than double to US$1.6 billion by 2025. ASEH is expanding its advanced packaging technologies and global footprint.

ASEH is focused on expanding its advanced packaging technologies and setting sustainability goals. It is diversifying its product portfolio to include solutions for AI, 5G, and automotive electronics. The company is also expanding its manufacturing facilities in key markets. Leadership emphasizes continued investment in innovation and strengthening industry partnerships.

ASEH's revenue from leading-edge packaging and testing services is expected to more than double to US$1.6 billion by 2025. The global semiconductor market is projected to reach USD 1 trillion within the next decade. ASEH plans to leverage its industry position in the AI era and strategic collaborations to sustain and expand revenue generation.

- Focus on advanced packaging to meet AI chip demands.

- Expansion of global manufacturing facilities.

- Commitment to sustainability and innovation.

- Strategic partnerships to enhance market position.

ASE Technology Holding Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ASE Technology Holding Company?

- What is Competitive Landscape of ASE Technology Holding Company?

- What is Growth Strategy and Future Prospects of ASE Technology Holding Company?

- What is Sales and Marketing Strategy of ASE Technology Holding Company?

- What is Brief History of ASE Technology Holding Company?

- Who Owns ASE Technology Holding Company?

- What is Customer Demographics and Target Market of ASE Technology Holding Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.